From: Terry Reilly

Sent: Wednesday, August 22, 2018 8:49:07 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/22/18

PDF attached

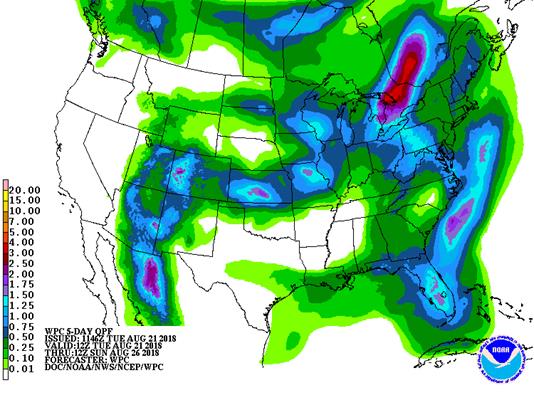

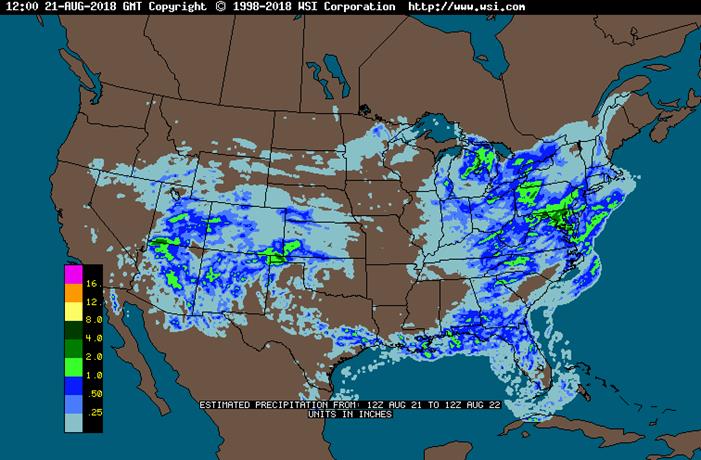

· The ECB will see rain mid-week. Rain returns to the US northwestern areas Friday and Saturday.

· The Delta will see drier weather through Saturday.

· US spring wheat will see minor harvesting delays for the balance of the week.

· HRW wheat country will see showers on and off through early next week.

· A ridge of high pressure may evolve across the southeastern states, Delta, Corn Belt, and eastern Hard Red Winter Wheat Region Aug. 28 – Sep. 4.

· Eastern Australia’s rainfall potential for late this week remains very good.

· Eastern China will see net drying through at least August 29.

· Canada’s Prairies will remain on the dry side this week.

· Indonesia and Malaysia rainfall are slowing and some attribute the below normal rainfall to El Nino.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Wed 15% cvg of up to 0.20” 15% cvg of up to 0.15”

and locally more; and locally more;

wettest SW wettest east

Thu-Fri 80% cvg of up to 0.75”

and local amts over 2.0”;

wettest south; far NW

driest

Thu-Sat 80% cvg of up to 0.65”

and local amts to 1.50”;

driest south

Sat-Sun 40% cvg of up to 0.75”

and local amts to 1.50”;

driest south

Sun-Mon 40% cvg of up to 0.35”

and local amts to 0.65”;

driest west

Mon-Aug 29 75% cvg of up to 0.75”

and local amts to 1.75”

Aug 28 15% cvg of up to 0.25”

and locally more

Aug 29-31 80% cvg of up to 0.75”

and local amts to 2.0”

Aug 30-31 40% cvg of up to 0.75”

and local amts to 1.50”

Sep 1-4 10-25% daily cvg of 10-25% daily cvg of

up to 0.30” and locally up to 0.30” and locally

more each day more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Wed-Thu 5-20% daily cvg of up

to 0.30” and locally

more each day

Wed-Sun Mostly dry with a few

insignificant showers

Fri-Mon 15-35% daily cvg of

up to 0.70” and locally

more each day; west

and south wettest

Mon-Aug 30 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Aug 28-Sep 1 15-35% daily cvg of

up to 0.50” and locally

more each day;

wettest west

Aug 31-Sep 4 5-20% daily cvg of up

to 0.30” and locally

more each day

Sep 2-4 10-25% daily cvg of

up to 0.35” and locally

more each day

Source: World Weather and FI

Source: World Weather Inc.

