From: Wagner, Jonathan

Sent: Tuesday, September 25, 2018 6:31:18 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

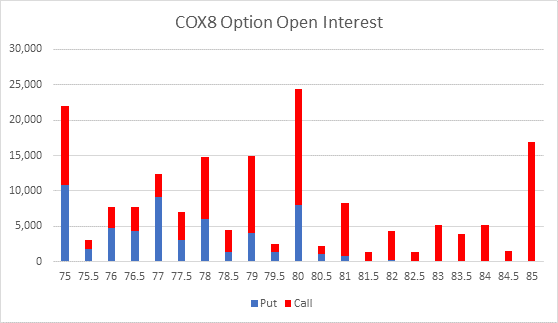

Good morning. Oil prices continue to push higher hitting levels not seen since q4 2014. X8 Brent option expiry is today with continued interest see to bal ’18 and q1 upside calls and call spreads pushing skew higher. Z8 85 calls and H9 85/100 and 95/110 call spreads have been active this morning and wingy z8 brt call skew has moved to +3% over atm. $100-$115 strike calls were active yesterday with Brent call volume trading a record 272k lots. As put skew continues to grind lower there was interest seen on blocks to own q1 wti downside with 18k of the F9 62 puts trading. Trump and Rouhani both agree that they will not meet each other this week at the UN while Vitol said last night @ APPEC that they would stop doing business with Iran after Nov due to US sanctions. Fyi, Trump is scheduled to speak at the UN this morning. Middle east cash Dubai was weaker today falling 7c to +1.39 over swaps. DME oman premium to swaps continues to skyrocket gaining $1 to +4.22/bbl.

Top stories listed below

Major powers, Iran meet to salvage nuclear deal without U.S. – Reuters News

Mattis dismisses Iran revenge threat, says U.S. not in attack – Reuters News

Iran video threatens missile strikes on UAE, Saudi Arabia – Associated Press

China says U.S. putting ‘knife to its neck’, hard to proceed on trade – Reuters News

U.S., Japan push back trade talks to Tuesday – Reuters News

Trump, Macron Said to Hold Constructive Meeting on Iran, Trade

Oil market hears echoes of 2007/8: Kemp – Reuters News

U.S.-China trade war poses oil demand shock in 2019 – BP – Reuters News

Vitol to halt business with Iran after U.S. sanctions start- executive – Reuters News

Middle East Crude-Oman jumps to multi-year high – Reuters News

Russia Urals Crude Loadings Set to Rise to 11-Month High

India’s oil demand to climb to 500 mln tonnes per year by 2040 -Indian Oil – Reuters News

Indian Oil Has `Alternatives’ to Iran’s Crude Lost to Sanctions

China Aug. Implied Crude Surplus Is 300% Higher Than in July

China Shandong refiners’ oil imports in H1 2018 rise 41 pct from year earlier – oil exec – Reuters News

Asia’s oil deficit to widen by 2025 – Total – Reuters News

Pemex August Crude Exports Rise 2.2% to 1.18M B/D: Co. Data

Colombia Studying Mexico-Style Oil Hedging

U.S. Crude Oil Exports Seen Rising to 5M B/D by 2025: Total

Canada heavy crude discount hits widest level on record – Reuters News

U.S. Cash Crude-Grades firm on second day of rebalancing – Reuters News

U.S. Cash Products-Group Three gasoline falls after hitting 3-yr high last week – Reuters News

Philadelphia-area crude rail terminal reawakened by discounted crude – Reuters News

No delays to implementing shipping fuel sulphur cap in 2020 -IMO official – Reuters News

