From: Wagner, Jonathan

Sent: Friday, September 21, 2018 6:35:48 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

Good morning. Oil prices are following global equities higher this morning with the dollar trading higher as well. The CSI 300 finished up 3% last night and major European stock markets are up .5 to 1% this am (US index futures are lagging). JPM’s latest note says that US sanctions on Iran could push crude to $90/bbl as “ as supply restrictions outweigh any hit to demand from emerging market weakness.” ““If no waivers were extended to buyers of Iranian oil then we could see oil rising very quickly to $90 a barrel,” the analysts said. “In the absence of Iran supply concerns, oil prices would have likely hovered around or below $70, but with the presence of Iran risks we expect oil prices to remain well supported in the months ahead.” Citibank’s latest note says “Some 1.5m b/d of crude supply seen at risk in Iran and elsewhere in Middle East and Latin America in 4Q.” They point to total spare capacity in OPEC and Russia at less than 1m b/d presently. ““By the skin of their teeth, the U.S., Russia, and Saudi Arabia seem capable of supplying enough oil in 4Q 2018 to blunt a price spike above $80,” according to Ed Morse. Goldman’s latest note said a stronger dollar is unlikely to derail its bullish view on commodities, which are likely to find support from physical shortages. “A stronger greenback makes the purchase of dollar-denominated international commodities more expensive for holders of other currencies, making buyers and users more likely to draw on any stored materials in preference to imports.” They maintain their near term Brent price target of $80/bbl.

Middle east crude prices pushed higher today as Dubai cash is trading +1.5 over swaps. Total offered Murban crude for loading from Yangpu on Oct. 15-Nov. 15 at 90 cents a barrel above the oil’s November OSP, 5 cents higher than Thursday. 21 Nov Dubai partials traded in the window with Unipec, Reliance and Totsa selling to Glencore, Shell, Mercuria, BP and Vitol. Sep/Oct Dubai is trading at 61c back while Oct/Nov Dubai is trading at 70c back. Asian demand remands solid as teapot runs hit their highest since December. Reuters is running an article this morning saying that China may issue an additional 3 million to 4 million tonnes of permits for refined fuel exports for 2018 to prevent state-owned refiners from having to slash throughput rates. The government has been looking to keep fuel export quotas at around 43 million tonnes this year, steady with 2017 levels, to maintain overall trade balances.

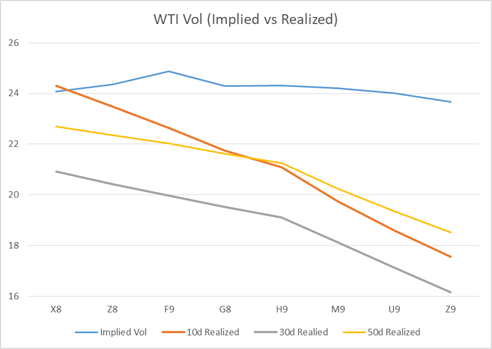

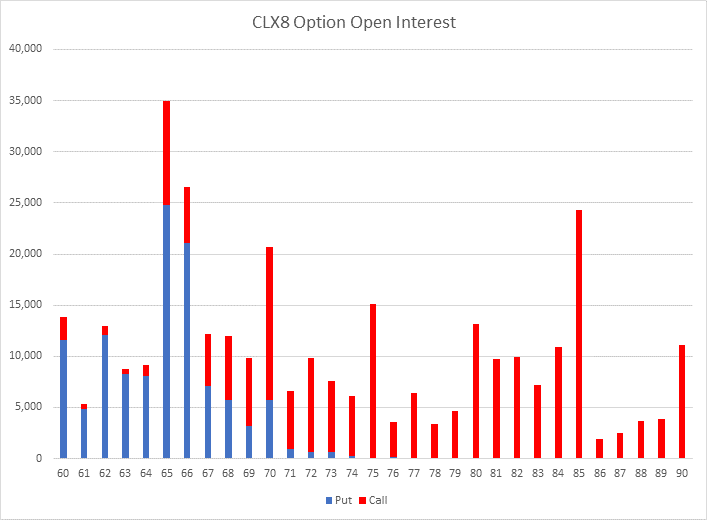

GC Grades were weaker yesterday on the back of the stronger WTI/Brent Arb and the upcoming Oct expiry. The three day cash roll period will start today and trade through Tuesday. Prompt LLS fell to +6.75 while MEH fell by a dollar to +5.70. Prompt Midland weakened to -12.85 after trading up to -10 earlier in the week. All of the action in Midland yesterday was seen in bal 18 as Cal 19 was very quiet. Genscape’s latest Cushing figures showed a mid week draw of 31k bbls while the full week draw came in at 647k bbls. Vols were weaker across the curve yesterday with good size front end WTI put flow going through on the screen. The WTI X8 66/65 put spread traded 18k lots yesterday with OI on the $66 put jumping to 20k this am (the 65 decreased). There was also interest seen on blocks in the Z8 68/63 1×2 put spread as well as interest buying G9 65 puts in WTI vs selling G9 75 puts in Brent (2100x). Put skew was only slightly bid in WTI as we have to keep in the back of our mind the possibility of an SPR release.

