From: Wagner, Jonathan

Sent: Tuesday, September 18, 2018 6:46:22 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

Good morning. Throw the trade war out the window apparently as oil prices ripped higher this morning following a Bloomberg headline that Saudi is said to be comfortable with Brent above $80/bbl. While there has been no official response from Saudi officials the article said that based off recent conversations between Al-Falih, other senior officials and discussions with market participants they are comfortable in the “short term.” According to the article (full story below), The change in Saudi Arabia’s view on prices coincides with some intense oil diplomacy. In the last two weeks, Al-Falih has met his counterparts from Russia and the U.S., Alexander Novak and Rick Perry, to discuss the oil market and the impact of U.S. sanctions on Iranian petroleum exports. It’s unclear, however, whether the Saudis discussed prices with Russian and American officials. JODI data for July was just released confirming that Saudi production fell to 10.288m b/d while Exports fell to 7.118m b/d (-120k b/d). July’s secondary source data for OPEC had July Saudi production at 10.387m b/d. Saudi’s direct crude burn increased by 112k b/d to 580k b/d (summer demand). For Aug, Saudi’s directly communicated production was inline w/ secondary source data at 10.4m b/d. Russia’s Novak said this morning that the $70-$80 price range was only temporary and were driven by sanctions… hmmm guess they should re-think their $50/bbl longer term forecast. Russia sees their crude production at 553 tons this year and 570m tons in 2021 (This year’s estimate equates to ~11.23m b/d in 2H, while 2021 target equates to almost 11.45m b/d). Lower Iranian export headlines continue to be seen daily with BB running a story titled “In Big Trump Win, U.S. Sanctions Cripple Iranian Oil Exports.” China also has said they will retaliate to the latest tariff which will continue to defend their own interests and global trade. Even with the new US tariffs the Chinese equity mkt was higher by 2% overnight (CSI 300) as the US had said yesterday that certain goods would be excluded and the tariff would be set at 10% for the bal of ’18 before going to 25% in ’19.

Middle east crude prices were roughly unchanged today as Vitol was seen buying Murban bbls at a 45c prem to its OSP on the window. Total was seen offering Murban Crude from Chinese storage for the first time. According to Reuters, The producer offered 500,0000 barrels to 2 million barrels of Murban crude at the beginning of the Platts window session on Tuesday, to be loaded between Oct. 15 and Nov. 15 from the Yangpu storage site in southern China’s Hainan province at $1.65 a barrel above the November OSP for the grade. The offer was later reduced to a premium of $1.20 a barrel, but no buyer came forward, the sources said. Seven Dubai partials traded in the window today with BP and Shell buying from Reliance and Glencore. Two Jan partials traded with Pero-Diamond buying from Gunvor. Sep/Oct and Oct/Nov Dubai spreads are trading at 82c and 64c backward respectively.

Front end crude spreads are trading 23c back after yesterday Genscape data showed a mid week Cushing draw of 615k bbls and a full week draw of 2.23m bbls. Shipping consultants and tanker tracking expect Padd 3 imports this week to come in at around 2.6m b/d while Platts is expecting exports to move back over 2m b/d. Crude grades remain strong as MEH and LLS cash closed at 7.90 and 7.75 respectively and Midland was well bid yesterday trading as high as -11 in the prompt. Vols finished the day unchanged while front end put and call skew was weaker.

Top stories listed below

Saudi Arabia Is Said to Be Comfortable With Brent Oil Above $80

Russia Raises 2018 Oil-Output Estimate to 553M Tons, Novak Says

Middle East Crude-Benchmarks little changed; Vitol snaps up Murban – Reuters News

Eni’s Goliat Field Shut Down for Maintenance for About 10 Days

North Sea Buzzard Oil in Forties Crude Increases After Works

OPEC’s Barkindo says he hopes to agree long-term OPEC+ cooperation by Dec – Reuters News

In Big Trump Win, U.S. Sanctions Cripple Iranian Oil Exports

U.S. sanctions cannot drop Iran’s oil sales to zero due to high demand -TV – Reuters News

Iraq poised to increase oil output ‘immediately,’ says SOMO chief – Platts

U.S. Is Said to Disown Haley Plan for UN Meeting on Iran: WaPo

U.S. imports of Libyan crude rebound in September after pause -data – Reuters News

U.S. shale oil production to rise to 7.6 million bpd in October – Reuters News

US shale producers tackle sharp decline rates – Argus

U.S. Cash Crude-Cash crude grades strengthen as WTI-Brent spread widens – Reuters News

US crude stocks expected to drop as exports surge – Platts

U.S. Cash Products-Midwest gasoline rises as wholesalers buy in region – Reuters News

U.S. East Coast gasoline prices steady despite unit shutdowns – Reuters News

USGC jet fuel weakens to lowest level since late March as storm dampens demand – Platts

BP Whiting Is Said to Start Multiunit Turnaround This Week

Lyondell Houston refinery begins planned overhaul -sources – Reuters News

Phillips 66 to restart Borger, Texas, refinery reformer by weekend -sources – Reuters News

China’s diesel demand has peaked, gasoline to peak 2025 -CNPC research – Reuters News

Asia Distillates-Gasoil refining margins dip to over five-week low – Reuters News

