From: Wagner, Jonathan

Sent: Wednesday, October 03, 2018 6:35:59 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

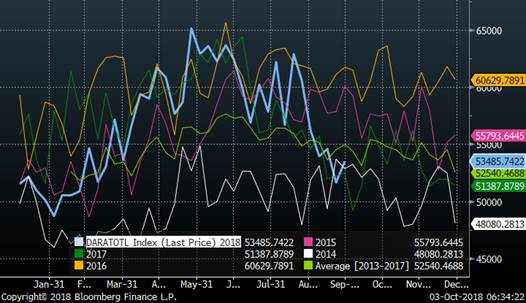

Good Morning. Oil prices are unchanged to start the day as Saudi Minister Al-Falih said that they are currently pumping 10.7m b/d of oil. He also said that November output would be slightly higher than Oct. The oil market is well supplied, “some would say oversupplied,” Saudi Energy Minister Khalid Al-Falih says in Moscow. He continued by saying that they are meeting every single demand for bbls and the current price is based on financial markets rather than physical flows. Russian minister Novak continues to stress that his country still has room to grow oil production if needed while Lukoil’s CEO said that Russian companies have reached their “maximum” in oil production. Lukoil is Russia’s 2nd largest crude producer. At least 3 other companies have said they have potential to further increase output, including Rosneft, Gazprom Neft, Tatneft. Iraqi oil minister Al-Luaibi said today that OPEC and its allies made the right decision about output increase and hasn’t been too cautious responding to changes in the market. He also said that they have some spare oil production capacity left as they continue to try and grow output to 5m b/d. Kazakh oil minister Bozumbayev said that geopolitics rather than supply and demand are pushing oil prices higher now and there is no need to rush decisions for more OPEC+ oil at this time. Bernstein is out with a note this morning saying that oil spare capacity may hit a historic low by year end. “Effective spare capacity, now at ~1.5m b/d, may reach historic lows by end-2018 as U.S. sanctions cut Iran’s 1m b/d capacity out of the market.” Bernstein estimates OPEC’s spare capacity closer to 2m b/d and effective core OPEC, Saudi Arabia plus U.A.E. and Kuwait, at 1.4m b/d. That’s against IEA estimate of 2.5m b/d capacity for OPEC, excluding Libya and Nigeria. JBC’s note today cuts energy oil demand growth by 300k b/d to less than 1.1m b/d for 2018 due to factors including higher flat prices, diving currencies in emerging markets, burgeoning product stockpiles and trade wars. According to their report, Demand grew by a lackluster 540k b/d over 2Q and 3Q; expects an increase to just over 1m b/d in 4Q. They expect 1m b/d demand growth in 2019, which JBC describes as “quite conservative compared to other agencies.”

Middle east oil prices continue to climb as cash Dubai and Oman’s premiums to swaps increased. Seven Dec Dubai partials traded in the window with Shell buying from Unipec and Lukoil. One Dec Oman partial traded with Shell buying from Unipec. Oct/Nov Dubai spread are trading 87c backward while Nov/Dec Dubai is trading at 69c back. Reuters published a story this morning saying that US oil shipments to China have “totally stopped,” This is according to the President of China Merchants Energy Shipping company who blames this on the growing trade war. "We are one of the major carriers for crude oil from the U.S. to China. Before (the trade war) we had a nice business, but now it’s totally stopped," Xie Chunlin, said on the sidelines of the Global Maritime Forum’s Annual Summit in Hong Kong.

API data released last night showed crude stocks building 907k bbls while Cushing stocks built by 2m bbls. Total Padd 2 stocks built by 4.6m bbls with Padd 3 adding 887k bbls. The chunky draw was seen in Padd 5 (-4.3m bbls). Gasoline stocks drew 1.7m bbls while disty stocks drew 1.2m bbls. Runs were lower by 158k b/d and crude imports increased by 157k b/d w/w to 8m b/d. Last week’s DOE imports were 7.8m b/d for comparison.

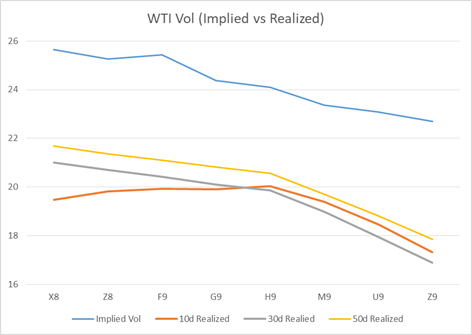

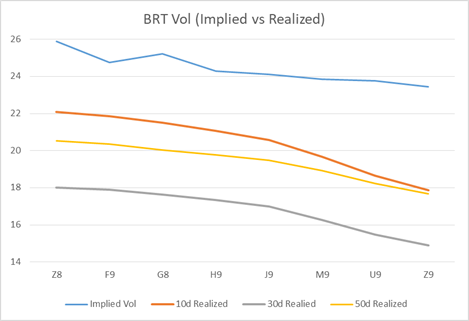

Front end vols were well offered in both WTI And Brent yesterday with call skew finishing the day unchanged in both markets. The early am call skew bid was met with good selling in the afternoon (X8 and Z8 WTI and Q1 Brent). Front end Wingy WTI and Brent call skew still remains at +3% over atm.

Lastly, Energy Aspects will host their annual PIRA week gathering this afternoon in NYC. I don’t expect many bearish statements given Amrita’s recent comments that Q4 could be the tightest we’ve seen in a decade (and that is with Saudi producing close to 11m b/d).

Top stories listed below

U.S. crude oil stocks rise 907,000 bbls-API

Al-Falih Says Current Saudi Oil Production Is About 10.7m B/D

Trump: I told Saudi king he wouldn’t last without U.S. support – Reuters News

Middle East Crude-Benchmarks gain ahead of Saudi OSPs – Reuters News

U.S. crude oil shipments to China "totally stopped" amid trade war – shipping exec – Reuters News

OPEC+ Made Right Output Decision, Wasn’t Too Cautious: Iraq Min

Kazakh Min: No Need for ‘Rush’ Decisions on More OPEC+ Oil Now

Lukoil CEO Says Russia Has Reached Oil-Output Peak: Vedomosti

Russia Still Has Capacity to Raise Oil Output If Needed: Novak

Russia’s Lukoil Sees `Fair’ Oil Price at $60-75/Bbl: Vedomosti

Kazakhstan Sees Oil Production Expanding as New Investment Flows

Iran says World Court ruling proves U.S. sanctions are "cruel" – Tasnim news – Reuters News

