From: Wagner, Jonathan

Sent: Tuesday, October 02, 2018 6:41:04 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

Good morning. Brent is the underperformer so far this morning with WTI trading unch’ed as global equities are in the red and the $ is marching back up towards 96. Yesterday’s price action was very impressive as continued worries emerge about the lack of spare capacity in the market and the ability or inability I should say to replace lost Iranian bbls. Goldman’s Currie said in their latest note that prices may remain above $80/bbl until producer hedging resumes (“No producer selling expected until year end, which leaves risks to the upside”). Citi’s Ed Morse in his latest note warmed US oil investors that American crude prices could fall to their steepest discount against Brent since 2013. It certainly feels that given the recent headlines and the money flow into Brent, many were expecting weaker WTI spreads / ARBs are we head into fall turnarounds. Genscape’s Cushing data released yesterday showed a mid week build of 485k bbls and a full week build of 1.5m bbls. Also looking at Open interest change over the past week, WTI has added 50k lots while Brent has lost 8k lots (and there aren’t many brt shorts out there at all). New inflow into WTI coupled with chunky producer hedging seen early last week has been the driver of the increased OI. In Brent, new managed money length has been offset by commercial liquidation.

Middle east crude prices moved higher today with 17 Dubai partials trading in the window. Shell, Equinor, and BP bought from Unipec, Totsa, Reliance, and Mercuria. Oct/Nov Dubai spreads remain firm at 80c back while Nov/Dec spreads are trading 67c back on continued Asian demand. Russia announced Sep oil production of 11.35m b/d (out yesterday) and Kazakhstan said that Kashagan output could increase by 30k b/d to 370k b/d in a month. Bloomberg and Reuters ship tracking data show shipments from OPEC’s 6 Persian Gulf countries, which account for ~75% of group’s output, fell to 18.11m b/d in September vs revised 18.31m in August. Iranian exports continue to fall, down 1.1m b/d versus April. Platts has an interesting article out today on the cat and mouse game Iran is playing with their tankers as the US sanction deadline approaches. According to the article, Iran’s oil tankers are switching their transponders off in a bid to appear oblivious to global satellite tracking systems as the OPEC member finds a way to sell its crude. Iran is also building stocks on its tankers as another line of defense along with significantly increasing its domestic refinery runs. Focus has turned to the oil tankers owned by state-owned National Iranian Tanker Company, which operates 38 VLCCs, making it second largest operator of such supertankers, the first being Saudi Arabian tanker company Bahri which now operates 47 VLCCs. Some NITC tankers are switching off their Automatic Identification System (AIS), an automated tracking system which reveals their position, according to S&P Global Platts trade flow software cFlow. According to this trade flow software, 11 Iranian tankers have had their transponders turned off as they are currently holding between 7 and 8 million bbls of crude and condensate on floating storage.

