From: Wagner, Jonathan

Sent: Wednesday, September 26, 2018 6:27:46 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

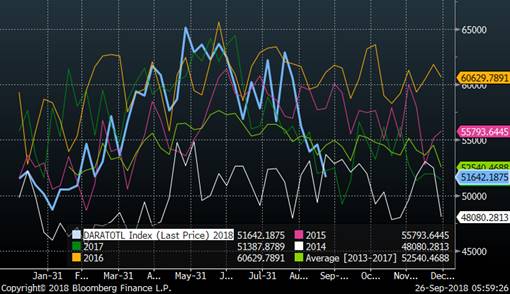

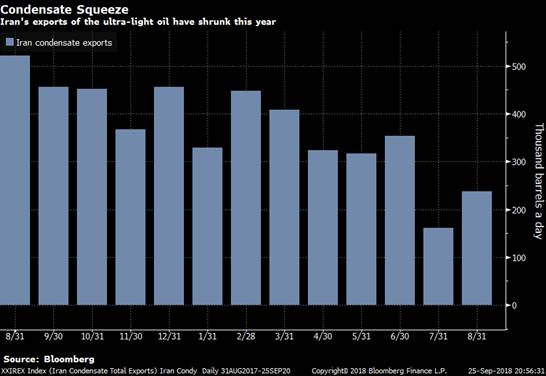

Good morning. Oil prices are unchanged to start the day with last night’s API data showing a 2.9m bbl build in crude while gasoline and distillate inventories were a net 0. While Cushing stocks built slightly (260k bbls) the entire build was concentrated in padd 5. Gasoline stocks increased by 950k bbls (which included an 819k bbl draw in padd 5) while distillate stocks drew 950k bbls (+1300 in padd 1 and -2k in padd 3). Crude imports fell 218k b/d w/w to 7.8m b/d with padd 3 imports falling 412k b/d w/w. . Last week’s DOE stats showed total US oil imports at 8.02m b/d with 2.69m b/d for padd 3. Refinery runs fell 687k b/d according to the API data as fall turnarounds pick up. After President Trump’s speech that UN yesterday, his administration and Iran continue to trade verbal jabs. NSA advisor Bolton said that he dismissed an EU plan for a special payments plan to circumvent U.S. sanctions against Iranian oil sales and that the US will remain aggressive and unwavering on sanctions. US Secretary of State Pompeo, has also criticized the EU’s plan for a SPV (special purpose vehicle) designed to circumvent U.S. sanctions against Iran’s oil exports. While Trump continues to press OPEC to lower prices, Iranian oil minister Zanganeh said this morning that Trump should stop “ill-suited interventions” that create tension in the Middle East and stop hampering Iran’s oil production and exports. In terms of replacing Iranian bbl, Iraq said that they have received request for additional oil. SOMO said they are following Saudi’s lead and are currently looking at acquiring storage tanks in Asia as the look to expand their foothold in the region. Iraq has also said that they will be doubling oil output at the Qayyara field in the north from 30k b/d to 60k b/d by the end of the year. UAE’s ADNOC plans to export a new crude grade in November that they will be marketing to its Asian customers (slightly heavier than Murban and Das). Initial production capacity will be 50k b/d and will ramp up to 129k b/d by the end of ’18. Saudi has also been trying to offer more ultra-light oil known as Khuff condensate to help replace lost Iranian condensate bbls. Spot supplies of Khuff are valued at about $2 a barrel over the official selling price for Arab Extra Light crude for the month of October. Nigeria said they are aiming to increase oil and condensate production by 100k b/d by the end of the year as well (2.15m b/d as of Aug in total). They believe that OPEC will continue to “stabilize and balance the market but this is limited due to available spare capacity.” Middle east cash DME Oman crude continues to surge now trading at +10/bbl over swaps for November. 11 Nov Dubai partials traded in the window with Shell buying from Reliance. Oct/Nov Dubai spreads are currently trading 78c backward.

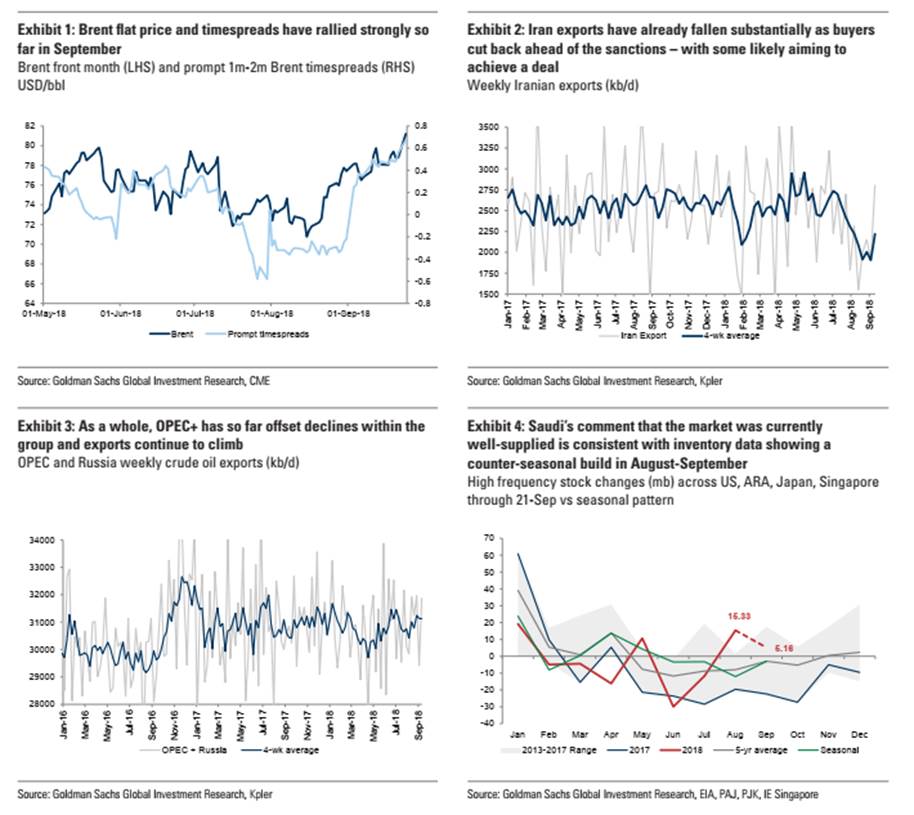

While APPEC this week saw many bullish headlines with calls for $100 oil, Goldman yesterday said they expect Brent prices to stabilize in the 70-80 range. This was after JPM called for a move to $90 earlier in the week. They expect Iranian exports to decline by 1.4m b/d but they expect that to be offset by a faster ramp up in production from other producers. They also believe an SPR release by the US is possible heading into the midterm elections which could add 30m bbls to the market over 60 days. One of the wild cards in terms of Iranian exports remains India. Yesterday a headline hit that India would take zero Iranian crude when sanctions hit in November. However, Reuters has a story out this morning saying that India’s gov’t has not told the country’s oil refiners to halt their imports (even as most have so far). IOC’s refinery director said they remain in a wait and watch environment. Nayara, one of India’s top buyer of Iranian oil is looking at alternatives for these bbls and may import US oil if economically viable. They said they also hope to retain Venezuelan and Mexican oil volumes. We will have to continue to watch for further headlines as the November deadline approaches.

