From: Wagner, Jonathan

Sent: Thursday, September 27, 2018 6:34:00 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

Good morning. Oil prices remain higher this morning on the back of Rick Perry saying the US has no intention of tapping the SPR…. I think we still need wait and see on that one. "If you look at the Strategic Petroleum Reserve and you were to introduce it into the market, it has a fairly minor and short-term impact. The numbers I’ve seen do anyway," Perry told reporters at the Department of Energy. He followed up by saying that "I’m comfortable that the world supply can absorb the sanctions that are coming.” This statement comes at the same time as Trump repeating that he is not happy with OPEC. Reuters is reporting this morning that Saudi will quietly add extra oil to the market over the next few months to offset a drop in Iranian bbls. Sources familiar with Saudi production plans said the kingdom would raise output by some 200,000-300,000 bpd in September and October on top of the 10.4 million bpd it produced in August, to meet additional client demand, mainly in Asia. A headline from Russia yesterday also had mentioned that they were producing slightly over their Aug figure of 11.21m b/d. IFX reported that Sep 1 – Sep 15 Russian production had come in at 11.35m b/d. While we still have no clear cut answer from India on imports, Iran’s Zarif said that India is committed to continuing economic cooperation and the import of oil from Iran. "Our Indian friends have always been categorical in their intention to continue with economic cooperation and import of oil. I heard the same statement from my Indian counterpart," Zarif said. A proposed plan by the European Union, Russia and China to sidestep U.S. sanctions on Iran by using an alternative payment system won’t give its oil buyers a free pass to handle Iranian crude. Legal sanctions experts and oil traders said the creation of a special purpose vehicle and payments channel to keep trade open with Iran, unveiled this week by EU Foreign Affairs chief Federica Mogherni, would still leave traders handling crude from the Islamic Republic vulnerable to punitive actions by the U.S. treasury department.

Middle East crude prices moved lower today with Cash Dubai falling 3c to +1.54 over swaps. DME Oman, which has been on fire fell to +5.71 over swaps after trading over +10/bbl yesterday as participants are concerned about the upcoming change in Aramco’s pricing methodology. 7 Nov Dubai partials traded in the window yesterday with Shell, Vitol and Equinor buying from Reliance, Chinaoil and Mercuria. Oct/Nov Dubai spreads are trading 68c backward. Angola has revised their Nov crude export program higher to 1.48m b/d (46 cargoes vs the orig planned 45). This compares to the Oct program of 1.51m b/d (49 cargoes planned). A Nigerian oil union says it’s optimistic a dispute with U.S. energy giant Chevron Corp. over a decision to close thousands of job contracts will be resolved after talks planned for Thursday. North Sea Brent loadings are set to rise to 6 cargoes in Nov (120k b/d) while Ekofisk crude loadings are set at 13 cargoes (260k b/d). These figures are both higher than the current October plan. GS Caltex is said to buy 6m bbl of US crude for Dec delivery while SK Energy is said to buy approximately 4m bbls of US crude for Dec delivery. The latest report from Energy Aspects calls for Q4 balances to be the tightest in more than an decade. “Our latest soundings suggest that Iranian exports may drop below 1m b/d in November.” “If Iranian exports were to drop to below 1m b/d, they would be nearly 2m b/d down from April export levels (2.85m b/d), which is something the market has not yet priced in.” Citi’s latest note says oil demand refinery runs will fall in autumn as summer demand declines. “While 1.5m b/d of supply is at risk in 4Q, high prices and slowing global economy could curb demand growth by 500k b/d next year. Saudi Arabia can deliver an extra 1m b/d if market requires it, including 500k b/d drawn from inventories.”

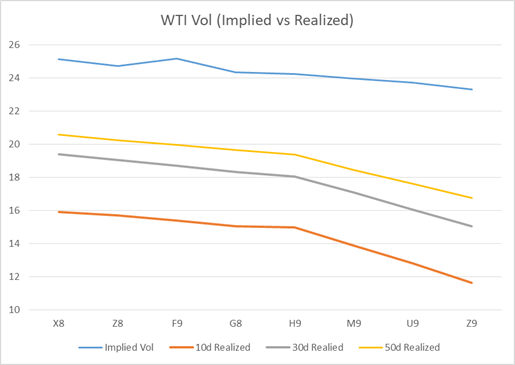

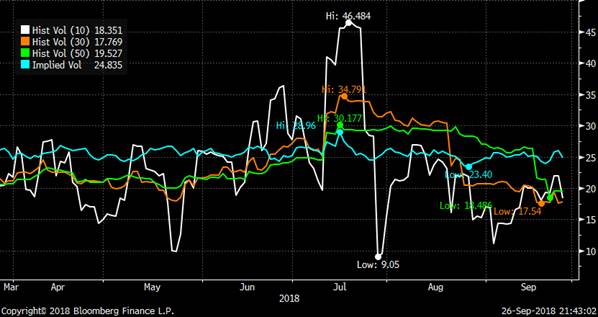

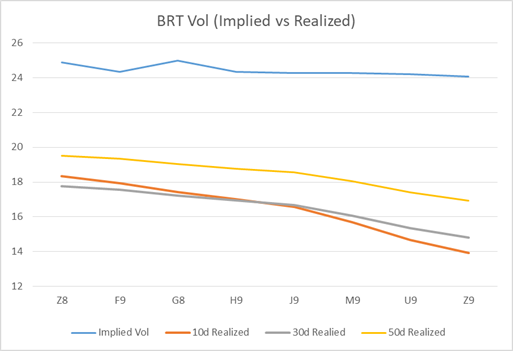

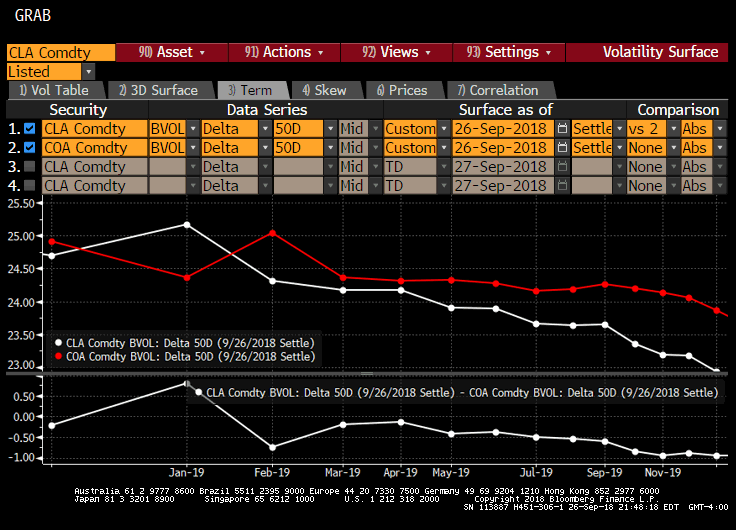

Vols were offered across the curve (primarily after stats) as front end implied’s continue to trade over recent realized. Z8 brent implied vol fell 1% yesterday with a breakeven of 1.27. front end call skew was offered for most of the day while interest emerged in the afternoon looking at various forms of risk reversals (to own call and sell put). This morning fences are trading in both WTI and Brent with interest seen looking to buy calls.

Top stories out this morning

U.S. will not tap oil reserve as Iran sanctions loom-Perry – Reuters News

Trump Again Reiterates He’s Not Happy With OPEC on Oil Prices

Saudi Arabia in short-term oil fix, fears extra U.S. supply next year – Reuters News

Iran’s foreign minister says India to continue economic cooperation, oil imports – media – Reuters News

Iran’s President Rouhani Says He Doesn’t Want War With U.S.