|

Implied Vol |

Realized Vol |

||||||

|

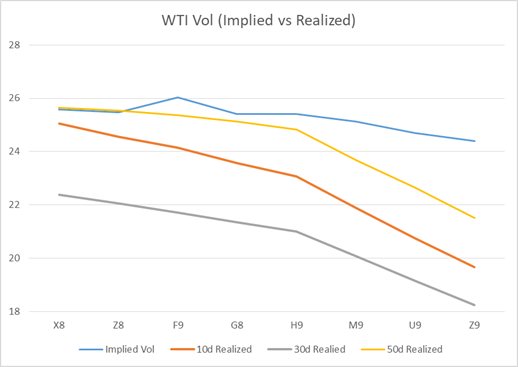

WTI Vol |

17-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.59 |

0.4 |

1.11 |

25.06 |

22.38 |

25.64 |

|

|

Z8 |

25.48 |

0.08 |

1.11 |

24.55 |

22.06 |

25.53 |

|

|

F9 |

26.03 |

0.02 |

1.13 |

24.15 |

21.73 |

25.37 |

|

|

G8 |

25.41 |

0 |

1.1 |

23.58 |

21.34 |

25.14 |

|

|

H9 |

25.41 |

-0.04 |

1.1 |

23.06 |

21.00 |

24.82 |

|

|

M9 |

25.12 |

0 |

1.08 |

21.89 |

20.08 |

23.69 |

|

|

U9 |

24.69 |

0 |

1.05 |

20.75 |

19.16 |

22.64 |

|

|

Z9 |

24.39 |

0.08 |

1.02 |

19.68 |

18.25 |

21.52 |

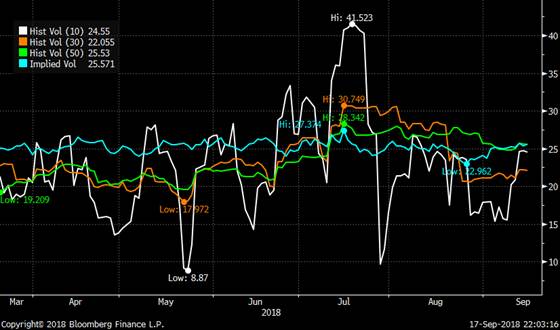

CLZ8 Implied Vs Realized Vol

|

Implied Vol |

Realized Vol |

||||||

|

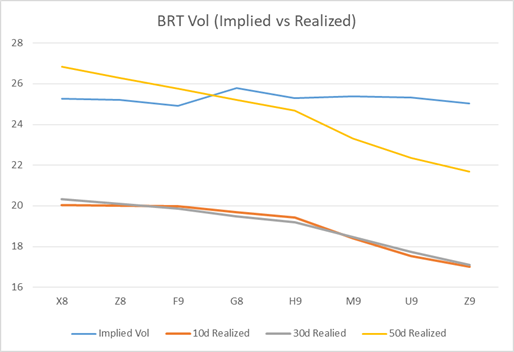

BRT Vol |

17-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.26 |

1.26 |

1.25 |

20.03 |

20.34 |

26.84 |

|

|

Z8 |

25.21 |

0.2 |

1.24 |

20.01 |

20.09 |

26.28 |

|

|

F9 |

24.91 |

0.04 |

1.22 |

19.99 |

19.86 |

25.75 |

|

|

G8 |

25.79 |

0.05 |

1.25 |

19.70 |

19.50 |

25.21 |

|

|

H9 |

25.31 |

-0.04 |

1.23 |

19.44 |

19.18 |

24.69 |

|

|

M9 |

25.37 |

-0.02 |

1.22 |

18.41 |

18.47 |

23.32 |

|

|

U9 |

25.32 |

-0.02 |

1.21 |

17.54 |

17.74 |

22.35 |

|

|

Z9 |

25.03 |

-0.01 |

1.18 |

17.01 |

17.11 |

21.69 |

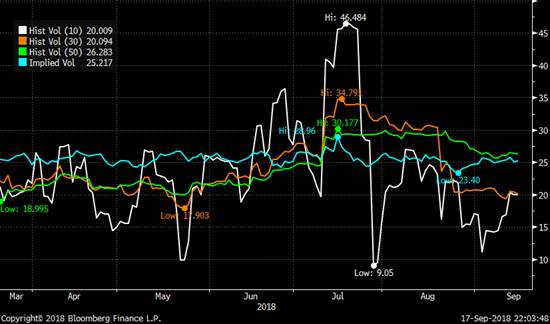

COZ8 Implied Vs Realized Vol

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

BRT X18 85 Call LIVE TRADES 5 5,000x (4,000x CME; 1,000x ICE)

WTI X18/F19 70 1.5×1 Call Roll x68.60/68.40 TRADES 64 1,150x; TRADES 62 1,350x

ICE Trade Recap

BRT X18 79 Call x78.50 TRADES 98 500x 44d

WTI Z18 69 Call x69.20 TRADES 29 500x 53d

BRT F19 ATM Call x78.00 TRADES 344 500x 52d

BRT F19 65/90 Strangle TRADES 194 500x

BRT G19 70 Put x76.80 TRADES 155 750x 21d

BRT G19 70/85 Strangle x77.50 TRADES 287 500x 7d

BRT H19 81/72 Fence x77.30 TRADES 54 1,250x 68d

BRT M19 72/80 Fence x76.30 TRADES 15 1,000x 78d

BRT M19 90/100 1×2 Call Spread TRADES 31 1,000x

CME Trade Recap

WTI X/Z19 69.50/69 Call Roll x69.10/69.00 TRADES 96 600x 49d/54d

WTI Z18 67 Put x68.80 TRADES 201 500x 35d

WTI H/N19 ATM Call Roll x68.00/67.00 TRADES 135 650x

WTI Z19 57/80 Fence x66.50 TRADES 122 800x

CSO/ARB/APO Trade Recap

WTI CSO V/X18 0.20 Put (7A) TRADES 4 500x

WTI CSO X/Z18-Z/F19 0.15 Put (WA) TRADES 19 500x

WTI CSO X/Z18 0.30 Call (WA) TRADES 9.5 2,500x; TRADES 8.5 2.500x

WTI APO X18 66 Put x68.25 TRADES 174 100x 34d

WTI APO Z18 70 Cal x68.45 TRADES 267 100x 48d

WTI APO H19 55/50 Put Spread x66.50 TRADES 108 100x 6d

Saudi Arabia Is Said to Be Comfortable With Brent Oil Above $80

Saudi Arabia is now comfortable with Brent oil prices rising above $80 a barrel, at least in the short term, as the global market adjusts to the loss of Iranian supply from U.S. sanctions, according to people familiar with the kingdom’s view. The world’s largest exporter has tried to keep crude from trading above $80 so far this year, in part because U.S. President Donald Trump sent several tweets in May and June calling for OPEC to rein in prices as they flirted with that level. In recent weeks, Saudi Oil Minister Khalid Al-Falih and other senior officials have discussed the oil market with investors, traders and other market participants in London, Houston and Washington, the same people said, asking not to be named because the talks were private. During the exchanges of views, the Saudis expressed concern both about the impact of American sanctions on Iran and effect of emerging-market turmoil on oil demand growth. Saudi officials were careful to avoid pinpointing a price target in their conversations, saying that while the kingdom has no desire to push prices higher than $80 a barrel, it may no longer be possible to avoid it. Saudi officials didn’t respond to requests for comment. Saudi Arabia, Russia and other major exporting countries, are scheduled to meet on Sunday in Algiers to review the oil market. The Joint Ministerial Monitoring Committee includes both OPEC and non-OPEC countries and oversees compliance with the production cuts agreed to in late 2016, meeting every three months. Brent crude on Monday traded around $78 a barrel, after touching $80.13 a barrel earlier this month. Brent rose to a three-year high of $80.50 a barrel in May, prompting Trump to publicly complain about rising fuel prices. The change in Saudi Arabia’s view on prices coincides with some intense oil diplomacy. In the last two weeks, Al-Falih has met his counterparts from Russia and the U.S., Alexander Novak and Rick Perry, to discuss the oil market and the impact of U.S. sanctions on Iranian petroleum exports. It’s unclear, however, whether the Saudis discussed prices with Russian and American officials. Saudi Arabia has markedly increased oil exports to America, a sign OPEC’s leading producer is responding to pressure from Trump. Earlier this month, Saudi shipments into the U.S. reached a four-week average of 1 million barrels a day for the first time since late 2017, according to government data. The International Energy Agency, the oil watchdog for industrialized countries, warned earlier this month that Brent prices could break out above $80 a barrel unless other producers act to offset deepening supply losses in Iran and Venezuela. “Things are tightening up,” said the Paris-based IEA. “If Venezuelan and Iranian exports do continue to fall, markets could tighten and oil prices could rise.” OPEC has sought to adjust production in anticipation of U.S. sanctions on Iran and the further collapse in Venezuelan output. The kingdom, according to people briefed by Saudi officials, would prefer to be cautious. Riyadh boosted production significantly in June, pumping 10.42 million barrels a day, up from 9.9 million barrels a day in April. But they cut output slightly in July, and kept it roughly stable in August. Iran’s oil exports have fallen about 35 percent since Trump announced new U.S. sanctions on Tehran. In the first two weeks of September, it sold an average of 1.6 million barrels a day, down from 2.5 million barrels a day in April, according to Bloomberg tanker tracking.