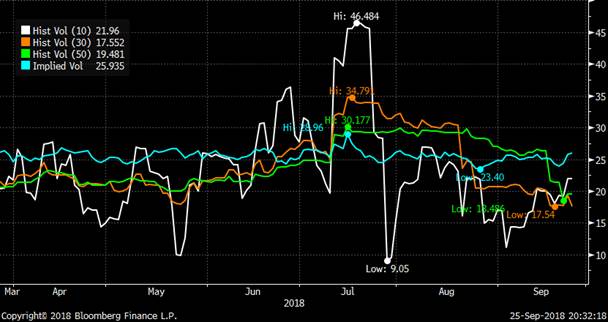

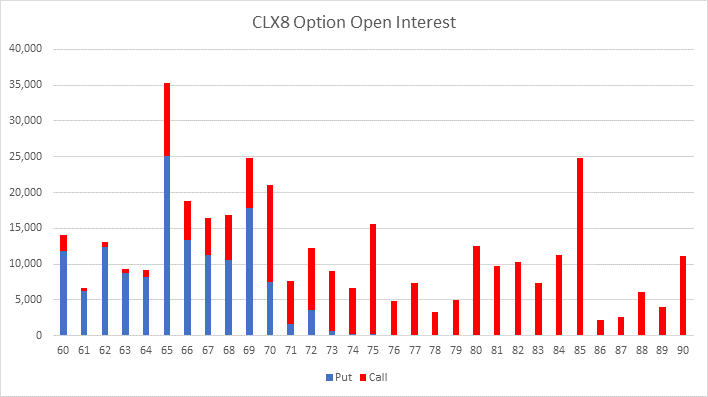

After the strong start to vol in the morning, the majority of the curve finished lower. Put skew was well offered and call skew was well bid early as well with that reverting closer to unchanged by the end of the day. There was continued upside interest in Brent to start the day while in WTI it looked like someone was rolling up strikes in X8 puts. The X8 69/66 PS traded 11k and OI on the 69 Put increased by 10k yesterday to 18k. We have also started to see interest in front end downside WTI structures in the event of an SPR release with put skew still looking relatively cheap.

Top stories listed below

Iran’s Rouhani: `Unlawful’ U.S. Sanctions Amount to `Terrorism’

U.S. Can’t Cut Iran Oil Sales Without Pushing Up Price: Minister

After Trump’s OPEC rebuke, UAE says oil prices driven by markets – Reuters News

Pompeo criticizes EU plan for special Iran payment channel – Reuters News

Bolton says U.S. will be aggressive, unwavering on Iran sanctions – Reuters News

Israel and Saudis Cheer Trump on Iran Moves While Europe Recoils

U.S. Oil Is Winning as Major Crude Buyer Works to Fill Iran Gap

Iraq Seeing Extra Requests From Customers to Replace Iranian Oil

UAE’s ADNOC to export new crude oil grade in Nov – sources – Reuters News

Crude Storage in ARA Falls to 5-Year Seasonal Low

India Is Said to Cut Imports of Iranian Oil to Zero in November

Saudis Shift Own Oil Diet to Supply Buyers Who Are Shunning Iran

Saudi Aramco signs crude oil supply term deal with China’s Rongsheng – source – Reuters News

Iran oil exports fall before US sanctions -global banking group – Reuters News

Iraq plans measured oil output and export rise: SOMO – Platts

Brent Oil to Stabilize in $70-$80/Bbl Into Year-End: Goldman

In Fight for Survival, China’s Dimming Oil Stars Pledge to Unite

U.S. Cash Crude-Grades firm on final day of rebalancing – Reuters News

U.S. Cash Products-Gulf Coast gasoline rises as trade for product rolls to November – Reuters News