Fed’s Powell says U.S. outlook "remarkably positive" – Reuters News

Indian rupee hits record low as high oil prices weigh – Reuters News

JBC Slashes Oil Demand Growth Forecast, Citing High Prices, EMs

Oil Spare Capacity May Reach Historic Low by Year-End: Bernstein

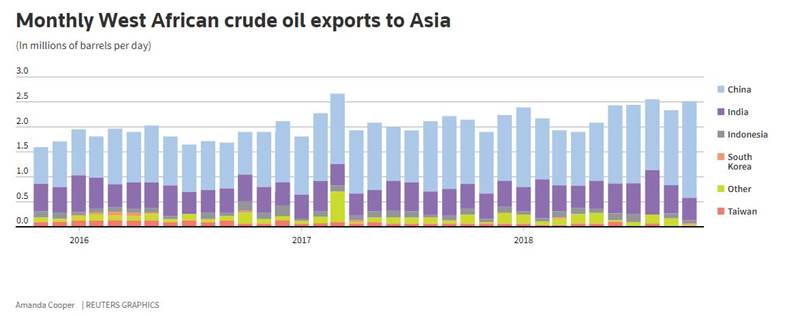

Asia scrambles for West African oil before U.S. sanctions hit Iran – Reuters News

Crude Storage in ARA Rises 3.6%, Genscape Weekly Data Show

Sanctions delay PdV oil dock repair: ministry – Argus

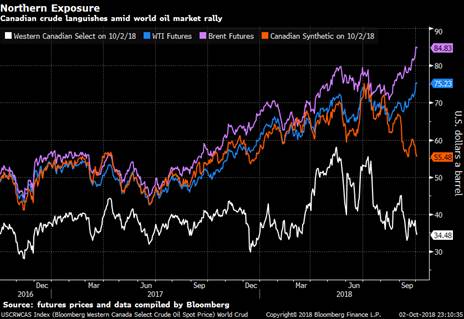

Canadian Oil Pain Grows as Crude Discount to WTI Hits $40

CANADA CRUDE-Heavy crude discount widens amid tight transport – Reuters News

U.S. Cash Crude-Coastal grades little changed in thin trade – Reuters News

After lean years, Big Oil is under pressure to spend – Reuters News

U.S. Cash Products-Chicago gasoline drops to lowest since August – Reuters News

U.S. oil refiners’ weekly capacity seen up 124,000 bpd -IIR – Reuters News

Venezuela refinery runs shrink to 25pc: PdV data – Argus

Exxon to Start Supplying IMO-2020 Compliant Ship Fuel in Asia

Over 10 mil barrels of European gasoline loading Sep-early Oct heading to East; up from Aug – Platts

FOB Singapore gasoil breaches $100/b mark for first time in nearly 4 years – Platts

