From: Wagner, Jonathan

Sent: Tuesday, April 14, 2020 10:01:43 PM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Evening Rundown

Good evening. The “historic” OPEC+ cut could not cover up the sheer fact that oil stocks globally are building and front end futures prices are still too high relative to where physical barrels are trading. May WTI settled just over $20 today with front end spreads remaining under severe pressure as longs continue to roll their length at a $7 contango in WTI and a $4 contango in Brent. API data released today showed crude stocks building by 13m bbls and Cushing building another 5.4m bbls. Refinery runs fell by another 1.2m b/d to 12.78m b/d and imports falling by 830k b/d w/w to 5.04m b/d. The build this week takes Cushing stocks to 55m bbls with many estimating tank tops at around 75m ish bbls.

The latest GS note released this afternoon said that U.S. oil purchases for the Strategic Petroleum Reserve won’t change the supply-demand balance as the nation’s government and storage capacity will become saturated this month. GS reiterates their view that the level of voluntary cuts and government’s oil purchases are too little and too late to balance the market, leading to more downside for inland crudes like WTI into the May contract expiration. However, “what the OPEC+ cuts and SPR purchases can’t achieve in coming weeks, they should achieve over time, reinforcing our view that the ongoing violent market rebalancing is increasingly likely to be followed by a sharp rebound in oil prices once demand starts to recover.” While some officials have talked about a 20m b/d cut, such numbers “significantly overstate the level of voluntary cuts” and they include “overly optimistic assumptions on market driven declines outside of OPEC+ and government crude purchases for strategic reserves.” Assuming full core-OPEC compliance and 50% compliance from others in May, OPEC+ voluntary reduction would only lead to a 4.3m b/d cut in output from 1Q 2020 levels. A 20m b/d cut means G20 producers expected to cut 3.7m-5m b/d, but only Norway, Alberta considering cuts, with hearings taking place in Texas to discuss curtailments.

Texas energy regulators listened as top executives on Tuesday debated whether the state should cut oil output by 1 million barrels per day, but did not indicate how they might vote after more than 10 hours of sometimes dire testimony. The hearing, based on a request by executives from shale producers Pioneer Natural Resources Co and Parsley Energy Inc, ignited a debate between those who favor free markets and those who worry that without intervention, small producers could get shut out of oil sales as storage fills next month. Some firms have already started closing wells, several executives said. The industry is facing a historic economic collapse with $3 per barrel to $10 per barrel oil in coming weeks, Pioneer Chief Executive Scott Sheffield warned commissioners on Tuesday. "Demand is not going to come roaring back," he said. Kirk Edwards, president of small producer Latigo Petroleum, argued uniform cuts could help thousands of firms like his continue to sell some of their oil production. But producers have reduced spending as much as 50% and output has started falling already, said Lee Tillman, CEO of Marathon Oil Corp, who opposed state-mandated cuts, arguing the market is taking care of the glut. The commissioners are expected to vote on the oil companies’ motion on April 21. At least two votes on the three-member Texas Railroad Commission are needed to pass the proposal. Commissioner Ryan Sitton has pushed for evaluating statewide cuts. Wayne Christian and Christi Craddick, have been careful not to reveal how they might vote, though Christian said Tuesday, "the hardest thing I think in my life is to sit back and do nothing, and yet that is sometimes" what is needed. "What if other states don’t do this?" Craddick asked at one point during the hearing, suggesting Texas could send oil revenue to nearby states. Some of the state’s largest and most influential oil companies, Exxon Mobil Corp, Chevron Corp and Occidental Petroleum Corp, have opposed imposing limits, along with some of the largest trade organizations. The idea, however, has gained proponents elsewhere. A group of Oklahoma oil producers filed a request with that state for a hearing to consider production curbs. It is set to take place May 11. The executive chairman of Oklahoma-based Continental Resources Inc, Harold Hamm, said at the Texas hearing that he would "not oppose" Oklahoma cuts and urged Texas regulators to consider cutting output 25%.

Front end spreads were also under a good deal of pressure today following Enterprise’s comments yesterday that they would have a dual flow of oil between Cushing and Texas. A subsidiary of Enterprise Products Partners LP, told regulators on Monday that it planned to start temporary service on May 1 to move oil from Katy, Texas inland to Cushing. While the pipeline name wasn’t specified, a company spokesman said on Tuesday that their arrangement allows the company to utilize unused capacity on Seaway. “We believe that Cushing is filling extremely quickly with arbs open into the pricing center from all directions and refinery runs further decreasing in Padd 2,” said Saad Rahim, chief economist at commodities trading house Trafigura Group. “Cushing will be full in early May.” With the reversal, inbound capacity is 50% higher than outbound capacity compared with 20% previously, according to Genscape. The reversal could also be problematic in coming weeks when storage tanks are forecast to fill, as outbound pipes will be used to move oil away from the storage hub.

Below is a list of the pipeline connections into and out of Cushing, according to Genscape.

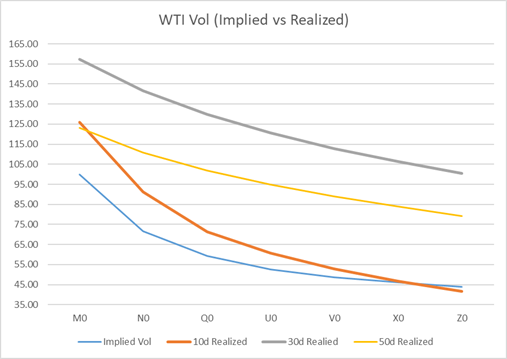

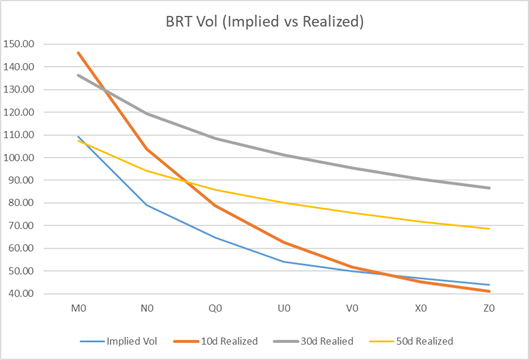

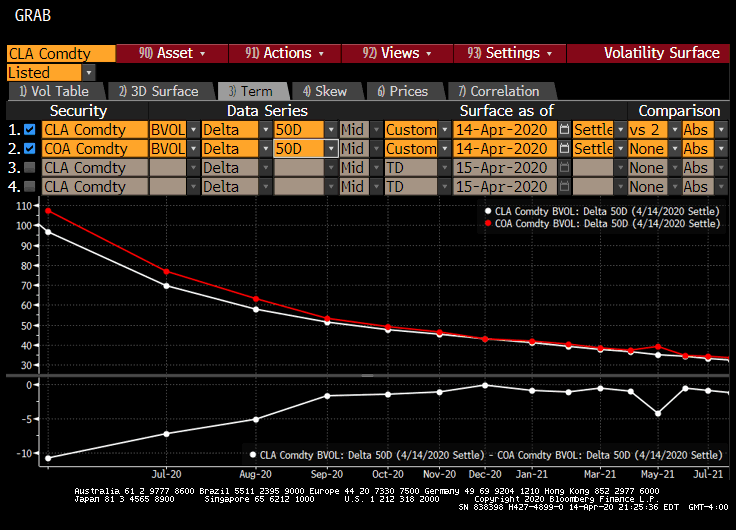

Vols finished the day higher across the curve with July outperforming in both WTI and Brent. Even with the sell off today wingy put skew was well offered across the balance of ’20 (except for z20 Brent). Call skew in WTI also underperformed while M20 Brent calls finished the day bid. In Brent the M20 22/35 fence was active in the morning trading 1k while the M20 40/45 call spread also traded 1k. The Brent N20 25/40 fence was active again today with continued interest seen selling puts vs buying calls. The Brent N20 30/25 1×1.5 put spread was very active trading as a Euro style today 3k. Further out the curve the Brent Z20 35/60 fence, the Z20 50/60 call spread and Z20 55/65 1×2 call spread were all active. In WTI The M20 28 vs U20 35 put roll was active throughout the day with interest buying the Sep. M20 fences were also active with buying puts and selling calls as per the 18/36 which traded 2k and the 24/37 which traded 1600x. Further out the curve the Z20/M21 atm call roll traded 1200x and Z20/Z21 ATM Roll traded 400x. Late in the day there was continued interest to own near atm puts in K20 WTI and we had interest in tight put spreads with continued expectations that K20 will move lower into option expiry on Thursday.

