From: Wagner, Jonathan

Sent: Monday, April 13, 2020 11:01:02 PM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Evening Rundown

Top stories listed below

China says difficulties facing trade cannot be underestimated – Reuters

IMF to provide debt relief to help 25 countries deal with pandemic – Reuters

Goldman Sees Advanced Economies Shrinking 35% Amid Pandemic

New York, California and other states plan for reopening as coronavirus crisis eases – Reuters

China’s March crude oil imports jump 12% on stockpiling – calculation – Reuters News

At least one worker at Pemex oil platform infected with coronavirus – sources – Reuters News

Oman says will cut oil output by 200,000 bpd from May 1 as OPEC+ pact – Reuters News

Top Thai Oil Driller Cuts Capex Up to 20% in Crash Survival Mode

U.S. shale oil output to drop by record 194,000 bpd in April – EIA – Reuters

The Oil Fracklog That Threatens to Take Down Any Market Comeback

Shell, Exxon halt some Gulf of Mexico output due to Exxon pipeline leak – Reuters News

Enterprise Interstate Crude to Start Gulf Coast-Cushing Service

U.S. Cash Crude-Sour grades firm, Mars flips to premium as Saudi ups prices – Reuters News

U.S. Cash Products-Group Three gasoline rises in thin trading day – Reuters News

BP Whiting, Indiana, refinery operations normal -sources – Reuters News

Shell Convent, Louisiana, refinery restarting heavy-oil hydrocracker -sources – Reuters News

Brazil gasoline, ethanol sales down 30-35% amid coronavirus -BR Distribuidora – Reuters News

