From: Wagner, Jonathan

Sent: Friday, September 28, 2018 5:59:30 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

Good morning. Oil prices are unchanged this morning while Asian equities finished the quarter higher overnight. European and US index stock futures are lower and the dollar is back up over 95 this morning. While its not official yet, Russian sources are saying that September output is 11.347m b/d (a new post-soviet record) and higher than the 11.21m b/d reported in August. They announced this figure as well using Sep 1 – 15 data but recently minister Novak said they were producing just over August levels. Kazakhstan’s crude output improved m/m in September as field maintenance ended with production growing to 1.86mb /d (up from 1.73m b/d). Production is likely to dip again in October, with maintenance planned at the country’s biggest field, Tengiz, and at work continuing at Karachaganak. Middle East crude prices were mixed today with DME Oman moving higher while Cash Dubai fell 17c to +1.37 over swaps. A whopping 115 Nov Dubai partials traded in the window to end the month with Chinaoil, Totsa, Reliance, Gunvor, and Unipec selling to Equinor, BP, Shell, Petro-Diamond, Vitol, and Mercuria. Shell will receive an al-Shaheen cargo from Chinaoil and an Upper Zakum cargo from Reliance. In all, Shell has taken delivery of four Upper Zakum cargoes and two al-Shaheen cargoes this month. Oct/Nov Dubai spreads are trading 73c backward. Imports of Iranian crude oil by major buyers in Asia hit a two-month low in August, hurt by a more than 80 percent plunge in South Korean purchases ahead of upcoming U.S. sanctions. China, India, Japan and South Korea last month imported 1.57m b/d from Iran. That was down 4.1% from August 2017, and marked a decline of about 300,000 bpd from the previous month.

