From: Terry Reilly

Sent: Wednesday, April 15, 2020 11:17:03 AM (UTC-06:00) Central Time (US & Canada)

Subject: FI PDF for NOPA – record monthly crush

PDF attached

Supportive soybean complex but we continue to see meal/oil spreading and strong upward move in CBOT crush.

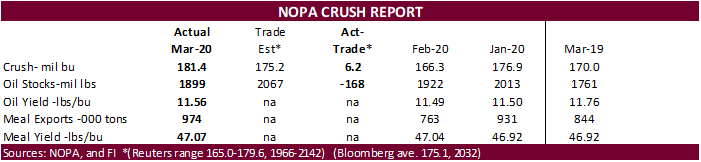

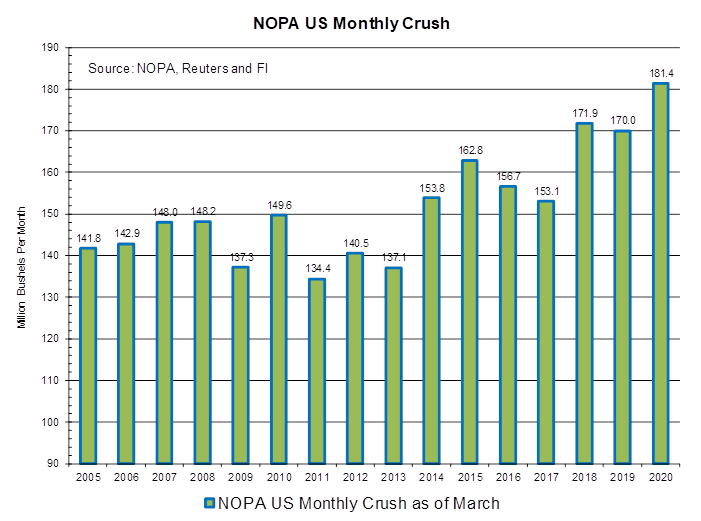

NOPA US March soybean crush of 181.4 million bushels was a record for the month and on a daily adjusted basis a record for any month. It came in 6.2 mil bu above trade expectations. The March crush on a daily adjusted basis was 2 percent higher than February and 6.7 percent higher than March 2019.

Soybean oil stocks of 1.899 billion pounds fell short of trade expectations by 168 million pounds, supportive, in our opinion, and are down from 1.922 billion pounds at the end of February. This helps our case that we think USDA was premature in lowering domestic demand in its last S&D report. The oil yield was 11.56 pounds, well up from 11.49 pounds last month. Implied demand was much better than expected.

Soybean meal exports were 974,000 short tons, above 763,000 short tons during February and above 844,000 short tons year ago. They were about 75,000 short tons above our expectations. The March soybean meal exports were the second largest for that month in our working history, and highest monthly volume since March 2017. The March soybean meal yield of 47.07 was up from 47.04 previous month and above 46.92 year ago.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.