From: Terry Reilly

Sent: Wednesday, September 26, 2018 8:14:44 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 09/26/18

PDF attached

· Frequent showers will occur in the Delta this week.

· The Midwest will also be active which should slow harvesting before a couple more days of net drying occurs outside the Ohio River Valley region.

· HRW wheat areas will see a mixture of sunshine and rain.

· Improving weather across Europe and the CIS is bearish for wheat.

· SA weather looks good.

· Canada is seeing too much precipitation in form of snow and rain, and temperatures will remain cool.

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Wed 15% cvg of up to 0.20”

and locally more;

wettest SE

Wed-Thu 35% cvg of up to 0.20”

and locally more;

driest south

Thu Mostly dry with a few

insignificant showers

Fri-Sat 40% cvg of up to 0.65” 35% cvg of up to 0.65”

and local amts to 1.25”; and local amts to 1.20”;

Ia. wettest north Il. to Mi. wettest

Sun 20% cvg of up to 0.20”

and locally more;

north and west wettest

Sun-Mon 70% cvg of up to 0.75”

and local amts to 1.50”;

wettest NE

Mon-Oct 2 80% cvg of up to 0.75”

and local amts to 1.50”

Oct 2-4 75% cvg of up to 0.75”

and local amts to 2.0”;

far NW driest

Oct 3-4 80% cvg of up to 0.75”

and local amts to 2.0”

Oct 5-9 Up to 20% daily cvg of Up to 20% daily cvg of

up to 0.20” and locally up to 0.20” and locally

more each day more each day

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Tdy-Wed 85% cvg of 0.30-1.10”

with lighter rain in a few

areas and local amts over

2.0”; driest north

Tdy-Thu 90-100% cvg of 0.15-1.10”

and local amts to 2.0”

with some 2.0-3.50”

amts in the west;

driest SE

Thu-Sat 10-25% daily cvg of

up to 0.35” and locally

more each day;

wettest south

Fri-Sat 20-40% daily cvg of

up to 0.60” and locally

more each day

Sun-Oct 2 5-20% daily cvg of up 5-20% daily cvg of up

to 0.20” and locally to 0.20” and locally

more each day; more each day

wettest north

Oct 3-4 80% cvg of up to 0.65” 70% cvg of up to 0.65”

and local amts to 1.40” and local amts to 1.40”

Oct 5-9 Up to 20% daily cvg of 5-20% daily cvg of up

up to 0.25” and locally to 0.25” and locally

more each day more each day

Source: World Weather Inc. and FI

WEDNESDAY, SEPT. 26:

- EIA U.S. weekly ethanol inventories, output, 10:30am

- FOMC rate decision, 2pm; analysts expect the Fed to raise U.S. interest rates by 25 basis points

- South African crop estimates

- Globoil international vegetable oil conference in Mumbai, Sept. 26-28

- Commerce Minister Suresh Prabhu and Food Minister Ram Vilas Paswan are expected to attend, along with Oil World Executive Director Thomas Mielke, Godrej Director Dorab Mistry, Sunvin CEO Sandeep Bajoria

- S&P Platts Kingsman sugar conference in Miami, final day, with speakers from Bonsucro, ALESA, Indian Sugar Exim Corp., Central American Sugar Assoc., Avenzza

THURSDAY, SEPT. 27:

- USDA weekly net-export sales for corn, wheat, soy, cotton, 8:30am

- USDA hogs & pigs inventory for 3Q, 3pm

- USDA agriculture prices received for August, 3pm

- International Grains Council monthly report

- Port of Rouen data on French grain exports

- Buenos Aires Grain Exchange weekly crop report

- Bloomberg weekly survey of analysts’ expectations on grain, sugar prices

- Globoil vegetable oil conference in Mumbai, 2nd day of 3

- EARNINGS: Cargill

FRIDAY, SEPT. 28:

- USDA grain stockpiles for 3Q, including corn, soy, wheat, barley, noon

- USDA wheat production report for September, noon

- Polish crop estimates

- FranceAgriMer weekly updates on French crop conditions

- Globoil vegetable oil conference in Mumbai, final day

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

· US stocks are higher, USD lower, WTI crude lower, and gold lower, at the time this was written. (8:00 am CT)

Corn.

- Corn is lower but that should change on expectations for CBOT soybeans to rally further from their 4.25-4.75 cent higher trade at the electronic break.

- News for corn is light.

- Baltic Dry Index is up 3.7 percent or 53 points to 1503 points.

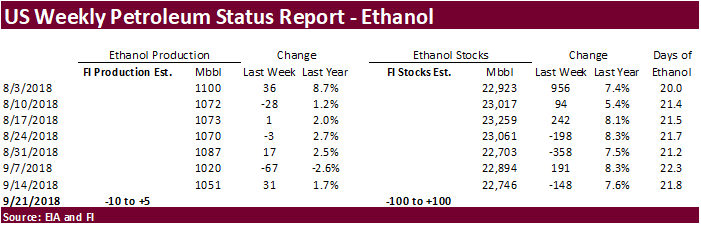

- A Bloomberg survey calls for weekly US ethanol production to decline to 1.027 million barrels per day from 1.051 million last week, and stocks to decline to 22.700 million from 22.746 million week earlier.

· China will sell 8 million tons of corn for the week ending September 28.

· China sold nearly 84 million tons of corn out of reserves this season.

Soybean complex.

· The soybean complex is higher in part on higher China values and strong US soybean sales to Mexico.

· Traders are slowly building a weather premium into the agriculture markets as wet weather later this week into all next week should slow US harvest progress.

· Look for soybeans to trade higher at the day session open from their 4.25-4.75 cent higher lead.