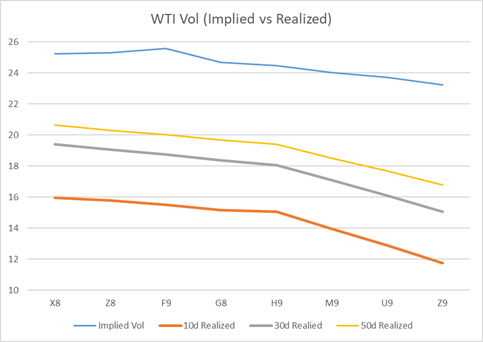

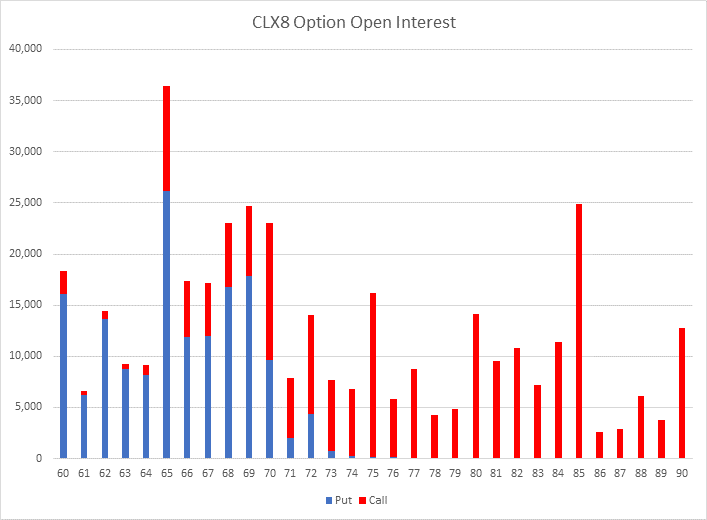

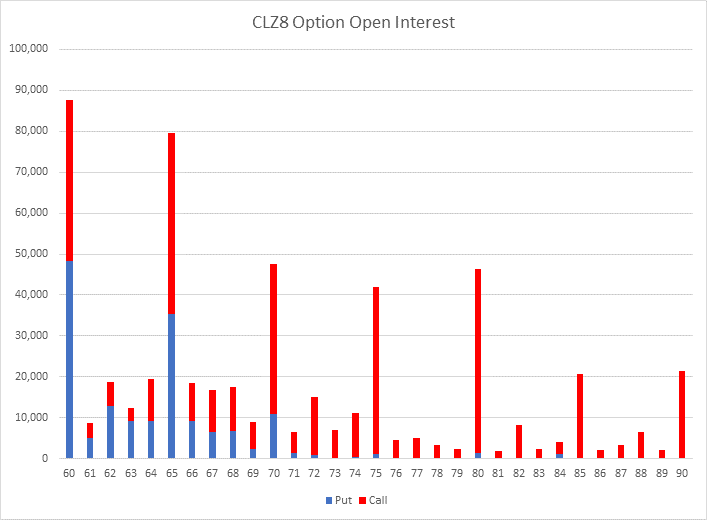

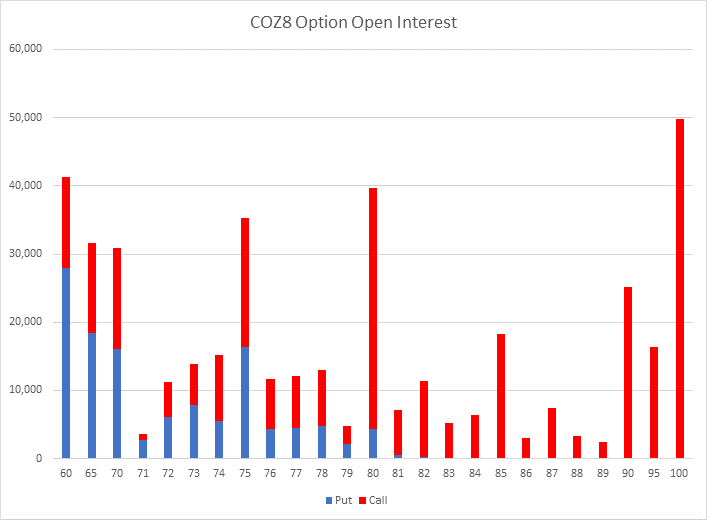

Front end WTI spreads remained offered this as we await the upcoming monthly index rolls in early Oct. Yesterday Gensacpe’s Cushing data showed a mid week build of 1.02m bbls and a full week build of 1.58m bbls. Fall turnarounds continue to increase with IIR estimating offline capacity of 1.5m b/d currently (increasing to 1.62m b/d by the second week in Oct). Front end Midland diffs firmed yesterday trading inside of -6 as we await the startup of the Plains Sunrise expansion set to begin on Nov 1. The curve has flattened pretty dramatically with Q4 18 settling at -6 and Q1 and Q2 flat at -7.25 (cal month avg). Front end vols finished the day higher with wingy put skew bid in WTI and Brent through 1h’19. The notable option flow on WTI was seen in the Z8 65 puts with 17k lots trading. OI increased by 10k d/d to 30k on that strike. Some notable block trade highlights from this morning are directly below.

Block trades seen on ICE and CME this morning

BRT Z18 85 Call x81.50 TRADES 99 100x 28d

BRT Z18 80 Put x81.50 TRADES 160 200x 36d

BRT Z18 82/87 Call Spread x81.50 TRADES 143.5 300x 28d

BRT H19 75/80/85 Iron Fly x80.50 TRADES 403 250x 3d

BRT M19 80/85/90 Call Fly TRADES 60 400x

WTI U19 55 Put x70.00 TRADES 156 400x 13d

WTI Dec 15d put skew

Cash Midland/WTI

Top stories listed below

Russian average oil output 11.347 bpd Sept. 1-27, set for record – source – Reuters News

Kazakhstan September Oil Output Rebounds as Maintenance Ends

Middle East Crude-DME Oman stays above Brent; Dubai weakens – Reuters News

Saudi Arabia Faces the Ultimate Oil Test: Producing at the Limit

Iranian Revolutionary Guards warns Saudi Arabia, UAE to respect its "red lines" – Reuters News

Nigerian Oil Union Says Talks to End Chevron Dispute Delayed

Most of Chinese State Refineries Increase Run Rates, SCI99 Says

Chinese Teapots Raise Rate to Highest Level Since May: Oilchem

China Shandong Port Crude Stocks at Highest Since Sept. 7: SCI99

Japan’s crude imports rise 5.9 pct in Aug -METI – Reuters News

Asia’s Aug Iran oil imports hit 2-month low, set to drop further – Reuters News

U.S. Cash Crude-WTI Midland firms on expectations bottlenecks will ease – Reuters News