U.S. oil refiners’ weekly capacity seen down 538,000 bpd -IIR – Reuters News

|

Implied Vol |

Realized Vol |

||||||

|

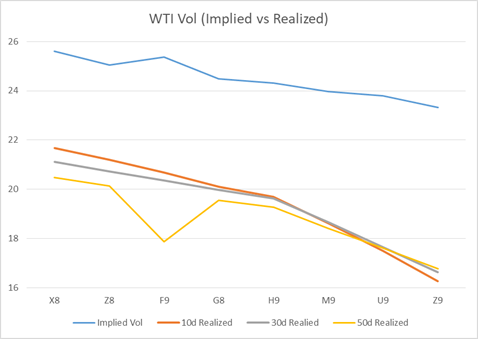

WTI Vol |

25-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.6 |

-0.04 |

1.17 |

21.69 |

21.12 |

20.48 |

|

|

Z8 |

25.04 |

-0.11 |

1.14 |

21.20 |

20.72 |

20.14 |

|

|

F9 |

25.38 |

-0.18 |

1.15 |

20.69 |

20.36 |

17.87 |

|

|

G8 |

24.48 |

-0.22 |

1.11 |

20.10 |

19.97 |

19.57 |

|

|

H9 |

24.31 |

-0.24 |

1.1 |

19.70 |

19.63 |

19.28 |

|

|

M9 |

23.97 |

-0.19 |

1.08 |

18.63 |

18.66 |

18.40 |

|

|

U9 |

23.8 |

-0.13 |

1.05 |

17.51 |

17.65 |

17.61 |

|

|

Z9 |

23.32 |

-0.18 |

1.02 |

16.27 |

16.64 |

16.79 |

CLV8 Implied Vs Realized Vol

|

Implied Vol |

Realized Vol |

||||||

|

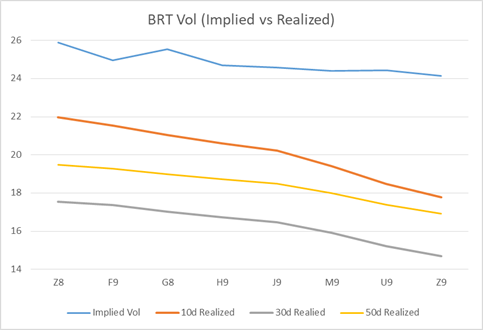

BRT Vol |

25-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

Z8 |

25.88 |

0.17 |

1.33 |

21.96 |

17.55 |

19.48 |

|

|

F9 |

24.96 |

0 |

1.27 |

21.53 |

17.36 |

19.28 |

|

|

G8 |

25.55 |

0 |

1.3 |

21.04 |

17.02 |

18.98 |

|

|

H9 |

24.7 |

-0.11 |

1.25 |

20.62 |

16.74 |

18.73 |

|

|

J9 |

24.58 |

-0.1 |

1.24 |

20.23 |

16.48 |

18.49 |

|

|

M9 |

24.4 |

-0.15 |

1.22 |

19.41 |

15.91 |

18.00 |

|

|

U9 |

24.43 |

-0.08 |

1.21 |

18.47 |

15.21 |

17.39 |

|

|

Z9 |

24.13 |

-0.04 |

1.18 |

17.78 |

14.71 |

16.91 |

COX8 Implied Vs Realized Vol

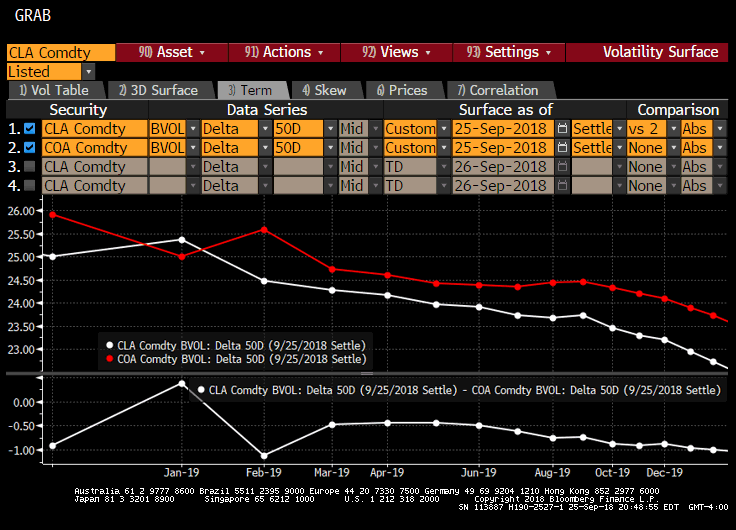

WTI/BRT Implied ATM Vol Curves

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

WTI/BRT Z18 ATM Call Roll x72.00/82.00 TRADES 67 1,900x

WTI G19 80 Call x71.35 vs BRT G19 90 Call x80.25 TRADES 11 2,000x 22d/20d

ICE Trade Recap

BRT Z18 82 Call x81.25 TRADES 211 850x 45d

BRT Z18 80/88 1×2 Call Spread x81.15 TRADES 197 500x 33d

BRT Z18 78/85 Fence x81.05 TRADES 7 1,000x 56d

BRT Z18 80 Put x71.20 TRADES 188 500x 41d

BRT F19 85/95 1×2 Call Spread x80.90 TRADES 107 500x 18d

BRT F/G19 80 Call Roll x80.60/80.25 TRADES 49 500x 53d/52d

BRT G19 73/83 Fence x80.85 TRADES 186 400x; TRADES 184 300x 64d

BRT G19 77/81/87/91 Call Condor TRADES 142 1,500x

BRT G19 80/90 Call Spread TRADES 311 200x; TRADES 309 100x; TRADES 306 200x; TRADES 305 500x; TRADES 304 1,000x; TRADES 303 1,000x

BRT H19 75/80/85/90 Call Condor TRADES 171 1,000x

BRT M19 65/80 Put Spread x79.10 TRADES 495 500x 32d

BRT M19 ATM Call x79.00 TRADES 588 1,150x

BRT M/Z19 ATM Call Roll x79.00/77.00 TRADES 183 1,000x 57d/60d

BRT M19 70/90 Fence x79.40 TRADES 22 500x 46d pp

BRT M19 80/90 Call Spread x79.25 TRADES 333 500x 29d

WTI Z/H20 85 Call Roll x79.65/75.90 TRADES 12 250x 42d/42d

CME Trade Recap

WTI X/Z18 73/74 Call Roll x72.30/72.00 TRADES 31 700x; TRADES 32 800x 45d/40d

WTI X18 70/77 Fence x72.10 TRADES 57 1,000x 45d

BRT Z18 84 Call x81.35 TRADES 140 1,400x 33d

BRT Z18 70/75 Put Spread vs 100 Call x81.20 TRADES 35 10,000x 11d

BRT Z18 70/75 Put Spread x81.20 TRADES 37.5 500x 10d

BRT G19 75/85 Strangle x80.55 TRADES 406 1,000x

WTI G19 67/71/77/81 Call Condor TRADES 157 1,000x

WTI H19 70/60 1×2 put spread x71.45 TRADES 188 1,000x 14d to the 1

WTI M19 75/90 Call Spread vs 60 Put x70.70 TRADES 97 600x 48d

WTI U19 ATM Call x70.00 TRADES 620 500x 60d

WTI Z19 90/102 1×2 Call Spread TRADES 12 1,200x

WTI Z19 60/80 Fence x68.70 TRADES 95 500x 51d

WTI Z/M20 ATM Call Roll x69.00/67.00 TRADES 71 300x; TRADES 69 100x 63d/63d

WTI Z/Z20 85/80 Call Roll TRADES 93 500x

CSO/ARB/APO Trade Recap

ARB Z18 -12.00 Put TRADES 10 100x

ARB Z18 -7.50 Call TRADES 18 200x

ARB Z18 -7.00/-9.00 Fence TRADES 61 500x

ARB Z18 -6.00 Call TRADES 9 1,000x

WTI APO F19 72 Call x71.60 TRADES 362 150x 50d

WTI APO 3Q19 50 Put TRADES 91 10x; TRADES 86 10x

WTI APO Cal19 50/60 Put Spread vs 75 Call x70.00 TRADES 183 25x

WTI APO Cal19 50/77.50 Fence TRADES 205 13x

WTI Skew Change (d/d)

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

X8 |

1.75 |

1.25 |

0.7 |

0.3 |

25.6 |

0.05 |

0.4 |

1.15 |

1.9 |

|

X8 (9/24) |

2 |

1.4 |

0.7 |

0.3 |

25.64 |

0.05 |

0.35 |

1.1 |

1.95 |

|

|

-0.25 |

-0.15 |

0 |

0 |

-0.04 |

0 |

0.05 |

0.05 |

-0.05 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

2.4 |

1.75 |

1 |

0.45 |

25.04 |

-0.1 |

0.05 |

0.65 |

1.4 |

|

Z8 (9/24) |

2.5 |

1.8 |

1 |

0.45 |

25.15 |

-0.15 |

-0.05 |

0.4 |

1.05 |

|

Change |

-0.1 |

-0.05 |

0 |

0 |

-0.11 |

0.05 |

0.1 |

0.25 |

0.35 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

2.75 |

2.1 |

1.25 |

0.65 |

25.38 |

-0.2 |

-0.1 |

0.4 |

1.1 |

|

F9 (9/24) |

3.05 |

2.25 |

1.35 |

0.65 |

25.56 |

-0.3 |

-0.25 |

0.1 |

0.75 |

|

Change |

-0.3 |

-0.15 |

-0.1 |

0 |

-0.18 |

0.1 |

0.15 |

0.3 |

0.35 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.1 |

2.45 |

1.55 |

0.8 |

24.48 |

-0.35 |

-0.25 |

0.2 |

0.85 |

|

G9 (9/24) |

3.3 |

2.6 |

1.7 |

0.85 |

24.7 |

-0.4 |

-0.45 |

-0.05 |

0.55 |

|

Change |

-0.2 |

-0.15 |

-0.15 |

-0.05 |

-0.22 |

0.05 |

0.2 |

0.25 |

0.3 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.6 |

2.9 |

1.95 |

1.05 |

24.31 |

-0.5 |

-0.5 |

-0.05 |

0.65 |

|

H9 (9/24) |

3.8 |

3.1 |

2.1 |

1.1 |

24.55 |

-0.6 |

-0.65 |

-0.3 |

0.4 |

|

Change |

-0.2 |

-0.2 |

-0.15 |

-0.05 |

-0.24 |

0.1 |

0.15 |

0.25 |

0.25 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4.35 |

3.7 |

2.6 |

1.4 |

23.97 |

-0.8 |

-0.9 |

-0.5 |

0.25 |

|

M9 (9/24) |

4.55 |

3.8 |

2.65 |

1.45 |

24.16 |

-0.9 |

-1.1 |

-0.5 |

-0.1 |

|

Change |

-0.2 |

-0.1 |

-0.05 |

-0.05 |

-0.19 |

0.1 |

0.2 |

0 |

0.35 |

Brent Skew change (d/d)