|

Implied Vol |

Realized Vol |

|||||||

|

WTI Vol |

1-Oct |

2-Oct |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

26.46 |

25.65 |

-0.81 |

1.22 |

19.48 |

21.00 |

21.69 |

|

|

Z8 |

25.52 |

25.27 |

-0.25 |

1.2 |

19.83 |

20.70 |

21.37 |

|

|

F9 |

25.54 |

25.44 |

-0.1 |

1.21 |

19.94 |

20.44 |

21.12 |

|

|

G9 |

24.4 |

24.39 |

-0.01 |

1.15 |

19.92 |

20.11 |

20.83 |

|

|

H9 |

24.09 |

24.09 |

0 |

1.14 |

20.04 |

19.87 |

20.58 |

|

|

M9 |

23.3 |

23.36 |

0.06 |

1.1 |

19.39 |

18.99 |

19.70 |

|

|

U9 |

23.25 |

23.09 |

-0.16 |

1.07 |

18.47 |

17.95 |

18.82 |

|

|

Z9 |

22.64 |

22.71 |

0.07 |

1.04 |

17.32 |

16.89 |

17.86 |

|

Implied Vol |

Realized Vol |

|||||||

|

BRT Vol |

1-Oct |

2-Oct |

Change |

Breakeven |

10d |

30d |

50d |

|

|

Z8 |

26.96 |

25.89 |

-1.07 |

1.39 |

22.09 |

18.02 |

20.53 |

|

|

F9 |

25.18 |

24.74 |

-0.44 |

1.32 |

21.86 |

17.90 |

20.34 |

|

|

G9 |

25.41 |

25.21 |

-0.2 |

1.34 |

21.51 |

17.63 |

20.04 |

|

|

H9 |

24.37 |

24.28 |

-0.09 |

1.28 |

21.07 |

17.33 |

19.76 |

|

|

J9 |

24.26 |

24.11 |

-0.15 |

1.27 |

20.58 |

16.99 |

19.49 |

|

|

M9 |

23.91 |

23.84 |

-0.07 |

1.25 |

19.66 |

16.28 |

18.94 |

|

|

U9 |

23.76 |

23.75 |

-0.01 |

1.22 |

18.65 |

15.47 |

18.24 |

|

|

Z9 |

23.38 |

23.45 |

0.07 |

1.19 |

17.88 |

14.88 |

17.68 |

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE Trade Recap

BRT H19 85/77 Fence x83.85 TRADES 211 500x 73d

BRT Z18 84/88 Call Spread x84.55 TRADES 152 700x 25d

BRT M19 75/90 Fence x82.50 TRADES 1 500x 57d

BRT H19 85/100 Call Spread x83.40 TRADES 319 1,000x 38d

WTI Z19 72 Call x72.00 TRADES 683 500x 55d

WTI H/Z19 65 Put Roll x74.65/71.75 TRADES 296 1,000x 14d/23d

BRT G19 84 Call x84.00 vs BRT M19 82.50 Call x82.50 1.5×1 TRADES 7 500x

BRT Z18 85/78.50 Put Spread x85.00 TRADES 189 400x; TRADES 188 100x 39d

BRT Z19 95 Call x80.40 TRADES 270 800x 27d

WTI X18 75.50 Call vs BRT Z18 85 Call TRADES 72 1,000x

BRT F19 75/71 1×2 Put Spread TRADES 4 1,000x

BRT Z19 95/110 1×2 Call Spread TRADES 54 50x; TRADES 56 200x

WTI M19 65/85 Fence x74.15 TRADES 48 500x 41d

BRT H19 100 Call x83.60 TRADES 72 1,000x 13d

BRT H20 70/85 Fence x79.00 TRADES 81 300x 71d

BRT H/M19 80 Put Roll x83.70/82.70 TRADES 166 400x 32d/35d

WTI Z/F20 70 Put Roll x71.7571.30 TRADES 33 400x 33d/33d

BRT J19 67 Put x83.60 TRADES 69 500x 7d

BRT H20 75 Put x79.00 TRADES 654 250x 34d

BRT F19 8595 Call Spread x84.50 TRADES 242 4,000x 35d

WTI X18 89 Call TRADES 3 1,500x

WTI X18 67/65 1×2 Put Spread TRADES Flat 500x

BRT F19 95 Call x84.25 TRADES 60 1,000x 12d

BRT G19 80/90 Fence x84.00 TRADES 47 1,000x 58d

CME Trade Recap

WTI H19 85 Call x74.60 TRADES 120 500x 19d

WTI H19 55/65/75 Put Fly x74.60 TRADES 229 500x 18d

WTI Z18 70 put x75.20 TRADES 82 500x 18d

BRT Z18 78/75 1×2 Put Spread TRADES 6 5,000x

WTI X18 76 Call x85.45 TRADES 135 500x 45d

WTI H19 71 Put TRADES 284 3,000x

WTI H19 70 Put x74.50 TRADES 253 1,000x; TRADES 254 700x 28d

BRT G19 85/90 Call Spread TRADES 46 1,000x

WTI M19 75/85 Call Spread x74.20 TRADES 326 1,000x 32d

WTI M19 85/95 1×2 Call Spread x74.00 TRADES 40 800x 7d

BRT G19 80/75 1×2 Put Spread TRADES 24 1,100x

WTI Z18 68/73 Put Spread x75.00 TRADES 118 600x 22d

WTI F-H19 68/77.50 Strangle vs 78 Call (2x) x74.50 TRADES 71 500x 58d

CSO/ARB/APO Trade Recap

ARB Z/G19 -5.00 Call Roll TRADES 12 1,000x

ARB Z18 -8.00 Call TRADES 19 200x; TRADES 21 800x

ARB G19 -10.00 Put TRADES 82 250x

WTI APO J19 59.50 Put LIVE TRADES 91 45x

WTI APO 1H19 65 Put TRADES 200 1x

WTI APO 2H19 65/80 Fence x72.35 TRADES 43 60x 60d

U.S. crude oil stocks rise 907,000 bbls-API

U.S. crude stocks rose last week as refineries cut output, while gasoline and distillate stocks fell, data from industry group the American Petroleum Institute showed on Tuesday. Crude inventories rose by 907,000 barrels in the week to Sept. 28 to 400.9 million, compared with analysts’ expectations for an increase of 2 million barrels. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 2 million barrels, API said. Refinery crude runs fell by 158,000 barrels per day, API data showed. Gasoline stocks fell by 1.7 million barrels, compared with analysts’ expectations in a Reuters poll for a 1.3 million-barrel gain. Distillate fuels stockpiles, which include diesel and heating oil, fell by 1.2 million barrels, compared with expectations for a 1.3 million-barrel drop, the API data showed. U.S. crude imports rose last week by 157,000 barrels per day to 8 million bpd.

Al-Falih Says Current Saudi Oil Production Is About 10.7m B/D

Oil market is well supplied, “some would say oversupplied,” Saudi Energy Minister Khalid Al-Falih says in Moscow, where he’s attending Russian Energy Week conference.

“We’re meeting every single demand for barrels”

“We’ve increased production quite significantly. We just have to be responsive to demand”

Current price based on financial markets, not physical flows

Trump: I told Saudi king he wouldn’t last without U.S. support – Reuters News

President Donald Trump made an undiplomatic remark about close ally Saudi Arabia on Tuesday, saying he warned Saudi Arabia’s King Salman he would not last in power "for two weeks" without the backing of the U.S. military. "We protect Saudi Arabia. Would you say they’re rich. And I love the King, King Salman. But I said ‘King – we’re protecting you – you might not be there for two weeks without us – you have to pay for your military,’" Trump said to cheers at a rally in Southaven, Mississippi. Trump did not say when he made those remarks to the Saudi monarch. Despite the harsh words, the Trump administration has had a close relationship with Saudi Arabia, which it views as a bulwark against Iran’s ambitions in the region. Trump made Saudi Arabia his first stop on his maiden international trip as president last year. Trump called King Salman on Saturday and they discussed efforts being made to maintain supplies to ensure oil market stability and global economic growth, according to Saudi state news agency SPA. Saudi Arabia is the world’s top oil exporter and the de facto leader of OPEC, which has been criticized by Trump for high oil prices. Speaking at the United Nations General Assembly in New York last month, Trump said OPEC members were "as usual ripping off the rest of the world." "We defend many of these nations for nothing, and then they take advantage of us by giving us high oil prices. Not good. We want them to stop raising prices, we want them to start lowering prices," Trump said. He has also pressed other U.S. allies, such as Japan, South Korea and Germany, to take more of the financial burden of their defense.

Middle East Crude-Benchmarks gain ahead of Saudi OSPs – Reuters News

The Middle East crude benchmarks increased on Wednesday with DME Oman’s premium to Dubai swaps extending gains and cash Dubai edging higher. Firm demand for fuel in north Asia during winter and upcoming sanctions on Iran that are expected to cut oil supply are supporting the crude oil market, traders said. Saudi Aramco and ADNOC are expected to announce official selling prices soon.

WINDOW: Seven cash Dubai partials traded on Wednesday with Shell snapping up all of them. Shell also bought an Oman partial from Unipec on Wednesday.

U.S. crude oil shipments to China "totally stopped" amid trade war – shipping exec – Reuters News

U.S. crude oil shipments to China have "totally stopped", the President of China Merchants Energy Shipping Co (CMES) said on Wednesday, as the trade war between the world’s two biggest economies takes its toll on what was a fast growing businesses. Washington and Beijing have slapped steep import tariffs on hundreds of goods in the past months. And although U.S. crude oil exports to China, which only started in 2016, have not yet been included, Chinese oil importers have shied away from new orders recently. "We are one of the major carriers for crude oil from the U.S. to China. Before (the trade war) we had a nice business, but now it’s totally stopped," Xie Chunlin, the president of CMES said on the sidelines of the Global Maritime Forum’s Annual Summit in Hong Kong. Ship tracking data in Refinitiv Eikon confirmed that U.S. crude oil shipments to China ground to a halt in September. "It’s unfortunately happened, the trade war between the U.S. and China. Surely for the shipping business, it’s not good," the CMES president said. He also said the trade dispute was forcing China to seek soybeans from suppliers other than the United States, adding that China now bought most its soybeans from South America.

OPEC+ Made Right Output Decision, Wasn’t Too Cautious: Iraq Min

OPEC and its allies made the right decision about output increase and hasn’t been too cautious responding to changes in the market, Iraq’s Oil Minister Jabbar Al-Luaibi tells reporters on the sidelines of the Russia Energy Week conference in Moscow.

The group will assess the impact of its decisions again at a meeting in November

Iraq still has some spare oil-production capacity

Kazakh Min: No Need for ‘Rush’ Decisions on More OPEC+ Oil Now

Geopolitics rather than supply and demand are pushing oil prices higher now, Kazakh Energy Minister Kanat Bozumbayev tells reporters in Moscow.

Lukoil CEO Says Russia Has Reached Oil-Output Peak: Vedomosti

Russian companies have reached their “maximum” in oil production, including Lukoil, Vedomosti newspaper reports, citing an interview with Vagit Alekperov, billionaire CEO of the nation’s 2nd biggest crude producer.

Not all companies reached peak in production, newspaper says, citing government official it doesn’t identify

Russian Energy Ministry declined to comment to Vedomosti

Russia’s crude production hit post-Soviet record in September, rising to ~11.356m b/d, according to data from Energy Ministry’s CDU-TEK statistical unit

Energy Minister Alexander Novak said last month that Russia still has spare capacity left of “a few hundred thousand barrels” a day, without elaborating; actual supplies will depend on market, he said

At least 3 companies have said they have potential to further increase output, including Rosneft, Gazprom Neft, Tatneft

Russia Still Has Capacity to Raise Oil Output If Needed: Novak

Russian companies have capacities to increase oil production if necessary, even “under the current conditions,” Energy Minister Alexander Novak tells reporters at the Russian Energy Week conference in Moscow.

