From: Terry Reilly

Sent: Friday, August 31, 2018 9:52:07 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 08/31/18

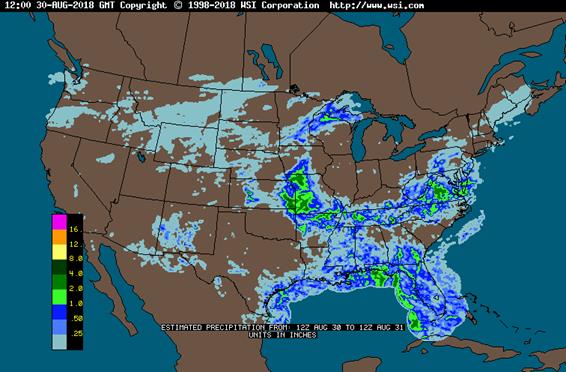

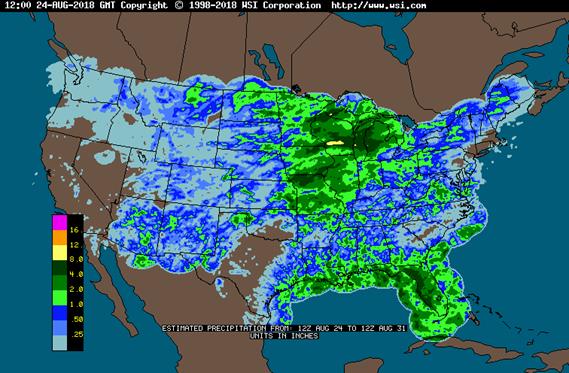

・ 6-10 day is drier for the eastern Midwest and 11-15 day is drier for the southern Great Plains and central Midwest.

・ In the US, good rain fell across eastern Kansas into Missouri and the northern Delta.

・ A large part of the western Corn Belt and northern Illinois will see frequent rounds of showers and thunderstorms through the first ten days of September, resulting in some flooding.

・ A mix of rain and sunshine is expected across the Delta and southeastern states through September 7.

・ Not much follow up rain is expected in Western Australia this weekend or next week. New South Wales and southeastern Queensland will get rain Thursday into Friday with a few showers early next week.

・ Dry conditions are raising planting and establishment concerns for central and eastern Ukraine into the middle and lower Volga River Basin, Kazakhstan and Russia’s Southern Region.

・ Canada’s Prairies will remain dry from southeastern Alberta through central and southern Saskatchewan through September 7.

・ Northern and western Europe weather will see below normal precipitation through early September.

Source: World Weather and FI

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Fri 75% cvg of up to 0.75”

and local amts to 1.50”

with some 1.50-4.0”

amts from central Ia.

to north Mo.; far NW

and far SE driest

Fri-Sat 70% cvg of up to 0.60”

and local amts to 1.20”

with some 1.20-3.0”

amts in north Il.

Sat-Sun 65% cvg of up to 0.75”

and local amts to 1.50”

with some 1.50-4.0”

amts from Neb. to Wi.;

far NW driest

Sun-Mon 60% cvg of up to 0.65”

and local amts to 1.50”;

north Il. wettest

Mon-Tue 80% cvg of up to 0.75”

and local amts to 2.0”;

far NW and far SE

driest

Tue-Sep 7 15-35% daily cvg of

up to 0.50” and locally

more each day;

wettest north

Wed-Sep 6 75% cvg of up to 0.75”

and local amts to 1.75”

Sep 7 20% cvg of up to 0.30”

and locally more

Sep 8 20% cvg of up to 0.30”

and locally more

Sep 8-10 70% cvg of up to 0.75”

and local amts to 1.50”

Sep 9-11 75% cvg of up to 0.65”

and local amts to 1.30”

Sep 11-13 10-25% daily cvg of

up to 0.30” and locally

more each day

Sep 12-13 10-25% daily cvg of

up to 0.30” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Sat 20-40% daily cvg of 55% cvg of up to 0.75”

up to 0.40” and locally and local amts to 2.0”;

more each day Carolinas and Va.