|

Implied Vol |

Realized Vol |

||||||

|

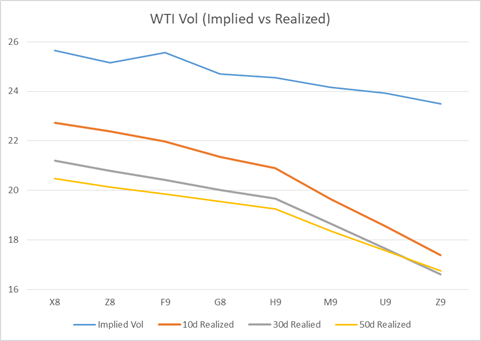

WTI Vol |

24-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.64 |

0.78 |

1.17 |

22.74 |

21.20 |

20.48 |

|

|

Z8 |

25.15 |

0.54 |

1.14 |

22.39 |

20.79 |

20.13 |

|

|

F9 |

25.56 |

0.5 |

1.16 |

21.97 |

20.42 |

19.86 |

|

|

G8 |

24.7 |

0.35 |

1.11 |

21.36 |

20.02 |

19.55 |

|

|

H9 |

24.55 |

0.2 |

1.11 |

20.90 |

19.67 |

19.26 |

|

|

M9 |

24.16 |

0.04 |

1.08 |

19.66 |

18.67 |

18.38 |

|

|

U9 |

23.93 |

-0.05 |

1.05 |

18.56 |

17.65 |

17.58 |

|

|

Z9 |

23.5 |

-0.09 |

1.02 |

17.38 |

16.62 |

16.76 |

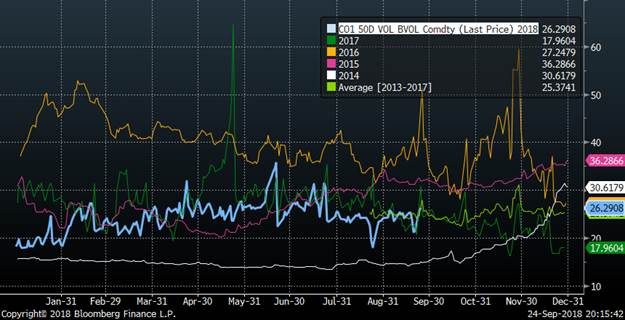

Front Rolling WTI ATM Implied Vol

|

Implied Vol |

Realized Vol |

||||||

|

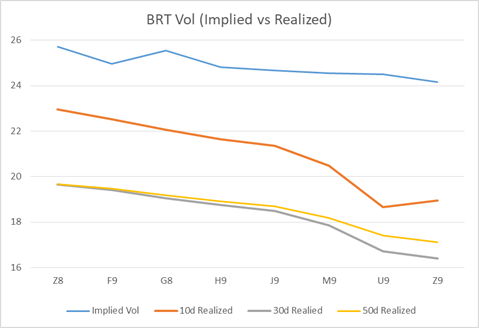

BRT Vol |

24-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

Z8 |

25.71 |

1.4 |

1.31 |

22.96 |

19.66 |

19.68 |

|

|

F9 |

24.96 |

0.91 |

1.26 |

22.51 |

19.42 |

19.47 |

|

|

G8 |

25.55 |

0.66 |

1.29 |

22.06 |

19.06 |

19.18 |

|

|

H9 |

24.81 |

0.41 |

1.25 |

21.66 |

18.75 |

18.92 |

|

|

J9 |

24.68 |

0.2 |

1.24 |

21.35 |

18.48 |

18.70 |

|

|

M9 |

24.55 |

0.04 |

1.22 |

20.49 |

17.86 |

18.20 |

|

|

U9 |

24.51 |

-0.05 |

1.20 |

18.66 |

16.73 |

17.41 |

|

|

Z9 |

24.17 |

-0.19 |

1.17 |

18.95 |

16.40 |

17.11 |

Front Rolling Brent ATM Implied Vol

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

BRT X18 80 Call vs WTI X18 71/74 Call Spread LIVE TRADES 42 300x

WTI F19 85 Call x71.35 vs BRT G19 95 Call x79.50 TRADES 14 800x 7d/7d

ICE Trade Recap

BRT X18 81 Call TRADES 30 3000x

BRT X18 82 Call x80.70 TRADES 22 250x; TRADES 21 750x 22d

BRT X18 81 Call vs BRT F19 90 Call LIVE TRADES 4 500x

BRT X18 82 Call vs BRT G19 100 Call LIVE TRADES 5 1,000x

WTI X18 61/58.50 1×2 Put Spread TRADES Flat 1,000x

BRT Z18 77/83.50 Fence TRADE 5 750x

BRT Z18 80 Call x79.80 TRADES 235 500x 51d

BRT Z18 85 Call x80.05 TRADES 78 650x; TRADES 80 500x 22d

WTI Z18 80/90 Call Spread vs 60 Put x71.50 TRADES 21 800x 14d

BRT Z/G19 78 Call Roll x79.75/79.00 TRADES 105 3,000x 63d/57d

BRT F19 86 Call x80.00 TRADES 126 2,000x 26d

BRT F19 90/94 1×2 Call Spread TRADES 1 800x

BRT F19 110 Call x79.65 TRADES 5 800x; TRADES 6 2,500x 1d

BRT F19 110 Call x79.65 TRADES 5 2,050x 1d

BRT F19 71/68 1×2 Put Spread TRADES 5 700x

BRT G19 80/90 Call Spread TRADES 281 500x; TRADES 275 1,000x; TRADES 270 1,000x

BRT G19 80 Call x79.00 TRADES 350 500x 50d

BRT G19 87 Call x79.00 TRADES 130 750x 24d

BRT H19 95/110 1×2 Call Spread x79.00 TRADES 37 1,000x 5d

WTI H19 55/51 1×2 Put Spread TRADES 3 1,000x

WTI H19 65/60 Put Spread x70.50 TRADES 114 1,000x 12d

BRT M19 78 Call x78.05 TRADES 585 500x 52d

WTI M19 55/50 1×2 Put Spread TRADEs 7 1,000x

BRT M19 95/105 1×2 Call Spread TRADES 15 500x

BRT M/Z19 90 Call Roll x78.25/71.65 TRADES 84 525x 22d/27d

BRT Z19 ATM Call x76.00 TRADES 765 600x; TRADES 768 1,000x 62d

WTI U19 60 Put x69.00 TRADES 297 500x; TRADES 296 300x 20d

BRT Z20 ATM Call x72.00 TRADES 927 400x 63d

CME Trade Recap

WTI X18 72/68 1×2 Put Spread x72.00 TRADES 82 900x 14d

WTI X18 68/67 Put Spread TRADES 15 4,400x

WTI F19 72 Call TRADES 308 1,000x

WTI F19 62 Put TRADES 67 250x; TRADES 68 4,500x; TRADES 62 3,425x; TRADES 61 850x

WTI G19 67/71/77/81 Call Condor TRADES 158 1,750x

WTI H19 55 Put TRADES 42 800x; TRADES 43 1,000x

WTI M19 70 Call x69.90 TRADES 529 500x 52d

WTI M19 67.50/54 1×2 Put Spread x70.00 TRADES 255 400x 15d

BRT M19 65/75 Put Spread x78.00 TRADES 291 500x 19d

WTI U19 60/65/70 Put Fly x68.90 TRADES 53 500x 2d

WTI Z19 85/100 1×2 Call Spread x68.00 TRADES 53 1,200x 8d

WTI Z19 100 Call x67.90 TRADES 52 3,000x

WTI Z19 65/75 Fence x68.00 TRADES 174 1,200x; TRADES 173 200x 72d

WTI Z/Z20 ATM Call Roll x68.50/64.50 TRADES 115 500x 64d/64d

CSO/ARB/APO Trade Recap

WTI CSO X/Z18 0.50/1.00 1×2 Call Spread (7A) TRADES 5 250x

ARB M19 -6.00 Call TRADES 58 150x

WTI APO F19 70 Call x70.65 TRADES 410 100x 55d

WTI APO F19 80 Call TRADES 103 35x

WTI APO H19 54.50 Put TRADES 55 45x

WTI APO Q19 57 Put vs 69/73 Call Spread LIVE TRADES 34 45x

WTI APO Cal19 60/80 Fence x69.20 TRADES 64 75d 42d

WTI APO 2H19 60/77 Fence x68.50 TRADES 32 140x 56d

WTI Skew change (d/d)

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

X8 |

2 |

1.4 |

0.7 |

0.3 |

25.64 |

0.05 |

0.35 |

1.1 |

1.95 |

|

X8 (9/21) |

2.45 |

1.9 |

1.1 |

0.55 |

24.86 |

-0.15 |

0 |

0.5 |

1.15 |

|

|

-0.45 |

-0.5 |

-0.4 |

-0.25 |

0.78 |

0.2 |

0.35 |

0.6 |

0.8 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

2.5 |

1.8 |

1 |

0.45 |

25.15 |

-0.15 |

-0.05 |

0.4 |

1.05 |

|

Z8 (9/21) |

3.1 |

2.25 |

1.35 |

0.7 |

24.61 |

-0.35 |

-0.4 |

-0.15 |

0.4 |

|

Change |

-0.6 |

-0.45 |

-0.35 |

-0.25 |

0.54 |

0.2 |

0.35 |

0.55 |

0.65 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

3.05 |

2.25 |

1.35 |

0.65 |

25.56 |

-0.3 |

-0.25 |

0.1 |

0.75 |

|

F9 (9/21) |

3.25 |

2.45 |

1.6 |

0.85 |

25.06 |

-0.45 |

-0.55 |

-0.3 |

0.2 |

|

Change |

-0.2 |

-0.2 |

-0.25 |

-0.2 |

0.5 |

0.15 |

0.3 |

0.4 |

0.55 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.3 |

2.6 |

1.7 |

0.85 |

24.7 |

-0.4 |

-0.45 |

-0.05 |

0.55 |

|

G9 (9/21) |

3.45 |

2.75 |

1.9 |

1.05 |

24.35 |

-0.6 |

-0.7 |

-0.5 |

0 |

|

Change |

-0.15 |

-0.15 |

-0.2 |

-0.2 |

0.35 |

0.2 |

0.25 |

0.45 |

0.55 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.8 |

3.1 |

2.1 |

1.1 |

24.55 |

-0.6 |

-0.65 |

-0.3 |

0.4 |

|

H9 (9/21) |

3.9 |

3.25 |

2.3 |

1.3 |

24.35 |

-0.75 |

-0.9 |

-0.7 |

-0.15 |

|

Change |

-0.1 |

-0.15 |

-0.2 |

-0.2 |

0.2 |

0.15 |

0.25 |

0.4 |

0.55 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4.55 |

3.8 |

2.65 |

1.45 |

24.16 |

-0.9 |

-1.1 |

-0.5 |

-0.1 |

|

M9 (9/21) |

4.5 |

3.8 |

2.75 |

1.55 |

24.12 |

-1 |

-1.3 |

-1.1 |

-0.5 |

|

Change |

0.05 |

0 |

-0.1 |

-0.1 |

0.04 |

0.1 |

0.2 |

0.6 |

0.4 |

WTI Jan 25d Risk Reversal (Put Prem)