U.S. Cash Products-Chicago ULSD rises on refiner buying – Reuters News

U.S. oil refiners’ weekly capacity seen down 480,000 bpd -IIR – Reuters News

|

Implied Vol |

Realized Vol |

||||||

|

WTI Vol |

27-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.22 |

0.1 |

1.15 |

15.97 |

19.41 |

20.63 |

|

|

Z8 |

25.29 |

0.58 |

1.15 |

15.77 |

19.06 |

20.28 |

|

|

F9 |

25.58 |

0.4 |

1.16 |

15.50 |

18.74 |

20.01 |

|

|

G8 |

24.66 |

0.33 |

1.12 |

15.15 |

18.37 |

19.69 |

|

|

H9 |

24.45 |

0.22 |

1.11 |

15.05 |

18.07 |

19.41 |

|

|

M9 |

24.01 |

0.05 |

1.08 |

13.94 |

17.11 |

18.50 |

|

|

U9 |

23.71 |

0 |

1.05 |

12.90 |

16.08 |

17.67 |

|

|

Z9 |

23.23 |

-0.06 |

1.02 |

11.74 |

15.06 |

16.79 |

|

Implied Vol |

Realized Vol |

||||||

|

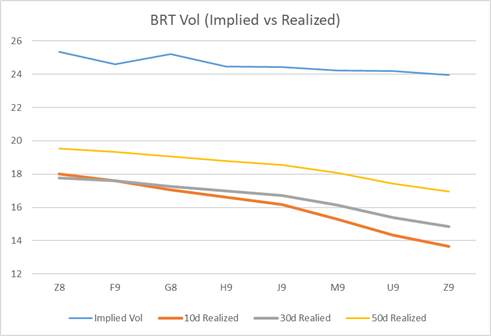

BRT Vol |

27-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

Z8 |

25.35 |

0.47 |

1.3 |

18.02 |

17.78 |

19.54 |

|

|

F9 |

24.61 |

0.28 |

1.26 |

17.61 |

17.61 |

19.35 |

|

|

G8 |

25.21 |

0.21 |

1.28 |

17.07 |

17.27 |

19.05 |

|

|

H9 |

24.47 |

0.13 |

1.24 |

16.62 |

16.99 |

18.80 |

|

|

J9 |

24.43 |

0.16 |

1.24 |

16.18 |

16.71 |

18.56 |

|

|

M9 |

24.23 |

-0.04 |

1.22 |

15.30 |

16.12 |

18.07 |

|

|

U9 |

24.19 |

-0.03 |

1.20 |

14.34 |

15.38 |

17.43 |

|

|

Z9 |

23.96 |

-0.12 |

1.17 |

13.65 |

14.85 |

16.95 |

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

BRT G19 75/85 Strangle x80.40 TRADES 391 600x 9d

WTI X18 70 Put x71.95 TRADES 90 900x 30d

ICE Trade Recap

BRT M19 80/85/90 Call Fly TRADES 72 700x

BRT M19 60/50 1×2 Put Spread x79.35 TRADES 40 500x 2d

BRT Z19 71.50/60 1×1.5 Put Spread x77.40 TRADES 218 2,250x 8d

BRT Z19 60/70 Put Spread x77.30 TRADES 267 500x 11d

BRT M20 65/80 Fence x75.00 TRADES 163 600x 74d

BRT Z20 65/60 Put Spread TRADES 163 1,750x

BRT Z18 75/80 Call Spread x72.30 TRADES 107 750x 23d

BRT G19 80/87 Call Spread TRADES 253 700x

BRT G19 70 Put TRADES 74 2,000x; TRADES 70 1,000x

WTI G19 58 Put x71.45 TRADES 42 1,500x 6d

BRT M19 65/95 Fence x79.25 TRADES 34 900x

BRT H19 65/60 1×2 Put Spread TRADES 5 500x

CME Trade Recap

WTI U/Z19 ATM Call Roll x70.00/69.00 TRADES 57 400x 53d/53d

BRT Z18 70 Put TRADES 12 1,000x; TRADES 13.5 5,000x; TRADES 13 1,500x

WTI Z18 75 Call x72.00 TRADES 141 1,000x 34d

WTI Z18 75 Call x71.75 TRADEs 135 1,000x 32d

WTI U19 60 Put x69.75 TRADES 273 1,500x 20d

WTI Z18 65 Put x71.90 TRADES 53 5,000x 14d

WTI Z18 65 Put TRADES 55 2,000x

WTI Z18 65 Put x71.75 TRADES 59 3,000x 14d

CSO/ARB/APO Trade Recap

WTI APO Cal19 65/73.30 Fence TRADES 20 1x

WTI APO V18 69 Put TRADES 38 300x

WTI APO 1H19 55 Put TRADES 70 2x

Russian average oil output 11.347 bpd Sept. 1-27, set for record – source – Reuters News