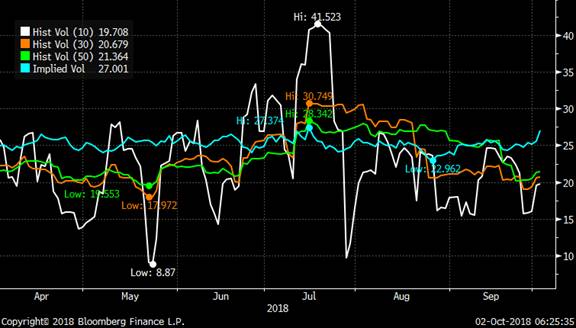

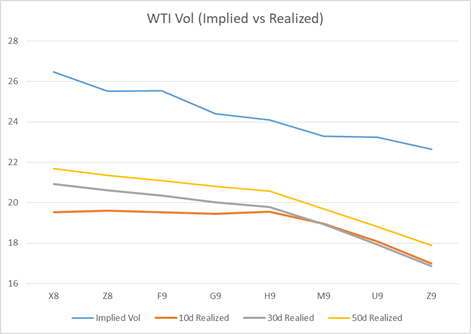

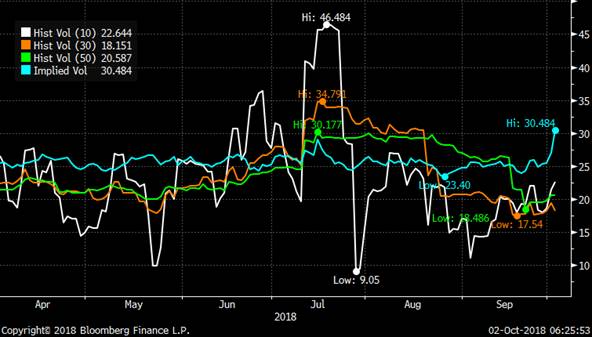

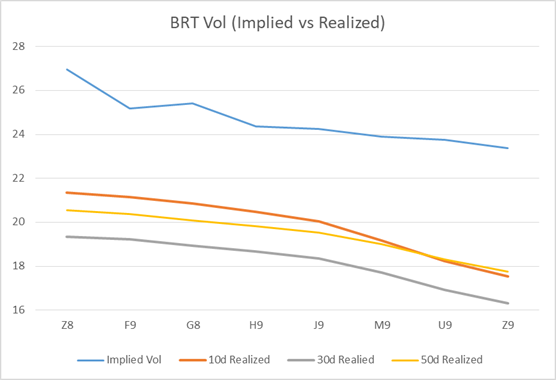

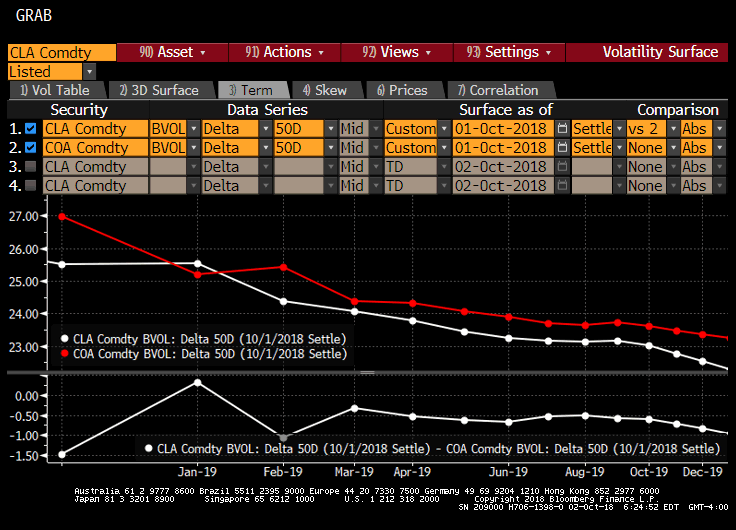

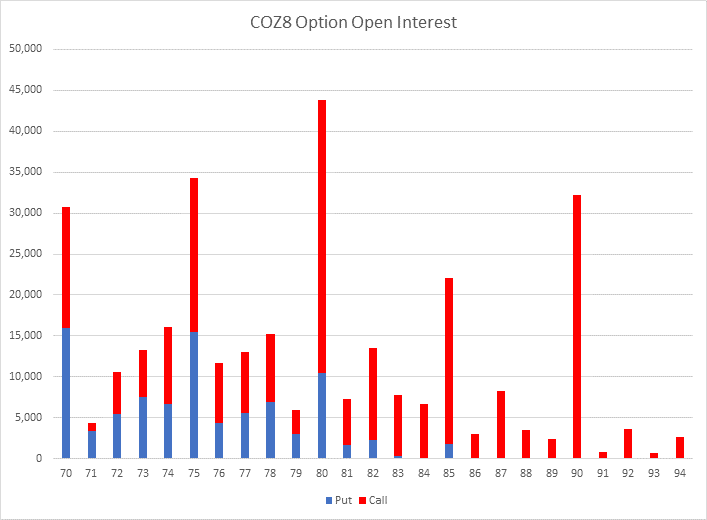

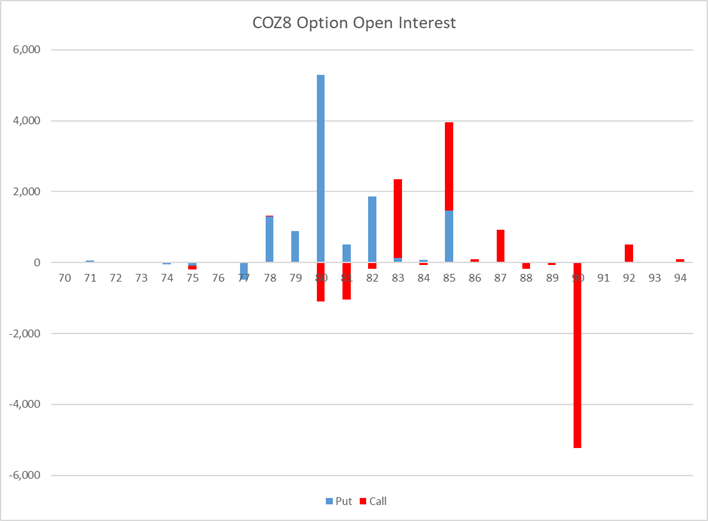

Front end Vols were well bid yesterday with WTI X8 breakevens closing at 1.26 while BRT Z8 breakevens closed at 1.45. Front end wingy WTI call skew was bid while put skew finished the day unch’ed. Brent skew was very quiet finishing the day unchanged even as upside structures continued to be seen going through the market. We saw interest early in day looking to sell brt call skew as vol rallied. The BRT Z8 90 call was the most actively traded strike yesterday with OI on that call dropping by 5k to 32k. This morning the BRT F9 100 call is active with 2,000x trading (33c value at the moment). Other structures seen on blocks this morning in Brent have been the Z8 84/88 call spread (700x) and the H9 77/85 fence (500x)

Brent Managed money net length vs Brent Commercial net length

Top stories listed below

Russian Oil Output Rises to Record as OPEC Cuts Rolled Back

Trump ramps up Saudi, OPEC criticism to little effect so far – Platts

U.A.E. Has `Alternatives’ to Buying Iran Oil: Minister Mazrouei

Middle East Crude-Benchmarks gain on firm demand – Reuters News

Iraq to Boost Rumaila Oil Field Output to 2.1m B/D: Jabbar

Fighting forces Libya to close Tripoli airport again – Reuters News

France seizes Iranian assets in response to foiled bomb plot – Reuters News

Iran’s oil tankers opt for Houdini tricks as US sanctions loom – Platts

Japan tells US corporate activity should not be impacted by Iran sanctions – Platts

Bill allowing U.S. to sue OPEC drawing renewed interest – Reuters News

OPEC GULF TRACKER: Iran Oil Flow Drop Drives Total Exports Down

Goldman Sees Oil Above $80/Bbl Until Producer Hedging Resumes

Citi Warns Looming Glut Will Push U.S. Oil Discount to 2013 Lows

Barclays Sees Rising Oil Prices to Hurt Demand, Draw New Supply

VENEZUELA TANKER TRACKER: Sept. Oil Exports Up Amid Dock Outage

FLOATING STORAGE: Kpler Says 1.56M Bbl of Oil in Malacca Strait

Canada Heavy crude discount narrows as new trading window opens – Reuters News

U.S. Cash Crude-Coastal grades firm as WTI/Brent widens – Reuters News

Plains Sunrise Pipeline to Begin New Tariffs for Expanded System

U.S. Cash Products-Gulf Coast diesel eases as refiners offer cargoes – Reuters News

U.S. East Coast refiners cash in by the trainload on Canadian oil – Reuters News Asia