Top stories listed below

U.S. crude stocks jump by 13 mln bbls in latest week – API

U.S. deaths set record daily increase; Spain and Austria ease restrictions – Reuters News

China reports fewer coronavirus cases but infections from Russia a worry – Reuters

Trump’s May 1 target too optimistic for U.S. coronavirus reopening, adviser Fauci says – Reuters

China cuts medium-term borrowing costs by 20 bps, steps up fight against pandemic – Reuters

Trump to convene G7 leaders in video call to discuss pandemic – Reuters News

U.S. SPR Oil Purchases Won’t Alter Suppy-Demand Balance: Goldman

Saudi Oil Keeps Flooding Market With Output Pact Yet to Begin

Iraq Oil Output Capacity Includes Kurdistan at 5M B/D: Minister

Texas oil hearing stirs hornet’s nest, as regulators offer no clue to decision – Reuters News

Shale Billionaire Harold Hamm Sees Oklahoma Limiting Oil Output

Oil Producers Aren’t Rushing to Take Up Trump’s Storage Offer

Key Oil Pipeline Reversal May Accelerate Cushing Tank Tops

Enterprise opens up pipeline freeway to Cushing storage hub for crude producers – Reuters News

Pin Oak Set to Begin Crude Loadings at Corpus Dock This week

U.S. Cash Crude-WTI MEH trades at premium as Seaway offers service to Cushing – Reuters News

U.S. Cash Products-Gulf Coast gasoline rises after cycle change – Reuters News

WTI Most Actively Traded Options

Brent Most Actively Traded Options

|

BRT M20 18/12.50 Put Spread x29.80 TRADES 13 500x 2d |

|

BRT M20 22/35 Fence x31.40 TRADES 60 500x 44d |

|

BRT M20 23/20 Put Spread LIVE TRADES 34 2,000x |

|

BRT M20 33 Call x31.50 TRADES 171 800x 57d |

|

BRT M20 40/45 Call Spread vs 27 Put 2×1 x31.10 TRADES 93 1,000x 27d |

|

BRT M/Q20 35/30 Put Roll x31.15/36.60 TRADES 145 50x; TRADES 147 650x 28d/25d |

|

BRT N20 25/40 Fence x34.45 TRADES 12 500x; TRADES 17 500x; TRADES 20 1,000x 46d |

|

BRT N20 30 Put x34.00 TRADES 230 100x; TRADES 235 550x; TRADES 239 350x 24d |

|

BRT N20 30/25 1×1.5 European Put Spread LIVE TRADES 70 1,000x; TRADES 78 1,000x |

|

BRT N20 30/25 1×1.5 Put Spread x34.00 TRADES 72 900x 1d |

|

BRT Q20 30/45 Fence x36.70 TRADES 99 500x 43d |

|

BRT Z20 25 Put x40.10 TRADES 87 500x 10d |

|

BRT Z20 35/60 Fence x40.10 TRADES 244 500x 31d |

|

BRT Z20 50/60 Call Spread x40.00 TRADES 105 500x 17d |

|

BRT Z20 55/65 1×2 Call Spread x39.60 TRADES 16 500x 5d |

|

BRT H21 55 Call x41.10 TRADES 139 300x 20d |

|

BRT Z21 25 Put x43.15 TRADES 95 550x 5d |

|

4/14 WTI Trade Recap |

|

WTI M/U20 28/35 Put Roll x29.00/35.25 TRADES 123 300x; TRADES 125 300x; TRADES 130 1,400x 26d/30d |