Oil production in Russia averaged 11.347 million barrels per day (bpd) between Sept. 1 and Sept. 27 and was on track to reach another post-Soviet high, an energy sector source told Reuters on Friday. Measured in tonnes, average daily oil production stood at 1.548 million tonnes in that period, the source said, citing preliminary data that the Russian Energy Ministry obtains from oil companies. The ministry, which is due to publish monthly production data for September on Oct. 2, did not immediately reply to a Reuters request for comment. In August, Russia’s oil output stood at 11.21 million bpd, virtually unchanged from July. Russia appears to have increased oil production by more than 130,000 bpd in September compared with August levels, according to the preliminary data cited by the source. Energy Minister Alexander Novak said earlier this month that oil production in September was expected to be higher than in August. Last week, OPEC’s leader Saudi Arabia and its biggest oil-producer ally outside the group, Russia, ruled out any immediate additional increase in crude output even though oil had reached $80 per barrel – a price considered too high by some producers and consumers.

Kazakhstan September Oil Output Rebounds as Maintenance Ends

Kazakhstan’s crude and condensate output recovered m/m in September, as maintenance work ended at key fields, government data compiled by Bloomberg show.

•Output rose to 1.86m b/d in September from 1.73m b/d in August, according to calculations based on data from the Ministry of Energy and nation’s Information-Analytical Centre of Oil and Gas

oProduction hit a new daily high of 262.8k tons, equivalent to 2m b/d, on Sept. 13 before slipping back to around 1.9m, probably reflecting the start of planned work at Karachaganak

oProduction is likely to dip again in October, with maintenance planned at the country’s biggest field, Tengiz, and at work continuing at Karachaganak

•Total output in September is estimated at ~7.334m tons, which Bloomberg derived from 21 data points up to Sept. 27; daily production numbers weren’t always provided

•August production was 7.057m tons, based on similar calculations

Middle East Crude-DME Oman stays above Brent; Dubai weakens – Reuters News

The Middle East crude benchmarks were mixed on Friday, as DME Oman strengthened and stayed above Brent, while cash Dubai weakened. DME Oman settled above Brent for a fourth straight session, while its premium to Dubai swaps rebounded to $6.23 a barrel. The premium touched a multi-year high of $10.58 a barrel on Wednesday.

SAUDI OSP PREVIEW: Saudi Aramco is expected to raise the official selling prices for all crude grades it sells to Asia by 80 cents a barrel for November, a trader said. He said earlier estimates were for a 60 cent increase but the spike in front-month DME Oman crude futures this week may push up Saudi OSPs by another 20 cents as the top exporter will switch to using DME Oman in its OSP formula from next month

IRAN: Imports of Iranian crude oil by major buyers in Asia hit a two-month low in August, hurt by a more than 80 percent plunge in South Korean purchases ahead of upcoming U.S. sanctions on Tehran, government and ship-tracking data showed. China, India, Japan and South Korea last month imported 1.57 million barrels per day (bpd) from Iran, according to the data. That was down 4.1 percent from August 2017, and marked a decline of about 300,000 bpd from the previous month.

RUSSIA: The loading plan for ESPO Blend crude oil ESPO-DUB from Russia’s Pacific port of Kozmino has been set at 2.6 million tonnes in November, compared with 2.7 million tonnes in the October plan, three industry sources told Reuters. Surgutneftegaz will close a tender to sell six cargoes later on Friday.

WINDOW: Cash Dubai’s premium to swaps fell 17 cents to $1.37 a barrel after a total 115 partials traded on the Platts window. Shell will receive an al-Shaheen cargo from Chinaoil and an Upper Zakum cargo from Reliance. In all, Shell has taken delivery of four Upper Zakum cargoes and two al-Shaheen cargoes this month.

Saudi Arabia Faces the Ultimate Oil Test: Producing at the Limit

For the first time since Saddam Hussein invaded Kuwait in 1990, Saudi Arabia could face the ultimate petroleum test: pushing its complex network of oilfields, processing plants, pipelines, tank farms and export terminals to the limit, pumping every possible barrel of oil. Today another Middle East crisis is stretching the Saudi oil machine. U.S. sanctions on Iran are crippling exports from the Islamic Republic, prompting buyers to look to the world’s largest exporter for replacement barrels. In a pithy description of its role during a supply crisis, Majid Al-Moneef, a former Saudi senior oil official, told U.S. lawmakers a few years back that "Saudi Arabia is the ‘Federal Reserve of oil,’" according to American intelligence cables published by Wikileaks. Yet, unlike a central bank, the Saudis can’t print unlimited amounts of money. Their crisis-fighting tool is finite: a buffer of wells sitting idle in the desert. Use them now, and there’s nothing left for the next crisis.