Distillates-Gasoil cash premiums rise, prompt-month spread widens – Reuters News

Asia Fuel Oil-Crack holds firm despite strong crude prices – Reuters News

Global Oil Refining Margins Slump Points to Sliding Demand: JBC

|

Implied Vol |

Realized Vol |

|||||||

|

WTI Vol |

28-Sep |

1-Oct |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

24.89 |

26.46 |

1.57 |

1.26 |

19.53 |

20.93 |

21.69 |

|

|

Z8 |

25.12 |

25.52 |

0.4 |

1.21 |

19.60 |

20.62 |

21.36 |

|

|

F9 |

25.4 |

25.54 |

0.14 |

1.21 |

19.54 |

20.34 |

21.10 |

|

|

G9 |

24.45 |

24.4 |

-0.05 |

1.16 |

19.45 |

20.03 |

20.82 |

|

|

H9 |

24.19 |

24.09 |

-0.1 |

1.14 |

19.56 |

19.80 |

20.57 |

|

|

M9 |

23.72 |

23.3 |

-0.42 |

1.09 |

18.96 |

18.94 |

19.70 |

|

|

U9 |

23.51 |

23.25 |

-0.26 |

1.08 |

18.08 |

17.92 |

18.83 |

|

|

Z9 |

23.12 |

22.64 |

-0.48 |

1.03 |

17.00 |

16.87 |

17.88 |

CLZ8 Implied vs Realized Vol

|

Implied Vol |

Realized Vol |

|||||||

|

BRT Vol |

28-Sep |

1-Oct |

Change |

Breakeven |

10d |

30d |

50d |

|

|

Z8 |

25.41 |

26.96 |

1.55 |

1.45 |

21.35 |

19.35 |

20.56 |

|

|

F9 |

24.7 |

25.18 |

0.48 |

1.34 |

21.16 |

19.23 |

20.38 |

|

|

G9 |

25.2 |

25.41 |

0.21 |

1.35 |

20.86 |

18.95 |

20.09 |

|

|

H9 |

24.41 |

24.37 |

-0.04 |

1.29 |

20.47 |

18.66 |

19.81 |

|

|

J9 |

24.35 |

24.26 |

-0.09 |

1.28 |

20.03 |

18.35 |

19.54 |

|

|

M9 |

24.24 |

23.91 |

-0.33 |

1.25 |

19.18 |

17.70 |

18.99 |

|

|

U9 |

24.08 |

23.76 |

-0.32 |

1.23 |

18.24 |

16.92 |

18.30 |

|

|

Z9 |

23.74 |

23.38 |

-0.36 |

1.19 |

17.53 |

16.33 |

17.76 |

COZ8 Implied Vs Realized Vol

WTI / Brent ATM Implied Vol Curve

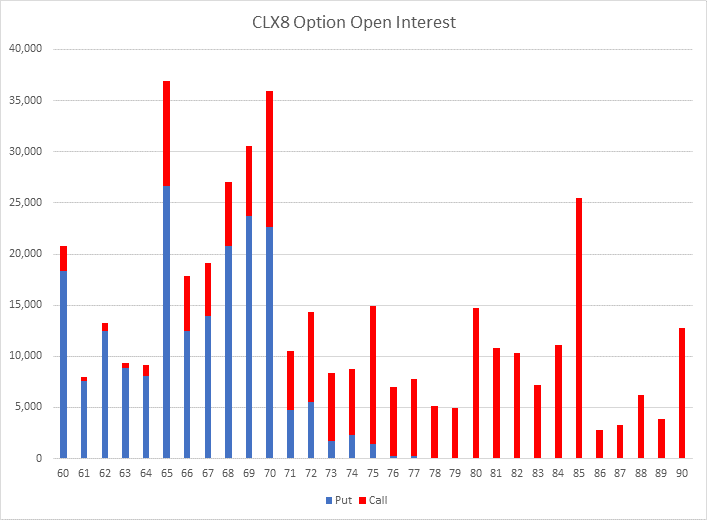

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

WTI Z20 90/100 Call Spread TRADES 58 1,200x

CME Trade Recap

WTI X/Z18 75 Call Roll TRADES 88 500x

WTI X18 70/75 Fence x74.80 TRADES 123 1,100x 60d

WTI X18 72.50/70 1×2 Put Spread x74.65 TRADES 18 3,000x 4d

WTI X18 74/77/80 Call Fly x75.00 TRADES 77 500x

WTI X18 69 Put vs BRT Z18 78 Put TRADES 29 5,000x; TRADES 28 5,000x

WTI Z18 72/75 Call Spread x73.22 TRADES 141 1,835x 21d

WTI Z18 75/80 Call Spread x74.50 TRADES 153 500x 29d

WTI M19 75/85 Call Spread x72.00 TRADES 261 1,000x 30d

WTI Z19 70/80 Call Spread x69.75 TRADES 378 300x 30d

WTI Z19 70/80 Call Spread x70.50 TRADES 400 700x 29d

WTI Z19 60 Put x71.25 TRADES 291 500x 18d

WTI Z19 70 Call x71.10 TRADES 738 400x 64d

WTI Z19 65/80 Fence x71.00 TRADES 125 500x 61d

ICE Trade Recap

WTI X18 76 Call x75.00 TRADES 122 500x 42d

WTI X18 65 Put TRADES 3.5 5,000x

BRT Z18 82 Put x82.75 TRADES 188 1,000x; TRADES 187 800x 45d

BRT Z18 85/90 1×2 Call Spread TRADES 76 500x

BRT Z18 95 Call vs WTI X18 85 Call 1×2 Call Spread TRADES 7 1,900x

BRT Z18 80/77 1×1.5 Put Spread TRADES 29 650x

BRT Z18 90 Call x85.35 TRADES 89 2,000x 21d

BRT Z18 895 Call x84.65 TRAES 24 2,500x 6d

WTI/BRT Z18 ATM Call Roll x73.00/83.00 TRADES 29 1,900x 51d/51d

BRT F19 95/110 Call Spread vs 65 Put x82.70 TRADES 26 1,600x 9d

BRT F19 85/90 Call Spread x83.50 TRADES 144 500x 22d

BRT F19 85/90 Call Spread x84.20 TRADES 160 250x 22d

BRT F19 78 Put x83.75 TRADES 115 1,000x 19d

BRT F19 83 Put x84.00 TRADES 284 1,500x 43d

BRT F19 90 Call x82.40 TRADES 95 500x 19d

BRT F19 90 Call vs BRT H19 100 Call TRADES 40 1,000x; TRADES 39 100x; TRADES 37 200x; TRADES 35 200x

BRT G19 95 Call TRADES 87 1,000x

BRT U19 80/70 1×1.5 Put Spread x79.60 TRADES 218 1,000x 10d

BRT G19 80/75 1×1.5 Put Spread x82.00 TRADES 90 1,100x 9d

BRT H19 90 Call x83.95 TRADES 241 950x 33d

BRT H19 91 Call x83.25 TRADES 197 5,000x 27d

BRT H/M19 90/85 Call Roll x83.50/82.50 TRADES 250 700x 31d/50d

BRT J19 79 Put x82.00 TRADES 368 550x 34d

WTI M19 55/65 Put Spread x73.25 TRADES 173 500x 16d

BRT M19 62.50/82 Fence x82.00 TRADES 508 2,500x 64d

BRT U19 80/60 1×2 Put Spread x79.90 TRADES 462 1,250x 23d

BRT U19 75/65 Put Spread x79.90 TRADES 279 1,000x 18d

BRT Z19 95/110 1×2 Call Spread TRADES 52 500x

BRT Z19 75/60 1×2 Put Spread x79.50 TRADES 241 500x 9d

WTI Z19 63.50/55 Put Spread x72.00 TRADES 201 500x 12d

BRT Z19 65/78 Put Spread x78.25 TRADES 458 700x 21d

BRT Z19 60/75 Put Spread x78.75 TRADES 424 800x 19d

BRT H20 60/75 Put Spread x78.20 TRADES 461 800x 18d

CSO/ARB/APO Trade Recap

WTI CSO X/Z18 0.40 Call (WA) TRADES 6 100x

WTI CSO 1Q19 0.50 Call (7A) TRADES 11 100x

WTI CSO Z/F19-G/H19 Flat Put (WA) TRADES 12 100x

WTI APO V18 71 Put TRADES 28 200x

WTI APO X18 75 Call x74.50 TRADES 224 200x 49d

WTI APO 1H19 82 Call TRADES 200 100x

WTI APO Z-G19 70/74 Call Spread TRADES 236 90x

WTI APO Cal19 50 Put TRADES 55 5x; TRADES 64 5x

Z8 BRT Option OI Change on day

Russian Oil Output Rises to Record as OPEC Cuts Rolled Back

Russia’s oil production rose to a post-Soviet high last month as the country completely rolled back the output cuts it had agreed on with OPEC, then pumped some more. The country produced a record 11.356 million barrels of oil and condensate a day in September, according to data released Tuesday by the Energy Ministry’s CDU-TEK statistical unit. That’s an increase of almost 150,000 barrels a day from August and follows Russia’s June agreement with OPEC to boost supplies amid climbing prices. OPEC itself raised output by 30,000 barrels a day last month as deepening losses in Iran were countered by other members, a Bloomberg survey showed. Russia’s production exceeded the previous high of 11.247 million barrels a day reached two years ago. That shows the country has completely erased its 300,000-barrel-a-day cut agreed on with the Organization of Petroleum Exporting Countries in 2016, and has added over 100,000 barrels a day more. “No surprise about Russia’s growth in capacities during the cutback, as investment continued apace, and so did upstream activity,” said Matthew Sagers, managing director of Russian and Caspian energy research at IHS Inc. “This has created an ‘overhang’ that will be further tapped in 2019.” The nation’s production next year may increase by an average of 300,000 barrels a day, excluding seasonal factors, according to Sagers. Energy Minister Alexander Novak said last month that the country had spare capacity to add more barrels if needed — “a few hundred thousand barrels” — yet a specific amount would depend on the market.