WTI Most Actively Traded Options

Brent Most Actively Traded Options

|

WTI Z20 36 call x36.00 vs BRT Z20 40 call x39.40 TRADES 8 500x 57d/54d |

|

WTI/BRT M21 ATM Call Roll x36.50/40.50 TRADES 40 950x 60d/60d |

|

4/13 Brent Trade Recap |

|

BRT M20 36/43 Call Spread x31.15 TRADES 78 500x 20d |

|

BRT M20 40 Call LIVE TRADES 27 700x |

|

BRT M/Z20 40/60 Call Roll LIVE TRADES 30 1,000x |

|

BRT N20 25 Put x32.85 TRADES 158 700x 10d |

|

BRT N20 29 Put x34.50 TRADES 172 500x 32d |

|

BRT N20 30/40 Fence x34.75 TRADES 87 450x; TRADES 86 550x 56d |

|

BRT N20 40 Call x34.90 TRADES 134 550x 35d |

|

BRT N20 ATM Call x35.00 TRADES 368 1,000x; TRADES 375 300x 70d |

|

BRT N20 ATM Put x34.50 TRADES 370 600x 61d |

|

BRT Q20 31/43 Fence x36.75 TRADES 88 750x 48d |

|

BRT Q20 50 Call x36.25 TRADES 42 300x; TRADES 40 200x 12d |

|

BRT U20 30/45 Fence x36.70 TRADES 96 1,250x 49d |

|

BRT Z20 40 Call x39.40 TRADES 488 400x; TRADES 495 100x 54d |

|

BRT Z20 40/30 Put Spread vs 50 Call x40.00 TRADES 178 1,000x 44d |

|

BRT Z20 45/55 1×1.5 Call Roll x39.70 TRADES 146 600x 21d |

|

BRT H21 50/60 1×1.5 Call Roll x40.75 TRADES 88 250x 14d |

|

BRT M21 30 Put x40.90 TRADES 187 500x 18d |

|

BRT M21 45/60 1×1.5 Call Roll x41.70 TRADES 270 400x 28d |

|

BRT Z21 100 Call LIVE TRADES 17 250x |

|

4/13 WTI Trade Recap |

|

WTI M20 25/35 Fence x29.60 TRADES 75 500x 50d |

|

WTI M20 27.50 Put x29.00 TRADES 284 500x 24d |

|

WTI M20 28 Put x29.10 TRADES 309 100x; TRADES 305 600x 26d |

|

WTI M20 32/38/41 1x3x2 Call Fly LIVE TRADES 98 300x |

|

WTI M20 45/50/55 Call Tree LIVE TRADES 1 900x |

|

WTI N20 25 Put x33.00 TRADES 151 500x 9d |

|

WTI N20 25 Put x33.15 TRADES 161 1,100x 9d |

|

WTI N20 36/40 1×1.5 Call Spread LIVE TRADES 71 550x |

|

WTI N20 ATM Call x33.00 TRADES 386 1,000x 65d |

|

WTI Q20 34 Straddle x34.60 TRADES 815 500x 5d |

|

WTI Q20 50/60 Call Spread x34.30 TRADES 22 500x 5d |

|

WTI Q/U20 30 Put Roll x34.00/34.75 TRADES 7 600x 19d/15d |

|

WTI Z20 35/25 Put Spread vs 45 Call x36.55 TRADES 115 850x 46d |

|

WTI Z20 50/65 1×2 Call Spread x36.65 TRADES 46 500x 4d |

|

WTI Z20 65 Call x35.80 TRADES 20 600x 4d |

|

WTI M21 40 Call x37.25 TRADES 396 400x 58d |

|

WTI M21 ATM Call x38.00 TRADES 542 900x 64d |

|

WTI Q21 40/50 Call Spread x37.60 TRADES 285 250x 30d |

|

WTI Z21 30/40 Fence x38.40 TRADES 237 250x 71d |

|

WTI Z21 50 Call LIVE TRADES 207 500x |

|

WTI Z21 60 Call LIVE TRADES 86 500x |

|

4/13 CSO/ARB/APO Trade Recap |

|

WTI CSO K20 -3.00 Put x22.50/29.35 TRADES 387 1,000x 100d |

|

WTI CSO K20 -7.00 Put TRADES 76 300x |

|

WTI CSO M20 -0.25 Call TRADES 3 1,000x |

|

WTI CSO M20 -4.50 Put TRADES 78 450x |

|

WTI CSO M20 -5.00 Put TRADES 80 400x; TRADES 79 500x |

|

WTI CSO N20 -2.50 Put TRADES 61 100x; TRADES 65 50x |

|

WTI CSO Cal21 0.75 Call TRADES 13 25x |

|

ARB Z20/Z21 -5.00 Put Roll TRADES 30 300x |

|

WTI APO M20 35/37 Call Spread x33.10 TRADES 83 200x 11d |

|

WTI APO N20 33/27 Put Spread LIVE TRADES 173 25x |

|

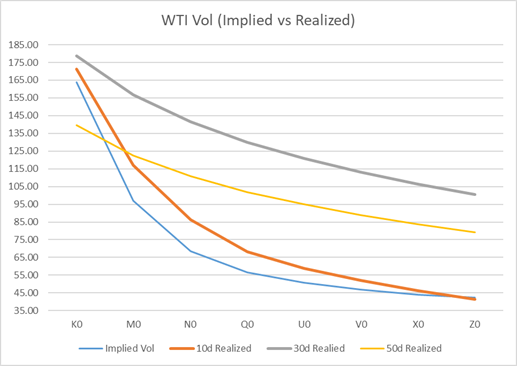

Implied Vol |

Realized Vol |

||||||

|

WTI Vol |

13-Apr |

Change |

B/E |

10d |

30d |

50d |

|

|

K0 |

163.73 |

-14.66 |

2.31 |

171.40 |

178.56 |

139.51 |

|

|

M0 |

97.04 |

-14.54 |

1.85 |

116.86 |

156.79 |

122.45 |

|

|

N0 |

68.50 |

-10.08 |

1.47 |

86.29 |

141.66 |

110.82 |

|

|

Q0 |

56.68 |

-8.35 |

1.26 |

68.18 |

130.06 |

101.96 |

|

|

U0 |

50.74 |

-6.38 |

1.15 |

58.91 |

120.77 |

94.87 |

|

|

V0 |

46.78 |

-5.69 |

1.07 |

51.90 |

113.00 |

88.91 |

|

|

X0 |

44.11 |

-4.53 |

1.02 |

46.14 |

106.44 |

83.85 |

|

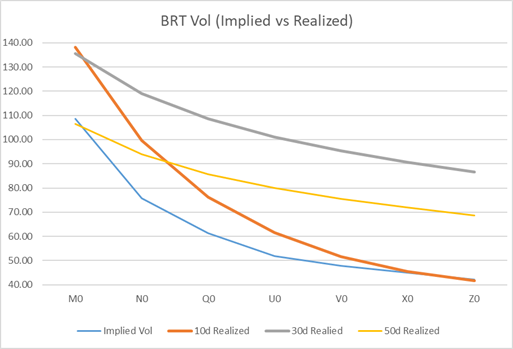

Implied Vol |

Realized Vol |

||||||

|

BRT Vol |

13-Apr |

Change |

B/E |

10d |

30d |

50d |

|

|

M0 |

108.72 |

-12.08 |

2.24 |

138.14 |

135.50 |

106.52 |

|

|

N0 |

75.73 |

-11.25 |

1.73 |

99.72 |

119.13 |

93.93 |

|

|

Q0 |

61.27 |

-7.80 |

1.46 |

76.22 |

108.50 |

85.74 |

|

|

U0 |

51.81 |

-6.78 |

1.27 |

61.57 |

101.15 |

80.03 |

|

|

V0 |

47.80 |

-5.89 |

1.2 |

51.51 |

95.40 |

75.57 |

|

|

X0 |

44.99 |

-4.68 |

1.14 |

45.58 |

90.65 |

71.85 |

|

|

Z0 |

42.21 |

-4.31 |

1.08 |

41.60 |

86.55 |

68.63 |

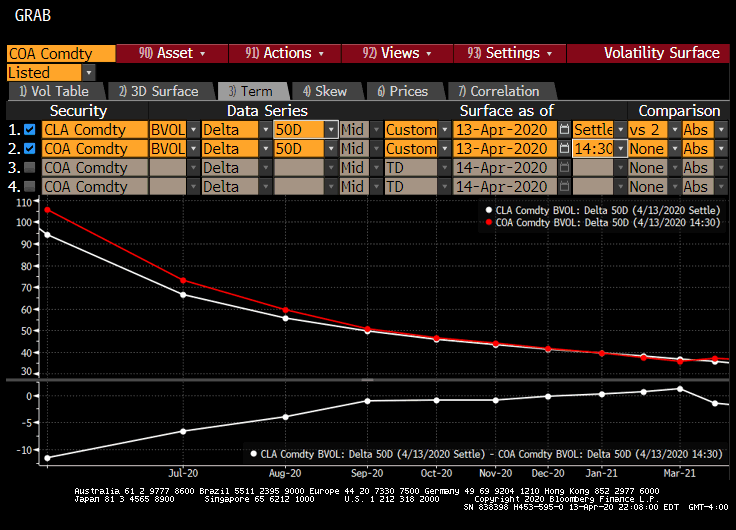

WTI/BRT Implied ATM Vol Curve

WTI Skew Change (d/d)

