From: Terry Reilly

Sent: Wednesday, September 12, 2018 8:21:47 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 09/12/18

PDF attached

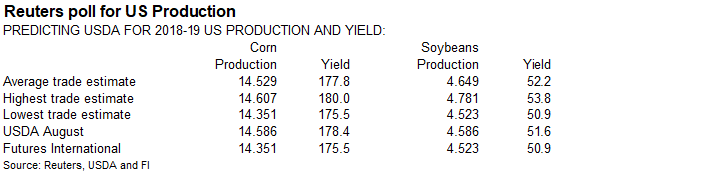

Bloomberg estimates for September USDA reports

US supply

|———-Survey Results———–|USDA

2018-19 Crop: | Avg | Low | High | Aug.

Corn | 14,516| 14,225| 14,750| 14,586

Corn Yield | 177.6| 174.0| 180.0| 178.4

Soybeans | 4,643| 4,523| 4,781| 4,586

Soybean Yield | 52.3| 50.9| 53.8| 51.6

Analyst |——-Corn——–|Soybean

Estimates: | Output | Yield | Output | Yield

Futures Int’l | 14,351| 175.5| 4,523| 50.9

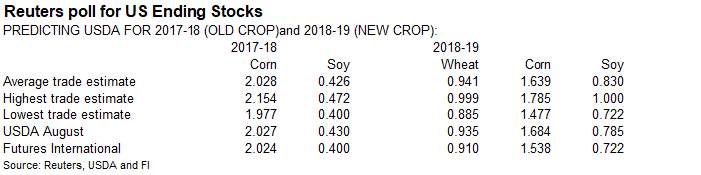

US ending stocks

|———-Survey Results———–|USDA

2018-19 Crop: | Avg | Low | High | Aug.

Corn | 1,614| 1,210| 1,785| 1,684

Soybeans | 828| 722| 1,000| 785

Wheat | 949| 885| 1,077| 935

2017-18 Crop: |

Corn | 2,022| 1,953| 2,154| 2,027

Soybeans | 426| 397| 506| 430

| 2018-19|2017-18

Analyst Estimates: | Corn | Soybeans |Wheat | Corn |Soybeans |

Futures Int’l | 1,538| 722| 910| 2,024| 400|

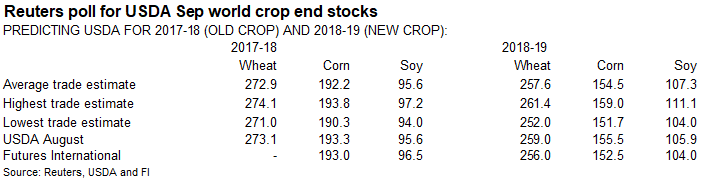

World stocks

|———-Survey Results———–|USDA

2018-19 Ending | | | |

Stocks: | Avg | Low | High | Aug.

Corn | 154.3| 152.0| 159.0| 155.5

Soybeans | 107.3| 104.0| 111.1| 105.9

Wheat | 257.4| 252.0| 261.4| 259.0

2017-18 Ending |

Stocks: |

Corn | 192.0| 188.0| 193.8| 193.3

Soybeans | 95.5| 94.0| 97.2| 95.6

Analyst | 2018-19|2017-18

Estimates: | Corn | Soybean | Wheat | Corn |Soybean

Futures Int’l | 152.5| 104.0| 256.0| 193.0| 96.5

Source: Bloomberg and FI

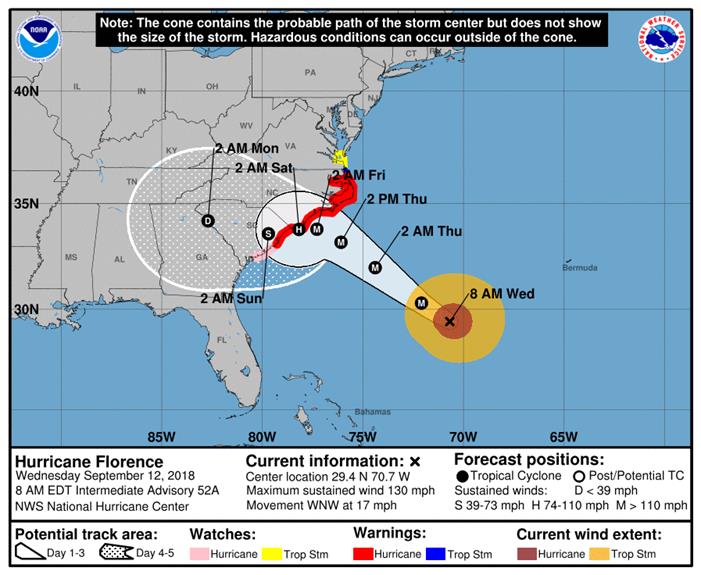

- Florence’s prediction path shifted south and encumbrances a wider destruction area.