Rosneft, Sakhalin-1

Among Russia’s top producers, state-run Rosneft PJSC and the Sakhalin-1 project, led by Exxon Mobil Corp., were key drivers of September’s output boost, according to Bloomberg calculations based on the CDU-TEK data. Smaller companies also contributed, as other majors including Lukoil PJSC, Gazprom Neft PJSC and Surgutneftegas PJSC held output steady or even reduced supply. Rising output from Russia — and from OPEC partner Saudi Arabia — hasn’t stopped oil prices from surging to an almost four-year high as losses from Iran boost supply concerns even before U.S. sanctions take effect in November. Brent crude rallied almost 10 percent in the past month, topping $85 a barrel on Monday for the first time since October 2014. Novak is set to meet his Saudi counterpart Khalid Al-Falih in Moscow this week during an energy conference. The pair will meet after King Salman bin Abdulaziz of Saudi Arabia had a phone conversation with U.S. President Donald Trump at the weekend on maintaining stable oil supplies.

Trump ramps up Saudi, OPEC criticism to little effect so far – Platts

US President Donald Trump has tried tweets, speeches and even a phone call, but his campaign of threats so far has failed to compel Saudi Arabia and other OPEC members to address rising oil prices, at least in the manner he wants, analysts said Monday. Concerned about the impact rising gasoline prices may have on the US economy and on his Republican party’s chances to maintain control of the House and Senate in November’s midterm elections, Trump wants Saudi Arabia and others to start outlining their plans for boosting global supply in hopes doing so will cause oil prices to reverse their current course. "Trump is very concerned about high oil prices, obviously," Joe McMonigle, an analyst with Hedgeye Risk Management, said Monday. "Trump believes he has an agreement with the Saudis and other countries to offset the barrels that will be lost [when Iran sanctions are reimposed in November]. He’s basically holding them to account this."

The Trump administration wants the Saudis and other producers to begin publicly outlining "direct, concrete production numbers," which could quell rising oil prices, something these countries have so far been reluctant to do. At the end of an OPEC/non-OPEC monitoring committee meeting in Algiers last week, for example, Saudi Energy Minister Khalid al-Falih told reporters that OPEC is reluctant to ramp up production too quickly due to fears of an oversupplied market. "What makes this moment so awkward is [Trump] is focused on short-term market developments while [Saudi King Salman bin Abdulaziz al-Saud] is more concerned with medium-term trends," said Matt Reed, vice president of Middle East consultancy Foreign Reports. "Looking out to 2019, the Saudis see

a market with slack. Why ramp up output now if it means they might have to negotiate a new round of production cuts next year? That’s no easy task." On Saturday, Trump spoke with Salman about "efforts to maintain supplies to ensure the stability of the oil market and ensure the growth of the global economy," according to the Saudi Press Agency. The White House said that Trump and Salman spoke "on issues of regional concern," but administration officials declined to comment further about the call. The phone call came four days after Trump, in a speech before the United Nations, accused OPEC nations of "ripping off" the world on oil prices.

"We want them to stop raising prices, we want them to start lowering prices and they must contribute substantially to military protection from now on," Trump said in the speech. On September 20, Trump tweeted a similar argument, claiming that Middle East countries were benefiting from US military protection while pushing oil prices higher. "The OPEC monopoly must get prices down now!" Trump tweeted. Trump once again reiterated the point during a campaign rally in West Virginia Saturday night, after his phone call with Salman that morning. "Why are we subsidizing their military?" Trump asked. Reed with Foreign Reports said Trump’s public criticism of the Saudis may, ultimately, mean little. "The Saudis generally don’t lose sleep over what US politicians say at rallies and fundraisers," Reed said. "They’ve heard it all before." But McMonigle with Hedgeye said Trump’s criticisms were getting attention. "They’re definitely not used to this," McMonigle said. McMonigle said the criticism may also lead to additional details of production increases in the near future. "I wouldn’t be surprised to see more announcements coming out of the ministry or Aramco and possibly the UAE and others," he said.

U.A.E. Has `Alternatives’ to Buying Iran Oil: Minister Mazrouei

Alternatives are available in the market, U.A.E. Energy Minister Suhail Al-Mazrouei says on sidelines of event in Abu Dhabi, when asked if the country will eliminate condensate imports from Iran.

“The U.A.E. is committed to abiding by any sanctions against any country, we have always been committed and our commitment will continue”

NOTE: U.A.E. condensate imports from Iran were 67k b/d in September, according to tanker-tracking data

“OPEC members and countries outside the organization have expressed readiness to meet any supply needs”

Oil market is balancing and “there won’t be supply issues”: Al-Mazrouei

Middle East Crude-Benchmarks gain on firm demand – Reuters News

The Middle East crude benchmarks rose on Tuesday on continued firm demand, industry sources said. Refiners expected to increase output to meet peak winter demand, while Chinese independent refineries are locking in cargoes before the end of the year, the sources said. Buyers of Iranian crude oil have cut imports as U.S. sanctions draw near.

SAUDI OSP: Saudi Aramco is expected to raise the official selling prices for its crude grades to Asia for November, though the exact increment is hard to pin down this month, an industry source said. "It’s very hard to say, because of the recent DME chaos," the source added. He was referring to DME Oman crude futures on the Dubai Mercentile Exchange touching their highest in four years and overtaking ICE Brent last week.

RUSSIA: Russia’s Surgutneftegaz awarded 600,000 tonnes of November ESPO Blend ESPO-DUB on Friday at premiums of $5.90-6.50 a barrel to November Dubai swaps, traders said on Monday. Surgutneftegaz awarded six cargoes loading from Kozmino port on November 8-12, 12-16, 14-18, 18-22, 23-27 and 25-29. According to trading sources, the first three cargoes were sold at premiums from $6 to $6.50 and the last three were sold at premiums of $5.90-6 a barrel. China’s Unipec and Chemchina were named among the buyers, but the details were slow to emerge. Premiums for ESPO could be trading at higher levels in the resale market, two traders said, though this could not immediately be confirmed.

WINDOW: There were 17 cash Dubai partials which traded on Tuesday with Shell snapping up most of the barrels, an industry source said.

Iraq to Boost Rumaila Oil Field Output to 2.1m B/D: Jabbar

Country plans to boost output in coming years from 1.47m b/d currently, Ihsan Abdul Jabbar, director-general of state-run Basra Oil Co., says by phone.

Abdul Jabbar comments after meeting officials from BP, field’s operator, in city of Basra

Rumaila is biggest oil field in Iraq, OPEC’s 2nd-largest producer

Fighting forces Libya to close Tripoli airport again – Reuters News

Libya has closed the only functioning airport in the capital Tripoli again after rockets were fired in its direction, officials said on Tuesday, days after flights had resumed following a earlier shutdown. Matiga airport, a former air base used for commercial flights since the main international airport was destroyed in 2014 by militia fighting, said all flights had been suspended. It has closed and opened several times since a flare-up in violence in late August. Rival armed groups based in and outside the city have fought over territory and resources in the OPEC oil producer since the toppling of Muammar Gaddafi in 2011.