Brent Skew Change (d/d)

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

1.7 |

0.95 |

0.35 |

0.05 |

25.71 |

0.25 |

0.65 |

1.35 |

2.35 |

|

Z8 (9/21) |

2.2 |

1.35 |

0.65 |

0.25 |

24.31 |

0.1 |

0.4 |

0.95 |

1.8 |

|

Change |

-0.5 |

-0.4 |

-0.3 |

-0.2 |

1.4 |

0.15 |

0.25 |

0.4 |

0.55 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

2.45 |

1.5 |

0.7 |

0.25 |

24.96 |

0.05 |

0.35 |

0.85 |

1.9 |

|

F9 (9/21) |

3.3 |

1.9 |

1 |

0.5 |

24.05 |

-0.2 |

-0.25 |

0.1 |

1.1 |

|

Change |

-0.85 |

-0.4 |

-0.3 |

-0.25 |

0.91 |

0.25 |

0.6 |

0.75 |

0.8 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.1 |

1.85 |

1.05 |

0.45 |

25.55 |

-0.1 |

0.05 |

0.5 |

1.75 |

|

G9 (9/21) |

3.1 |

2.1 |

1.25 |

0.65 |

24.89 |

-0.25 |

-0.25 |

0.05 |

0.75 |

|

Change |

0 |

-0.25 |

-0.2 |

-0.2 |

0.66 |

0.15 |

0.3 |

0.45 |

1 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.1 |

2.3 |

1.4 |

0.7 |

24.81 |

-0.2 |

0 |

0.55 |

1.5 |

|

H9 (9/21) |

3.3 |

2.55 |

1.6 |

0.8 |

24.4 |

-0.4 |

-0.3 |

0.1 |

0.75 |

|

|

-0.2 |

-0.25 |

-0.2 |

-0.1 |

0.41 |

0.2 |

0.3 |

0.45 |

0.75 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

J9 |

3.6 |

2.85 |

1.7 |

0.85 |

24.68 |

-0.4 |

-0.4 |

0.25 |

1.25 |

|

J9 (9/21) |

3.65 |

2.9 |

1.8 |

0.95 |

24.48 |

-0.5 |

-0.6 |

-0.15 |

0.6 |

|

|

-0.05 |

-0.05 |

-0.1 |

-0.1 |

0.2 |

0.1 |

0.2 |

0.4 |

0.65 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

3.95 |

3.25 |

2.15 |

1.15 |

24.55 |

-0.6 |

-0.55 |

0.05 |

0.95 |

|

M9 (9/21) |

4 |

3.3 |

2.25 |

1.25 |

24.51 |

-0.75 |

-0.85 |

-0.35 |

0.4 |

|

|

-0.05 |

-0.05 |

-0.1 |

-0.1 |

0.04 |

0.15 |

0.3 |

0.4 |

0.55 |

BRT Jan 10d Call Skew

Major powers, Iran meet to salvage nuclear deal without U.S. – Reuters News

Iran has ample reason to stay in the 2015 nuclear deal despite the U.S. withdrawal and the remaining parties on Monday will discuss ways to blunt the effect of impending U.S. sanctions on Tehran, the European Union’s foreign policy chief said. Speaking before a gathering of senior officials from Britain, China, Germany, Russia and Iran, the EU’s Federica Mogherini made the case for Iran remaining in the deal that U.S. President Donald Trump abandoned on May 8. "An essential part of the agreement and its implementation regards Iran having the possibility of benefiting from the lifting of sanctions, and this is exactly why we are discussing tonight, operational concrete steps that we can put in place," Mogherini told reporters before the talks at the United Nations. "Iran has good arguments and good reasons to remain in the agreement. … the more operational decisions we will manage to take and … implement, I believe the more Iran will have reasons to do," she added. The European Union, however, has so far failed to devise a workable legal framework to shield its companies from U.S. sanctions that go into effect in November and that, among other things, seek to choke off Iran’s oil sales, diplomats said. Highlighting just how difficult it will be for the Europeans to come up with concrete solutions, French state-owned bank Bpifrance on Monday abandoned its plan to set up a financial mechanism to aid French companies trading with Iran. The crux of the deal, negotiated over almost two years by the administration of former U.S. President Barack Obama, was that Iran would restrain its nuclear program in return for the relaxation of sanctions that had crippled its economy. Trump considered it flawed because it did not include curbs on Iran’s ballistic missiles program or its support for proxies in Syria, Yemen, Lebanon and Iraq. The United States began reimposing economic sanctions this summer and the most draconian measures, which seek to force Iran’s major customers to stop buying its oil, resume Nov. 5. Their impending return has contributed to a slide in Iran’s currency. The rial has lost about two-thirds of its value this year, hitting a record low against the U.S. dollar this month. There are limits to what the EU can do to counter the oil sanctions, under which Washington can cut off from the U.S. financial system any bank that facilitates an oil transaction with Iran.

Mattis dismisses Iran revenge threat, says U.S. not in attack – Reuters News

U.S. Defense Secretary Jim Mattis on Monday dismissed Iran’s threats of revenge against those behind Saturday’s deadly attack on a military parade in southwestern Iran and said it was "ludicrous" for Tehran to allege U.S. involvement. Asked whether Iran’s threat gave him any concern, Mattis told reporters at the Pentagon: "No, it does not. We’ve been very clear that they shouldn’t take us on like that. And I am hopeful that cooler, wiser heads will prevail." Iran’s Revolutionary Guards Brigadier General Hossein Salami was quoted as saying the attack, which killed 25 people, had exposed the dark side of an alliance that the United States, Saudi Arabia and Israel had created to counter Iranian influence in the region.