Bloomberg weekly agenda

- India, Singapore, Malaysia, Indonesia, Egypt on holiday

- Agritel presser on French wheat harvest 2018 season, 3am ET (9am Paris)

- DBV outlook on German crop outlook

- ProFarmer U.S. crop tour, Day 3

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA cold-storage report for July, 3pm

THURSDAY, AUG. 23:

- China’s General Administration of Customs releases July agricultural commodity trade data (final), including imports of palm oil, wheat, cotton and corn, 2:30am ET (2:30pm Beijing)

- Intl Grains Council’s monthly market forecasts, 8:30am ET (1:30pm London)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production for July, 3pm

- Brazilian research foundation Fundecitrus releases report on greening incidence on oranges; Brazil is top producer, exporter

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- ProFarmer U.S. crop tour, Day 4

- U.S. is set to impose 25% tariffs on additional $16b in Chinese imports; China said it will retaliate

- EARNINGS: Sanderson Farms, Hormel Foods

FRIDAY, AUG. 24:

- ProFarmer issues final yield estimates after crop tour, 2pm

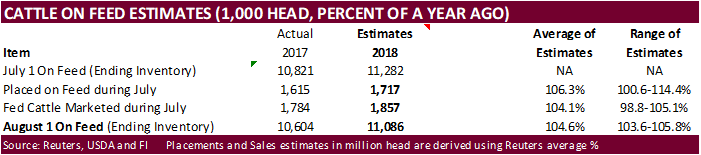

- USDA cattle-on-feed report for July, 3pm

- Unica bi-weekly report on Brazil Center-South sugar output

- Salvadoran coffee council’s El Salvador July export data

- Nicaragua’s coffee council releases July export data

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- No changes

· US stocks are higher, USD lower, WTI crude higher, and gold higher, at the time this was written.

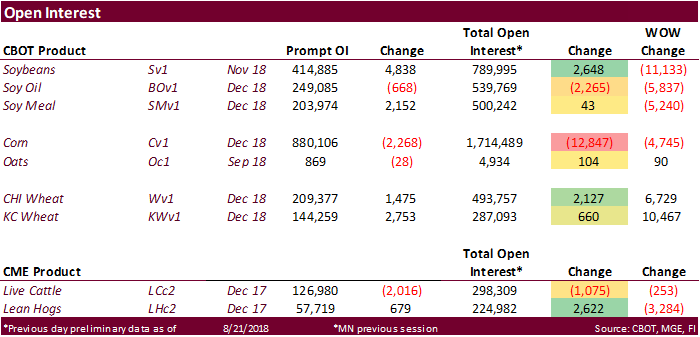

Corn.

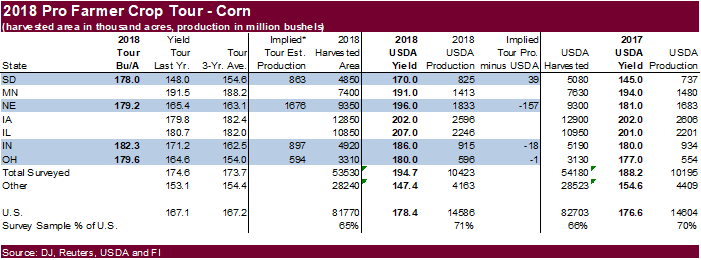

· Day two of the crop tour suggests implied corn production is a touch below USDA and soybeans slightly above. See what today brings. So far overall corn production could be trimmed by USDA, in our opinion.

· IN could have an early start to its corn harvest season.

- Day two of the US ProFarmer Crop Tour showed corn yields up from a year ago and above average. NE was pegged at 179.2 bu/ac, up from 165.4 in 2017 and average of 163.1 bu/ac. IN was projected sharply higher than a year ago at 179.6 bushels per acre, above 164.6 for 2017 and average of 154.0 bu/ac.

- Note most NE crop tour corn yields in the past were thought to be underestimated as many of the field stops included unirrigated areas opposed to irrigated fields.

- Day one of the US ProFarmer Crop Tour showed South Dakota corn yields up from a year ago and above average. SD was pegged at 178.0 bu/ac, up from 148.0 in 2017 and average of 154.6 bu/ac. Ohio were projected sharply higher than a year ago at 179.6 bushels per acre, above 164.6 for 2017 and average of 154.0 bu/ac.

- Final crop tour results will be out Friday, August 24.

- Baltic Dry Index decreased 1 point or 0.1 percent to 1735 points.

- China has turned to Chile for pork imports.

- China’s Lianyungang culled 14,500 hogs as of Aug 20 after finding African swine fever.

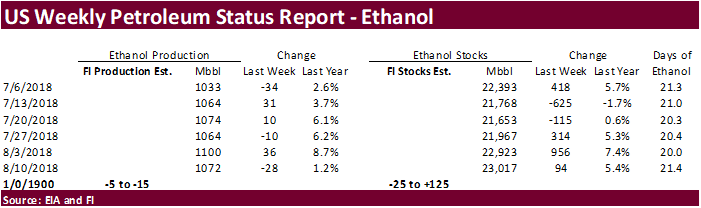

- A Bloomberg survey looks for weekly ethanol production to increase to 1.084 versus 1.072 last week and stocks to decrease to 22.788 from 23.017 last week.

· None reported.

· China sold about 63.7 million tons of corn out of reserves this season. Another 4 million tons will be offered late this week.

Soybean complex.

· The soybean complex is lower ahead of the 2-day US/China trade talks starting today, and large US crop production prospects.

· The Brazilian real is tanking, down for the sixth consecutive day. It traded at 4.075 reals/USD.