"Any unforeseen outages such as those from Libya, Venezuela or elsewhere could potentially expose the lack of OPEC’s spare capacity — particularly of Saudi Arabia," said Abhishek Deshpande, an oil analyst at JPMorgan Chase & Co. The Saudis and their OPEC allies seem aware that using their spare capacity is a now a double-edged sword: it may cool down prices, but the impact could be limited by the risk-premium as the market worries about what’s left. Oil’s already passed the $80 mark despite assurances from Riyadh and its allies that it can fill Iran’s gap. Some traders are predicting oil could reach $100 this winter as the impact of sanctions ratchets up. The United Arab Emirates’s energy minister, Suhail Al-Mazrouei, told reporters last week the cartel had to be cautious and not "overuse" its limited buffer. OPEC’s current spare capacity is relatively thin. The U.S. Energy Information Administration, puts it at just 1.4 million barrels a day, and estimates that it will drop to 1.2 million by late 2019, one of the lowest levels on record and similar to 2008 when oil prices zoomed to $150 a barrel. Nonetheless, Riyadh says there’s lots of extra oil at hand. Energy Minister Khalid Al-Falih last week said more barrels can flow "within days and weeks." Officially, the kingdom claims to be able to pump at a maximum of 12.5 million barrels a day, up from a near-record 10.4 million produced in August — spare capacity of more than 2 million barrels. Before the sanctions were announced in May, Iran was exporting between 2.5 million and 2.8 million barrels a day. By the time the sanctions take effect in November sales may drop to just 1 million barrels, far lower than anticipated. On paper, the Saudis should be able to fill the 1.5 million to 1.8 million gap — but only just.

"The market is discovering that margins are not so high," Patrick Pouyanne, the head of French oil giant Total SA, said in an interview. The energy industry is increasingly worried. The angst was evident at the annual Asia Pacific Petroleum Conference — one of the biggest annual gatherings of the oil-trading industry — this week in Singapore. In client meetings, conferences and the round of evening cocktail parties, executives were privately doubtful the Saudis can quickly lift output beyond 11 million to 11.5 million barrels a day — not enough to replace Iran. "Near-term spare capacity is effectively maxed out," Amrita Sen of consultant Energy Aspects Ltd. said, echoing a widely held view across the industry. Spare capacity is a fluid concept. For some, it means extra output that can flow at the flick of a switch. Realistically, most industry executives define it as production that can be brought onstream in 30 days, and then sustained for a at least three months. Beyond that, some of the spare capacity is simply oil on the ground that can be pumped by drilling new wells, requiring more time. Over the years, Saudi Arabia has been cagey about how much of its spare capacity falls in each bucket. But Ali Al-Naimi, who was oil minister for nearly 25 years until 2016, offered a glimpse in 2012. "I believe we can easily get up to 11.4, 11.8, almost immediately in a few day," Naimi told CNN in 2012. "All we need is to turn valves," he added. The other 700,000 barrels a day to reach about 12.5 million requires three months of work, however. "And the 90 days is for one thing: to mobilize additional drilling," he said. There’s one more complication: of the 12.5 million barrels a day, only 12 million is controlled directly by state-owned company Saudi Arabian Oil Co., or Aramco. The other 500,000 barrels a day lies in the so-called Neutral Zone shared with Kuwait. But the region hasn’t produced a single barrel for nearly two years due to a dispute between Kuwait and Riyadh. Beyond production, Riyadh has another line of defense to meet a supply outage like Iran: a vast network of storage facilities, both in the kingdom and overseas, that can be drawn down temporarily. Al-Falih said last week that "as the supply shortfalls were a concern" for customers, "we did make a determined effort to top up the storage that was not already full." As well as domestic storage, Saudi Arabia has filled up its strategic storage in Okinawa, Japan; Sidi Kerir in the Mediterranean coast of Egypt; and in the European oil hub of Rotterdam. Officially, Saudi Arabia declared stocks of 229 million barrels in July, the latest data available, down from a record high of 329 million in October. Yet again, as with the spare capacity data, the market also has its doubts. Antoine Halff, an executive at Kayrros, a company that uses satellite data to track storage, takes issue with the Saudi numbers. "From the sky, we see 70 million barrels in storage," he said, out of the 125 million barrels that the kingdom can store in 231 tanks spread across with terminals and refineries. "We don’t see anything extraordinary either in Saudi overseas tanks." The naysayers should be wary, however. The kingdom has been here before, and proved its doubters wrong: it tapped its spare capacity and pumped more than expected during the Iranian revolution in 1979, the Iran-Iraq war between 1980 and 1988 and during the first Gulf War in 1990-91. To a lesser extent, it also tapped its spare capacity during turmoil in Venezuela in 2003. Moreover, Riyadh and the rest of OPEC are taking measures to reinforce its production machine: it has brought on stream 300,000 barrels a day of new production from the Khurais oilfied. The expansion was meant to compensate declines elsewhere, but over the short-term it could help to boost spare capacity. Others within OPEC are also trying to help. The United Arab Emirates is bringing forward the expansion of the offshore Umm Lulu and SARB fields, which will pump 129,000 barrels a day by the end of the year, up from 50,000 barrels a day now. Iraq is bringing on stream the expansion of its Halfaya oilfield, doubling output to 400,000 barrels a day. Yet, despite the efforts, the Saudis and OPEC face a huge challenge to replace Iran. Pouyanne, the head of Total, puts it in simple terms: "You need to mobilize the wells, the rigs… It’s not immediate. In our industry, you don’t push a button and then oil flows. It’s more complex!"

