From: Terry Reilly

Sent: Monday, August 13, 2018 8:24:07 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/13/18

It was hot over the weekend across the northwestern United States and the Canada’s Prairies

o 110 degrees Fahrenheit at Boise, Idaho

o 107 in southeastern Saskatchewan

o 105 in southern British Columbia

o 104 in southern Alberta

o 107 in northeastern Montana

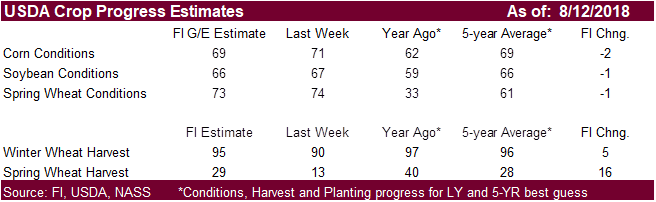

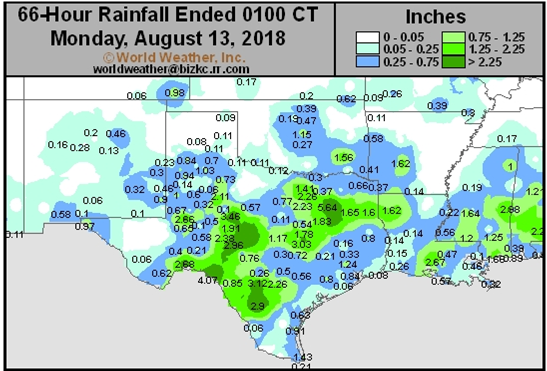

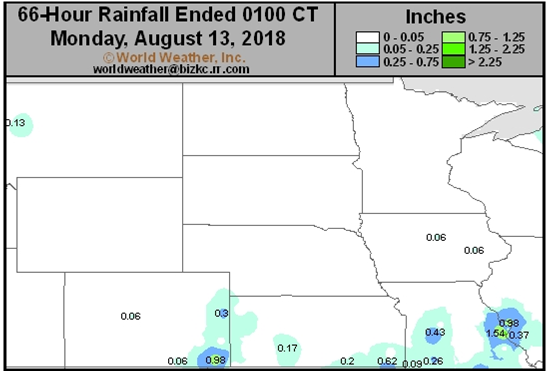

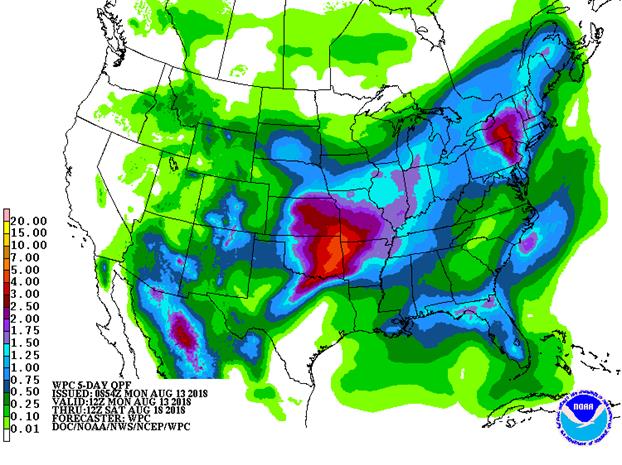

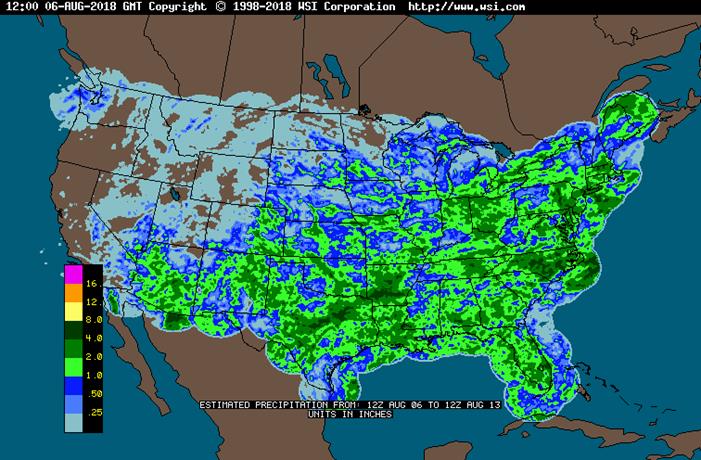

· U.S. rainfall this week show scattered showers and thunderstorms from Texas to Nebraska and east through the Midwest, Delta and Tennessee River Basin.