Russia Raises 2018 Oil-Output Estimate to 553M Tons, Novak Says

Russian Energy Minister Alexander Novak said on Tuesday that oil prices of between $70 and $80 per barrel were only temporary and were driven by sanctions, adding that the long-term price would stand at around $50 per barrel. Russia sees its crude production at ~553m tons this year, with further increase to ~570m tons in 2021, Energy Minister Alexander Novak says at government meeting near Moscow.

- This year’s estimate equates to ~11.23m b/d in 2H, while 2021 target equates to almost 11.45m b/d based on average ratio of 7.33 bbl/ton

- Novak said in July that Russia may produce 551m tons of oil this year and ~555m tons in 2019 (about 11.15m b/d,); actual Russian production in 1H 2018 was 271m tons (~10.98m b/d)

- A government official said in August that most recent estimates show Russia’s production this year at ~553m tons, while target may change again if Russia and its allies from so-called OPEC+ group agree on supply increase

- While Russia’s oil production seen peaking in 2021, further development of the industry depends on tax decisions

- New tax linked to profit rather than revenue may help in adding 1.2t rubles of investments in key production region, West Siberia, per year, Novak says at the meeting

- Russia’s long-term oil-price scenarios based on crude averaging ~$50/bbl; current price level of ~$70/bbl accounts for Iranian risks

Middle East Crude-Benchmarks little changed; Vitol snaps up Murban – Reuters News

Middle East crude benchmarks were little changed on Tuesday with most grades trading at steady levels from earlier deals. November-loading Murban maintained at a premium of 45 cents a barrel after Vitol bought four cargoes from Total on the window, traders said. Inpex has sold a Das cargo to JX Nippon at a premium of about 40 cents a barrel to its official selling price (OSP), they said. BAPCO has likely sold two Banoco Arab Medium cargoes for November-loading via a tender at 20-30 cents a barrel above its OSP, a trader said. Exxon Mobil has sold a Sokol cargo loading on Nov. 13-16 at a premium of slightly stronger than ONGC’s earlier deal at $5.10-$5.20 a barrel above Dubai quotes. Trafigura also sold a cargo at this level, traders said.

WINDOW

For the first time, Total has offered Murban crude oil from storage tanks in southern China during the S&P Global Platts price assessment process, traders said. The producer offered 500,0000 barrels to 2 million barrels of Murban crude at the beginning of the Platts window session on Tuesday, to be loaded between Oct. 15 and Nov. 15 from the Yangpu storage site in southern China’s Hainan province at $1.65 a barrel above the November OSP for the grade. The offer was later reduced to a premium of $1.20 a barrel, but no buyer came forward, the sources said. The offer seemed expensive as the oil was probably loaded out of United Arab Emirates (UAE) in September, when OSPs, spot differentials and freight rates were much lower, some traders said. Total was also likely compensating for its tank storage costs, traders said. The payment term, at 15 days after the bill of lading, could also increase credit cost for buyers, traders said. The rare offer came as Total explored different ways to market the Abu Dhabi light crude in the past two months. Last month, Total also sold for the first time a supertanker of Murban crude to Japanese refiner JX Nippon on a cost-and-freight basis from Singapore. The oil major also made the first delivery of a Murban crude cargo on the Platts window after selling 20 Oman partials to Shell. Total offered a 500,000-barrel Murban cargo for loading from the UAE on Nov. 1-25 at 60 cents a barrel above the November OSP on Tuesday, traders said. Total subsequently reduced the offer to a premium of 45 cents a barrel and sold four cargoes to Vitol, they said.

Eni’s Goliat Field Shut Down for Maintenance for About 10 Days

Eni’s Goliat oil field in Norway’s Barents Sea is shut down for planned maintenance for about 10 days, a company spokeswoman said, confirming a report of a gas leak on the platform on Sunday.

- Gas leak occurred at about 7:30pm local time on Sunday; situation was under control by 9pm

- Workers on platform went to lifeboats, but there was no evacuation, contrary to an earlier report by Stavanger Aftenblad

- Eni is looking into causes of the event, Petroleum Safety Authority has been notified

- It was unclear whether oil production was shut down immediately as a result of the gas leak or on Monday in connection with the planned maintenance period

- Goliat has had 97% production regularity so far this year

- Goliat has a capacity of 100,000 barrels of oil a day; Eni is the operator with a 65% stake, Equinor owns the rest

North Sea Buzzard Oil in Forties Crude Increases After Works

Proportion of Buzzard crude in Forties blend rose to 13% in the week of Sept. 10-16 from 0% a week earlier, according to data on the Ineos website.

- Field shut for maintenance on Aug. 31; restart was delayed to last week due to adverse weather conditions in the North Sea

- Buzzard is largest component of Forties blend; typically comprises about one-third of grade’s production

OPEC’s Barkindo says he hopes to agree long-term OPEC+ cooperation by Dec – Reuters News

OPEC Secretary General Mohammad Barkindo said on Tuesday that OPEC and non-OPEC countries aim to agree a framework for long-term cooperation by December, when the oil producers plan to meet in Vienna. "Our determination is to institutionalize this cooperation and to get the permanent framework hopefully by December," Barkindo told a news conference in Fujairah, in the UAE. He also said that at a meeting in Algeria on Sept. 23, oil producers will discuss the best mechanism to adopt to ensure they reach 100 percent compliance with crude supply targets.

