From: Wagner, Jonathan

Sent: Wednesday, September 19, 2018 6:24:32 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

Good morning. Wishing all who are celebrating Yom Kippur today and easy fast. Oil prices are unchanged this morning Chinese equities up again overnight, European equities higher and the dollar lower. API data released last night showed crude stocks building 1.2m bbls while Cushing stocks drew 1.6m bbls. Product stocks were unchanged as Gasoline drew 1.5m bbls and distillate built 1.5m bbls. Refinery runs fell 312k b/d as we enter the beginning of fall maintenance (and some unplanned outages) and total US crude imports added 555k b/d w/w to 8.1m b/d in total. Last week according to the DOE runs were 17.857m b/d and Total US crude imports were 17.857m b/d. Earlier in the week clipper expected Padd 3 imports this week to come in around 2.58m b/d while Bloomberg’s tanker tracker was estimating 2.39m b/d. the DOE had Padd 3 imports at 2.147m b/d last week. Exports are also expected to increase to 2m b/d this week (1.828m b/d last week according to the DOE).

Middle East crude Cash Dubai was weaker by 2c today to +1.44 over swaps while spot premiums for light grades moved higher after Shell bought Murban and Sokol bbls. Total sold a November Murban crude cargo to Shell at 50 cents a barrel above the grade’s OSP. The premium is 5 cents higher than the level at which Total sold four cargoes to Vitol on Tuesday. For a second day, Total offered Murban crude to be loaded from the Yangpu oil storage site in Hainan in southern China. Three Nov Dubai partials traded in the window today with Shell and BP buying from Reliance. Sep/Oct Dubai spreads are trading 84c back while Oct/Nov spreads are trading 69c back. Platts has an article out this morning which discusses the stronger demand seen for Persian Gulf light sour crude grades (full article below). “Light sour crude grades from the Persian Gulf have seen spot differentials flip from discount to premium amid firm buying interest from traders and end-users in Asia, market sources said Wednesday. Barrels of light, medium and heavy sour crude grades loading from Middle Eastern ports in November headed to Southeast and Far East Asia have received firm buying interest across the board — barely a month after trading at substantial discounts. The rise in spot differentials paid for light sour crude grades such as Abu Dhabi’s Murban and Qatar’s Land has caught participants by surprise, as the market was thought to have been focused on securing replacement barrels for medium to heavy sour Iranian crudes.”

Gulf coast US Crude Cash were quite yesterday with MEH trading +8 and LLS falling slightly to +7.6 over WTI. The strength in grades yesterday was seen from Midland as cash went out at -9.75 vs WTI (+1.75 on the day). Cash Midland started the month of September trading -18 vs WTI. Cash was bid ahead of deadlines for shippers to nominate crude volumes on pipelines ahead of upcoming 3 day roll. Plains also said at the end of Aug that they would be ready to begin receiving crude from shippers as line fill for the new expanded sunrise pipeline. The company expects to have received all necessary line-fill for the pipe by Oct 31. Bal 18 – Q2 Midland was very strong yesterday helping to flatten out the curve. However, late in the day weakness was seen Nov and Dec as prices traded almost a dollar of the intraday high. Below I have a chart of the Cal month Midland curve (FF contract) from yesterday’s settle vs 1 month ago.

