From: Terry Reilly

Sent: Friday, September 21, 2018 6:17:03 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 09/21/18

PDF attached

Please note I will be unavailable all day today

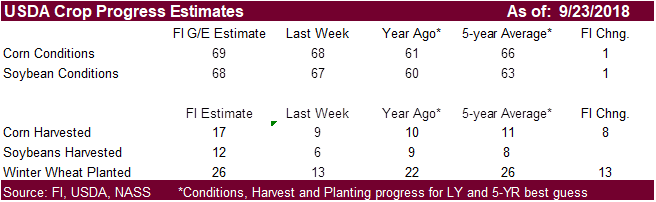

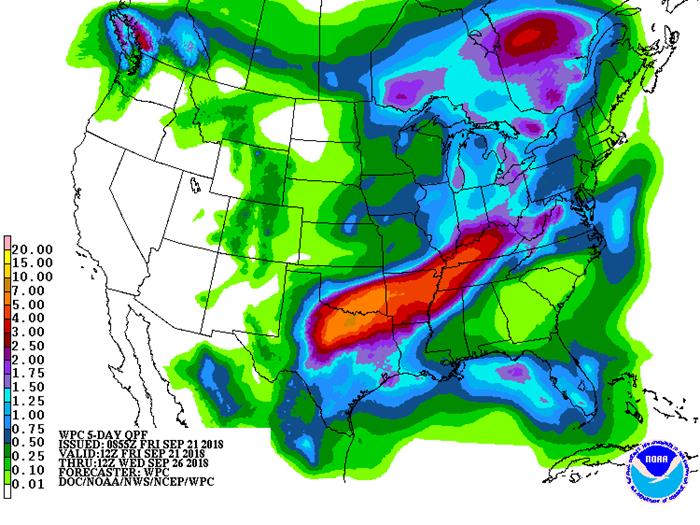

· Models turned wetter for the rain event across northeastern TX through lower Midwest and upper Delta.

· El Nino will not develop in the next few weeks.

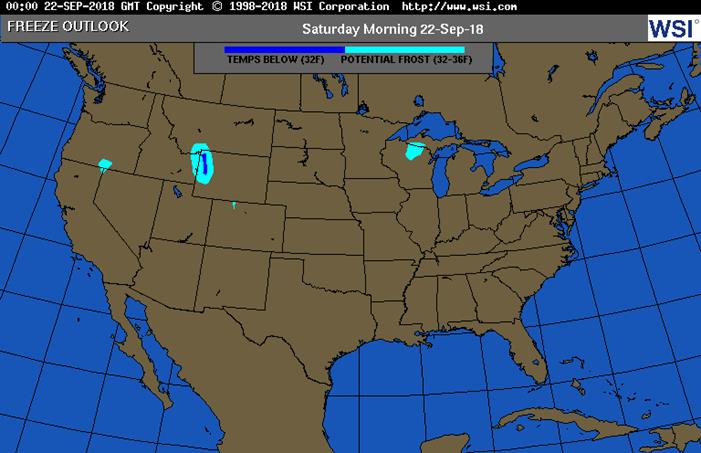

· The central and eastern North America will see a cold air mass next week, bringing frost like condition that will extend into early October.

· The Northwestern US Plains and southern most Canada Prairies will receive periodic precipitation slowing farming activity.

· The US Southern Plains will see rain through the end of this weekend.

· The Delta turns wet Friday into early next week.

· France will not receive much rain in the coming week.

· Russia’s Volga River Basin will see two waves of rain. The first occurs Sunday into Monday and the second a little later next week.

· Western Australia will trend wetter last days of September and early October, but confidence in the rain event is low. East-central Australia may get some showers this weekend, but mostly in northeastern New South Wales and extreme southeastern Queensland.

· After seeing rain, China’s weather will trend drier again in the Yellow River Basin for a while.

· Brazil will receive additional rain in the center west, center south and far southern crop areas through end of September. Winter wheat harvest delays may occur in parts of Parana, Sao Paulo and Mato Grosso do Sul.

· Argentina will see a mixture of rain and sunshine.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Tdy-Fri 75% cvg of up to 0.35”

and local amts to 0.75”;

wettest south

Fri-Sat 15% cvg of up to 0.50”

and local amts to 1.0”;

SE Mo. wettest

Sat-Sun 20% cvg of up to 0.40”

and local amts to 1.0”;

mostly south

Sun-Tue 85% cvg of up to 0.75”

and local amts to 1.75”

Mon-Wed 85% cvg of up to 0.75”

and local amts to 2.0”

Wed-Sep 28 55% cvg of up to 0.35”

and local amts to 0.85”

Sep 27-28 60% cvg of up to 0.35”

and local amts to 0.65”