Iran video threatens missile strikes on UAE, Saudi Arabia – Associated Press

An Iranian media outlet close to the country’s hard-line Revolutionary Guard published a video Tuesday threatening the capitals of Saudi Arabia and the United Arab Emirates with missile attacks, further raising regional tensions after a weekend militant attack on a military parade in Iran. The video tweeted and later deleted by the semi-official Fars news agency comes as Iran’s Supreme Leader Ayatollah Ali Khamenei blamed Riyadh and Abu Dhabi for the attack in the city of Ahvaz on Saturday that killed at least 25 people and wounded over 60. The threat amplifies the unease felt across the greater Persian Gulf, which is seeing Iran’s economy upended in the wake of America’s withdrawal from Tehran’s nuclear deal with world powers and Saudi and Emirati forces bogged down in their yearslong war in Yemen. The video shows file footage of previous ballistic missile attacks launched by the Guard, then a graphic of a sniper rifle scope homing in on Abu Dhabi in the United Arab Emirates and Riyadh in Saudi Arabia. The video also threatened Israel. "The era of the hit-and-run has expired," Khamenei’s voice is heard in the video, the segment taken from an April speech by the supreme leader. "A heavy punishment is underway." Iran has fired its ballistic missiles twice in anger in recent years. In 2017, responding to an Islamic State attack on Tehran, the Guard fired missiles striking targets in Syria. Then, earlier this month, it launched a strike on a meeting of Iranian Kurdish separatists in northern Iraq. The Guard, a paramilitary force answerable only to Khamenei, has sole control over Iran’s ballistic missile program. Under Khamenei’s orders, Iran now limits its ballistic missiles to a range of 2,000 kilometers (1,240 miles), which gives Tehran the range to strike Israel, Gulf countries like Saudi Arabia and the UAE, as well as regional American military bases. Saturday’s attack targeted one of many parades in Iran marking the start of the country’s long 1980s war with Iraq, part of a commemoration known as "Sacred Defense Week." Militants disguised as soldiers opened fire as rows of troops marched past officials in Ahvaz. Arab separatists in the region claimed the attack and Iranian officials have blamed them for the assault. The separatists accuse Iran’s Persian-dominated government of discriminating against its ethnic Arab minority. Iran’s Khuzestan province, where Ahvaz is the provincial capital, also has seen recent protests over Iran’s nationwide drought, as well as economic protests. The Islamic State group also claimed Saturday’s attack, initially offering incorrect information about it and later publishing a video of three men it identified as the attackers. The men in the video, however, did not pledge allegiance or otherwise identify themselves as IS followers. State TV reported late Monday that authorities have detained 22 suspects linked to the group behind the attack and confiscated ammunition and communication equipment. Fars also reported that five militants took part in the assault, all of whom were killed. It said two of them were brothers and another one was their cousin. On Monday, the Guard’s acting commander, Gen. Hossein Salami, vowed revenge against the perpetrators and what he called the "triangle" of Saudi Arabia, Israel and the United States. "You are responsible for these actions; you will face the repercussions," the general said. "We warn all of those behind the story, we will take revenge." Khamenei, who has final say on all state matters, said Monday that the attack showed Iran has "a lot of enemies," according to remarks posted on his website. He linked the attackers to the United States, Saudi Arabia and the UAE. "Definitely, we will harshly punish the operatives" behind the terror attack, he added.

China says U.S. putting ‘knife to its neck’, hard to proceed on trade – Reuters News

A senior Chinese official said on Tuesday it is difficult to proceed with trade talks with the United States while Washington is putting "a knife to China’s neck", a day after both sides heaped fresh tariffs on each other’s goods. When the talks can restart would depend on the "will" of the United States, Vice Commerce Minister Wang Shouwen said at a news conference in Beijing. U.S. tariffs on $200 billion worth of Chinese goods and retaliatory taxes by Beijing on $60 billion worth of U.S. products including liquefied natural gas (LNG) kicked in on Monday, unnerving global financial markets. "Now that the United States has adopted such a huge trade restriction measure … how can the negotiations proceed? It’s not an equal negotiation," Wang said, stressing the United States has abandoned its mutual understanding with China. China’s top diplomat also told business people at a meeting in New York that talks could not take place against the backdrop of "threats and pressure", the Foreign Ministry said. Certain forces in the United States have been making groundless criticisms against China about trade and security issues, which has poisoned the atmosphere for Sino-U.S. ties and is highly irresponsible, State Councillor Wang Yi was quoted as saying, without naming anyone. "If this continues, it will destroy in an instant the gains of the last four decades of China-U.S. relations," Wang told members of the U.S.-China Business Council and National Committee on United States-China Relations. U.S. representatives there included Blackstone Group LP co-founder and Chief Executive Stephen Schwarzman and Mastercard Inc Chief Executive Ajay Banga, the National Committee on United States-China Relations said on its website. China also accused the United States of engaging in "trade bullyism", and said Washington was intimidating other countries to submit to its will, according to a white paper on the dispute published by China’s State Council, or cabinet, on Monday. Several rounds of Sino-U.S. talks in recent months have appeared to produce no breakthroughs, and fresh mid-level negotiations which had been expected in coming weeks have been shelved after Beijing reportedly decided late last week not to send a delegation to Washington. While Vice Commerce Minister Wang said he still hopes "there is a way out" if both sides treat each other with sincerity, analysts say neither side looks to be in the mood to compromise in the increasingly bitter dispute, raising the risk of a lengthy battle that could chill the global economy by discouraging business investment and disrupting trade. "The sharp criticism (from Beijing on Monday) suggests that China might prefer to wait out the current U.S. administration, rather than embarking on potentially futile negotiations," Mizuho Bank said in a note to clients. "Given these developments, it is increasingly likely that both sides will not resume negotiations for some time, at least until there is a noticeable shift in the political mood on either side."

U.S., Japan push back trade talks to Tuesday – Reuters News

Japan and the United States will begin a second round of trade talks in New York on Tuesday, Japan’s top government spokesman said, amid concerns in Tokyo that Japan will face greater pressure to reduce its large trade surplus. U.S. Trade Representative Robert Lighthizer and Economy Minister Toshimitsu Motegi had been scheduled to meet on Monday evening, ahead of a Wednesday summit between U.S. President Donald Trump and Japanese Prime Minister Shinzo Abe on the sidelines of a U.N. General Assembly meeting. Due to a scheduling issue, the U.S. side asked to delay the meeting, which is now scheduled for 8:30 a.m. EDT (1230 GMT) on Tuesday, Chief Cabinet Secretary Yoshihide Suga told a news conference. "We believe the talks will focus on further expanding trade and investment between Japan and the U.S. to bring benefits to both nations," Suga said. Lighthizer and Motegi met in August but failed to narrow differences on whether to open up negotiations for a bilateral free trade agreement. Abe, after a Sunday dinner with Trump, told reporters the two had constructive talks on trade, which Motegi and Lighthizer would continue. Japan is hoping to avert any import curbs and potentially steeper U.S. import tariffs on its cars, and fend off U.S. demands for a free trade agreement. Japanese media have said Tokyo is considering an agreement that would lower tariffs on U.S. agriculture imports in exchange for avoiding higher tariffs on Japanese autos.