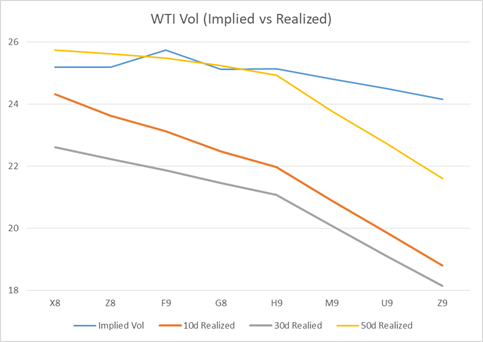

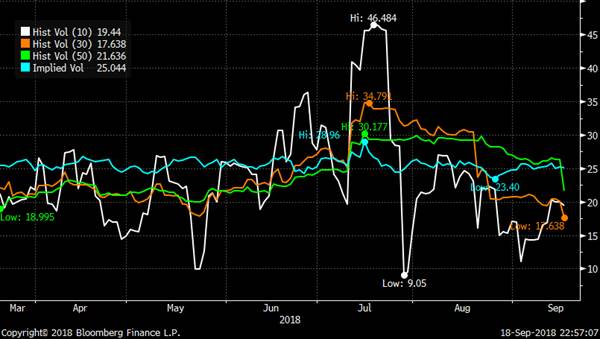

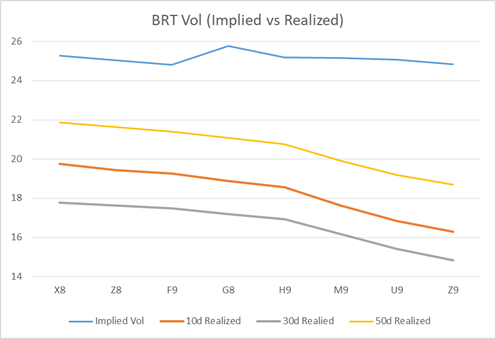

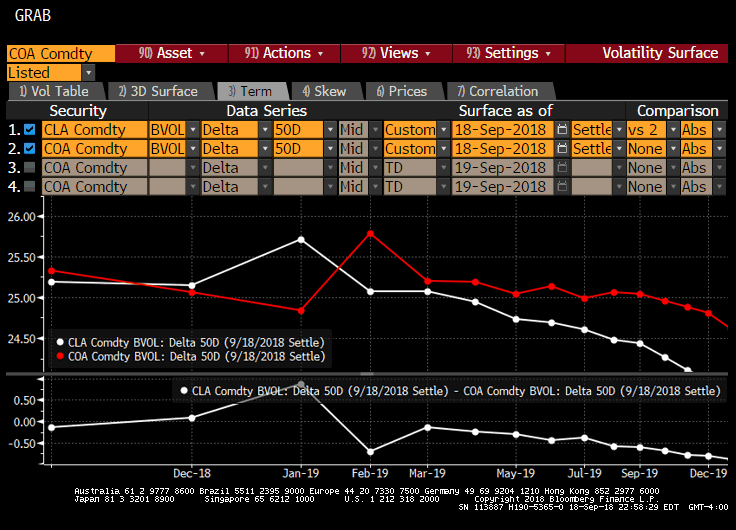

Vols finished the day lower lead by front end WTI as the CLX8 Breakeven went out at 1.11. Front end put skew continues to move lower while call skew was unchanged yesterday. In Brent put premium to calls in the front has evaporated as the Z8 25d Risk reversal is now trading almost flat. Q1 put premium on Brent has also been crushed as continued upside interest has been seen over the past few weeks. Couple that with chunky put flow going through looking to own closer to the money puts while selling the wingy puts.

WTI Dec 25d Risk Reversal (put prem)

Brent Dec 25d Risk Reversal (Put prem)

Brent Feb 25d Risk Reversal (Put prem)

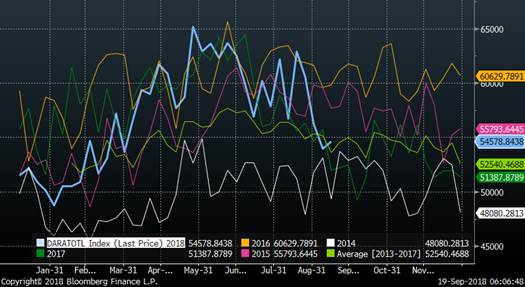

Midland Cash

Midland Cal Curve (FF) Yesteday’s settle vs End Aug

|

Implied Vol |

Realized Vol |

||||||

|

WTI Vol |

18-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.19 |

-0.4 |

1.11 |

24.31 |

22.61 |

25.73 |

|

|

Z8 |

25.18 |

-0.3 |

1.11 |

23.62 |

22.24 |

25.62 |

|

|

F9 |

25.73 |

-0.3 |

1.13 |

23.13 |

21.88 |

25.47 |

|

|

G8 |

25.11 |

-0.3 |

1.1 |

22.47 |

21.45 |

25.24 |

|

|

H9 |

25.14 |

-0.27 |

1.1 |

21.98 |

21.08 |

24.92 |

|

|

M9 |

24.8 |

-0.32 |

1.08 |

20.88 |

20.08 |

23.78 |

|

|

U9 |

24.5 |

-0.19 |

1.05 |

19.85 |

19.10 |

22.73 |

|

|

Z9 |

24.15 |

-0.24 |

1.02 |

18.79 |

18.15 |

21.59 |

CLZ8 Implied Vs Realized Vol

|

Implied Vol |

Realized Vol |

||||||

|

BRT Vol |

18-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.28 |

0.02 |

1.26 |

19.74 |

17.78 |

21.88 |

|

|

Z8 |

25.03 |

-0.18 |

1.24 |

19.44 |

17.64 |

21.64 |

|

|

F9 |

24.8 |

-0.11 |

1.22 |

19.26 |

17.48 |

21.39 |

|

|

G8 |

25.76 |

-0.03 |

1.27 |

18.90 |

17.18 |

21.07 |

|

|

H9 |

25.18 |

-0.13 |

1.24 |

18.55 |

16.93 |

20.76 |

|

|

M9 |

25.15 |

-0.22 |

1.22 |

17.62 |

16.18 |

19.91 |

|

|

U9 |

25.06 |

-0.26 |

1.20 |

16.84 |

15.42 |

19.19 |

|

|

Z9 |

24.83 |

-0.2 |

1.18 |

16.30 |

14.85 |

18.68 |

COZ8 Implied vs Realized Vol

WTI / BRT Implied ATM Vol curve

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

WTI G19 61.50 Put x69.25 vs BRT G19 70 Put x78.00 TRADES 3 2,700x; TRADES 4 800x 18d/18d