driest

Sun-Mon 60% cvg of up to 0.75”

and local amts to 1.50”;

wettest south

Sun-Mon 15-30% daily cvg of

up to 0.50” and locally

more each day; south

and west wettest

Tue 20% cvg of up to 0.35”

and locally more

Tue-Wed 10-25% daily cvg of

up to 0.30” and locally

more each day;

wettest south

Wed-Sep 10 5-20% daily cvg of up

to 0.30” and locally

more each day

Sep 6-10 5-20% daily cvg of up

to 0.35” and locally

more each day

Sep 11-13 10-25% daily cvg of 10-25% daily cvg of

up to 0.30” and locally up to 0.40” and locally

more each day more each day

Source: World Weather and FI

FRIDAY, AUG. 31:

- Malaysia on holiday; No palm oil futures trading on Bursa Malaysia Derivatives

- Statistics Canada’s domestic crop production report for July, 8:30am ET

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

MONDAY, SEPT. 3:

- U.S., Canada Labor Day public holidays

- Corn, soy, wheat on CBOT halted until 8pm ET

- Raw sugar, arabica coffee, cotton closed on ICE Futures U.S. in New York

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

- Russia’s Agriculture Ministry expected to meet to discuss grain exports

- Cargo surveyors Intertek, AmSpec and SGS release their respective data on Malaysia’s palm oil exports for August

- Honduran Coffee Institute’s export data for August

- Costa Rica coffee exports data

- Ivory Coast weekly cocoa arrivals

TUESDAY, SEPT. 4:

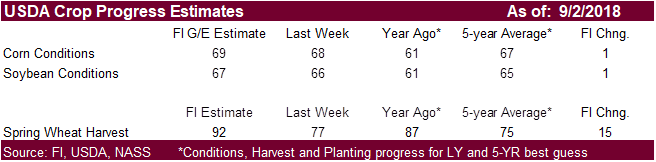

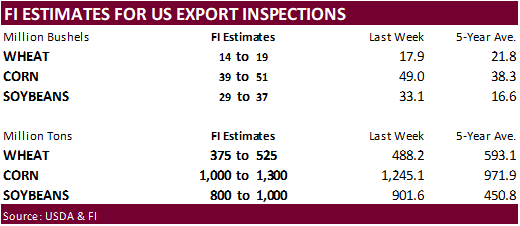

- USDA weekly corn, soybean, wheat export inspections, 11am; USDA weekly crop progress report, 4pm (delayed from Monday because of Labor Day holiday)

- New Zealand dairy auction on Global Dairy Trade online market starts ~7am ET (~noon London, ~11pm Wellington)

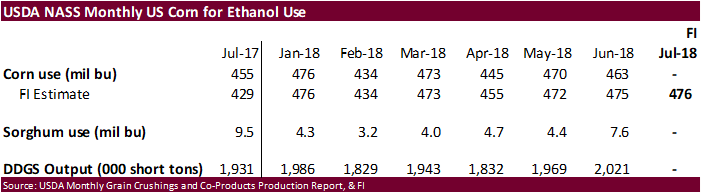

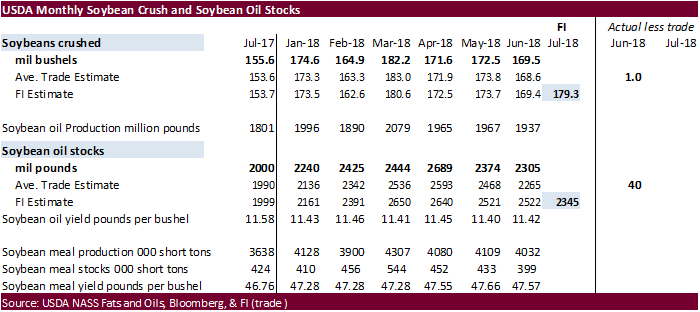

- USDA soybean crush for July, 3pm

- UN Climate Change Conference in Bangkok, Sept. 4-9

- Malaysian Rubber Glove Manufacturers Association hosts International Rubber Glove Conference and Exhibition in Kuala Lumpur, Sept. 4-6

WEDNESDAY, SEPT. 5:

- 9th Annual Kingsman Asia Sugar Conference in New Delhi, Sept. 5-6

- Indian Sugar Mills Association President Gaurav Goel, Intl Sugar Organization Executive Director Jose Orive due to speak

- Rabobank 2019 market outlook seminar in Kuala Lumpur

- Projections include palm oil, soy; Global Head of Financial Markets Research Jan Lambregts, analyst Oscar Tjakra due to speak

- UN Climate Change Conference in Bangkok, Day 2

- Intl Rubber Glove Conference in Kuala Lumpur, Day 2

THURSDAY, SEPT. 6:

- Trump administration awaits Sept. 6 end of public comment period before it potentially proceeds with next round of tariffs on $200b Chinese goods; China expected to retaliate

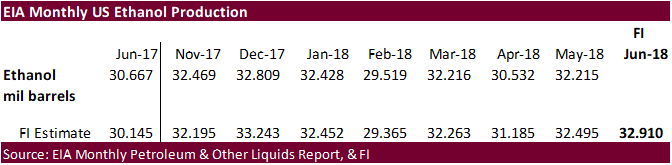

- EIA U.S. weekly ethanol inventories, output, 11am (delayed from Wednesday because of Labor Day holiday)

- Statistics Canada’s domestic crop stockpile report for July, 8:30am ET

- FAO Food Price Index for August, 4am

- The Russian Grain Union hosts conference in Moscow

- Agriculture Ministry’s director for food markets Anatoly Kutsenko, director of crop department Pyotr Chekmarev expected to attend

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- UN Climate Change Conference in Bangkok, Day 3

- Kingsman Asia Sugar Conference in New Delhi, final day

- Intl Rubber Glove Conference in Kuala Lumpur, final day

FRIDAY, SEPT. 7:

- Brazil on public holiday

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am (delayed from Thursday because of Labor Day holiday)

- Guatemala’s National Coffee Association’s export data for August

- FranceAgriMer weekly updates on French crop conditions

- UN Climate Change Conference in Bangkok, Day 4

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

SATURDAY, SEPT. 8:

- China’s General Administration of Customs releases agricultural commodity trade data for August (preliminary), including soybean imports

- UN Climate Change Conference in Bangkok, Day 5

Bloomberg Bull/Bear Survey (taken Wed.)

- Soybeans: Bullish: 1 Bearish: 10 Neutral: 4

- Wheat: Bullish: 9 Bearish: 4 Neutral: 1

- Corn: Bullish: 7 Bearish: 7 Neutral: 1

- Raw Sugar : Bullish: 4 Bearish: 1 Neutral: 2

- White sugar: Bullish: 3 Bearish: 2 Neutral: 2

- White-sugar premium: Widen: 1 Narrow: 4 Neutral: 2

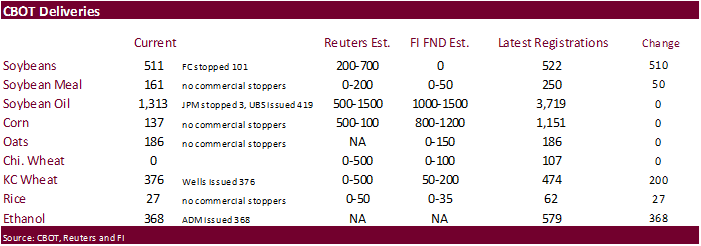

- Ethanol up 368 to 579

- Soybeans up 510 to 522

- Soybean meal up 50 to 250, Owensboro

- Rice up 27 to 62

- KC wheat up 200 to 474

・ US stocks are mixed, USD higher, WTI crude lower, and gold higher, at the time this was written.

・ China’s factory orders for Aug were better than expected.

Corn.

- Corn is higher in part to short covering after FC lowered their US yield estimate from last month and lower than expected Canadian grain production estimates.

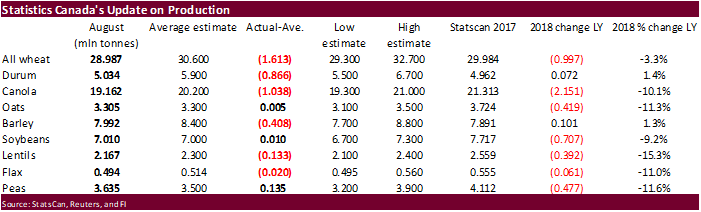

- Statistics Canada reported 2018 barley production at 7.992 million tons, 408,000 tons below a Reuters trade estimate and 101,000 tons above 2017.