Trump, Macron Said to Hold Constructive Meeting on Iran, Trade

President Donald Trump didn’t bring up any new areas of contention in his Monday meeting with French President Emmanuel Macron, and the two found areas of agreement over Iran and Syria, French officials said. Trump and Macron “discussed a wide range of international issues, including the situation in Syria, countering threats posed by Iran, and promoting fair terms of trade between the United States and the European Union,” the White House said in a statement. The meeting lasted about an hour. French officials told reporters that Trump asked Macron for his views, listened to the answers, and didn’t seek confrontation. The official spoke on condition that their names not be used because only the president himself can be quoted on official visits. Macron and Trump shared the same concerns about Iran’s ballistic missile program and its regional meddling, the officials said, but Trump insisted that the U.S.’s policy of imposing sanctions was bearing fruit by weakening Iran’s economy and it was therefore too early to consider talks. On Syria, they agreed to work with Turkey to save civilian lives in the Idlib area. On trade, Trump said Europe had been unfair to the U.S., and Macron replied that the U.S. has high tariffs and barriers of its own, but they agreed both sides should keep talking. Macron has established a closer working relationship with Trump than have the leaders of Germany and Britain, though the two have had fierce clashes over Iran, trade, and above all on an issue they didn’t even discuss on Monday – climate. Trump said he enjoyed a July visit to Paris and before Monday’s meeting he recalled for reporters his dinner with Macron at the Eiffel Tower during that visit. The two leaders later discussed Trump’s planned Nov. 11 trip to Paris to celebrate the 100th anniversary of the World War I armistice.

Oil market hears echoes of 2007/8: Kemp – Reuters News

Eleven years ago, on Monday Sept. 24, 2007, the price of Brent crude closed just below $79 per barrel, not far from where it is today. Three days later, Brent closed above $80 for the first time in history. Less than 10 months after that, prices closed at an all-time high of $146. Past prices are not necessarily a guide to the future, but the events of 2007/08 are a reminder that price moves are highly non-linear, especially around turning points in the cycle. Price moves tend to accelerate in the run-up to cyclical peaks and troughs, as the market struggles to overcome a worsening deficit or surplus. As a result, oil prices tend to rise far higher, and fall much further, than commentators thought possible just a few months earlier.

A DISTANT MIRROR

The current situation in the global economy and the oil market has many similarities to what happened in 2007 and 2008. In the earlier episode, the global economy had been expanding strongly for several years, with rapid growth in oil consumption. The U.S. economic cycle peaked in December 2007, though that was not evident until about a year afterwards, and oil prices continued rising for another seven months. Yields on short-term U.S. Treasury notes peaked around June 2007 and U.S. equity markets hit their pinnacle in October 2007. Most of the other major industrial economies tipped into recession in the second half of 2007 or the first half of 2008. In the oil market, persistent concerns about demand destruction were raised, but dismissed by many participants, and validated only after prices peaked. The introduction of new low-Sulphur standards for distillate fuel oil in the United States led to concerns about the availability of enough sweet crude. There were mounting concerns about the exhaustion of OPEC’s spare capacity and the organization’s ability to add more medium-sweet barrels to meet demand from refiners.

OPEC STAYS ON SIDELINE

Throughout 2007 and early 2008, OPEC leaders continued to insist the oil market was adequately supplied and they would make additional barrels available if refiners requested them. But the Brent market moved into a sharp backwardation in the second half of 2007 and the first four months of 2008, indicating traders were concerned about oil availability. In September 2007, OPEC agreed to increase its collective production by 500,000 barrels per day from the start of November, citing the tightness in U.S. fuel markets and the shift in crude futures into backwardation. In December 2007, however, OPEC’s conference judged the market remained well supplied and that crude and product stocks were at comfortable levels and decided not to increase output further. In March 2008, the conference continued to judge the market well supplied, noting growing downside risks in the world economy, and blamed the continued rise in oil prices on non-fundamental factors, especially speculators. In May, the organization’s secretary-general issued a statement saying “there is clearly no shortage of oil in the market” and blaming speculative funds for the increasing volatility in crude oil. The organization promised to be proactive in monitoring developments and act if necessary to ensure a stable and balanced market but did not promise additional barrels. Prices continued to accelerate higher and became increasingly volatile, with $5-per-day price moves becoming frequent, and many traders pulling back from making markets due to the increase in risk. OPEC insisted throughout that oil supplies were adequate, Saudi Arabia and other members would provide more oil, if refiners asked, but that prices were being driven by non-fundamental factors. Eventually, the backwardation began to break down in May and spot prices started to fall from early July as the financial and economic outlook deteriorated. With the intensification of the financial crisis in September 2008, the global economy headed deeper into recession through the second half of the year and in the first half of 2009.

WILL HISTORY REPEAT?

Could the same sequence of events play out in 2018/19? The U.S. economy and financial markets are again at a relatively late stage in the current cyclical expansion. In the rest of the world, the global outlook is softening, with the balance of risks tilted towards the downside, according to many forecasters. Oil consumption growth has been strong but may be starting to soften, though as usual this will not be certain until after the event. Six-month Brent calendar spreads are trading in a backwardation of around $2 per barrel, which is comparable to the corresponding point in September 2007. New pollution regulations will tighten Sulphur specifications for marine fuels from the start of 2020, which will put pressure on the availability of medium-density and sweet crudes. There are reported shortages of medium crudes as imminent sanctions reduce the export of medium-density oil from Iran (“Saudi Arabia worries oil crunch could push up prices”, Wall Street Journal”, Sept. 21). Saudi Arabia says it has enough spare capacity to increase production by another 1.5 million barrels per day but some market participants are skeptical about the amount and the quality. The Joint Ministerial Monitoring Committee of OPEC and non-OPEC producers concluded on Sunday the overall balance between supply and demand remains healthy. But hedge funds have amassed a large bullish position in Brent crude, amounting to almost 470 million barrels, betting prices will head even higher.

U.S.-China trade war poses oil demand shock in 2019 – BP – Reuters News

U.S. sanctions on Iran will tighten global oil supplies sharply until the end of the year, but a threat to world demand looms in 2019 from the U.S.-China trade war, the head of BP’s oil trading in Asia said. "We’re moving into the tightest part of 2018 … the re-imposition of Iran sanctions is the main factor as the market will tighten substantially from now to year-end," Janet Kong, chief executive of Integrated Supply and Trading Eastern Hemisphere at BP told Reuters. Saudi Arabia and Russia won’t add significantly more oil to the market because of a lack of capacity, a top Iranian official said on Monday, predicting prices will probably rise further. Sanctions on Venezuela are also exacerbating a production decline there, while outages in Nigeria and Libya have further crimped supplies, Kong said, with Brent LCOc1 supported at above $80 a barrel. "The market fundamentals in the short term look very bullish and positive due to supply shocks, but over time, when supply catches up and the shock to demand becomes more evident, the market will go through another round of re-balancing next year," she said. The world’s two largest economies, China and the United States, have imposed tariffs on each other’s imports in an escalating trade war that has rattled global markets and raised concerns of a slowdown in world economies and commodities demand next year. "Going into 2019, I worry about the impact of the U.S.-China trade war, manifesting itself slowly," Kong said. "The trade war impact has not really shown up in the data anywhere, but it will show up gradually over time. So the supply shock is very sharp and prompt, while the impact from trade war is boiling over slowly." Analysts and the International Monetary Fund have forecast a 0.5 percent to 1 percent drop in world gross domestic product growth next year, she said. The International Energy Agency said in its monthly oil report that global oil demand is set to to top 100 million bpd next year, although emerging market crises and trade disputes could dent this figure. "The Trump administration wants intellectual property protection … reducing subsidies to Chinese SOEs (state-owned enterprises) and open market access by all businesses which are difficult, in my view, for the Chinese government to agree to," Kong said.