WTI/BRT H19 ATM Call Roll x69.00/78.00 TRADES 28 500x 58d/56d

ICE Trade Recap

BRT Z18 80/85 Call Spread x78.85 TRADES 139 500x 26d

WTI X18 70 Call vs BRT X18 80 Call TRADES 110 900x; TRADES 111 100x

BRT G19 70 Put x78.00 TRADES 130 1,400x 18d

BRT H19 65/60 1×2 Put Spread TRADES 12 2,500x

BRT X/Z18 78 Put Roll x79.60/79.05 TRADES 156 28d/41d

WTI U19 57.50 Put x67.75 TRADES 268 1,000x 19d

BRT G/M19 ATM Call Roll x78.00/77.00 TRADES 189 1,100x 52d/54d

BRT H/M19 75 Put Roll x77.40/76.60 TRADES 163 500x 36d/36d

CME Trade Recap

WTI Z20 85 Call x63.40 TRADES 171 500x 18d

WTI U19 55/60 Put Spread x67.50 TRADES 96 500x 5d

WTI Z19 55/80 Fence x66.85 TRADES 47 1,000x 45d

WTI Z19 45/60/75 Put Fly x67.00 TRADES 386 1,000x 17d

BRT F19 74/84 Fence x74.85 TRADES 25 500x 55d

WTI U19 60/75 Fence x67.50 TRADES 27 900x 63d

WTI Z18 ATM Call x69.50 TRADES 281 600x 54d

WTI H19 62/68/74 Iron Fly TRADES 465 500x

CSO/ARB/APO Trade Recap

WTI CSO V/X18 0.25 Put (WA) TRADES 4 4,500x

WTI CSO 1Q19 Flat Put (WA) TRADES 11.5 1,250x

WTI CSO V/X18 0.30 Call (WA) TRADES 3 350x

WTI CSO Z/F19 -0.20/+.50 Fence (7A) TRADES 5 2,500x

WTI CSO V/X18 0.25 Straddle (WA) TRADES 8 200x

WTI CSO X/Z18-Z/F19 1.00 Call (7A) TRADES 3 500x

ARB X18 -8.00 Call TRADES 15 100x; TRADES 8 100x

ARB Z18 -5.00/-7.00 Call Spread TRADES 20 650x

ARB Z18 -7.00 Call TRADES 20 500x

ARB Z18 -10.00 Put TRADES 40 250x; TRADES 44 250x

WTI APO X19 67 Put x69.40 TRADES 173 100x 32d

WTI APO 1H19 60/74.75 Fence TRADES 27 1x

WTI APO Cal19 ATM Call x67.50 TRADES 567 50x 64d

U.S. crude oil stocks rise 1.2 mln bbls-API

U.S. crude stocks rose last week, while gasoline inventories decreased and distillate stocks built, industry group the American Petroleum Institute said on Tuesday. Crude inventories rose by 1.2 million barrels in the week to Sept. 14 to 397.1 million, compared with analysts’ expectations for a decrease of 2.7 million barrels. Crude stocks at the Cushing, Oklahoma, delivery hub fell by 1.6 million barrels, API said. Refinery crude runs fell by 312,000 barrels per day, API data showed. Gasoline stocks fell by 1.5 million barrels, compared with analysts’ expectations in a Reuters poll for a 104,000-barrel decline. Distillate fuels stockpiles, which include diesel and heating oil, rose by 1.5 million barrels, compared with expectations for a 651,000-barrel gain, the API data showed.

Middle East Crude-Nov premiums for light grades rise – Reuters News

The Middle East crude benchmarks held steady on Wednesday, while spot premiums for light sour grades rose after Shell bought Murban and Sokol. Total sold a November Murban crude cargo to Shell at 50 cents a barrel above the grade’s official selling price (OSP) on Wednesday, on a free-on-board basis from the United Arab Emirates on Platts window, trade sources said. The premium is 5 cents higher than the level at which Total sold four cargoes to Vitol on Tuesday. For a second day, Total offered Murban crude to be loaded from the Yangpu oil storage site in Hainan in southern China, the sources said. The offer for up to 2 million barrels of Murban crude to be loaded on Oct. 15-Nov. 15 from Yangpu was initially at $1.20 a barrel above Murban’s November OSP. Total reduced the offer to $1 at market close, but the oil remained unsold.

RUSSIA: ONGC Videsh has sold a cargo of Russian Sokol crude loading in November at the highest premium in five months on robust demand in Asia, trade sources said. The 700,000-barrel cargo loading on Nov. 16-22 was sold to Shell at $5.28 a barrel above Dubai quotes, they said, up from a previous deal at a premium of $5.10-$5.20 a barrel. This is the second November-loading cargo ONGC has sold via tenders this month. Spot premiums for Russian and Middle East grades have hit multi-month highs in this month’s trade as they are priced off Middle East benchmark Dubai, which has become relatively cheaper than Brent. Asia’s demand for crude such as Sokol, that yield more Middle Distillates, has also strengthened ahead of peak winter consumption. Russian producer Surgutneftegaz has issued a tender to sell a second ESPO cargo loading on Nov. 3-8. The tender will close later on Wednesday. Surgut may have sold the Oct. 31-Nov. 5 cargo at a premium of more than $4, but details remained unclear.

