From: Terry Reilly

Sent: Thursday, September 20, 2018 8:28:38 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 09/20/18

PDF attached

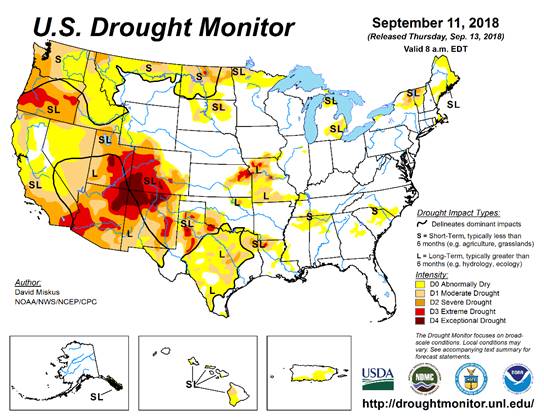

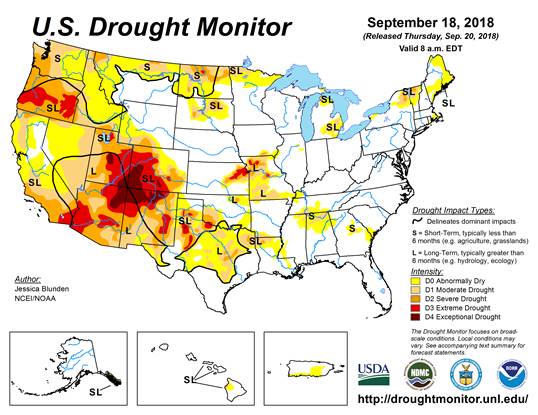

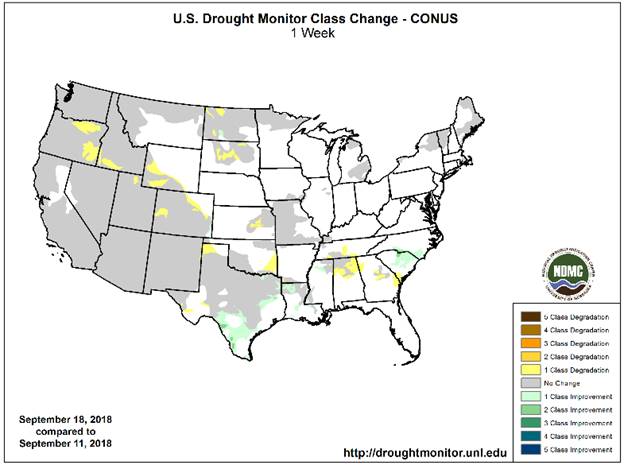

・ One more day of much warmer-than-normal temperatures and dry conditions will occur in most of the lower and eastern Midwest.

・ US harvesting delays will occur in a few parts of the US this week.

・ Frost and freezes may eventually develop in the northern most Midwest and a part of the northern Plains in late September.

・ HRW wheat country will see rain delaying plantings of winter wheat but the precipitation was welcome.

・ Canada’s Prairies will be cool and wet this week, delaying harvesting efforts.

・ Australia’s precipitation will remain limited this week.

・ Russia’s Volga River Basin could see additional rain will fall this week.

・ Europe will see limited rainfall through Thursday.

・ Brazil will see good rain this week from Mato Grosso do Sul and Paraguay to southern Minas Gerais, Parana, Santa Catarina and Parana.

・ Argentina will see a mixture of rain and sunshine.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

-Thu 80% cvg of 0.40-1.65”

and local amts to 3.25”

from east S.D. and NE

Neb. to central and

north Ia. and central

and NW Wisc. with up

to 0.75” and local amts

to 1.20” elsewhere; far

south driest

Thu-Fri 70% cvg of up to 0.35”

and local amts to 0.75”

Fri-Sat 15% cvg of up to 0.50”

and local amts to 1.0”;

SE Mo. wettest

Sat-Sun 20% cvg of up to 0.40”

and local amts to 1.0”;

mostly south

Sun-Tue 85% cvg of up to 0.75”

and local amts to 1.75”;

far NW driest

Mon-Sep 26 85% cvg of up to 0.75”

and local amts to 2.0”