Iran determined to cooperate with UN in all fields/Stressing global community’s efforts to safeguard JCPOA

Iran to Continue to Work to Offset U.S. Sanctions: Zarif

EU Plan to Sidestep Iran Sanctions Won’t Keep Its Oil Flowing

Iran says Israel will "regret" further attacks on Syria – Reuters News

Middle East Crude-DME Oman stays above Brent; premium cools – Reuters News

Baffling Oil Surge Makes Obscure Benchmark the World’s Costliest

Oil Market’s 4Q to Be Tightest in More Than a Decade on Iran: EA

Total Sees $100 Oil Coming, And Says It May Not Be a Good Thing

SK Is Said to Buy 2 VLCCs of U.S. Crude for December

GS Caltex Is Said Buy 6M Bbl U.S. Crude for December

Russia Keeps October Crude Shipments Unchanged in Final Program

Angola Revises Crude Exports Higher to 1.48M B/D in Nov.: Plan

India’s U.S. Oil Imports Rise Nine Fold in April-August: DGCIS

US-Korea October crude flows to hit new high – Argus

Japan’s Iran Oil Imports Drop 31.7% Y/Y as Sanctions Near

Trump not happy about Federal Reserve raising interest rates – Reuters News

Venezuela’s president says he is willing to meet with Trump – Reuters News

Pemex plans light crude oil imports likely from U.S., says CEO – Reuters News

China’s CNPC says to boost domestic crude output through more winter drilling – Reuters News

APPEC interview: Qingdao Port sees Shandong refineries’ crude imports stable in 2019 – Platts

Cenovus Energy signs crude-by-rail transport deals with CN, CP – Reuters News

Brazil port to add floating crude storage – Argus

U.S. Cash Crude-Grades steady in thin trade – Reuters News

U.S. Cash Products-Midwest gasoline falls after surging last week – Reuters News

Singapore fuel oil inventories jump as weekly exports fall to over 7-year low – Reuters News

Singapore Weekly Fuel Stockpiles for Sept. 26 Rise 6.2% W/W

|

Implied Vol |

Realized Vol |

||||||

|

WTI Vol |

26-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.12 |

-0.48 |

1.14 |

15.90 |

19.39 |

20.59 |

|

|

Z8 |

24.71 |

-0.33 |

1.12 |

15.70 |

19.04 |

20.24 |

|

|

F9 |

25.18 |

-0.2 |

1.14 |

15.41 |

18.71 |

19.96 |

|

|

G8 |

24.33 |

-0.15 |

1.09 |

15.06 |

18.34 |

19.64 |

|

|

H9 |

24.23 |

-0.08 |

1.09 |

14.97 |

18.04 |

19.37 |

|

|

M9 |

23.96 |

-0.01 |

1.07 |

13.87 |

17.09 |

18.46 |

|

|

U9 |

23.71 |

-0.09 |

1.04 |

12.81 |

16.06 |

17.62 |

|

|

Z9 |

23.29 |

-0.03 |

1.01 |

11.65 |

15.04 |

16.75 |

CLZ8 implied vs realized vol

|

Implied Vol |

Realized Vol |

||||||

|

BRT Vol |

26-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

Z8 |

24.88 |

-1 |

1.27 |

18.35 |

17.77 |

19.53 |

|

|

F9 |

24.33 |

-0.63 |

1.23 |

17.94 |

17.57 |

19.33 |

|

|

G8 |

25 |

-0.55 |

1.26 |

17.44 |

17.23 |

19.04 |

|

|

H9 |

24.34 |

-0.36 |

1.23 |

17.02 |

16.94 |

18.78 |

|

|

J9 |

24.27 |

-0.31 |

1.22 |

16.58 |

16.67 |

18.55 |

|

|

M9 |

24.27 |

-0.13 |

1.21 |

15.69 |

16.08 |

18.05 |

|

|

U9 |

24.22 |

-0.21 |

1.19 |

14.66 |

15.34 |

17.43 |

|

|

Z9 |

24.08 |

-0.05 |

1.17 |

13.93 |

14.81 |

16.94 |

COZ8 implied vs realized vol

WTI / BRT Implied ATM Vol curve

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

WTI X18 72 Straddle vs BRT G19 81 Straddle TRADES 439 250x

WTI Z18 70 put x71.75 vs BRT Z18 80 put x80.85 TRADES 13 300x 35d/42d

WTI F19 75 Call x71.50 vs BRT F19 85 Call x80.20 TRADES 44 500x 35d/29d

WTI Z20 80 Call vs BRT M19 95 Call TRADES 132 1,000x

ICE Trade Recap

WTI X18 72 Call x72.00 TRADES 171 750x 53d

BRT Z18 85/92.50 Call Spread x81.25 TRADES 82 500x 22d

BRT Z18 85 Call TRADES 84 1,000x

BRT Z18 78.50/80.50/82.50 Call Fly TRADES 30 1,350x

BRT Z18 81/84 Call Spread x80.75 TRADES 111 450x 20d

BRT 1Q19 73/85 American Fence Strip x80.00 TRADES 59 500x 50d

BRT F19 73 Put x80.60 TRADES 83 500x; TRADES 82 1,000x 16d

BRT G19 77 Put x80.20 TRADES 246 500x 32d

BRT G19 80/90 Call Spread x80.10 TRADES 295 1,000x 36d

WTI G19 58/88 Fence x71.15 TRADES 13 500x 12d

WTI H19 80/90/100 Call Fly x71.15 TRADES 73 500x 11d

WTI H19 65/60 1×2 Put Spread TRADES 11 600x

BRT J19 75/68 1×2 Put Spread x79.65 TRADES 52 300x; TRADES 51 100x 2d

BRT M19 85 Call x79.10 TRADES 338 900x 39d

BRT M19 70/65 1×1.5 Put Spread TRADES 37 2,300x

WTI M19/N19 ATM Call Roll x70.50/70.00 TRADES 30 500x 55d/55d

BRT M19/Z19 ATM Call Roll x79.00/77.00 TRADES 184 600x 57d/60d

BRT Z19 ATM Call x77.00 TRADES 765 600x 60d

BRT Z19 68/78 Fence x76.80 TRADES 288 400x 80d

CME Trade Recap

WTI X18 75 Call TRADES 64 1,000x

WTI X18 70/68 1×2 Put Spread TRADES 1 500x

BRT Z18 70 Put TRADES 12 2,500x

WTI H19 80/90/100 Call Fly x71.15 TRADES 73 1,000x 11d

WTI H19/M19 71/70.50 Call Roll x71.15/70.50 TRADES 98 1,400x 55d/55d

WTI M19 70/75/85 Broken Call Fly x70.70 TRADES 4 1,100x

WTI M19 55/50 1×2 Put Spread TRADES 8 700x

WTI Z19 65/70 Put Spread x68.50 TRADES 218 500x 12d

WTI Z20 75/100 1×2 Call Spread x64.75 TRADES 222 500x 26d

WTI Z20 60/70 Fence x64.50 TRADES 70 400x

CSO/ARB/APO Trade Recap

WTI CSO X/Z18 0.20 Put (7A) TRADES 16.5 500x

WTI CSO Z/F19 0.25 Put (WA) TRADES 21 1,000x; TRADES 22 1,000x; TRADES 21.5 2,000x

WTI CSO Z/F19 0.50 Put (WA) TRADES 40 2,000x

WTI CSO Z/F19 0.20 Put (7A) TRADES 20 500x

WTI CSO F/G19 0.50/1.00 Call Spread vs -0.15 Put (7A) TRADES 1 2,500x

ARB Z18 -6.00 Call TRADES 9 3,000x; TRADES 8 1,500x

ARB Z18 -7.00 Call TRADES 32 500x

ARB M19 -6.00 Call TRADES 51 100x; TRADES 52 100x

WTI APO 4Q18 72 Call x71.60 TRADES 221 60x 50d

WTI Skew Change (d/d)