WINDOW: Cash Dubai’s premium to swaps edged down 2 cents to $1.44 a barrel.

Platts crude MOC sees uptick in Murban trading; 2 million barrels traded Tuesday – Platts

Active buying interest for Murban crude was demonstrated in the Platts Market on Close assessment process this week, with four 500,000-barrel clips of the crude traded on Tuesday. Oil major Total had initially offered a 500,000-barrel cargo of Murban crude for November loading in the MOC at a premium 60 cents/b to the OSP as of 0800 GMT on Tuesday. The cargo was steadily offered lower, and was purchased by trading house Vitol when it reached a premium of 45 cents/b. The cargo was then re-offered and purchased repeatedly, amounting to a total of four trades between Total and Vitol for a total of 2 million barrels of November loading Murban crude. Total also placed a second Murban offer in the MOC Tuesday, selling barrels of the crude loading over October 15 to November 15 from the Chinese port of Yangpu. The offer stipulated cargo sizes ranging from 500,000 barrels up to 2 million barrels, and was priced on a floating basis against the November Murban OSP plus a differential. Total initially offered the cargo at a premium of $1.80 to the OSP. As of 0830 GMT, the offer stood at OSP plus $1.20/b, FOB Yangpu, with no buying interest seen. The Platts MOC also saw bidding interest for Murban earlier this week, when Gunvor had placed a bid for 500,000 barrels of the crude on Monday. Gunvor had bid up to a premium of 40 cents/b to the November Murban OSP, while an offer from Total for a similar cargo stood at 45 cents/b as of 0830 GMT during the MOC on Monday. The Platts MOC saw its first ever cargo of Murban crude declared via the partials delivery mechanism late last month. A 500,000-barrel cargo of October-loading Murban was declared by Total to Shell, after Total sold its 20th partial of Oman crude to Shell during the MOC assessment process at $75.95/b on August 31. The declaration concluded an actively traded session for Oman partials, in which there was firm bidding interest from Shell at the onset as well as active selling from Total as well as other counterparties. Twenty-eight partials of 25,000 barrels each, or 700,000 barrels in total, of October Oman crude traded during the Platts MOC on the day.

Asian light sour crude demand firms on higher cracks, closed arbitrage – Platts

Light sour crude grades from the Persian Gulf have seen spot differentials flip from discount to premium amid firm buying interest from traders and end-users in Asia, market sources said Wednesday. Barrels of light, medium and heavy sour crude grades loading from Middle Eastern ports in November headed to Southeast and Far East Asia have received firm buying interest across the board — barely a month after trading at substantial discounts. The rise in spot differentials paid for light sour crude grades such as Abu Dhabi’s Murban and Qatar’s Land has caught participants by surprise, as the market was thought to have been focused on securing replacement barrels for medium to heavy sour Iranian crudes.

"For mediums and heavies it [higher demand] was expected — very surprising for the light sour end," a seller of Persian Gulf crude based in Singapore said earlier this month, when the differentials began rising. Robust refining margins for middle distillates, combined with a closed arbitrage from the West of Suez to Asia, has spurred demand for light sour Persian Gulf crude grades this month, sour crude traders said. In addition, producers such as ADNOC and Qatar Petroleum slashed official selling prices for lighter crudes earlier this month in line with the discounts seen in the spot market for October loading barrels last month. Subsequently, November-loading cargoes of ADNOC’s light sour Murban and Das Blend crude grades have thus far traded at premiums of around 35-45 cents/b to their respective OSPs. Qatari light sour Land crude traded even higher, at premiums in the range of 50-60 cents/b to its OSP, sources said. "EFS is wider and light sweet is going up in price everywhere else, so that will definitely drive the price of light sour up a little bit combined with OSP cuts," a North Asian buyer said. "The Med and US arbs are not landing cheap anymore," said a trader dealing in arbitrage grades for Asia. The November Brent/Dubai EFS, a barometer of the viability of arbitrage of Brent-linked crudes into Asia, has averaged $3.34/b to date in September. The October EFS averaged $1.85/b in August — almost 45% lower. A higher or "wider" EFS number makes it harder to justify selling Brent-linked barrels into Asia, according to traders.

FOCUS ON MURBAN IN MOC PROCESS

Active buying interest for Murban crude also emerged in the Platts Market on Close assessment process this week, with four 500,000-barrel clips traded Tuesday. Oil major Total initially offered a 500,000-barrel cargo of Murban for November loading in the MOC process at a premium 60 cents/b and steadily offered lower until it was bought by trading house Vitol at a premium of 45 cents/b. Cargo was then re-offered and purchased repeatedly, amounting to a total of four trades between Total and Vitol for a total 2 million barrels of November-loading Murban crude. Total also placed a second Murban offer in the MOC process Tuesday, selling barrels of the crude loading over October 15-November 15 from China’s Yangpu port. The offer stipulated cargo sizes ranging from 500,000 to 2 million barrels and was priced on a floating basis against the November Murban OSP plus a differential. Total initially offered the cargo at a premium of $1.80 to the OSP. At 0830 GMT, it stood at OSP plus $1.20/b FOB Yangpu, to no buying interest. The MOC process also saw bidding interest for Murban earlier this week when Gunvor placed a bid for 500,000 barrel on Monday. It raised its bid to a premium of 40 cents/b to the November Murban OSP, while an offer from Total for a similar cargo stood at 45 cents/b at 0830 GMT in Monday’s MOC process. The MOC process saw its first ever cargo of Murban crude declared via the partials delivery mechanism late last month; a 500,000-barrel cargo of October-loading Murban declared by Total to Shell, after Total sold its 20th partial of Oman crude to Shell during the August 31 MOC process at $75.95/b.

