From: Terry Reilly

Sent: Friday, August 17, 2018 8:37:18 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/17/18

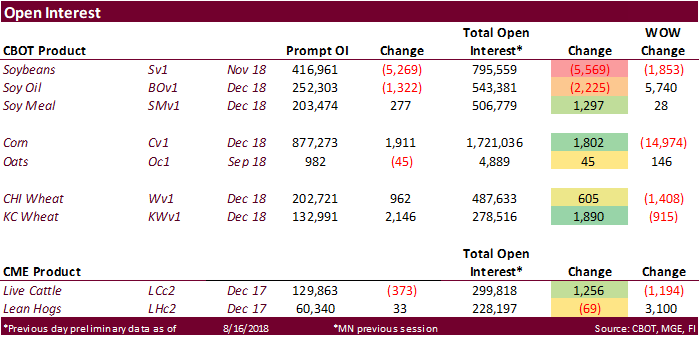

· US soybean and corn crop conditions could have stabilized this week. Look for the G/E ratings to be unchanged.

· We look for spring wheat conditions to end up also unchanged.

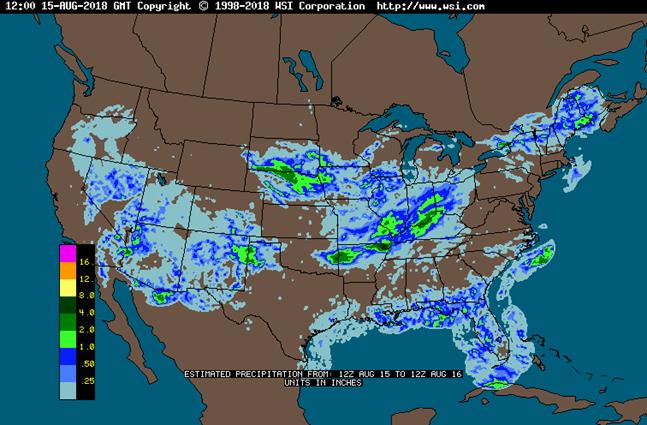

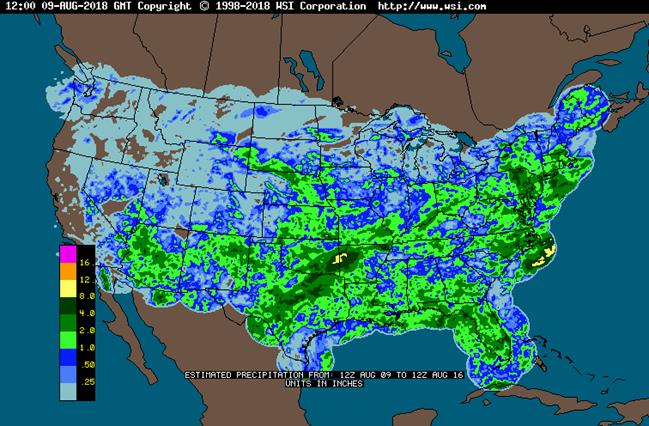

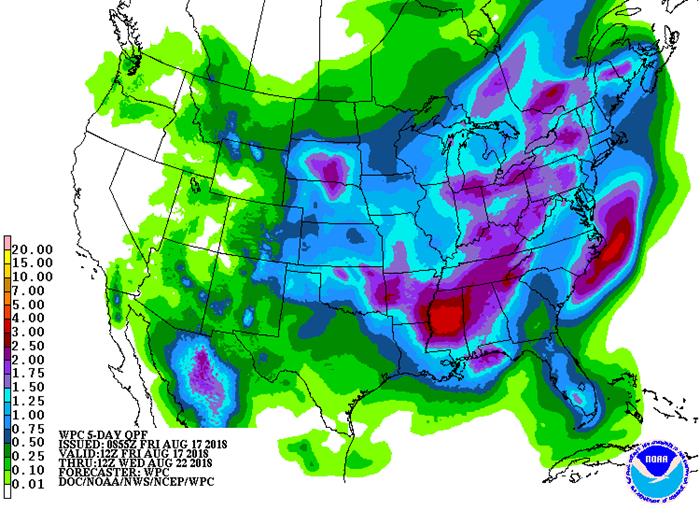

· 6-10 is wetter for the northern Great Plains and northwestern Midwest, and drier for the Delta and southern Great Plains. The 11-15 day is drier for the northern and southern Great Plains.

· The drier forecast for the northwestern Midwest areas should be monitored as that areas was expected to see rain Sunday, and Tuesday & Wednesday next week.

· Overall US weather will remain favorable into next week with timely rainfall and less threatening temperatures.

· The Northern U.S. Delta and Tennessee River Basin will see good rains.

· West Texas will see rain this weekend.

· Canada’s Prairies will receive scattered showers and thunderstorms during the coming week.