In Big Trump Win, U.S. Sanctions Cripple Iranian Oil Exports

Aggressive and undiplomatic, certainly, but also extremely effective. With nearly 50 days to go before new U.S. oil sanctions against Iran enter into force, President Donald Trump has already managed to crush the country’s petroleum exports, dealing severe economic damage to Tehran. Iranian oil exports have plunged about 35 percent since April, the month before Trump ripped up the diplomatic deal that Barack Obama negotiated to curtail Tehran’s nuclear program and announced new oil sanctions. "Iranian oil exports are coming down pretty hard," said Roger Diwan, a veteran oil analyst at consultant IHS Markit Ltd. The bigger-than-expected reduction, with more to come, is a win for Trump, who made a tougher stance on Iran a cornerstone of his foreign policy and imposed the sanctions despite opposition in Europe and open hostility from China and India, the top buyers of Iranian crude. When the sanctions were first announced, their unilateral nature prompted many in the oil market to question their effectiveness. Oil accounts for nearly 80 percent of Iran’s tax revenue, according to the International Monetary Fund, making petroleum the regime’s economic lifeblood. As oil exports have plunged, Iran’s currency — the rial — has dived 60 percent on the unofficial market, pushing up inflation. While the success of sanctions will help Trump put pressure on Iran, there may be a less welcome side effect: higher oil prices for U.S. consumers in the run-up to November’s mid-term elections.

The sanctions are reverberating through the global oil market, pushing benchmark Brent oil above $80 a barrel last week. Even though Russia and Saudi Arabia, which have cooperated closely in oil over the last two years, have offset some of the impact by boosting their own output, traders are betting it won’t be sufficient to replace all the losses from Iran. "The physical market has clearly tightened, reinforcing the bullish narrative on geopolitical and supply risks," said Thibaut Remoundos, founder of Commodities Trading Corporation Ltd. who’s been trading oil for more than 20 years. It’s not just the headline oil price that shows the market impact of U.S. sanctions. As oil refiners from China to France scramble to find alternative supplies, they are pushing up the prices of crudes that can substitute for lost Iranian shipments. Russia’s Urals blend, for example, is trading at its highest premium to the Brent benchmark since the beginning of the year. Chinese refiners recently bought large amounts of Urals from the port of Rotterdam, an unusually long voyage. Oman crude is also unusually expensive, and Basrah Light of Iraq is selling better than usual. The unilateral American sanctions, which formally only take effect on Nov 4., have scared buyers in Europe and Asia, including Japan and India. In the first two weeks of September, Iran sold an average of 1.6 million barrels a day, down from 2.5 million barrels a day in April, according to Bloomberg tanker tracking. A group of oil-market analysts predicted in April that sanctions wouldn’t cut exports by more than 800,000 barrels a day. Even though European countries opposed Trump’s actions, and have reassured Iran’s government that they want the nuclear deal to continue, European refiners have had little choice but to comply with sanctions. Washington can cut off access to the U.S. financial system for any company judged to be doing business with Iran.

With early indications that European nations and Japan will stop buying Iranian crude altogether next month, the country’s exports can easily drop another 350,000 barrels a day by November, down to about 1.3 million barrels a day. South Korea, a major importer of Iranian crude in the past, hasn’t shipped any oil from Iran for 75 days. Iran isn’t just losing customers for its crude, like it did under earlier sanctions from 2012 to 2015, but also for condensate, a form of super-light oil used mostly in the petrochemical industry. With South Korea not buying any, total Iranian exports of condensate dropped in the first half of September to 175,000 barrels a day, down more than 40 percent from April. The earlier-than-expected decline in both crude and condensate exports appears to be a reaction to U.S. banking and shipping insurance sanctions that went into effect over the summer. "The first wave of sanctions in August sent the message to the market that the U.S. was serious, and I think has resulted in these early cuts to Iranian exports ahead of the Nov. 4 implementation of oil sanctions," said Joe McMonigle, energy analyst at Hedgeye Risk Management LLC and a former senior official at the U.S. Energy Department. Iran has tried to offset some of the impact by offering China and India, two countries likely to keep buying at least some oil, to ship the crude using its own tankers at no extra cost, effectively giving New Delhi and Beijing a small discount. So far, it doesn’t appear to be working: in the first two weeks of September, India has loaded just 240,000 barrels a day of Iranian oil, less than half the usual amount. In the starkest sign that buyers are running away, Iran is now starting to store unsold crude in supertankers, a practice known as floating storage that it also used during the Obama-era sanctions. According to Bloomberg tanker tracker data, Iran now has four supertankers carrying about 7 million barrels of crude anchored off its main export terminals for at least seven days. Another two tankers with 3 million barrels of condensate are anchored offshore the port of Jebel Ali in Dubai.

The dramatic decline in Iran’s exports will figure in the deliberations of ministers from the Organization of Petroleum Exporting Countries and other oil producers in the so-called OPEC+ group when they meet this weekend in Algiers. Iran is a “very important producer and exporter” of oil, OPEC Secretary-General Mohammad Barkindo said on Tuesday. “When you have major producers facing supply challenges, it’s of concern” for OPEC and consumers alike, he said. Saudi Arabia, OPEC’s largest exporter, is ready to accept oil prices above $80 barrel because of the sudden drop off from Iran, according to people familiar with the views of the country. Benchmark Brent traded near $79 a barrel on Tuesday in London. Despite the initial success, the White House is still far away from its official aim of cutting Iran’s oil revenues to "zero." But there are reasons to think exports could plunge lower still. After Nov 4., even the countries that continue buying Iranian oil will struggle to transfer the money back to Tehran, potentially stranding billions of dollars in revenues overseas and forcing Iran into barter deals that swap crude for other goods, traders said. In that way, oil exports will remain above zero, but Iran will receive only a portion of the revenues. "The loss of Iranian exports is gaining pace," said Amrita Sen, chief oil analyst at Energy Aspects Ltd. "This has led to a rise in floating storage off Iran and onshore storage is nearly full.”

U.S. sanctions cannot drop Iran’s oil sales to zero due to high demand -TV – Reuters News

An adviser to Iran’s oil minister said on Tuesday that expected U.S. sanctions on Iran’s energy sector could not reduce the country’s oil sale to zero because of high demand levels in the market, state TV reported. "Considering the high demand and low supply in the market, America’s sanctions cannot drop Iran’s oil sale to zero … Other oil producers cannot replace Iran’s oil," said Moayyed Hosseini Sadr, an adviser to Oil Minister Bijan Zanganeh. In May, U.S. President Donald Trump pulled out of an international nuclear deal with Iran and announced sanctions against OPEC member Iran. Washington is pushing allies to cut imports of Iranian oil to zero and will impose a new round of sanctions on Iranian oil sales in November. It is also encouraging other oil producers such as Saudi Arabia, other OPEC members and Russia, to pump more to meet any shortfall. However, Washington said this month that it would consider waivers for Iranian oil buyers such as India but that such buyers would eventually have to halt imports. Under the 2015 nuclear deal, most international sanctions against Tehran were lifted in 2016 in exchange for Iran curbing its nuclear program. Iran is currently the third-largest producer in OPEC.