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

X8 |

2.05 |

1.6 |

0.95 |

0.45 |

25.12 |

-0.15 |

-0.05 |

0.35 |

0.9 |

|

X8 (9/25) |

1.75 |

1.25 |

0.7 |

0.3 |

25.6 |

0.05 |

0.4 |

1.15 |

1.9 |

|

|

0.3 |

0.35 |

0.25 |

0.15 |

-0.48 |

-0.2 |

-0.45 |

-0.8 |

-1 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

2.75 |

1.95 |

1.15 |

0.55 |

24.71 |

-0.2 |

-0.15 |

0.25 |

0.9 |

|

Z8 (9/25) |

2.4 |

1.75 |

1 |

0.45 |

25.04 |

-0.1 |

0.05 |

0.65 |

1.4 |

|

Change |

0.35 |

0.2 |

0.15 |

0.1 |

-0.33 |

-0.1 |

-0.2 |

-0.4 |

-0.5 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

3.05 |

2.25 |

1.35 |

0.7 |

25.18 |

-0.3 |

-0.2 |

0.2 |

0.8 |

|

F9 (9/25) |

2.75 |

2.1 |

1.25 |

0.65 |

25.38 |

-0.2 |

-0.1 |

0.4 |

1.1 |

|

Change |

0.3 |

0.15 |

0.1 |

0.05 |

-0.2 |

-0.1 |

-0.1 |

-0.2 |

-0.3 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.35 |

2.6 |

1.65 |

0.85 |

24.33 |

-0.4 |

-0.35 |

0.1 |

0.7 |

|

G9 (9/25) |

3.1 |

2.45 |

1.55 |

0.8 |

24.48 |

-0.35 |

-0.25 |

0.2 |

0.85 |

|

Change |

0.25 |

0.15 |

0.1 |

0.05 |

-0.15 |

-0.05 |

-0.1 |

-0.1 |

-0.15 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.9 |

3.1 |

2.1 |

1.1 |

24.23 |

-0.55 |

-0.6 |

-0.15 |

0.5 |

|

H9 (9/25) |

3.6 |

2.9 |

1.95 |

1.05 |

24.31 |

-0.5 |

-0.5 |

-0.05 |

0.65 |

|

Change |

0.3 |

0.2 |

0.15 |

0.05 |

-0.08 |

-0.05 |

-0.1 |

-0.1 |

-0.15 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4.75 |

3.9 |

2.65 |

1.45 |

23.96 |

-0.85 |

-1 |

-0.65 |

0 |

|

M9 (9/25) |

4.35 |

3.7 |

2.6 |

1.4 |

23.97 |

-0.8 |

-0.9 |

-0.5 |

0.25 |

|

Change |

0.4 |

0.2 |

0.05 |

0.05 |

-0.01 |

-0.05 |

-0.1 |

-0.15 |

-0.25 |

Brent Skew Change (d/d)

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

2.2 |

1.35 |

0.55 |

0.2 |

24.88 |

0.1 |

0.35 |

0.8 |

1.55 |

|

Z8 (9/25) |

1.65 |

0.95 |

0.4 |

0.1 |

25.88 |

0.2 |

0.55 |

1.2 |

2.25 |

|

Change |

0.55 |

0.4 |

0.15 |

0.1 |

-1 |

-0.1 |

-0.2 |

-0.4 |

-0.7 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

2.7 |

1.5 |

0.7 |

0.25 |

24.33 |

0 |

0.2 |

0.65 |

1.7 |

|

F9 (9/25) |

2.4 |

1.4 |

0.65 |

0.25 |

24.96 |

0.05 |

0.35 |

1.05 |

2.55 |

|

Change |

0.3 |

0.1 |

0.05 |

0 |

-0.63 |

-0.05 |

-0.15 |

-0.4 |

-0.85 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.05 |

1.95 |

1.05 |

0.45 |

25.00 |

-0.1 |

0.1 |

0.55 |

1.5 |

|

G9 (9/25) |

2.65 |

1.75 |

0.95 |

0.4 |

25.55 |

0 |

0.25 |

0.8 |

1.75 |

|

Change |

0.4 |

0.2 |

0.1 |

0.05 |

-0.55 |

-0.1 |

-0.15 |

-0.25 |

-0.25 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.25 |

2.4 |

1.4 |

0.65 |

24.34 |

-0.2 |

0 |

0.55 |

1.4 |

|

H9 (9/25) |

2.95 |

2.15 |

1.3 |

0.65 |

24.7 |

-0.15 |

0.1 |

0.7 |

1.75 |

|

|

0.3 |

0.25 |

0.1 |

0 |

-0.36 |

-0.05 |

-0.1 |

-0.15 |

-0.35 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

J9 |

3.6 |

2.8 |

1.65 |

0.8 |

24.27 |

-0.35 |

-0.15 |

0.4 |

1.25 |

|

J9 (9/25) |

3.25 |

2.6 |

1.55 |

0.75 |

24.58 |

-0.25 |

-0.1 |

0.5 |

1.5 |

|

|

0.35 |

0.2 |

0.1 |

0.05 |

-0.31 |

-0.1 |

-0.05 |

-0.1 |

-0.25 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4.05 |

3.25 |

2.1 |

1.1 |

24.27 |

-0.55 |

-0.5 |

0.15 |

1.1 |

|

M9 (9/25) |

3.75 |

3.05 |

2 |

1.05 |

24.4 |

-0.5 |

-0.4 |

0.3 |

1.35 |

|

|

0.3 |

0.2 |

0.1 |

0.05 |

-0.13 |

-0.05 |

-0.1 |

-0.15 |

-0.25 |

U.S. will not tap oil reserve as Iran sanctions loom-Perry – Reuters News

The Trump administration is not considering a release from the U.S. emergency oil stockpile to offset the impact of looming Iran sanctions, and will instead rely on big global producers to keep the market stable, Energy Secretary Rick Perry said on Wednesday. "If you look at the Strategic Petroleum Reserve and you were to introduce it into the market, it has a fairly minor and short-term impact. The numbers I’ve seen do anyway," Perry told reporters at the Department of Energy, explaining the administration’s thinking. Oil analysts have speculated for months that the Trump administration could tap the U.S. Strategic Petroleum Reserve (SPR) in an effort to tame rising prices ahead of the Nov. 6 midterm elections. High oil prices are a political risk for President Donald Trump and his fellow Republicans. The SPR currently holds about 660 million barrels of mostly sour grade crude in underground caverns in Texas and Louisiana. Under U.S. law, the government can sell up to 30 million barrels of oil, or about the amount of petroleum the United States uses in 36 hours, from the reserve over a number of weeks. Perry said that, while price spikes are possible in the short-term, "I’m comfortable that the world supply can absorb the sanctions that are coming." Up to 300,000 barrels per day (bpd) of oil could reach markets if Iraq allows it to flow from the Kurdistan region in the north, Perry said. He also said up to an additional 300,000 bpd could soon come to market from an oilfield in the Neutral Zone that Saudi Arabia and Kuwait share, if they come to agreement. Oil traded in London fell 53 cents to settle at $81.34 a barrel on Wednesday. On Tuesday, Brent crude rose as high as $82.55, the highest since November 2014, on worries about the re-imposition of U.S. sanctions on Nov. 4 on Iran, a member of the Organization of the Petroleum Exporting Countries (OPEC). Oil producers from OPEC and Russia met over the weekend but ruled out any immediate increase in output. The move effectively rebuffed Trump’s calls on oil producers to take action. Saudi Arabian Energy Minister Khalid al-Falih said on Sunday he does not influence oil prices, after Trump called on OPEC to bring down the cost of fuel. The White House has said it wants Iran’s oil consumers to cut their purchases to zero. But there are expectations that the administration could offer exemptions to countries that have reduced their intake. Perry said he thought the sanctions could be carried out on a "graduated" basis, apparently meaning limits on purchases could increase over time, but he did not offer further details.

Trump Again Reiterates He’s Not Happy With OPEC on Oil Prices

“I’m not happy with OPEC,” President Trump says, speaking during a news conference in New York. “I told them: ’I’m not happy with OPEC."

Saudi Arabia in short-term oil fix, fears extra U.S. supply next year – Reuters News

Saudi Arabia will quietly add extra oil to the market over the next couple of months to offset a drop in Iranian production but is worried it might need to limit output next year to balance global supply and demand as the United States pumps more crude. The kingdom, OPEC’s top producer, came under renewed pressure last week from U.S. President Donald Trump to cool oil prices ahead of a meeting in Algiers between a number of OPEC ministers and allies including Russia. Two sources familiar with OPEC policy said Saudi Arabia and other producers discussed a possible production increase of about 500,000 barrels per day (bpd) among the Organization of the Petroleum Exporting Countries and non-OPEC allies. But Riyadh decided against pressing for an official increase now as it realised it would not secure agreement from all producers present at the talks, some of which lack spare production capacity and would be unable to boost output quickly. Such a move would have unsettled relations among producers, the sources said, with the Saudis keen to maintain unity among the so-called OPEC+ alliance in case Riyadh wants to change course in future and seek their collaboration on an output cut. "There are only two months left until the end of the year, so why create tensions now between Saudi Arabia, Iran and Russia?" one source familiar with the Algiers discussions said. Saudi Energy Minister Khalid al-Falih said on Sunday he was concerned that oil production gains, mainly from the United States, could outstrip a projected increase in oil demand and result in an inventory overhang globally. "There are more demand threats next year compared to supply threats," said the second source, who also has knowledge of the talks. Oil prices rose to their highest since 2014 above $80 per barrel this week on fears that a steep decline in Iranian oil exports because of new U.S. sanctions will deepen an oil deficit, along with production declines in Venezuela.