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

1.65 |

0.95 |

0.4 |

0.1 |

25.88 |

0.2 |

0.55 |

1.2 |

2.25 |

|

Z8 (9/24) |

1.7 |

0.95 |

0.35 |

0.05 |

25.71 |

0.25 |

0.65 |

1.35 |

2.35 |

|

Change |

-0.05 |

0 |

0.05 |

0.05 |

0.17 |

-0.05 |

-0.1 |

-0.15 |

-0.1 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

2.4 |

1.4 |

0.65 |

0.25 |

24.96 |

0.05 |

0.35 |

1.05 |

2.55 |

|

F9 (9/24) |

2.45 |

1.5 |

0.7 |

0.25 |

24.96 |

0.05 |

0.35 |

0.85 |

1.9 |

|

Change |

-0.05 |

-0.1 |

-0.05 |

0 |

0 |

0 |

0 |

0.2 |

0.65 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

2.65 |

1.75 |

0.95 |

0.4 |

25.55 |

0 |

0.25 |

0.8 |

1.75 |

|

G9 (9/24) |

3.1 |

1.85 |

1.05 |

0.45 |

25.55 |

-0.1 |

0.05 |

0.5 |

1.75 |

|

Change |

-0.45 |

-0.1 |

-0.1 |

-0.05 |

0 |

0.1 |

0.2 |

0.3 |

0 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

2.95 |

2.15 |

1.3 |

0.65 |

24.7 |

-0.15 |

0.1 |

0.7 |

1.75 |

|

H9 (9/24) |

3.1 |

2.3 |

1.4 |

0.7 |

24.81 |

-0.2 |

0 |

0.55 |

1.5 |

|

|

-0.15 |

-0.15 |

-0.1 |

-0.05 |

-0.11 |

0.05 |

0.1 |

0.15 |

0.25 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

J9 |

3.25 |

2.6 |

1.55 |

0.75 |

24.58 |

-0.25 |

-0.1 |

0.5 |

1.5 |

|

J9 (9/24) |

3.6 |

2.85 |

1.7 |

0.85 |

24.68 |

-0.4 |

-0.4 |

0.25 |

1.25 |

|

|

-0.35 |

-0.25 |

-0.15 |

-0.1 |

-0.1 |

0.15 |

0.3 |

0.25 |

0.25 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

3.75 |

3.05 |

2 |

1.05 |

24.4 |

-0.5 |

-0.4 |

0.3 |

1.35 |

|

M9 (9/24) |

3.95 |

3.25 |

2.15 |

1.15 |

24.55 |

-0.6 |

-0.55 |

0.05 |

0.95 |

|

|

-0.2 |

-0.2 |

-0.15 |

-0.1 |

-0.15 |

0.1 |

0.15 |

0.25 |

0.4 |

Iran’s Rouhani: `Unlawful’ U.S. Sanctions Amount to `Terrorism’

U.S. is committing "economic terrorism" by imposing "unlawful sanctions" on Iran, President Hassan Rouhani says in remarks during the UN General Assembly Tuesday in New York.

"The government of the United States of America, at least the current administration" seeks to render all international institutions irrelevant, Rouhani says

U.S. approach to international relations is "authoritarian" and displays a "Nazi disposition"

"We appreciate the efforts of the international community, the European Union, Russia, and China" in implementation the Iran nuclear accord, Rouhani says

Pleased international community didn’t acquiesce to U.S.

Rouhani invites U.S. back to negotiating table on Iran deal and says "beginning the dialogue" starts with ending threats

"Sanctions and extremism are two sides of the same coin"

Iran supports peace and democracy in entire Mideast and will continue to confront "genuine terrorism" in the region

U.S. Can’t Cut Iran Oil Sales Without Pushing Up Price: Minister

If U.S. President Donald Trump doesn’t want oil prices to go higher, he should stop “ill-suited interventions” that create tension in the Middle East and stop hampering Iran’s oil production and exports, Oil Minister Bijan Namdar Zanganeh says, according to Iranian Students News Agency.

“You can’t have your cake and eat it too”; Trump wants to cut Iran’s oil exports substantially without a price hike, “but these two can’t come together”

“It’s safe to say that no one has additional capacity for production”

After Trump’s OPEC rebuke, UAE says oil prices driven by markets – Reuters News

A senior UAE official said on Tuesday that oil prices were driven by markets, after U.S. President Donald Trump earlier rebuked OPEC and high oil prices. "At the end of the day we all know that oil prices are driven by markets, by supply and demand," said Anwar Gargash, UAE Minister of State for Foreign Affairs. "These are not things that can be manipulated by a decision here or there and god knows in the past OPEC had tried to lift the prices up by deliberation. It depends on inventories, expectation for growth," said Gargash, whose country is an OPEC member.

Pompeo criticizes EU plan for special Iran payment channel – Reuters News

The European Union’s plans for a "special purpose vehicle" (SPV) designed to circumvent U.S. sanctions against Iran’s oil exports is deeply counterproductive, U.S. Secretary of State Mike Pompeo said on Tuesday. "Unfortunately, just last night I was disturbed and indeed deeply disappointed to hear remaining parties in the Iran (nuclear) deal announce they are setting up a special payment system to bypass U.S. sanctions. This is one of the most counterproductive measures imaginable for regional global peace and security," Pompeo said at conference. "By sustaining revenues to the regime you are solidifying Iran’s ranking as (the) No. 1 state sponsor of terror."