Iraq poised to increase oil output ‘immediately,’ says SOMO chief – Platts

Iraq can increase oil production "immediately" to support the market ahead of the implementation of US sanctions on Iran, Iraq’s crude sales chief told S&P Global Platts. The comments from Alaa al-Yassiri, the director general of Iraq’s State Oil Marketing Organization, come as officials from the group and its allies led by Russia are debating how to ensure market stability once the sanctions imposed by the order of US President Donald Trump come into force in November. Iran could lose up to 1.4 million b/d of exports by the end of the year, according to the latest projections by Platts Analytics. Oil prices spiked briefly above $80/b last week amid growing concern over the loss of Iranian barrels and the lack of spare capacity amongst its OPEC partners outside Saudi Arabia. The kingdom has already increased its shipments significantly to win more market share at Iran’s expense. However, Yassiri also urged OPEC members to support Iran, without elaborating on what specific backing the group can provide Tehran. "Iran is a founding member state of OPEC, and all the members [of OPEC] should help Iran to get out of its crisis," Yassiri said. "OPEC is supposed to keep the stability of the market," said Yassiri. "As a result, if there is no stability, there will be damage for the consumers and producers." Ahead of the upcoming meeting of the joint OPEC, Non-OPEC, Joint Ministerial Monitoring Meeting in Algeria on September 23, Yassiri said member countries with the capacity to increase production should do so if required by the market. "If the producers, the member states of OPEC, reach the conclusion that supply is less than the demands, certainly we will be seeking a decision for alternatives for members that have the ability to increase," he said. Iraq, which has only recently returned to production targets set by OPEC, is expected to continue to boost output from fields operated by international oil companies. It has increased production by around 100,000 b/d in both July and August.

CAPACITY EXPANSION

Baghdad has plans to continue to aggressively expand its export capacity. Yassiri said capacity of its Persian Gulf terminals is at 3.7 million b/d, and work continues on the facilities, pipelines feeding them, and the onshore storage facility at Fao to further increase its scale. He said a political deal with the semi-autonomous Kurdistan region and Turkey to utilize a pipeline sending crude from northern Iraq to Ceyhan would "add an amount of 400,000 b/d of exports." Accessing Kurdistan’s pipeline to Turkey and Ceyhan storage would also require commitment that all of the crude would be sold by SOMO, officials have told S&P Global Platts. The fear is that crude would not be handed back over once it reached Ceyhan and would be sold by Kurdistan to cover claims of due payments. An estimate for 2019 exports is going to be made in November when term contracts for the year are agreed to, said Yassiri. "We will have a complete plan for 2019, about how much real production we will have, and how much will be consumed locally, and then I’ll be informed about the amount available for the exports," he said. "Any amount that the Ministry of Oil decides, SOMO will be able to export it." Yassiri said a crude swap deal with Iran remains in place, but was delayed by disputes within the Iraqi Customs Commission and the need for additional trucking companies to commit to sending oil from the Kirkuk area into Iran. One senior North Oil Company official told Platts that around 5,000 b/d is being trucked to Iran, though that is likely to increase over the coming month. "We already have 500,000 barrels of oil in Iran. And we are trying to reach to 1 million, in order to be a commercial shipment that we could sell it, before November 4," he said, referring to the day sanctions are due to kick in. Trucking "resumed more than a week ago."

TRADING

Yassiri also said there had been progress in expanding an experiment of forming joint ventures with trading arms of international oil companies in an effort to profit more from Iraqi crude after it is initially sold, gain more market share in strategic countries, and increase SOMO’s experience in global trade. While each JV has different aims unique to the partnership, they operate the same: it purchases crude from SOMO and sells it on into pre-agreed markets. "We are very close to signing a deal with China’s CNOOC," Yassiri said. "The Chinese market is very important for us." This follows a joint venture with China’s ZhenHua, which Platts first reported in March. "With ZhenHua it is to get knowledge about China’s market. It is a big market, and ZhenHua is a state-owned company," he said. Currently, the two split the profit of crude that ZhenHua sells into the Chinese market. In November, he said, SOMO will decide whether to formalize the agreement into a company, in which SOMO will own 50% in addition to profit sharing. The first such experiment was with Litasco, the crude trading arm of Lukoil. It formed a company, initially called Lima, now renamed Iraq Petroleum Trading. "Right now, SOMO shares profits, but it doesn’t have shares [in IPT]," he said. A decision on that is also set for November. "We also have very good negotiations with BP, too," he added, without providing any details.

U.S. Is Said to Disown Haley Plan for UN Meeting on Iran: WaPo

Trump administration disowning a plan presented by U.N. Ambassador Nikki Haley for President Trump to hold a meeting at the UN next week focused on Iran, Washington Post reports, citing unidentified diplomats familiar with the planning.

- Focusing meeting on Iran drew immediate concerns from U.S. allies

- Trump will instead chair a debate on nonproliferation, constitutionalism and sovereignty, which doesn’t single out any country

- Officials at the White House and the U.S. mission to the UN declined to comment to Washington Post on why the topic of the meeting is different from the Iran-centered one unveiled by Haley on Sept. 4

U.S. imports of Libyan crude rebound in September after pause -data – Reuters News

Libyan crude flows to the United States resumed in September after falling to zero last month amid earlier port closures, Thomson Reuters trade flows data showed on Monday. Unrest that closed major Libyan ports cut the chaotic OPEC nation’s crude production in July, but output rebounded by 280,000 barrels per day (bpd) in August to 950,000 bpd, and ports reopened, according to the International Energy Agency, which coordinates the energy policies of industrialized nations. Four tankers carrying a total of 2.1 million barrels, or 70,800 barrels per day (bpd), from Libya’s major port in Es Sider and other terminals will arrive or have already made port in Philadelphia, New York and Houston this month. The Seascout arrived on Sept. 4 with 600,000 barrels at Phillips 66’s Bayway Refinery in the Port of New York and New Jersey, the data showed. Phillips 66 declined to comment. The Silverway, chartered by Italian oil major Eni, is set to reach Philadelphia on Wednesday after leaving Libya’s Mellitah port with more than 600,000 barrels. In August, U.S. East Coast refiners including Monroe Energy in Trainer, Pennsylvania, shifted to light, sweet Saharan Blend from Algeria to offset the drop in imports from Libya, Thomson Reuters data show. The U.S. imported 140,000 barrels per day of the Saharan blend in August, the largest volume in two years. Imports of Saharan blend are set to fall to 48,000 bpd in September, the data show. Other African suppliers are able to quickly step in and replace Libyan barrels that are lost due to unrest, said Judith Dwarkin, chief economist at market intelligence firm RS Energy Group. Saharan Blend traded around a $0.70 and $1 discount to global benchmark Brent in August for September delivery and rose to a $0.20 premium in September, traders said.