GLUT FEARS?

However, OPEC’s latest report released at the weekend forecast that its non-OPEC rivals led by the United States would increase output by 2.4 million bpd in 2019 while global oil demand should grow by just 1.5 million bpd. That, Saudi thinking goes, could create a large surplus of crude next year, especially if a stronger dollar and weaker emerging market economies reduce global demand for oil. The big unknown, however, is to what extent Iran will be forced to reduce output next year as customers in Europe and Asia walk away from its oil, in reaction to U.S. sanctions. OPEC’s own reports show Iranian supply has already fallen by around 300,000 bpd in recent weeks, although Iran insists it has remained steady at some 3.8 million bpd. Sources familiar with Saudi production plans said the kingdom would raise output by some 200,000-300,000 bpd in September and October on top of the 10.4 million bpd it produced in August, to meet additional client demand, mainly in Asia.

DECEMBER CROSSROADS

Saudi Arabia, the world’s largest oil exporter, is the only major producer with enough spare capacity to raise output quickly, balancing supply and demand. The kingdom effectively acts as the oil market’s central banker, its thinking and action on supply closely watched by traders. At the moment, Riyadh is gathering data and has not decided on its exact course of action for next year. If Iranian supply turns out tighter than anticipated and prices rise further, a formal production increase from OPEC and allies next year may still be possible and will be discussed at a meeting on Dec. 6-7, the two sources said. The exact, additional volumes and the timeline for any increase would depend on producers’ compliance with their current output agreement in coming months and the market outlook for 2019, one of the sources said. "The reality is that no one (outside Saudi Arabia) can raise output in the next few weeks. But many can do that in 12 months or so," one of the sources said.

Iran’s foreign minister says India to continue economic cooperation, oil imports – media – Reuters News

Iran’s Foreign Affairs Minister Mohammad Javad Zarif said that India is committed to continuing economic cooperation and the import of oil from Iran, video news agency ANI, a Reuters affiliate, reported on Thursday. Zarif made the comments after a meeting with his Indian counterpart Sushma Swaraj in New York on the sidelines of United Nation General Assembly though no time was given for when the meeting occurred, according to the ANI video. "Our Indian friends have always been categorical in their intention to continue with economic cooperation and import of oil. I heard the same statement from my Indian counterpart," Zarif said, according to the ANI video. U.S. President Donald Trump is due to renew sanctions against Iran from Nov. 4 to halt the OPEC member nation’s oil exports.

Iran’s President Rouhani Says He Doesn’t Want War With U.S.

Iranian President Hassan Rouhani said his nation doesn’t want to go to war with the U.S., striking a conciliatory tone a day after President Donald Trump’s national security adviser warned Iran’s rulers there will be "hell to pay" if they harm the U.S. “We do not wish to go to war with America anywhere in the region, we do not wish to attack them,” Rouhani told reporters in New York. “But we ask America to adhere to laws and respect the national sovereignty of nations.” Rouhani’s comments came after Trump used a United Nations Security Council session officially focused on non-proliferation to reiterate his view that the 2015 nuclear agreement with Tehran was a “horrible, one-sided deal.”

Both Trump and Rouhani spoke before the General Assembly on Tuesday, trading accusations against each other’s countries. The Trump administration is trying to win global support for its tougher Iran policy, which includes the U.S,. withdrawal in May from the international nuclear accord negotiated by President Barack Obama, and re-imposing sanctions on the Persian Gulf country. His stated aim is to force Iran’s leaders into a new agreement that also curbs their regional ambitions. But the rest of the world isn’t following suit, with the European Union, China and Russia earlier this week announcing their plans for a financing mechanism to allow “legitimate” business to continue with Iran. Rouhani on Wednesday said he was “encouraged” by the financing announcement but that more constructive efforts are needed for Iran to remain part of the nuclear deal. He acknowledged the U.S. sanctions were putting pressure on his nation’s economy, but said Iran would hunker down until the Americans eventually return to the deal. The financing initiative was condemned by U.S. Secretary of Secretary Mike Pompeo at an anti-Iran event in New York on Tuesday. At the same gathering, National Security Adviser John Bolton said, “We do not intend to allow our sanctions to be evaded by Europe or anybody else.” On Monday, Bolton declared that the “days of impunity for Tehran and its enablers are over” and warned: “The murderous regime and its supporters will face significant consequences if they do not change their behavior. Let my message today be clear: We are watching, and we will come after you.” At his news conference on Wednesday evening, Trump predicted that Iran "is going to come back to me" to negotiate, adding that the country’s fortunes would improve if that happened. "I want them to have a great economy," he said. "I want them to sell so much oil" to keep oil prices down. Rouhani on Wednesday underscored his country’s determination to resist outside pressure, and expressed some optimism for the future. “The U.S. will one day come back to the nuclear deal. What the U.S. is doing does not benefit the people of America or the people of Iran,” he said. “The Iranian government has been in much tougher positions. Our people are patient people, we have resisted such pressures in the past.”

Iran determined to cooperate with UN in all fields/Stressing global community’s efforts to safeguard JCPOA

In the meeting with Secretary-General of the United Nations António Guterres on Wednesday in New York, President Hassan Rouhani said, “The United Nations should carry out its responsibilities in solidity of international laws, so that no country can violate international commitments, including resolutions of the Security Council”. He also said, “The clear stances of UN Secretary General in protecting the JCPOA as the symbol of success gained from dialogue and diplomacy will be effective”. After the United States’ illegal withdrawal from the nuclear deal, Iran has so far lived up to its commitments under the deal, said the President, adding, “We should work hard so that other countries can cooperate for the continuation of the JCPOA in action, in addition to taking political stances”. He also said that Iran was ready to cooperate with UN and regional and international issues, as well as positive measures in resolving the Syrian and Yemeni crises, adding, “Iran, Turkey and Russia have been able to take good steps in establishing peace and security and fighting terrorism in Syria”. “The three countries’ agreement prevented bloodshed in Idlib from breaking out and we hope that the Astana process, along with Geneva process, can achieve full success,” continued Rouhani. He went on to express concerns about human catastrophes in Yemen and said, “The United Nations should work more on the Yemeni situation and deliver humanitarian aid to the people of the country”. Dr Rouhani said, “The Islamic Republic of Iran is determined to have full cooperation and coordination with the UN in different regional and international fields”. At the same meeting, Secretary-General of the United Nations António Guterres hailed the Iranian government’s response to the United States’ withdrawal from the JCPOA, adding, “As an international agreement, the JCPOA is endorsed by the United Nations and the Security Council and should be fully implemented, and sanctions against Iran are not endorsed by the UN”. Stating that the UN encourages Europe and Iran’s other partners to resist against sanctions against Iran, he said, “We believe that the breach of the agreement was against UNSC regulations and sanctions out of the framework of the UN regulations will be followed by human and economic impacts”. He also hailed Iran’s positive role in Syrian developments, and stressed more cooperation with Iran in the fight against terrorism and helping crisis-hit peoples in the region, especially in Yemen.

Iran to Continue to Work to Offset U.S. Sanctions: Zarif

"We will continue to work to offset unlawful U.S. sanctions & irrevocably eliminate destabilizing phenomenon of U.S. extraterritorial laws," Iranian Foreign Minister Mohammad Javad Zarif says in tweet.

Zarif says U.S. "is so devoid of credibility it’s been forced to hide behind procedure in order to avoid facing Iran at the Security Council."

"It is unfortunate to see a U.S. Administration with destructive unilateralism in its DNA abuse a multilateral forum to attack multilateralism."

Says "deeply troubling behavior at home, and deeply malign activities abroad," are why the U.S. administration would need "cheap distractions to obfuscate its commitment to destabilization."