Iranian Revolutionary Guards warns Saudi Arabia, UAE to respect its "red lines" – Reuters News

Iran’s Revolutionary Guards (IRGC) told Saudi Arabia and the United Arab Emirates on Friday to respect Tehran’s "red lines" or face retaliation, as the United States and its Gulf allies increase pressure on Tehran to curb its regional influence. Iran accuses Saudi Arabia and the UAE of funding five gunmen who attacked a military parade in Iran last Saturday and killed 25 people, 12 of them members of the elite IRGC. Saudi Arabia and the UAE have denied any involvement. "If you cross our red lines, we will surely cross yours. You know the storm the Iranian nation can create," the Fars news agency quoted Brigadier General Hossein Salami, deputy head of the Guards, as saying. Addressing worshippers attending Friday prayers in Tehran, Salami said in a strongly-worded speech: "Stop creating plots and tensions. You are not invincible. You are sitting in a glass house and cannot tolerate the revenge of the Iranian nation… We have shown self-restraint." Salami also told the United States to "stop supporting the terrorists or they will pay the price". Iran has accused the United States of supporting the assailants who carried out last Saturday’s attack. Washington has denied having any prior knowledge of the incident. The Revolutionary Guards vowed on Sunday to exact "deadly and unforgettable" vengeance for Saturday’s attack. Shi’ite Muslim Iran and Sunni Muslim Saudi Arabia are arch-rivals in the Middle East and support opposing sides in the Syrian and Yemen conflicts.

Nigerian Oil Union Says Talks to End Chevron Dispute Delayed

Talks between Chevron Corp. and a Nigerian oil labor union to resolve a dispute over the U.S. energy giant’s plan to fire thousands of workers didn’t take place Thursday as scheduled, the union said. “The meeting is no longer being held because not all the parties were available,” Fortune Obi, a spokesman for the Petroleum and Natural Gas Senior Staff Association of Nigeria, or Pengassan, said by phone. A new date will be communicated, he said, without providing details. Obi said prior to the meeting that he was optimistic the dispute would be resolved at the talks. Pengassan, a manager-level union, warned on Sept. 22 it would call a nationwide strike in Africa’s top oil producer if Chevron declined to rescind the decision to cut jobs. Chevron has said it plans to end current job contracts and replace them with new ones in November. The union says the move is in violation of existing contracts and is appealing to the government to have the contracts rolled over instead. Separately, Pengassan workers on Thursday joined a nationwide strike action initiated by labor unions demanding a minimum wage raise. “However, those on critical and essential services are required to remain on their duty posts,” Pengassan Secretary-General Lumumba Okugbawa said in an emailed statement.

Most of Chinese State Refineries Increase Run Rates, SCI99 Says

Operating rates at state refineries in Southwest China were 83.38% as of Sept. 28, up 0.09 ppt from Sept.14, according to data from Shandong-based industry researcher SCI99.