U.S. shale oil production to rise to 7.6 million bpd in October – Reuters News

Oil output from seven major shale formations in the United States is expected to rise by 79,000 barrels per day to 7.6 million bpd in October, the U.S. Energy Information Administration said Monday. Surging oil output from shale formations boosted total U.S. crude production to a record high of nearly 10.7 million barrels a day in June, the latest month for which data is available. Production is expected to rise 31,000 bpd in the Permian formation of Texas and New Mexico, the agency said in a monthly report. Output from five other major shale formations is expected to rise in the month. Output in the Haynesville shale, the smallest of the seven formations that the EIA tracks, was expected to be unchanged at 43,000 bpd in the month. Production per rig from new wells was expected to rise in all formations except for the Permian Basin, where it was expected to decline by nine barrels a day. Meanwhile, U.S. natural gas production was projected to increase to a record 73.1 billion cubic feet per day (bcfd) in October. That would be up almost 1 bcfd over the September forecast and would be the ninth monthly increase in a row. In October 2017 output was just 60.3 bcfd. The EIA projected gas output would increase in all the big shale basins in October. Output in the Appalachia region, the biggest shale gas play, was set to rise almost 0.3 bcfd to a record high of 29.4 bcfd in October. Production in Appalachia was 24.2 bcfd in the same month a year ago. EIA said producers drilled 1,520 wells and completed 1,282 in the biggest shale basins in August, leaving total drilled but uncompleted wells up 238 at a record high 8,269, according to data going back to December 2013. That was the most wells drilled and completed in a month since early 2015, according to EIA data.

US shale producers tackle sharp decline rates – Argus

Nearly a decade since independent oil firms ushered in the US unconventional oil boom with advances in hydraulic fracturing, a key challenge remains — how to stem sharp decline rates at shale wells without burning through budgets. US oil production is forecast to rise by 1.3mn b/d to a record 10.7mn b/d this year and hit 11.5mn b/d in 2019, driven by growth in tight oil output from the Permian basin and other shale formations, according to the Energy Information Administration (EIA). UK bank Barclays predicts tight oil output to increase by around 1mn b/d a year to 13.2mn b/d by 2025 from 5.6mn b/d last year. But growth will depend on how well companies succeed in slowing the steep decline rates of as much as 70pc that tight oil reservoirs exhibit in the first 2-3 years following start-up. The initial response has been to drill longer lateral wells and pump more proppant, or sand, and water. But there are limits to the amount of water or sand that can be injected and the length that a well can be drilled to, leaving companies searching for longer-term fixes. "We have yet to understand how reservoir conditions and well productivity change as we continue to inject billions of pounds of proppant and billions of gallons of water into the ground each year," oil service firm Schlumberger chief executive Paal Kibsgaard says. A growing concern is the impact of secondary wells on output and on primary wells as more producers switch to pad drilling to lower their barrel of oil equivalent costs. If the spacing between wells is too close, it can lead to less than expected production, and more importantly, reduce pressure in the primary well, creating so-called pressure sinks. The percentage of secondary wells in the Eagle Ford has reached 70pc, Schlumberger says, and in the three-year period since the level has breached the 50pc mark there has been a steady reduction in unit well productivity. The industry needs to better understand the subsurface and fluid technologies it uses, Kibsgaard says. But that increases costs, going against producers’ priorities as they deal with investor pressure to spend within cash flows and improve returns. "Deploying these technologies requires a significant mindset change throughout the industry, and a willingness to increase investments," he says.

Parental guidance

The industry is at an "inflection point" and whoever successfully addresses the challenge of having pressure sinks that create the "parent-child relationship" between wells "is going to be a value creator", Concho chief executive Tim Leach says. The key lies in the sequencing of the zones and the timing between drilling the wells, according to Leach. The right mix "optimizes recoveries, optimizes economics and reduces stranded wells," he says. Beyond secondary well challenges, producers and service providers are touting other technological advances. EOG Resources has developed a predictive algorithm to make better and quicker decisions. "We are able to produce both high returns and high growth and we are able to do it organically," chief executive Bill Thomas says. And service giant Halliburton has just launched its Prodigi intelligent fracturing service, with adaptive and automated controls that respond in real time to changes in the formation. The company is also working with Microsoft and Accenture to develop digital technology. Barclays views innovation as key to sustaining output growth. Some companies have reported that reservoir performance has been slipping in key basins, Barclays says, but it doesn’t agree with the idea that industry may be reaching the end of the efficiency gains cycle. "We believe that, on balance, industry innovation will keep inevitable productivity declines in check," it says.

U.S. Cash Crude-Cash crude grades strengthen as WTI-Brent spread widens – Reuters News

U.S. cash crude differentials strengthened on Monday, with West Texas Intermediate at East Houston reaching the highest level in three months as the spread between U.S. crude futures and global benchmark Brent widened, dealers said. WTI at East Houston, also called MEH, traded at a $7.90 per barrel premium to U.S. crude futures, as demand for U.S. crude exports continued to rise with the widening WTI/Brent spread. U.S. crude’s discount to Brent widened by 5 cents to minus $9.37 per barrel, after narrowing by 45 cents on Friday. When U.S. crude gets cheaper compared with Brent, coastal grades get pricier as foreign buyers pick out more U.S. crude oil. West Texas Intermediate at Midland traded at the strongest level in six weeks ahead of a deadline to nominate crude volumes on pipelines out of the area, dealers said. "When you put in your nomination and get (approved), you run out and buy barrels, and you see an uptick in the price," a broker said. WTI Midland traded at an $11 per barrel discount to U.S. crude futures, up from as much as a $13.75 per barrel discount on Friday and the strongest level since Aug. 10. Crude bottlenecks have weighed on the inland grade for months, with WTI Midland hitting a six-year low last month. Crude inventories at the U.S. storage hub in Cushing, Oklahoma fell to 25.2 million barrels on Friday, down by 2.2 million barrels a week before, dealers said, citing data from market intelligence firm Genscape.

- Light Louisiana Sweet WTC-LLS for October delivery fell 5 cents to a midpoint of $7.70 and traded between $7.40 and $8 a barrel premium to U.S. crude futures.

- Mars Sour WTC-MRS was unchanged at a midpoint of $4.50, trading between $4.25 and $4.75 a barrel premium to U.S. crude futures.

- WTI Midland WTC-WTM rose $1.75 to a midpoint of $12 and traded between $13.25 and $10.75 a barrel discount to U.S. crude futures.

- West Texas Sour WTC-WTS rose $2.50 to a midpoint of $12 and traded between 12.50and $11.50 a barrel discount to U.S. crude futures.

- WTI at East Houston WTC-MEH, also known as MEH, traded at $7.75 and $8 per barrel over U.S. crude futures.