Longer-term plans will depend on the government’s moves on oil-industry taxation

Russia’s Lukoil Sees `Fair’ Oil Price at $60-75/Bbl: Vedomosti

Oil-price rally may hit growth of global economy in 4Q and 1Q 2019, especially in developing countries, Vedomosti newspaper reports, citing interview with Vagit Alekperov, billionaire CEO of Russia’s 2nd-biggest crude producer.

Fair price level is $60-$75/bbl

Lukoil currently uses $65/bbl oil in planning, raised the target recently to move it closer to current situation

Maintains plan to split any additional gains from oil above $50/bbl equally between shareholders and co. development

Alekperov has no plan to sell or split his stake in Lukoil which is currently ~23%

Lukoil’s management has never planned to gain control in company; current shareholder structure is “comfortable”

Co. has no plan to sell its stake in JV with state-run Rosneft, developing Trebs-Titov oil project even amid difficulties in relations with the partner

Producer seeks stable tax regime for oil industry in Russia after legislation changed ~40 times in past 5-6 years

Sees need to expand experiment with profit-based taxes, especially in West Siberia

Kazakhstan Sees Oil Production Expanding as New Investment Flows

Kazakhstan’s government expects oil output to rise and billions of dollars of new investment to flow into projects around the country, said Energy Minister Kanat Bozumbayev.

The nation could pump about 90 million tons of oil next year, equivalent to 1.88 million barrels a day, Bozumbayev said in an interview in Astana on Tuesday. That’s an increase of about 3 percent from the ministry’s planned production for 2018. Central Asia’s largest oil producer already has several giant oil projects in the works. The Kashagan field continues ramping up output after more than a decade of development. A consortium led by Chevron Corp. is spending $37 billion to expand the Tengiz project. Bozumbayev said that Kazakhstan will receive a further $10 billion of new investment in the Karachaganak, Kalamkas and Khazar deposits in the coming years. The Karachaganak investment “may possibly lead to an increase of output,” the minister said. At the very least it will “lead to extension of time of liquid hydrocarbons production plateau at the field.” That would give Kazakhstan additional revenue of $23 billion by 2037 if oil prices were to remain at current levels, he said. Royal Dutch Shell Plc, Eni SpA, Chevron and Lukoil PJSC are partners in Karachaganak.

OPEC Ally

Kazakhstan’s ambitious plans come as the nation is considering whether to prolong its cooperation with the Organization of Petroleum Exporting Countries, Russia and other major producers into next year. The group came together in late 2016, agreeing to cut output in order to eliminate a supply glut and boost prices. Although Kazakhstan has failed to curb its production for almost the entire duration of the deal, the plan succeeded and its alliance with OPEC has endured. The nation pumped about 1.86 million barrels a day in September, according to government data compiled by Bloomberg. Kashagan is currently pumping about 340,000 barrels a day and should reach 370,000 next month, Bozumbayev said. After spring maintenance next year, daily output could reach 380,000 barrels. Shell and Eni also have large stakes in Kashagan. Still only about one sixth of the field’s potential has been employed and the government wants the consortium operating it to outline a full-scale development plan early in 2019, the minister said. New investments in the other fields may also start next year. Like Kashagan, the Kalamkas and Khazar deposits are also in the same area of the northern part of the Caspian Sea. That’s encouraged the Kashagan operating company to consider co-development of its Kalamkas field with Shell-led Khazar. There’s no sign that rising oil prices are causing cost inflation, Bozumbayev said. Spending on the Tengiz expansion will be in line with its budget of $7 billion to $8 billion this year, and $11 billion in 2019 when the main construction works start, he said. “There are concerns that when the oil price is up, costs for services are always up,” he said. “Possibly the budget will grow, but no one came to us yet.”

Iran says World Court ruling proves U.S. sanctions are "cruel" – Tasnim news – Reuters News

Iran welcomed on Wednesday a ruling of the World Court, the highest United Nations tribunal, that ordered the United States to ensure that sanctions against Tehran do not impact humanitarian aid or civil aviation safety. "The decision proved once again that the Islamic Republic is right and the U.S. sanctions against people and citizens of our country are illegal and cruel," the foreign ministry said in a statement published on Tasnim news agency and state media.

Fed’s Powell says U.S. outlook "remarkably positive" – Reuters News

U.S. Federal Reserve Chairman Jerome Powell on Tuesday hailed a "remarkably positive outlook" for the U.S. economy that he feels is on the verge of a "historically rare" era of ultra-low unemployment and tame prices for the foreseeable future. It is a view, he said, based on how a changed economy is operating today, with businesses and households immunized by strong central bank policy from the inflationary psychology that caused unemployment, inflation and interest rates to swing wildly in the 1960s and 1970s. It is an outlook that includes an economic performance "unique in modern U.S. data," with unemployment of below 4 percent expected for at least two more years and inflation remaining modest even as wages rise. And it is an outlook he feels will even survive the Trump administration’s efforts to rewrite the global trading system, a policy shift Powell said may lead to one-time price hikes, but not to persistent changes in the annual rate of inflation going forward. "This forecast is not too good to be true," Powell told the National Associate for Business Economics, but instead "is testament to the fact that we remain in extraordinary times." "These developments amount to a better world for households and businesses which no longer experience or even fear the scourge of high and volatile inflation." Asked about the impact of tariffs on inflation, he replied that, so far, "we don’t see that in the data." Powell spoke as debate among economic analysts and investors has begun turning toward a central question: Will the current low rate of unemployment inevitably doom a near decade-long expansion by driving inflation to levels the Fed will have to suppress with faster and higher than expected rate increases? That’s not the view contained in the Fed’s most recent round of forecasts, which sees a hot job market, steady economic growth, steady 2 percent inflation and only modest rate increases through 2021 – as if the United States had slipped into the sort of pleasant long-run equilibrium described in textbook economic models.

SEEDS OF TROUBLE

But several economists here argue that the seeds of trouble have already been planted, with companies using the recent tariff hikes on steel and other goods as an excuse to raise prices more generally, and to perhaps keep doing so. At a time when Amazon announced a nationwide minimum wage increase that could put pressure on other retailers, the administration was trumpeting a trade pact with Mexico and Canada that will steer auto production to higher wage locales, and leaves in place new tariffs on steel, a key industrial input. Boston Federal Reserve bank president Eric Rosengren said the current debate over globalization was not so much a "trade war" but "more of a supply chain war" that could take years to sort out as companies shift around production to higher-cost locales to escape tariffs on imports from China. "Big importers will tell you it is not that easy to change…It becomes a real risk if all of a sudden you are not sure what your price is going to be," he said on Monday. Catherine Mann, global chief economist at Citigroup and former chief economist at the Organization for Economic Cooperation and Development, said the spark could be lit early next year. The costs of adjusting to tariffs and to trade uncertainty "gives firms cover to say, ‘I’m going to raise my prices,’" she told the NABE annual conference. "I’m timing it for the beginning of the year," Mann said, when a windfall from this year’s tax cuts fade. Powell, in his remarks, said the Fed is not blind to the possible "revenge" of prices rising as they have before during times of sustained low unemployment. The central bank is guarding against that with its current, gradual interest rate increases, and will respond "with authority" if an inflationary mindset threatens to take hold. But he noted that many current and past Fed officials, himself among them, had warned in the years following the 2007 to 2009 financial crisis that falling unemployment and the Fed’s printing of trillions of dollars of new money would unhinge inflation at any moment. It never happened, and he said there is no reason now to expect it will. "I am glad to be able to stand here and say that the economy is strong, unemployment is near 50-year lows, and inflation is roughly at our 2 percent objective," Powell said. "The baseline outlook for forecasters inside and outside the Fed is for more of the same."