"So it’s very likely this war will drag on for a long time."

Vitol to halt business with Iran after U.S. sanctions start- executive – Reuters News

Energy trader Vitol will stop doing business with Iran after the United States re-imposes sanctions on Tehran’s oil trade from Nov. 4, a senior company executive said on Tuesday. "Business with Iran or anything to do with Iran has to come to an end," said Mike Muller, who handles business development for Vitol, on the sidelines of the Asia Pacific Petroleum Conference (APPEC) in Singapore. "We have a long-standing relationship with Iran and clearly I look forward to when trade can be resumed, but for now, one needs explicit waivers from the U.S., and not just the U.S. but the global banking community and everything else," he said. The United States announced in May that it would re-impose sanctions on Iran, the third-largest producer in the Organization of the Petroleum Exporting Countries, to force the country to renegotiate an agreement limiting Iran’s nuclear program. The sanctions started on Aug. 7 with limitations on the country’s access to the global financial system and in November will be extended to Iran’s petroleum sector. Some traders are forecasting that the sanctions could remove up to 1.5 million barrels per day of crude from the market. Global benchmark Brent crude jumped more than 3 percent on Monday to a four-year high above $80 a barrel after Saudi Arabia and Russia ruled out any immediate increase in production despite calls by U.S. President Donald Trump for action to raise global supply. Any push towards higher oil prices will need new drivers, with the current oil prices having already factored in market risks, Muller said in comments during APPEC. "Anything leading to higher numbers will require some new evidence coming to light," he said. Substantial additions of non-OPEC supply of up to 2 million barrels per day could flow to global markets next year, with half of that to come from the United States, he added. He declined to provide an oil price forecast but his comments appear to be less bullish than commodity traders Mercuria and Trafigura who predicted $100 a barrel oil by early 2019 on Monday. Separately, Muller added that a deal to acquire stakes in Nigerian offshore fields that are held by Brazil’s Petrobras and its partners, is not yet finalized. "It’s a deal that’s going to be rather big for Vitol… there is a transaction being finalised," he said. Reuters reported in June that a consortium led by Vitol has entered exclusive talks to acquire the assets which are estimated to be worth up to $2.5 billion.

Middle East Crude-Oman jumps to multi-year high – Reuters News

The Middle East crude market was mixed on Tuesday as DME Oman’s premium to swaps soared to a multi-year high while cash Dubai softened. DME Oman’s premium rose more than $1 from the previous session to $4.22 a barrel on Tuesday, Reuters calculations showed. Supply concerns ahead of U.S. sanctions against Iran and strong crude demand from China and Japan before winter have pushed up spot crude premiums this month. But the more than $1 jump in Oman’s premium puzzled industry players, given that it is occurring in a week when most of the oil industry is tied up with meetings at APPEC in Singapore. Brent shot to its highest in four years on Tuesday, catapulted by imminent U.S. sanctions on Iranian crude exports and the apparent reluctance of OPEC and Russia to raise output to offset the potential hit to global supply.

WINDOW: Cash Dubai’s premium to swaps fell 7 cents to $1.39 a barrel. Unipec will deliver a second Upper Zakum crude cargo to Shell.

Russia Urals Crude Loadings Set to Rise to 11-Month High

Russia will export total of 1.871m b/d of Urals from its three main ports next month, according to preliminary loading program seen by Bloomberg.

That’s highest since November, data compiled by Bloomberg show

Urals breakdown as follows:

Primorsk to load 34 cargoes, equating to 804k b/d of Urals, up from 660k b/d in September

Ust-Luga set at 25 cargoes, or 591k b/d, up from 513k b/d in September

Novorossiysk Urals set at 476k b/d vs 469k b/d in September

Novorossiysk also to ship 5*80k tons of Siberian Light; equivalent to about 95k b/d, down from 139k b/d this month

India’s oil demand to climb to 500 mln tonnes per year by 2040 -Indian Oil – Reuters News

India’s crude oil demand is forecast to grow to 500 million tonnes per year by 2040, but persistent increases in oil prices might act as a dampener for the rate of growth, Partha Ghosh, an executive director at Indian Oil Corp IOC.NS said on Tuesday. That would be equivalent to around 10 million barrels per day (bpd), up from about 4.7 million bpd in 2017. Globally oil demand will increase by 15.8 million bpd from now until 2040, Ghosh said during the Asia Pacific Petroleum Conference (APPEC) in Singapore. India’s growth of 5.9 million bpd will make up about 24 percent of the overall gain, he said. India’s refining capacity would increase to about 439 million tonnes per year by the financial year of 2030 as new and existing refineries continue enhancing their infrastructure, while domestic demand is forecast to increase to 356 million tonnes per year over the same period, Ghosh said. Higher refining capacity will mean India could export more refined oil products to countries in the region. "In the future, say about five to seven years down the line, when more refineries with bigger capacities come up, better (export) infrastructure will come along with that," Ghosh, the executive director for optimization at Indian Oil Corp, the country’s biggest refiner, said on the sidelines the conference. "Then, it’ll be possible, even if the domestic demand does not grow because of high prices, refineries will be competitive enough to actually supply products to the entire region, be it East Africa or Asia." India’s strong economic growth and the demographic advantage of having a pool of young people will remain key drivers in its energy demand growth. The rate of oil demand growth, however, will slow down by 2024 to 2025. "While alternatives and energy efficiency is expected to reduce oil demand, the biggest dampening factor will come from a sustained increase in oil prices," Ghosh said. "India’s economy is very sensitive to oil prices. It’s said that a $10 per barrel increase reduces India’s GDP by 0.2 to 0.3 percent." India is a major buyer of Iranian oil and is seeking a waiver on the sanctions the United States is set to impose on the country in November. However, Indian Oil will be able to manage even if it does not gain an exemption, Ghosh said. "We’ll have to increase buying from other resources…. Indian refineries are quite versatile. They’re not dependent on any particular type of crude. So, it’s possible to manage with alternative sources," he said.

Indian Oil Has `Alternatives’ to Iran’s Crude Lost to Sanctions

Indian Oil Corp. has options to compensate for curbs on crude supply from Iran because of U.S. sanctions, co.’s executive director of optimization Partha Ghosh says at the Asia Pacific Petroleum Conference (APPEC) in Singapore.

- Co. has optional volumes in term contracts with other national oil companies

- “We have alternatives, because when we get into the term contracts with various NOCs we have optional quantities to pick up”

- While India is building mega refineries to meet domestic and foreign demand, rising crude prices will hurt, Ghosh says

- “Definitely there will be a huge impact on demand” if crude prices keep rising as they are now

- Country will almost double production of gasoline, diesel in 2030 and will have surplus to cater demand in neighboring regions

China bought ~917k b/d surplus crude in Aug., 300% higher than July, according to Bloomberg calculations based on data from National Bureau of Statistics and General Administration of Customs.