- Funds are shoring up positions as the month soon ends.

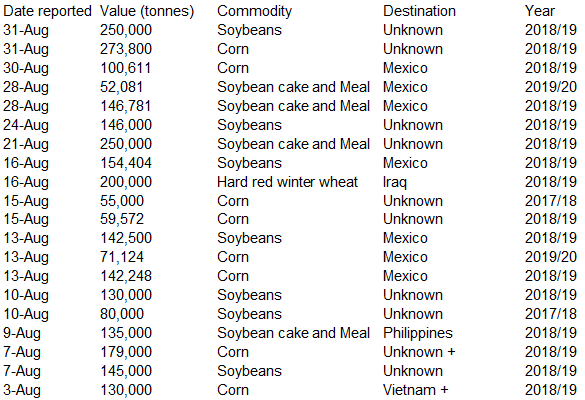

- Under the 24-hour announcement system, USDA reported 273,800 tons of corn to unknown for the 2018-19 marketing year.

- INTL FCStone released their September estimates ahead of the U.S. holiday for the U.S. soy and corn crop. They lowered the estimate for the U.S. 2018 corn crop to 177.7 bu/acre yield from 178.1 bu/acre last month and production to 14.532 billion bu from 14.562 billion bu.

- We are hearing Commodity Weather group is at 179.6 bu/ac.

- Baltic Dry Index fell 2.2 percent to 1,579 points, a 7-week low.

- China banned transportation of live hogs from infected provinces.

- China corn hit a 30-month high.

China January futures

- Under the 24-hour announcement system, USDA reported 273,800 tons of corn to unknown for the 2018-19 marketing year.

・ China sold 1.119 million tons corn at 1,431 yuan per ton ($209.50/ton), 30 percent of what was offered. Yesterday China sold 2.615 million tons corn at 1,557 yuan per ton ($227.79/ton), 66 percent of what was offered.

・ China sold about 71 million tons of corn out of reserves this season. Another 8 million tons of China corn reserves will be offered next week.

Soybean complex.

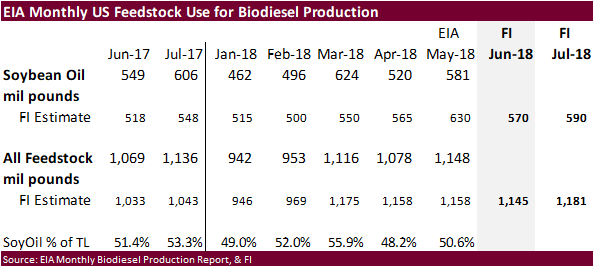

・ The soybean complex is mixed with end of month positioning. Soybeans are higher. Canada’s canola crop could fall 10 percent from the previous year according to StatsCan. We think traders had already worked in a high yield estimate from the FC Stone August yield and production survey. People are ignoring comments that additional US tariffs on China imports could kick in next week. The USD is higher. Argentina’s currency is weaker while Brazil’s real is rebounding. Soybean meal and oil traded two-sided on lack of direction before buying in meal came in about a half hour into the day session on expectations over short China soybean meal supplies during late Q4 and Q1 2019.

・ A recent presentation by a China representative in KC this week suggested an 86MMT import projection for China soybean imports. This could be achievable if China overhauled their compound feed equations and cut back on animal units. With parts of South America in turmoil, there

・ Yesterday U.S. President Trump said he was ready to support $200 billion USD in tariffs as early as next week. This along with the higher FCStone numbers will further pressure the overnight trade.

- Under the 24-hour announcement system, USDA reported 250,000 tons of soybeans to unknown for the 2018-19 marketing year.

- Statistics Canada reported 2018 canola production at 19.162 million tons, 1.038 million below a Reuters trade estimate and 2.151 million tons below 2017.

- A significant frost and freeze event is expected in Canada’s Prairies Tuesday and Wednesday.