Top stories listed below

Middle East Crude-Benchmarks rebound on firm demand – Reuters News

Iran puts on "show of strength" military exercise in Gulf – Reuters News

JPMorgan Says Oil Could Quickly Hit $90 as Iran Sanctions Bite

Citi Sees ~1.5M B/d Oil Supply at Risk in Iran, Elsewhere in 4Q

Goldman: Strong Dollar Unlikely To Derail Bullish View On Commodities – Reuters News

Taiwan’s CPC buys Azeri and U.S. crudes for Dec delivery – sources – Reuters News

Venezuela-China Sinovensa JV To Boost Output to 165k B/d of Oil

China Teapot Run Rate Climbs to Highest Since December: SCI99

China Qingdao Crude Stocks Decline to Lowest Since June: SCI99

China may issue more fuel export quotas to refiners to prevent run cuts -sources – Reuters News

Thailand excels as most flexible sweet crude buyer in Southeast Asia – Platts

U.S. Strikes Refining Gold on Cheap Oil as Europe, Asia Struggle

U.S. Cash Crude-Grades weaken ahead of cash roll period – Reuters News

U.S. Cash Products-Midwest gasoline shows signs of cooling, Group Three holds 3-yr high – Reuters News

U.S. oil refiners’ weekly capacity seen down 370,000 bpd -IIR – Reuters News

Asia Distillates-Gasoil margins gain, cash premiums surge to new high – Reuters News

Russian Offline Refining Capacity Grows to 618k B/D: Ministry

Chinese petcoke buyers turning to Russia, Mideast after U.S. tariffs – Reuters News