- Rate is highest since May

- Implied oil stock build was ~813k b/d in Jan.-Aug., lower than same period last year

China Shandong refiners’ oil imports in H1 2018 rise 41 pct from year earlier – oil exec – Reuters News

- Independent refiners in China’s Shandong province imported 42.4 million tonnes of crude in the first half of 2018, 41.4 percent higher that a year earlier, a senior refinery executive said on Tuesday

- The group of refiners, also known as teapots, processed 39.14 million tonnes crude in the first half of 2018, up 53.4 percent from a year earlier, said Zhang Liu Cheng, general manager of the Shandong Refiners & Energy Group at the Asia Pacific Petroleum Conference (APPEC)

- But the group faces challenges as new and more competitive refining complexes are coming online while rising taxes and liquidity crunch have hurt profits, he said

- He added that China’s crude processing capacity is expected to reach 808 million tonnes in 2018, 35 million tonnes higher than in 2017

Asia’s oil deficit to widen by 2025 – Total – Reuters News

Asia’s oil deficit will widen to 35 million barrels per day (bpd) by 2025, up about 30 percent from the current 27 million bpd, amplifying global trade flow imbalances, a senior executive at French oil and energy group Total said on Tuesday. At the same time, Europe’s imports will be cut by 10 million bpd, while exports from North America and the Middle East will increase, said Thomas Waymel, the company’s president of trading and shipping. The United States will export shale oil, but its refineries will continue to import medium and heavy sour grades, Waymel said during the Asia Pacific Petroleum Conference (APPEC) in Singapore. Regulatory changes like IMO 2020, which will cap sulphur content in ship fuel, will be another driver for growth and changing trade flows, he said. "The fuel oil flows will be reduced. At the same time, the shipping industry will need distillates … so Europe and Singapore will attract more distillates," Waymel said. New trade flows might emerge for high sulphur fuel oil either in coker capacity or power plants switching back from coal or gas to high sulphur fuel oil. Light sweet crude will be more in demand, while heavy sour grades will need to be processed by complex refineries, he said. "Regulatory changes will dramatically affect an increase in flows of both crude and products. It should also have positive impact on freight rates which is finally good news for ship owners," he said.

Pemex August Crude Exports Rise 2.2% to 1.18M B/D: Co. Data

The Mexican state-owned oil company’s Aug. crude production fell 1.3% m/m to 1.82m b/d, according to data from Pemex’s website.

Aug. production by type in b/d:

Heavy: -0.84% m/m to 1.06m b/d

Light: +12% m/m to 629k

Ultra-light: -38% m/m to 130k

Aug. crude exports by destination in b/d:

Americas: +0.76% m/m to 798k

Asia: +23% m/m to 254k

Europe: -18% m/m to 129k

Aug. exports by grade in b/d:

Maya, Altamira and Talam: +2.2% m/m to 1.18m b/d

Isthmus: unchanged at zero

Olmeca: unchanged at zero

Gasoline production: +7.5% m/m to 228.7k b/d

Gasoline imports: -12% m/m to 547k b/d

Colombia Studying Mexico-Style Oil Hedging

Colombia looking at mechanisms of the type Mexico has used for years, Finance Minister Alberto Carrasquilla tells lawmakers in Bogota.

“We are studying the way to cover, that is to say to see at what price the oil market should be willing to buy the oil both that Ecopetrol and others produce. There are countries like Mexico that have been doing this for 17 years.”

“We have started the work to see in what circumstances we could discuss this theme in the next phase of our budget debate.”

Asks for time to see what can realistically be achieved in the futures market

Estimated oil price of $67 per barrel in 2019 budget “seems low”

Colombia has ways to smooth out the necessary spending adjustments

U.S. Crude Oil Exports Seen Rising to 5M B/D by 2025: Total

U.S. crude oil exports seen at 2m b/d in 2018, Thomas Waymel, president of trading and shipping at Total, says at Asia Pacific Petroleum Conference in Singapore on Tuesday.

- U.S. crude exports and imports forecast to total 14m b/d by 2025 from 10m b/d this year

- Quality mismatch and cheap cost of transportation is another reason for driving trade flows

- Regulatory changes such as IMO 2020 are going to be the main driver in coming months

- Fuel oil flows to major bunkering hubs in Europe and Singapore will decrease amid IMO 2020

- Full impact will depend on scrubber penetration; shipping industry will need more distillates and Europe and Singapore will attract more distillates

- Positive impact seen on freight rates; new crude flows will emerge, with light and sweet crudes seeing higher demand

Canada heavy crude discount hits widest level on record – Reuters News

The Canadian heavy oil differential closed at its widest point on record against the West Texas Intermediate (WTI) benchmark on Monday in thin trade, as transportation constraints continued to weigh. Western Canada Select (WCS) heavy blend crude for October delivery in Hardisty, Alberta, settled at $42.00 a barrel below the WTI benchmark crude futures CLc1, compared with Friday’s settle of $41.00, according to Shorcan Energy brokers. Higher production compared with the second quarter has swelled volumes in storage and put pressure on prices, while tight pipeline space and insufficient rail capacity have pushed the differential even wider, say analysts. Some of the recent price weakness can be attributed to leftover barrels stranded by Canada’s pipeline apportionment system, where shippers nominate a certain volume of barrels but see their shipments reduced if lines are oversubscribed. "Often what we see post-apportionment is simply weak pricing in the aftermarket," said Matt Murphy, an energy analyst with Tudor, Pickering, Holt & Co. Murphy noted that rail volumes continue to rise, but still appear to be insufficient to clear the market. A jump in the global benchmark for crude also weighed on the Canadian prices, with Brent rising 3 percent to a four-year high above $80 a barrel after Saudi Arabia and Russia ruled out any immediate increase in production. The transportation constraints mean Canadian producers are not able to get their barrels to market, leaving them unable to fully benefit from rising benchmark prices. Monday’s WCS close surpasses a previous record discount of $41.50 reached in November 2013. Light synthetic crude from the oil sands for October delivery settled at $17.75 under WTI, recovering slightly compared with Friday’s settle of $18.90 under.

U.S. Cash Crude-Grades firm on second day of rebalancing – Reuters News

U.S. cash crude grades mostly rose on Monday as traders rebalanced positions for a second day and as U.S. crude’s discount to Brent widened. Traders rebalanced positions on the second day of cash roll trading, after the October futures contract expired on Thursday. The October/November roll traded between +$0.95 and +$1.20. The three-day cash roll window ends Tuesday. U.S. crude’s discount to Brentwidened by $1.10 to minus $9.12 per barrel, supporting coastal crude differentials. Export demand for coastal grades typically rises when U.S. crude trades at a bigger discount compared with Brent. The spread widened as Brent crude jumped more than 3 percent on Monday to a four-year high above $80 a barrel after Saudi Arabia and Russia ruled out any immediate increase in production. Light Louisiana Sweet strengthened slightly to trade at a $5.85 and $6.80 per barrel premium to U.S. crude futures. West Texas Intermediate at East Houston WTC-WTM, also known as MEH, climbed by more than 60 cents to trade at a midpoint of about of a $6.25 per barrel premium to futures. U.S. grades have become increasingly popular among Asian buyers as the discount has emerged. CME Group Inc CME.O on Monday joined the race to provide oil traders with a futures contract deliverable in the U.S. Gulf Coast, as crude exports have surged since the lifting of a decades-old ban in late 2015. Inland grades also strengthened. West Texas Intermediate at Midland WTC-WTM rose to as little as a $10 per barrel discount to U.S. crude. Meanwhile, inventories at Cushing rose by about 530,000 barrels in the week to Sept. 21, according to market intelligence firm Genscape.