· Rainfall in the heart of the Midwest will vary from 0.50 to 1.50 inches by Sunday.

· Northern Plains rainfall will vary from 0.10 to 0.60 inch and local totals to 0.75 inch, but most of the region will experience net drying until next weekend when greater rain falls in the east.

· The Delta will see daily rounds of showers and thunderstorms through the next 7 days.

· Upcoming Thomson Reuters crop tours: August 6-8: U.S. corn & soybeans

· Two waves of rain will move through northwestern portions of the CIS during the coming week. Most of the precipitation will occur from western Ukraine, Belarus and Baltic States across northwestern Russia to the Volga-Vyatsk.

· India’s monsoon is not likely to resume normally in the west or far south for another 5 days and that will continue of some concern.

· Canada’s Prairies continues to suffer from drought. Some rain may develop this weekend.

· Western Australia, South Australia and Victoria may see rain this week, but New South Wales and Queensland remain dry.

Source: World Weather and FI

Source: World Weather and FI

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

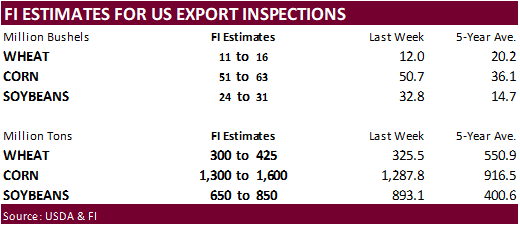

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA weekly crop progress report, 4pm

- Ivory Coast weekly cocoa arrivals

- Malaysia announces crude palm oil export tax for September

- EARNINGS: Wilmar International, Ros Agro, Sao Martinho

TUESDAY, AUG. 14:

- Olam International media briefing on earnings, 10:30am Singapore Aug. 14 (10:30pm ET Aug. 13)

- EARNINGS: JBS, Golden Agri- Resources, Olam International, WH Group, Marfrig

WEDNESDAY, AUG. 15:

- India on holiday

- Cargo surveyors Intertek, AmSpec release respective data on Malaysia’s Aug. 1-15 palm oil exports, 11pm ET Tuesday (11am Kuala Lumpur Wednesday)

- SGS data for same period, 3am ET Wednesday (3pm Kuala Lumpur Wednesday)

- EIA U.S. weekly ethanol inventories, output, 10:30am

- National Oilseed Processors Association report on U.S. soybean processing data, noon

- The Salvadoran coffee council releases monthly El Salvador export data

THURSDAY, AUG. 16:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

FRIDAY, AUG. 17:

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- EARNINGS: Deere & Co.