|

Implied Vol |

Realized Vol |

||||||

|

WTI Vol |

20-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

24.07 |

-0.1 |

1.07 |

24.31 |

20.93 |

22.70 |

|

|

Z8 |

24.36 |

0.04 |

1.08 |

23.49 |

20.43 |

22.36 |

|

|

F9 |

24.88 |

-0.06 |

1.1 |

22.65 |

19.97 |

22.02 |

|

|

G8 |

24.29 |

-0.11 |

1.07 |

21.75 |

19.53 |

21.63 |

|

|

H9 |

24.32 |

-0.12 |

1.07 |

21.09 |

19.12 |

21.25 |

|

|

M9 |

24.2 |

-0.12 |

1.06 |

19.74 |

18.13 |

20.24 |

|

|

U9 |

24.02 |

-0.03 |

1.03 |

18.60 |

17.13 |

19.37 |

|

|

Z9 |

23.67 |

-0.04 |

1.01 |

17.56 |

16.17 |

18.52 |

|

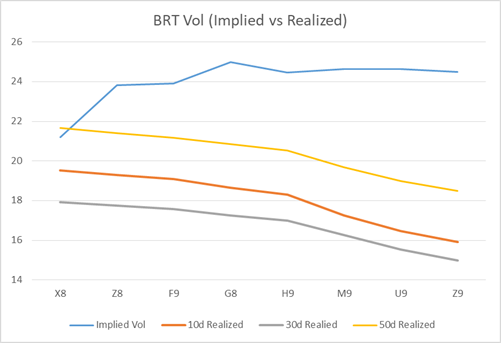

Implied Vol |

Realized Vol |

||||||

|

BRT Vol |

20-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

21.2 |

-2.62 |

1.05 |

19.52 |

17.91 |

21.66 |

|

|

Z8 |

23.83 |

-0.46 |

1.18 |

19.29 |

17.76 |

21.42 |

|

|

F9 |

23.91 |

-0.28 |

1.18 |

19.08 |

17.58 |

21.17 |

|

|

G8 |

24.99 |

-0.19 |

1.23 |

18.66 |

17.26 |

20.84 |

|

|

H9 |

24.47 |

-0.12 |

1.2 |

18.31 |

17.00 |

20.52 |

|

|

M9 |

24.65 |

-0.01 |

1.20 |

17.25 |

16.26 |

19.68 |

|

|

U9 |

24.64 |

-0.01 |

1.18 |

16.46 |

15.52 |

18.98 |

|

|

Z9 |

24.5 |

0 |

1.16 |

15.90 |

14.97 |

18.49 |

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

BRT X18 80 Call Switch TRADES Flat 5,000x

WTI/BRT Z18 ATM Call Roll x70.00/78.00 TRADES 31 250x 54d/54d

WTI/BRT G19 65/75 Put Roll x70.25/78.25 TRADES 66 2,100x 25d/30d

WTI/BRT G19 65/75 Put Roll x70.25/77.60 TRADES 86 200x 25d/37d

ICE Trade Recap

BRT X18 82/83 call spread x79.30 TRADES 10 500x 8d

BRT Z18 78.00 Straddle TRADES 464 250x

WTI/BRT Z18 ATM Call Roll x70.50/78.50 TRADES 27 1,200x 53d/53d

WTI U19 55/80 Fence x67.90 TRADES 2 750x 39d

CME Trade Recap

WTI X/Z18 75/80 Call Roll TRADES 22.5 500x

WIT Z18 68/63 1×2 Put x70.40 TRADES 65 1,000x 10d

WTI M19 50/60/70 Put Fly x69.10 TRADES 198 900x 11d

CSO/ARB/APO Trade Recap

WTI CSO X/V18 0.50 Call (WA) TRADES 9 5,000x

WTI CSO X/Z18-Z/F19 Flat/0.50 Fence (WA) TRADES 3.5 500x

WTI CSO X/Z18 0.50 Call (7A) TRADES 8.5 500x

WTI CSO X/Z18 0.50/0.75 Call Spread (7A) TRADES 5.5 750x

ARB H19 -12.00/-15.00 Put Spread TRADES 7 500x

ARB F19 -6.00 Call TRADES 35 1,000x

ARB Z18 -8.00/-10.00 Put Spread TRADES 64 750x

ARB F19 -10.00 Put TRADES 38 1,000x

ARB X18 -8.00 Call TRADES 28 25x; TRADES 30 50x

WTI APO 1Q19 70/77 Call Spread x69.80 TRADES 251 150x 30d

WTI APO X18 71 Call x70.20 TRADES 22 100x 48d

WTI APO 1Q19 60 Put x69.40 TRADES 121 14x

Middle East Crude-Benchmarks rebound on firm demand – Reuters News

Middle East crude benchmarks rebounded on Friday as a confluence of factors supported demand in Asia. Refiners are preparing to ramp up output ahead of peak winter season, while Chinese teapots are rushing to book cargoes before year-end to secure their import quotas next year. Buyers of Iranian crude oil have either reduced or cut imports to zero as U.S. sanctions draw near.

IRAQ: KOGAS has sold 1 million barrels of Basra Light loading in end-October to Unipec at 70 cents a barrel above its official selling price (OSP), traders said. Oil exports from southern Iraq are heading for a record high this month, two industry sources said, adding to signs that OPEC’s second-largest producer is following through on a deal to raise supply and local unrest is not affecting shipments. Southern Iraqi exports in the first 19 days of September averaged 3.6 million barrels per day, according to ship-tracking data compiled by an industry source, up 20,000 bpd from August’s 3.58 million bpd – the existing monthly record.

RUSSIA: Indian refiner MRPL has bought 1 million barrels of Russian Urals crude via a tender, trade sources said. The refiner bought the cargo from Litasco at $3.30 a barrel above Dubai quotes on a cost-and-freight (C&F) basis, one of the sources said. MRPL bought the same volume of Urals in a tender last month. Russia’s Sakhalin Energy has sold a cargo of Sakhalin Blend crude at $4.28 a barrel above Dubai quotes, the highest premium in eight months, on robust demand from Asia ahead of peak winter season, trade sources said. The cargo is scheduled for loading between Dec. 10 and Dec. 16, they said. The premium is the highest since an April-loading cargo was sold at a premium of $5.15 a barrel. Sakhalin Energy has sold three of the four cargoes it offered this month to Chinese and South Korean end-users, they said. The other cargoes are to load on Dec. 16-22, 22-28, Dec. 28-Jan. 3. Buyers of November-loading Russian ESPO crude cargoes have emerged, trade sources said. Mitsui bought the cargo loading on Oct. 31-Nov. 5 from Surgutneftegaz at a premium of about $4.90 a barrel to Dubai quotes, they said, adding it was not immediately clear who this cargo is re-sold to. CEFC has sold at least three November-loading ESPO cargoes at prices linked to a formula, they said. ESPO premiums hit their highest in more than four years buoyed by strong Chinese and Japanese demand ahead of peak winter season.

WINDOW: Cash Dubai’s premium to swaps rose 17 cents to $1.50 a barrel. Total offered Murban crude for loading from Yangpu on Oct. 15-Nov. 15 at 90 cents a barrel above the oil’s November OSP, 5 cents higher than Thursday.