IRAQ TANKER TRACKER: September Oil Exports Slip From 2-Year High

Iraq sold less oil in the first half of September than the average for August, when exports exceeded 4m b/d for the first time since 2016.

Total exports dropped to 3.93m b/d in initial 15 days of September vs revised 4.093m b/d in August, according to tanker tracking and data from port agents compiled by Bloomberg; last month was first time Iraq sold more than 4m b/d since December 2016; country shipped record 4.095m b/d in November 2016

Shipments from southern port of Basra fell ~3% to 3.53m b/d in 1H September vs revised 3.65m b/d in August; Basrah shipments last month reached highest level in tanker-tracking data going back to January 2015; figure is also higher than reported exports prior to 2015

Sales from semi-autonomous Kurdish region in Iraq’s north fell to 397k b/d vs 445k b/d in August

Basra

Exports in 1H September 3.53m b/d, down 116k b/d vs average 3.65m b/d in August

Flows comprise:

2.59m b/d of Basrah Light, down 288k b/d

943k b/d of Basrah Heavy crude, up 172k b/d

Crude flows from Basra (b/d) in September vs revised August:

To China 1.06m b/d vs 570k

India 784k b/d vs 913k

South Korea 468k vs 449k

U.S. 402k vs 582k

Greece 275k b/d vs 100k

Malaysia 133k b/d vs none in August

Taiwan 133k b/d vs 62k

Italy 70k b/d vs 99k

Netherlands 69k vs 64k

Spain 67k b/d vs 65k b/d

China will use trade war with US to replace imports – state media – Reuters News

China is not afraid of "extreme measures" the United States is taking in their trade war and will use it as an opportunity to replace imports, promote localization and accelerate the development of high-tech products, state media said. The People’s Daily newspaper, which is published by the ruling Communist Party, made the comments in a front-page article in its overseas edition on Wednesday. The world’s two largest economies dove deeper into a trade war on Tuesday after Beijing added $60 billion of U.S. products to its import tariff list in retaliation for U.S. President Donald Trump’s planned levies on $200 billion worth of Chinese goods. "To deal with the trade war, what China really should do is to focus on doing its own thing well," the People’s Daily said. "(China) is not worried that the U.S. trade counter measures will raise domestic commodity prices by too much but will instead use it as an opportunity to replace imports, promote localization or develop export-oriented advanced manufacturing," it said. The Global Times tabloid, which is affiliated to the People’s Daily, said the trade war was a chance to pursue greater global recognition of its financial markets and that it could open its A-share market more to listings by Western firms. The United States has so far imposed tariffs on $50 billion worth of Chinese products to pressure China to make sweeping changes to its trade, technology transfer and high-tech industrial subsidy policies. The new tariffs will begin on Sept. 24 and will increase to 25 percent by the end of 2018. Beijing has retaliated in kind but some analysts and American businesses are concerned it could resort to other measures, such as pressuring U.S. companies operating in China. Another Chinese state-owned newspaper, the China Daily, also said in an editorial on Wednesday the U.S. tactics would prove to be ineffective. "China has always managed to find the proper solutions to put its economy back on track," the China Daily said. "The trade conflict will not force China to succumb to US pressure. Instead, given its economic resilience, it will squarely face those challenges, find the right solutions, and emerge stronger," it said.

Crude Storage in ARA Rises 1.2%, Genscape Weekly Data Show

Crude inventories in ARA region rose 651.4k bbl in week ended Sept. 14 to 54.6m bbl, Genscape data show.