- Refinery runs in Northeast China +0.03 ppt to 82.7%

- East China +0.01 ppt to 81.37%

- South China -0.01 ppt to 82.68%

- Northwest China +2.76 ppt to 78.01%

- Central China +8.01 ppt to 81.53%

- North China +0.20 ppt to 68.55%

Chinese Teapots Raise Rate to Highest Level Since May: Oilchem

Operating rates at independent refineries, known as teapots, in eastern Shandong province dropped to 65.94% of capacity in week to Sept. 27 from revised 65.11% in the previous week, according to industry website Oilchem.net.

- Run rate increased for 5th week, according to Oilchem data compiled by Bloomberg

- Rate seen falling next week partly because of national holidays in October: Oilchem

China Shandong Port Crude Stocks at Highest Since Sept. 7: SCI99

Crude oil inventories at seven ports in Shandong rose 23% w/w to 40.45m bbl in week to Sept. 28, according to industry researcher SCI99.

- That’s first increase in 3 weeks

- Stockpiles at Qingdao port rose 28% w/w to ~16.81m bbl

- Fuel oil stockpiles at Shandong ports -4.8% w/w to ~523k bbl, lowest since Dec., 2016

- Inventories at Qingdao -16% w/w to ~179k bbl

Japan’s crude imports rise 5.9 pct in Aug -METI – Reuters News

Japan’s crude oil imports in August rose 5.9 percent from a year earlier to 3.39 million barrels per day (16.72 million kilolitres), marking the first year-on-year gain in three months, monthly data from the Ministry of Economy, Trade and Industry (METI) showed on Friday. The rise came even as domestic oil sales in Japan fell 1.1 percent to 2.83 million barrels per day (bpd) last month from a year earlier, marking the lowest volumes for the month in at least 30 years, a ministry official said. Oil demand in the world’s third-biggest economy hit a record high around 2000 but has since gradually declined, reflecting a falling population and a shift to more efficient vehicles and equipment. Japan imported Shabwa blend crude oil from Yemen and Yamal condensate from Russia for the first time last month, the METI official said. Japan’s imports of Iranian oil jumped 65.3 percent last month to 177,475 bpd, the data showed before the country’s refiners halted loadings.

Asia’s Aug Iran oil imports hit 2-month low, set to drop further – Reuters News

Imports of Iranian crude oil by major buyers in Asia hit a two-month low in August, hurt by a more than 80 percent plunge in South Korean purchases ahead of upcoming U.S. sanctions on Tehran, government and ship-tracking data showed. China, India, Japan and South Korea last month imported 1.57 million barrels per day (bpd) from Iran, according to the data. That was down 4.1 percent from August 2017, and marked a decline of about 300,000 bpd from the previous month. Overall purchases of crude from Iran by the four countries are expected to drop further in coming months. Washington is pushing allies to cut Iranian oil imports to zero once the U.S. sanctions kick in on Nov. 4. Japan has joined South Korea in temporarily halting Iranian oil loadings as it remains unclear whether the U.S. administration will grant Tokyo an exemption from the sanctions, the head of the country’s refinery association said last week. Exports of Iranian crude oil and condensates have declined by 0.8 million bpd from April to September 2018, the Institute of International Finance said on Tuesday. The Organization of the Petroleum Exporting Countries (OPEC) and other oil producers are considering raising output by 500,000 bpd to counter falling supply from Iran. South Korean August imports slumped 84.2 percent to 64,516 bpd. The country halted all shipments of Iranian oil from July for the first time in six years, sources said. That outweighed a 65.3 percent jump in Japan’s imports to 177,475 bpd in August, trade ministry data showed on Friday, before the country’s refiners halted loadings. China’s imports of Iranian crude rose 2.3 percent in August from a year ago to 804,839 bpd, according to oil flow data on Thomson Reuters Eikon. China earlier this year halted the release of country breakdowns for its crude imports. Meanwhile India’s August imports from Iran jumped 55.9 percent from last year to 522,900 bpd. India is committed to buying Iranian oil and continuing the two nations’ economic cooperation, the Iranian foreign minister said on Thursday.