Indian rupee hits record low as high oil prices weigh – Reuters News

The Indian rupee dropped to a record low on Wednesday as a sharp rise in global crude oil prices heaped more pressure on the currency, prompting the central bank to quickly intervene to slow its fall. The partially convertible rupee hit 73.4050 per dollar in early trade, an all-time low, and sharply lower than its previous close of 72.91. Indian markets were closed on Tuesday for a holiday. At 0335 GMT, the rupee was trading at 73.30. The Reserve Bank of India stepped into the market to sell dollars, helping the rupee retrace to as much as 73.23 to the dollar. The benchmark 10-year bond yield IN071728G=CC was up 7 basis points at 8.06 percent. "The pace of fall in the rupee starts to accelerate as the depreciation matures," said Anindya Banerjee, deputy vice president, currency derivatives at Kotak Securities. "The RBI is intervening more in the currency derivatives market through forwards and futures than in the spot market." Indian stocks were also down dragged by financials and auto stocks such as ICICI Bank Ltd ICBK.NS and Eicher Motors Ltd. The broader NSE index .NSEI was down 0.47 percent at 10,956.9 as of 0405 GMT, while the benchmark BSE index was 0.37 percent lower at 36,392.53. Maruti Suzuki (India) MRTI.NS was trading 2.2 percent lower. The carmaker had reported 0.5 percent decline in sales for September on Monday. Among gainers, Yes Bank Ltd YESB.NS surged 9 percent and was the top percentage gainer on the NSE index. Oil prices have firmed on expectations of tighter supply once U.S. sanctions start targeting Iran’s petroleum industry from next month. Though a strong dollar and rising U.S. crude supply are curbing gains, prices are hovering at the highest levels since November 2014. In India, the world’s third-largest oil importer, its currency plunge has meant oil prices have risen nearly 50 percent in rupee terms this year. Other emerging currencies also weakened while the dollar index was at 95.334 after scaling 95.744 overnight, its highest since Sept. 4. India’s central bank is widely expected to raise its policy repo rate at a review on Friday in a bid to slow the rupee’s decline and rein in inflationary pressures.

INR

Brent in INR

JBC Slashes Oil Demand Growth Forecast, Citing High Prices, EMs

JBC Energy cuts forecast for 2018 oil-demand growth by “whopping” 300k b/d to less than 1.1m b/d, due to factors including higher flat prices, diving currencies in emerging markets, burgeoning product stockpiles and trade wars.

Demand grew by a lackluster 540k b/d over 2Q and 3Q, Vienna-based researcher says in daily research report; expects an increase to just over 1m b/d in 4Q

Expects 1m b/d demand growth in 2019, which JBC describes as “quite conservative compared to other agencies”

Sees core product demand rebounding in 4Q in part due to deferred German and French heating demand and stockpile refilling in Rhine

Expects 4Q y/y growth at close to 600k b/d, though still need to see whether this will be enough to help refining margins and stave off potential economic run cuts

Refiners burdened by tightness in crude market as flows reshuffleddue to U.S. sanctions on Iran; outright price rally “threatens to kill off more oil demand”

Oil Spare Capacity May Reach Historic Low by Year-End: Bernstein

Effective spare capacity, now at ~1.5m b/d, may reach historic lows by end-2018 as U.S. sanctions cut Iran’s 1m b/d capacity out of the market, analysts at Bernstein including Neil Beveridge say in Oct. 3 report.

Bernstein estimates OPEC’s spare capacity closer to 2m b/d and effective core OPEC, Saudi Arabia plus U.A.E. and Kuwait, at 1.4m b/d

That’s against IEA estimate of 2.5m b/d capacity for OPEC, excluding Libya and Nigeria

Supply losses from Iran sanctions, Venezuelan disruptions, potential Libya civil war and Niger Delta instability may exceed core OPEC spare capacity

Even if Saudis and others offset loss of Iranian barrels, spare capacity could fall to “dangerously low levels”

One unexpected disruption in Venezuela or Libya may push oil prices to significant premium above spare capacity

U.S., where supply is constrained by pipeline bottlenecks, could respond by releasing oil from SPR, but that’s seen as an act of desperation

Iranian sales cut by 1m-1.7m bbl so far; Bernstein estimates country’s shipments to drop by 500k-1m bbl when U.S. sanctions come into effect

Assuming imports from Europe, India go to zero and China’s imports are cut by 50%, then another 1m b/d reduction likely for Iranian supplies

Asia scrambles for West African oil before U.S. sanctions hit Iran – Reuters News

Shipments of West African oil to Asia are set to hit a two-month high in October as Chinese refineries scramble for alternatives to Iranian crude before U.S. sanctions take effect on Nov. 4. Loadings for Asia will rise to 2.52 million barrels per day (bpd) in October, equivalent to 75 percent of total output from Angola, Nigeria, Republic of Congo, Ghana and Equatorial Guinea, based on Reuters calculations, shipping brokers and Refinitiv Eikon data. This compares to September’s 2.27 million bpd, which was almost 70 percent of regional output. China has been the main driver for Asian demand before the implementation of U.S. sanctions that analysts estimate will remove 500,000 bpd to 2 million bpd of Iranian oil from the market. Chinese imports from West Africa are set to rise to a record 1.94 million bpd, or 60 cargoes, in October from 1.5 million bpd, or 45 cargoes, in September. West African grades tend to produce a large proportion of high-value distillates, such as diesel or jet fuel, much like Iranian crude oil, making it an attractive replacement. Other buyers across Asia and Europe have also said they would cut back on purchases of Iranian oil, unleashing a burst of demand for West African and other crudes rich in distillates, such as grades from Saudi Arabia or the North Sea. The looming deadline on Iranian crude is not the only factor behind the surge in demand for October cargoes to China. Independent Chinese refineries, known as teapots, eased up on imports earlier in the third quarter for maintenance. Now they are restocking before the end of the month, as their import quotas are based on purchases made from January to October. "The resurgence of Chinese teapot buying could not have come at a more awkward time for the oil market," consultancy Energy Aspects wrote. "China was widely expected to need to restock. But its renewed appetite for crude has been bolstered by panic buying from teapots," the consultancy said. Elsewhere in Asia, India is offering some respite for the stretched West African market, buying about 451,000 bpd in October, down from September’s 500,000 bpd, while Glencore will ship a rare suezmax cargo of West African crude to South Korea. India’s state-run refiners tend to take less West African crude at tender and buy more on the spot market. State firms Indian Oil Corp (IOC) , Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL) will take 10 of the 14 India-bound cargoes. Nigerian Agbami, Qua Iboe and Bonny Light make up the bulk of the WAF exports to India.