Venezuela Looks to Reverse Oil Production Slide in Turn to China

Venezuela plans to use a new $5 billion loan from China to nearly double oil production that’s fallen to a seven-decade low. That would mean revitalizing an oil industry that’s fallen into ruin while turning away from cash-paying customers such as the U.S. President Nicolas Maduro confirmed a $5 billion financing deal with China at a press conference Tuesday in Caracas, without offering details. State oil company Petroleos de Venezuela SA would use the money to boost its daily oil production by one million barrels in a year, Maduro said. PDVSA would increase exports to China to 1 million barrels a day from 350,000 barrels, meaning most of that fresh output will be shipped to China. Venezuela has resorted to loans from China as it’s been unable to shore up production on its own. Oil output fell for the 14th consecutive month in August to 1.235 million barrels a day, according to OPEC secondary sources. That’s about half of what the nation with the world’s biggest oil reserves pumped in early 2016. “A million barrels, only for China,” Maduro said at the conference held in the presidential palace. “There will be financing to grow oil production, which Venezuela badly needs.” Maduro said Venezuela doesn’t owe China any money from previous financing deals, while Asdrubal Oliveros, director at consultant Ecoanalitica, says the government owes its Asian ally $5 billion in debt service, for a total of $22 billion in outstanding debt. China agreed to provide a $5 billion credit line to Venezuela, Finance Minister Simon Zerpa told Bloomberg News last week in Beijing as Maduro traveled there for talks. Zerpa said that Venezuela would pay back the loan with either cash or oil. Officials from China National Petroleum Corporation, known as CNPC, will arrive in Venezuela Tuesday to continue working on the financing plan, Maduro said. Representatives from both state oil companies will discuss details about PDVSA’s sale of 9.9 percent of its Sinovensa joint venture stake, which would give CNPC 49 percent control. The $5 billion will likely come with strings attached, analysts at Eurasia Group wrote Friday in a note. “Any credit will probably be tied to specific projects and aimed at protecting existing loans, rather than freely disposable resources," the analysts said.

Colombia Says August Crude Production +0.9% Y/Y to 886.5K B/D

Crude production rose 0.7% m/m, according to statement from Colombia Mining and Energy Ministry. Increase due to reactivation of Mantis and Matenegra fields and start of production operations at Guarimena field

U.S. Cash Crude-Midland grades surge ahead of pipeline volume nominations – Reuters News

West Texas Intermediate at Midland cash crude differentials on Tuesday surged to the strongest levels in nine weeks, ahead of deadlines for shippers to nominate crude volumes on pipelines out of the biggest U.S. oil field and the three-day cash roll period, dealers said. WTI Midland traded as high as a $10 per barrel discount to U.S. crude futures, its strongest level since June 26. Bids and offers also emerged for the inland grade between a $9.50 and $8.25 per barrel discount. West Texas Sour also traded at a $10 per barrel discount, the strongest in nine weeks. Crude oil bottlenecks in the Permian Basin have weighed on Midland grades for months, with WTI Midland reaching a six-year low in August. Oil production there will rise next month by 31,000 barrels per day (bpd), the lowest level since late 2016 as transport limits erode gains, according to the Energy Information Administration. But transport constraints in the Permian will continue to overshadow slower production growth, and prices are likely to reverse course after the cash roll period ends next week, traders said. WTI Midland hit a six-year low last month. Coastal grades were mixed on Tuesday, with WTI at East Houston also called MEH, trading at an $8 per barrel premium to U.S. crude, the highest since June 19. Mars Sour fell 7 cents to a $4.43 per barrel premium. The mixed trading came as the spread between U.S. crude and global benchmark Brent narrowed by 4 cents to $9.33 per barrel, after it had mostly widened from around $5 per barrel since early August. Market participants evaluated the latest U.S.-China tariffs exchange as initially less harsh than expected, easing worries the trade dispute would crimp global demand.

- Light Louisiana Sweet for October delivery was unchanged at a midpoint of $7.70, trading between $7.40 and $7.80 a barrel premium to U.S. crude futures.

- Mars Sour fell 7 cents to a midpoint of $4.43 and traded between $4.30 and $4.55 a barrel premium to U.S. crude futures.

- WTI Midland rose $1.62 to a midpoint of $10.38 and traded between $11 and $9.75 a barrel discount to U.S. crude futures.

- West Texas Sour rose $2.00 to a midpoint of $10 and traded between $10.50 and $9.50 a barrel discount to U.S. crude futures.

- WTI at East Houston, also known as MEH, traded at $7.85 and $8.05 per barrel over U.S. crude futures.

Platts to Begin Pricing U.S. Crudes Delivered to Europe

Oil pricing agency S&P Global Platts has moved closer to revamping its dated Brent benchmark, launching new price assessments for two grades of U.S. crude in Europe in response to the swell of imports into the region. S&P Global Platts, which publishes the daily Brent benchmark price that underpins two-thirds of the world’s oil trades, said it would provide daily price assessments for West Texas Intermediate Midland and Eagle Ford 45, both light, sweet crudes for delivery to Rotterdam in northwest Europe and Augusta in the Mediterranean. "We have long said that one of the possible futures for the North Sea is to incorporate delivered values and we have said there are a range of possible grades from outside the region that could play that part," S&P Global Platts senior director Jonty Rushforth said. U.S. crude oil exports are now above 2 million barrels per day, having grown swiftly since a decades-old restriction was lifted nearly two years ago. S&P Global Platts estimates that roughly 400,000 to 500,000 bpd of that total comes into Europe. This rise "has created opportunities not only for sellers of U.S. crude, but also a diverse set of buyers around the world," said Vera Blei, S&P Global Platts head of oil markets. The dated Brent benchmark is backed by five North Sea crudes – Brent itself, Forties, Oseberg, Ekofisk and Troll (BFOET). Major traders in the oil market, such as Vitol and Royal Dutch Shell, have urged Platts to include other grades in its pricing process to combat the natural decline in supply of the current benchmark crudes that the world’s oldest deepwater basin produces.