- The GFS models for the storm are converging with the European models with the system very close to the North Carolina coast Thursday and then slowly shifts south to near the South Carolina coast by Sunday.

- Pockets of heavy rain is forecast for most parts of China’s northeast and north Wednesday-Thursday.

- The North China Plains and east central China crop areas are still experiencing drought conditions, increasing maturity rates and yield losses for summer grains. If the drought continues, it could impact winter wheat seedings.

- Alberta, Canada will experience a couple of cold air shots from mid- to late-week this week resulting in snow and freezing temperatures.

- Australia will see limited rainfall with exception of the coastal areas this week.

- Rain this week will be limited from France to Poland. France, Italy, southern Germany, Australia and Czech Republic all have an opportunity for rain next week.

- The lower Volga River Basin needs additional rain.

- This week a large portion of the Midwest will dry down. It will remain wet across the northern spring wheat states into the upper WBC. HRW wheat states will see very little rain.

- Argentina will be wet this week while southern Brazil turns wet mid-week into next week.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Wed Mostly dry with a few

insignificant showers

Wed 15% cvg of up to 0.75”

and local amts to 1.35”;

far NW wettest

Thu-Sat 10-20% daily cvg of

up to 0.30” and locally

more each day;

wettest NW

Thu-Mon 5-20% daily cvg of up

to 0.25” and locally

more each day;

wettest east

Sun-Sep 18 80% cvg of up to 0.75”

and local amts to 1.50”

Sep 18-19 40% cvg of up to 0.35”

and locally more

Sep 19 20% cvg of up to 0.35”

and local amts to 0.80”;

wettest south

Sep 20 15% cvg of up to 0.20” 15% cvg of up to 0.20”

and locally more and locally more

Sep 21-22 75% cvg of up to 0.75”

and locally more

Sep 21-23 80% cvg of up to 0.75”

and locally more

Sep 23-25 10-25% daily cvg of up

to 0.40” and locally

more each day

Sep 24-25 10-25% daily cvg of

up to 0.40” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

-Wed 50% cvg of up to 0.40” 70% cvg of up to 0.75”

and local amts to 1.0”; and local amts to 2.0”;

wettest south east-central and NE

Ms. to north Ala. driest

Thu-Sat 10-25% daily cvg of

up to 0.35” and locally

more each day;

wettest south

Sun-Sep 18 Up to 20% daily cvg of 5-20% daily cvg of up

up to 0.30” and locally to 0.30” and locally

more each day; some more each day

days may be dry

Thu-Mon 45% cvg of 5.0-12.0”

with a few bands of

12.0-20.0” and locally

more in central and

east N.C. and SE Va.

with up to 2.50” and

locally more elsewhere;

Rain is from

Hurricane Florence

Sep 18-20 5-20% daily cvg of

up to 0.30” and locally

more each day

Sep 19-20 30% cvg of up to 0.50”

and locally more;

wettest north

Sep 21-25 Up to 20% daily cvg of 5-20% daily cvg of up

up to 0.30” and locally up to 0.30” and locally

more each day more each day

Source: World Weather and FI

WEDNESDAY, SEPT. 12:

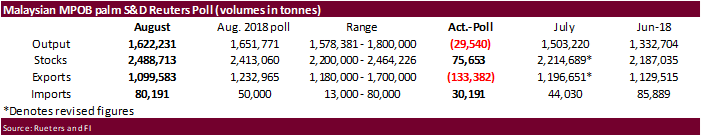

- Malaysian Palm Oil Board (MPOB) data on stockpiles, exports, production for August, 12:30am ET (12:30pm Kuala Lumpur)

- Cargo surveyor SGS data on Malaysia’s Sept. 1-10 palm oil exports, 3am ET (3pm Kuala Lumpur)