Below is a table of West African exports to major Asian buyers:

|

Oct cargoes |

Bpd (Mln) |

Sept cargoes |

Bpd (Mln) |

|

|

China |

60 |

1.935 |

45 |

1.5 |

|

India |

14 |

0.452 |

15 |

0.5 |

|

Indonesia |

2 |

0.065 |

3 |

0.10 |

|

Taiwan |

1 |

0.032 |

0 |

0 |

|

S Korea |

1 |

0.032 |

0 |

0 |

|

Japan |

0 |

0.000 |

0 |

0 |

|

Others |

0 |

0.000 |

6 |

0.167 |

|

TOTAL |

80 |

2.516 |

69 |

2.267 |

Crude Storage in ARA Rises 3.6%, Genscape Weekly Data Show

Crude inventories in ARA region rose 1.8m bbl in week ended Sept. 28 to 53.5m bbl, Genscape data show

Sanctions delay PdV oil dock repair: ministry – Argus

The south dock at Venezuelan state-owned PdV’s Jose oil export terminal will likely remain out of service until mid-November because US financial sanctions have delayed repairs, the energy ministry said.

The terminal’s south dock has been shut since Greek-flagged tanker Meganisi collided with the structure on 25-26 August. The incident occurred during a docking operation to unload a cargo of imported naphtha earmarked for diluting with Orinoco extra-heavy crudes. PdV initially said the dock would restart loading/offloading operations by 1 October. But the ministry said today that repairs could take six more weeks to complete because US financial sanctions have blocked PdV’s efforts to secure financing to cover imports of replacement parts unavailable in Venezuela. "International banks aren’t accepting PdV’s money and won’t extend credit to PdV because of the US sanctions," a ministry official said. PdV’s Jose terminal, consisting of three docks (East, West and South) and two monobuoys with a combined nameplate crude handling capacity of 1.5mn b/d integrated with PdV’s 600,000 b/d Orinoco upgrader and 130,000 b/d crude blending complex on the coast of Anzoategui state, handles over 70pc of Venezuela’s crude exports and crude/product imports. The dock’s shutdown reduced PdV’s exports in September by up to 160,000 b/d, to about 1.11mn b/d from 1.27mn b/d the previous month, the ministry said. Contractual deliveries to major clients including Russian state-controlled Rosneft, Chevron and Valero were disrupted, hurting PdV’s cash flow last month in spite of higher average export prices that as of 28 September averaged over $73/bl compared with about $60/bl as of first-half August, the ministry said. Until south dock repairs are completed PdV will continue diverting tankers to the nearby smaller Guaraguao terminal in Puerto La Cruz, the ministry said. But infrastructure and water depth limitations at Guaraguao restrict maximum individual tanker cargoes to 500,000 bl compared with loads of up to 1mn bl that the Jose is able to accommodate.

Canadian Oil Pain Grows as Crude Discount to WTI Hits $40

Canadian heavy crude’s discount to West Texas Intermediate futures increased to the widest in almost five years, raising the specter of local oil producers curtailing operations. Western Canadian Select’s discount for November fell $1.25 to $40.75 a barrel Tuesday, the biggest since November 2013, data compiled by Bloomberg show. The plunge came as new supply from Suncor Energy Inc.’s Fort Hills mine helps to fill pipelines to capacity. “If you get this sustained wide differential, you are going to see these guys start to ramp down production,” Mike Walls, a Genscape Inc. analyst, said by phone. When discounts widened to $30 a barrel early this year on the back of a pipeline outage, companies including Cenovus Energy Inc. and Canadian Natural Resources Ltd. said they were cutting some production or starting maintenance earlier than planned. Yet, with oil sands maintenance soon to wind down and further maintenance not planned until next spring, there is “no relief valve for the next two to four months,” according to Walls. Other grades of Canadian crude are also suffering. Light synthetic crude, produced from bitumen processed in an oil sands upgrader, fell to a $19.75 a barrel discount to New York futures on Tuesday as Syncrude Canada Ltd. prepared its upgrader next month back to full production after a plant-wide shutdown in June. New pipeline projects, including the Trans Mountain expansion to the Vancouver area, have been stymied by court-imposed delays. While increasing volumes of oil are being shifted onto rail cars, the pickup in crude-by-rail has been slow, Walls said. Exports rose one percent in July from June to 207,000 barrels a day, National Energy Board data show. Cenovus said last month it signed oil-by-rail agreements to ship about 100,000 barrels a day on tracks but the agreements won’t go into full effect until the second quarter next year.

CANADA CRUDE-Heavy crude discount widens amid tight transport – Reuters News

The Canadian heavy oil differential widened against the West Texas Intermediate (WTI) benchmark on Tuesday:

*Western Canada Select (WCS) heavy blend crude for November delivery in Hardisty, Alberta, settled at $42 a barrel below the WTI benchmark crude futures CLc1, compared with Monday’s settle of $39.50, according to Shorcan Energy brokers.

*Friday’s settle of $43.50 marked a new record spread for the differential.

*Rising output from Canada’s oil sands has run up against full pipelines, swelling volumes in storage and putting pressure on prices, analysts say. While crude by rail volumes are up, they have not yet had a material impact on the build-up.

*Global oil prices eased on Tuesday after rallying for three straight sessions, but remained close to four-year highs on worries that global supplies will drop due to Washington’s sanctions on Iran.

*Light synthetic crude from the oil sands for November delivery settled at $19.50 under WTI, compared with Monday’s settle of $19.00 under.

U.S. Cash Crude-Coastal grades little changed in thin trade – Reuters News

U.S. crude differentials were steady on Tuesday in light volumes as U.S. crude’s discount to Brent narrowed slightly, dealers said. Offshore grades were seen weaker, with Mars easing from the highest level since June 11. U.S. crude’s discount to Brent narrowed by 8 cents to $9.76 per barrel, but was still seen as wide enough to support export demand, dealers said. West Texas Intermediate at Midland WTC-WTM was seen trading at about $7.75 a barrel discount, recovering from a discount of as much as $17 a barrel in late August, on signs of increased takeaway capacity from the nearby Permian basin. Midland differentials had plunged to the weakest in four years late in August as production in the nearby Permian Basin surged beyond pipeline takeaway capacity. The Sunrise Pipeline, from Loving County, Texas, in the Permian basin to the storage hub of Cushing, Oklahoma, is expected to bring relief when it starts full operations in early November. Meanwhile, crude inventories rose by 907,000 barrels in the week to Sept. 28 to 400.9 million, data from industry group the American Petroleum Institute showed, compared with analysts’ expectations for an increase of 2 million barrels. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 2 million barrels, API said.

• Light Louisiana Sweet WTC-LLS for November delivery was unchanged at a midpoint of $8.25, trading between $8 and $8.50 a barrel premium to U.S. crude futures CLc1.

• Mars Sour WTC-MRS fell 25 cents to a midpoint of $5.25 and traded between $5 and $5.50 a barrel premium to U.S. crude futures CLc1.