|

WTI M20 18/36 Fence LIVE TRADES 35 2,000x |

|

WTI M20 20/35 Strangle LIVE TRADES 175 500x |

|

WTI M20 20/35 Strangle LIVE TRADES 177 500x |

|

WTI M20 21/20 Put Spread LIVE TRADES 19 1,000x |

|

WTI M20 24/37 Fence x29.15 TRADES 107 550x; TRADES 110 1,100x 33d |

|

WTI M20 29 Call x29.25 TRADES 344 800x 70d |

|

WTI M20 30 Call x28.00 vs WTI N20 30 Put x32.00 TRADES 94 1,000x 37d/43d |

|

WTI M20 32/38/41 1x3x2 Call Fly LIVE TRADES 93 300x |

|

WTI M20 36/44 Call Spread x28.60 TRADES 55 500x 14d |

|

WTI 3Q20 33/41/44 1x3x2 Call Fly LIVE TRADES 226 300x |

|

WTI U20 ATM Call x35.50 TRADES 433 100x; TRADES 427 400x 50d |

|

WTI Z20 60/75/90 Call Fly LIVE TRADES 15 500x |

|

WTI Z20/M21 ATM Call Roll x37.00/38.00 TRADES 59 1,200x 64d/64d |

|

WTI Z20/Z21 ATM Call Roll x36.50/38.50 TRADES 96 400x 66d/66d |

|

WTI H21 30/41 Fence x37.00 TRADES 79 400x 68d |

|

WTI M21 52/45 Put Spread LIVE TRADES 548 1,000x |

|

WTI Z21 30/25 Put Spread x38.50 TRADES 123 300x 8d |

|

WTI Z21 55 Call x38.40 TRADES 136 300x 18d |

|

4/14 CSO/ARB/APO Trade Recap |

|

WTI CSO 4Q20 -0.50 Put TRADES 41 200x |

|

WTI CSO K20 -4.00/-6.00 Put Spread TRADES 166 2,700x |

|

WTI CSO K20 -5.00 Call TRADES 20 500x |

|

WTI CSO K20 -5.00/-6.50 Put Spread TRADES 101 5,000x |

|

WTI CSO M20 -0.25 Call TRADES 2 850x; TRADES 1.5 2,150x |

|

WTI CSO M20 -4.00 Put TRADES 111 50x |

|

WTI CSO M20 -4.50/-6.00 Put Spread TRADES 40 400x |

|

WTI CSO M20 -5.00 Put TRADES 85 950x; TRADES 83 750x; TRADES 80 200x |

|

ARB M20 -3.00 Put x28.05/30.55 TRADES 75 350x 44d/44d |

|

ARB M21 -4.50 Put TRADES 101 600x |

|

ARB Z21 -8.00 Put TRADES 34 1,000x |

|

WTI APO N20 33/27 Put Spread LIVE TRADES 186 50x |

|

Implied Vol |

Realized Vol |

||||||

|

WTI Vol |

14-Apr |

Change |

B/E |

10d |

30d |

50d |

|

|

M0 |

99.98 |

2.94 |

1.79 |

126.00 |

157.27 |

123.05 |

|

|

N0 |

71.75 |

3.25 |

1.49 |

91.09 |

141.65 |

110.92 |

|

|

Q0 |

59.26 |

2.58 |

1.29 |

71.39 |

129.97 |

101.97 |

|

|

U0 |

52.59 |

1.84 |

1.17 |

60.69 |

120.66 |

94.84 |

|

|

V0 |

48.66 |

1.89 |

1.1 |

52.97 |

112.90 |

88.88 |

|

|

X0 |

46.01 |

1.90 |

1.06 |

46.73 |

106.35 |

83.83 |

|

|

Z0 |

43.77 |

1.57 |

1.02 |

41.76 |

100.50 |

79.30 |

|

Implied Vol |

Realized Vol |

||||||

|

BRT Vol |

14-Apr |

Change |

B/E |

10d |

30d |

50d |

|

|

M0 |

109.15 |

0.43 |

2.08 |

146.25 |

136.30 |

107.37 |

|

|

N0 |

79.09 |

3.36 |

1.73 |

103.90 |

119.29 |

94.18 |

|

|

Q0 |

64.67 |

3.41 |

1.5 |

78.68 |

108.52 |

85.83 |

|

|

U0 |

54.22 |

2.41 |

1.3 |

62.56 |

101.10 |

80.06 |

|

|

V0 |

49.92 |

2.12 |

1.23 |

51.70 |

95.33 |

75.57 |

|

|

X0 |

46.89 |

1.91 |

1.18 |

45.38 |

90.59 |

71.85 |

|

|

Z0 |

43.89 |

1.69 |

1.12 |

41.18 |

86.49 |

68.63 |

WTI / Brent Implied ATM Vol Curve

WTI Skew Change (d/d)

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M0 |

51.15 |

40.55 |

26.55 |

14.00 |

99.98 |

-9.00 |

-12.85 |

-14.75 |

-14.45 |

|

M0 (4/13) |

55.60 |

42.90 |

26.20 |

13.10 |

97.04 |

-8.00 |

-11.40 |

-13.10 |

-12.80 |

|

|

-4.45 |

-2.35 |

0.35 |

0.90 |

2.94 |

-1.00 |

-1.45 |

-1.65 |

-1.65 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

N0 |

37.15 |

29.90 |

19.60 |

10.30 |

71.75 |

-6.55 |

-9.30 |

-10.65 |

-10.50 |

|

N0 (4/13) |

41.95 |

32.00 |

19.30 |

9.50 |

68.50 |

-5.70 |

-8.00 |

-9.05 |

-8.70 |

|

|

-4.80 |

-2.10 |

0.30 |

0.80 |

3.25 |

-0.85 |

-1.30 |

-1.60 |

-1.80 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Q0 |

29.90 |

23.60 |

15.05 |

7.85 |

59.26 |

-4.90 |

-6.85 |

-7.55 |

-7.00 |

|

Q0 (4/13) |

33.25 |

24.95 |

14.55 |

7.10 |

56.68 |

-4.20 |

-5.80 |

-6.25 |

-5.70 |

|

Change |

-3.35 |

-1.35 |

0.50 |

0.75 |

2.58 |

-0.70 |

-1.05 |

-1.30 |

-1.30 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

U0 |

25.75 |

18.75 |

12.40 |

6.90 |

52.59 |

-4.30 |

-5.75 |

-5.75 |

-4.55 |

|

U0 (4/13) |

27.40 |

20.50 |

12.20 |

6.10 |

50.74 |

-3.60 |

-4.90 |

-5.10 |

-4.35 |

|

|

-1.65 |

-1.75 |

0.20 |

0.80 |

1.84 |

-0.70 |

-0.85 |

-0.65 |

-0.20 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

V0 |

20.60 |

14.95 |

10.10 |

5.75 |

48.66 |

-3.80 |

-5.10 |

-5.10 |

-3.90 |

|

V0 (4/13) |

25.05 |

17.15 |

10.55 |

5.70 |

46.78 |

-3.45 |

-4.50 |

-4.25 |

-2.95 |

|

|

-4.45 |

-2.20 |

-0.45 |

0.05 |

1.89 |

-0.35 |

-0.60 |

-0.85 |

-0.95 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z0 |

16.45 |

11.90 |

7.85 |

4.45 |

43.77 |

-3.05 |

-4.20 |

-4.25 |

-3.15 |

|

Z0 (4/13) |

19.35 |

13.50 |

8.30 |

4.45 |

42.20 |

-2.75 |

-3.65 |

-3.45 |

-2.30 |

|

|

-2.90 |

-1.60 |

-0.45 |

0.00 |

1.57 |

-0.30 |

-0.55 |

-0.80 |

-0.85 |

Brent Skew Change (d/d)