Sep 26-27 55% cvg of up to 0.35”

and local amts to 0.85”

Sep 27-28 60% cvg of up to 0.35”

and local amts to 0.65”

Sep 28-29 Up to 20% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Sep 29-30 Up to 20% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Sep 30-Oct 2 60% cvg of up to 0.70”

and locally more

Oct 1-3 70% cvg of up to 0.70”

and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

-Thu Up to 20% daily cvg of 5-20% daily cvg of up

up to 0.30” and locally to 0.30” and locally

more each day; some more each day

days may be dry

Fri-Sun 85% cvg of up to 0.65” 10-20% daily cvg of

and local amts to 1.30”; up to 0.50” and locally

wettest north more each day; north

and west wettest

Mon-Tue 80% cvg of up to 0.75”

and local amts to 2.0”

Mon-Sep 26 80% cvg of up to 0.75”

and local amts to 1.75”

Sep 26-28 80% cvg of up to 0.75”

and local amts to 2.0”

Sep 27-Oct 1 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Sep 29-Oct 1 10-25% daily cvg of

up to 0.30” and locally

more each day

Oct 2-3 40% cvg of up to 0.35”

and locally more

Oct 2-4 35% cvg of up to 0.40”

and locally more

Source: World Weather and FI

THURSDAY, SEPT. 20:

- Intertek and AmSpec release their respective data on Malaysia’s Sept. 1-20 palm oil exports, 11pm ET Wednesday (11am Kuala Lumpur Thursday)

- SGS data for same period, 3am ET Thursday (3pm Kuala Lumpur Thursday)

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA red meat production for August, 3pm

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Intl Palm Oil Sustainability Conference in Kota Kinabalu, final day

FRIDAY, SEPT. 21:

- Ghana public holiday

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- USDA cattle-on-feed report for August, 3pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Registrations

Macros.

・ US stocks are higher, USD lower, WTI crude higher, and gold lower, at the time this was written.

・ China plans to impose import tariffs as soon as October. (Bloomberg)

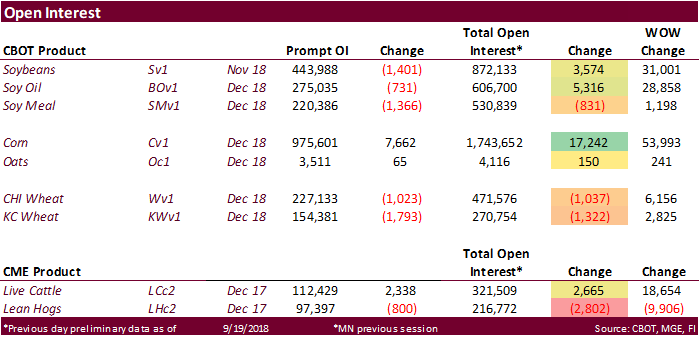

Corn.

・ Corn futures are higher on follow through short covering.

・ USDA export sales for corn were better than expected of 1.384 million tons.

・ Baltic Dry Index was up 23 points or 1.7% to 1396.

・ Reuters: CIF corn bids for September barges were bid 4 cents lower at 24 cents a bushel above Chicago Board of Trade December futures CZ8. Spot FOB offers held at around 43 cents over futures.

・ EU corn (futures) hit a 2-month low.

・ Ukrainian corn hit a 9-month low (Platts) of $168.50/ton.

・ USDA’s Attaché estimates Egypt will import 9.5 million tons of corn, up from 9.4 million a year earlier.

・ Weekly US ethanol production increased 31,000 barrels per day to 1.051 million, higher than trade expectations, 1.7 percent above the comparable period a year ago but 2.1% below 4 weeks earlier. US ethanol stocks decreased 148,000 barrels to 22.746, about in line with expectations.

・ The USDA Broiler Report showed eggs set in the US down 2 percent and chicks placed down slightly. Cumulative placements from the week ending January 6, 2018 through September 15, 2018 for the United States were 6.81 billion. Cumulative placements were up 1.4 from the same period a year earlier.

・ China sold 2,999,788 tons of corn at auction of state reserves at an average price of 1,559 yuan ($227.65) per ton, 75.45 percent of total corn available at the auction.

・ China will sell another 4 million tons of corn on Friday.