U.S. Cash Products-Chicago CBOB rises to 10-month high after rush to buy product – Reuters News

Chicago CBOB gasoline cash differentials rose on Tuesday for the fourth consecutive day, reaching a more than 10-month high, as a slew of market participants scrambled to buy the product, causing the price to surge on increased demand, traders said. Chicago CBOB gasoline gained 2.75 cents a gallon to trade at 12.50 cents per gallon above the gasoline futures benchmark on the New York Mercantile Exchange, market participants said. The fuel has not traded that high since Nov. 3, when it traded at 17.50 cents per gallon above futures. Chicago ultra-low sulfur diesel rose 1.25 cents a gallon to trade at 1.00 cent per gallon above the heating oil futures contract as refiners actively bought in the region. Elsewhere in the Midwest, Group Three gasoline rose for the third consecutive day, climbing 2.50 cents a gallon to trade at 13.50 cents per gallon above futures, its highest since Aug. 31, 2017. On the Gulf Coast, A3 CBOB gasoline gained a half penny to trade at 3.25 cents per gallon below the futures benchmark, traders said. 62-grade ULSD in the region rose a quarter of a penny to trade at 4.25 cents per gallon below futures. In New York Harbor, M2 conventional gasoline rose a penny to trade at 7.50 cents per gallon above futures, market participants said. U.S. gasoline stocks fell by 1.5 million barrels, industry group the American Petroleum Institute said on Tuesday, compared with analysts’ expectations in a Reuters poll for a 104,000-barrel decline. Distillate fuels stockpiles rose by 1.5 million barrels, compared with expectations for a 651,000-barrel gain, the API data showed. Refinery crude runs fell by 312,000 barrels per day, API data showed. The RBOB futures contract on NYMEX rose 2.81 cents to settle at $2.0049 a gallon on Tuesday. NYMEX ultra-low sulfur diesel futures gained 2.93 cents to settle at $2.2357 a gallon. Renewable fuel (D6) credits for 2018 traded at 19, 20 and 20.5 cents apiece, traders said, slightly weaker than trades ranging from 20 to 21 cents on Monday. Biomass-based diesel credits (D4) traded at 39 and 40 each, compared to trades of 40 cents on Monday.

U.S. oil refiners’ weekly capacity seen down 370,000 bpd -IIR – Reuters News

U.S. oil refiners are estimated to have 1,073,000 barrels per day (bpd) of capacity offline in the week ending Sept. 21, decreasing available refining capacity by 370,000 bpd from the previous week, data from research company IIR Energy showed on Wednesday. IIR expects offline capacity to rise to 1,455,000 bpd in the week to Sept. 28. The following are IIR weekly figures for offline capacity (in thousands of bpd):

|

Week ended Friday |

Sept. 19 |

Sept. 17 |

Sept. 14 |

|

9/28/18 |

1,455 |

1,362 |

1,244 |

|

9/21/18 |

1,073 |

949 |

960 |

|

9/14/18 |

703 |

514 |

514 |

|

9/07/18 |

322 |

276 |

276 |

|

8/31/18 |

663 |

663 |

663 |

BP Whiting, Indiana refinery large crude unit shutting down -sources – Reuters News

BP Plc was shutting the large crude distillation unit (CDU) on Tuesday at its 413,500 barrel per day (bpd) Whiting, Indiana, refinery for a planned overhaul, sources familiar with plant operations said. The 240,000 bpd Pipestill 12 CDU will be completely shut on Wednesday for the overhaul that is planned to continue through the end of October, the sources said. The largest of three CDUs at the Whiting refinery, Pipestill 12 is the primary focus of the seven weeks of work, the sources said. A vacuum distillation unit and a coking unit associated with Pipestill 12 are also supposed to be shut during the work, the sources said. A BP spokesman declined to discuss the company’s plans for maintenance at the Whiting refinery, which is BP’s largest in North America. In July, BP’s Chief Financial Office Brian Gilvary said during a conference call to discuss second quarter results with Wall Street analysts, that the Whiting refinery would undergo a turnaround overhaul in September. Traders in Midwest crude and refined products markets have said they understood the work was beginning on Tuesday at the Whiting refinery. This is the first complete overhaul of Pipestill 12 since it underwent a total revamp that finished in 2013 to enable the CDU to run crude from Canada’s tar sands fields in Alberta. The Whiting refinery revamp was the centerpiece in a new North American strategy by BP to focus on refineries in the northern United States that process Canadian crude. The company sold refineries in California and Texas as part of the change. CDUs do the primary refining of crude oil and provide hydrocarbon feedstock for all other units. They operate at atmospheric pressure. Vacuum distillation units (VDUs) refine residual crude oil received from CDUs. Coking units convert residual crude oil received from VDUs into motor fuel feedstocks or petroleum coke, a coal substitute.

Saras Says Refinery Tanks Had Lightning Strike, Fire Last Night

Fire was contained and dealt with in a few hours, spokeswoman says by email.