France seizes Iranian assets in response to foiled bomb plot – Reuters News

France seized assets belonging to Iran’s intelligence services and two Iranian nationals in response to a June plot to attack an exiled Iranian opposition group’s rally outside Paris, the government said on Tuesday. France had warned Tehran to expect a robust response after an Iranian diplomat was arrested in Germany suspected of involvement in a plot to bomb the meeting of the Paris-based National Council of Resistance of Iran (NCRI). U.S. President Donald Trump’s lawyer, Rudy Giuliani, and several former European and Arab ministers attended the rally in Villepinte. "An attempted attack in Villepinte was foiled on June 30. An incident of such gravity on our national territory could not go unpunished," said a joint statement by the foreign, interior and economy ministries. A spokesman at the Iranian Embassy in Paris did not immediately respond to a request for comment. There was no immediate response to the French move from Tehran. The asset freezes targeted two individuals identified as Assadollah Asadi and Saeid Hashemi Moghadam, the French statement said. A unit within the Iranian intelligence services was also targetted. The hardening of relations with France could have wider implications for Iran. France has been one of the strongest advocates of salvaging a 2015 nuclear deal between Iran and world powers, which U.S. President Donald Trump pulled out of in May. On Monday, a court in southern Germany said the detained Iranian diplomat, who is accredited in Austria, could be extradited to Belgium, where two other individuals suspected of involvement in the bomb plot were arrested on June 30. They were caught in possession of explosives. Earlier on Tuesday, some 200 police, some of them elite officers from Paris, swooped at dawn on a Muslim centre in northeastern France. Two security sources said the raids were not linked to the asset freezes.

Iran’s oil tankers opt for Houdini tricks as US sanctions loom – Platts

The global oil industry is growing more and more curious to find out how Iran is coping with the looming US sanctions which have already severely disrupted the country’s oil exports. Iran is opting for a cat and mouse game for now, with the help of its oil tankers. Iran’s oil tankers are switching their transponders off in a bid to appear oblivious to global satellite tracking systems as the OPEC member finds a way to sell its crude. Iran is also building stocks on its tankers as another line of defense along with significantly increasing its domestic refinery runs. Focus has turned to the oil tankers owned by state-owned National Iranian Tanker Company, which operates 38 VLCCs, making it second largest operator of such supertankers, the first being Saudi Arabian tanker company Bahri which now operates 47 VLCCs. Some NITC tankers are switching off their Automatic Identification System (AIS), an automated tracking system which reveals their position, according to S&P Global Platts trade flow software cFlow.

HIDE AND SEEK

Almost 11 Iranian oil tankers have had their transponders turned off these last few weeks, making it tricky to track Iran’s crude oil exports. VLCCs like Dino I, Diona, Navarz, Humanity have had their AIS data turned off since mid-September, making it tough to track where the shipments are going, data showed. But tankers like Snow, Huge, Sea Cliff, Dream II, Happiness I and Deep Sea which had their transponders off last week have re-emerged on satellite tracking system this week — all seen off the west coast of India. Recent tanker data had shown a sharp fall in exports to India, but the reappearance of these tankers may imply that flows to India may not be as low as preliminary data showed. A similar ploy was used by Iran during 2011-2014 when it was also hit by sanctions. Some tankers lose their signals due to weather and atmospheric issues but several analysts believe this trend of Iranian tankers is more to do with sanctions than climate. Representatives at NITC were unavailable for comment. Iran’s crude and condensate exports have tapered off sharply since early May when US President Donald Trump withdrew from the Iran nuclear deal and reimposed sanctions on the country. Iran’s crude oil and condensate exports fell to 1.7 million b/d in September, a fall of almost 700,000 b/d from May, according to Platts estimates.

FLOATING BARRELS

Iran is currently holding around 7 million-8 million barrels of crude and condensate on floating storage mainly off its main crude oil terminals, according to cFlow. This compares with levels of around 15 million-17 million barrels around three weeks ago, but the volume has fallen as some of those tankers turned off their transponders. Analysts have said that the rise in Iran’s oil storage along with its ghosts tankers show that the country’s production has not yet been curtailed as much as exports have fallen. Some analysts also said Iran is forced to store crude oil as it cannot easily close its taps, mainly because it needs the associated gas produced with crude oil to meet very high demand for natural gas and partly because of reservoir issues. Iran resorted to floating storage for its crude under the previous Western sanctions on its oil which ran from 2011 to 2016. At its height, Iran held some 50 million barrels of its crude and condensate in tankers during the curbs. Iranian production has already begun to suffer in advance of the sanctions, falling to 3.6 million b/d in August, the lowest in more than two years, according to Platts data. Output is expected to fall even further in the coming months as US sanctions targeting Iran’s oil sector kick in. Analysts expect the US sanctions to eventually shut in around 1 million-1.7 million b/d or more of Iranian exports.

Japan tells US corporate activity should not be impacted by Iran sanctions – Platts

Japanese delegates told US counterparts during a meeting in Washington Monday that Japanese corporate activities should not be impacted by looming sanctions against Iran, and the both sides agreed to continue discussions, Japan’s Ministry of Foreign Affairs said in a statement Tuesday. The meeting, the fourth round of its kind, came just over a month before US sanctions on Iran snap back on November 5. Tokyo has been seeking a US exemption for its Iranian oil imports as it sees the supplies as important for the country’s energy security and businesses. During the latest meeting, "both sides actively discussed the US’ reimposition of sanctions against Iran," while Tokyo reiterated its basic principle that Japanese corporate activity should not be impacted by the US sanctions, MOFA said in the statement, without elaborating. The meeting spearheaded by Hiroshi Oka, MOFA’s Director-General, Middle Eastern and African Affairs Bureau, and Sandra Oudkirk, Deputy Assistant Secretary, Bureau of Energy Resources, US Department of State, was attended by Japanese officials including from the Ministry of Economy, Trade and Industry, and US officials including from the Treasury and Department of Energy.

INCREASED IMPORTS AHEAD OF US SANCTIONS

Japan’s crude oil imports from Iran jumped 65% year on year in August, marking the fourth consecutive month of increase, according to the latest METI data. This signals domestic refiners’ efforts to take as many cargoes as possible before US sanctions against Iran come into effect in November. The 65% rise lifted Japan’s imports of Iranian crude oil to 177,475 b/d in August, contributing to the 5.9% year-on-year rise in overall crude imports to 3.39 million b/d in the month. Imports of Iranian crude in August edged down 3.3% from July, but the Persian Gulf producer was the fifth-largest supplier to Japan in the month, accounting for 5.2% of the total volume, according to METI data. Japanese refiners have now temporarily suspended Iranian oil loadings ahead of US sanctions, while they are also closely monitoring government talks with Washington on securing a waiver to continue their imports, Petroleum Association of Japan President Takashi Tsukioka said on September 20.