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M0 |

36.70 |

31.45 |

23.10 |

13.35 |

109.15 |

-9.85 |

-14.45 |

-17.25 |

-17.55 |

|

M0 (4/13) |

38.70 |

33.75 |

25.70 |

15.15 |

108.72 |

-11.20 |

-16.45 |

-19.95 |

-20.70 |

|

Change |

-2.00 |

-2.30 |

-2.60 |

-1.80 |

0.43 |

1.35 |

2.00 |

2.70 |

3.15 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

N0 |

34.75 |

27.25 |

20.80 |

12.75 |

79.09 |

-8.85 |

-12.55 |

-14.65 |

-14.75 |

|

N0 (4/13) |

41.20 |

31.40 |

21.75 |

12.25 |

75.73 |

-8.00 |

-11.35 |

-13.15 |

-13.05 |

|

Change |

-6.45 |

-4.15 |

-0.95 |

0.50 |

3.36 |

-0.85 |

-1.20 |

-1.50 |

-1.70 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Q0 |

28.95 |

22.95 |

15.65 |

8.50 |

64.67 |

-5.55 |

-7.90 |

-9.00 |

-8.70 |

|

Q0 (4/13) |

33.90 |

25.60 |

15.85 |

8.05 |

61.27 |

-5.05 |

-7.20 |

-8.35 |

-8.15 |

|

Change |

-4.95 |

-2.65 |

-0.20 |

0.45 |

3.41 |

-0.50 |

-0.70 |

-0.65 |

-0.55 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

U0 |

24.80 |

17.20 |

11.35 |

6.45 |

54.22 |

-4.10 |

-5.35 |

-5.05 |

-3.45 |

|

U0 (4/13) |

28.30 |

18.95 |

11.60 |

6.20 |

51.81 |

-3.80 |

-5.05 |

-4.90 |

-3.55 |

|

|

-3.50 |

-1.75 |

-0.25 |

0.25 |

2.41 |

-0.30 |

-0.30 |

-0.15 |

0.10 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

V0 |

19.15 |

13.10 |

8.35 |

4.75 |

49.92 |

-3.20 |

-4.25 |

-4.00 |

-2.65 |

|

V0 (4/13) |

23.20 |

15.50 |

9.20 |

4.90 |

47.80 |

-3.10 |

-4.20 |

-4.05 |

-2.90 |

|

|

-4.05 |

-2.40 |

-0.85 |

-0.15 |

2.12 |

-0.10 |

-0.05 |

0.05 |

0.25 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z0 |

19.20 |

11.95 |

5.95 |

3.05 |

43.89 |

-2.15 |

-2.90 |

-2.70 |

-1.65 |

|

Z0 (4/13) |

17.65 |

11.45 |

6.55 |

3.55 |

42.21 |

-2.25 |

-2.90 |

-2.30 |

-0.75 |

|

|

1.55 |

0.50 |

-0.60 |

-0.50 |

1.69 |

0.10 |

0.00 |

-0.40 |

-0.90 |

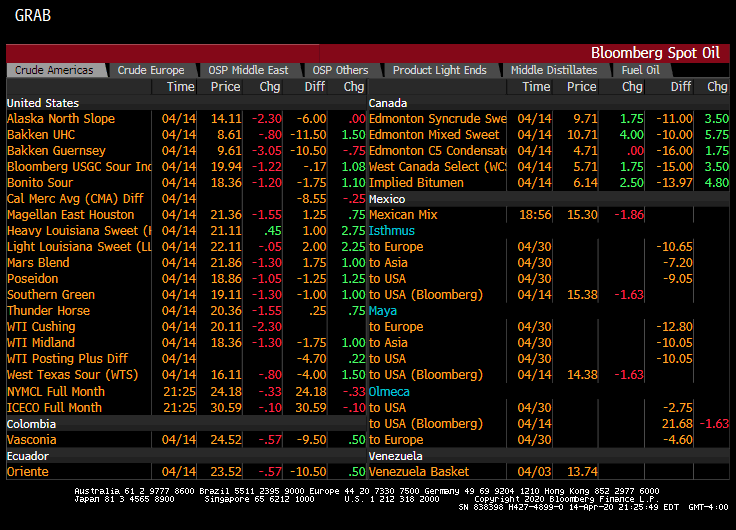

Spot Grades vs WTI

|

FF |

14-Apr |

13-Apr |

D/D Change |

E5 |

14-Apr |

13-Apr |

D/D Change |

HTT |

14-Apr |

13-Apr |

D/D Change |

||

|

K0 |

(3.52) |

(3.64) |

0.12 |

K0 |

(3.10) |

(3.48) |

0.38 |

K0 |

(1.31) |

(1.74) |

0.43 |

||

|

M0 |

(2.43) |

(2.53) |

0.10 |

M0 |

(1.25) |

(1.05) |

(0.20) |

M0 |

(0.75) |

(0.55) |

(0.20) |

||

|

Q3 ’20 |

(1.46) |

(1.37) |

(0.09) |

Q3 ’20 |

(1.10) |

(1.20) |

0.10 |

Q3 ’20 |

(0.38) |

(0.35) |

(0.03) |

||

|

Q4 ’20 |

(0.29) |

(0.17) |

(0.11) |

Q4 ’20 |

(0.35) |

(0.40) |

0.05 |

Q4 ’20 |

0.50 |

0.50 |

– |

||

|

K-Z ’20 |

(1.40) |

(1.35) |

(0.05) |

K-Z ’20 |

(1.09) |

(1.17) |

0.08 |

K-Z ’20 |

(0.21) |

(0.23) |

0.02 |

||

|

C21 |

0.39 |

0.39 |

(0.00) |

C21 |

1.33 |

1.36 |

(0.03) |

C21 |

1.63 |

1.63 |

– |

||

|

WTT |

14-Apr |

13-Apr |

D/D Change |

YV |

14-Apr |

13-Apr |

D/D Change |

||||||

|

K0 |

(4.02) |

(4.47) |

0.45 |

K0 |

(1.95) |

(2.09) |

0.14 |

||||||

|

M0 |

(3.00) |

(3.25) |

0.25 |

M0 |

(3.28) |

(3.63) |

0.35 |

||||||

|

Q3 ’20 |

(1.85) |

(1.88) |

0.02 |

Q3 ’20 |

(3.53) |

(3.75) |

0.23 |

||||||

|

Q4 ’20 |

(0.63) |

(0.50) |

(0.13) |

Q4 ’20 |

(2.93) |

(3.00) |

0.08 |

||||||

|

K-Z ’20 |

(1.81) |

(1.86) |

0.05 |

K-Z ’20 |

(3.07) |

(3.25) |

0.18 |

||||||

|

C21 |

0.40 |

0.40 |

– |

C21 |

(1.63) |

(1.78) |

0.15 |

U.S. crude stocks jump by 13 mln bbls in latest week -API – Reuters News

U.S. crude oil, gasoline and distillate stocks all rose sharply, data from industry group the American Petroleum Institute showed on Tuesday. Crude inventories rose by 13.1 million barrels in the week to April 10 to 486.9 million barrels, compared with analysts’ expectations for a build of 11.7 million barrels. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 5.4 million barrels, API said. Refinery crude runs fell by 1.2 million barrels per day, API data showed. Gasoline stocks rose by 2.2 million barrels, compared with analysts’ expectations in a Reuters poll for a 6.4 million-barrel increase. Distillate fuel inventories, which include diesel and heating oil, rose by 5.6 million barrels, compared with expectations for an increase of 1.4 million barrels. U.S. crude imports fell last week by 830,000 barrels per day, the data showed.

U.S. deaths set record daily increase; Spain and Austria ease restrictions – Reuters News

U.S. coronavirus deaths set a single-day record on Tuesday, a grim milestone as the country debated how to reopen its economy and as Spain and Austria allowed partial returns to work but the UK, France and India extended lockdowns. The World Health Organization (WHO) warned that infections had "certainly" not yet peaked. Nearly 2 million people globally have been infected and more than 124,000 have died in the most serious pandemic in a century, according to a Reuters tally. The epicentre has shifted from China, where the virus emerged in December, to the United States, which has now recorded the most deaths. World leaders, in considering easing curbs, have to balance risks to health and to the economy as the lockdowns have strangled supply lines, especially in China, and brought economic activity to a virtual halt. The shutdown is costing the U.S. economy perhaps $25 billion a day in lost output, St. Louis Federal Reserve President James Bullard said, calling for widespread testing and risk-management strategies so the economy can restart. President Donald Trump, who has declared he will decide when to lift lockdowns, suggested some Democratic state governors were "mutineers" after New York Governor Andrew Cuomo said he would refuse any order that risked reigniting the outbreak. Trump also said he was halting U.S. funding to the WHO, which he criticized for not sharing information in a timely manner to prevent the outbreak. The White House said Trump would hold a video teleconference with leaders from the Group of Seven nations on Thursday to coordinate responses. The global economy is expected to shrink by 3% this year, the International Monetary Fund said, marking the steepest downturn since the Great Depression. The WHO said the number of new cases was tailing off in some parts of Europe, including Italy and Spain, but outbreaks were growing in Britain and Turkey. "The overall world outbreak – 90% of cases are coming from Europe and the United States of America. So we are certainly not seeing the peak yet," WHO spokeswoman Margaret Harris told a briefing in Geneva. But world stocks gained after Chinese trade data came in better than expected and as some countries partly lifted restrictions. Some Spanish businesses, including construction and manufacturing, were allowed to resume. Shops, bars and public spaces are to stay closed until at least April 26. Spain was flattening the curve on the graph representing the rate of growth of the outbreak, Health Minister Salvador Illa said on Tuesday. The overnight death toll from the coronavirus rose to 567 on Tuesday from 517 a day earlier, but the country reported its lowest increase in new cases since March 18. Total deaths climbed to 18,056. Some Spanish workers expressed concern that the relaxation of restrictions could trigger a new surge of infections. But for Roberto Aguayo, a 50-year-old Barcelona construction worker, the restart came just in time. "We really needed it. Just when we were going to run out of food, we returned to work," he told Reuters. Italy, which has the world’s second-highest death toll at 21,067, maintained some tight restrictions on movement, while Denmark, one of the first European countries to shut down, will reopen daycare centres and schools for children in first to fifth grades on Wednesday. The Czech government will gradually reopen stores and restaurants from next Monday, although people will continue to be required to wear masks. Thousands of shops across Austria reopened on Tuesday, but the government cautioned that the country was "not out of the woods". Austria acted early to shut schools, bars, theatres, restaurants, non-essential shops and other gathering places about four weeks ago. It has told the public to stay home. The Alpine republic has reported 384 deaths in total, fewer than some larger European countries have been suffering each day. Hospitalizations have stabilized.