· Argentina will receive rain in the central and east this weekend.

· Western Australia will see limited rain in northern and eastern parts of the production region during the next ten days.

Source: World Weather and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Fri 90-100% cvg of 0.15-0.90”

and local amts over 2.0”;

west Ky. to south In.

wettest

Fri-Sat 10-15% daily cvg of

up to 0.25” and locally

more each day; wettest

east Friday and wettest

west Saturday

Sat 30% cvg of up to 0.40”

and local amts to 1.10”;

south and east wettest

Sun 10% cvg of up to 0.20”

and locally more

Sun-Mon 80% cvg of up to 0.75”

and local amts over 2.0”;

far NW driest

Mon-Tue 80% cvg of up to 0.75”

and local amts to 1.50”

Tue 10% cvg of up to 0.20”

and locally more

Wed-Aug 23 50% cvg of up to 0.40”

and local amts to 1.0”;

far NW driest

Wed-Aug 24 5-20% daily cvg of up

to 0.25” and locally

more each day

Aug 24-25 45% cvg of up to 0.75”

and locally more;

wettest north

Aug 25-26 50% cvg of up to 0.60”

and locally more

Aug 26-28 65% cvg of up to 0.70”

and locally more

Aug 27-28 70% cvg of up to 0.50”

and locally more

Aug 29-31 5-20% daily cvg of up 10-25% daily cvg of

to 0.25” and locally up to 0.25” and locally

more each day more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

-Fri 75% cvg of 0.60-1.50”

and local amts to 3.0”

north with up to 0.60”

and locally more in

central and southern

areas

Fri-Sun 85% cvg of 0.35-1.50”

and local amts over 3.0”

from east Ms.to west

Ga. with up to 0.75”

and local amts to 2.0”

elsewhere

Sat-Sun 80% cvg of up to 0.75”

and local amts to 2.75”;

far north and far south

driest

Mon-Tue 75% cvg of up to 0.55”

and local amts to 1.20”

Mon-Wed 80% cvg of up to 0.75”

and local amts to 2.0”

Wed-Aug 24 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Aug 23-25 60% cvg of up to 0.75”

and local amts to 1.50”;

driest west

Aug 25-26 60% cvg of up to 0.65”

and local amts to 1.40”;

wettest north

Aug 26-30 15-35% daily cvg of

up to 0.60” and locally

more each day

Aug 27-30 5-20% daily cvg of up

to 0.30” and locally

more each day

Source: World Weather and FI

Bloomberg weekly agenda

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- EARNINGS: Deere & Co.

MONDAY, AUG. 20:

- Argentina, Egypt on holiday

- Intertek, AmSpec release respective data on Malaysia’s Aug. 1-20 palm oil exports, 11pm ET Sunday (11am Kuala Lumpur Monday)

- SGS data for same period, 3am ET Monday (3pm Kuala Lumpur Monday)

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

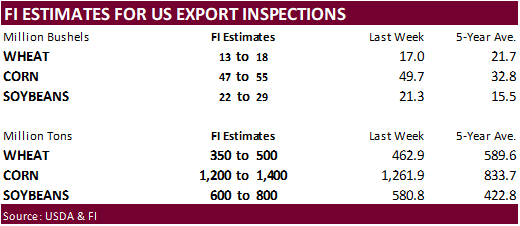

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA milk production data for July, 3pm

- USDA weekly crop progress report, 4pm

- ProFarmer U.S. soy/corn crop tour, Day 1

- Ivory Coast weekly cocoa arrivals

- Most active period of Atlantic hurricane season begins, and peaks around Sept. 10

TUESDAY, AUG. 21:

- Egypt on Eid Al-Adha holiday

- Brazilian agency Conab’s 2nd estimate for 2018-19 sugarcane crop

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington)

- ProFarmer U.S. crop tour, Day 2

WEDNESDAY, AUG. 22:

- India, Singapore, Malaysia, Indonesia, Egypt on holiday

- Agritel presser on French wheat harvest 2018 season, 3am ET (9am Paris)

- DBV outlook on German crop outlook

- ProFarmer U.S. crop tour, Day 3

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA cold-storage report for July, 3pm

THURSDAY, AUG. 23:

- China’s General Administration of Customs releases July agricultural commodity trade data (final), including imports of palm oil, wheat, cotton and corn, 2:30am ET (2:30pm Beijing)

- Intl Grains Council’s monthly market forecasts, 8:30am ET (1:30pm London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production for July, 3pm

- Brazilian research foundation Fundecitrus releases report on greening incidence on oranges; Brazil is top producer, exporter

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- ProFarmer U.S. crop tour, Day 4

- U.S. is set to impose 25% tariffs on additional $16b in Chinese imports; China said it will retaliate

- EARNINGS: Sanderson Farms, Hormel Foods

FRIDAY, AUG. 24:

