From: Terry Reilly

Sent: Monday, September 24, 2018 8:23:41 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 09/24/18

PDF attached

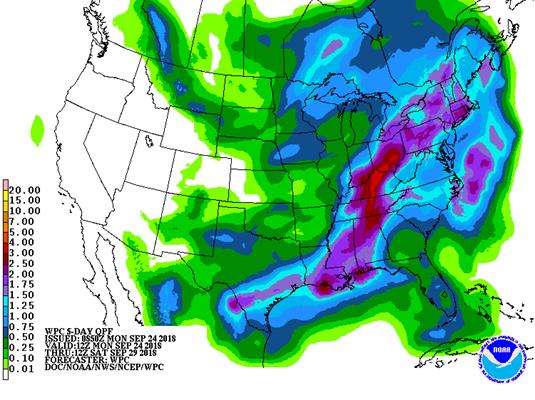

・ 6-10 day is wetter in the northwestern Midwest and northern Plains, drier in the southern Plains and Delta.

・ 11-15 day is wetter in the Delta.

Below taken from World Weather Inc.

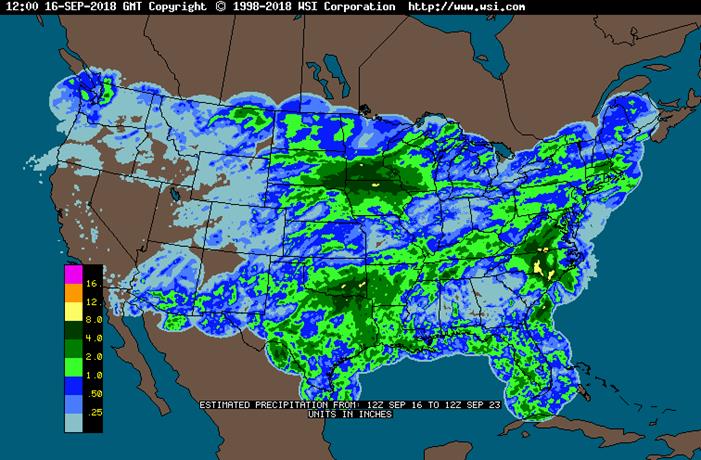

・ Central and southern Oklahoma and north-central Texas saw some heavy rain over the weekend.

・ Rain fell across western and northern Delta through parts of the Tennessee River Valley to Kentucky and farther northeast into New York, Pennsylvania and Virginia.

・ Frequent showers will occur in the Delta this week raising concern over cotton quality and delaying the advancement of cotton, soybean, rice and sorghum harvest progress.

・ The Midwest will see a mix of rain and sunshine this week and next week. Rainfall by next Sunday will vary from 0.10 to 0.60 inch with local totals near 1.00 inch with the exception of Kentucky and immediate neighboring areas where 1.00 to 3.00 inches and locally more may occur because of rain early to mid-week

・ Hard red winter wheat areas may experience net drying this week with some areas completely dry while others in Oklahoma and Texas might receive another 0.20 to 0.75 inch C most of that occurs during mid-week.

・ Northern Plains will receive 0.50 to nearly 2.00 inches of moisture from Montana to northern Minnesota with it occurring in waves

・ U.S. bottom line includes an immediate need for drying in Oklahoma, Arkansas and northern Texas after weekend flooding. Additional drying is also needed in southern Minnesota, Wisconsin, Iowa and southeastern South Dakota where flooding occurred earlier last week. The southeastern states need continued limited rainfall after Hurricane Florence ravaged the area. Too much rain has been occurring in the Delta and this pattern may continue for a while resulting in some cotton and rice quality decline and harvest delays for many summer crops. Moisture in the northern and central Plains will be good for winter wheat planting, emergence and establishment. Cooling will slow maturation rates and some eventual frost and freezes are expected, but they may only help to defoliate soybeans and expedite summer crop maturation. Very little bean quality decline is expected because of cool temperatures. Frost and freezes are most likely this weekend through the first few days in October.

・ South America’s greatest rainfall this week will be concentrated on northeastern Argentina, far southern Brazil and immediate neighboring areas of Paraguay and Uruguay

・ Canada Prairies are advertised to be wetter biased over the next week to ten days with frequent bouts of light precipitation and cooler than usual temperatures

・ Western Europe is facing another week to ten days of below average precipitation

・ Eastern Europe will receive periodic precipitation this week, but mostly north of Italy and the Balkan Countries

・ Russia’s middle and upper Volga Basin will experience improving soil moisture over the next ten days improving the establishment and emergence of winter wheat and rye

・ Russia’s lower Volga River Basin and southeastern Ukraine may not get abundant moisture for a while, but light precipitation will still be beneficial

・ Eastern Australia will receive some rain during the coming week, but no general soaking is likely and much of the moisture will be confined to far northeastern New South Wales and southeastern Queensland

・ Western Australia may receive some rain Friday through the weekend, but it is not expected to be well organized

MONDAY, SEPT. 24:

- China, Japan on public holidays

- Futures trading including corn, wheat, sugar, palm oil, cotton will be halted in Shanghai, Dalian and Zhengzhou

- Rubber trading on Tokyo Commodity Exchange will be halted

- A 10% U.S. tariff on about $200b in Chinese goods takes effect. China has retaliated by levying tariffs on $60b of U.S. goods.