LOCKDOWNS EXTENDED

Britain, where the government has come under criticism for its slow approach to testing and for not getting protective equipment to the frontlines of health care, has the fifth-highest death toll globally. The toll in British hospitals rose to 12,107 as of Monday but is expected to be much higher when deaths in the community are included. Foreign Secretary Dominic Raab has said there would be no easing of lockdown measures when they come up for review this week. The Times newspaper said on Tuesday that Raab, deputising for Prime Minister Boris Johnson, who is recuperating from a COVID-19 infection, would extend the curbs until at least May 7. In France, President Emmanuel Macron on Monday extended a virtual lockdown to May 11. India, the world’s second-most populous country after China, extended its nationwide lockdown until May 3 as the number of coronavirus cases crossed 10,000. Neighbours Pakistan and Nepal also extended their curbs. Russia might need to call in the army to help tackle the crisis, President Vladimir Putin said on Monday. Moscow warned the capital might run out of hospital beds in coming weeks. China’s northeastern border province of Heilongjiang saw 79 new cases on Monday – all Chinese citizens travelling back from Russia, state media said. As of Tuesday, China had reported 82,249 coronavirus cases and 3,341 deaths. There were no deaths in the past 24 hours. Health ministers from the Group of 20 major economies will speak by videoconference on Sunday to address the outbreak’s impact.

China reports fewer coronavirus cases but infections from Russia a worry – Reuters

China reported on Wednesday a decline in new confirmed cases of the coronavirus in the mainland, although an increasing number of local transmissions in its far northeast bordering Russia remained a concern for authorities. China reported 46 new confirmed cases on Tuesday compared with 89 cases a day earlier, according to the National Health Commission. Of the new cases, 36 involved travellers arriving in China from overseas, compared with 86 a day earlier. The 10 remaining cases were new locally transmitted infections, with Heilongjiang province accounting for eight of them and southern Guangdong province two. The northeastern province of Heilongjiang has become a front line in China’s fight to keep out imported cases as infected Chinese nationals return overland from Russia. China has closed the border with Russia at Suifenhe, a city in Heilongjiang with a checkpoint into Russia. New infections involving travellers arriving from Russia have also hit other parts of China such as the northern autonomous region of Inner Mongolia and the financial hub of Shanghai. Some of the new confirmed cases had been asymptomatic. Two of the latest confirmed Heilongjiang cases on Tuesday were patients who showed no symptoms of the virus previously. Heilongjiang reported one new asymptomatic case on Tuesday, a Chinese national returning from Russia. That brings the current number of asymptomatic cases in the province involving travellers arriving from abroad to 52.

NO SYMPTOMS

In mainland China, the number of new asymptomatic cases increased to 57 on Tuesday from 54 a day earlier. China does not include patients with no clinical symptoms such as a cough or a fever in its tally of confirmed cases. China has launched an epidemiological survey in nine regions in an effort to determine the full scale of asymptomatic infections and overall immunity levels, the official China Daily newspaper reported on Wednesday. Chinese authorities said earlier in April that two-thirds of asymptomatic cases develop symptoms. Central Hubei province, the origin of the coronavirus outbreak in China, reported just two asymptomatic patients who went on to develop signs of infection between March 31 and April 14. Hubei province’s health authority has reported 429 new asymptomatic cases since it began publishing data for such cases on April 1. As of Tuesday, the total number of confirmed cases in mainland China reached 82,295. Authorities said 3,342 people have died from the virus in China, including one new fatality in central Hubei province, the origin of the outbreak in the country.

Trump’s May 1 target too optimistic for U.S. coronavirus reopening, adviser Fauci says – Reuters

President Donald Trump’s May 1 target for restarting the economy is "overly optimistic," his top infectious disease adviser said on Tuesday, after Trump and state governors clashed over who has the power to lift restrictions aimed at curbing the coronavirus pandemic. Anthony Fauci, head of the National Institute of Allergy and Infectious Diseases, echoed many governors in saying that health officials must first be able to test for the virus quickly, isolate new cases and track down new infections before social-distancing restrictions can be eased safely. Trump’s administration has recommended stay-at-home guidelines through the end of April, and the president has floated May 1 as a possible date to start reopening shuttered workplaces in some areas. That date may be "a bit overly optimistic," Fauci, who has become a trusted national figure during the pandemic, said in an interview with the Associated Press. "We have to have something in place that is efficient and that we can rely on, and we’re not there yet," Fauci added. Fauci, who frequently appears with Trump at White House coronavirus briefings, has previously contradicted Trump on some issues, such as an unproven medical treatment promoted by the president. Trump on Sunday retweeted a message on Twitter from a conservative political figure calling for Fauci’s firing, but the president later denied plans to dismiss his adviser. Trump, a Republican who before the pandemic had touted a vibrant U.S. economy as a pillar of his Nov. 3 re-election bid, lashed out at Democratic state governors, suggesting they were "mutineers," after New York’s Andrew Cuomo said he would refuse any order by the president to reopen the economy too soon. "If he ordered me to reopen in a way that would endanger the public health of the people of my state, I wouldn’t do it," Cuomo told CNN early in the day. At a news conference later, Cuomo said Trump was "clearly spoiling for a fight on this issue" and that he did not want a partisan battle, but added, "We don’t have a king in this country, we have a Constitution and we elect the president." Social distancing restrictions imposed since last month by governors in 42 states have crippled the U.S. economy, with businesses forced to close and millions of Americans thrown out of work, casting a shadow over Trump’s re-election hopes.

U.S. DEATH TOLL NEARS 26,000

The U.S. death toll from COVID-19, the highly contagious respiratory illness caused by the virus, topped 25,700 on Tuesday, out of more than 600,000 known U.S. infections, according to a running Reuters tally. Despite tentative signs in recent days that the outbreak was starting to ebb, the number of U.S. deaths counted on Tuesday rose to at least 2,104, the highest toll yet in a single 24-hour period, with a few states left to report their latest totals. David Reich, president of New York’s Mount Sinai Hospital, said even if hospital admissions there had leveled off, it still remains an extraordinary time of strain for staff and resources. "The plateau is not a very comfortable place to live," Reich said in a telephone interview. "So I don’t think people should be celebrating prematurely." Offering an expansive assessment of the powers of the presidency, Trump on Monday asserted he has "total" authority to decide on reopening the economy even though he earlier had deferred to the governors in putting social-distancing orders in place. Cuomo, a Democrat whose state has been the epicenter of the U.S. outbreak, and governors of six other northeastern states have announced they will formulate a regional plan to gradually lift restrictions. On the Pacific Coast, the governors of California, Oregon and Washington state announced a similar regional approach. Trump, whose attacks on Democrats appeal to his conservative political base, posted tweets attacking Cuomo individually and Democratic governors in general. "Tell the Democrat Governors that ‘Mutiny On The Bounty’ was one of my all-time favorite movies," the Trump wrote on Twitter on Tuesday, referring to a classic film about a rebellion against the commanding officer of a British naval vessel in the late 18th century. "A good old fashioned mutiny every now and then is an exciting and invigorating thing to watch, especially when the mutineers need so much from the Captain. Too easy!" Trump wrote. Trump rejected the idea that governors should determine when and how to reopen state economies, insisting "the president of the United States calls the shots." But governors had their own plans. California Governor Gavin Newsom and Oregon Governor Kate Brown, both Democrats, on Tuesday offered frameworks for eventually restarting public life and business in their states. Some Republicans, including the governors of Ohio, Maryland and New Hampshire, also said states have the right to decide when and how to reopen.