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

K0 |

50.50 |

38.70 |

23.45 |

12.10 |

163.73 |

-8.05 |

-11.25 |

-11.20 |

-8.30 |

|

K0 (4/9) |

55.50 |

42.90 |

25.75 |

13.00 |

178.38 |

-8.15 |

-11.15 |

-10.80 |

-7.90 |

|

|

-5.00 |

-4.20 |

-2.30 |

-0.90 |

-14.66 |

0.10 |

-0.10 |

-0.40 |

-0.40 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M0 |

55.60 |

42.90 |

26.20 |

13.10 |

97.04 |

-8.00 |

-11.40 |

-13.10 |

-12.80 |

|

M0 (4/9) |

54.90 |

41.30 |

26.05 |

13.55 |

111.57 |

-8.50 |

-11.95 |

-13.40 |

-12.75 |

|

|

0.70 |

1.60 |

0.15 |

-0.45 |

-14.54 |

0.50 |

0.55 |

0.30 |

-0.05 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

N0 |

41.95 |

32.00 |

19.30 |

9.50 |

68.50 |

-5.70 |

-8.00 |

-9.05 |

-8.70 |

|

N0 (4/9) |

43.50 |

30.40 |

19.10 |

10.35 |

78.58 |

-6.45 |

-8.95 |

-9.75 |

-8.80 |

|

Change |

-1.55 |

1.60 |

0.20 |

-0.85 |

-10.08 |

0.75 |

0.95 |

0.70 |

0.10 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Q0 |

33.25 |

24.95 |

14.55 |

7.10 |

56.68 |

-4.20 |

-5.80 |

-6.25 |

-5.70 |

|

Q0 (4/9) |

37.20 |

25.85 |

15.80 |

8.35 |

65.03 |

-5.15 |

-7.10 |

-7.70 |

-6.85 |

|

|

-3.95 |

-0.90 |

-1.25 |

-1.25 |

-8.35 |

0.95 |

1.30 |

1.45 |

1.15 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

U0 |

27.40 |

20.50 |

12.20 |

6.10 |

50.74 |

-3.60 |

-4.90 |

-5.10 |

-4.35 |

|

U0 (4/9) |

30.00 |

21.55 |

13.25 |

7.00 |

57.12 |

-4.35 |

-6.10 |

-6.60 |

-5.80 |

|

|

-2.60 |

-1.05 |

-1.05 |

-0.90 |

-6.38 |

0.75 |

1.20 |

1.50 |

1.45 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

V0 |

25.05 |

17.15 |

10.55 |

5.70 |

46.78 |

-3.45 |

-4.50 |

-4.25 |

-2.95 |

|

V0 (4/9) |

27.75 |

18.50 |

11.15 |

6.10 |

52.46 |

-3.95 |

-5.45 |

-5.55 |

-4.30 |

|

|

-2.70 |

-1.35 |

-0.60 |

-0.40 |

-5.69 |

0.50 |

0.95 |

1.30 |

1.35 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z0 |

19.35 |

13.50 |

8.30 |

4.45 |

42.20 |

-2.75 |

-3.65 |

-3.45 |

-2.30 |

|

Z0 (4/9) |

20.50 |

14.50 |

8.95 |

4.80 |

46.59 |

-3.10 |

-4.35 |

-4.45 |

-3.40 |

|

|

-1.15 |

-1.00 |

-0.65 |

-0.35 |

-4.39 |

0.35 |

0.70 |

1.00 |

1.10 |

Brent Skew Change (d/d)