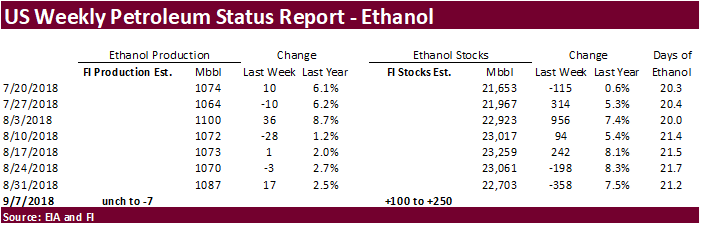

- EIA U.S. weekly ethanol inventories, output, 10:30am

- USDA releases monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon

- FranceAgriMer updates estimates for grain crops

THURSDAY, SEPT. 13:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- U.S. National Weather Service’s Climate Prediction Center updates its monthly forecast for El Nino, 9am

- Strategie Grains monthly report on European market outlook

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- EARNINGS: Fonterra Co-operative Group

FRIDAY, SEPT. 14:

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly updates on French crop conditions

- Malaysia to announce crude palm oil export tax for October

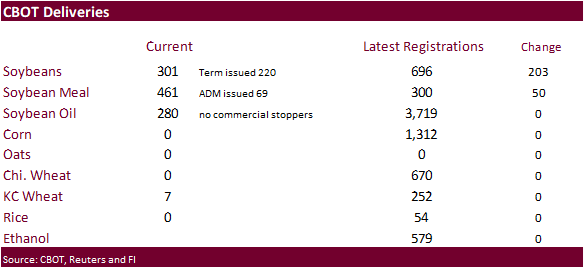

- Soybeans up 203 to 696 (+220 CAHOKIA, IL C LDC; -17 Chicago, IL – COFCO)

- Soybean meal up 50 to 300 (+50 GILMAN, IL C INCOBRASCA)

The CME Group increased margins for hog and Brazilian real futures.

https://www.cmegroup.com/content/dam/cmegroup/notices/clearing/2018/09/Chadv18-362.pdf

・ US stocks are lower, USD lower, WTI crude higher, and gold lower, at the time this was written.

・ US PPI Final Demand (Y/Y) Aug: 2.8% (est 3.2% ; prev 3.3%)

– US PPI Final Demand (M/M) Aug: -0.1% (est 0.2% ; prev 0.0%)

– US PPI Ex-Food/Energy (Y/Y) Aug: 2.3% (est 2.7% ; prev 2.7%)

– US PPI Ex-Food/Energy (M/M) Aug: -0.1% (est 0.2% ; prev 0.1%)

– US PPI Ex-Food/Energy/Trade (Y/Y) Aug: 2.9% (prev 2.8%)

– US PPI Ex-Food/Energy/Trade (M/M) Aug: 0.1% (prev 0.3%)

・ Canada Capacity Utilization Q2: 85.5% (est 86.9% ; prevR 83.7% ; prev 86.1%)

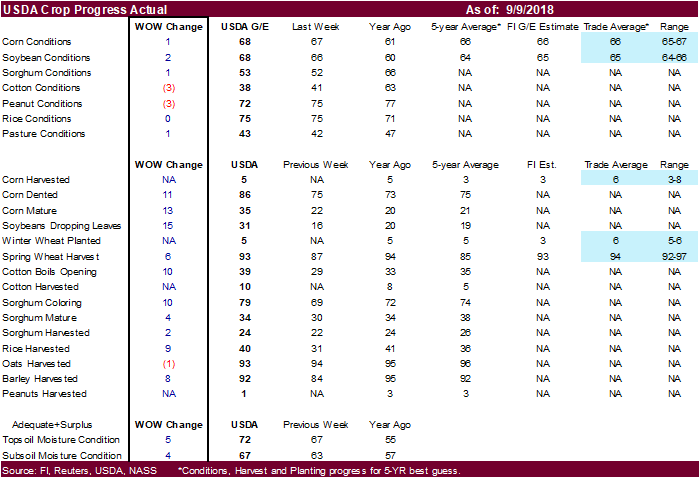

Corn.

- Corn prices lower on US crop progress and harvesting pressure.