Bolton says U.S. will be aggressive, unwavering on Iran sanctions – Reuters News

White House national security adviser John Bolton on Tuesday dismissed an EU plan for a special payments plan to circumvent U.S. sanctions against Iranian oil sales and pressed the SWIFT global payments messaging system to rethink dealing with Tehran. Speaking at a conference, Bolton also said the United States would be "aggressive and unwavering" in enforcing economic sanctions on Iran that are resuming after Washington withdrew from the 2015 Iran nuclear deal. He said the United States would not allow the European Union or anyone else to undermine them. In a statement after a meeting of Britain, China, France, Germany, Russia and Iran on Monday – the countries still in the deal, the group said they were determined to develop payment mechanisms to continue trade with Iran despite skepticism by many diplomats that this will be possible. Bolton, however, was skeptical that the European Union could create a "special purpose vehicle" – described by diplomats as a sovereign barter channel much like one used by the Soviet Union during the Cold War – that would sustain Iran’s oil sales. "The European Union is strong on rhetoric and weak on follow-through," Bolton said. "We will be watching the development of this structure that doesn’t exist yet and has no target date to be created. We do not intend to allow our sanctions to be evaded by Europe or anybody else." Bolton also said the United States expected Iran’s oil customers to slash their imports of Iranian crude to zero by Nov. 4 before U.S. sanctions kick back in on Nov. 5. U.S. officials have sent mixed signals on whether the oil purchases needed to be eliminated by then or simply significantly reduced. "Banks and financial messaging services such as SWIFT must take a good hard look at their business with Iran and ask themselves whether it is worth the risk," Bolton said. "SWIFT should follow the example of a growing number of businesses … that reexamined their dealings with the Iranian regime." Iran was barred from SWIFT, the Belgium-based Society for Worldwide Interbank Financial Telecommunication, in 2012, crippling its ability to make international bank transfers crucial to foreign trade. After the 2015 nuclear deal, it was reconnected, but European officials have said they expect the United States to apply pressure on SWIFT to once again cut Iran off.

Israel and Saudis Cheer Trump on Iran Moves While Europe Recoils

While U.S. President Donald Trump struggles to convince the world to follow his lead on Iran, he’s got at least three key allies firmly on his side. Blocks away from the UN, where Trump gave a speech Tuesday excoriating the Iranian regime and calling on the world to isolate its economy, the Saudis, Emirates and Israelis got together at a Manhattan hotel for a conference with essentially one theme: confronting Iran. The head of the Mossad, Israel’s intelligence agency, took the stage for a rare address in public just minutes after Saudi Foreign Minister Adel al-Jubeir and UAE Ambassador Yousef Al Otaiba spoke, in a vivid display of a growing thaw in relations between former Mideast rivals. And while Israelis and Saudis didn’t shake hands at the event, and made sure to sit at least one seat apart, they all brought the same message to the U.S. and the international community: With the 2015 nuclear deal falling apart, the world needs to crack down on Iranian involvement in Yemen, Syria and Lebanon, which they say poses a more immediate danger to the region. “If a missile is launched at Saudi Arabia and UAE, what will the reaction be and how will we be defended?” said Al Otaiba, the UAE’s ambassador to Washington “With or without JCPOA, the focus needs to be on Iran’s destabilization,” he said, referring to the Iran nuclear accord. An Israeli official, speaking on condition of anonymity, said Prime Minister Benjamin Netanyahu’s visit to New York this week, which will include meetings with Trump as well as French President Emmanuel Macron, will focus on Iran’s presence in Syria and its transfer of weapons to Hezbollah. “We have to find a way past this current impasse over the implementation of sanctions,” Michael Singh, managing director of The Washington Institute and a former senior director for Middle East affairs at the National Security Council, said at the conference. “Sanctions aren’t going to push Iran out of Syria. It won’t stop a conflict on the Golan Heights.”

U.S. Oil Is Winning as Major Crude Buyer Works to Fill Iran Gap

After South Korea became the first of Iran’s major oil customers to reduce imports to zero under American pressure, the nation’s biggest refiner is seeking alternative supplies to fill the gap. And U.S. crude is on the list. SK Innovation Co. is increasing purchases from America to make up for the drop in Iranian oil shipments before U.S. sanctions come into effect, according to a company spokesperson. Russia and Australia are other options, with the refiner already buying condensate, an ultra-light crude oil variety, from Russian producers, said the official, who asked not to be named because of internal policy. With U.S. pressure set to be more intense than during the Obama administration, the world’s oil buyers are having to look elsewhere to replace supplies from the Persian Gulf nation. Purchasing more from the U.S. may also help bilateral relations after President Donald Trump last year berated the Asian nation for a trade deficit, prompting the South Korean government to look to energy imports to fill the gap. The tightening Asian market due to the Iranian sanctions offers opportunity for U.S. condensate producers to boost exports to the region, Morningstar said last week. Condensate is especially popular with South Korea’s refiners, who have also been buying the oil from countries including Australia, Norway and Saudi Arabia. SK Innovation bought 3.08 million barrels of crude from the U.S. for July arrival, up from 1.04 million in March and 2.08 million barrels in April, a month before Trump said he would reimpose sanctions on Iran. It completely halted Iranian condensate shipments for August arrival.

Iraq Seeing Extra Requests From Customers to Replace Iranian Oil

Customers want to satisfy their needs with spot cargoes if they are available in addition to contractual quantities, Ali Nazar Faeq al-Shatari, Iraq’s national representative to OPEC, tells reporters in Singapore on Wednesday.

- The requirement is not permanent

- Iraq has received requests for additional oil that’s in excess of its capacity since 2016

- Disruption in Iranian exports is new factor to supply their refineries with alternative crude

- “Iran factor is added on the prompt demand”

- Iraq’s state oil company SOMO is looking at acquiring storage tanks in Asia and is open to discussions on more profit-sharing agreements as it seeks to expand its foothold in the region

UAE’s ADNOC to export new crude oil grade in Nov – sources – Reuters News

The Abu Dhabi National Oil Company (ADNOC) plans to export a new crude grade in November and started marketing the oil to its Asian customers this week, two sources with knowledge of the matter said on Wednesday. The new grade is Umm Lulu, which has an API gravity of 38.7 degrees and contains 0.7 percent sulphur, they said. "It’s heavier than Murban and Das," one of the sources said, referring to ADNOC’s traditional light grades. ADNOC could initially start exporting one to two cargoes a month, the source said. Umm Lulu is a blend produced from its Umm Lulu and SARB fields, operated by ADNOC Offshore. The fields will make a material contribution to the company’s production capacity target of 3.5 million barrels by end of 2018, a company spokesman said. Initial production capacity of the two fields is 50,000 barrels per day, which will ramp up to 129,000 barrels per day by the end of the 2018 and 215,000 barrels per day by 2023, he said.

Crude Storage in ARA Falls to 5-Year Seasonal Low

•Crude inventories in ARA region fell last week to the lowest level for the time of year since 2013, Genscape data show

•Stockpiles fell 2.9m bbl in week ended Sept. 21 to 51.6m bbl

•Biggest regional net weekly change was in Rotterdam -3.6m bbl

India Is Said to Cut Imports of Iranian Oil to Zero in November

India is not planning to buy any crude oil from Iran in November, raising the prospect that Tehran will lose another major customer as U.S. sanctions hit. Indian Oil Corp. and Bharat Petroleum Corp. haven’t asked for any Iranian cargoes for loading in November, according to officials at the companies. Nayara Energy also doesn’t plan any purchases, said an industry executive. Mangalore Refinery and Petrochemicals Ltd. hasn’t made any nominations for that month, but may do so later, a company official said. Final decisions on purchases aren’t due until early October, so the refiners could still change their minds. The company officials and industry executive asked not to be named citing internal policies. The rapid drop in Iranian exports has helped to push Brent crude, the global benchmark, to a four-year high above $80 a barrel. Further output losses could push prices even higher as refiners urgently seek replacement barrels elsewhere. Around the world, only Saudi Arabia and, to a lesser extent, United Arab Emirates and Russia, have the capacity to pump more. Brent hit an intraday high of $82.55 a barrel on Tuesday, up 23 percent this year, just after U.S. President Donald Trump railed against OPEC and demanded the cartel lower oil prices.