• WTI Midland WTC-WTM fell 75 cents to a midpoint of $7.75 a barrel discount and traded between $7.50 and $8 a barrel discount to U.S. crude futures CLc1.

• West Texas Sour WTC-WTS was unchanged at a midpoint of $7.50 a barrel discount, trading between $7.75 and $7.25 a barrel discount to U.S. crude futures CLc1.

• WTI at East Houston, also known as MEH WTC-MEH, was seen bid and offered $7.85 and $8 a barrel over WTI.

After lean years, Big Oil is under pressure to spend – Reuters News

Executives at the world’s biggest oil and gas companies are under growing pressure to loosen the purse strings to replenish reserves, halt output declines and take advantage of a crude price rally after years of austerity. With oil at a four-year high of $85 a barrel, exploration departments are urging company boards to drill more, wages are creeping higher, service companies say rates will have to rise and some investors say Big Oil must start growing again soon. For the heads of companies such as BP, Chevron and Royal Dutch Shell who have pledged to stick to lower spending after slashing budgets by as much as 50 percent since 2014, the pressure may become hard to resist. As in previous oil price cycles, there are concerns about the strength and duration of the business cycle, now in its 10th year of growth after the 2008 financial crisis. Unlike previous oil price cycles, there is the prospect, eventually, of an end to growth in oil demand as the world shifts to cleaner energy. But there are already signs some cost cuts implemented after oil slumped from $115 a barrel in 2014 to $26 in 2016 are being rolled back. Shell, for example, said last month its teams in the UK North Sea will switch to a less tiring rota of two weeks offshore then three weeks onshore. During the austerity years, teams spent three weeks offshore then four onshore. More frequent rotations mean more ships and helicopters will need to be chartered. Shell says the change will increase costs slightly but is convinced it will make its North Sea operations more cost effective and productive. More generally, salaries across the oil and gas sector have edged up about 6 percent so far in 2018 after declining in the previous three years, according to a survey published by Rigzone. At one major firm, senior managers who had been meeting by video conference for several years are now getting flights approved for face-to-face gatherings, according to an executive at the company. The boards of large oil firms are facing more internal requests to invest in new projects and acquisitions, and to beef up staff, according to senior executives present at such discussions. "There is lots of pressure from all the units to get more money," said an executive at a large European oil company.

LONG-CYCLE INVESTMENTS

New project approvals are picking up. Shell and its partners this week gave the green light to LNG Canada, one of the largest liquefied natural gas (LNG) projects in recent years. "Shell’s motivations for the project are clear: without this project, the company’s upstream, LNG contract portfolio and LNG production was set to go into decline early next decade," Wood Mackenzie analyst Dulles Wang said. Typically, after a period of lower capital spending, or capex, and low prices comes an era of rapid investment as oil recovers and supplies tighten. During the lean years, companies cut back sharply. Now, they generate as much cash as in 2014 and are vowing to remain thrifty to focus on higher dividends, buying back shares and reducing debt. But in an industry where reserves and production decline naturally as oil is pumped from fields, continued investment is considered critical. "We are likely in need of more long-cycle investments given the persistent and accelerating base declines observed in global conventional and offshore projects," said a source at in investment firm with large stakes in big oil companies. Although some companies such as BP BP.L were able to stem production declines thanks to technology and lower costs, a drop in new production has taken a toll on the longer-term outlook for many companies. Oilfield decline rates doubled from 3 percent in 2014 to 6 percent in 2016. For the big oil firms, rates went from 1.5 percent to just over 2 percent during the same period, according to Morgan Stanley. "I expect capex rises due to a significant drop in reservoir life. Some capex will be used to reinvigorate existing wells," said Darren Sissons, partner at Campbell Lee & Ross Investment Management, adding that increases would be cautious initially.

RESERVE LIFE

Spending by the world’s top seven oil companies is expected to rise to a combined $136 billion by 2020 from $105 billion in 2017, according to analysts at Morgan Stanley and Jefferies. Starting from the middle of next year, boards will change their tone to prepare shareholders for higher spending from 2020, Morgan Stanley analyst Martijn Rats said. "New project awards will likely already accelerate in 2019, but for major developments, capex in the first year tends to be limited. From 2020 onwards, capex is likely to go higher." Boards are not blind to the pressure. Many companies have defined a range for spending, while committing to the lower end. Shell, for example, has a "soft floor" and a "hard ceiling" for spending of $25 billion to $30 billion per year. For some companies such as Italy’s Eni ENI.MI, which is developing major gas projects in Egypt and Mozambique, boosting costs may be unavoidable. "(Oil companies) proved themselves in a low oil price environment, but at some point they do need to start respending on new projects to keep getting oil out of the ground," said David Smith, fund manager of the Henderson High Income Trust. Patrick Pouyanne, chief executive of French oil company Total TOTF.PA, conceded this week that while it aimed to stick to its spending range of $15 billion to $17 billion a year beyond 2020, capex could rise to $20 billion. "Our view is that the majors’ capex is probably 5 to 10 percent or so too low if they are to maintain their current reserve lives," said Jonathan Waghorn, co-manager of Guinness Asset Management’s global energy fund. The pressure to increase spending also comes at a time oil services companies are slowly increasing rates, saying their sacrifices to help Big Oil weather the slump should now be rewarded as crude prices rise. "Current investment levels, particularly in the international market, are clearly not sustainable to meet either medium-term demand or long-term reserves replacement needs," Paal Kibsgaard, Chief Executive Officer of Schlumberger SLB.N, the world’s largest oil services provider, told a conference last month. He said the international production base needed double-digit growth in investment for the foreseeable future just to keep production at current levels. But investors and executives say reserve life – which was at its lowest in at least two decades in 2017 – is no longer the gold standard for measuring the health of oil companies. A spending splurge could also eat into profits and revive fears oil companies are returning to the wasteful practices of the first half of the decade when crude prices soared. "Historically, excess free cash flow above dividend cost has seen capex rise in the industry but the sector is trying to shake off the capital indiscipline tag and I believe they will stick to that," said Rohan Murphy, analyst at Allianz Global Investors.

U.S. Cash Products-Chicago gasoline drops to lowest since August – Reuters News

Gasoline for physical delivery in Chicago dropped for a sixth consecutive session on Tuesday, plunging to the lowest since Aug. 24 as abundant supply was seen and few buyers were active, market participants said. Chicago gasoline dropped 4.50 cents per gallon to trade at a 1.50 cent per gallon premium to the futures contract on the New York Mercantile Exchange. Midwest V-Grade gasoline for delivery in the Group 3 region also fell, dropping 2.50 cents per gallon to trade at 3.50 cents per gallon above the futures contract for gasoline. Gulf Coast A3 CBOB gasoline CBOB-DIFF-USG was actively traded late in the day, as refiners were seen as sellers, traders said. It fell 0.25 cent per gallon to 2.00 cents below the benchmark. In New York Harbor, F4 RBOB gasoline weakened slightly, dropping 0.15 cents to trade at 0.75 cent above the futures contract, market participants said. Renewable fuel (D6) credits for 2018 traded at 15 and 16 cents each on Tuesday, little changed from 16 cents each on Monday, traders said. Biomass-based (D4) credits fetched 36 cents each, unchanged from Monday, traders said.

