From: Terry Reilly

Sent: Friday, September 28, 2018 8:01:50 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 09/28/18

PDF attached

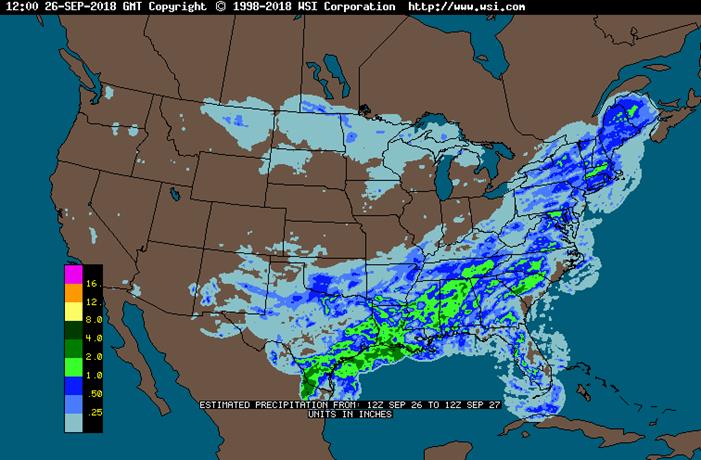

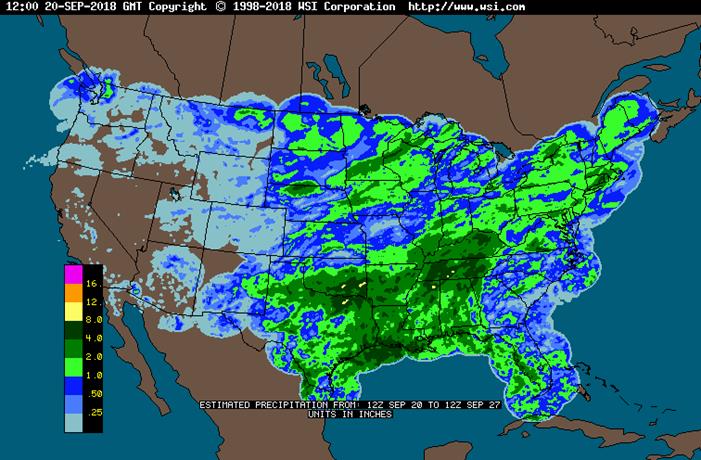

· US saw good harvesting weather across the Midwest on Thursday.

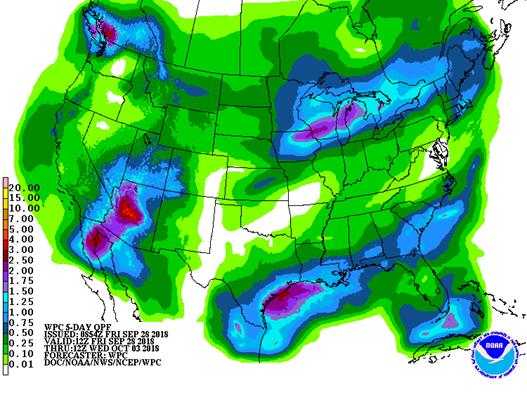

· Frequent showers will occur in the Delta through Tuesday.

· The Midwest will also be active starting later this week which should slow harvesting before a couple more days of net drying occurs outside the Ohio River Valley region.

· HRW wheat areas will see a mixture of sunshine and rain.

· Improving weather across Europe and the CIS is bearish for wheat.

· SA weather looks good.

· Canada is seeing too much precipitation in form of snow and rain, and temperatures will remain cool.

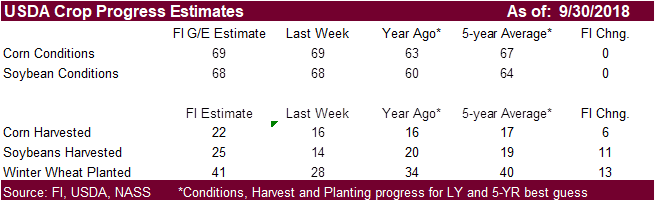

SIGNIFICANT CORN AND SOYBEAN BELT PRECIPITATION EVENTS

WEST CORN BELT EAST CORN BELT

Fri-Sat 40% cvg of up to 0.50” 35% cvg of up to 0.30”

and local amts to 0.80”; and local amts to 0.50”;

south Ia. wettest north Il. wettest

Sun 30% cvg of up to 0.25”

and local amts to 0.40”;

wettest north

Sun-Mon 65% cvg of up to 0.75”

and local amts to 2.0”;

Ia. to Wi. wettest

Mon-Tue 60% cvg of up to 0.50”

and local amts to 1.10”;

SW and north wettest

Tue-Wed 70% cvg of up to 0.75”

and local amts to 2.0”;

wettest NE

Wed-Oct 4 75% cvg of up to 0.60”

and local amts to 1.20”;

driest SW

Oct 4-6 80% cvg of up to 0.75”

and local amts to 2.0”;

wettest south

Oct 5-7 80% cvg of up to 0.75”

and local amts to 2.0”