Iran puts on "show of strength" military exercise in Gulf – Reuters News

The Iranian Revolutionary Guards and army carried out a joint aerial military drill in the Gulf on Friday in what official media said indicated the "pounding reply" that awaited the country’s enemies. Tehran has suggested in recent weeks that it could take military action in the Gulf to block other countries’ oil exports in retaliation for U.S. sanctions intended to halt its sales of crude. Washington maintains a fleet in the Gulf that protects oil shipping routes. "In addition to a show of strength, this ceremony is a message of peace and friendship for friendly and neighboring countries," Colonel Yousef Safipour, the deputy commander of the army for public relations said, according to the Islamic Republic News Agency (IRNA). "And if the enemies and arrogant powers have an eye on the borders and land of Islamic Iran they will receive a pounding reply in the fraction of a second." Mirage, F-4 and Sukhoi-22 jets took part in the exercise on Friday, according to IRNA. The Islamic Republic has a large naval military drill, including approximately 600 naval vessels, planned on Saturday, IRNA reported. Separately, a prominent Iranian cleric said Friday that the time had come for Israel to say goodbye. He did not give any further information on what that could mean. "Mr. Netanyahu, you and your intelligence services know well that the time to say goodbye has arrived and what position of strength the resistance of Hezbollah and the people of Gaza are in," Hassan Abu-Torabi Fard, the temporary Friday prayers leader in Tehran, said, according to Fars News.

JPMorgan Says Oil Could Quickly Hit $90 as Iran Sanctions Bite

U.S. sanctions on Iran could see crude quickly surging to $90 a barrel as supply restrictions outweigh any hit to demand from emerging market weakness, JPMorgan Chase & Co. said.

The bank raised its Brent crude forecast for the fourth quarter by $22 a barrel, to $85, dropping a previous bearish view. Supply side risks in crude are now “significant” and more than offset any possible hit to consumption, analysts including Abhishek Deshpande wrote in a report.

“If no waivers were extended to buyers of Iranian oil then we could see oil rising very quickly to $90 a barrel,” the analysts said. “In the absence of Iran supply concerns, oil prices would have likely hovered around or below $70, but with the presence of Iran risks we expect oil prices to remain well supported in the months ahead.”

Sanctions on Iran’s oil exports will come back into effect on November 4. The country’s shipments have been falling faster than anticipated by many in the market, with flows already down by 1 million barrels a day from April, according to Bloomberg tanker tracking. While some nations, such as India, are seeking to find ways of continuing with at least some imports of crude, others have already pulled imports back to zero.

Citi Sees ~1.5M B/d Oil Supply at Risk in Iran, Elsewhere in 4Q

Some 1.5m b/d of crude supply seen at risk in Iran and elsewhere in Middle East and Latin America in 4Q, bank analysts including Ed Morse say in Sept. 21 note.

- Total effective spare capacity in OPEC and Russia seen less than 1m b/d at present

- With Saudi output at 10.4m b/d, no experience of pumping above 10.9m b/d, and with neutral zone still shut, just ~600k b/d of spare capacity is available in short term in the kingdom

- Russia can add another +200k b/d for now and Kuwait, U.A.E. can muster another 230k b/d

- “By the skin of their teeth, the U.S., Russia, and Saudi Arabia seem capable of supplying enough oil in 4Q 2018 to blunt a price spike above $80”

- Russia seen leading the charge, perhaps orchestrating an output increase at the upcoming JMMC meeting in Algiers

- U.S. already announced 183k b/d SPR release for Oct.-Nov. with possibly more later

- Saudis have drawn down its vast stockpiles to boost exports by 1m b/d

Goldman: Strong Dollar Unlikely To Derail Bullish View On Commodities – Reuters News

- GOLDMAN SAYS REVISING ITS 12 MONTH GOLD PRICE FORECASTS TO $1,325/TOZ FROM $1,450/TOZ

- GOLDMAN SAYS DOLLAR UNLIKELY TO DERAIL ITS BULLISH VIEW ON COMMODITIES

- GOLDMAN SAYS OIL HAS THE STRONGEST FUNDAMENTAL OUTLOOK GOING FORWARD DRIVEN BY STRONG US DEMAND GROWTH, SANCTIONED LOSSES AND OTHER SUPPLY DISRUPTIONS AND STILL CONSTRAINED US SHALE PRODUCTION

- GOLDMAN SAYS NEAR-TERM BRENT PRICE TARGET REMAINS $80/BBL

- GOLDMAN SAYS MAINTAINING ITS END-OF-YEAR COPPER TARGET OF $6500/T

- GOLDMAN SEES GOLD PRICES AT $1250/TOZ, $1300/TOZ AND $1325/TOZ OVER THE NEXT 3, 6 AND 12 MONTHS (PREVIOUSLY $1350/TOZ, $1375/TOZ AND $1450/TOZ)

- GOLDMAN SEES 5.1 PERCENT, 4.5 PERCENT 8 PERCENT RETURNS FOR S&P GSC INDEX FOR 3, 6 AND 12 MONTHS

Taiwan’s CPC buys Azeri and U.S. crudes for Dec delivery – sources – Reuters News

Taiwanese refiner CPC Corp has bought about 4 million barrels of sweet crude for delivery in December or loading in November, two industry sources said on Friday.