・ China sold about 83 million tons of corn out of reserves this season.

USDA Export Sales Text

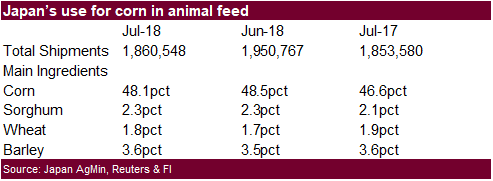

・ Corn: Net sales of 1,383,700 MT for 2018/2019 were reported for Mexico (344,600 MT, including decreases of 100 MT), South Korea (204,300 MT), Peru (148,900 MT, including 72,600 MT switched from unknown destinations), Japan (145,200 MT, including 44,900 MT switched from unknown destinations), and Costa Rica (135,900 MT, including decreases of 3,000 MT). For 2019/2020, net sales of 9,700 MT were reported for Mexico. Reductions were reported for El Salvador (9,000 MT) and Israel (700 MT). Exports of 1,077,700 MT were primarily to Mexico (398,900 MT), Japan (96,000 MT), Taiwan (86,900 MT), Saudi Arabia (73,800 MT), and Colombia (73,300 MT). Optional Origin Sales: For 2018/2019, new optional origin sales were reported for South Korea (69,000 MT) and unknown destinations (55,000 MT). The current outstanding balance of 1,089,000 MT is for South Korea (481,000 MT), unknown destinations (353,000 MT), Vietnam (130,000 MT), Saudi Arabia (70,000 MT), and Malaysia (55,000 MT).

・ Barley: No sales were reported during the week. Exports 100 MT reported were to Taiwan.

・ Sorghum: Net sales of 20,200 MT for 2018/2019 were reported for unknown destinations (10,200 MT) and Japan (10,000 MT). Exports of 1,700 MT were reported to Mexico.

・ Beef: Net sales of 15,900 MT reported for 2018 were up 47 percent from the previous week, but down 16 percent from the prior 4-week average. Increases were reported for Mexico (3,600 MT, including decreases of 100 MT), Hong Kong (3,000 MT, including decreases of 200 MT), South Korea (2,900 MT, including decreases of 300 MT), Japan (2,500 MT, including decreases of 1,200 MT), and Taiwan (1,600 MT). For 2019, net sales of 300 MT were reported for Japan (200 MT) and Taiwan (200MT). Exports of 17,300 MT were up 10 percent from the previous week and 3 percent from the prior 4-week average. The primary destinations were Japan (5,500 MT), South Korea (4,200 MT), Hong Kong (1,800 MT), Mexico (1,800 MT), and Taiwan (1,300 MT).

・ Pork: Net sales of 22,900 MT reported for 2018 were up 22 percent from the previous week, but down 2 percent from the prior 4-week average. Increases were reported primarily for Mexico (7,700 MT), Colombia (4,000 MT), South Korea (3,000 MT), Japan (2,700 MT), and Hong Kong (2,000 MT). For 2019, net sales of 2,500 MT were reported for Australia (2,400 MT) and South Korea (100 MT). Exports of 20,800 MT were up 11 percent from the previous week and unchanged from the prior 4-week average. The destinations were primarily Mexico (8,700 MT), Japan (3,900 MT), Hong Kong (1,600 MT), South Korea (1,600 MT), and Canada (1,500 MT).

Soybean complex.

・ Soybeans are slightly lower on Thursday as traders seek fresh news.

・ USDA export sales for soybeans were better than expected although we don’t see Argentina in the summary text. Soybean meal was on the lower end and soybean oil within expectations. Shipments of both products were ok.

・ Reuters: Soybean barges loaded this month were bid at a 7-cents-per-bushel discount to CBOT November futures SX8, 3 cents firmer than Tuesday. Spot soybean export premiums held at about 10 cents over futures.

・ Elevators out east could take North and South Dakota soybeans, if elevators are in fact turning some producers away.

・ JCI warned reducing animal feed may disrupt China’s pork supply. Reduction of soybean meal in animal feed rations by 2-3% could extend the growing period of hogs. JCI also mentioned China will continue to take previously booked US soybean cargos, crush it, and export the soybean meal. This does not make sense to us. In a Bloomberg article, it was noted about 400,000 tons out of 700,000-800,000 tons booked have been shipped and some cargoes have already unloaded for crushers including plants in Shandong, Guangdong and Guangxi.