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M0 |

40.70 |

35.85 |

27.35 |

15.85 |

108.72 |

-11.25 |

-16.40 |

-19.65 |

-20.20 |

|

M0 (4/9) |

35.40 |

29.40 |

22.00 |

13.25 |

120.79 |

-10.20 |

-14.70 |

-16.75 |

-15.60 |

|

Change |

5.30 |

6.45 |

5.35 |

2.60 |

-12.08 |

-1.05 |

-1.70 |

-2.90 |

-4.60 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

N0 |

42.35 |

32.20 |

22.85 |

13.10 |

75.73 |

-8.30 |

-11.60 |

-13.20 |

-12.75 |

|

N0 (4/9) |

50.95 |

35.10 |

21.70 |

12.30 |

86.98 |

-8.45 |

-12.05 |

-13.90 |

-13.45 |

|

Change |

-8.60 |

-2.90 |

1.15 |

0.80 |

-11.25 |

0.15 |

0.45 |

0.70 |

0.70 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Q0 |

34.40 |

26.10 |

17.00 |

8.95 |

61.27 |

-5.40 |

-7.50 |

-8.30 |

-7.70 |

|

Q0 (4/9) |

37.00 |

27.30 |

17.05 |

8.95 |

69.07 |

-5.80 |

-8.30 |

-9.60 |

-9.40 |

|

Change |

-2.60 |

-1.20 |

-0.05 |

0.00 |

-7.80 |

0.40 |

0.80 |

1.30 |

1.70 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

U0 |

28.00 |

19.40 |

12.05 |

6.45 |

51.81 |

-3.85 |

-5.10 |

-4.95 |

-3.65 |

|

U0 (4/9) |

33.55 |

22.20 |

13.45 |

7.50 |

58.59 |

-4.95 |

-6.80 |

-7.10 |

-5.80 |

|

|

-5.55 |

-2.80 |

-1.40 |

-1.05 |

-6.78 |

1.10 |

1.70 |

2.15 |

2.15 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

V0 |

23.20 |

15.50 |

9.35 |

5.00 |

47.80 |

-3.10 |

-4.05 |

-3.70 |

-2.25 |

|

V0 (4/9) |

26.45 |

17.35 |

10.35 |

5.80 |

53.68 |

-4.00 |

-5.60 |

-5.85 |

-4.75 |

|

|

-3.25 |

-1.85 |

-1.00 |

-0.80 |

-5.89 |

0.90 |

1.55 |

2.15 |

2.50 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z0 |

20.35 |

12.75 |

6.35 |

3.20 |

42.21 |

-2.05 |

-2.70 |

-2.20 |

-0.90 |

|

Z0 (4/9) |

24.55 |

16.40 |

8.00 |

3.95 |

46.51 |

-2.60 |

-3.60 |

-3.55 |

-2.75 |

|

|

-4.20 |

-3.65 |

-1.65 |

-0.75 |

-4.31 |

0.55 |

0.90 |

1.35 |

1.85 |

Spot Grades vs WTI

|

FF |

13-Apr |

9-Apr |

D/D Change |

E5 |

13-Apr |

9-Apr |

D/D Change |

HTT |

13-Apr |

9-Apr |

D/D Change |

||

|

K0 |

(3.64) |

(4.14) |

0.50 |

K0 |

(3.48) |

(5.31) |

1.83 |

K0 |

(1.74) |

(2.27) |

0.53 |

||

|

M0 |

(2.53) |

(3.16) |

0.63 |

M0 |

(1.05) |

(4.43) |

3.38 |

M0 |

(0.55) |

(1.13) |

0.58 |

||

|

Q3 ’20 |

(1.37) |

(1.84) |

0.46 |

Q3 ’20 |

(1.20) |

(2.28) |

1.08 |

Q3 ’20 |

(0.35) |

(0.48) |

0.13 |

||

|

Q4 ’20 |

(0.17) |

(0.42) |

0.25 |

Q4 ’20 |

(0.40) |

(1.00) |

0.60 |

Q4 ’20 |

0.50 |

0.35 |

0.15 |

||

|

K-Z ’20 |

(1.35) |

(1.76) |

0.41 |

K-Z ’20 |

(1.17) |

(2.45) |

1.28 |

K-Z ’20 |

(0.23) |

(0.47) |

0.24 |

||

|

C21 |

0.39 |

0.41 |

(0.02) |

C21 |

1.36 |

1.16 |

0.21 |

C21 |

1.63 |

1.64 |

(0.01) |

||

|

WTT |

13-Apr |

9-Apr |

D/D Change |

YV |

13-Apr |

9-Apr |

D/D Change |

||||||

|

K0 |

(4.47) |

(5.48) |

1.01 |

K0 |

(2.09) |

(3.12) |

1.03 |

||||||

|

M0 |

(3.25) |

(3.80) |

0.55 |

M0 |

(3.63) |

(6.00) |

2.37 |

||||||

|

Q3 ’20 |

(1.88) |

(2.48) |

0.60 |

Q3 ’20 |

(3.75) |

(4.75) |

1.00 |

||||||

|

Q4 ’20 |

(0.50) |

(0.85) |

0.35 |

Q4 ’20 |

(3.00) |

(3.75) |

0.75 |

||||||

|

K-Z ’20 |

(1.86) |

(2.41) |

0.55 |

K-Z ’20 |

(3.25) |

(4.33) |

1.08 |

||||||

|

C21 |

0.40 |

0.42 |

(0.01) |

C21 |

(1.78) |

(2.09) |

0.31 |

China says difficulties facing trade cannot be underestimated – Reuters

CHINA CUSTOMS SPOKESMAN SAYS THERE ARE SIGNS OF RECOVERY FOR FOREIGN TRADE FROM JAN-FEB PERIOD

CHINA CUSTOMS SPOKESMAN SAYS DOMESTIC DEMAND PLAYED IMPORTANT ROLE IN PROMOTING IMPORTS AS THINGS RETURN TO NORMAL

CHINA CUSTOMS SPOKESMAN SAYS SHRINKING INTERNATIONAL DEMAND WILL IMPACT OUR EXPORTS

CHINA CUSTOMS SPOKESMAN SAYS DIFFICULTIES FACING FOREIGN TRADE CANNOT BE UNDERESTIMATED

CHINA CUSTOMS SPOKESMAN SAYS CHINA’S FOREIGN TRADE IS RESILIENT

CHINA CUSTOMS SPOKESMAN SAYS CHINA CONFIDENT IN ITS ABILITY TO ENSURE STABILITY IN FOREIGN TRADE AND MINIMISE IMPACT OF CORONAVIRUS OUTBREAK

CHINA CUSTOMS SPOKESMAN SAYS AS WE GRADUALLY IMPLEMENT THE PHASE 1 DEAL WITH U.S., WE HAVE SEEN SOME POSITIVE DEVELOPMENTS

CHINA CUSTOMS SPOKESMAN, ASKED ABOUT IMPLEMENTATION OF PHASE 1 TRADE DEAL WITH U.S., SAYS WE CANNOT NEGLECT NEGATIVE IMPACT OF COVID-19

CHINA CUSTOMS SPOKESMAN, ASKED ABOUT IMPLEMENTATION OF PHASE 1 TRADE DEAL WITH U.S., SAYS IMPORT OF AGRICULTURAL PRODUCTS INCREASING