EU Plan to Sidestep Iran Sanctions Won’t Keep Its Oil Flowing

A proposed plan by the European Union, Russia and China to sidestep U.S. sanctions on Iran by using an alternative payment system won’t give its oil buyers a free pass to handle Iranian crude. Legal sanctions experts and oil traders said the creation of a special purpose vehicle and payments channel to keep trade open with Iran, unveiled this week by EU Foreign Affairs chief Federica Mogherni, would still leave traders handling crude from the Islamic Republic vulnerable to punitive actions by the U.S. treasury department. “I think it is a welcome development,” Daniel Martin, a partner and sanctions expert at Holman Fenwick Willan in London, said of the EU’s alternative plan. “But oil is not the arena it is going to be tested and used first.” Crude is the key driving force behind Iran’s economy and the Trump administration is trying to cripple the regime by re-imposing sanctions, despite a deal struck in 2015 that saw the country agree to curtail its nuclear program. Even if they used an alternative payment system incorporating bartering, envisioned in the proposal from the EU, Russia and China, any customers would still be vulnerable to secondary sanctions for simply buying the oil. “I don’t think you can make out a case that a barter transaction is not a purchase,” Martin said. The only oil trading companies willing to use the proposed system would also have to be willing to take on the risk of being sanctioned themselves, Martin said. The biggest traders, such as Vitol Group, Trafigura Group Pte Ltd., who are based in Europe, transact mostly in U.S. dollars and have operations in America and would be unwilling to take that risk. Gunvor Group Ltd., which handles about 2.7 million barrels a day of crude and products, and opened offices in Houston and Stamford, Connecticut, last year, said it won’t be handling Iranian oil anytime soon. “Gunvor does no trading with Iran. We comply strictly with all applicable international sanctions, and will not trade oil or products with any country, including Iran, that would consist of a violation of those sanctions,” Seth Pietras, a company spokesman said. Trafigura and Vitol also don’t plan to use the proposed payment channel, people familiar with the traders’ plans said. The relatively high dollar value of crude cargoes will also make oil an unlikely product to be traded under the proposed bartering system. A supertanker with a full cargo of oil would be worth about $160 million at today’s prices. That means some form of traditional commodity trade financing, outside of the special payments channel, would likely be necessary, even though banks and financial institutions are reluctant to support legal trade with Iran, Martin said. The plan also wouldn’t address reputational risks for oil traders, Martin said. Those trying to use the payment system would likely face U.S. entities refusing to do business with them for handling Iran oil, even if they weren’t technically violating the U.S. sanctions.

Iran says Israel will "regret" further attacks on Syria – Reuters News

The secretary of Iran’s Supreme National Security Council has said Israel will be sorry if it continues to attack Syria’s army and its allies. Iran and Russia have both backed Syrian President Bashar al-Assad in a seven-year war against rebels. But Israel, increasingly concerned that its enemy Iran may establish a long-term military presence in its neighbor, says it has carried out more than 200 attacks against Iranian targets in Syria in the last two years. "The Zionist regime has been trying to establish a crisis in Syria and has taken steps to directly support terrorist groups and target the Syrian army and forces who are confronting terrorism," Ali Shamkhani, secretary of Iran’s Supreme National Security Council, said on Thursday, according to the semi-official Tasnim news agency. "And if it continues, it will face reactions that will cause regret." He did not specify what this might mean. The Supreme National Security Council, chaired by President Hassan Rouhani, decides on Iran’s foreign and security policy together with Supreme Leader Ayatollah Ali Khamenei. Shamkhani made the comments during a meeting with his Russian counterpart, Nikolai Patrushev, in Tehran. Russia said on Monday it would supply Syria with an S-300 surface-to-air missile system despite strong Israeli objections, a week after Moscow accused Israel of indirectly causing the downing of a Russian military jet by Syria air defenses.

Middle East Crude-DME Oman stays above Brent; premium cools – Reuters News

Middle East crude benchmark DME Oman’s settlement price on Thursday remained above Brent for a third session, although its premium to Dubai swaps tumbled from multi-year highs as short-covering activities eased, traders said. DME Oman’s premium to Dubai swaps dropped to $5.71 a barrel from $10.48 in the previous session, Reuters calculations showed.

RUSSIA: Surgutneftegaz has offered six ESPO cargoes for November loading in a tender that will close on Friday. It last sold an ESPO cargo at $6 a barrel above Dubai quotes. Traders said ESPO may have traded at $6.50 a barrel late last week, although there were no details on the buyer or seller. ONGC also offered a Sokol cargo loading in end-November to early December.

WINDOW: Cash Dubai’s premium to swaps edged down 3 cents to $1.54 a barrel.

Baffling Oil Surge Makes Obscure Benchmark the World’s Costliest

A two-day surge has turned a sludgy, sulfurous and low-quality crude into the world’s costliest oil benchmark, confounding traders and throwing the Asian market into turmoil. Oman oil on the Dubai Mercantile Exchange, which will play a key role when Saudi Arabia sets the cost of its shipments to Asia next month, is now more expensive than New York’s West Texas Intermediate and London’s Brent. Speculation over what’s driving the gain includes lower supply of similar-quality barrels from Iran because of U.S. sanctions and purchases by top crude importer China. The dramatic gain of 11 percent in just two days reverberated this week around the annual Asia Pacific Petroleum Conference in Singapore — one of the biggest gatherings of the global oil-trading industry. “Have you seen Oman?” replaced “Good evening” for many in the cocktail circuit. The speed and strength of Oman’s surge versus other benchmarks surprised market participants, industry consultant JBC Energy GmbH said in a report on Thursday. “It is very unusual to see DME at a premium to ICE Brent, let alone at such a high level. Given that the vast share of Omani crude is delivered to China, it is easy to conclude that it is the main driver for this unusual jump.” Previously a lesser-known marker, DME Oman’s status was boosted by Saudi Arabia’s decision to start using it as a reference in how it prices supplies to Asia. Now, concern is growing over whether the surge will inflate the cost of the Middle East producer’s cargoes compared with those from Kuwait and Iraq, who haven’t switched to the new benchmark, according to a Bloomberg survey of five traders and refiners.

Cargo Risk

One executive at an Asian buyer said it might consider seeking to take fewer the cargoes from Saudi Arabia if they are too expensive versus other supplies. OPEC’s biggest member is expected to announce official selling prices for November-loading shipments in the next couple of weeks. Oman briefly traded on Wednesday as high as $90.90 a barrel on the DME. By the end of Singapore trading at 4:30 p.m., it was at $88.96 a barrel, compared to $82.15 for Brent, and $72.36 for WTI. “While we expect the spread to quickly return back to normal levels, Oman should remain relatively strong, reflecting the increasing tightness in the Asian crude balance,” JBC said in its report. Healthy processing margins and reinvigorated independent refiners in China are providing ample demand, it said. Oman is considered a sour crude due to its high sulfur content, making it more difficult to refine into petroleum products such as gasoline and diesel. That means it usually trades at a discount to lower-sulfur, or sweet benchmarks Brent and WTI. The closely watched spread between Oman and swaps for Dubai crude, another key Middle East benchmark used to price regional cargoes, has widened to a record of over $10 a barrel, surpassing the peak set in 2011 at $6.22 a barrel, according to data from S&P Global Platts.

Oil Market’s 4Q to Be Tightest in More Than a Decade on Iran: EA

A steep decline in Iranian crude exports will make 4Q the tightest quarter for the demand-supply balance in more than a decade and tighter than any forecast for 2019, Energy Aspects says in report.