Bill allowing U.S. to sue OPEC drawing renewed interest – Reuters News

With oil prices hitting fresh four-year highs, long-dormant proposals to allow the United States to sue OPEC nations are getting a fresh look in Congress, though they were once considered a longshot to becoming law. A U.S. Senate subcommittee on Wednesday will hear testimony on the so-called No Oil Producing and Exporting Cartels Act, or NOPEC, which would revoke the sovereign immunity that has long shielded OPEC members from U.S. legal action. The bill would change U.S. antitrust law to allow OPEC producers to be sued for collusion; it would make it illegal to restrain oil or gas production or set those prices – removing sovereign immunity that U.S. courts have ruled exists under current law. Past U.S. leaders have opposed the NOPEC bill, but the possibility of its success may have increased due to President Donald Trump’s frequent criticism of the Organization of the Petroleum Exporting Countries, and as some predict that Brent crude, the international benchmark, could reach $100 a barrel before long. "OPEC is a pet peeve for him," said Joe McMonigle, senior energy policy analyst at Hedgeye Potomac Research. "Everybody thinks he could easily support NOPEC." Saudi Arabia is lobbying the U.S. government to prevent the bill’s passage, sources familiar with the matter said. Business groups and oil companies also oppose the bill, citing the possibility of retaliation from other countries. OPEC controls output from member nations by setting production targets. Prices are up 82 percent following the cartel’s decision to cut output at the end of 2016, hitting $84 a barrel on Monday, and lawmakers have trained their ire on the group, saying it is again harming consumers and represents interference in free markets. Wednesday’s hearing before the Senate Subcommittee on Antitrust, Competition Policy and Consumer Rights could give insight into the executive branch’s stance, McMonigle said. One of the witnesses will be Makan Delrahim, assistant attorney general for the Justice Department’s Antitrust Division, who has written in support of such legislation. A version of NOPEC passed both houses of Congress in 2007 but was shelved after President George W. Bush said he would veto the legislation. Chances of passage this year are slim, as the U.S. House of Representatives is scheduled to be in session only 16 days the rest of this year, leaving little time for anything but must-do legislation like keeping the government funded. Saudi Arabia, the world’s top oil exporter, is worried that NOPEC could turn into another Justice Against Sponsors of Terrorism Act (JASTA) law, which allows victims of the Sept. 11 attacks in the United States to sue Riyadh, the sources said. The JASTA law is seen as key to why state-run Saudi Aramco was hesitant in publicly listing its shares on U.S. markets in an IPO that has since been shelved. With close to $1 trillion in investments in the United States, Riyadh has a lot to lose if NOPEC becomes law. Saudi Energy Minister Khalid al-Falih raised concerns about it with U.S. officials, including U.S. Energy Secretary Rick Perry, during private meetings in recent months, two sources told Reuters on condition of anonymity. Earlier this year, the U.S. Chamber of Commerce and American Petroleum Institute told Congress they opposed the bill, saying surging U.S. energy output had mitigated OPEC’s influence. Since the U.S. renewed sanctions on Iran this May, other nations, including Saudi Arabia, have agreed to increase production. However, that has not yet stopped oil’s upward climb.

OPEC GULF TRACKER: Iran Oil Flow Drop Drives Total Exports Down

Observed exports of crude and condensate from the Persian Gulf edged down in September, as the region’s producers failed to offset deepening losses of Iranian supplies before impending U.S. sanctions, according to Bloomberg tanker tracking.

- Shipments from OPEC’s 6 Persian Gulf countries, which account for ~75% of group’s output, fell to 18.11m b/d in September vs revised 18.31m in August

- Iran’s exports continue to show the impact of renewed U.S. sanctions, with combined crude, condensate flows falling to their lowest since February 2016

- Nation’s flows were down by 1.1m b/d, or 39%, vs April, the last month before President Trump pulled the U.S. out of the Iran nuclear deal

- Flows from Iraq’s southern Basra oil terminal rose to a record as the country continued to raise output after OPEC eased restrictions

- Saudi exports edged lower as flows to the U.S., South Korea, Thailand and France all fell

- Exports from the U.A.E. were also down, as flows fell to Thailand, Australia and Japan

- Kuwait was the big positive, with flows nearing 2.1m b/d, up from 1.833m b/d in August; large gains to India, Japan, Philippines; nation’s shipments were still second lowest this year

- Iran’s exports continue to show the impact of renewed U.S. sanctions, with combined crude, condensate flows falling to their lowest since February 2016

- Tanker tracking shows the following shipments of crude and condensate in m b/d:

|

Country |

September |

August |

|

|

Saudi Arabia |

7.127 |

vs |

7.183 |

|

Iraq (Basra) |

3.644 |

vs |

3.616 |

|

U.A.E. |

2.705 |

vs |

2.745 |

|

Iran |

1.721 |

vs |

1.978 |

|

Kuwait |

2.055 |

vs |

1.833 |

|

Qatar |

0.856 |

vs |

0.959 |

- Flows from Persian Gulf to main buyers in m b/d:

|

Destination |

September |

August |

|

|

China |

3.289 |

vs |

3.014 |

|

India |

2.725 |

vs |

2.436 |

|

Japan |

2.411 |

vs |

2.712 |

|

South Korea |

1.888 |

vs |

2.404 |

|

U.S. |

1.266 |

vs |

1.714 |

Goldman Sees Oil Above $80/Bbl Until Producer Hedging Resumes

Recent uptick in crude driven by financial flows from consumers and investors, Goldman Sachs analysts including Jeff Currie say in report.

Prices may remain above $80/bbl until producer hedging resumes

“No producer selling expected until year end, which leaves risks to the upside”

Most producers have already sold forward their 2019 production

Gains in long-dated crude prices reflect concerns about spare production capacity

Export losses from Iran are potentially front-loaded, with most risk over the next two months

Brent has carry of 8% per annum, so should still see positive 12-month returns even if crude pulls back to $80

Citi Warns Looming Glut Will Push U.S. Oil Discount to 2013 Lows

Citigroup Inc. has a warning for U.S. oil investors: American crude prices may tumble to the steepest discount against global benchmark Brent since 2013. West Texas Intermediate futures in New York will fall further to become as much as $15 a barrel cheaper than London’s Brent, said Ed Morse, the bank’s global head of commodities research. That’s because inventories in Cushing, Oklahoma — the largest U.S. storage hub — are set to grow as a pipeline bottleneck stops booming output in the Permian Basin from reaching the American Gulf Coast. WTI’s discount to Brent has more than doubled since mid-July as crude produced in America’s hottest shale play finds it increasingly hard to reach export terminals and refineries on the coast. That’s pushed Cushing stockpiles higher in five of the last seven weeks. Meanwhile, fears that the Organization of Petroleum Exporting Countries may struggle to fill the void left by U.S. sanctions on Iran’s oil exports have helped buoy Brent prices. “As U.S. production grows, the likelihood is overwhelming that a lot of the valves to get into the Gulf Coast are going to close,” Morse said in an interview during the Asia Pacific Petroleum Conference (APPEC) in Singapore last week. “It’s bottlenecked getting to the Gulf Coast but it’s not as bottlenecked getting into Cushing,”

The Forecast

Stockpiles at Cushing may grow from the current 20-million-barrel level to 70 million barrels by April, before new pipelines are added in the fourth quarter of next year, Morse said. WTI traded at a $9.47 discount to Brent on Friday, compared with $4.34 on July 19. A $15 gap, as forecast by Morse, would be the widest spread since December 2013. U.S. production has been hitting new records this year while rigs drilling for crude have also expanded. Soaring output, dwindling pipeline space and a rail and trucking shortage have raised shipping costs, increasing the discount producers in the region give to offload their oil. “We expect that Permian production is going to continue to grow,” Morse said. “We have production from Colorado to Oklahoma, even from North Dakota and Canada, that has to go to Cushing before getting to the Gulf Coast.” Janet Kong, who heads BP Plc’s trading business in Asia, agrees that U.S. oil will stay pressured. On top of the pipeline squeeze in America, the ongoing trade quarrel between the world’s two largest economies as well as supply shocks outside the U.S. may lead to Brent’s gain over WTI, she said. China would need to find supplies from elsewhere if it boycotts U.S. barrels, lifting the price of crude outside of America, Kong said. Meanwhile, shale production is likely to keep growing, she said. “It’s possible that WTI-Brent trading will be very volatile.”