- EU weekly grain, oilseed import and export data, 10am ET (3pm London)

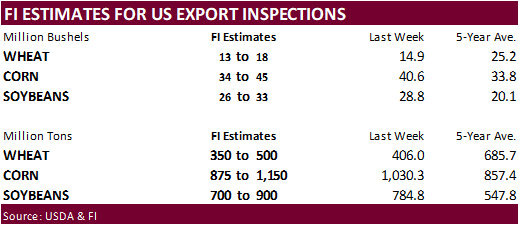

- USDA weekly corn, soybean, wheat export inspections, 11am

- USDA cold storage report for August, 3pm

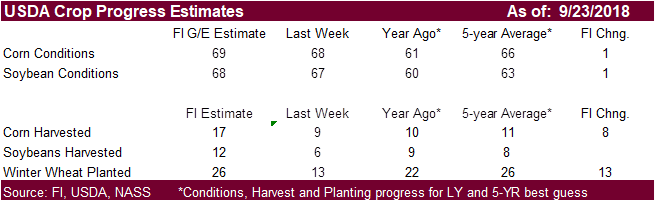

- USDA weekly crop progress report, 4pm

- Ivory Coast weekly cocoa arrivals

TUESDAY, SEPT. 25:

- Intertek and AmSpec release their respective data on Malaysia’s Sept. 1-25 palm oil exports, 11pm ET Monday (11am Kuala Lumpur Tuesday)

- SGS data for same period, 3am ET Tuesday (3pm Kuala Lumpur Tuesday)

- Unica’s bi-weekly Brazil Center-South sugar output, 9am ET (10am Sao Paulo)

- USDA poultry slaughter for August, 3pm

- S&P Platts Kingsman sugar conference in Miami, 1st day of 2, with speakers from ED&F Man Sugar, RaboResearch, Citi, Mexico National Chamber of the Sugar and Alcohol Industries, Sucroliq, Puma Energy

WEDNESDAY, SEPT. 26:

- EIA U.S. weekly ethanol inventories, output, 10:30am

- FOMC rate decision, 2pm; analysts expect the Fed to raise U.S. interest rates by 25 basis points

- South African crop estimates

- Globoil international vegetable oil conference in Mumbai, Sept. 26-28

- Commerce Minister Suresh Prabhu and Food Minister Ram Vilas Paswan are expected to attend, along with Oil World Executive Director Thomas Mielke, Godrej Director Dorab Mistry, Sunvin CEO Sandeep Bajoria

- S&P Platts Kingsman sugar conference in Miami, final day, with speakers from Bonsucro, ALESA, Indian Sugar Exim Corp., Central American Sugar Assoc., Avenzza

THURSDAY, SEPT. 27:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA hogs & pigs inventory for 3Q, 3pm

- USDA agriculture prices received for August, 3pm

- International Grains Council monthly report

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Globoil vegetable oil conference in Mumbai, 2nd day of 3

- EARNINGS: Cargill

FRIDAY, SEPT. 28:

- USDA grain stockpiles for 3Q, including corn, soy, wheat, barley, noon

- USDA wheat production report for September, noon

- Polish crop estimates

- FranceAgriMer weekly updates on French crop conditions

- Globoil vegetable oil conference in Mumbai, final day

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Macros.

・ US stocks are lower, USD lower, WTI crude higher, and gold higher, at the time this was written. (7:00 am CT)

・ Most of the US federal government could shut down at the end of this week unless Congress passes — and Trump signs — a short-term spending bill to keep $$ running.

Corn.

- Corn futures are lower after China cancelled trade talks with the US.

- US crude oil is higher.

- Baltic Dry Index is up 1.5 percent or 21 points to 1434 points.

・ China imported 330,000 tons of corn in August, down 13.5 percent from a year ago.

・ China imported 550,000 tons of barley in August, down 29 percent from a year ago.

・ China imported 60,000 tons of corn in August, down 78.5 percent from 259,892 tons a year ago, and down from 220,000 tons imported in July.

- China reported more cases of African swine fever in Inner Mongolia.