“Our latest soundings suggest that Iranian exports may drop below 1m b/d in November”

“If Iranian exports were to drop to below 1m b/d, they would be nearly 2m b/d down from April export levels (2.85m b/d), which is something the market has not yet priced in”

Tightness also driven by lack of any near-term spare capacity, and resurgence in Chinese teapot refinery buying

Only path to a balanced market in short-term would involve significant compression in refining margins, reducing crude demand; Med refiners already trimming runs

Cash WTI has “ripped” on fears of tank bottoms at Cushing

Should lead to narrower WTI-Brent arb, which may choke off U.S. exports just as world needs them

Time-spreads across all 3 benchmarks — Brent, Dubai and WTI — should rise in tandem, pulled higher by “complete lack” of crude availability in the East

“The physical side does not get better than this”

Total Sees $100 Oil Coming, And Says It May Not Be a Good Thing

Total SA is among a growing chorus that sees $100 oil on the horizon. But the French energy giant isn’t thrilled about it. Chief Executive Officer Patrick Pouyanne sees supportive elements, such as looming sanctions on Iran and disruptions in Venezuela, that are stripping supply from the market and pushing prices back into triple digits for the first time seen since 2014, he said in a Bloomberg television interview. “I’m not sure it’s a good news” for the global economy, Pouyanne said. “Even for the oil industry, because you know, when price goes too high then you open the door to your competitors” and demand will fall, he said. Total SA Chief Executive Officer Patrick Pouyanne said he sees oil heading to $100 with strong support for prices. While oil’s rally has stabilized an industry pulverized by the 2014 crash, there’s growing concern that it may become a drag on global growth. It could prove particularly damaging for emerging economies, where weakening currencies are making dollar-denominated imports costlier. Meanwhile, competition from new energy vehicles is seen carving out a chunk of future global demand. Brent crude climbed back above $80 this month for the first time in almost four years as the Organization of Petroleum Exporting Countries signaled it won’t take rapid action to temper prices. Impending U.S. sanctions targeting Iranian oil sales are likely to have a bigger impact on the market than they did last time, BP Plc CEO Bob Dudley said this week.

‘It Takes Time’

Major trading house Mercuria Energy Group Ltd. said this week that prices may spike over $100 a barrel in the fourth quarter, while competitor Trafigura Group expects it in early 2019. Not all are convinced, however. Goldman Sachs Group Inc. thinks another supply shock beyond Iran is needed for oil to return to that level. The U.S. has ruled out releasing oil from emergency stockpiles to prevent prices from spiking when Iranian sanctions start in November. Energy Secretary Rick Perry said to unleash crude from the Strategic Petroleum Reserve would have a “fairly minor and short-term impact” and that other producers can offset the losses. Any help from OPEC kingpin Saudi Arabia to plug the supply gap will take time, according to Total’s Pouyanne, who said he’d been calling the return of $100 since June. “In our industry, you don’t push a button and then oil flows,” Pouyanne said. “It’s more complex than that, so it takes time.”

SK Is Said to Buy 2 VLCCs of U.S. Crude for December

S. Korean refiner buys ~4m bbl of U.S. grades including WTI, Eagle Ford and White Cliffs for Dec. arrival, according to traders who asked not to be identified.

Co. bought ~2m bbl of WTI Midland and Eagle Ford grades for Nov. arrival in last reported purchase of U.S. crude

GS Caltex Is Said Buy 6M Bbl U.S. Crude for December

S. Korean refiner purchases ~6m bbl of U.S. crudes including WTI, Eagle Ford and Mars Blend for December arrival, according to traders who asked not to be identified.

Russia Keeps October Crude Shipments Unchanged in Final Program

Russia to export 2.415m tons of crude from Black Sea port of Novorossiysk in October, according to final loading program seen by Bloomberg.

Volume is unch. from preliminary program released on Sept. 25

Primorsk Urals exports set at 3.4m tons, and Ust-Luga at 2.5m tons; both unch. from preliminary plans

Angola Revises Crude Exports Higher to 1.48M B/D in Nov.: Plan

Angola to export 46 cargoes totaling 44.24m bbl in November, one shipment more than provisionally planned, according to final loading program seen by Bloomberg.

Cargo of Palanca crude added to final schedule

November loadings compare with 49 cargoes planned in October equivalent to 1.51m b/d

India’s U.S. Oil Imports Rise Nine Fold in April-August: DGCIS

India bought 2.61m tons of crude oil from the U.S. in April-August, nine times more than in the same period last year, according to Directorate General of Commercial Intelligence and Statistics (DGCIS), an arm of India’s ministry of commerce and industries.

That’s the biggest gain in shipments among all suppliers in the period, according to the data on the directorate’s website

India imports +9% y/y to ~94m tons, or 4.48m b/d, in the period

Shipments from Iran jumped 44% ahead of U.S. sanctions in November

Iraq continued its lead over Saudi Arabia as the top supplier

US-Korea October crude flows to hit new high – Argus

US oil exports to South Korea are poised to rise nearly ninefold year-on-year to a record high in October. At least 13mn bl, or nearly 420,000 b/d, of US crude has been booked to leave the US Gulf coast for South Korea in October, according to shipping fixture reports compiled by Argus. That would reflect a roughly 57.3pc increase compared to preliminary September volumes of roughly 265,000 b/d and more than eight times the 49,000 b/d shipped from the US to South Korea in October 2017. US crude exports to South Korea have been trending upward since early 2018 on widening spread between West Texas Intermediate (WTI) and the Asian oil benchmark Dubai, which reflects an improving arbitrage for US crudes to the region compared to similar grades. WTI averaged a $6.74/bl discount to Dubai during the October US trade month, which ended yesterday, compared to an average $4.26/bl discount the month prior. The trend has been encouraged by a South Korean subsidy on oil imports from regions other than the Mideast Gulf, in which state-owned KNOC refunds a $2.26/bl tariff to refiners that import from non-Mideast suppliers. The goal of the tax incentive has essentially been achieved, as South Korean importers cut their reliance on Middle East oil to less than 77pc of all supplies in January-June this year from 85pc in the first half of 2017, according to KNOC data. But South Korea’s government is now considering the elimination of this credit, potentially weighing on future crude flows from the US.

|

Planned US cargoes to South Korea |

000 bl |

||

|

Load date |

Tanker name |

Charterer |

Approx. volume |

|

1-Oct-18 |

British Vantage |

GS Caltex |

2,000 |

|

5-Oct-18 |

Cosflying Lake |

GS Caltex |

2,000 |

|

10-Oct-18 |

Maran Athena |

SK Energy |

2,000 |

|

11-Oct-18 |

Lawhah |

GS Caltex |

1,000 |

|

18-Oct-18 |

New Triumph |

SK Energy |

2,000 |

|

24-Oct-18 |

Awtad |

Lord Energy |

2,000 |

|

24-Oct-18 |

Maran Carina |

Lord Energy |

2,000 |

Japan’s Iran Oil Imports Drop 31.7% Y/Y as Sanctions Near

Japan’s crude imports from Iran fell 31.7% y/y to ~706k kiloliters, or ~143k b/d, in Aug. according to data from Ministry of Finance

Jan.-Aug. shipments -1.4% to 6.42m kiloliters

NOTE: Japanese refiners have temporarily halted Iranian oil loadings as U.S. sanctions are set to take full effect in Nov., Takashi Tsukioka, chairman of Idemitsu Kosan, said Sept. 20

Imports from Japan’s other major suppliers:

Saudi Arabia -12.1% to 5.8m kls

U.A.E. +20.6% to 5.22m kls, highest since July 2015

Qatar +58% to 1.46m kls, highest since March

Kuwait +44.5% to 1.36m kls, highest since Jan.

Russia -5.2% to 835k kls

Trump not happy about Federal Reserve raising interest rates – Reuters News

President Donald Trump on Wednesday said he was not happy about the Federal Reserve’s decision earlier in the day to raise its benchmark interest rate, but added the increase was a result of a strong economy. "We’re doing great as a country. Unfortunately they just raised interest rates because we are doing so well. I’m not happy about that," Trump told a press conference. "I’d rather pay down debt or do other things, create more jobs. So I’m worried about the fact that they seem to like raising interest rates." The U.S. Federal Reserve raised interest rates on Wednesday and left intact its plans to steadily tighten monetary policy, as it forecast that the U.S. economy would enjoy at least three more years of growth.