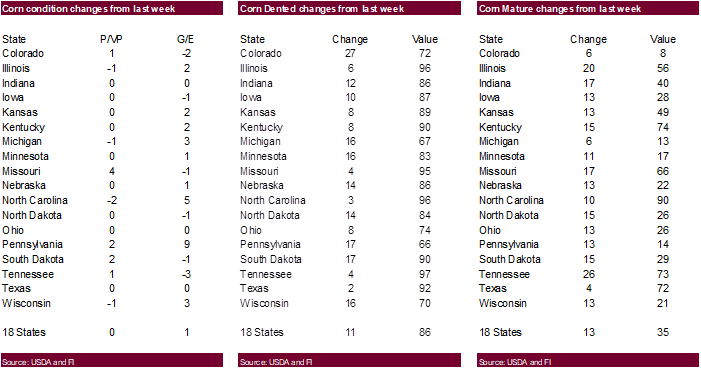

- USDA corn crop conditions increased 1 point in the combined G/E categories from the previous week to 68 percent, 2 points above a trade average.

- US corn harvest was reported at five percent complete, with TX leading the way, one point below a Reuters trade average and apparently matches last year and 5-year average.

- Today there is a possibility for USDA to reduce 2018 global corn production by 5MMT and 2018-19 corn ending stocks by 3 million tons. We look for a much smaller US yield than the trade at 175.5 versus 177.8 average. USDA was 178.4 in August. Recall US corn conditions declined in late July through mid-August.

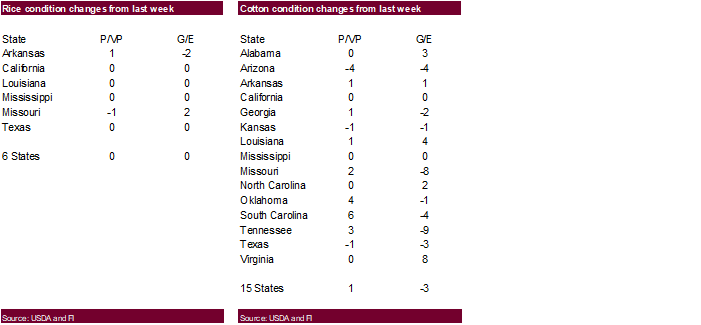

- Traders will be monitoring Hurricane Florence that will impact the Carolina’s, affecting several unharvested summer crops including cotton. Corn and other crop losses are inevitable.

・ Baltic Dry Index is last 1,439 down 43 points or 2.9% from last session.

・ China will sell another 8 million tons of corn September 13 and 14. China sold about 75.3 million tons of corn out of reserves this season.

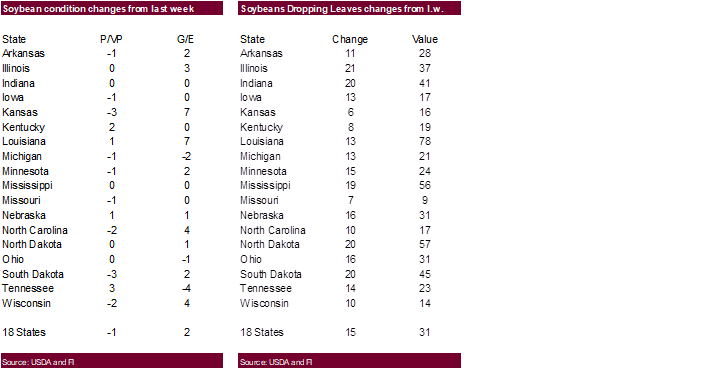

Soybean complex.

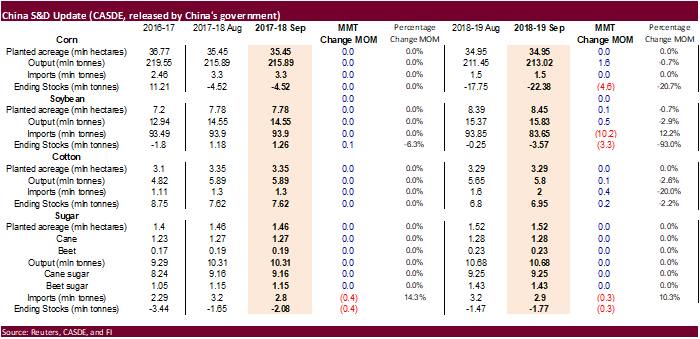

・ China’s CASDE showed a large reduction in soybean imports to reflect the trade war by 10.2MMT to 83.65 (USDA Aug 95/Attaché 94/CNGOIC 86), and at the same time widened the deficit in ending stocks to negative 3.57MMT from negative 0.25MMT).