Oct 7-8 Up to 20% daily cvg of

up to 0.25” and locally

more each day

Oct 8-9 Up to 20% daily cvg of

up to 0.25” and locally

more each day

Oct 9-11 75% cvg of up to 0.65”

and locally more

Oct 10-12 75% cvg of up to 0.65”

and locally more

U.S. DELTA/SOUTHEAST SIGNIFICANT PRECIPITATION EVENTS

DELTA SOUTHEAST

Fri-Sat Up to 15% daily cvg of

up to 0.25” and locally

more each day; some

days may be dry

Fri-Mon 20-40% daily cvg of

up to 0.60” and locally

more each day; south

and east wettest

Sun-Tue 10-25% daily cvg of

up to 0.35” and locally

more each day

Tue-Oct 5 Up to 20% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Wed-Oct 5 Up to 20% daily cvg of

up to 0.20” and locally

more each day; some

days may be dry

Oct 6-7 80% cvg of up to 0.75”

and local amts to 1.50”

Oct 6-8 80% cvg of up to 0.75”

and local amts to 1.50”

Oct 8-10 Up to 20% daily cvg of

up to 0.20” and locally

more each day

Oct 9-10 Up to 20% daily cvg of

up to 0.20” and locally

more each day

Oct 11-12 60% cvg of up to 0.60” 60% cvg of up to 0.50”

and locally more and locally more

Source: World Weather Inc. and FI

FRIDAY, SEPT. 28:

- USDA grain stockpiles for 3Q, including corn, soy, wheat, barley, noon

- USDA wheat production report for September, noon

- Polish crop estimates

- FranceAgriMer weekly updates on French crop conditions

- Globoil vegetable oil conference in Mumbai, final day

- ICE Futures Europe commitments of traders weekly report on coffee, cocoa, sugar positions, ~1:30pm ET (~6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Weekly Bloomberg Bull/Bear Survey (taken Wed)

· Raw sugar survey results: Bullish: 2 Bearish: 7 Neutral: 0

· White sugar: Bullish: 2 Bearish: 7 Neutral: 0

· White-sugar premium: Widen: 2 Narrow: 6 Neutral: 1

· Wheat: Bullish: 4 Bearish: 2 Neutral: 6

· Corn: Bullish: 7 Bearish: 2 Neutral: 3

· Soybeans: Bullish: 3 Bearish: 6 Neutral: 3

· US stocks are lower, USD higher, WTI crude near unchanged, and gold slightly higher, at the time this was written. (7:25 am CT)

Corn.

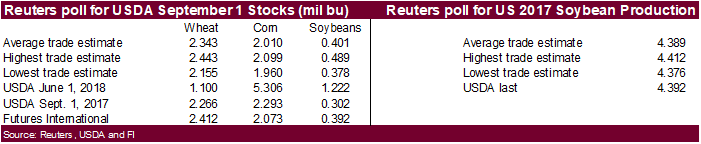

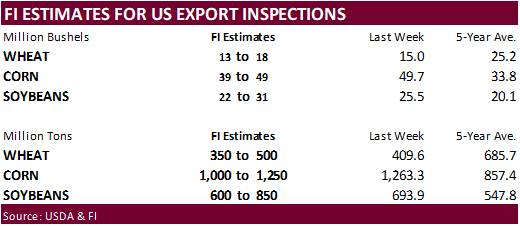

- Corn futures are trading near unchanged. Basis at some US domestic locations eased on Thursday as US harvesting increased. We look for higher than trade average US September 1 stocks when reported later today. Our reasoning is the ongoing higher use of sorghum, DDGS, and soybean meal for feed, over corn.

- France harvested 31 percent of their corn crop as of September 24, up from 8 percent week earlier.

- Baltic Dry Index is up 16 points or 1 percent to 1540 points.

· The European Commission lowered its estimate for corn production to 61.9 million tons from 64.2 million previously and compares to 64.5MMT last year.

- The White House is considering restricting biofuel credit trading. This might be rolled in the E15-all year bill.

- Reuters: Corn barges loaded this month were bid at about 35 cents a bushel above Chicago Board of Trade December futures CZ8, unchanged from Wednesday. Spot FOB offers were around 45 cents over futures, traders said.

· China sold 575,469 tons of corn at auction of state reserves at average price of 1,447 yuan ($210.21) per ton, 14.41 percent of total corn available for the auction. Yesterday China sold 2,903,808 tons of corn at auction of state reserves at an average price of 1,550 yuan ($225.49) per ton, 73.49 percent of total corn available at the auction.

· China will sell 8 million tons of corn for the week ending October 5.

· China sold about 85.5 million tons of corn out of reserves this season and some are predicting up to 100 million tons will be sold by the end of the marketing season.

Soybean complex.