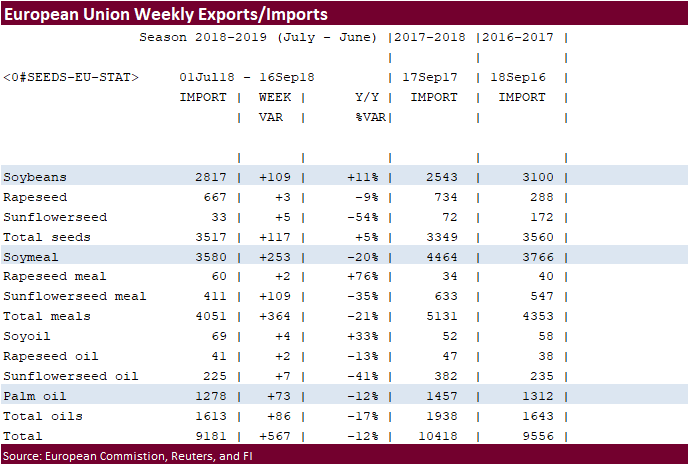

・ The European Union reported soybean import licenses since July 1 at 2.817 million tons, above 2.543 million tons a year ago. European Union soybean meal import licenses are running at 3.580 million tons for 2018-19, below 4.464 million tons a year ago. EU palm oil import licenses are running at 1.278 million tons for 2018-19, down from 1.457 million tons a year ago.

・ The market share for soybean exports to the EU has increased, but it’s a small total relative to the global trade balance.

・ India officials met with Chinese officials on Wednesday about opening exports to China, specifically soybean meal and other feed stuff.

・ Malaysian palm oil fell to a 3-year low.

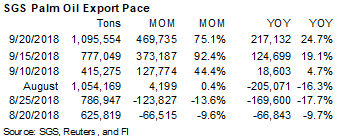

・ Cargo surveyor SGS reported month to date September 20 Malaysian palm exports at 1,095,554 tons, 469,735 tons above the same period a month ago or up 75%, and 217,132 tons above the same period a year ago or up 25%.

・ AmSpec reported palm exports up 73% and ITS up 79%.

・ Malaysia December palm oil was down 12. Malaysian cash palm oil was down $5.00.

・ A Reuters survey showed Indonesia palm oil production was seen at a multi-year high for August of 4.006 million tons, up from 3.897 million tons in July and compares to 3.587 million tons in August 2017.

・ Rotterdam oils were mixed and SA soybean meal when imported into Rotterdam higher.

・ Offshore values were suggesting a higher lead for US soybean meal by $3.60 and were lower lead in SBO by 10l.

・ Iran seeks 30,000 tons of sunflower oil on September 24.

・ China sold about 2.38 MMT of soybeans out of reserves this season.

USDA Export Sales Text

・ Soybeans: Net sales of 917,600 MT for 2018/2019 were reported for Mexico (165,600 MT, including decreases of 1,300 MT), Indonesia (90,500 MT, including 83,600 MT switched from unknown destination and decreases of 1,400 MT), Costa Rica (70,300 MT), Spain (66,900 MT, including 65,000 MT switched from unknown destinations and decreases of 200 MT), and Iran (66,500 MT, including 65,000 MT switched from unknown destinations). Reductions were reported for unknown destinations (28,000 MT) and China (4,000 MT). Exports of 800,900 MT were primarily to Mexico (140,900 MT), Spain (126,900 MT), Indonesia (119,600 MT), Iran (66,500 MT), and the Netherlands (65,200 MT). Optional Origin Sales: For 2018/2019, the current outstanding balance of 63,000 MT is for unknown destinations. Export for Own Account: The current export for own account outstanding balance is 61,600 MT, all Canada.