China cuts medium-term borrowing costs by 20 bps, steps up fight against pandemic – Reuters

China’s central bank on Wednesday cut the interest rate on its medium-term funding for financial institutions to the lowest level on record, in an attempt to combat the economic fallout from the coronavirus health crisis. The move should pave the way for a similar reduction to the country’s benchmark loan prime rate (LPR), which will be announced on the 20th, to lower financing costs for companies hit by pandemic. The People’s Bank of China (PBOC) said it was lowering the one-year medium-term lending facility (MLF) loans to financial institutions to 2.95%, the lowest level since the liquidity tool was introduced in September 2014, down 20 basis point from 3.15% previously. The cut came largely in line with market expectations, as economists believe the central bank would keep its yield curve steady by lowering the MLF rate by the same margin as the cut to the 7-day reverse repo rate in late March. And a lower MLF rate should incentivize commercial banks to reduce the lending benchmark, as the medium-term lending cost now serves as a guide for the LPR. Global central banks have rolled out unprecedented stimulus measures in the past few weeks, cutting rates sharply and injecting trillions of dollars to backstop their economies as many countries have been put under tight lockdowns to contain the pandemic. The PBOC said in a statement that it was injecting 100 billion yuan ($14.19 billion) through the liquidity tool. There is no MLF loans due to expire on the day, though a batch of 200 billion yuan worth of such loans is maturing on Friday. Another 267.4 billion yuan worth of targeted medium-term lending facility loans are set to expire on April 24, with many traders expecting the central bank will them roll over and cut the interest rate accordingly.

Trump to convene G7 leaders in video call to discuss pandemic – Reuters News

U.S. President Donald Trump will hold a video teleconference with G7 leaders on Thursday to coordinate national responses to the coronavirus outbreak, the White House said on Tuesday. Trump, who is head of the G7 this year, had planned to hold this year’s summit at the presidential retreat of Camp David, Maryland, in June, but moved it to a virtual setting due to the virus. The Group of Seven nations consists of the United States, France, Britain, Italy, Canada, Japan and Germany, and all seven of them have been hit hard by the virus. Trump spoke with French President Emmanuel Macron on Tuesday about the G7 teleconference and "efforts to defeat the coronavirus pandemic and reopen world economies," White House spokesman Judd Deere said. British Prime Minister Boris Johnson was released from a London hospital this week after treatment for the virus, which left him in the intensive care unit for several days. "Working together, the G7 is taking a whole-of-society approach to tackle the crisis across multiple areas, including health, finance, humanitarian assistance, and science and technology," Deere said. The Thursday session is a follow-up to a March 16 video conference, the first time G7 leaders had met in that format, to go over efforts to defeat the coronavirus. In addition to the meeting this week, another session is expected in May to lay the groundwork for the June video conference.

U.S. SPR Oil Purchases Won’t Alter Suppy-Demand Balance: Goldman

U.S. oil purchases for the Strategic Petroleum Reserve won’t change the supply-demand balance as the nation’s government and storage capacity will become saturated this month, Goldman Sachs analysts including Damien Courvalin said in April 14 note.

Bank reiterates view that the level of voluntary cuts and government’s oil purchases are too little and too late to balance the market, leading to more downside for inland crudes like WTI into the May contract expiration

However, “what the OPEC+ cuts and SPR purchases can’t achieve in coming weeks, they should achieve over time, reinforcing our view that the ongoing violent market rebalancing is increasingly likely to be followed by a sharp rebound in oil prices once demand starts to recover”

While some officials have talked about a 20m b/d cut, such numbers “significantly overstate the level of voluntary cuts” and they include “overly optimistic assumptions on market driven declines outside of OPEC+ and government crude purchases for strategic reserves”

Assuming full core-OPEC compliance and 50% compliance from others in May, OPEC+ voluntary reduction would only lead to a 4.3m b/d cut in output from 1Q 2020 levels

A 20m b/d cut means G20 producers expected to cut 3.7m-5m b/d, but only Norway, Alberta considering cuts, with hearings taking place in Texas to discuss curtailments

Saudi Oil Keeps Flooding Market With Output Pact Yet to Begin

Saudi Arabia and other Gulf suppliers may have agreed to cut oil production again starting next month, but by all indications the taps are set to remain wide open until then — swelling stockpiles for at least a few more weeks. The kingdom’s crude exports so far in April stand at 9.3 million barrels a day, according to tanker-tracking data compiled by Bloomberg. That compares with 6.8 million barrels a day through the first two weeks of March. What’s more, there are at least 10 supertankers with the capacity to haul a combined 20 million barrels of oil waiting to load at the Saudi port of Ras Tanura in the coming days. State-owned oil company Saudi Aramco pledged to boost output to 12.3 million barrels a day in April as it slashed prices in a battle for market share, following the collapse of the three-year old OPEC+ pact in March. As the coronavirus spread across the globe, governments imposed restrictions on movement and demand declined further, as did prices. Following marathon international talks this past weekend, there’s now a new global deal to limit output, with Saudi Arabia agreeing to trim production to 8.5 million barrels a day in May and June. There’s been no indication that any producer will close the taps before May, meaning millions of barrels a day of crude entering the market that aren’t needed. “The arrangement is from May,” Prince Abdulaziz bin Salman, the Saudi oil minister, told reporters on a conference call on Monday in reference to the OPEC+ agreement. “All of April was sold.” In other words, the price war is still on for now. So far, the market hasn’t been impressed. Global benchmark Brent crude fell by as much as 6% in London on Tuesday.

Deep Discounts

Another measure — the official selling prices that traders pay for actual barrels of crude in the physical market — indicates that Saudi Arabia is still looking to gain market share. The so-called OSPs for April were already at their lowest in at least three decades. The kingdom released May’s prices earlier this week, deepening the discounts to most markets, especially Asia, where the cut was greater than expected. Traders are awaiting similar figures from other Gulf producers like the United Arab Emirates and Kuwait, which generally follow the Saudi lead on pricing and production. They also have little incentive to cut output sooner than required. U.A.E. Energy Minister Suhail Al Mazrouei said on his Twitter account after the meeting that the country “is committed to reducing production from its current production level of 4.1m” barrels a day. That’s at least 1 million barrels a day higher than it pumped in March, according to Bloomberg estimates. All of that oil has to go somewhere, and with demand decimated, there’s only one obvious destination — storage. With cargo nominations already set for this month, Saudi Arabia isn’t likely to reduce shipments to its customers. But it could trim volumes it’s sending to storage tanks in Egypt, Rotterdam and Japan. Without any reduction in those flows, though, stockpiles will continue to build through the remainder of April.

Iraq Oil Output Capacity Includes Kurdistan at 5M B/D: Minister

Iraq, OPEC’s second-biggest producer, said recent OPEC+ output cut deal would cover the country’s autonomous oil producing region that is now exporting more than 500K b/d, Oil Minister Thamir Ghadhban said in a televised interview on state-run Iraqiya channel.