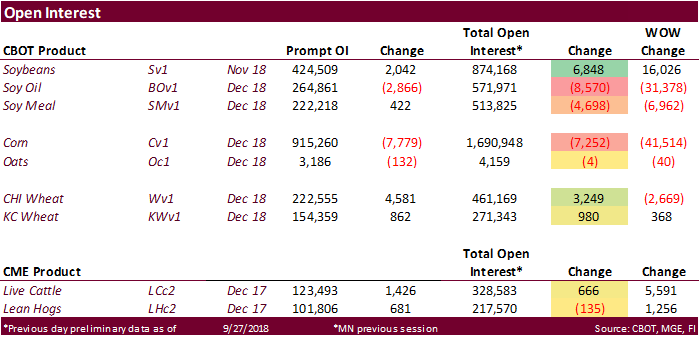

· CBOT soybeans are lower on US harvesting pressure and positioning ahead of the USDA Sep 1 stocks report due out at 11 am CT. Meal is finding support after China SBM hit multi month highs overnight and spreading against soybean oil.

· Soybean oil futures over the next week could see limited downside on the recent firming of basis across the ECB and Gulf, but energy and palm prices will continue to have a good influence in price fluctuations.

· Taiwan signed a ceremonial deal to buy $1.56 billion of soybeans from Iowa and Minnesota. (up to 3.9MMT).

· The European Commission increased its estimate for the rapeseed crop to 19.7MMT t from 19.2 last month, below 21.95 in 2017-18.

· US harvesting delays are in the spotlight but we think US harvest progress could advance a healthy 11 points to 25 percent, 6 points above average.

· Next week China is on a week-long holiday.

· China soybean meal was up 47 yuan or 1.4 percent to 3345 and leading CBOT $5.60 higher.

· China soybeans were 31 yuan higher (0.8%) and China soybean oil 2 lower. China palm was down 18 yuan or 0.4%.

· China soybean crush margins on our analysis are running at 163 cents, up from 142 cents last session and compares to 115 late last week and 85 cents a year ago.

· One analyst expects India’s rapeseed crop to increase to 7 million tons from 6 million tons previously.

· Dorab Mistry expects Indonesian palm production to hit 40 million tons in 2018, up from previous forecast of 38.5 million tons, and noted palm prices to needed to decline to 2100MYR or $507.25/ton to remain competitive.

· Oil World looks for a 41MMT Indonesian palm output and 20.3MMT Malaysian palm production. Palm prices could trade between 2200-2600MRY in FH 2019.

· Malaysia December palm oil was up 8 and leading SBO 27 lower. Malaysian cash palm oil was unchanged at $553.75/ton.

· Rotterdam oils were higher and SA soybean meal when imported into Rotterdam mostly higher.

· Offshore values were suggesting a higher lead for US soybean meal by $2.50 ($7.50 higher for the week to date) and lower lead in SBO by 41 points (48 lower for the week to date).

- Reuters: CIF soybean barges for September were bid about 5 cents per bushel over CBOT (CBOT) November futures SX8, up about a penny from Wednesday. Spot soybean export premiums were about 12 cents over futures.

- China will offer 100,000 tons of soybeans out of reserves on October 10.

- Results awaited: Iran seeks 30,000 tons of sunflower oil on September 24.

Wheat

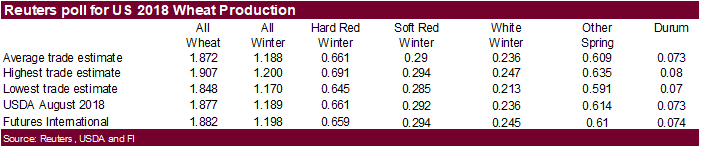

· Chicago wheat is mixed and KC & MN mostly weaker as traders await the Small Grains Summery due out at 11 am CT.

· The European Commission reduced its 2018-19 common wheat production to 128.7MMT from 128.8 last month.

- China sold 5,959 tons of imported 2013 wheat at auction of state reserves at an average price of 2,200 yuan ($319.82) per ton, 0.64 percent of total wheat available at the auction.

- Postponed: UAE seeks 60,000 tons of wheat for Oct/Nov shipment.

- Results awaited: Ethiopia seeks 200,000 tons of milling wheat for shipment two months after contract signing. Ethiopia got offers from 7 firms. Lowest offer was for 100,000 tons at $272.05/ton, c&f.

- Morocco seeks 336,364 tons of US durum wheat on September 28 for arrival by December 31.

- Bahrain seeks 25,000 tons of wheat on October 2 for Nov shipment.

- Taiwan seeks 110,000 tons of US wheat on October 2 for Nov-Dec shipment.

- Jordan retendered for another 100,000 tons of feed barley on October 3.

- Bangladesh seeks 50,000 tons of 12.5 percent wheat on October 9, optional origin.

- Japan in a SBS import tender seeks 120,000 tons of feed wheat and 200,000 tons of barley on October 10 for arrival by late February.

Rice/Other

· The Philippines seek 250,000 tons of rice on October 18 for arrival by late November.

· Mauritius seeks 9,000 tons of rice for delivery between Nov. 15, 2018, and March 31, 2019, set to close is Sept. 27.

· Thailand seeks to sell 120,000 tons of sugar on October 3.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.