U.S. Cash Crude-WTI Midland firms on expectations bottlenecks will ease – Reuters News

Sept 27 (Reuters) – U.S. crude differentials were little changed on Thursday, while West Texas Intermediate in Midland firmed to the strongest level since June, dealers said. West Texas Intermediate at Midland firmed to as little as a $6 per barrel discount to U.S. crude, the strongest since June 22. West Texas differentials had plunged to the weakest in four years late in August as production in the nearby Permian Basin surged beyond pipeline takeaway capacity. However, Plains All American Pipeline LP will begin operations on an expanded West Texas Sunrise oil pipeline on Nov. 1, which will help ease the bottleneck, it said in a regulatory filing. Traders believe Midland differentials could strengthen further ahead of the pipeline coming into service but expressed skepticism that it could flip from a discount to a premium. U.S. crude’s discount to Brent narrowed by 17 cents to $9.60 per barrel from the widest level in nearly two weeks, dampening Gulf Coast grades. Light Louisiana Sweet WTC-LLS West Texas Intermediate at East Houston WTC-MEH was seen trading lower, weakening from near three-month highs. Meanwhile, U.S. crude inventories at the Cushing, Oklahoma, delivery hub rose by about 1.5 million barrels in the week to Sept. 25, dealers said citing market intelligence firm Genscape.

- Light Louisiana Sweet WTC-LLS for November delivery fell 25 cents to a midpoint of $7.75 and traded between $7.50 and $8 a barrel premium to U.S. crude futures CLc1.

- Mars Sour WTC-MRS was unchanged at a midpoint of $4.75, trading between $4.50 and $5 a barrel premium to U.S. crude futures CLc1.

- WTI Midland WTC-WTM rose $1.50 to a midpoint of $6 a barrel discount and traded between $5.75 and $6.25 a barrel discount to U.S. crude futures CLc1.

- West Texas Sour WTC-WTS was unchanged but was seen bid and offered between $6.50 and $6 a barrel discount to U.S. crude futures CLc1.

- WTI at East Houston, also known as MEH WTC-MEH, traded at $6.85 a barrel over WTI.

U.S. Cash Products-Chicago ULSD rises on refiner buying – Reuters News

Chicago ultra-low sulfur diesel cash differentials gained on Thursday as refiners actively bought the product while the region undergoes planned maintenance, market participants said. Chicago ULSD gained 1.75 cents a gallon to trade at 1.25 cents per gallon above the heating oil futures contract on the New York Mercantile Exchange, traders said. Chicago CBOB gasoline fell 1.25 cents a gallon to trade at 8.25 cents per gallon above the gasoline futures benchmark RBc1. The product has fallen for three straight days after last week hitting 15.75 cents per gallon above futures, its highest since Nov. 3. On the Gulf Coast, M3 conventional gasoline rose 2.00 cents a gallon to trade at 5.50 cents per gallon above futures, market participants said. A3 CBOB gasoline lost a quarter of a cent to trade at 0.75 cent per gallon below futures. Total SA shut the small crude distillation unit (CDU) at its 225,500 barrel per day (bpd) Port Arthur, Texas, refinery on Thursday for repairs, said Gulf Coast market sources. (Full Story) In New York Harbor, F4 RBOB gained a quarter of a penny to trade at 0.50 cent per gallon below futures, market participants said. The RBOB futures contract on NYMEX gained 2.39 cents to settle at $2.0824 a gallon on Thursday. NYMEX ultra-low sulfur diesel futures rose 2.33 cents to settle at $2.3231 a gallon. Renewable fuel (D6) credits for 2018 traded at 14 cents each on Thursday, up from 13 cents on Wednesday, traders said. Biomass-based (D4) credits fetched 34.5 and 35 cents each, slightly higher than 34 cents each on Wednesday, traders said.

U.S. oil refiners’ weekly capacity seen down 480,000 bpd -IIR – Reuters News

U.S. oil refiners are estimated to have 1,512,000 barrels per day (bpd) of capacity offline in the week ending Sept. 28, reducing available refining capacity by 480,000 bpd from the previous week, data from research company IIR Energy showed on Friday. IIR expects offline capacity to fall to 1,444,000 bpd in the week to Oct. 5. The following are IIR weekly figures for offline capacity (in thousands of bpd):

|

Week ended Friday |

Sept. 28 |

Sept. 26 |

Sept. 24 |

|

10/12/18 |

1,618 |

– |

– |

|

10/05/18 |

1,444 |

1,529 |

1,529 |

|

9/28/18 |

1,512 |

1,570 |

1,561 |

|

9/21/18 |

1,032 |

1,032 |

1,087 |

|

9/14/18 |

695 |

695 |

703 |

|

9/07/18 |

322 |

322 |

322 |

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.