A technical delegate from Kurdistan will visit Baghdad on Thursday to discuss the mechanism for the output cut

The country’s current refining capacity stands at 700K b/d, while demand is at 1.5m b/d according to previous studies

Iraq sees U.S. import exemption on Iranian gas continuing after April

Iraq imports Iranian gas and electricity for its power needs

“We expect the U.S. administration to understand Iraq’s need to boost its own power output,” the minister said

Texas oil hearing stirs hornet’s nest, as regulators offer no clue to decision – Reuters News

Texas energy regulators listened as top executives on Tuesday debated whether the state should cut oil output by 1 million barrels per day, but did not indicate how they might vote after more than 10 hours of sometimes dire testimony. Oil and gas companies are gushing red ink and cutting tens of thousands of workers as oil prices tumble, prompting regulators in the largest U.S. oil-producing state to wade into global oil politics and consider the calls for cuts. U.S. crude oil prices CLc1 fell during the hearing to under $20 a barrel at one point, a nearly 18-year low. While the federal government has little power to influence oil production, many state regulators like the Texas Railroad Commission have powers that can include limiting production across the state. The hearing, based on a request by executives from shale producers Pioneer Natural Resources Co PXD.N and Parsley Energy Inc PE.N, ignited a debate between those who favor free markets and those who worry that without intervention, small producers could get shut out of oil sales as storage fills next month. Some firms have already started closing wells, several executives said. The industry is facing a historic economic collapse with $3 per barrel to $10 per barrel oil in coming weeks, Pioneer Chief Executive Scott Sheffield warned commissioners on Tuesday. "Demand is not going to come roaring back," he said. Kirk Edwards, president of small producer Latigo Petroleum, argued uniform cuts could help thousands of firms like his continue to sell some of their oil production. But producers have reduced spending as much as 50% and output has started falling already, said Lee Tillman, CEO of Marathon Oil Corp MRO.N, who opposed state-mandated cuts, arguing the market is taking care of the glut. The commissioners are expected to vote on the oil companies’ motion on April 21. The hearing was held days after the Organization of the Petroleum Exporting Countries and allies agreed to reduce their output by 9.7 million barrels per day (bpd) in May and June. However, U.S. crude futures CLc1 continued to fall this week as traders bet the historic OPEC deal was not large enough to counter oil demand destruction caused by coronavirus-related travel restrictions and business halts. At least two votes on the three-member Texas Railroad Commission are needed to pass the proposal. Commissioner Ryan Sitton has pushed for evaluating statewide cuts. Wayne Christian and Christi Craddick, have been careful not to reveal how they might vote, though Christian said Tuesday, "the hardest thing I think in my life is to sit back and do nothing, and yet that is sometimes" what is needed. "What if other states don’t do this?" Craddick asked at one point during the hearing, suggesting Texas could send oil revenue to nearby states. Some of the state’s largest and most influential oil companies, Exxon Mobil Corp XOM.N, Chevron Corp CVX.N and Occidental Petroleum Corp OXY.N, have opposed imposing limits, along with some of the largest trade organizations. The idea, however, has gained proponents elsewhere. A group of Oklahoma oil producers filed a request with that state for a hearing to consider production curbs. It is set to take place May 11. The executive chairman of Oklahoma-based Continental Resources Inc CLR.N , Harold Hamm, said at the Texas hearing that he would "not oppose" Oklahoma cuts and urged Texas regulators to consider cutting output 25%.

Shale Billionaire Harold Hamm Sees Oklahoma Limiting Oil Output

Continental Resources Inc. founder Harold Hamm told Texas oil regulators he expects neighboring Oklahoma to adopt crude-production limits in a bid to bolster energy prices. Hamm’s comments came during a marathon hearing Tuesday of the Texas Railroad Commission on whether to enact quotas amid the worst crude-market crash on record. Oklahoma, the fourth-largest U.S. oil-producing state, plans to consider imposing caps on May 11. Hamm said he expects the Oklahoma Corporation Commission to restrict crude output in a manner similar to how it already has limited natural gas production. While some smaller drillers in Oklahoma support curtailments, not everyone is on board. An industry group known as the Petroleum Alliance of Oklahoma has called such requests “naive.”

Oil Producers Aren’t Rushing to Take Up Trump’s Storage Offer

Even as U.S. oil producers run out of places to store swelling crude supplies, they’re not exactly rushing to take up the Trump administration’s offer to stow their unwanted barrels in the nation’s emergency stockpile. The Energy Department has opened 30 million barrels of federal storage capacity to American companies “struggling with catastrophic financial losses” from the recent price collapse. Yet, as of Tuesday, the agency was negotiating with just nine companies to rent about 75% of the available space. Part of the problem is that the reserve’s network of Gulf Coast salt caverns can’t take just any kinds of crude. For that reason, the agency had sought 22.8 million barrels of sweet crude, like that produced in shale fields, and 7.2 million barrels of sour oil, such as that produced offshore. There was simply more interest in storing sweet than sour, according to senior administration officials who asked not to be identified discussing internal matters. The reserve also has operational constraints that make it a less convenient alternative to commercial storage, which remains available in some parts of the country, the officials said. For instance, oil can’t be injected and withdrawn freely. Nevertheless, the agency plans to move forward with a second oil-storage offer, this time making available as much as 47 million additional barrels of capacity.

Key Oil Pipeline Reversal May Accelerate Cushing Tank Tops

The reversal of a U.S. oil pipeline could take as much as 13% of outbound capacity away from Cushing, Oklahoma, raising concern that tanks at the delivery point for the U.S. oil futures contract will fill up faster than expected.

A subsidiary of Enterprise Products Partners LP, told regulators on Monday that it planned to start temporary service on May 1 to move oil from Katy, Texas inland to Cushing. While the pipeline name wasn’t specified, a company spokesman said on Tuesday that their arrangement allows the company to utilize unused capacity on Seaway.

Before news of the reversal, investors had already raised concern that inventories at the largest U.S. storage hub — which as of April 3 hovered at 49.2 million barrels — would hit so-called tank tops in coming weeks. Working storage capacity at Cushing was 76.1 million barrels as of September 2019, according to the most recent U.S. government data. Hitting storage limits could portend the next leg of a price rout.

“We believe that Cushing is filling extremely quickly with arbs open into the pricing center from all directions and refinery runs further decreasing in Padd 2,” said Saad Rahim, chief economist at commodities trading house Trafigura Group. “Cushing will be full in early May.”

With the reversal, inbound capacity is 50% higher than outbound capacity compared with 20% previously, according to Genscape.The reversal could also be problematic in coming weeks when storage tanks are forecast to fill, as outbound pipes will be used to move oil away from the storage hub.

Below is a list of the pipeline connections into and out of Cushing, according to Genscape.

|

Cushing Pipeline and Connections (in thousand barrels per day) |

|||

|

Into Cushing |

Out of Cushing |

||

|

Blueknight OK Mainline* |

25 |

Magellan Tulsa* |

30 |

|

Northern Cimarron* |

32 |

Sunoco OK1* |

35 |

|

Keystone – Steele City to Cushing |

590 |

Sunoco OK2* |

35 |

|

Spearhead |

193 |

CushPo* |

122 |

|

White Cliffs |

90 |

BP1 |

180 |

|

Medford/Plains LPG* |

25 |

Coffeyville* |

110 |

|

Basin |

550 |

Osage |

165 |

|

Centurion North |

170 |

Diamond |

200 |

|

Eagle North |

20 |

Ozark |

360 |

|

Cashion |

250 |

Red River – Cushing to Longview |

150 |

|

Hawthorn |

90 |

Seaway (Legacy) |

400 |

|

Mississippian Lime |

150 |

Seaway Twin |

550 |

|

Glass Mountain – Cleo Springs to Cushing |

147 |

Phillips |

59 |

|

Pony Express |

400 |

Marketlink |

750 |

|

Great Salt Plains |

35 |

Plains All American Cherokee* |

18 |

|

Flanagan South |

600 |

||

|

Saddlehorn – Grand Mesa |

340 |

||

|

Red River |

35 |

||

|

SCOOP |

70 |

||

|

Total |

3,812 |

Total |

3,164 |

|

Source: Genscape, * means not monitored |

Enterprise opens up pipeline freeway to Cushing storage hub for crude producers – Reuters News