Major Buyer

India is the second-largest buyer of Iranian oil, having imported an average of 577,000 barrels a day this year, or about 27 percent of the Middle Eastern country’s exports, according to Bloomberg tanker tracking data. With South Korea, Japan and European nations also cutting imports to zero, the loss of the Indian refiners, even if temporarily, is a major blow for the Islamic republic. At the same time, the U.S. sanctions that are due to go into effect in early November are creating a major gap in the global oil market just as Brent crude hits a four-year high above $80 a barrel. Mercuria Energy Group Ltd. and Trafigura Group, among the world’s biggest trading houses, are predicting the loss of Iran’s supply will boost prices to $100 a barrel for the first time since 2014. That risk has been echoed by some of the world’s biggest oil companies. BP Plc Chief Executive Officer Bob Dudley sees the sanctions on the OPEC nation having a bigger impact on the market this time than the previous round of restrictions six years ago.

Harder Stance

U.S. President Donald Trump’s administration is taking a harder stance. It wants all oil imports from Iran to end by November, and it’s unclear if any waivers will be granted. In previous sanctions under Barack Obama, the government had allowed nations to continue purchases at reduced levels. The tougher attitude is already showing in Iranian barrels vanishing from the market. South Korea became the first of Iran’s top-three oil customers to heed the U.S. diktat by refraining from any purchases last month. Japanese refiners have also temporarily halted loadings. India and China had held out hope for Iran. It was only about four months ago that India’s foreign minister said that the country won’t adhere to unilateral restrictions and will continue buying Iranian crude. China also made similar comments and was said to have rejected an American request to cut imports. When Trump in May announced plans to reimpose sanctions on Iran’s oil exports, the market estimated a cut of about 300,000 to 700,000 barrels a day, Trafigura’s co-head of oil trading Ben Luckock said this week. However, the consensus has now moved to as much as 1.5 million barrels as the U.S. is “incredibly serious” about its measures, he said.

Saudis Shift Own Oil Diet to Supply Buyers Who Are Shunning Iran

As impending U.S. sanctions squeeze Iranian oil supplies, top OPEC member Saudi Arabia is changing its own crude diet to meet customer demand for alternative cargoes. The trading arm of state-run producer Saudi Aramco is said to be offering an ultra-light oil known as Khuff condensate, a rarely traded grade that’s typically processed in the nation’s domestic refineries. To free up this more valuable supply for export, the Middle East country is diverting its Extra Light crude to units that split it into raw materials for petrochemicals and fuels. Saudi Khuff supplies are entering the market at a time of growing demand for condensate, as operators of purpose-built splitters in countries such as South Korea and Japan scramble for alternative feedstock following a halt in purchases of Iran’s South Pars variety. The countries have turned to cargoes from Norway and the U.S., as well as the oil-product known as naphtha, to make up for the shortfall. Spot supplies of Khuff are valued at about $2 a barrel over the official selling price for Arab Extra Light crude for the month of October, according to a Bloomberg survey of three traders who participate in the market. Unlike crude exports from the kingdom, condensates can be traded in the spot market and come without destination restrictions. While Aramco sells most of its output via long-term contracts, its trading unit is increasingly leveraging the parent’s global network in procurement and refining. It’s dealing in non-Saudi crude, and made a sale of U.S. Mars oil to Taiwan’s Formosa Petrochemical Corp. in July this year. It’s also leaning on domestic refining operations to absorb restricted barrels in order to cash in on demand for more valuable and freely traded grades. Its strategy is playing out just as the Organization of Petroleum Exporting Countries rebuffs demands from U.S. President Donald Trump that it take action to reduce prices. The group and its allies signaled less urgency and stopped short of promising specific extra volumes of crude, saying output would be boosted only if customers requested it.

Saudi Aramco signs crude oil supply term deal with China’s Rongsheng – source – Reuters News

Saudi Aramco has signed a long-term deal with Zhejiang Rongsheng to supply crude oil to the Chinese company’s new refinery in eastern China, a source with knowledge of the matter said on Wednesday. The volume and grades to be supplied were not available. Saudi Aramco and Rongsheng could not be immediately reached for comment. Rongsheng International Trading Co, the trading arm of Chinese conglomerate Zhejiang Rongsheng Holding Group, has already bought spot Omani crude ahead of the new refinery’s start-up. Zhejiang Petrochemical, 51 percent owned by textile giant Rongsheng Holding Group, was in August awarded a quota to import 5 million tonnes of crude oil this year. The company plans to start up its 400,000-barrels-per-day refinery-petrochemical project in eastern China in late 2018.

Iran oil exports fall before US sanctions -global banking group – Reuters News

Iranian oil exports are declining ahead of a second round of U.S. sanctions to be imposed on Nov. 4 and Iran’s economy is likely to contract 3 percent this year and 4 percent in 2019, the Institute of International Finance said on Tuesday. Exports of crude oil and condensates have declined by 0.8 million barrels a day (mbd) from April to September 2018, the IIF, which represents major banks and financial institutions from around the world, said. It said crude oil and condensates exports were 2.8 mbd in April and are now estimated at 2.0 mbd in September. The IIF said in an updated note on Iran’s economy that oil exports are falling even although Iran is selling key grades at a deep discount and using its own tankers to ship products to China and India at no extra cost. The IIF said Iranian shippers were also providing generous payment terms and, in some cases, accepting euros and Chinese yuan instead of U.S. dollars. The IIF said barter trade and cash could play a bigger role as U.S. sanctions are enforced. The updated report comes as U.S. President Donald Trump and Iranian President Hassan Rouhani exchanged taunts at the United Nations General Assembly on Tuesday. The remaining parties to the 2015 Iran nuclear deal, which curbed Iran’s nuclear program in exchange for sanctions relief and from which Trump withdrew the United States in May, agreed on Monday to work to maintain trade with Tehran despite skepticism this is possible as U.S. sanctions to choke off Iranian oil sales resume in November. In a statement after a meeting of Britain, China, France, Germany, Russia and Iran, the group said they were determined to develop payment mechanisms to continue trade with Iran despite skepticism by many diplomats that this will be possible. The European Union’s plans for a "special purpose vehicle" (SPV) designed to circumvent U.S. sanctions against Iran’s oil exports is deeply counterproductive, U.S. Secretary of State Mike Pompeo said on Tuesday. Several European diplomats said the SPV idea was to create a barter system, similar to one used by the Soviet Union during the Cold War, to exchange Iranian oil for European goods without money changing hands. The IIF said such a system would likely fail to persuade major European companies to do business with Iran for fear of U.S. sanctions. "Iran may continue to be committed to the 2015 nuclear deal providing the EU and others do the same," the IIF said. "However, failure to renegotiate the deal with the U.S. would likely bring about even deeper damage to Iran’s economy," it added.