- Traders will be monitoring Hurricane Florence that will impact the Carolina’s, affecting several unharvested summer crops including cotton.

・ Malaysia is back holiday and futures basis the November fell 29MYR to 2237, and cash was off $6.25 or 1.1% to $566.25/ton.

・ MPOB stocks came in much higher after August palm exports were reported much lower than trade expectations.

・ Cargo surveyor SGS reported month to date September 10 Malaysian palm exports at 415,275 tons, 127,774 tons above the same period a month ago or up 44%, and 18,603 tons above the same period a year ago or up 5%.

・ Rotterdam oils were lower and SA soybean meal when imported into Rotterdam $2.00-$4.00/ton lower.

・ Offshore values were suggesting a higher lead for US soybean meal by $0.30 and higher lead for soybean oil by 29 points.

- USDA in its September S&D update could lower new-crop global soybean production by 3 million tons and reduce stocks by 2 million tons. We look for US soybean production to decline from August rather increase like what much of the trade expects. Our soybean yield of 50.9 bushels per bushel is predicated on past September USDA projections versus a short trend yield and weighted crop condition in late August. Although crop conditions for US soybeans increased recently, they did decline at least three consecutive weeks around FH August. The trade average for the US soybean yield is 52.2 bu/ac, above USDA’s August estimate of 51.6.

- The trade should see EPA release RIN generation figures soon.

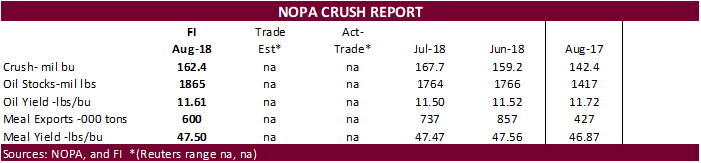

- US soybean crush downtime in August was a little lighter than normal, from what we hear. On September 17 the NOPA August crush report will be released. We are looking for a strong crush rate of 5.24 bushels per day (lowest for the crop-year), up from 4.59 bu/day a year ago and down from 5.41 bu/day during July. Our tentative August NOPA crush is 162.4 million bushels, up from 142.4 million a year ago. If realized the August 2018 crush rate would be down 3.2 percent from July. On average the daily August crush rate fell 5.8 percent over the past five years.

- China sold about 2.29 MMT of soybeans out of reserves this season.

・ Iran seeks sunflower oil.

・ Egypt’s General Authority for Supply Commodities (GASC) this Thursday seeks at least 30,000 tons of soyoil and 10,000 tons of sunflower oil. The agency will also accept offers of at least 10,000 tons of soyoil and 5,000 tons of sunflower oil in Egyptian pounds. It’s for arrival Oct. 16-31.

・ The CCC seeks 1540 tons of fully refined vegetable oil on September 18 for carious countries for Oct/Nov delivery.

- Iran seeks 30,000 tons of sunflower oil on September 24.

Wheat

・ US wheat is higher on fund short covering and the potential for USDA to lower global production later this morning.

・ US winter wheat planting progress was reported at 5 percent complete, a point below expectations.

・ Russia’s Grain Union sees the wheat crop at 68MMT, down from 85.9MMT year ago.

- Egypt seeks wheat for October 25-November 4 shipment. Lowest offer was $222.70/ton for Russian wheat.

- Algeria seeks 50,000 tons of wheat for November shipment.

- Japan in a SBS import tender bought 1,000 tons of barley for arrival by late February. They passed on feed wheat.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 19 for arrival by late February.

- Jordan received offers for feed barley.

- Jordan seeks 120,000 tons of wheat September 13.

- Syria’s General Establishment for Cereal Processing and Trade (Hoboob) seeks 200,000 tons of soft bread wheat from Russia, Romania or Bulgaria, with shipment sought between Oct. 15 and Dec. 15. The deadline is Sept. 17 and requires payment in Syrian pounds.

- Ethiopia seeks 200,000 tons of milling wheat on September 18 for shipment two months after contract signing.

- Morocco seeks 336,364 tons of US durum wheat on September 28 for arrival by December 31.

Rice/Other

・ The Philippines seeks an extra 250k tons of rice for Q4 and Q1 2019 shipment.

・ Iraq seeks 30,000 tons of rice from India on October 9 for LH October / FH November shipment.

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTC); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTC waives no privilege or confidentiality due to any mistaken transmission of this email.