US crude stocks expected to drop as exports surge – Platts

A strong uptick in US exports coupled with still-strong refinery runs likely contributed to a further draw in US crude stocks last week, an S&P Global Platts Analysis showed Monday. Commercial crude inventories were expected to have fallen by 3 million barrels during the week ended 14 September, according to analysts surveyed by Platts on Monday. The expectations for a further decline came on the heels of a larger than expected draw of 5.3 million barrels the week prior. Total US waterborne crude exports reached 2.16 million b/d for the reporting period ending 14 September, up nearly 24 percentage points from 1.74 million b/d during the week prior, according to S&P Global Analytics cFlow estimates. Stepped-up exports from the US Gulf Coast to Northwest Europe accounted for the bulk of the uptick, cFlow, Platts trade-flow software showed. Flows to the United Kingdom grew to 2.13 million barrels, up from 511,000 barrels the week prior, and 1.08 million barrels were exported to the Netherlands, which took no USGC crude during the previous week. The discount for WTI compared to Brent dipped to more than $10/b last week, favoring USGC exports into Europe on paper. Platts data last showed WTI at a definitive discount to North Sea Forties in Rotterdam during the last week of July, when WTI averaged $1.41/b below Forties for the week ended 3 August. But in the weeks since, arbitrage economics appear to be shifting in favor of local grades, Platts data showed. To date in September WTI delivered into Rotterdam has averaged at a 59 cent/b premium compared to North Sea Forties crude, up from roughly plus 34.4 cents/b in August.

REFINERY RATES FALL AS TURNAROUNDS INCREASE

Analysts surveyed by Platts expected crude inventories to fall even as they anticipated a 0.8 percentage point reduction in refinery utilization last week. This is expected to take refinery utilization to 96.8% of capacity. Total refinery utilization remains very strong, with rates just below 10-year highs, according to the Energy Information Administration. Last week analysts had expected a 0.9 percentage point decline in utilization during the week ended 7 September, but EIA data later showed that utilization had increased by 1 percentage point to 97.6% of total capacity. But increased refinery turnarounds is expected to bring this number lower. Refinery maintenance took 2.38 million b/d of refinery capacity offline during the week ended 14 September, an uptick of 545,000 b/d from the week prior, according to S&P Global Platts Analytics data. In addition, last week ExxonMobil and Phillips 66 each reported processing unit issues at separate Illinois refineries. Exxon notified regulators of issues with an undisclosed unit at its 238,000 b/d Joliet refinery in Channahon and Phillips 66 reported issues with an undisclosed unit at its 314,000 b/d Wood River plant in Roxana.

PRODUCTS OUTLOOK MIXED

Analysts also expect product stocks to decline. Analysts uniformly expected gasoline inventories to drop amid strong demand, with the survey average showing a 1.6 million-barrel draw. Implied gasoline demand was 9.68 million b/d over a four-week moving average for the period ending 7 September, according to EIA, up slightly from 9.65 million b/d the week prior. But analysts surveyed were mixed on the direction of distillate stocks last week. On average the Platts survey showed stocks to be 282,000 barrels lower last week, even as a sizable minority of analysts expected an increase. EIA data showed that distillate stocks gained sharply during the week ended 7 September, increasing by 6.2 million barrels to 139.28 million barrels.

U.S. Cash Products-Midwest gasoline rises as wholesalers buy in region – Reuters News

U.S. Midwest gasoline cash differentials rose on Monday, with Group Three gasoline reaching a one-year high, as wholesalers actively bought in the region, market participants said. Group Three gasoline gained 2.00 cents to trade at 11.00 cents per gallon above the gasoline futures benchmark on the New York Mercantile Exchange, traders said, the highest since Sept. 6. Chicago CBOB gasoline rose 2.25 cents a gallon to trade at 9.75 cents per gallon above futures. The product has not traded that high since Dec. 21, when it traded at 11.50 cents per gallon above futures. Trade began on the third cycle for September delivery into the Buckeye complex. In New York Harbor, M2 conventional gasoline rose a half penny to trade at 6.50 cents per gallon above the futures contract, traders said. RBOB lost 11.35 cents a gallon to trade at 0.85 cent per gallon below futures as F4 became the dominant grade in the region. Philadelphia Energy Solutions (PES) does not plan to restart the 85,000 bpd gasoline-making unit at the Girard Point section of the Philadelphia refinery complex for at least five days, a source familiar with the matter said on Monday. PES shut the fluid catalytic cracker on Saturday. Strong gasoline inventories on the U.S. East Coast have kept cash prices for the product steady, traders said on Monday, despite refiners recently shutting gasoline-making units in the region due to leaks or to make repairs. On the Gulf Coast, 62-grade ultra-low sulfur diesel gained a quarter of a penny to trade at 4.50 cents per gallon below the heating oil futures contract, traders said. The RBOB futures contract on NYMEX gained 0.66 cent to settle at $1.9768 a gallon on Monday. NYMEX ultra-low sulfur diesel futures fell 0.28 cent to settle at $2.2064 a gallon. Renewable fuel (D6) credits for 2018 traded at 20, 20.5 and 21 cents each on Monday, compared to 22 cents each on Friday, traders said. Biomass-based diesel credits (D4) fetched 40 cents each, down from 43 cents each on Friday, traders said.

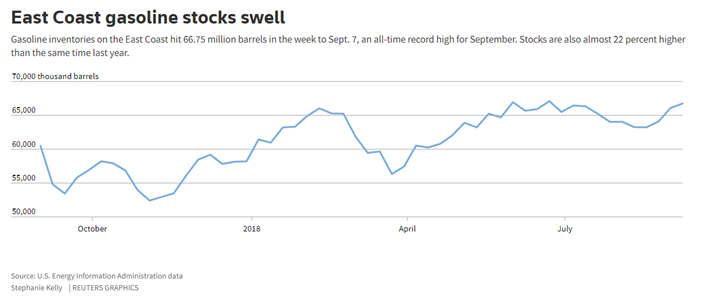

U.S. East Coast gasoline prices steady despite unit shutdowns – Reuters News

Strong gasoline inventories on the U.S. East Coast have kept cash prices for the product steady, traders said on Monday, despite refiners recently shutting gasoline-making units in the region due to leaks or to make repairs. High imports into the East Coast have kept inventories up, offsetting any potential supply disruptions from unit shutdowns at Philadelphia Energy Solutions’ (PES) refinery complex in Philadelphia and Phillips 66’s Bayway refinery in Linden, New Jersey, market sources said. Gasoline and blending components imports into the East Coast have been higher than year-ago levels for each of the last seven months, said Matt Smith, director of commodities research at ClipperData. August imports were about 160,000 barrels per day more than the same time last year, he added. This has pushed stockpiles higher. East Coast gasoline inventories were at 66.75 million barrels in the week to Sept. 7, the highest level for any September on record, according to data from the U.S. Energy Information Administration. PES shut the 85,000-bpd gasoline-making unit on Saturday at the Girard Point section of the Philadelphia refinery complex due to a leak. It does not plan to restart the fluid catalytic cracker (FCC) for at least five days, a source familiar with the matter said on Monday. The 150,000-bpd gasoline unit at P66’s Bayway refinery remains shut until the end of the month after the unit had been shut and restarted several times since the end of March, following a two-month turnaround. Additional shutdowns in the region are expected. Monroe Energy plans a refinery-wide shutdown of its 185,000-bpd refinery outside Philadelphia on Sept. 22, Reuters previously reported. Despite the shutdowns, prices of gasoline in New York Harbor were little changed on Monday from the previous session. F4, the dominant RBOB grade in the region, traded at about 0.85 cent per gallon below the gasoline futures contract on the New York Mercantile Exchange traders said.