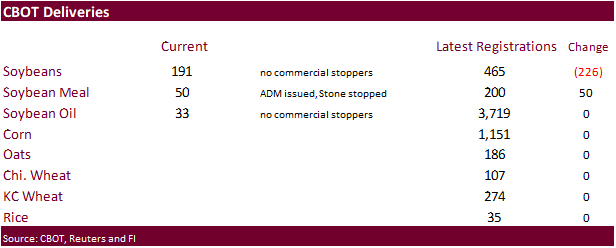

- Soybeans down 226, Cofco Chicago

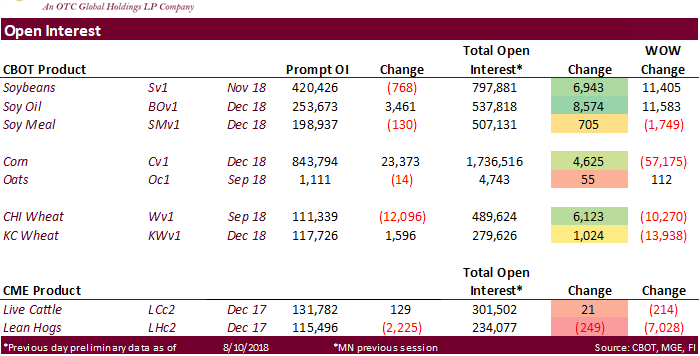

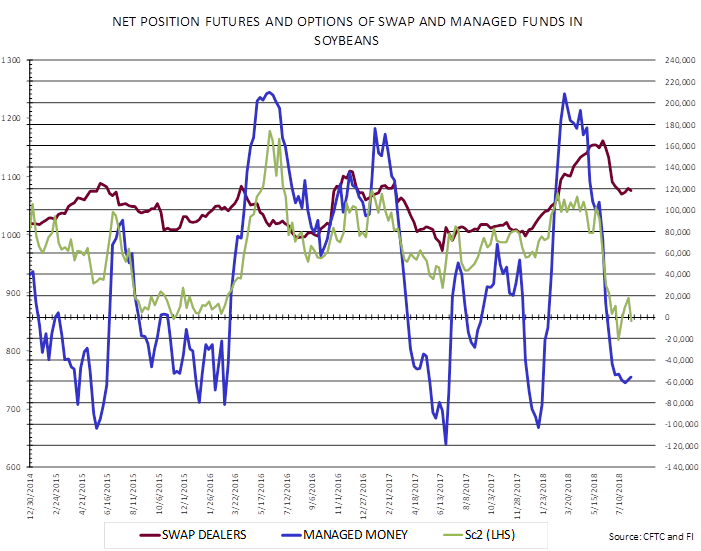

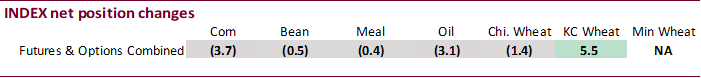

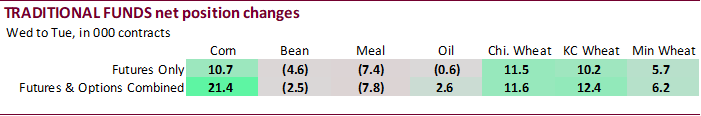

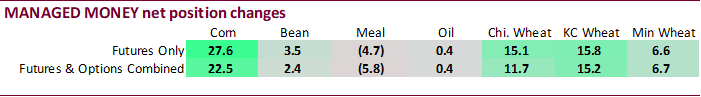

CFTC Commitment of Traders

· Funds futures only in Chicago wheat was a new record long of 86,528 contracts.

· Funds futures and options combined in Chicago wheat was net long 63,219, just shy of its record established 8/7/2012.

· Remarkably, daily fund trade estimates didn’t deviate that much from actual positions reported as of last Tuesday.

· Funds were active buyers in corn and wheat. Same goes for managed money.

· Indexes were light sellers.

USDA FSA initial crop data showed corn at 85,770 million acres, 30,000 less than what we were looking for to be an ideal figure to be on target for USDA’s NASS acreage estimate released in June. Soybeans of 86,954 million were below our idea target and all-wheat of 44,510 million were slightly above. August is a poor correlation when predicting changes in planted area in October by USDA/NASS, but for now we think corn and wheat may see little changes, while the soybean area could be lower.

USDA Latest versus ideal FSA target to see little or no change in planted area:

Corn 89.128 FSA area around 85.8 Actual was 85,770

Soybeans 89.557 FSA area around 87.8 Actual was 86,954

All-wheat 47.821 FSA area around 44.4 Actual was 44,510

U.S. corn and soybean plantings

Prevented planting

(thousands of acres)

Crop Aug 2018 Aug 2017

Corn 918 950

Soybeans 271 437

Wheat 363 614

Rice 62 361

Barley 26 29

Sorghum 66 33

Cotton-Upland 122 116

U.S. corn and soybean plantings

Plantings

(thousands of acres)

Crop Aug 2018 Aug 2017

Corn 85,770 86,832

Soybeans 86,954 88,219

Wheat 44,510 42,761

Rice 2,882 2,421

Barley 2,283 2,353

Sorghum 4,859 4,942

Cotton-Upland 13,530 12,117

https://www.nass.usda.gov/Education_and_Outreach/Understanding_Statistics/FSA_Acreage.pdf

· US stocks are mixed, USD lower, WTI crude lower, and gold lower, at the time this was written.

Corn.