・ Soybean Cake and Meal: Net sales of 59,600 MT for 2017/2018 were up 71 percent from the previous week, but down 19 percent from the prior 4-week average. Increases were reported for Canada (12,300 MT), unknown destinations (10,300 MT), Indonesia (9,700 MT, including decreases of 100 MT), Colombia (9,600 MT, including 8,000 MT switched from unknown destinations and decreases of 800 MT), and Guatemala (5,700 MT, all switched from unknown destinations). Reductions were reported for El Salvador (1,700 MT) and Honduras (1,600 MT). For 2018/2019, net sales of 77,800 MT reported for the United Kingdom (30,000 MT), the Dominican Republic (16,000 MT), Israel (16,000 MT), Peru (15,000 MT), and Canada (10,800 MT), were partially offset by reductions for unknown destinations (13,200 MT) and Panama (9,600 MT). Exports of 224,200 MT were up 9 percent from the previous week and 11 percent from the prior 4-week average. The primary destinations were Mexico (53,300 MT), the Philippines (50,600 MT), Guatemala (24,100 MT), Canada (20,600 MT), and Colombia (20,400 MT).

・ Soybean Oil: Net sales of 9,600 MT for 2017/2018 were up noticeably from the previous week and 27 percent from the prior 4-week average. Increases were reported for Guatemala (6,000 MT), Mexico (3,300 MT), and Canada (200 MT). For 2018/2019, net sales of 8,600 MT were reported for the Dominican Republic (5,900 MT) and Mexico (2,700 MT). Exports of 10,000 MT were up noticeably from the previous week, but down 43 percent from the prior 4-week average. The primary destinations were the Dominican Republic (4,500 MT), Colombia (2,500 MT), and Mexico (2,300 MT).

Wheat

・ US wheat is lower following EU wheat.

・ USDA export sales for all-wheat of 468,400 tons were within expectations.

・ From Matt Pierce: “Weather in Australia remains a real issue moving forward with persistent dryness hampering wheat during key production cycle. Overnight temps in Victoria and NSW was below zero again but not expensive enough to cause new freeze chatter. The focus remains on dryness. AWZ traded +3.75 to $280.00 so far this morning via 100 lot block at 1.33 CST. This adds to yesterday’s 1.25 gains. Market continues to gain on cash price surge, technical hold of the 50-day MA and continued weather woes. Black sea wheat basis DEC settled +2.00 sitting at 248.50. Basis March gained 3.50 to 255.00. Looks like the Z/H spread is starting to follow the model from V/Z which is currently sitting at 15 bucks. . Nov has traded via blocks at 241, showing +1.25 from yesterday’s settlement. Black sea Corn continues to tumble -.50 yesterday at 168.00. The lifetime low of the contract is 165.50.”

・ USDA’s Attaché estimates Egypt will import 12.5 million tons of wheat, up from 12.3 million a year earlier.

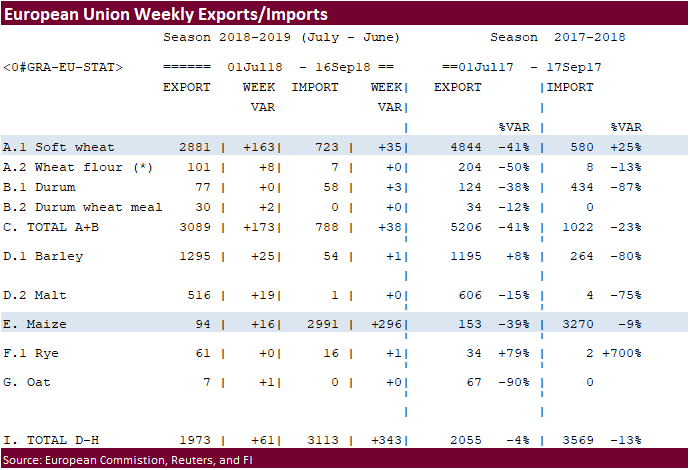

・ The European Union granted export licenses for 163,000 tons of soft wheat imports, bringing cumulative 2018-19 soft wheat export commitments to 2.881 million tons, well down from 4.844 million tons committed at this time last year.

・ The EU granted import licenses for 25,068 tons of wheat under import quota.

・ Ukraine 2019 winter grain plantings are at 20 percent, 1.4 million hectares, out of the projected 7.2 million. 7.24 million were planted in second half 2018.

・ China sold 2,631 tons of imported 2013 wheat at auction from state reserves at an average price of 2,231 yuan ($325.42) per ton, 0.3 percent of total wheat available at the auction.