CHINA CUSTOMS SPOKESMAN SAYS CHINA’S Q1 EXPORTS TO U.S. DOWN 23.6%, Q1 IMPORTS FROM U.S. DOWN 1.3%

CHINA CUSTOMS SPOKESMAN SAYS CHINA’S Q1 EXPORTS TO U.S. DOWN 23.6%, IMPORTS FROM U.S.DOWN 1.3%

IMF to provide debt relief to help 25 countries deal with pandemic – Reuters

The International Monetary Fund said on Monday it would provide immediate debt relief to 25 member countries under its Catastrophe Containment and Relief Trust (CCRT) to allow them to focus more financial resources on fighting the coronavirus pandemic. IMF Managing Director Kristalina Georgieva said the fund’s executive board approved on Monday the first batch of countries to receive grants to cover their debt service obligations to the fund for an initial six months. She said the CCRT had about $500 million in resources on hand, including new pledges of $185 million from Britain, $100 million from Japan, and undisclosed amounts from China, the Netherlands and others. The fund is pushing to raise the amount available to $1.4 billion. About $215 million of the total would be used for grants to the first 25 countries over the next six months, with extensions possible up to two years, an IMF spokeswoman said. "This provides grants to our poorest and most vulnerable members to cover their IMF debt obligations for an initial phase over the next six months and will help them channel more of their scarce financial resources towards vital emergency medical and other relief efforts," Georgieva said in a statement. She urged other donor countries to help replenish the CCRT and boost the fund’s ability to provide additional debt service relief for a full two years to its poorest member countries. Eric LeCompte, executive director of Jubilee USA Network, a non-profit group, said the grants would help the IMF’s poorest members, including the Central African Republic, which has only three critical-care unit beds for a population of 5 million. "It’s a great start, but we need more donors to be able to offer this relief," he said, adding that the IMF should also consider selling some of its gold reserves, now worth an estimated $140 billion, as was done in past crises. An IMF spokesman said the fund was looking at actions that could be taken quickly, but "another sale of gold reserves is not currently on the table." The IMF in March approved changes that would allow the CCRT to provide up to two years of debt service relief to the fund’s poorest members as they responded to the outbreak of COVID-19, the respiratory illness caused by the novel coronavirus. The changes enabled countries to request the aid even if the outbreak had not yet caused significant impact. More than 1.8 million people have been reported to be infected by the coronavirus globally and 115,242 have died, according to a Reuters tally. A precursor of the CCRT was used for Haiti after the devastating earthquake that struck the island nation in 2010. Renamed CCRT, it was also used to provide relief to countries affected by the 2014 Ebola outbreak. The first countries that will receive debt service relief from the CCRT are Afghanistan, Benin, Burkina Faso, Central African Republic, Chad, Comoros, the Democratic Republic of Congo, Gambia, Guinea, Guinea-Bissau, Haiti, Liberia, Madagascar, Malawi, Mali, Mozambique, Nepal, Niger, Rwanda, São Tomé and Príncipe, Sierra Leone, Solomon Islands, Tajikistan, Togo and Yemen, the IMF said.

Goldman Sees Advanced Economies Shrinking 35% Amid Pandemic

(Bloomberg) — Advanced economies will shrink about 35% this quarter from the prior three months, four times as much as the previous record set in 2008 during the financial crisis, according to annualized figures from Goldman Sachs Group Inc. How fast economies will rebound is an open question because nobody knows how quickly people can get back to work, New York-based economist Jan Hatzius wrote in a note to clients dated April 13. The number of new virus cases appears to be peaking globally, but the bad news is that “the improvement is probably a direct consequence of social distancing and the plunge in economic activity, and could reverse quickly if people just went back to work,” Hatzius wrote.

Overall, global policy makers have mounted an impressive response to try to replace people’s incomes and keep credit flowing so that households and businesses can stay afloat, but Europe should do more and wealthy countries will need to help developing economies, he wrote. “The response in Europe needs to be scaled up, via greater (and ideally centrally funded) fiscal easing and a more unconditional ‘whatever it takes’ commitment to the integrity of the euro area,” Hatzius wrote. “Emerging economies will need a lot more help from the rich world” to get through the crisis.

New York, California and other states plan for reopening as coronavirus crisis eases – Reuters

Ten U.S. governors on the east and west coasts banded together on Monday in two regional pacts to coordinate gradual economic re-openings as the coronavirus crisis finally appeared to be ebbing. Announcements from the New York-led group of Northeastern governors, and a similar compact formed by California, Oregon and Washington state, came as President Donald Trump declared any decision on restarting the U.S. economy was up to him. New York Governor Andrew Cuomo said he was teaming up with five counterparts in adjacent New Jersey, Connecticut, Delaware, Pennsylvania and Rhode Island to devise the best strategies for easing stay-at-home orders imposed last month to curb coronavirus transmissions. Massachusetts later said it was joining the East Coast coalition. "Nobody has been here before, nobody has all the answers," said Cuomo, whose state has become the U.S. epicenter of the global coronavirus pandemic, during an open conference call with five other governors. "Addressing public health and the economy: Which one is first? They’re both first." The three Pacific Coast states announced they, too, planned to follow a shared approach for lifting social-distancing measures, but said they "need to see a decline in the rate of spread of the virus before large-scale reopening" can take place.

SAFETY AND HEALTH FIRST

The 10 governors, all Democrats except for Charlie Baker of Massachusetts, gave no timeline for ending social lockdowns that have idled the vast majority of more than 100 million residents in their states. But they stressed that decisions about when and how to reopen non-essential businesses, along with schools and universities, would put the health of residents first and rely on science rather than politics. The announcements came as signs emerged that the crisis had peaked. At least 1,500 new U.S. fatalities were reported on Monday, below last week’s running tally of roughly 2,000 deaths every 24 hours. Likewise, the number of additional confirmed cases counted on Monday, about 23,000, was well below last week’s trend of 30,000 to 50,000 new cases a day. Cuomo, whose state accounts for the largest number of cumulative deaths, over 10,000, said on Monday "the worst is over" for his state. Governors of at least two other hard-hit states – John Bel Edwards of Louisiana and J.B. Pritzker of Illinois, both Democrats – also disputed the notion that authority to lift or modify their stay-at-home orders rested with anyone but them. Pritzker said reopening his state may occur in stages and be accompanied by new face-covering requirements in public places and workplace capacity limits. "The most important thing is safety and health," he said. Trump, a Republican who before the pandemic had touted a vibrant U.S. economy as a pillar of his November re-election bid, has pressed repeatedly in recent weeks for getting Americans back to work soon. Ahead of the governors’ announcement on Monday, he insisted he had unilateral authority for ending the lockdowns that have strangled the U.S. economy, throwing at least 17 million Americans out of work in just three weeks. Legal experts say the president has limited power under the U.S. Constitution to order citizens back to their places of employment, to require cities to reopen government offices and transportation, or to order local businesses to resume. Pressed on the question of whether governors or the federal government would make the decision to re-open shuttered schools and businesses, Trump insisted he had ultimate authority. "The president of the United States calls the shots," Trump told a White House briefing after the announcements by the governors, reiterating a stance he expressed earlier in the day on Twitter. "With that being said, we’re going to work with the states," Trump told reporters. "They can’t do anything without the approval of the president of the United States," Trump went on. "When somebody is the president of the United Sates, the authority is total, and that’s the way it’s going to be. … The governors know that." He offered no specifics backing his assertion of authority over the states nor any details of plans to relax social distancing rules. Political leaders said a reopening of the economy may hinge on more widespread testing to better determine the full extent of infections and cautioned that lifting stay-at-home orders prematurely could reignite the outbreak. The Trump administration has signaled May 1 as a potential date for easing the restrictions.