Barclays Sees Rising Oil Prices to Hurt Demand, Draw New Supply

Oil prices may rally further this month on falling Iranian exports, though softening demand growth and new supply should cool bullish sentiment and push prices lower by year-end, Barclays analysts including Michael Cohen say in Oct. 2 report.

Bank raises its Brent est. for 3Q to $76/bbl from $72/bbl previously; 4Q price forecast at $77 vs $74

2018 est. revised up to $74 from $72

While bullish narrative may persist at least until the next OPEC meeting in early December, prices are ripe for correction as recent rally will lead to response from U.S., consumers, OPEC and Saudi Arabia

Supply from other OPEC members will continue to offset decline from Venezuela and Iran; recent supply increases have not come at the expense of spare capacity

Interpretation of market fundamentals seems one of the biggest upside risks to prices

“How U.S. policymakers, OPEC, and Saudi Arabia assess the market will serve as the basis for critical decisions for the oil market in the coming months”

“With so many cooks in the oil price kitchen, the broth is bound to spoil”

Best way for U.S. to cut Iranian revenue is to allow prices fall to $70-$80 and let Iran to export ~1.4m b/d, slightly below current levels

If U.S. doesn’t do so by issuing waivers, bank sees high probability of an SPR release in 4Q

VENEZUELA TANKER TRACKER: Sept. Oil Exports Up Amid Dock Outage

Exports of Venezuelan crude oil rose m/m in September despite a dock outage as PDVSA boosted use of underutilized loading points, according to fixture reports and ship-tracking data compiled by Bloomberg.

Total exports +12% m/m, -4.3% y/y to ~1.282m b/d in September

Loadings rose despite an outage at the south dock as PDVSA boosted loadings via the underutilized loading points, including the Petrozuata monobuoy and Puerto La Cruz

In 2001, at its peak, Venezuela exported 2.309m b/d crude oil, according to Venezuela’s oil ministry data compiled by Bloomberg

To U.S., top buyer, -4.7% m/m to 452.5k b/d

U.S. Gulf Coast refinery utilization -3.2 ppt w/w to 93.3% week of Sept. 21, according to EIA data

To China -32% m/m to 180k b/d

Previously, Sept. 18: Venezuela to boost oil exports to China to 1m b/d, Maduro says

To India +8.4% m/m to 353.3k b/d

Data is based on month of loading of vessels; loadings for Jose, Puerto La Cruz, FSO Nabarima, Puerto Miranda, Bajo Grande and ship-to-ship transfers off Venezuela, Cayman Islands, Trinidad, Aruba

FLOATING STORAGE: Kpler Says 1.56M Bbl of Oil in Malacca Strait

A total of 1.56m bbl of crude oil are floating in Strait of Malacca as of Sept. 30, according to data from cargo-tracking and intelligence co. Kpler.

That’s down ~72% from 5.669m bbls a month earlier

Floating storage defined as oil-laden tankers idled for 15 days; Strait of Malacca consists of anchorage areas including Pelepas, Linggi, Batu Pahat, Tanjung Bruas

Canada Heavy crude discount narrows as new trading window opens – Reuters News

The Canadian heavy oil differential narrowed against the West Texas Intermediate (WTI) benchmark on Monday, the first day of a new monthly trading window. Western Canada Select (WCS) heavy blend crude for November delivery in Hardisty, Alberta, settled at $39.50 a barrel below the WTI benchmark crude futures CLc1, compared with Friday’s settle of $43.50, according to Shorcan Energy brokers. Friday’s settle marked a new record spread for the differential. Rising output from Canada’s oil sands has run up against full pipelines, swelling volumes in storage and putting pressure on prices, analysts say. While crude by rail volumes are up, they have not yet had a material impact on the buildup. Global oil futures jumped more than $2 a barrel on Monday, rising to levels not seen since November 2014, as U.S. sanctions on Iran loom and a North American trade deal fosters growth. Light synthetic crude from the oil sands for November delivery settled at $19.00 under WTI, compared with Friday’s settle of $18.00 under.

U.S. Cash Crude-Coastal grades firm as WTI/Brent widens – Reuters News

U.S. coastal crude differentials strengthened on Monday in light volumes as U.S. crude’s discount to Brent widened, dealers said. Gulf grades including Light Louisiana Sweet (LLS) and Mars firmed with Mars climbing to the highest level since June 11. U.S. crude’s discount to Brent widened by 13 cents to $9.84 per barrel, and was seen as supportive to exports but the strength in Gulf grades has weighed on arbitrage economics to Europe and Asia, dealers said. Still, Mexico’s state-run Pemex has launched a tender to buy 350,000 barrels of LLS crude for October delivery, according to a document seen by Reuters on Monday. West Texas Intermediate at Midland WTC-WTM was seen trading at about $7 a barrel discount after trading as little as $6 per barrel below U.S. crude last week, the strongest since June 22. Midland differentials had plunged to the weakest in four years late in August as production in the nearby Permian Basin surged beyond pipeline takeaway capacity. Sunrise Pipeline set rates for its new crude pipeline system from Loving County, Texas in the Permian basin to the storage hub of Cushing, Oklahoma, effective Nov. 1, according to a regulatory filing on Monday. Crude is already flowing in the line and it is expected to go into full service in early November. Meanwhile, inventories at the Cushing hub rose by about 1.5 million barrels in the week to Sept. 28, traders said, citing data from market intelligence firm Genscape. U.S. fall refinery turnarounds are set to be 15 percent above normal through October, led by robust Midwest activity, Morgan Stanley analysts have said.

Light Louisiana Sweet WTC-LLS for November delivery rose 25 cents to a midpoint of $8.25 and traded between $8 and $8.50 a barrel premium to U.S. crude futures.

Mars Sour WTC-MRS rose 37.5 cents to a midpoint of $5.50 and traded between $5.25 and $5.75 a barrel premium to U.S. crude futures.

WTI Midland WTC-WTM rose 25 cents to a midpoint of $7 a barrel discount and traded between $7.50 and $6.50 a barrel discount to U.S. crude futures.

West Texas Sour WTC-WTS was unchanged at a midpoint of $7.50 a barrel discount, and was seen bid and offered between $7.75 and $7.25 a barrel discount to U.S. crude futures.

WTI at East Houston, also known as MEH, WTC-MEH was seen bid and offered at $7.25 and $7.75 a barrel over WTI.

Plains Sunrise Pipeline to Begin New Tariffs for Expanded System

Sunrise Pipeline to start new rates for crude shipments on its expanded system from Nov. 1, according to a FERC filing.