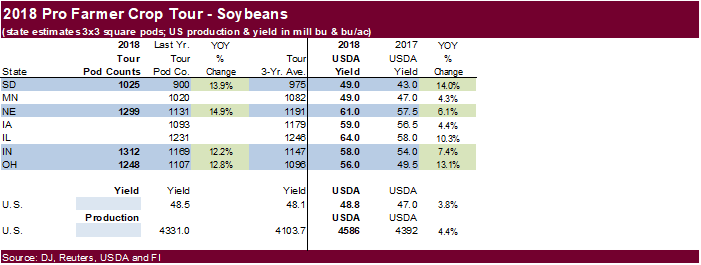

· Day two of the crop tour suggests implied corn production is a touch below USDA and soybeans slightly above. See what today brings.

- Day two of the US ProFarmer Crop Tour showed IN soybean pods in a 3-by-3 foot area averaged 1,312, above 1169 pods a year ago and the three-year average of 1147 pods. Pods in NE averaged 1,299 pods, up from 1131 pods in 2017 and the three-year average of 1191. See our table below

- Day one of the US ProFarmer Crop Tour showed South Dakota soybean pods in a 3-by-3 foot area averaged 1,024.7, above 900.0 pods a year ago and the three-year average of 975.1 pods. Pods in Ohio averaged 1,248.2 pods, up from 1,107.0 pods in 2017 and the three-year average of 1,095.8.

- Final results will be out Friday, August 24. Follow the Pro Farmer Midwest Crop Tour here on Twitter #pftour18

- Strategie Grains looks for a 7-year high EU soybean meal import season of 20.2MMT.

· Malaysia is on holiday.

· Rotterdam oils were lower and SA soybean meal when imported into Rotterdam $6.00-$8.00/short ton lower.

· China cash margins were last 89 cents/bu on our analysis, unchanged from the previous session, compared to 97 cents late last week, and 96 cents last year.

· Offshore values were suggesting a lower lead for US soybean meal by $0.30 and lower lead for soybean oil by 12 points.

- China sold 13,021 tons of rapeseed oil at auction from state reserves at an average price of 6,038 yuan per ton ($878.38/ton), 21.6 percent of what was offered.

- China sold 74,666 tons of 2013 soybeans at auction from state reserves at an average price of 3,020 yuan per ton ($439.34/ton), 25.5 percent of what was offered. Nearly 1.3MMT has been sold this season.

- China failed to sell any of the 17,477 tons of soybean oil at auction from state reserves.

- Iran seeks 30,000 tons of sunflower oil on September 24.

· Follow through selling was noted this morning in US wheat amid Russia grain production potential and cheaper supplies by major competitors.

· Germany plans to give out 340 million euros in aid to producers after production of wheat and many other agriculture commodities declined. Livestock sector is in bad shape as well. One group was seeking a billion euros.

· DVB, Germany’s grain lobby, looks for the grain harvest to decline 22 percent this year to 35.6 million tons.

· EU December wheat was 2.50 euros lower at 204.25 euros, at the time this was written.

· Agritel expects 2018 French soft wheat exports to fall this year as they project the soft wheat production at 34.2 million tons, 12% protein.

· Agritel looks for Russia 2018-19 wheat exports to decline to 31.5 million tons from the record 42MMT last year. If they are correct, US exports could increase 50-150 million bushels in 2018-19.

· Water levels on the Danube dropped to record lows on three sections of the river in Hungary.

· Ukraine exported 4.6 million tons of grain so far this season, down from nearly 5 million tons a year ago.

· The quality of the Ukraine wheat is poorer than most years and traders look for the share of milling wheat to fall below 45 percent, down from 55 percent last year. The AgMin has 13MMT milling wheat out of 25MMT.

- Note Eastern Australia’s rainfall potential for late this week remains very good.

Export Developments.

· China sold 19,442 tons of 2013 imported wheat at 2,244 yuan per ton ($326.45/ton), 1.2 percent of what was offered.

- Japan in a SBS import tender passed on 120,000 tons of feed wheat and 200,000 tons of barley for arrival by January 31.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on August 29 for arrival by January 31.

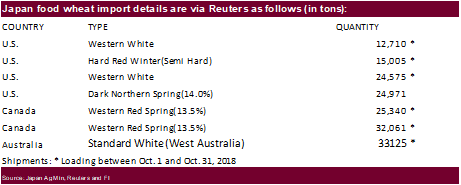

· Japan seeks 167,787 tons of food wheat.

· Jordan seeks 120,000 tons of feed barley on August 28.

· Jordan seeks 120,000 tons of hard milling wheat on Aug 29 for Nov/Dec shipment.

Rice/Other

· Results awaited: Egypt’s ESIIC seeks 100,000 tons (150k previously) of raw sugar for shipment within the first half of September and two 50,000-ton shipments from September 15-Oct 15.

· Thailand plans to sell 120k tons of raw sugar on Aug. 22.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.