“A violent storm hit the Sarroch area where the refinery is located, caused the flooding of some tanks with residual hydrocarbons on the surface that, hit from lightning, caught fire”

Nobody was harmed

Sarroch oil refinery can process ~300k b/d

MIDEAST-EUROPE FUEL FLOWS: Imports Could Hit Lowest Since Feb.

European imports of clean products from the Middle East, mostly middle distillates, could fall this month to the lowest level since February, tanker-tracking and fixtures compiled by Bloomberg show.

A total of 14 tankers carrying 871k tons have arrived as of Sept. 18, mostly into ports in northwest Europe

An additional 17 tankers totaling 1.07m tons are currently en route from the Middle East

Of these, 13 vessels carrying a total 788.9k tons are signaling September arrival in Europe

Remaining four do not have European ETA; may arrive this month

Total already arrived/signaling this month comes to ~1.7m tons, or ~55k tons/day

Would be lowest since February, when arrivals were 1.09m tons, or 39k tons/day; if the four tankers without a current European ETA arrive, total would come to ~65k tons/day, lowest since June’s 63k tons/day

Compares with total August arrivals of 2.2m tons, or 71k tons/day

Asia Distillates-Gasoil cash premiums hit fresh high on firmer buying interest – Reuters News

Asia’s cash premiums for gasoil with 10 ppm sulphur content rose to their highest levels of this year on Wednesday buoyed by stronger demand, while the front-month spread widened its backwardated structure. Cash premiums for 10ppm gasoil climbed to 77 cents a barrel to Singapore quotes, the highest since S&P Global Platts switched the benchmarks in Asian gasoil grades last January to maximum sulphur content of 10 ppm sulphur, from 500 ppm sulphur previously. The premiums were at 60 cents a barrel on Tuesday. The refining margins, or cracks for 10 ppm gasoil, which has fallen about 9 percent since hitting a near three-year high a couple of weeks ago, rose to $15.85 a barrel over Dubai crude during Asian trading hours, compared with $15.62 a barrel on Tuesday. The Oct/Nov time spread widened to 80 cents a barrel, from 72 cents a barrel on Tuesday. Backwardation, when the front-month contract is more expensive than subsequent months, is usually seen as a sign that the market is rebalancing and prices are likely to head higher in future months. There is firm buying interest for gasoil, especially in the physical market, and the upcoming fourth quarter typically being the strongest for middle distillates, the fundamentals should remain supported in the short-term, trade sources said. Meanwhile, cash discounts for jet fuel JET-SIN-DIF narrowed to 8 cents a barrel to Singapore quotes on Wednesday, after a stronger physical deal in the Singapore window. On Tuesday, the cash discounts were at 16 cents per barrel. Jet fuel refining margins climbed to $15.23 a barrel over Dubai crude on Wednesday, up from $15.04 a barrel on Tuesday.

FUJAIRAH STOCKS

– Middle distillates inventories in the Fujairah Oil Industry Zone (FOIZ) rose about 0.1 percent, or 6,000 barrels from a week ago in the week to Sept. 17, data via S&P Global Platts showed. FUJAIRAH/

– Fujairah middle distillate stocks were at 4.18 million barrels in the week ended Monday, the highest weekly levels since July last year.

– Since the start of the year, middle distillate inventories in the Fujairah oil hub have averaged 2.7 million barrels a week, compared with a weekly average of about 3.3 million barrels in 2017, Reuters calculations showed.

– Compared with year-ago levels, weekly Fujairah middle distillate inventories were about 72 percent higher.

Asia Naphtha/Gasoline-Cracks ease; Formosa seeks Nov naphtha – Reuters News

Asia’s naphtha crack eased 3 percent to a two-session low of $96.30 a tonne on Wednesday amid plentiful supplies, trade and industry sources said.

– The current low spot prices at discount levels from Taiwan to South Korea, Japan and Malaysia are in favour of buyers, they said.

– Asia’s top naphtha importer Formosa Petrochemical emerged with tenders on Wednesday for cargoes delivering to Mailiao in November.

– The Taiwanese firm usually issues one tender at a time but there were two tenders seen from Formosa, traders said.

– One of the tenders was for open-specification naphtha for Nov. 11 to 20 delivery, while the other was for similar grades but for Nov. 1-10 delivery.

– Formosa had on Sept. 12 paid a discount for cargoes scheduled for second-half October delivery, the first discount it had paid since February this year. (Full Story)

– Earlier this week, Japan’s Asahi Kasei and South Korea’s Hanwha Total had paid discounts for cargoes delivering in first-half November. LDIS/A

* TENDERS: India’s Oil & Natural Gas Corp (ONGC) sold 35,000 tonnes of naphtha for Oct. 3-4 loading from Mumbai to BP at premiums of about $9 a tonne to Middle East quotes on a free-on-board (FOB) basis.

– This was the lowest premium ONGC has fetched for a cargo sold out of Mumbai in about seven months. NAP/TENDA

* GASOLINE: Asia’s gasoline crack eased 0.8 percent to a sixth-session low of $8.49 a barrel, weighed down by high oil prices.

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.