Venezuela’s president says he is willing to meet with Trump – Reuters News

VENEZUELA’S MADURO SAYS HE IS WILLING TO ‘SHAKE HANDS’ WITH U.S. PRESIDENT DONALD TRUMP

VENEZUELA’S MADURO SAYS HE IS WILLING TO TALK ABOUT ANYTHING THE U.S. GOVERNMENT WANTS TO DISCUSS

Pemex plans light crude oil imports likely from U.S., says CEO – Reuters News

Mexican state-run oil company Pemex expects to begin importing light crude oil, likely from the United States, in late October and at least until the current administration of President Enrique Pena Nieto leaves office on Nov. 30, its chief executive said on Wednesday. "A hundred thousand barrels (per day) more or less is what we’re going to import to process and incorporate into our refineries, mostly at Salina Cruz," Pemex CEO Carlos Trevino said in an interview with Reuters on the sidelines of the Mexican Petroleum Congress in Acapulco. Salina Cruz, like Pemex’s other five refineries, has recently been producing far below capacity due to accidents and operational problems, as well as Pemex’s focus on maximizing the value of its oil even if that means refining less domestically. "We’re going to mix it with Mexican crude, with some of our mix to be able to process at the levels we want to get back to in refining. We should be around 800,000 barrels (per day of refining) by the end of the year," he added. Mexico’s refining network can process up to 1.6 million bpd of crude. It has been working this year at around 40 percent. Trevino said he expects oil auctions scheduled for February, which include the selection of key partners for Pemex, will take place as planned. "I think there is total certainty" that Mexico’s oil regulator, the National Hydrocarbons Commission (CNH), will carry out the auctions. Mexican President-elect Andres Manuel Lopez Obrador has said that oil auctions are suspended until contracts already awarded over the past few years have been reviewed. Pemex, whose oil production and refining volumes have continued declining this year amid the depletion of some of its main oilfields, will not meet its crude output target of 1.95 million barrels per day in 2018. "We’re not going to meet the goal," Trevino said. He expects another year of production decline in 2019, even though Pemex had originally planned to stabilize output by then.

China’s CNPC says to boost domestic crude output through more winter drilling – Reuters News

Energy giant China National Petroleum Corp (CNPC) will keep drilling through the winter at oilfields in the west of the country to boost domestic crude output, answering calls from Beijing to bolster the nation’s energy independence. Some of CNPC’s oilfields in western Chinese regions such as Qinghai, Xinjiang and Shaanxi will not take their usual four-month winter break this year, CNPC’s official newspaper said on Thursday, citing a document from the firm’s oil engineering and services unit. Fields in western China typically take such breaks due to harsh winter conditions that make drilling more difficult and expensive. More easterly fields tend to operate year-round. "CNPC will need to take more forceful measure to boost domestic production as China stresses the importance of energy security," the newspaper said. CNPC is the nation’s largest crude oil producer. China has been pushing to curb its appetite for overseas energy supplies amid a tit-for-tat trade war with the United States. A CNPC official told Reuters that the cost of oil engineering services had fallen to the lowest level in five years, helping make winter production economic. China’s crude oil output climbed in August, ramped up after President Xi Jinping called for a boost to national energy security. Prior to that, output had seen nearly three years of decline. CNPC’s engineering unit, China Petroleum Engineering Corp 600339.SS, will carry out an additional 2 million metres of drilling from November to February, CNPC said via the newspaper.

APPEC interview: Qingdao Port sees Shandong refineries’ crude imports stable in 2019 – Platts

China’s Qingdao Port International is confident that crude imports by Shandong-based independent refiners in 2019 will remain stable from 2018, dispelling concerns that independent refiners may be slowing their operations in response to increased competition and tighter tax regulations, the company’s general manager, Liu Jin, told S&P Global Platts on the sidelines of the Asia Pacific Petroleum Conference in Singapore this week. The Shandong refiners were expected to slow down operations and imports next year following the start-up of two large integrated greenfield refineries — Hengli Petrochemical and Zhejiang Petrochemical — later this year. However, Liu believes the Shandong-based independent refineries, though smaller in size and scale, are more flexible in adapting to market changes. "They have a relatively mature share in oil products’ market, and have been preparing themselves to tackle the possible challenges, so it’s not likely for them to cut crude imports drastically," he said. QPI operates the Qingdao port and the Dongjiakou port in Shandong province, and accounts for about 16%-18% of total crude imports into China. China’s independent refineries imported around 64.70 million mt of crude oil over January-August, 46% of which was imported via the QPI ports, a Platts survey showed. Given that the port handles such a large volume, imports via Qingdao usually determines the overall import trend by the independent refining sector in Shandong. Platts Analytics expects the total crude oil imports by independent refineries will hit 92 million mt by year end, more or less stable from last year. Imports over January-August were up a marginal 0.6% year on year.

LOWER LOGISTICS COST

To better serve the independent refineries’ robust demand for crude imports, Qingdao port plans to expand its crude pipeline further to Dongying, Shandong province’s refining hub. This will further cut the logistics cost for independent refineries. "The logistics cost will be cut by at least Yuan 100 million ($14.6 million) annually for a refinery once it is connected to the pipeline network," Liu estimated. The 2.2 million mt/year Qirun Petrochemical refinery, for example, has been able to lower its crude shipping cost from the QPI ports by 40% from around Yuan 110/mt, since it began using the pipeline compared with the traditional way of shipping crude on trucks, Liu added. QPI started up the Qirun section of the Dongwei pipeline in July — part of the pipeline network that connects the refinery with Dongjiakou port. Logistics usually account for around 3%-5% of the total cost by independent refineries, and savings on this translate to higher margins, which have been under pressure by rising taxes. The two ports currently have three VLCC berths, two crude pipelines and a storage capacity totaling around 16 million cubic meters.

PORT PLANS

To further connect another five independent refineries with the two ports by end-2019, QPI plans to start construction work on Phase 3 of the Dongwei crude oil pipeline in October. Once completed, a total 14 independent refineries will be connected to the crude pipeline network from Dongjiakou. Around 30 million mt/year of crudes are expected to be transmitted via the network in 2020, which would account for a third of the sector’s total imports. The Dongwei crude oil pipeline, which connects the Dongjiakou port with storage facilities in Weifang, is dedicated for independent refineries around Weifang, Zibo and Guangrao. QPI also plans to construct a second VLCC berth in Dongjiakou in 2019, in an effort to boost total storage capacity to 26 million cu m by end-2020.

Cenovus Energy signs crude-by-rail transport deals with CN, CP – Reuters News

Cenovus Energy Inc said on Wednesday that it had signed three-year deals with Canada’s two major railways to transport roughly 100,000 barrels per day (bpd) of crude from Northern Alberta to the U.S. Gulf Coast. The major Canadian energy producer will start shipments on Canadian National Railway Co from its Bruderheim Energy terminal in the fourth quarter of this year, and on Canadian Pacific Railway Ltd through USD Partner LP’s Hardisty, Alberta terminal in the second quarter of 2019. Reuters exclusively reported earlier this month that Cenovus had signed a deal to move more crude on CN Rail. The deals come as the discount on Canadian heavy oil has spread to $42, its widest point on record, as rising production from Alberta’s oil sands has run up against full pipelines, leading to swelling volumes in storage. “Our rail strategy provides a means of mitigating the price impact of pipeline congestion," said Cenovus Chief Executive Alex Pourbaix in a statement. "While we remain confident new pipeline capacity will be constructed, these rail agreements will help get our oil to higher-price markets.” There are three major Canadian oil pipeline projects in the works, though all have been hit with delays and the first likely to be in service is not expected online until late 2019 at the earliest. Pipelines are the cheapest mode to transport oil to market. Cenovus said it expects all-in costs to transport the oil from Alberta to the Gulf Coast under the rail deals to be in the mid-to-high teens in U.S. dollars. That pricing is in line with what the company has been guiding, said Phil Skolnick, an analyst with Eight Capital, in an email. "This should start to help differentials and sentiment, in our view," Skolnick said, adding he expects further oil by rail deals to be announced. Houston-based USD Partners separately said it had signed a four-year extension with Cenovus boosting the oil producer’s contracted loading capacity at its Hardisty rail terminal. Reuters reported earlier this month that USD Partners is moving ahead with an expansion at that terminal, which will boost capacity by 50 percent, or one more 120-car unit train per day. Canada’s crude by rail exports hit record levels above 200,000 bpd in June. They are expected to rise to more than 300,000 bpd by year end and continue climbing sharply through 2019.