- AgRural estimated that farmers in Brazil have planted first-crop corn on 24% of expected area compared to the 5-yr average of 19% as positive weather conditions have allowed early sowing.

・ China will sell another 8 million tons of corn for the week ending September 28.

・ China sold nearly 84 million tons of corn out of reserves this season.

US monthly cattle on feed highlights – USDA

・ US September 1 cattle on feed was reported at 106%.

・ US August cattle placed on feed 107%.

・ US August cattle marketed 100%

Soybean complex.

・ Soybeans are lower on ongoing US/China trade concerns.

・ There is talk of CBOT soybeans eroding below $8.00/bushel. Some people are looking for $7.50. We think $8.00 is a strong support area.

・ Malaysia December palm oil was up 20 and leading SBO 25 lower. Malaysian cash palm oil was up $5.00.

・ WTI crude oil is higher.

・ Rotterdam oils were higher and SA soybean meal when imported into Rotterdam lower.

・ China and Japan are on holiday.

・ Offshore values were suggesting a lower lead for US soybean meal by $0.30 and were higher lead in SBO by 2.

・ There are two cargoes of beans headed to China in spite of the tariffs. The market is eyeing the cargoes to see if China scrutinizes these shipments as trade tensions build.

・ CFTC reported that CBOT soybean specs increased their net short position by 11,828 contracts to 123,395 in the week ending September 11.

・ AgRural showed that soybean planting is moving ahead of the 5-yr pace for Brazil with the largest gain in pace seen in Paraná with 11.2% sown compared to 1.7% planted last year and 1.9% over the last 5-yrs.

・ AgRural also raised the projected soy area for 2018/19 by 110,000 hectares to 35.8 million hectares.

- Under the 24-hour reporting system, US private exporters reported the sale of 162,000 tons of soybeans for delivery to unknown destinations during the 2018-19 marketing year.

- Egypt’s GASC seeks at least 30,000 tons of soyoil and 10,000 tons of sunflower oil for arrival between Oct. 25 and Nov. 10,

- Results awaited: Iran seeks 30,000 tons of sunflower oil on September 24.

- China sold about 2.38 MMT of soybeans out of reserves this season.

Wheat

・ US wheat is higher on spreading against soybeans and higher Russian wheat prices in comparison to the previous week.

・ IKAR reported 12.5 percent Russian wheat up $3.00/ton to $220/ton.

・ (MPI) Black sea wheat basis DEC settled -1.50 on Friday at 248.00. NO trade yet overnight via blocks. Recently we have noted the spreads between Z and H has tightened the carry from 9.00 back to 5.00. Something to watch because if spreads start to work with gusto, flat price will follow quickly.

・ China imported 140,000 tons of wheat in August, down 52 percent from a year ago.

・ India monsoon rains are starting to wind down.

・ CFTC reported that CBOT wheat specs increased their net short position by 18,775 contracts to 24,265 in the week ending September 11.

- UAE seeks 60,000 tons of wheat on September 24 for Oct/Nov shipment.

- Bahrain seeks 25,000 tons of wheat on October 2 for Nov shipment.

- Canadian wheat is the lowest offer in Iraq’s import tender. Lowest was $337/ton. Offers valid until September 27. Iraq needs wheat for four after Turkey restricted flour shipments.

- Results awaited: Ethiopia seeks 200,000 tons of milling wheat for shipment two months after contract signing. Ethiopia got offers from 7 firms. Lowest offer was for 100,000 tons at $272.05/ton, c&f.

・ Results awaited: Turkey seeks a total of 252,000 tons of red milling wheat for October 2-22 loading. It closes on September 22. The depreciation of the lira sent importers seeking Turkish wheat flour, causing them to restrict exports. But countries like Iraq that heavily depend on flour from Turkey may have to import from other countries.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on September 26 for arrival by late February.

- Jordan seeks 120,000 tons of feed barley, optional origin, on September 26.

- Jordan seeks 120,000 tons of feed wheat, optional origin, on September 27.

- Iraq seeks 50,000 tons of wheat on September 23, with offers valid until September 27. Iraq needs wheat for four after Turkey restricted flour shipments.

- Morocco seeks 336,364 tons of US durum wheat on September 28 for arrival by December 31.

Rice/Other

・ The Philippines are increasing rice imports by securing 500,000 tons on top of 250,000 they previously had planned to buy.

・ Mauritius seeks 9,000 tons of rice for delivery between Nov. 15, 2018, and March 31, 2019, set to close is Sept. 27.

・ Iraq seeks 30,000 tons of rice optional origin on October 1, valid until October 7.

・ Iraq seeks 30,000 tons of rice from India on October 9 for LH October / FH November shipment.

Terry Reilly

Senior Commodity Analyst C Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.