Iraq plans measured oil output and export rise: SOMO – Platts

Iraq expects to increase its output and exports in a gradual manner and has no intention of affecting market price and balance or taking another supplier’s market share, Ali Nazar Faeq Al-Shatari, Deputy Director General of State Oil Marketing, told S&P Global Platts in an interview. "For the end of this year, our plan is not that different from what figures show right now," Shatari, who is Iraq’s national representative for OPEC, said Monday on the sidelines of the Asia Pacific Petroleum Conference in Singapore. Iraq’s oil exports from the south could show a slight increase in September from August, he said, but added that the increase is within what the market needs. "It would not be a sudden increase that may affect the market price and the market balance," he said. By the end of this year, Shatari said: "So in this case it will be around 3.6 million b/d for exports…The production capacity may reach to over 4 million b/d." Iraq boosted its crude exports from the south to a new record high of 3.583 million b/d in August, up 40,000 b/d from July as the producer group followed up on its agreement to release more barrels to the market.

MARKET SHARE

Asked whether Iraq faces incremental demand for oil today because of looming US sanctions against Iran, Shatari said: "No we have had incremental demand since two years ago, and it’s the same demand. We have not been able to satisfy it because of limited export capacity." "We are not going to increase the production in order to take the market share of any other player. But it is based on market needs," he said. South Korea for one imported 36.21 million barrels of crude oil from Iraq in the second quarter, higher than 30.92 million imported in Q1 and 31.85 million received in Q4 last year, the latest data from state-run Korea National Oil Corp. showed. Reflecting Asia’s growing interest in Iraqi barrels, the spread between second-month Basrah Light crude and second-line Platts Dubai swap rallied to $1.18/b earlier this month on September 11, the highest premium since Platts first launched the daily cash assessment of the flagship Iraqi export grade in November last year.

ASIAN SHARE

Asia’s share in Iraq’s oil exports has risen to as high as 73% in recent months, up from about 28% in 2006, as the country has stepped up efforts to penetrate the market by satisfying customers’ needs, "It’s reaching high limits. It started from 28% in 2006, now it’s around 63% on average and in some months it even reached 73% of Iraqi crude oil going to Asia, [with] the rest going to Europe and the US," Shatari said. The Asian market is Iraq’s priority. "The strategy is to increase market share by satisfying the needs of customers, and our customers are mainly end-users who have refining systems of their own." A strategy that has helped Iraq boost market share is that it is not fussy about the size of the customer and offers reliable supply. "We are always searching and opening our doors to new customers even if they have limited refining capacity. We also don’t discriminate and apply the same terms and conditions to all our customers," he said, adding that Iraq also offers a lot of certainty to its buyers. Another strategy is to take stakes in assets in countries such as China, India and South Korea. But this is still being studied, he said. For example, Iraq was still studying the possibility of acquiring storage capacity in East Asia through holding talks with Chinese, South Korean and Japanese companies.

BASRAH MEDIUM CRUDE

Iraq is planning to add a new grade, Basrah Medium, to add more variety and supply its customers, he said. "Currently we have Basrah Light and Basrah Heavy, but Iraq has production of light crude oil in Basrah and some fields with an API of 34 to more than 40 API," he said. There are enough Basrah Medium supplies for export, but exports will only start once the logistics are ready, he said. Once Basrah Medium is launched, it will replace Basrah Light, said Shatari, adding that the big bunch of crude oil will be Basrah Medium, and Basrah Heavy crude will remain as it is.

Iraq’s crude oil offerings will comprised of Basrah Light with an API gravity of 34-40, Basrah Medium with 29-30 API and Basrah Heavy with 23-24 API. Asked to comment whether SOMO is reviewing its benchmark pricing for crude oil sales to Asia Shatari said: "SOMO keeps an eye and evaluates and assesses the market benchmark if it is from Platts, DME, Argus…Whatever benchmarks are available in the market." "Always we keep an eye and assessing it in very efficient ways. We are not in a hurry to apply any changes."

Brent Oil to Stabilize in $70-$80/Bbl Into Year-End: Goldman

Global marker Brent crude prices to stabilize in $70-$80/bbl range into the end of year as “another supply catalyst beyond Iran would likely be needed for prices to meaningfully break to the upside,” Goldman Sachs’ analysts including Damien Courvalin say in note Tuesday.

Price rally to November 2014 highs due to Iran exports declining faster than expected, OPEC not delivering commitment to strongly increase output, while global growth expectations are stabilizing and China restocking occurring

Iranian oil loadings showing 0.65m b/d decline since April across destinations, with negligible exports to Europe, Japan and Korea; shipments to India and China also down

Some Iranian production likely being exported through Iraq, with Basra loadings up 0.3m b/d over same period

Expects OPEC to offset such losses

OPEC guidance implies incremental 0.5m b/d production growth; Goldman believe there remains sufficient spare capacity to deliver this growth and offset further declines in Iranian output to expected cumulative loss of 1.4m b/d

Lack of new production growth guidance by OPEC “does not reflect a desire to let prices appreciate meaningfully further, but rather the historical pattern of OPEC responding to rather than front-running production losses”

While Iran exports have fallen quickly, path forward remains uncertain due to factors such as U.S-China trade war; China could increase imports from Iran

A large price increase from current levels will likely lead to an SPR release by the U.S. ahead of midterm elections

Goldman still says being long oil “offers a compelling returns opportunity, mostly from the 10% annual carry created by the current level of backwardation”

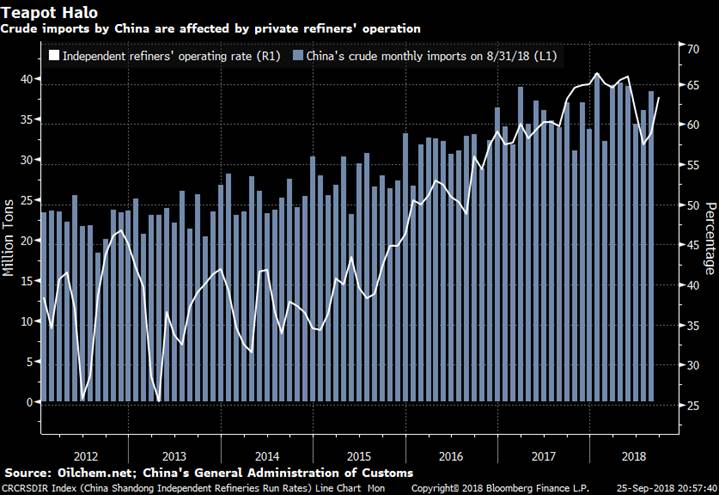

In Fight for Survival, China’s Dimming Oil Stars Pledge to Unite

A clutch of oil buyers in the world’s top market are facing an existential crisis, forcing them to band together or face the prospect of perishing. Independent refiners in the eastern Chinese province of Shandong plan to join forces to create three or four mega-projects over the next five years, according to Zhang Liucheng, who heads an alliance of the processors. With a proposed investment of 100 billion yuan ($15 billion), the consolidated plants will have capacity of 20 million tons a year each, and will focus on making more lucrative products like petrochemicals, he said. The refiners — known as teapots — burst onto the global oil market only a couple of years ago, and helped lift China past the U.S. as the world’s largest crude buyer. Now, they’re struggling in the face of competition from giant state-backed rivals, stricter tax rules, reduced access to funding and a campaign to cut overcapacity supported by President Xi Jinping. Profits have shrunk, and at least one has gone bust this year. “The supply-side reform in our industry might happen in second-half 2019,” Zhang, General Manager of Shandong Petrochemical & Energy Group, said in reference to the proposed government-backed policy to curb overcapacity. “Some smaller players face the risk of closures,” he said during the annual Asia Pacific Petroleum Conference (APPEC) in Singapore this week.