It bought 2 million barrels of Azeri Light crude oil and 2 million barrels of U.S. WTI Midland crude, they said.

Price details and sellers were not immediately known.

Last month, the refiner bought about 6 million barrels of U.S. WTI Midland crude for delivery in November, sources have said.

Venezuela-China Sinovensa JV To Boost Output to 165k B/d of Oil

Venezuela and China will increase production of the Sinovensa joint venture from 105,000 to 165,000 barrels per day, Venezuela’s oil ministry said in a statement. Oil Minister and president of state oil co. PDVSA Manuel Quevedo and China National Petroleum Corporation (CNPC) General Manager Zhang Jianhua inspected Sinovensa expansion project at the Jose Mixing Plant

China Teapot Run Rate Climbs to Highest Since December: SCI99

Operating rates at independent Chinese refineries +1.48 ppt w/w to 69.31% in the week through Sept. 21, according to data provided by industry researcher SCI99. Rate increases for 4th week and is at the highest level since Dec. 15, 2017

China Qingdao Crude Stocks Decline to Lowest Since June: SCI99

Crude oil inventories at Qingdao port fell 26.3% w/w to ~13.1m bbls in week to Sept. 21, according to data by industry researcher SCI99.

- That’s lowest since June 29

- Including Qingdao, stockpiles at 7 ports in Shandong fell 18% w/w to ~32.8m bbl

- Fuel oil stockpiles at Shandong ports -27% w/w to 549.5k bbl

- Inventories at Qingdao -35% w/w to 211.8k bbl

China may issue more fuel export quotas to refiners to prevent run cuts -sources – Reuters News

China may issue an additional 3 million to 4 million tonnes of permits for refined fuel exports for 2018 to prevent state-owned refiners from having to slash throughput rates, according to three sources briefed on the matter. The government has been looking to keep fuel export quotas at around 43 million tonnes this year, steady with 2017 levels, to maintain overall trade balances. But the state refiners have been using the quotas already granted for this year faster than expected, rushing to ship more gasoline, diesel and jet kerosene overseas in the first nine months compared to the same period of 2017 because domestic refinery production has expanded faster than demand. While exports may not be as lucrative as sales in the domestic market, where margins are largely guaranteed, the overseas shipments helped bolster margins at home by thinning local fuel supplies. Refiners – including Sinopec Corp, PetroChina, CNOOC and Sinochem – will have already used about 35 million tonnes, or 81 percent of the total grants so far by end-September, according to a state oil executive with direct knowledge of the situation. "The big oil firms are trying this week to persuade the government to release more quotas, or they may be forced to cut runs in the fourth quarter as the remainder is far from enough," said the executive. Most refiners would try to avoid reducing runs in the fourth quarter, when diesel fuel demand typically picks up with an increase in construction activities and the lifting of a summer fishing ban, and the Golden Week holiday of early October, which lifts gasoline and jet fuel consumption. The three sources at state oil firms estimated the government could issue an additional 3 million to 4 million tonnes of fuel export quotas as early as next week. The sources declined to be named as the discussions are not public. Representatives of CNPC, Sinopec, CNOOC and Sinochem did not respond to requests for comment. The National Development & Reform Commission (NDRC) and Ministry of Commerce also did not respond to queries. Chinese customs data showed huge gains in transportation fuel exports this year. Gasoline exports in the first seven months grew 44 percent over the same period last year to 8.33 million tonnes, diesel rose 25 percent to 11.68 million tonnes, and jet kerosene gained 15 percent to 8.08 million tonnes. State-run refiners earned bumper profits this year as diesel demand firmed while many small fuel blenders were forced out of business and some independent oil processors slashed output over the summer months because of stricter government tax scrutiny enacted from March.