Sep 29-30 Up to 20% daily cvg of 5-20% daily cvg of up

up to 0.20” and locally to 0.20” and locally

more each day; some more each day

days may be dry

Oct 1-2 50% cvg of up to 0.50”

and locally more

Oct 1-3 60% cvg of up to 0.60”

and locally more

Oct 3-4 Up to 20% daily cvg of

up to 0.20” and locally

more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

Fri-Sun 85% cvg of 0.15-0.90”

and local amts to 2.20”

with lighter rain in a

few areas; driest SE

Fri-Mon 15-30% daily cvg of

up to 0.70” and locally

more each day;

wettest west

Mon-Wed 85% cvg of up to 0.75”

and local amts to 2.0”

Tue-Sep 27 80% cvg of up to 0.75”

and local amts to 2.0”

Sep 27-Oct 1 Up to 20% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Sep 28-29 10-25% daily cvg of

up to 0.30” and locally

more each day

Sep 30-Oct 1 Up to 20% daily cvg of

up to 0.25” and locally

more each day

Oct 2-3 40% cvg of up to 0.35”

and locally more

Oct 2-4 40% cvg of up to 0.40”

and locally more

Source: World Weather and FI

FRIDAY, SEPT. 21:

- Ghana public holiday

- FranceAgriMer weekly updates on French crop conditions

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

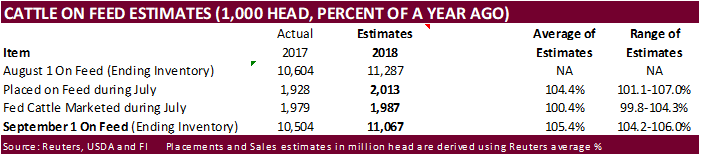

- USDA cattle-on-feed report for August, 3pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

SUNDAY, SEPT. 23:

- China’s General Administration of Customs releases agricultural commodities trade data for August (final), including wheat, sugar, corn, ~11pm ET Saturday (~11am Beijing Sunday)

- Country-of- origin breakdown details won’t be announced

MONDAY, SEPT. 24:

- China, Japan on public holidays

- Futures trading including corn, wheat, sugar, palm oil, cotton will be halted in Shanghai, Dalian and Zhengzhou

- Rubber trading on Tokyo Commodity Exchange will be halted

- A 10% U.S. tariff on about $200b in Chinese goods takes effect. China has retaliated by levying tariffs on $60b of U.S. goods.

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

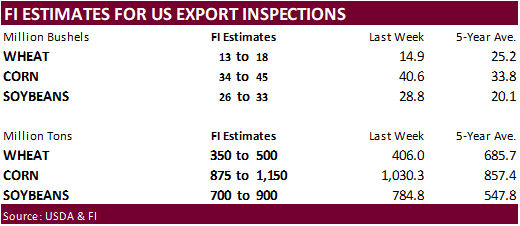

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA cold storage report for August, 3pm

- USDA weekly crop progress report, 4pm

- Ivory Coast weekly cocoa arrivals

TUESDAY, SEPT. 25:

- Intertek and AmSpec release their respective data on Malaysia’s Sept. 1-25 palm oil exports, 11pm ET Monday (11am Kuala Lumpur Tuesday)

- SGS data for same period, 3am ET Tuesday (3pm Kuala Lumpur Tuesday)

- Unica’s bi-weekly Brazil Center-South sugar output, 9am ET (10am Sao Paulo)

- USDA poultry slaughter for August, 3pm

- S&P Platts Kingsman sugar conference in Miami, 1st day of 2, with speakers from ED&F Man Sugar, RaboResearch, Citi, Mexico National Chamber of the Sugar and Alcohol Industries, Sucroliq, Puma Energy

WEDNESDAY, SEPT. 26:

- EIA U.S. weekly ethanol inventories, output, 10:30am

- FOMC rate decision, 2pm; analysts expect the Fed to raise U.S. interest rates by 25 basis points

- South African crop estimates

- Globoil international vegetable oil conference in Mumbai, Sept. 26-28

- Commerce Minister Suresh Prabhu and Food Minister Ram Vilas Paswan are expected to attend, along with Oil World Executive Director Thomas Mielke, Godrej Director Dorab Mistry, Sunvin CEO Sandeep Bajoria

- S&P Platts Kingsman sugar conference in Miami, final day, with speakers from Bonsucro, ALESA, Indian Sugar Exim Corp., Central American Sugar Assoc., Avenzza

THURSDAY, SEPT. 27:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA hogs & pigs inventory for 3Q, 3pm

- USDA agriculture prices received for August, 3pm

- International Grains Council monthly report

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Globoil vegetable oil conference in Mumbai, 2nd day of 3

- EARNINGS: Cargill

FRIDAY, SEPT. 28:

- USDA grain stockpiles for 3Q, including corn, soy, wheat, barley, noon

- USDA wheat production report for September, noon

- Polish crop estimates

- FranceAgriMer weekly updates on French crop conditions

- Globoil vegetable oil conference in Mumbai, final day

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Registrations

Macros.

· US stocks are higher, USD up 15, WTI crude higher by $0.40, and gold mixed, at the time this was written. (5:35 am CT)

· US stock markets are at or near all-time highs.

Corn.