・ Results awaited: Ethiopia seeks 200,000 tons of milling wheat for shipment two months after contract signing. Ethiopia got offers from 7 firms. Lowest offer was for 100,000 tons at $272.05/ton, c&f.

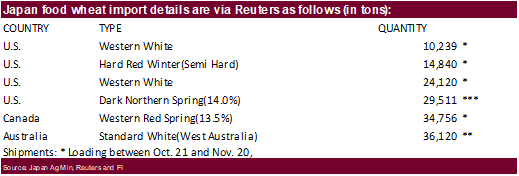

・ Japan bought 149,586 tons of wheat. Original details as follows:

・ Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 26 for arrival by late February.

・ Results awaited: Algeria seeks 75,000 tons of feed barley for November shipment.

・ Turkey seeks a total of 252,000 tons of red milling wheat for October 2-22 loading. It closes on September 22. The depreciation of the lira sent importers seeking Turkish wheat flour, causing them to restrict exports. But countries like Iraq that heavily depend on flour from Turkey may have to import from other countries.

・ Jordan seeks 120,000 tons of feed barley, optional origin, on September 26.

・ Jordan seeks 120,000 tons of feed wheat, optional origin, on September 27.

・ Iraq seeks 50,000 tons of wheat on September 23, with offers valid until September 27. Iraq needs wheat for four after Turkey restricted flour shipments.

・ Morocco seeks 336,364 tons of US durum wheat on September 28 for arrival by December 31.

Rice/Other

・ Mauritius seeks 9,000 tons of rice for delivery between Nov. 15, 2018, and March 31, 2019, set to close is Sept. 27.

・ Iraq seeks 30,000 tons of rice from India on October 9 for LH October / FH November shipment.

USDA Export Sales Text

・ Wheat: Net sales of 468,400 metric tons for 2018/2019 were up 21 percent from the previous week and 32 percent from the prior 4-week average. Increases were reported for the Philippines (80,000 MT), Indonesia (70,000 MT), Vietnam (61,000 MT), Thailand (55,100 MT), and South Korea (48,600 MT, including decreases of 1,500 MT). Reductions were for unknown destinations (27,200 MT), Costa Rica (4,000 MT), Peru (2,400 MT), and Honduras (1,900 MT). Exports of 315,100 MT were down 27 percent from the previous week and 20 percent from the prior 4-week average. The destinations were primarily to Japan (150,600 MT), Mexico (49,900 MT), Malaysia (43,500 MT), Ecuador (25,000 MT), and Honduras (17,700 MT).

・ Cotton: Net sales of 97,800 RB for 2018/2019 were up 20 percent from the previous week, but down 24 percent from the prior 4-week average. Increases were reported for Vietnam (25,500 RB, including 900 RB switched from Taiwan), Mexico (18,500 RB), Pakistan (15,300 RB), Bangladesh (13,100 RB, including decreases of 100 RB), and Thailand (8,700 RB). Reductions were reported for Taiwan (900 RB). For 2019/2020, net sales of 32,900 RB were reported for Thailand (23,300 RB), Mexico (8,400 RB), Guatemala (800 RB), and China (400 RB). Exports of 148,900 RB were up 10 percent from the previous week, but down 7 percent from the prior 4-week average. Exports were reported primarily to Vietnam (43,700 RB), Indonesia (19,200 RB), China (16,200 RB), Mexico (16,100 RB), and Pakistan (8,800 RB). Net sales of Pima totaling 3,300 RB for 2018/2019 were down 42 percent from the previous week and 61 percent from the prior 4-week average. Increases reported for Peru (1,800 RB), India (800 RB), China (600 RB), and Vietnam (300 RB, switched from Japan), were partially offset by reductions for Japan (300 RB). For 2019/2020, net sales of 400 RB were reported for Peru. Exports of 8,700 RB were up noticeably from the previous week and 50 percent from the prior 4-week average. The primarily destinations were India (3,500 RB), Thailand (2,400 RB), and Pakistan (1,200 RB). Optional Origin Sales: For 2018/2019, the current optional origin outstanding balance is for Vietnam (1,800 RB). Exports for Own Account: The current exports for own account outstanding balance is 7,400 RB, all China.

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.