DEATH TOLL TOPS 23,500

The U.S. death toll from COVID-19, the highly infectious lung disease caused by the virus, topped 23,600 on Monday, out of more than 581,000 known U.S. infections, according to a Reuters tally. The United States, with the world’s third-largest population by country, has recorded greater loss of life from COVID-19 than any other nation. Wyoming reported its first death from the coronavirus on Monday, the final U.S. state to report a fatality. An influential University of Washington research model this week raised its U.S. mortality forecasts on Monday to nearly 69,000 deaths through Aug. 4, up from 61,500 projected last week, assuming that social-distancing measures remain in place. The university’s Institute for Health Metrics and Evaluation said higher death tolls now projected in Massachusetts and New York state accounted for part of the upward revision. Regardless of the death toll, continued difficulties in ramping up diagnostic testing pose a major hurdle for public health experts in determining at what point it is safe enough to relax social distancing measures. New York City Health Commissioner Dr. Oxiris Barbot acknowledged a "tightening" of the supply chain for the nasal swabs needed in coronavirus testing, and said it was part of a "national and international challenge" to ramp up testing.

China’s March crude oil imports jump 12% on stockpiling – calculation – Reuters News

China’s crude oil imports in March rose 11.7% from a year earlier, as refiners stocked up on lower-priced cargoes despite falling domestic fuel demand and cuts in refining rates caused by the COVID-19 disease outbreak. China, the world’s top crude oil importer, took in 43.91 million tonnes of oil, according to a Reuters calculation based on data from the General Administration of Customs. That is equal to 10.34 million barrels per day (bpd). That compared to an average of 10.47 million bpd for the first two months of the year. Imports for the first quarter rose 5% from a year earlier to 130 million tonnes, customs said, equal to 10.43 million bpd. Refiners, including state majors and private plants, began slashing crude throughput in February as fuel demand collapsed amid a nationwide lockdown to contain the novel coronavirus. But independent plants, also known as "teapots", started cranking up production rates in March, as a plunge in oil prices triggered by the Saudi-Russia price war boosted margins. “Teapots started to book crude oil from late February when domestic virus transmission was easing. Some of the vessels have arrived in March and more will come in in April," said Li Yan, senior analyst at Longzhong Information Group. Li also expected an increase in oil imports in late April and May as Chinese refineries scrambled to purchase cheap energy after oil prices collapsed. Chinese fuel demand has started to recover as companies resume operations and travel curbs are eased, although analysts expect demand across the full year to fall 19.1% from 2019 in what would be the steepest drop since at least 2004. Natural gas imports, including piped and liquefied natural gas, in the first quarter were 24.66 million tonnes, up 1.8% from a year earlier, customs said. In March, imports were 6.86 million tonnes, down 1.2% from a year earlier, according to a Reuters calculation.

At least one worker at Pemex oil platform infected with coronavirus – sources – Reuters News

At least one worker at Mexican state oil company Pemex’s Abkatun-A processing center, in shallow waters in the Gulf of Mexico, has been diagnosed with coronavirus, two people with knowledge of the matter told Reuters. At the end of last week, executives from Abkatun-A reported internally that 21 workers, including the doctor on staff, had shown "feverish symptoms," two other people with knowledge of the matter told Reuters. At least one person had since been diagnosed with coronavirus, one of the latest sources said. The second source said "several" people had. Pemex did not immediately respond to a request for comment on how many people had been diagnosed or whether the facility’s operations would be affected. Four people were transferred on Friday by plane from the Abkatun-A processing center to the Pemex hospital in Ciudad del Carmen, in Campeche state, according to an internal document seen by Reuters. A "health intervention" was carried out on Sunday with the support of local health authorities in Ciudad del Carmen and Pemex medical personnel to take samples from center workers, according to another company document. Workers who remain at the site will have to work "triple shifts" to make up for those who are out with symptoms of coronavirus, according to one of the people with knowledge of the matter, without giving further details. The Abkatun-A processing center has lodgings for 225 people, a production platform, a compression platform, a connection platform and a drilling platform in addition to two burners. All are connected by bridges. The center is part of the Abkatun-Pol-Chuc complex, which produces around 172,000 barrels per day (bpd) of crude. Pemex currently pumps around 1.6 million bpd, without accounting for production with partners, according to company data. Mexico registered 353 new cases of coronavirus on Monday, bringing its total to 5,014 cases and 332 deaths, the health ministry said.

Oman says will cut oil output by 200,000 bpd from May 1 as OPEC+ pact – Reuters News

Oman has told its oil producing companies to cut 200,000 barrels per day starting from May 1 until the end of June in line with OPEC+ crude supply reduction pact and will inform its customers of the same plan, its oil ministry said. OPEC and allies led by Russia, a group known as OPEC+, agreed on Sunday to a record cut in output to prop up oil prices amid the coronavirus pandemic in an unprecedented deal with fellow oil nations, including the United States, that could curb global oil supply by up to 20%. Gulf oil producer Oman is a member of the OPEC+ alliance.

Top Thai Oil Driller Cuts Capex Up to 20% in Crash Survival Mode

(Bloomberg) — Thailand’s biggest oil driller is cutting spending by as much as 20% this year as it tries to conserve cash amid a price collapse. PTT Exploration & Production Pcl may reduce 2020 capital expenditures to $3.7 billion by canceling or delaying major projects, including postponing the construction of an offshore production platform in Myanmar, Phongsthorn Thavisin, the company’s chief executive officer, said in a phone interview Monday. The drilling arm of state-owned oil powerhouse PTT Pcl is pumping normally but may shut in production if prices fall below $15 a barrel, Phongsthorn said. The company is working to lower its operating costs by about 30% from current levels of about $30 per barrel of oil equivalent. Brent futures settled at $31.74 a barrel Monday, down more than 50% so far this year. “For us to survive, we need to adapt and reduce costs as much as we can,” Phongsthorn said. “But we won’t do it too quickly that it limits our capability in the future.”