For shipments originating at Conan Station in Texas bound for Cushing, Okla.:

Uncommitted rate at $1.69/bbl

Anchor committed rate at $1.70/bbl

Non-anchor committed rate at $1.75/bbl

Anchor Committed Shippers must have made a volume commitment of => 80k b/d in its transportation services agreement for a term of at => 7 years

U.S. Cash Products-Gulf Coast diesel eases as refiners offer cargoes – Reuters News

U.S. Gulf Coast diesel for physical delivery slipped Monday as refiners offered cargoes early in the session, traders said. The grade eased early in the session, and ended the day down about 0.25 cent per gallon at 1.30 cents below the futures contract on the New York Mercantile Exchange, after some of the cargoes were bought for shipment on the Explorer pipeline, traders said. M3 conventional gasoline traded flat during the session, traders said. The grade reached 5.50 cents per gallon above last week, the highest since Sept. 4. U.S. oil refiners are estimated to have 1.36 million barrels per day (bpd) of capacity offline in the week ending Oct. 5, increasing available refining capacity by 131,000 bpd from the previous week, data from research company IIR Energy showed on Monday. Chicago CBOB gasoline lost 1.75 cents per gallon to trade at 6.00 cents per gallon above futures, market participants said. Group Three gasoline also fell, losing 1.75 cents to trade at 6.00 cents per gallon above futures. In New York Harbor, F4 RBOB rose 1.65 cents per gallon to trade at 85 cents per gallon above futures. The RBOB futures contract on NYMEX fell 0.60 cents to settle at $2.1275 a gallon on Monday. NYMEX ultra-low-sulfur diesel futures lost 0.97 cents to settle at $2.4079 a gallon. Renewable fuel (D6) credits for 2018 traded at 16 cents each on Monday, up from 14 cents each on Friday, traders said. Biomass-based (D4) credits fetched 36 cents each, up from 34 cents each on Friday, traders said.

U.S. East Coast refiners cash in by the trainload on Canadian oil – Reuters News

U.S. East Coast oil refiners are ramping up rail deliveries of crude from Western Canada, grabbing stranded barrels that full pipelines have driven to a record discount. That trend is expected to accelerate, as prices will remain weak, with no new Canadian export pipelines expected until late 2019. Rail volumes from Canada to East Coast refineries averaged 35,000 barrels a day for the 12 months ending in July, up from 16,000 bpd for the prior 12-month period. Canada is having difficulty building and expanding pipelines due to environmental and aboriginal opposition, prompting a swing back to its crude-by-rail delivery system. Bottlenecks helped drive the discount of Western Canadian Select heavy crude, the primary grade of oil produced in the province of Alberta, to a record $43.50 below U.S. West Texas Intermediate oil futures late last week. Canadian light synthetic crude trades around $18 below WTI, making both Canadian benchmarks more attractive to U.S. East Coast refiners than U.S. grades of oil or crude imported from Europe or Africa. Brent, the international benchmark, is currently trading at nearly a $10 premium above U.S. crude. "Historically, East Coast refiners would be at the mercy of global waterborne Atlantic pricing, but given how North American crude differentials materially weakened, this has been a significant boon," said Michael Tran, commodity strategist at RBC Capital Markets. With five of the top 10 U.S. refiners of Canadian crude scheduled to go offline for maintenance in the next six months, Canadian prices may remain depressed, Tran said.

If the Canadian differential stays wide and rail capacity grows, traders expect volumes east to return to record levels around 100,000 bpd, last reached in 2014. Just one East Coast refinery regularly processes the heavy oil that accounts for most Western Canadian production, traders said. Recent rail shipments of heavy crudes have gone to PBF Energy Inc’s 190,000-bpd Delaware City refinery, and light crude to Philadelphia Energy Solutions Inc’s 335,000-bpd complex, sources said. Phillips 66 PSX.N took in Canadian heavy crude to its 258,000-bpd New Jersey refinery in April for the first time in a year and a half, and also imported in May and June, the last months for which data is available. PBF, Phillips 66 and PES declined to comment on commercial operations. Rail volumes from Canada to Gulf Coast refineries are larger than those to the East Coast, but their growth rate is slower. Those volumes averaged 81,000 bpd in the 12 months to July, up 26 percent from the previous 12-month period, EIA data showed. "There’s existing shippers who have increased their volumes to the east," said Iqbal Gill, head of hydrocarbon supply for BarrelTex. "Gulf Coast shipments have increased as well but not to the degree Eastward movements have." Canada’s overall crude exports by rail hit a new record at 206,624 bpd in July. This is expected to keep rising, yet shipments may be hindered by competition from other commodities like grains and a shortage of rail cars. Regulators are fast-tracking the phase-out of older, more puncture-prone cars, while top U.S. railroad BSNF is limiting the use of retrofitted cars on its lines, citing safety concerns. Those changes together affect roughly 17 percent of the current fleet of crude rail cars in North America, said Matt Murphy, an energy analyst with Tudor, Pickering, Holt & Co. This will limit volumes of Canadian crude to East Coast refineries, say traders. "Every refinery out there that has access to rail is looking for more unit trains but they’re nowhere to be found," said one East Coast refinery trader, who declined to be named, citing company policy.

Asia Distillates-Gasoil cash premiums rise, prompt-month spread widens – Reuters News

Asia’s cash differentials for 10ppm gasoil climbed to their highest in over a week on Tuesday, buoyed by stronger buying interests amid limited supply, while the prompt-month spread widened its backwardated structure. Cash premiums for gasoil with 10ppm sulphur content rose to 84 cents a barrel to Singapore quotes during Asian trade on Tuesday, compared with a premium of 80 cents a barrel on Monday. The current high cash differentials for gasoil would likely sustain because the region is quite strong lately due to some turnarounds in North Asia, trade sources said, adding supply available is quite limited at present. The Oct/Nov time spread widened in backwardation to $1.45 a barrel on Tuesday, from $1.10 a barrel on Monday. Backwardation, when the front-month contract is more expensive than subsequent months, makes it uneconomical to store the product, resulting in a drawdown in inventories. It is usually seen as a sign that the market is rebalancing and prices are likely to head higher in future months. Refining margins for 10ppm gasoil climbed to $16.82 a barrel over Dubai crude during Asian trading hours, compared with $16.68 per barrel a day earlier. Meanwhile, refining margins for jet fuel inched down to $16.02 a barrel over Dubai crude, compared with Monday’s $16.18 a barrel, their highest in over three weeks. Cash discounts for jet fuel narrowed to 67 cents a barrel to Singapore quotes, compared with a discount of 70 cents on Monday. The physical market for jet fuel in the Singapore window remained subdued with no bids or deals on Tuesday.

Asia Fuel Oil-Crack holds firm despite strong crude prices – Reuters News

The front-month barge 380-cst fuel oil crack slightly narrowed its discount to Brent crude on Tuesday despite crude oil prices climbing to their highest in nearly four years this week. The relatively strong fuel oil crack reflects market expectation of tighter fuel oil supplies over the near-term amid weak arbitrage economics, lower output and looming sanctions on Iranian oil exports early next month, trade sources said. The November crack discount was at minus $11.64 a barrel to Brent crude on Tuesday, compared to minus $11.72 a barrel in the previous session. Brent oil prices fell on profit-taking on Tuesday but remained near their highest since November 2014 as markets braced for tighter supply once U.S. sanctions against Iran kick in next month.

WINDOW TRADES

– One cargo trades were reported in the Singapore trading window, totalling 20,000 tonnes of 380-cst high-sulphur fuel oil (HSFO).

– Vitol bought the cargo from Sinopec Hong Kong at a $5.15 per tonne premium to the balance of average October quotes.

Global Oil Refining Margins Slump Points to Sliding Demand: JBC

The evident weakness in global refining margins is a warning sign of stumbling crude demand and can be reckoned as an important bearish force on market strength, says Vienna-based JBC Energy in emailed report.

"There is a decent chance that we are currently feeling the peak impact of the Iran sanctions"

Latest storage indicators show no signs of strong draws, a stark contrast to this time last year, says JBC

Current prices rally more a reflection of crude stocking before presumed shortness in November

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.