Enterprise Products Partners LP EPD.N said it will give oil companies hunting for places to store crude the chance to ship barrels on its Seaway pipeline from the Gulf Coast to Cushing, Oklahoma, the main U.S. storage hub. Storage is filling rapidly in the United States as the coronavirus pandemic has chopped fuel demand by roughly 30% and sent oil prices plunging, leaving few options for producers. Even though the world’s oil producers agreed to cut output by as much as 19.5 million barrels per day, traders expect U.S. storage to be full by mid-year as the cuts are playing catch-up to last month’s plunge in demand. The Cushing delivery point for benchmark U.S. crude futures has roughly 27 million barrels of free space out of about 76.1 million barrels of total working capacity. "Given the current turmoil in the crude oil market, including impacts on both refinery and export demand, there is strong market interest to access the Cushing storage market," Enterprise said in a filing late Monday with the U.S. Federal Energy Regulatory Commission (FERC). The 400,000-barrel-per-day Seaway line once only went to Cushing before it was reversed in 2012 to send barrels to the U.S. Gulf for exports. The space that will be used now to send barrels from Fort Bend County, Texas to Cushing represents previously unused capacity on the pipeline system, and barrels will still be shipped in the other direction to the Houston area, a company spokesman said in a statement. Most recent U.S. pipeline construction has been geared for moving oil from big shale plays to the U.S. Gulf to take advantage of growing U.S. exports. But exports have fallen as demand slumped and companies are scrambling for storage. Plains All American Pipeline PAA.N President Harry Pefanis described the scarcity of storage in stark terms at a Texas regulatory hearing on Tuesday. His company now requires proof of destination to ship oil. "We can’t act as a storage facility for everybody that doesn’t have a market," Pefanis said. About 54% of total U.S. crude working storage capacity was full as of April 3, according to the U.S. Energy Information Administration. Enterprise said it would offer service from Enterprise Katy in Fort Bend County, Texas, to Cushing. It plans to charge spot shippers $3 a barrel for the service, effective May 1, according to the filing. Seaway is not the only line responding to the need for storage. Phillips 66 Partners LP PSXP.N is offering storage on its Gray Oak crude system in Texas. Front-month U.S. crude futures for May delivery traded at more than $7 a barrel below futures for June delivery CLc1-CLc2 on expectations of oversupply at Cushing. That is the widest front-month spread since 2009. Physical crude prices in the Houston area firmed as barrels were expected to move inland from the coast on Seaway, traders said.

Pin Oak Set to Begin Crude Loadings at Corpus Dock This week

Pin Oak Terminals expects to receive its first crude tanker Wednesday at its newly completed dock in Corpus Christi, Texas, according to co. spokesman David Hubenak.

Oil Dock 14 at Pin Oak’s Corpus Christi terminal will have a loading rate of 40k bbl/hour, and is expected to receive 6 tankers this month, he says in email

Handle ships as large as suezmaxes

Storage capacity is now at 4m bbl for all oil commodities

For crude only, co. plans to add 500k bbl of storage by end-2020 that will take total crude capacity at the terminal to 3.5m bbl

Terminal now has connectivity to Gray Oak pipe, so Dock 14 loadings would mainly be of Permian crude

Will also connect to EPIC’s crude and products pipelines

Terminal already has connections to neighboring Valero and Citgo refineries

U.S. Cash Crude-WTI MEH trades at premium as Seaway offers service to Cushing – Reuters News

U.S. cash crude differentials strengthened on Tuesday, with WTI at East Houston, or MEH, trading back at a premium to futures after Seaway pipeline said it would offer service inland to Cushing, Oklahoma, from the Gulf Coast starting in May, dealers said. The 400,000-barrel-per-day Seaway line once only went to Cushing before it was reversed in 2012 to send barrels to the U.S. Gulf for exports. The space to be used to send barrels from Fort Bend County, Texas, to Cushing was previously unused capacity on the pipeline system, and barrels will still be shipped in the other direction to the Houston area, a company spokesman said in a statement. Sour grades also strengthened as Saudi Arabia raised its official crude pricing (OSP) for May for the United States, reducing the prospects for an influx of barrels arriving in the U.S. Gulf Coast, dealers said. The Organization of the Petroleum Exporting Countries, along with Russia and other countries – known as OPEC+ – agreed over the weekend to cut output by 9.7 million barrels per day (bpd) in May and June, representing about 10% of global supply. Inland grade WTI Midland crude also firmed to trade as strong as minus 50 cents a barrel as regulators in Texas weighed coordinated output cuts. Texas energy regulators listened as top energy executives on Tuesday backed a plan to cut the state’s output by 1 million barrels per day without tipping their hands through more than five hours of sometimes dire testimony. Meanwhile, U.S. crude inventories rose by 13.1 million barrels in the week to April 10 to 486.9 million barrels, the American Petroleum Institute industry group said, compared with analysts’ expectations for a build of 11.7 million barrels. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 5.4 million barrels, API said.

Light Louisiana Sweet WTC-LLS for May delivery was unchanged at a midpoint of $3.25 a barrel discount, but was seen bid and offered between a premium of $1 and $2.50 a barrel to U.S. crude futures CLc1.

Mars Sour WTC-MRS rose 50 cents to a midpoint of $1 and traded between $1.50 and 50 cents a barrel premium to U.S. crude futures CLc1.

WTI Midland WTC-WTM rose $2.37 to a midpoint of $1.13 a barrel discount and traded between $1.75 and 50 cents a barrel discount to U.S. crude futures CLc1.

West Texas Sour WTC-WTS rose $5.25 to a midpoint of $2.75 a barrel discount and traded between $3 and $2.50 a barrel discount to U.S. crude futures CLc1.

WTI at East Houston, also known as MEH, WTC-MEH traded at a midpoint of $1.50 a barrel over WTI.

U.S. Cash Products-Gulf Coast gasoline rises after cycle change – Reuters News

U.S. Gulf Coast gasoline cash differentials rose on Tuesday as the product started trading on Colonial Pipeline’s 24th cycle for delivery to New York Harbor, market participants said. U.S. Gulf Coast M2 conventional gasoline gained three quarters of a cent, trading 11.5 cents lower than the gasoline futures benchmark on the New York Mercantile Exchange RBc1, market participants said. A2 CBOB gasoline gained half a cent, trading 16.75 cents per gallon below futures, traders said. Chicago ultra-low sulfur diesel fell 10 cents as refiners tried to sell the product, trading 26 cents per gallon below diesel futures HOc1. Elsewhere in the Midwest, Group 3 V-grade gasoline gained 3 cents, trading 30.75 cents lower than the benchmark. Group 3 diesel gained half a cent, trading 0.5 cents lower than the benchmark. In New York Harbor, M2 conventional gasoline fell 2 cents, trading 12 cents per gallon below futures, traders said. U.S. gasoline stocks rose by 2.2 million barrels, data from industry group the American Petroleum Institute showed on Tuesday, compared with analysts’ expectations in a Reuters poll for a 6.4 million-barrel increase. Distillate fuel inventories rose by 5.6 million barrels, compared with expectations for an increase of 1.4 million barrels. Refinery crude runs fell by 1.2 million barrels per day, API data showed. The RBOB futures contract on NYMEX RBc1 rose 1.67 cents to settle at $0.72 a gallon on Tuesday. NYMEX ultra-low sulfur diesel futures HOc1 fell 5.04 cents to settle at $0.9442 a gallon on Tuesday. Renewable fuel (D6) credits for 2019 traded at 40.5 cents each, up from 39 cents in the previous session, traders said. Biomass-based (D4) credits RIN-D4-US traded at 54 cents each, little changed from previous, traders said.

Jonathan Wagner

Ion Energy Group

180 Maiden Lane 25th Floor

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

![]()

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.