- Corn is lower on US weather returning to a more favorable pattern and sharply lower soybeans and wheat.

- Domestic and importers like 2019-20 prices for corn and that was conformed after Mexico bought US corn for 2019-20 arrival.

- Baltic Dry Index increased 1.1 percent to 1709 points.

- Today is day 5 of the Goldman Roll.

- China is planning to increase controls after African swine fever was discovered for the first time earlier this month. Initially they are banning any pigs from areas where it was discovered.

· Private exporters reported to the U.S. Department of Agriculture the following activity:

–Export sales of 213,372 metric tons of corn for delivery to Mexico. Of the total 142,248 metric tons is for delivery during the 2018/2019 marketing year and 71,124 metric tons is for delivery during the 2019/2020 marketing year; and

· China sold about 61.4 million tons of corn out of reserves this season. Another 8 million tons will be offered this week.

Soybean complex.

· Soybeans extended losses on Monday from follow through selling on record ending stocks for US and world as predicted by USDA and mostly favorable US weather. Good rains fell in the southern US Great Plains. This pressure wheat as well. The northern part of the Corn Belt had rain over the weekend but rain that fell last week boosted soil moisture levels.

· New-crop soybeans were sold to Mexico.

· US temperatures this week are nonthreatening.

· Some traders are looking for China to purchase US soybeans in coming weeks to make up for a Q4 shortfall in supplies. There is one 70,000-ton US soybean cargo unloading at Dalian, according to Reuters. It’s been parked there for a month. Port congestion was one of the reasons for the delay.

· Sinograin will pay the tariff on the delayed 70,000-ton cargo of about $6 million (USD).

· China cash margins were last 76 cents/bu on our analysis, down from 87 cents late last week, and compares to 94 cents last week.

· China’s soybean complex traded lower led by a 1% decrease in soybean meal and 1.0% decrease in soybeans. China vegetable oils fell 0.7 and 0.4 percent for soybean oil and palm, respectively.

· Offshore values were suggesting a higher lead for US soybean meal by $5.60 and higher lead for soybean oil by 1 point.

· October Malaysian palm was lower overnight by 38 ringgits and leading SBO 1 point higher. Cash was $8.75/ton lower. August Malaysian palm exports are slow.

· Malaysia’s CPO export tax was set at zero percent for September, down from 4.5 percent in August.

· Rotterdam meal was unchanged to lower and vegetable oils lower. Rotterdam rapeseed oil is not offered through October.

· Germany plans to end the use of glyphosate. A major ag company recently lost a case in California and some SA countries are looking to end the use as well.

- Private exporters reported to the U.S. Department of Agriculture the following activity:

–Export sales of 142,500 metric tons of soybeans for delivery to Mexico during the 2018/2019 marketing year.

- Iran seeks 30,000 tons of sunflower oil on September 24.

- China sold 1.091 million tons of soybeans out of reserves so far, this season.

· The long fund position in wheat is starting to come off and that is pressuring wheat prices on Monday.

· EU December wheat was 3.75 euros lower at 209 euros, at the time this was written.

· Egypt extended their timeframe allowing wheat imports continuing up to 13.5 percent moisture through early March. They extended it 9 months retroactive July 3.

· Ukraine’s AgMin said the wheat harvest is nearly complete at 24.4 million tons, 98 percent of the planned area.

· Iraq seeks 50,000 tons of milling wheat on 8/15.

· Jordan issued an import tender for 120,000 tons of hard milling wheat on August 15.

· China sold 1,303 tons of imported wheat at auction at an average price of 2351 yuan/ton ($341.79/ton), 0.07% of what was offered.

· China sold 2,070 tons of 2012 wheat at auction at an average price of 2360 yuan/ton 2% of what was offered.

· Jordan issued an import tender for 120,000 tons of feed barley on August 14.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 22 for arrival by January 31.

Rice/Other

· China sold 26,191 tons of rice at auction at an average price of 2642 yuan/ton ($384.29/ton), 3% of what was offered.

· Results awaited: Iraq seeks 30,000 tons of rice on August 12, open until Aug 16. Lowest offer was $449.50/ton c&f from Thailand.

· Thailand to sell 120k tons of raw sugar on Aug. 22.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.