From: Terry Reilly

Sent: Thursday, December 26, 2019 8:06:10 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI Morning Grain Comments 12/26/16

PDF attached

U.S. President

Donald Trump said he and Chinese President Xi Jinping will have a signing ceremony for phase one soon. It could be done by the end of the month. Happy Boxing Day!

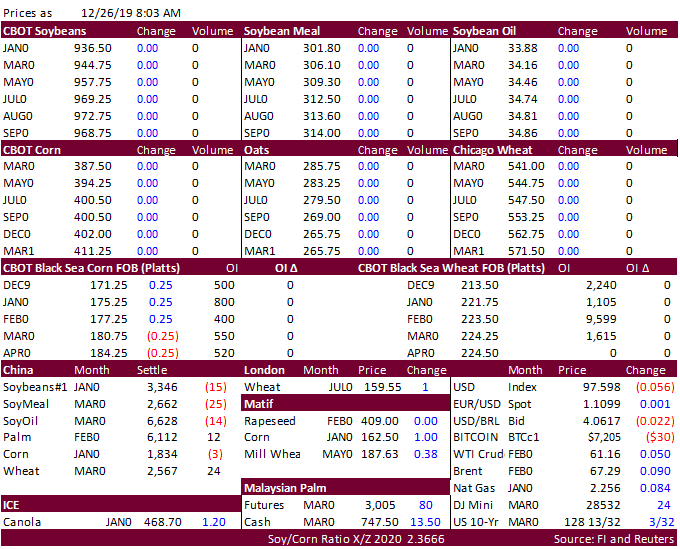

CBOT

opening calls: (we like SBO/SBM spreading. Our bias for calls is based on weather)

·

Soybeans: steady to 2 lower

·

Soybean meal: steady to 1.50 lower

·

Soybean oil: steady to 10 higher

·

Corn: steady to 2 lower

·

Chicago wheat:

steady