U.S. oil refiners’ weekly capacity seen up 124,000 bpd -IIR – Reuters News

U.S. oil refiners are estimated to have 1,378,000 barrels per day (bpd) of capacity offline in the week ending Oct. 5, increasing available refining capacity by 124,000 bpd from the previous week, data from research company IIR Energy showed on Wednesday. IIR expects offline capacity to rise to 1,618,000 bpd in the week to Oct. 12. The following are IIR weekly figures for offline capacity (in thousands of bpd):

|

Week ended Friday |

Oct. 3 |

Oct. 1 |

Sept. 28 |

|

10/12/18 |

1,618 |

1,618 |

1,618 |

|

10/05/18 |

1,378 |

1,360 |

1,444 |

|

9/28/18 |

1,502 |

1,491 |

1,512 |

|

9/21/18 |

983 |

983 |

1,032 |

|

9/14/18 |

637 |

637 |

695 |

Venezuela refinery runs shrink to 25pc: PdV data – Argus

Venezuelan state-owned PdV utilized less than a quarter of the nameplate processing capacity at its main oil refineries in July, reflecting a shrinking pool of domestic feedstock and chronic equipment breakdowns.

According to internal company data obtained by Argus, monthly average refinery throughputs fell steadily since January 2018 at five refineries: the 940,000 b/d CRP complex, which includes the 635,000 b/d Amuay and 305,000 b/d Cardon refineries; the 146,000 b/d El Palito; and the 190,000 b/d Puerto La Cruz refinery. The company data also encompasses the PdV-leased 220,000 b/d Isla refinery on the Dutch Caribbean island of Curacao. In July, throughput at the four facilities averaged 348,000 b/d, compared with total design capacity of around 1.5mn b/d, equivalent to 23.2pc utilization. January 2018 throughput averaged 591,000 b/d, or 39.4pc of nameplate capacity. The 2018 refining data is more striking when compared with 2017, when throughput averaged 641,000 b/d or 42.7pc of its design potential. The year-to-date average through July 2018 was just 460,000 b/d, or 30.6pc of nameplate. All of the refineries are running at consistently low levels, but Puerto La Cruz was nearly shut down altogether in July. PdV has been struggling to restart an $8bn project to upgrade the refinery to process heavier crude, but the company has no capital to pay its contractors. PdV´s lease on the Isla refinery expires in December 2019. Curacao´s government plans to award a contract as early as next week to a third party to help revive Isla´s operations in the face of PdV´s near-abandonment of the facility. PdV’s dwindling crude production and operational refining capacity is reflected in widespread shortages of gasoline, diesel and other oil products in the domestic market.

Exxon to Start Supplying IMO-2020 Compliant Ship Fuel in Asia

ExxonMobil will start supplying IMO-2020 compliant marine fuel, which has sulfur content of no more than 0.5% in key ports of Singapore, Hong Kong and Thailand in Asia-Pacific region, Matt Bergeron, Vice President for Asia Pacific Fuels Business at ExxonMobil Fuels & Lubricants, says at an industry conference Wednesday in Singapore.

Compliant fuel will be also available in some key European ports such as Antwerp and Rotterdam

Additional ports including the ones in America will be announced by the end of this year

Over 10 mil barrels of European gasoline loading Sep-early Oct heading to East; up from Aug – Platts

Robust demand for gasoline in East of Suez markets, amid supply tightness in the region, has seen the number of arbitrage barrels loading in Europe in September and early October rise above 10 million, market sources said. The tightness was partly as the result of a reduction in Chinese gasoline exports, while an excess of summer-grade barrels in Europe has also helped open the arbitrage. "The East-West [arbitrage] is there. Q4 and Q1 are historically high demand periods for Asia," a broker based in Europe said, while a European trader said: "The market is for LR2s". The East-West — the spread between the Platts FOB Singapore October gasoline swap and the Platts October Eurobob barge swap — averaged $1.05/b last month, up from minus $2.42/b in August, S&P Global Platts data showed. The spread was mostly negative between end-February and late August, Platts data showed. Traders first started booking ships to carry European gasoline to the Middle East to cover a shortfall in production stemming from refinery outages around mid-August. Subsequently, additional demand was heard from some national oil companies from Iraq, Oman and Pakistan. Also, China and India were heading towards their peak gasoline demand season, market sources said. At least 23 product tankers carrying 1.300 million mt, or 11.050 million barrels, of European gasoline were chartered to ship September and early October-loading cargoes through the Suez to the Middle East and Asia. Some 478,000 mt of August European gasoline made it into the East of Suez market. "The East is pulling a lot [of gasoline]. The paper market, as well, is supporting flows from the West to East," another trader said. Fixture data showed several product tankers carrying another 305,325 mt of European gasoline to the Americas or to Africa also had options to discharge in the East of Suez market. Meanwhile, Indonesia’s state-owned Pertamina plans to import 11 million barrels of gasoline in spot and term cargoes this month, slightly below its year-to-date high of 11 million-12 million barrels planned for September. Pertamina, which recently awarded gasoline buy tenders for the fourth quarter, has sought 69,822 mt of gasoline via spot tenders for October loading.

FOB Singapore gasoil breaches $100/b mark for first time in nearly 4 years – Platts

The flat price of 10 ppm sulfur gasoil cargoes for loading from Singapore pushed through the psychologically important $100/b mark for the first time in nearly four years at the Asian close Tuesday, amid higher crude and demand for the middle distillates. At 0830 GMT Tuesday, S&P Global Platts assessed FOB Singapore 10 ppm sulfur gasoil at $100.83/b. Platts data showed that the flat price for FOB Singapore 10 ppm sulfur gasoil cargoes was last higher on October 14, 2014, when it was at $102.14/b. The prompt-month Singapore October gasoil swap also soared above $100/b at the Asian close Tuesday, jumping $2.65/b to $100.45/b. The last time the swap was higher was also on October 14, 2014, at $101/b, Platts data showed. Crude oil futures have been gaining ground as the market braces for tighter global supply as a result of US sanctions on Iran, which will come into effect on November 4. "[The] markets remained concerned about the tightening market balance," ANZ analysts said in a note, referring to the reimposition of US sanctions on Iran from November. Separately, the Asian gasoil market has been pushed to multi-year highs in recent weeks by strong demand from the high seas sector because of tighter regional supply. The crimp in supply comes at the start of the fourth quarter when demand is usually strong. "The market was very strong at the beginning of this week [Monday], but I think it will stabilize soon," a Singapore-based trader said Tuesday, adding that the strength was expected to continue. Asian gasoil traders said the continuous rise in prices was a reflection of demand, with traders pricing in expectations of a drop in regional supply because of refinery maintenance scheduled for Q4. Several trading sources said that an Indian refiner would be carrying out substantial maintenance at its Gujarat refinery. Sources said the turnaround would last about a month, from the second half of November to H2 December. This could not be confirmed with the refinery, however. "With the turnaround, gasoil exports from India would be lower, which would probably mean an even stronger market for Q4," a trader said this week.

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.