U.S. shale oil output to drop by record 194,000 bpd in April – EIA – Reuters

U.S. shale oil output is expected to drop by 194,000 barrels per day (bpd) in April, most on record, to about 8.7 million bpd, according to the U.S. Energy Information Administration, as producers slash drilling activity after oil prices plunged. Shale production has been sliding for several months, but the declines are expected to accelerate as demand has fallen by roughly 30% worldwide due to the coronavirus pandemic. Numerous producers, including U.S. majors Exxon Mobil Corp XOM.N and Chevron Corp CVX.N, have announced plans to rein in spending and are forecasting reduced output in coming months. April’s decline is forecast to be followed by fall in May by 183,000 bpd to 8.53 million bpd, which would be the lowest since June 2019, and a sixth straight month of declines, the EIA said in a monthly forecast. Crude oil prices LCOc1, CLc1 dropped by more than 65% in the first quarter as demand plummeted due to the coronavirus pandemic and supply ballooned due to a price war between Saudi Arabia and Russia. On Sunday, major producers inked a deal to cut production by 9.7 million bpd, with declining output from other nations expected to result in an overall fall of as much as 19.5 million bpd, or about 20% of world supply. Output at every shale formation is expected to fall in May, with the biggest drop forecast in the Permian, the biggest U.S. basin, the EIA said. Production in the Permian basin of Texas and New Mexico is expected to drop by 86,500 bpd in April, most since December 2015, and then by 76,000 bpd in May to 4.51 million bpd, the lowest since September. The second-biggest decline is forecast to come from the Eagle Ford basin, with a drop of 35,000 bpd to 1.3 million bpd, lowest since May 2018. Overall U.S. production hit a record of 12.9 million bpd in November 2019; of that, shale production was 9.1 million bpd, also a record, according to U.S. Energy Department figures. The EIA said producers drilled 990 wells, the least since June 2017. Total drilled but uncompleted (DUC) wells fell 80 to 7,575, lowest since November 2018. U.S. natural gas output was projected to drop to 83.2 billion cubic feet per day (bcfd) in May, lowest since August 2019, and what would be six straight months of decline. Output in the Appalachia region, the biggest U.S. shale gas formation, was set to fall 0.3 bcfd to 31.9 bcfd.

The Oil Fracklog That Threatens to Take Down Any Market Comeback

(Bloomberg) — The unprecedented deal by OPEC+ members to curb supply is designed to quickly stabilize the oil market. But U.S. producers in the Permian Basin, America’s largest oil play, are building a back log of drilled but uncompleted wells that could lead to the next output surge as prices recover. Producers in West Texas and New Mexico have boosted the number of these wells, known within the industry as DUCs, for three straight months, according to the U.S. Energy Information Administration’s Drilling Productivity Report. The number has now reached 3,441, up about 10% since January 2019. That’s one of the highest levels for the so-called fracklog since records began in late 2013, and about three times higher than during the 2015-2016 price downturn. By drilling these wells but not opening them for production, explorers hope to be able to steer through an oversupplied oil market as a killer pandemic destroys demand. At the same time, when prices do recover, producers can quickly finish the wells to dramatically boost the amount of crude produced. “The main point now is that Permian operators will be well prepared to boost production quickly when oil prices improve due to the abnormal build-up in DUC inventory. By the end of 2020, we expect to see a year of completion activity at the current pace in DUC inventory,” said Artem Abramov, head of shale research at Rystad Energy. The build, however, appears only to be a trend in the Permian, as the number of DUCs in the Bakken and the Eagle Ford are around the same levels from the last downturn. Still, Permian DUCs make up 45% of the total DUC count across the major U.S. shale plays.

Shell, Exxon halt some Gulf of Mexico output due to Exxon pipeline leak – Reuters News

A leak in a pipeline that carries oil from U.S. Gulf of Mexico offshore facilities has halted production at two fields, Exxon Mobil Corp XOM.N and Royal Dutch Shell RDSa.L said on Monday. Shell said it temporarily halted production on its 100,000-barrel-per-day deepwater Perdido production hub last Thursday after a subsurface leak was discovered on Exxon’s Hoover Offshore Oil Pipeline System (HOOPS). Production on Exxon’s Hoover platform also was halted because of the leak, Exxon said. The HOOPS pipeline has been closed for repairs, a spokeswoman for Shell said. Exxon has notified government agencies and shippers and has responded to an onshore release of crude oil at a facility in Freeport, Texas, spokesman Todd Spitler said on Monday. "We anticipate resuming flow on the line in a timely manner once it is safe to do so," he said. Exxon did not say what caused the leak or how much production was affected. HOOPS connects the Exxon-operated Hoover, Marshall and Madison offshore fields, which combined produce about 4,000 barrels of oil per day, according to a 2018 marketing brochure. Shell’s Perdido hub is moored in some 8,000 feet (2,438 m) of water about 200 miles (322 km) south of Galveston, Texas, and is a joint venture among Shell, BP Plc BP.L and Chevron Corp. The 153-mile (246-km) HOOPS pipeline brings oil from several offshore oilfields to the Quintana Terminal near Freeport, according to an Exxon website.

Enterprise Interstate Crude to Start Gulf Coast-Cushing Service

Enterprise Interstate Crude to begin temporary service to ship oil on its system from Enterprise Katy, Texas, to Cushing, Okla., according to a FERC filing.