Here’s a rundown of key outages:

- Philadelphia Energy Solutions: Girard Point FCC is shut 1-3 weeks, Point Breeze reformer also shut, an alkylation unit to shut for turnaround in October

- Phillips 66 Bayway: FCC is shut through September to repair a reactor

- Monroe Trainer is said to begin full-plant turnaround, including FCC, on Sept. 28

- PBF Energy Delaware City, Del.: Turnaround on FCC lasting 30-35 days in fourth quarter

- PBF Energy Paulsboro, N.J.: Turnaround on coker, smaller crude unit lasting 20-40 days from mid-September

USGC jet fuel weakens to lowest level since late March as storm dampens demand – Platts

The US Gulf Coast jet fuel differential dropped Monday to its lowest level in nearly six months after demand softened in the wake of Hurricane Florence, sources said. S&P Global Platts assessed benchmark Gulf Coast jet fuel on the first day of trading for Colonial Pipeline’s prompt 54th cycle at the NYMEX October ULSD futures contract minus 8 cents/gal, down 55 points from Friday. The last time it was assessed lower was March 21, when the assessment was the front-month futures minus 8.25 cents/gal on March 21. "Colonial is running at full capacity despite Florence. Shoving barrels into markets flooded by the storm will absolutely cause differentials to fall on all products, as demand last weekend was ravaged by the storm," said one USGC distillates trader. Jet fuel supply was strong even before Florence developed into a hurricane last week, causing thousands of canceled flights. The latest Energy Information Administration data showed nationwide jet inventories rose 2.35 million barrels to 44.34 million barrels, the highest mark seen since June 2, 2017 when EIA reported stocks totaled 44.60 million barrels. US jet production was also strong, climbing 43,000 b/d week on week to 1.93 million b/d, EIA said. "Jet is very heavy in the market. Demand has cooled off," said another trader.

BP Whiting Is Said to Start Multiunit Turnaround This Week

BP’s Whiting, Ind., refinery will begin a multiunit turnaround this week that will continue into early November, people familiar with maintenance plans say.

- Work includes 243.5k b/d Pipestill 12, largest of 3 crude units at Whiting

- PS-12 was reconfigured in 2012-2013 to process mostly heavy Canadian crude

- Also shutting for maintenance during staggered work schedule are Coker 2, a gasoil hydrotreater and sulfur recovery complex that were added in 2013 to support a revamped Pipestill 12

- 75k b/d Pipestill 11-A has returned to operations after shutting last week for repairs, person familiar with the situation says

- Whiting has a crude processing capacity of 413.5k b/d: data compiled by Bloomberg

- The largest Midwest refinery, Whiting supplies gasoline and diesel to the Chicago area market

Lyondell Houston refinery begins planned overhaul -sources – Reuters News

Lyondell Basell Industries began a planned overhaul of the small crude distillation unit and the large coker at its 263,776-barrel-per-day (bpd) Houston refinery on Monday, Gulf Coast market sources said. The 120,000-bpd 536 crude distillation unit (CDU) and 56,000-bpd 737 coker are scheduled to be shut for up to six weeks to complete the overhaul, the sources said.

Phillips 66 to restart Borger, Texas, refinery reformer by weekend -sources – Reuters News

Phillips 66 plans to restart the small reformer at its 146,000 barrel-per-day, joint-venture Borger, Texas, refinery by the coming weekend, sources familiar with plant operations said on Monday. Phillips 66’s media relations office sent an email saying planned maintenance was underway at the Borger refinery, but did not say which units were involved in the work. The 7,000-bpd reformer was shut on Sunday for repairs, the sources said.

China’s diesel demand has peaked, gasoline to peak 2025 -CNPC research – Reuters News

China’s diesel demand has peaked and gasoline will peak in 2025, while natural gas demand will increase over the next two decades to feed a massive gasification campaign, according to a forecast released on Tuesday by a research arm on a state energy group. The research unit of China National Petroleum Corp (CNPC) also said that China’s total oil demand will top out at around 690 million tonnes a year, or 13.8 million barrels per day (bpd), by 2030. China, the world’s top crude oil importer, will maintain annual crude oil production of 200 million tonnes, or about 4 million barrels per day, before 2030, CNPC said. Demand for diesel is waning amid moderating economic growth and tighter environmental scrutiny, while gasoline demand is capped by slowing growth in private car sales and the rise of electric and natural gas-fuelled vehicles. One of the government’s recent plans is to replace a million heavy-duty diesel trucks, almost 20 percent of the national fleet, with ones that burn cleaner fuels such as natural gas and lower-sulphur diesel, as Beijing ramps up its war on pollution. This would be a blow to China’s oil refineries, as diesel is a main contributor to its fuel sales revenue. As additions to China’s refining capacity outpace the nation’s fuel demand growth, more than 50 million tonnes of surplus fuel is forecast for 2050, CNPC said. The country’s natural gas demand will reach 620 billion cubic metres (bcm) by 2035, CNPC also said. That represents 160 percent growth from the consumption level for 2017. Domestic gas production is expected to reach 300 bcm by 2035, the forecast said, more than doubling the 147 bcm produced last year. China’s campaign to clear its skies has increased demand for the fuel and will keep it reliant on imports of liquefied natural gas (LNG) and piped gas. Demand for the cleaner-burning fuel has risen nearly 17 percent in the first half of the year. CNPC also brought forward the timeline for peak total energy demand for the world’s second-largest economy to 2035, from a previous forecast of 2040.

Asia Distillates-Gasoil refining margins dip to over five-week low – Reuters News

Asia’s refining margins for 10ppm gasoil slipped to their weakest in more than five weeks on Tuesday, while cash premiums for the industrial fuel rose on stronger bids in the physical market. The refining margins for gasoil with 10ppm sulphur content fell to $15.52 a barrel over Dubai crude during Asian trading hours, compared with Monday’s $15.85 a barrel. Cash premiums for 10ppm gasoil climbed to 60 cents a barrel to Singapore quotes on Tuesday, compared with 53 cents a barrel on Monday. "The kind of premiums going on at the moment, given it appears there is adequate supply and the cracks are dropping, is indicative of a play that is not quite consistent with the general supply-demand," said Sukrit Vijayakar, director of Indian oil consultancy Trifecta. "The current (gasoil) margins are above-average… I don’t see them spiking from here on. They might stay flat or ease slightly, but I don’t see the margins going up by a dollar or two." Meanwhile, cash discounts for jet fuel JET-SIN-DIF narrowed to 16 cents a barrel to Singapore quotes on Tuesday, compared with a discount of 27 cents a day earlier. Jet fuel refining margins were at $15.08 a barrel over Dubai crude on Tuesday, down from $15.15 a barrel on Monday.

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.