- ProFarmer issues final yield estimates after crop tour, 2pm

- USDA cattle-on-feed report for July, 3pm

- Unica bi-weekly report on Brazil Center-South sugar output

- Salvadoran coffee council’s El Salvador July export data

- Nicaragua’s coffee council releases July export data

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- Soybeans down 44 to 12, Cofco Chicago

Weekly Bloomberg Bull/Bear survey (taken Wed)

· Soybeans: Bullish: 1 Bearish: 7 Neutral: 3

· Wheat: Bullish: 2 Bearish: 3 Neutral: 6

· Corn: Bullish: 5 Bearish: 1 Neutral: 5

· Raw Sugar : Bullish: 1 Bearish:3 Neutral: 3

· White sugar: Bullish: 2 Bearish: 3 Neutral: 2

· White-sugar premium: Widen: 1 Narrow: 4 Neutral: 2

· US stocks are lower, USD lower, WTI crude higher, and gold higher, at the time this was written.

Corn.

- Look for a two-sided trade in corn with a higher close if wheat is able to hold gains.

- Monday is the start of the annual US ProFarmer Crop Tour. Results will be out Friday, August 24.

- Baltic Dry Index increased 0.2 percent to 1723 points.

- Argentina’s corn harvest is 94 percent complete, according to the BA Grains Exchange, versus 89 percent last week and 85 percent average. Production was left unchanged at 31 million tons.

- The shipping lineup shows Brazil is scheduled to ship 2.66MMT tons of corn as of August 16.

- France corn conditions as of August 12 fell one point to 61 percent for the combined good/excellent categories.

- China pork producer WH Group shut down a processing plant in Zhengzhou 6 weeks after African swine fever was discovered.

- China July pig herds fell 2 percent from the previous year and down 0.8% from June. Sow herds are down 4 percent and off 1.9 percent from last month.

- Russia reported a bird flu outbreak in the western part of the country. Details were lacking.

- The US will see cool temperatures next week which should benefit crop development.

- The EPA reported 1.37 billion ethanol (D6) blending credits were generated in July, up from 1.26 billion in June, and up from 1.274 billion in July 2017.

· China sold 850,780 tons of corn out of auction at an average price of 1433 yuan per ton ($207.94/ton), 21.5 percent of wheat was offered. Yesterday China sold 1.53 million tons of corn out of auction at an average price of 1544 yuan per ton, 38.4 percent of wheat was offered.

· China sold about 63.7 million tons of corn out of reserves this season.

· Another 4 million tons will be offered late next week.

Soybean complex.

· Offshore values are leading meal lower. Soybeans are weaker on lack of US country movement and weakening basis at the Gulf. Soybean oil may find support on higher crude oil.

· The meeting between the US and China’s vice commerce minister will be August 22-23.

- It appears the CBOT soybeans are headed to zero as demand out of the Lakes remains strong.

- The Brazil AgMin plans to appeal a federal judge’s decision that suspended the use of glyphosate.

- SEA sees India’s 2017-18 palm oil imports may fall 15 percent to 7.9MMT, a 6-year low. Edible oil imports are projected at 14.2MMT, 6 percent lower than 2016-17.

- Dalian Commodity Exchange will lower intraday trading fees for soybean oil and palm oil futures by 50% to 1.25 yuan per lot from August 22.

· China cash margins were last 96 cents/bu on our analysis, compared to 95 previous session, 87 cents late last week, and 94 cents last week.

- Iran seeks 30,000 tons of sunflower oil on September 24.

· Wheat futures are sharply higher.

· Rumors the Russian AgMin may impose a 30-million-ton wheat export cap for 2018-19 sent US futures prices sharply higher. Grain production is expected to be down from last year after adverse weather hit a good portion of the major growing regions.

· EU December wheat was 4.00 euros higher at 214.25 euros, at the time this was written.

- Saskatchewan’s harvest progress as of August 13 was 5 percent complete. Hot and dry weather have hit the region.

· The EU awarded 82,000 tons of reduced tariff wheat imports of various origins.

· Yesterday September and December Chicago wheat poked above its 20-day MA but settled below it. The same happened in KC and MN, in the front months. Technically wheat looks bullish.

· A US trade official mentioned they see a “breakthrough” in NAFTA soon.

December EU wheat via Reuters & FI

Export Developments.

· Jordan seeks 120,000 tons of hard milling wheat on Aug 29 for Nov/Dec shipment.

· Jordan seeks 120,000 tons of feed barley on August 28.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 22 for arrival by January 31.

· Egypt’s ESIIC seeks 100,000 tons (150k previously_ of raw sugar on Aug 18 for shipment within the first half of September and two 50,000-ton shipments from September 15-Oct 15.

· Thailand to sell 120k tons of raw sugar on Aug. 22.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.