Light Louisiana Sweet WTC-LLS for October delivery rose 5 cents to a midpoint of $6.3 and traded between a $5.75 and $6.85 a barrel premium to U.S. crude futures.

Mars Sour WTC-MRS rose 95 cents to a midpoint of $4 and traded between a $3.75 and $4.25 a barrel premium to U.S. crude futures.

WTI Midland WTC-WTM rose $1 to a midpoint of $10.50 a barrel discount and traded between a $11 and $10 a barrel discount to U.S. crude futures.

West Texas Sour WTC-WTS rose $2.75 and was seen bid and offered between a $11.50 and $10.50 a barrel discount to U.S. crude futures.

WTI at East Houston, also known as MEH, traded at $6, $6.10 and $6.20 a barrel over WTI.

U.S. Cash Products-Group Three gasoline falls after hitting 3-yr high last week – Reuters News

U.S. Group Three gasoline cash differentials fell on Monday as the product traded against the November futures contract on the New York Mercantile Exchange, market participants said. Group Three gasoline lost 3.00 cents a gallon to trade at 12.75 cents per gallon above the NYMEX gasoline futures benchmark RBc1, traders said. The product has come off slightly from a nearly three-year high reached last week. Elsewhere in the Midwest, Chicago ultra-low-sulfur diesel fell 2.50 cents a gallon to trade at 2.25 cents per gallon below the heating oil futures contract. In the Gulf Coast, 54-grade jet fuel lost a quarter of a penny to trade at 7.75 cents per gallon below futures as the product traded on Colonial Pipeline’s 55th cycle for delivery to New York Harbor, market participants said. A3 CBOB gasoline gained a quarter of a cent to trade at 1.75 cents per gallon below futures. In New York Harbor, M2 conventional gasoline rose a quarter of a penny to trade at 6.75 cents per gallon above futures, traders said. The RBOB futures contract on NYMEX gained 3.76 cents to settle at $2.0547 a gallon on Monday. NYMEX ultra-low-sulfur diesel futures rose 5.99 cents to settle at $2.2859 a gallon. Renewable fuel (D6) credits for 2018 were trading at 14 cents each, slightly lower than between 14 and 16 cents on Friday traders said. Biomass-based (D4) credits fetched 35 cents each, little changed from Friday, the traders said.

Philadelphia-area crude rail terminal reawakened by discounted crude – Reuters News

NEW YORK, Sept 25 (Reuters) – A rail terminal outside of Philadelphia has begun taking deliveries of Bakken crude after going dormant for nearly three years, according to shipping data and a source familiar with operations, as refiners snatch up discounted North American crude barrels. The 90,000 barrel-per-day-rail terminal in Eddystone, Pennsylvania, has been getting routine deliveries of Bakken crude for the past month, the first significant deliveries since the site went dark in January 2016. Monroe Energy, a subsidiary of Delta Air Lines Inc DAL.N, is using the terminal to help supply its 185,000 bpd refinery in Trainer, Pennsylvania. The return of crude deliveries at Eddystone highlights the growing pains confronting U.S. producers who are facing bottlenecks as booming production outpaces pipeline growth. It also shows how U.S. refiners are trying to seize on the bottlenecks, doing whatever they can to access the distressed crude. The Eddystone rail terminal was one of several facilities built on the U.S. East Coast in the early part of this decade to take advantage of discounted crude out of North Dakota. But business at this terminal and others slumped as the discount vanished and cheap imports came into favor. North Dakota oil production hit a record 1.3 million barrels per day in July, outpacing pipeline capacity, forcing producers to discount crude and making it attractive for coastal buyers. The Dakota Access Pipeline, the key artery out of North Dakota, was nearly 100 percent full in August, according to energy industry intelligence service Genscape. Flows on the line, which runs from North Dakota to Illinois, are averaging just over 500,000 bpd, and further expansion is expected. U.S. crude’s discount to global benchmark Brent rose to more than $10 a barrel this month, the widest in three months and near the biggest discount in over three years. That spread is key for East Coast refiners, since the Bakken grade is priced off U.S. crude while import grades are typically priced off Brent. But other factors such as full pipelines have also contributed to the pickup in crude by rail, traders said. Rail volumes from North Dakota to the East Coast hit nearly 75,000 bpd in June, according to the latest federal data, up from near zero volumes in August and September of last year. At the height of the boom, more than 450,000 bpd ran from the Bakken to the East Coast. The activity could persist as long as the discounts for Bakken crude remain, according to traders and analysts. Brent crude’s premium to Bakken has been between $10 and $11 for November, traders said. It is expected to average around $7 a barrel in 2019, according to Morgan Stanley. Delta Air Lines used the Eddystone terminal to supply the refinery from 2013 until the contract collapsed in 2016. It is unclear whether the new deliveries are part of a new supply contract or represent spot purchases. The terminal is owned by Canopy Prospecting, which bought out its partner, Enbridge Inc, last year. Jack Galloway, one of the partners at Canopy, declined comment when reached by phone on Friday. Monroe Energy did not respond to comment for this story.

No delays to implementing shipping fuel sulphur cap in 2020 -IMO official – Reuters News

The International Maritime Organization (IMO) will not delay implementing a reduction in the amount of sulphur in marine fuel in 2020, an IMO official said on Tuesday. "I can categorically say there will not be a delay," said Edmund Hughes, the head of air pollution and energy efficiency at the IMO, during the Asia Pacific Petroleum Conference (APPEC) in Singapore. IMO, the United Nations’ shipping agency, will require that vessels start in 2020 using fuel oil with 0.5 percent sulphur, down from 3.5 percent currently. The IMO regulations imposed will create a level playing field for the global shipping industry and if it were to back down, it could lead different rules being implemented in different regions, creating greater levels of uncertainty for the global industry, argued Hughes. "A delay to the regulation would damage the IMO’s reputation and credibility as a rule-making body for international shipping and would lead to more regional and national action to control air pollution from ships," said Hughes. The shipping and oil refining industries are scrambling to prepare for the shift and have made large investments to comply with the new standards since they were announced in 2016. But some shippers have been slow to respond and have argued that the burden of compliance with the IMO’s stricter fuel standards should rest with refiners to produce lower sulphur fuels that meet the new standards. "(This) is a shipping regulation and its amazing how many times I’ve heard this is a refining problem," said Savvas Manousos, global head of trading at Maersk Oil Trading, at the conference. "The onus of compliance is on the shipping industry, not on the refining industry," said Manousos, adding that the two industries must work together to address the global issue. Maersk Oil Trading purchases marine fuel for its parent company A.P. Moller-Maersk and is among the biggest ship fuel buyers in the world.

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.