Shrinking Spotlight

At the previous APPEC, Zhang had announced that his company will team up with an equity fund that’s part of the provincial government of the Shandong province and a few other companies to form a $5 billion alliance. The venture even planned to gather more capital. A year on, the industry is being racked with uncertainty about its future. A deleveraging movement by China’s central government has reduced funding to teapots and raised financing costs. Financial risks remain Zhang’s biggest concern over the industry, with operating costs rising due to factors including a near 40 percent rally in crude prices in the past year and the closure of a tax loophole that has led to higher levies. Most of the teapots rely on state-run oil firms to sell to after the central government stopped allowing them to export fuel. Now they are likely to also be hit by a giant refinery run by Hengli Group that will begin supplying large volumes to state-backed companies such as PetroChina Co. and Sinopec from next year, Zhang said. That could reduce procurement from Shandong teapots significantly, he said.

High Hopes

Zhang has high hopes that consolidation will stem the decline of their business. The private processors will move away from their current mainstay of making oil products such as gasoline and diesel, shifting more than 40 percent of their revenue make-up to chemicals including aromatics and olefins, he said. The teapots that mainly produce oil products have a margin of about 5,600 yuan per ton, compared to an estimated margin of 7,500 yuan per ton for refineries that focus on petrochemicals, Zhang said. Switching will help Shandong teapots catch up with new refineries in China, he added. The teapots, of which there are now about 40, developed largely without the support of the government in a country dominated by state-backed enterprises. They grew from village-level businesses in the 1990s to become rising stars of China’s burgeoning energy industry. For Zhang, who likens the difficult conditions now to when the teapots first started, the threat facing the industry is merely a harsh season waiting to pass. “Our strength is that we are survivors,” Zhang said. “We are children of winter, why would we be afraid of the harsh cold?”

U.S. Cash Crude-Grades firm on final day of rebalancing – Reuters News

U.S. crude differentials strengthened on Tuesday as traders rebalanced positions and as U.S. crude’s discount to Brent widened to the most in a week. Traders rebalanced positions on the final day of cash roll trading, after the October futures contract expired last week. The October/November roll traded between +$0.30 and +$1. The three-day cash roll window ends Tuesday. U.S. crude’s discount to Brent widened by 47 cents to $9.59 per barrel, the widest level in over a week. Export demand for coastal grades typically rises when U.S. crude trades at a bigger discount compared with Brent. Light Louisiana Sweet firmed to trade at a $8.50 per barrel premium to U.S. crude futures, the strongest level in three months. West Texas Intermediate at East Houston, strengthened by about $1.50 to trade at a midpoint of about a $7.75 per barrel premium to futures. Inland grades also strengthened. West Texas Intermediate at Midland rose to as little as a $8 per barrel discount to U.S. crude, the strongest in about three months. Signs of a slowdown in production growth has supported prices and helped ease bottlenecks that sent prices to four-year lows, traders said. Meanwhile, crude inventories rose by 2.9 million barrels in the week to Sept. 21 to 400 million, industry group the American Petroleum Institute said, compared with analysts’ expectations for a decrease of 1.3 million barrels. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 260,000 barrels, API said.

•Light Louisiana Sweet WTC-LLS for October delivery jumped $2.20 to a midpoint of $8.5 and traded between an $8 and $9 a barrel premium to U.S. crude futures.

•Mars Sour WTC-MRS rose 75 cents and was seen bid and offered between a $4.50 and $5 a barrel premium to U.S. crude futures.

•WTI Midland WTC-WTM rose $1.50 to a midpoint of $9 a barrel discount and traded between a $10 and $8 a barrel discount to U.S. crude futures.

•West Texas Sour WTC-WTS rose $1.50 and was seen bid and offered between a $10 and $9 a barrel discount to U.S. crude futures.

•WTI at East Houston, also known as MEH, WTC-MEH traded at $7.80, $8 and $8.50 a barrel over WTI.

U.S. Cash Products-Gulf Coast gasoline rises as trade for product rolls to November – Reuters News

U.S. Gulf Coast gasoline cash differentials rose on Tuesday as the product rolled to trade against the November futures contract on the New York Mercantile Exchange, market participants said. M3 conventional gasoline gained 1.50 cents a gallon to trade at 3.25 cents per gallon above the gasoline futures benchmark, traders said. Trade for the product moved to Colonial Pipeline’s 55th cycle for delivery to New York Harbor. A3 CBOB gasoline rose 1.25 cents a gallon to trade at 0.5 cent per gallon below futures. In the Midwest, Chicago CBOB gasoline lost 1.75 cents a gallon to trade at 11.00 cents per gallon above the futures contract, market participants said. Trade began on the first cycle of October delivery into the Buckeye complex. Chicago ultra-low sulfur diesel rose a half penny to trade at 1.75 cents per gallon below the heating oil futures benchmark. In New York Harbor, M2 conventional gasoline rose a quarter of a penny to trade at 7.00 cents per gallon above the futures contract, traders said. U.S. gasoline stocks rose by 949,000 barrels, industry group the American Petroleum Institute said on Tuesday, compared with analysts’ expectations in a Reuters poll for a 788,000-barrel gain. Distillate fuels stockpiles fell by 944,000 barrels, compared with expectations for a 752,000-barrel gain, the API data showed. Refinery crude runs fell by 687,000 barrels per day, API data showed. The RBOB futures contract on NYMEX rose 1.3 cents to settle at $2.0677 cents a gallon on Tuesday. NYMEX ultra-low sulfur diesel futures gained 1.94 cents to settle at $2.3053 a gallon. Renewable fuel (D6) credits for 2018 hit fresh lows of 11 cents each on Tuesday, dropping from 14 cents each on Monday, traders said. Biomass-based (D4) credits fetched 33 cents each, down 35 cents each on Monday, traders said.

U.S. oil refiners’ weekly capacity seen down 538,000 bpd -IIR – Reuters News

U.S. oil refiners are estimated to have 1,570,000 barrels per day (bpd) of capacity offline in the week ending Sept. 28, reducing available refining capacity by 538,000 bpd from the previous week, data from research company IIR Energy showed on Wednesday. IIR expects offline capacity to fall to 1,529,000 bpd in the week to Oct. 5. The following are IIR weekly figures for offline capacity (in thousands of bpd):

|

Week ended Friday |

Sept. 26 |

Sept. 24 |

Sept. 21 |

|

10/05/18 |

1,529 |

1,529 |

1,529 |

|

9/28/18 |

1,570 |

1,561 |

1,455 |

|

9/21/18 |

1,032 |

1,087 |

1,073 |

|

9/14/18 |

695 |

703 |

703 |

|

9/07/18 |

322 |

322 |

322 |

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.