- SA business was slow this week up until Friday.

- Argentina’s currency hit another record low against the USD this morning. The central bank increased the interest rate up to 60 percent from 45 percent after the International Monetary Fund (IMF) called for stronger monetary and fiscal policies. Argentina asked the IMF to release some money from its $50 billion financing facility. (Reuters). Bond spreads increased, and five-year credit default swaps rose 43 bps in early trading to 696 bps.

・ A report issued by the USDA Attaché in Argentina lowering soybean production to 36 million tons on drought, USDA is at 37 million tons on the last WASDE report.

・ Malaysia is on holiday.

・ AmSpec and ITS reported August palm exports improved during the past five days, by estimated exports at 1.073 and 1.074 million tons, respectively, up 4.0% and 3.1% from the previous month.

・ Rotterdam oils were higher and SA soybean meal when imported into Rotterdam mixed.

・ China cash margins were last 85 cents/bu on our analysis, up 1 cent from previous session, and compares to 84 cents late last week, and 96 cents last year.

・ Offshore values were suggesting a higher lead for US soybean meal by $1.00 ($4.40 higher for the week to date) and lower lead for soybean oil by 22 points (44 lower for the week to date).

- Under the 24-hour announcement system, USDA reported 250,000 tons of soybeans to unknown for the 2018-19 marketing year.

・ South Korea seeks 15,000 tons of non-GMO soybeans on September 4 for Nov/Dec arrival.

- USDA seeks 5,000 tons of refined oil for the export program on September 5 for October shipment.

- Iran seeks 30,000 tons of sunflower oil on September 24.

・ China plans to suspend rapeseed oil sales from reserves on September 10. The remaining stocks of imported rapeseed and soybean oil will be auction off through September 6.

- China sold about 1.35MMT of soybeans out of reserves this season.

Wheat

- Higher protein and lower production compared to last year is the theme for Canadian wheat. Statistics Canada reported 2018 all-wheat production at 28.987 million tons, 1.613 million below a Reuters trade estimate and 997,000 tons below 2017. Durum wheat was reported at 5.037 million tons, 866,000 below the trade.

・ Canada and the US are closed Monday for trading.

・ Ukraine exported about 6MMT of grain so far this season, 600,000 tons less than year ago.

・ Dry conditions are raising planting and establishment concerns for central and eastern Ukraine into the middle and lower Volga River Basin, Kazakhstan and Russia’s Southern Region.

・ Western Argentina is still very dry.

Export Developments.

・ Reuters noted Indonesian flour millers bought 60,000 ton of wheat from the Black Sea region for shipment in October/November at around $250 a ton, c&f. Thailand earlier this week bought 50,000 tons of US white, hard and spring varieties of wheat. U.S. Soft White wheat was quoted in Asia this week at $270-$272 a ton, including cost and freight (C&F), Hard Red Winter wheat at $275-$280 a ton and Dark Northern Spring wheat at $290 a ton.

・ Results awaited: Note Taiwan seeks 110,500 tons of US milling wheat from the US on August 31 for October/November shipment.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 5 for arrival by January 31.

- Syria’s General Establishment for Cereal Processing and Trade (Hoboob) seeks 200,000 tons of soft bread wheat from Russia, Romania or Bulgaria, with shipment sought between Oct. 15 and Dec. 15. The deadline is Sept. 17 and requires payment in Syrian pounds.

- Ethiopia seeks 200,000 tons of milling wheat on September 18 for shipment two months after contract signing.

Rice/Other

・ The Philippines may go away from capping rice imports to help ease inflation.

・ The Philippines will import 132,000 tons of additional rice soon.

・ Results awaited: South Korea seeks 92,783 tons of rice on Aug. 31 for Nov/Dec arrival.

TONNES(M/T) GRAIN TYPE ARRIVAL/PORT

10,000 Brown medium Nov 30/Gwangyang

10,000 Brown medium Dec 31/Busan

20,000 Brown medium Dec 31/Gunsan

20,000 Brown medium Dec 31/Mokpo

20,000 Brown medium Dec 31/Donghae

12,783 Brown long Nov 30/Masan

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.