Brazil port to add floating crude storage – Argus

Prumo-operated Acu port in Rio de Janeiro state plans to install a 2mn bl VLCC for floating storage, Acu Petroleum commercial director Eduardo Goulart tells Argus. The vessel will be docked at one of three berths at the terminal, which is currently used by Shell and Portugal’s Galp to export pre-salt crude. The floating storage facility is scheduled to start operating in the first quarter of 2019, and will be followed by an onshore crude storage site in 2022. Goulart said the new projects are in line with an expected doubling of crude exports, which are now at around 1mn b/d, in the next 10 years. "Tankage benefits oil companies by allowing companies to produce and store oil, disassociating production from the immediate need for export. With this, there is an optimization in the DP ship fleet involved in the oil export logistics, reducing the cost with the leasing of ships," Goulart said, referring to dynamic-positioning vessels used for transshipment. The planned floating storage allows traders to consolidate export cargos from smaller independent producers. Shell Trading currently acquires all crude produced in the 16,000 b/d Atlanta field, operated by Brazilian independent QGEP, and the 6,000 b/d Tubarao Martelo, operated by local independent Dommo.

The offshore terminal with a current 1.2mn b/d of capacity started operations at Acu in August 2016 with Suezmax capacity, and has to date carried out six VLCC transshipment operations since it was authorized to receive the vessels in May. This week Prumo signed a cooperation agreement with the Port of Houston that envisages the exchange of expertise and best practices. "The unlocking of the oil and gas industry in Brazil must take place along with infrastructure investments. And the Port of Açu is in a unique position to benefit from new planned investments and from the transformation that will take place in this industry," Decio Oddone, a former Prumo executive and now director general of Brazilian hydrocarbons regulator ANP, said of the deal. Galp and Shell are currently the only two crude clients at Acu, but the expansion is expected to attract other big pre-salt producers such as state-controlled Petrobras and France’s Total. Acu is looking beyond its leading position as a crude and iron ore export hub. BP, through its Acu-based marine fuel joint venture with Prumo, is planning an onshore fuel storage terminal to accommodate product imports, a project still in the licensing phase. BP is also involved in a gas-to-wire project currently under construction at the port. A 150,000 b/d greenfield refinery is planned for the port farther down the road, a Prumo executive tells Argus. In October 2013, US investment fund EIG paid 1.3bn real ($596mn) for a controlling stake in Prumo, then known as LLX. LLX had been part of Brazilian magnate Eike Batista’s defunct EBX commodities empire.

U.S. Cash Crude-Grades steady in thin trade – Reuters News

U.S. crude differentials were steady in light volumes on Wednesday as November trade began, dealers said. Traders rebalanced positions for three days through Tuesday after the October futures contract expired last week and November barrels began trading Wednesday. Light Louisiana Sweet WTC-LLS was seen bid lower while West Texas Intermediate at East Houston WTC-MEH, weakened amid slowing export demand. U.S. crude’s discount to Brent widened by 18 cents to $9.77 per barrel, the widest level in nearly two weeks, strengthening Gulf coast grades. However, favorable economics to export to Europe have faded as Gulf grades have firmed to the highest levels in three months, dealers said. Inland grades also strengthened on signs of easing bottlenecks. West Texas Intermediate at Midland WTC-WTM firmed to as little as a $6.50 per barrel discount to U.S. crude, the strongest in about three months. Plains All American L.P. will begin operations on an expanded West Texas Sunrise oil pipeline on Nov. 1, helping to ease a bottleneck that has weighed on Midland crude prices for months, it said in a regulatory filing. "Looks like the Sunrise start up is beginning to price in out for Middy (Midland)," one trader said. Meanwhile, U.S. crude inventories rose 1.9 million barrels to 396 million barrels in the week to Sept. 21, the Energy Information Administration said, after five consecutive weeks of drawdowns pushed stockpiles to the lowest levels since February 2015. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 461,000 barrels, EIA said.

Light Louisiana Sweet WTC-LLS for October delivery fell 50 cents and was seen bid and offered between $7.75 and $8.25 a barrel premium to U.S. crude futures.

Mars Sour WTC-MRS was unchanged and seen bid and offered between $4.50 and $5 a barrel premium to U.S. crude futures.

WTI Midland WTC-WTM rose $1.50 to a midpoint of $7.50 a barrel discount and traded between $8.50 and $6.50 a barrel discount to U.S. crude futures.

West Texas Sour WTC-WTS rose $2.25 was seen bid and offered between $7.50 and $7 a barrel discount to U.S. crude futures.

WTI at East Houston, also known as MEH, WTC-MEH traded at $7 and $6.85 a barrel over WTI.

U.S. Cash Products-Midwest gasoline falls after surging last week – Reuters News

U.S. Midwest gasoline cash differentials fell on Wednesday, traders said, as market participants readjusted positions after prices for the fuel in the region shot higher last week. Group Three gasoline lost 3.75 cents a gallon to trade at 8.50 cents per gallon above the gasoline futures contract on the New York Mercantile Exchange, traders said. The product reached 16.25 cents per gallon above futures on Thursday, its highest level since October 2015. Chicago CBOB gasoline CBOB-DIFF-MC fell 1.50 cents a gallon to trade at 9.50 cents per gallon above futures. Chicago ultra-low sulfur diesel ULSD-DIFF-MC gained 1.25 cents a gallon to trade at 0.50 cent per gallon below the heating oil futures benchmark. In New York Harbor, jet fuel lost 3.00 cents to trade at 5.00 cents per gallon below futures, its lowest level since mid-January. The product is trading against the November futures contract on NYMEX. M3 conventional gasoline, the dominant grade in the region, lost three-quarters of a penny to trade at 6.25 cents per gallon above futures, traders said. On the Gulf Coast, M3 conventional gasoline gained a quarter of a penny to trade at 3.50 cents per gallon above futures, traders said. U.S. gasoline stocks rose by 1.5 million barrels, the Energy Information Administration said on Wednesday, compared with analyst expectations in a Reuters poll for a 788,000-barrel gain. Distillate stockpiles fell 2.2 million barrels, versus expectations for a 752,000-barrel increase, the EIA data showed. Refinery crude runs fell by 901,000 barrels per day, EIA data showed. Refinery utilization rates fell by 5 percentage points to 90.4 percent, the lowest since May, driven by seasonal declines in Midwest and East Coast refining activity. The RBOB futures contract on NYMEX lost 0.92 cent to settle at $2.0585 a gallon on Wednesday. NYMEX ultra-low sulfur diesel futures fell 0.55 cent to settle at $2.2998 a gallon. Renewable fuel (D6) credits for 2018 inched up to 13 cents on Wednesday, up from new fresh lows of 11 cents each on Tuesday, traders said. Biomass-based (D4) credits fetched 34 cents each, up from 33 cents each on Tuesday, traders said.

Singapore fuel oil inventories jump as weekly exports fall to over 7-year low – Reuters News

Singapore fuel oil inventories jumped 15 percent to a 10-week high in the week to Sept. 26, boosted by thin export volumes, official data showed on Thursday.

– Singapore’s onshore fuel oil inventories surged 2.328 million barrels, or about 347,000 tonnes, to 17.616 million barrels, or 2.629 million tonnes, data from International Enterprise (IE) Singapore showed. O/SING1

– Singapore fuel oil exports totalled just 55,000 tonnes in the week to Sept. 26, the lowest since June 2011. O-SGEXP-FO

– Low export volumes helped lift net fuel oil imports into Singapore to a two-week high of 966,000 tonnes, up 67 percent from the week before, the data showed.

– Singapore fuel oil net imports have averaged 774,000 tonnes per week in 2018.

– This week’s onshore fuel oil inventories were 24 percent lower than a year ago.

– Singapore’s net exports of fuel oil to Bangladesh topped the week ended Sept. 26 at 23,000 tonnes, followed by Indonesia at 7,500 tonnes and Myanmar at 10 tonnes.

– The largest net imports into Singapore originated from Russia at 274,000 tonnes, followed by Malaysia at 191,000 tonnes, Belgium at 101,000 tonnes and Saudi Arabia at 90,000 tonnes.

– Fuel oil inventories in Singapore have averaged 19.166 million barrels, or 2.861 million tonnes, a week since the start of 2018, compared with 23.552 million barrels, or 3.515 million tonnes, in 2017.

Singapore Weekly Fuel Stockpiles for Sept. 26 Rise 6.2% W/W

Total stockpiles 39.6m bbl, +6.2% w/w

Light Distillates 11.8m bbl, -4.7% w/w

Middle Distillates 10.1m bbl, +6.2% w/w

Residues 17.6m bbl, +15.2% w/w

Singapore Light Distillate Stocks

Singapore Middle Distillate Stocks

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.