Effective May 1, only for uncommitted shippers

Rate at $3/bbl

New service due to requests from at least one unaffiliated shipper

Given the current turmoil in the crude oil market, including impacts on both refinery and export demand, there is strong market interest to access Cushing storage

U.S. Cash Crude-Sour grades firm, Mars flips to premium as Saudi ups prices – Reuters News

U.S. cash crude differentials strengthened on Monday, with Mars sour crude trading at a premium to futures as Saudi Arabia raised crude selling prices to the United States, reducing the prospects of an influx of crude, dealers said. The Organization of the Petroleum Exporting Countries, along with Russia and other countries – known as OPEC+ – agreed over the weekend to cut output by 9.7 million barrels per day (bpd) in May and June, representing about 10% of global supply. After the deal, Saudi Arabia announced its official crude pricing (OSP) for May, selling oil more cheaply to Asia while raising them for the United States. Sour grades produced in offshore Gulf of Mexico, such as Poseidon and Southern Green Canyon (SGC) strengthened on Monday as a result, traders said. Separately, a leak in a pipeline that carries oil from U.S. Gulf of Mexico offshore facilities has halted production at two fields, Exxon Mobil Corp XOM.N and Royal Dutch Shell RDSa.L said on Monday. Onshore grade WTI Midland crude oil also firmed to a midpoint of about $3.50 a barrel discount to U.S. crude futures. U.S. shale oil output is expected to drop by 194,000 barrels per day (bpd) in April, most on record, to about 8.7 million bpd, according to the U.S. Energy Information Administration, as producers slash drilling activity after oil prices plunged. April’s decline is forecast to be followed by fall in May by 183,000 bpd to 8.53 million bpd, which would be the lowest since June 2019, and a sixth straight month of declines, the EIA said in a monthly forecast. Meanwhile, traders continued to point to swelling supplies. Inventories in Cushing, Oklahoma, the delivery point for U.S. crude futures, rose by about 5.4 million barrels in the week through Friday, traders said, citing data from market intelligence firm Genscape.

Light Louisiana Sweet WTC-LLS for May delivery was unchanged at a midpoint of $3.25 a barrel discount, trading between $3 and $3.50 a barrel premium to U.S. crude futures CLc1.

Mars Sour WTC-MRS rose 75 cents to a midpoint of 50 cents a barrel premium and traded between $1 a barrel premium and parity to U.S. crude futures CLc1.

WTI Midland WTC-WTM rose $1.75 to a midpoint of $3.50 a barrel discount and traded between $3 and $4 a barrel premium to U.S. crude futures CLc1.

West Texas Sour WTC-WTS was unchanged at a midpoint of $8 a barrel discount, trading between $8.50 and $7.50 a barrel discount to U.S. crude futures CLc1.

WTI at East Houston, also known as MEH, WTC-MEH traded at parity to WTI.

U.S. Cash Products-Group Three gasoline rises in thin trading day – Reuters News

Group Three gasoline cash differentials rose on Monday in a session with thin trading volumes, traders said. Group 3 V-grade gasoline gained 2.25 cents, trading 33.75 cents lower than the gasoline futures benchmark on the New York Mercantile Exchange RBc1. In Chicago, ultra-low sulfur diesel fell 9 cents, trading 16 cents per gallon below diesel futures HOc1. U.S. Gulf Coast M2 conventional gasoline fell 1.25 cents, trading 12.25 cents lower than futures, market participants said. A2 CBOB gasoline CBOB-DIFF-USG gained 1.25 cents, trading 17.25 cents per gallon below futures, traders said. Gulf Coast 62-grade ULSD gained 1 cent, trading 8.75 cents per gallon below futures. In New York Harbor, M2 conventional gasoline fell 3 cents, trading 10 cents per gallon below futures, traders said. The RBOB futures contract on NYMEX RBc1 rose 2.60 cents to settle at $0.7033 a gallon on Monday. NYMEX ultra-low sulfur diesel futures HOc1 rose 2.20 cents to settle at $0.9946 a gallon on Monday. Renewable fuel (D6) credits RIN-D6-US for 2020 traded at 39 cents each on Monday, up from 37 cents in the previous session, traders said. Biomass-based (D4) credits RIN-D4-US traded at 54 cents each, up from 53 cents each previously, traders said.

BP Whiting, Indiana, refinery operations normal -sources – Reuters News

BP Plc’s BP.L 430,000 barrel-per-day (bpd) Whiting, Indiana, refinery was operating normally on Monday afternoon, sources familiar with plant operations said. All units at the refinery including the 102,000 bpd coker were operating normally, the sources said. A report said the coker had decreased production on Monday.

Shell Convent, Louisiana, refinery restarting heavy-oil hydrocracker -sources – Reuters News

Royal Dutch Shell Plc began restarting the heavy-oil hydrocracker at its 211,270 barrel-per-day (bpd) Convent, Louisiana, refinery on Monday, said sources familiar with plant operations. The 45,000-bpd hydrocracker, called the H-Oil Unit, shut down on Saturday because of a malfunction, the sources said. Shell spokesman Curtis Smith declined to comment. The H-Oil Unit converts residual crude oil into motor fuels, primarily diesel, using a catalyst and hydrogen under high heat and pressure.

Brazil gasoline, ethanol sales down 30-35% amid coronavirus -BR Distribuidora – Reuters News

Brazilian fuel distributor Petrobras Distribuidora SA BRDT3.SA, better known by its BR Distribuidora brand name, has seen demand for gasoline and ethanol plummet during the new coronavirus outbreak, its chief executive officer told Reuters on Monday. CEO Rafael Grisolia said the company’s sales for those fuels initially fell 60% after the arrival of the disease in Brazil, and in recent days has recovered slightly with demand down 30-35%, compared with levels prior to the outbreak. Grisolia said the company attributed the sales recovery in the last two or three days to greater movement in major cities, where social isolation measures have begun to slip. He said sales of diesel are down only 20% as demand is propped up by truckers transporting Brazil’s grain crop, which is currently being harvested. BR Distribuidora is the largest fuel distributor in Brazil, holding market share of just over 25%.

Jonathan Wagner

Ion Energy Group

180 Maiden Lane 25th Floor

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

![]()

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.