Thailand excels as most flexible sweet crude buyer in Southeast Asia – Platts

The strong uptrend in international outright crude prices has prompted Thailand to actively diversify its crude supply sources so far this year and the country may earn the title as the most flexible sweet crude importer in Southeast Asia, with state-run PTT picking up more than 10 different low sulfur grades from across the globe since the second quarter. Battling against rising benchmark crude prices and sharp depreciation in domestic currencies, some of the major Southeast Asian energy consumers including Indonesia and Vietnam have been urged to maximize the use of domestic crude production to slash their energy import bills and current account deficits. However, with Thailand’s own domestic crude production only enough to cover around 20% of its overall refining requirements, it had stepped up efforts to seek the most economical spot crude cargoes from as far as the US and Libya, industry sources said. "[PTT] is not exactly that flexible … but not afraid to try new and different options," a trade source at the state-run Thai company said, adding that Thailand remains keen to import more US crude. The long list of low sulfur crude grades snapped up by PTT in the international spot market over the past several months includes Australia’s Gippsland Blend and Cooper Basin crude, the US Bakken crude and WTI Midland, Nigeria’s Agbami, Vietnam’s Hai Thach condensate and Libya’s Wafa condensate. Most recently, PTT bought via spot tender 300,000 barrels of Libyan Bu Attifel crude for the very first time, trade sources with close knowledge of the deal said. The cargo is expected to reach Thailand’s IRPC refinery in Rayong around November 5-20. Bu Attifel is a light sweet crude with gravity of 43.6 API and sulfur content of 0.03%, according to the assay of the grade seen by S&P Global Platts. Sources said the company likely picked the Libyan crude grade over others as Southeast Asian sweet crude grades were not competitive currently. Malaysian light sweet Kimanis crude for one, which often feeds refineries in Thailand, saw its spot differential surge to an 11-month high earlier this month. Platts assessed the grade at a premium of $4.35/b to Platts Dated Brent on September 4, its highest differential since October 2017.

THAI BAHT ADVANTAGE

Thai currency baht’s outperformance in the regional money market may have helped Southeast Asia’s second-biggest economy insulate against rising oil prices to some extent, placing PTT in a much more comfortable position than other Southeast Asian refiners to shop for crude across the globe, energy market analysts said. The Thai currency has been strengthening against the US dollar so far during the third quarter and emerged as one of the top performers in the Asian foreign exchange market. The dollar/baht pair fell from Baht 33.33 in mid-July to 32.34 Thursday and the pair remains steady for the year so far, hovering near the Baht 32.30-32.60 range seen during the first week of January. "Stronger currency doesn’t necessarily give you the right to go out and buy expensive crude … but it gives you the confidence to go try different options," said J.W Shon, commodities and energy market research analyst at SK Securities. In stark contrast, Vietnam’s dong and Indonesia’s rupiah were among the slew of emerging market Asian currencies to take a significant hit so far in Q3 amid widening current account deficits and macro-economic uncertainties surrounding the US-China trade war. The dollar/dong exchange rate surged above Dong 23,300 to reach an all-time high last month, while the dollar/rupiah surged above Rupiah 15,300 earlier this month to hit a fresh 20-year high, according to 24-hourly dollar/dong and dollar/rupiah candlestick charts seen by Platts. Reflecting Indonesia’s faltering spending power, state-run energy firm Pertamina has failed to extend previous years’ spot cargo buying spree from Africa and the Mediterranean markets in 2018, market sources said. Latest data from Statistics Indonesia showed that the country’s crude exports and imports both tumbled 9% and 37% year on year respectively in July amid Jakarta’s ongoing efforts to maximize the use of local resources to slash energy import bills. In Vietnam, state-run Binh Son Refining and Petrochemical Company’s refinery at Dung Quat continues to feed primarily on domestic medium and heavy sweet grades including Bach Ho, Su Tu Den, Thang Long and Ruby. "In general, [Dung Quat] always prefers domestic crude," an industry source with close knowledge of the refinery operation said. The country’s new 200,000 b/d refinery at Nghi Son depends on Kuwait for the majority of its crude feedstock requirements and the plant has not been seen procuring other crude grades from the international market, industry sources said.

U.S. Strikes Refining Gold on Cheap Oil as Europe, Asia Struggle

It’s great to be an oil refiner in the U.S. right now. In Asia and Europe, not so much. Gulf Coast processors are enjoying profits above the highest level over 2013-2017 for this time of the year, according to data compiled by Bloomberg. Thanks to relatively cheap West Texas Intermediate crude, margins from producing distillates such as gasoline and gasoil are about 110 percent higher than their average level in the five-year period. More specifically, plants equipped with secondary processing units that upgrade lower-value heavy residue to premium fuel are cashing in on cheap crude that’s drilled at home as pipeline bottlenecks limit the sale of more barrels to higher-priced export markets. Refiners in Europe and Asia, however, can’t bank on such profits as the cost of imported crude such as Nigeria’s Bonny Light and Dubai grades remain supported. The premium of Brent crude — the benchmark for oil from Africa — widened to more than $10 a barrel over WTI this month, keeping European refining margins near the five-year average. Singapore refining margins are hovering under the average over the last five years, despite a hike of more than 15 percent since earlier this month. Even as refiners in the top oil-consuming region scour the globe for cargoes to replace lost Iranian crude, Asia could see higher flows of light fuel-products such as naphtha from the U.S. as elevated American margins prompt refiners to process more domestic shale crude.