· There is speculation China may still turn to the US for soybeans as Brazil and Argentina may soon run out of supplies for export. Yesterday there was talk Brazil may have to import 1 million tons of US soybeans after overselling their current crop to China.

· China soybean meal was up 1.0% or 32 yuan/ton to 3296, and leading CBOT meal $2.60 higher.

· China soybean meal inventories fell 70,000 tons from the previous week to 890,000 tons (CNGOIC).

· Next week China is on a week-long holiday.

· China soybeans were 0.1% higher and China soybean oil 64 higher or 1.1%. China palm was up 0.6% or 30 yuan higher.

· China soybean crush margins on our analysis are running at 143 cents, up from 141 cents last session and compares to 115 late last week and 85 cents a year ago.

· Malaysia December palm oil was up 9 (for the 3rd straight day) and leading SBO 5 lower. Malaysian cash palm oil was unchanged.

· Strong Malaysian palm oil exports are countering with rising palm production.

· Govindbhai Patel estimated India will need to import a record 15.2 million tons of edible vegetable oils during the November 2018-October 2019 period, based on several elements including a 2.1% increase in domestic consumption and 9 percent shortfall in normal rainfall

· Rotterdam oils were higher and SA soybean meal when imported into Rotterdam higher.

· Offshore values were suggesting a higher lead for US soybean meal by $0.80 and higher lead in SBO by 7 points.

· The Argentina vessel lineup shows one more soybean cargo is set to load and leave soon for China.

· Soybean planting progress just started in Mato Grosso but more rain may be needed in October, according to the local AgMin, Imea.

· Parana, Brazil is 18 percent complete on soybean planting progress. Three-year average is 7 percent.

· Brazil’s Agribrasil calculated 1.0 million tons of soybeans will be imported from the US to make up for insufficient supplies. They have Brazil exports at 80 million tons (68MMT last year), and crush at 41.5 MMT (41.8 last year).

· Canola harvest progress in Manitoba, Canada, are about 85 percent harvested and soybeans are 30 percent complete.

- Under the 24-hour announcement system, US exporters sold 650,387 tons of soybeans for delivery to Mexico during the 2018-19 marketing year.

- China sold 600 tons of 2011 imported soyoil from auction of state reserves at an average price of 5,000 yuan ($727.45) per ton, 2.05 percent of total soyoil available at the auction.

- China sold 100,642 tons of 2013 soybeans at auction of state reserves at average price of 3,051 yuan ($443.89) per ton, 100 percent of total 2013 soybean available for the auction.

- China sold about 2.5MMT of soybean out of reserves this season.

- China will offer 100,000 tons of soybeans out of reserves on October 10.

- Results awaited: Iran seeks 30,000 tons of sunflower oil on September 24.

- Yesterday Egypt’s GASC bought 30,000 tons of soyoil and 21,500 tons of sunflower oil for arrival between Oct. 25 and Nov. Soybean oil was bought at $698.70/ton. Sunflower oil was bought at $719/ton.

Wheat

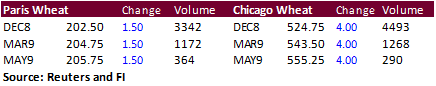

· US wheat is struggling higher on steady but strong global import demand.

· Paris wheat is higher on a lower EU, although the currency remains near a 3-year high against the USD.

- Ukraine will keep its export caps on for milling and feed wheat at 8 million tons, each.

· Turkey bought 252,000 tons of red milling wheat at $232.90/ton c&f for October 2-22 loading.

- Jordan passed on 120,000 tons of barley.

- Jordan seeks 120,000 tons of feed wheat, optional origin, on September 27.

- Japan in a SBS import tender passed on 120,000 tons of feed wheat and 200,000 tons of barley for arrival by late February.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on October 10 for arrival by late February.

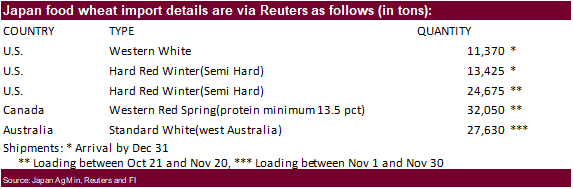

- Japan seeks 109,150 tons of food wheat on Thursday. Original details as follows.

· China sells 1,787 tons of imported 2013 wheat at auction of state reserves at an average price of 2,144 yuan ($311.93) per ton, 0.19 percent of total wheat available at the auction.

· China sells 126,652 tons of wheat at auction of state reserves at an average price of 2,409 yuan ($350.63) per ton, 6.31 percent of total wheat available at the auction.

- Results awaited: UAE seeks 60,000 tons of wheat on September 24 for Oct/Nov shipment.

- Results awaited: Ethiopia seeks 200,000 tons of milling wheat for shipment two months after contract signing. Ethiopia got offers from 7 firms. Lowest offer was for 100,000 tons at $272.05/ton, c&f.

- Canadian wheat is the lowest offer in Iraq’s import tender. Lowest was $337/ton. Offers valid until September 27. Iraq needs wheat for four after Turkey restricted flour shipments.

- Morocco seeks 336,364 tons of US durum wheat on September 28 for arrival by December 31.

- Bahrain seeks 25,000 tons of wheat on October 2 for Nov shipment.

- Taiwan seeks 110,000 tons of US wheat on October 2 for Nov-Dec shipment.

- Bangladesh seeks 50,000 tons of 12.5 percent wheat on October 9, optional origin.

Rice/Other

· Iraq bought at least 60,000 tons of rice from Vietnam at $577/ton c&f.

· Thailand sold rice to China for the first time in six years.

· Mauritius seeks 9,000 tons of rice for delivery between Nov. 15, 2018, and March 31, 2019, set to close is Sept. 27.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.