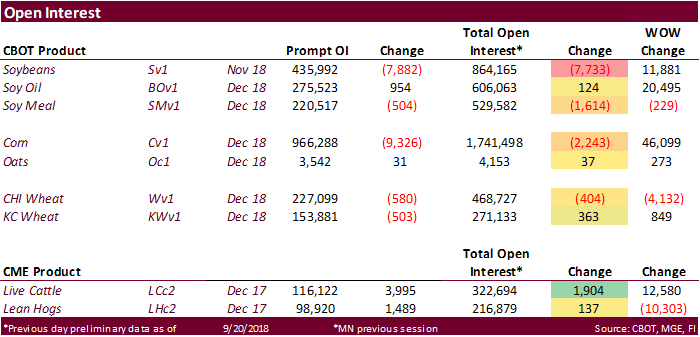

· Corn futures are higher on follow through short covering.

· China reported 2 more cases of African swine fever, in Jilin and Inner Mongolia.

· The EPA reported 1.35 billion of ethanol (D6) blending credits were generated in August, down from 1.37 billion in July.

· Poor ethanol margins are forcing downtime on a few plants across Iowa and Mississippi.

· Reuters: CIF corn bids for September barges were bid at 28 cents a bushel above Chicago Board of Trade December futures CZ8, up 4 cents from Wednesday. Spot FOB offers held at around 43 cents over futures.

· China sold 773,429 tons of corn at auction of state reserves at an average price of 1,461 yuan ($213.57) per ton, 19.5 percent of total corn available at the auction.

· Yesterday China sold 2,999,788 tons of corn at auction of state reserves at an average price of 1,559 yuan ($227.65) per ton, 75.45 percent of total corn available at the auction.

· China will sell another 8 million tons of corn for the week ending September 28.

· China sold nearly 84 million tons of corn out of reserves this season.

Soybean complex.

· Soybeans and its products are giving up some of their gains from yesterday on long liquidation ahead of the weekend. The rally yesterday was thought to be China and overall demand related, whereas Argentina (may have) bought up to 15 cargoes of US soybeans, Argentina sold at least three cargos of beans to China, end user buying for US soybean meal, good USDA export sales, and buy stops in November and January futures.

· Price losses on Friday may not be large. China soybean meal was up overnight on supply concerns, up 2.4% this week.

· Reuters: Soybean barges loaded this month were bid at a 9-cents-per-bushel discount to CBOT November futures SX8, 2 cents weaker than Wednesday. Spot soybean export premiums held at about 10 cents over futures.

· Malaysia’s CPO export tax in October will be left at zero percent.

· Malaysia December palm oil was down 3. Malaysian cash palm oil was down $2.50.

· Rotterdam oils were lower and SA soybean meal when imported into Rotterdam higher.

· Offshore values were suggesting a lower lead for US soybean meal by $2.00 and were lower lead in SBO by 48.

· The EPA reported 345 million biodiesel (D4) blending credits were generated in August, compared with 310 million a month earlier.

· EPA granted biofuel mandate exemptions for 29 small refineries for 2017, up from 19 waivers for 2016 and 7 in 2015.

· Iran seeks 30,000 tons of sunflower oil on September 24.

· China sold about 2.38 MMT of soybeans out of reserves this season.

Wheat

· US wheat is lower following EU wheat.

· Kazakhstan may export half of its 20 million ton grain crop in 2018-19.

· IKAR lowered its estimate for Russia wheat production to 69.2 million tons from 69.6 million, and exports to 33.0 million tons from 33.9 million previously.

· Australia sold 50,000 tons of wheat to Thailand-first signing of its kind. $280/ton was set for APW wheat.

· China sold 25,412 tons of imported 2013 wheat at auction from state reserves at an average price of 2,200 yuan ($321.66) per ton, 2.6 percent of total wheat available at the auction.

· Results awaited: Ethiopia seeks 200,000 tons of milling wheat for shipment two months after contract signing. Ethiopia got offers from 7 firms. Lowest offer was for 100,000 tons at $272.05/ton, c&f.

· Yesterday Algeria bought 75,000 tons of feed barley for November shipment.

· Turkey seeks a total of 252,000 tons of red milling wheat for October 2-22 loading. It closes on September 22. The depreciation of the lira sent importers seeking Turkish wheat flour, causing them to restrict exports. But countries like Iraq that heavily depend on flour from Turkey may have to import from other countries.

· Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 26 for arrival by late February.

· Jordan seeks 120,000 tons of feed barley, optional origin, on September 26.

· Jordan seeks 120,000 tons of feed wheat, optional origin, on September 27.

· Iraq seeks 50,000 tons of wheat on September 23, with offers valid until September 27. Iraq needs wheat for four after Turkey restricted flour shipments.

· Morocco seeks 336,364 tons of US durum wheat on September 28 for arrival by December 31.

Rice/Other

· Mauritius seeks 9,000 tons of rice for delivery between Nov. 15, 2018, and March 31, 2019, set to close is Sept. 27.

· Iraq seeks 30,000 tons of rice from India on October 9 for LH October / FH November shipment.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.