U.S. Cash Crude-Grades weaken ahead of cash roll period – Reuters News

U.S. cash crude differentials weakened on Thursday as traders squared their books ahead of the October crude futures contract close, with Midland grades’ discounts to U.S. crude widening as much as $4 per barrel, dealers said. West Texas Intermediate at Midland traded with a midpoint of a $14 per barrel discount to U.S. crude futures, down $4.05 from Wednesday. West Texas Sour also weakened by $4 to $13.75 per barrel. Both grades had jolted upward, to around a $10 per barrel discount, ahead of an upcoming deadline to nominate pipeline volumes, which had spurred oil purchases. Now traders are trying to jettison excess barrels, dealers said. Coastal grades Mars Sour and West Texas Intermediate at East Houston, also called MEH, weakened to their lowest in weeks. Mars fell $1.25 to trade at a $3 per barrel premium to U.S. crude futures, the weakest since Sept. 3. MEH fell almost $2 per barrel to a $5.70 per barrel premium, the lowest in three weeks. Light Louisiana Sweet traded at a $6.80 premium to U.S. crude futures, down 20 cents. The October contract expires on Thursday, with the three-day cash roll trading period starting on Friday and ending on Tuesday. Crude inventories at the storage hub in Cushing, Oklahoma fell to about 25 million barrels on Tuesday, down 647,000 barrels from the previous Tuesday, dealers said, citing Genscape data.

- Light Louisiana Sweet for October delivery fell 20 cents to a midpoint of $6.80 and traded between $6.70 and $6.90 a barrel premium to U.S. crude futures.

- Mars Sour dropped $1.25 to a midpoint of $3 and traded between a $2.75 and $3.25 a barrel premium to U.S. crude futures.

- WTI Midland dropped $4.05 to a midpoint of $14 and traded between a $15 and $13 a barrel discount to U.S. crude futures.

- West Texas Sour dropped $4.00 to a midpoint of $13.75 and traded between $14.50 and $13 a barrel discount to U.S. crude futures.

- WTI at East Houston, traded at $5.50 and $5.90 over U.S. crude futures.

U.S. Cash Products-Midwest gasoline shows signs of cooling, Group Three holds 3-yr high – Reuters News

U.S. Midwest gasoline cash differentials showed signs of cooling on Thursday after skyrocketing over the last several sessions and after Group Three gasoline hit an almost three-year high, market participants said. Group Three gasoline edged higher on Thursday, gaining 0.50 cent a gallon to trade at 16.25 cents per gallon above the gasoline futures benchmark on the New York Mercantile Exchange, traders said. That gain compared with a surge of 2.25, 2.50 and 2.00 cents a gallon in the last three sessions. Chicago CBOB gasoline lost a penny to trade at 14.75 cents per gallon above futures. The product hit 15.75 cents per gallon above futures on Wednesday, its highest since Nov. 3. In New York Harbor, M2 conventional gasoline lost 1.25 cents a gallon to trade at 6.50 cents per gallon above futures, traders said. Heating oil in the region lost a quarter of a penny to trade at 2.75 cents below the ultra-low sulfur diesel futures contract. On the Gulf Coast, A3 CBOB gasoline rose a penny to trade at 2.25 cents per gallon below futures, traders said. M3 conventional gasoline gained a quarter of a penny to trade at 1.50 cents per gallon above futures. The RBOB futures contract on NYMEX fell 0.61 cent to settle at $2.0146 a gallon on Thursday. NYMEX ultra-low sulfur diesel futures lost 1.86 cent to settle at $2.228 a gallon. Renewable fuel (D6) credits for 2018 remained weak, fetching 17 to 19 cents, compared with trades of 18 to 19 cents on Wednesday, traders said. Biomass-based (D4) credits traded at 38.5 and 40 cents, traders said. That is compared with trades on Wednesday of 39 to 41 cents.

U.S. oil refiners’ weekly capacity seen down 370,000 bpd -IIR – Reuters News

U.S. oil refiners are estimated to have 1,073,000 barrels per day (bpd) of capacity offline in the week ending Sept. 21, reducing available refining capacity by 370,000 bpd from the previous week, data from research company IIR Energy showed on Friday. IIR expects offline capacity to rise to 1,455,000 bpd in the week to Sept. 28 and then to 1,529,000 bpd in the week after. The following are IIR weekly figures for offline capacity (in thousands of bpd):

|

Week ended Friday |

Sept. 21 |

Sept. 19 |

Sept. 17 |

|

10/05/18 |

1,529 |

– |

– |

|

9/28/18 |

1,455 |

1,455 |

1,362 |

|

9/21/18 |

1,073 |

1,073 |

949 |

|

9/14/18 |

703 |

703 |

514 |

|

9/07/18 |

322 |

322 |

276 |

Asia Distillates-Gasoil margins gain, cash premiums surge to new high – Reuters News

Asian refining margins for 10ppm gasoil rose on Friday to post their biggest weekly percentage gain in six weeks, but traders said higher stocks and prospects for rising supplies may dampen activity. The refining margins, or cracks for 10 ppm gasoil GO10SGCKMc1 rose to about $16.30 a barrel over Dubai crude during Asian trading hours, compared with $16.23 a barrel on Thursday. The cracks have climbed over 2 percent this week. "Demand is still strong, but there is also some concern on growing supply from regional exporters," a Singapore-based trader said. India’s diesel exports in August rose 14.5 percent to 2.84 million tonnes from July, government data showed on Thursday, after oil ministry data showed domestic diesel sales in India dropped 7 percent to 6.17 million tonnes in August from July. India’s diesel demand usually drops during monsoon months because travel in some parts of the country take a hit due to the heavy rains, which also reduce consumption of diesel used in irrigation pumps — typically resulting in increased exports of fuel from India. Meanwhile, weekly gasoil inventories in independently held storage in the Amsterdam-Rotterdam-Antwerp (ARA) refining hub climbed to the highest levels in six months, data from Dutch consultancy PJK International showed. The build in ARA gasoil stocks mirrors the upward trend in middle distillate inventories in Singapore and Fujairah Oil Industry Zone, reported this week. Asia’s cash premiums for 10ppm gasoil continued to gain on Friday, clinching a fresh high for this year amid stronger deals. Cash premiums for gasoil with 10 ppm sulphur content GO10-SIN-DIF rose to 89 cents a barrel to Singapore quotes, from 82 cents a barrel on Thursday. Friday’s cash differentials were the highest since S&P Global Platts switched the benchmarks in Asian gasoil grades last January to maximum sulphur content of 10 ppm sulphur, from 500 ppm sulphur previously. The Asian gasoil price spread between east and west LGOAEFSMc1 widened to minus $6.22 a tonne on Friday from minus $5.87 on Thursday, but it was still not profitable to ship cargoes from east to west, trader sources said. "High products inventory at ARA and returning refineries after maintenance has been keeping (European) market well-supplied at least in short term," ING Research said in a note on Thursday. Meanwhile, cash discounts for jet fuel narrowed to 4 cents a barrel to Singapore quotes on Friday, from a discount of 6 cents a barrel on Thursday. Jet fuel refining margins JETSGCKMc1 inched up to $15.16 a barrel over Dubai crude on Friday, from $15.13 a barrel a day earlier.

Russian Offline Refining Capacity Grows to 618k B/D: Ministry

Russian refineries had 84.3k tons of capacity offline as of Wednesday, CDU-TEK, a unit of Russia’s energy ministry, says in weekly report. Offline capacity is equivalent to 618k b/d; that’s up from 482k b/d a week ago

Chinese petcoke buyers turning to Russia, Mideast after U.S. tariffs – Reuters News

Chinese importers of petroleum coke are buying more volumes from Russia and the Middle East due to a hefty tariff on shipments from the United States, previously one of China’s main sources of the material used in aluminium and cement production. China slapped a 25 percent tariff on U.S. petroleum coke, a byproduct of oil refining, from Aug. 23 as part of its escalating trade row with the United States. The move, when added to a longstanding 3 percent duty, brought China’s total import tariff on U.S. petcoke up to 28 percent in a price-sensitive market. Liu Tao, chairman of Shandong-based Sinoway Carbon, said his company stopped importing U.S. petcoke in August due to the tariffs. It had earlier this year imported two 50,000 tonne cargoes of fuel-grade petcoke from the U.S. Gulf of Mexico. "We can still buy from other areas such as China, Russia and the Middle East," Liu told Reuters on the sidelines of AZ China’s aluminium and raw materials conference in Shanghai. AZ China is a consultancy focused on China’s aluminium sector. One grade of petcoke is used to make anodes for the aluminium smelting process, and a higher-sulphur grade known as fuel-grade petcoke is used in cement kilns. Angela Chen, vice president of Beijing-based DQ Carbon Group, said refiners in the United States would feel the sharpest impact. China imported around 3.5 million tonnes of petcoke from the United States in 2017, nearly half of its total imports of about 7.2 million tonnes, she said. "U.S. refineries will be largely affected due to their reliance on exports to the China market," if the trade war keeps raging, Chen said. The most likely replacements would come from Saudi Arabia and Russia, she said.

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.