From: Wagner, Jonathan

Sent: Tuesday, April 14, 2020 6:12:07 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

Good morning. Oil prices are bid out the curve again as front end spreads remain well offered keeping a lid on prompt prices. The most interesting news has been the Enterprise headline that they are once again going to send barrels from the Gulf Coast to Cushing (which should only add further pressure to prompt WTI spreads). Enterprise said in a FERC filing yesterday afternoon that it planned to start a temporary service using leased pipeline capacity after receiving interest from at least one shipper to move oil to Cushing. The filing doesn’t say which pipeline Enterprise intends to use, but it does say it plans to ship from its station in Katy, Texas, which is on the Seaway system. Seaway has two pipelines with a combined capacity of 850,000 barrels a day, and is jointly owned by Enterprise and Enbridge Inc. M/Z WTI, which has been a popular short of late is weaker by 80c to -7.82 this morning. Prompt May WTI remains pressured as there is still 370k lot of Open Interest left before expiry on Monday. Genscape’s Cushing data which was release yesterday showed a full week build of 5.4m bbls while the midweek came in at +726k. US grades firmed yesterday as Mars was bid on the Saudi increase in light OSP’s to the US, while Midland and MEH firmed as production expectations continue to drop. Yesterday, in the latest EIA Drilling Productivity Report, they stated that U.S. shale oil output is expected to drop by 194,000 barrels per day in April, most on record, to about 8.7 million bpd. April’s decline is forecast to be followed by fall in May by 183,000 bpd to 8.53 million bpd, which would be the lowest since June 2019, and a sixth straight month of declines. Also of note, USO finished their monthly roll yesterday, liquidating the balance of 37k lots of May and in turn net buying June when the day was over. 41,843 lots of June were purchased putting the total position at 129k lots ($3.7B in mkt cap)

India plans to completely fill its strategic petroleum reserve by the third week of May by moving about 19 million barrels into the sites by then, the managing director of the country’s SPR said on Tuesday. India is moving the oil to the SPR to help the country’s refineries reduce their excess crude as the lockdown to contain the outbreak of the Coronavirus. India’s fuel demand in March declined by 17.8%, the lowest in over two decades. India will be diverting cargoes for loading in April already bought by refiners Indian Oil Corp, Bharat Petroleum, Hindustan Petroleum and Mangalore Refinery and Petrochemicals Ltd. The refiners cut their crude processing after local fuel demand collapsed and are unable to store the excess oil themselves. "As of now the plan is to fill the caverns by (the third week of May), before the arrival monsoon rains. We are buying oil from state refiners," H.P.S. Ahuja, the managing director of the Indian Strategic Petroleum Reserves Ltd said. ISPRL is responsible for building and filling of SPR sites. ISPRL wants to receive the cargoes before India’s monsoon begins in May as the single point mooring system that can unload very large crude carriers at the port of Mangalore, which will feed two SPR sites, is shut during the three-month rainy season. Reuters last month reported India planned to buy oil from the United Arab Emirates and Saudi Arabia to fill its SPR to gain from low prices. "We are taking advantage of low oil prices," he said, adding most of these cargoes are linked to official selling prices for April.

Middle East Crude prices moved lower again today with Cash Dubai’s discount to swaps widening by almost a dollar to -10.92. DME Oman’s discount to swaps fell to -7.24. Indian oil explorer ONGC Videsh has sold a cargo of Russian Sokol crude loading June 16-22 at a narrower discount of around $5.80-$6.00 a barrel to Dubai quotes, likely to Chinaoil according to a source. Yesterday, Saudi Aramco cut their May OSP for Arab light to Asia by 4.20 which will only create more competition from other Middle Eastern and West African producers now. About 20 million barrels of April-loading crude remains unsold from West Africa alone. That’s on top of unsold May-loading supplies from the region that are estimated to be at least triple that of the month before. Crude from non-Saudi producers in the Middle East is also available with grades including Oman and Upper Zakum being offered on a flexible basis, allowing buyers’ to pick out their preferred arrival periods. Refiners in Asia have until the middle of this week to decide on the amount of oil they want to buy from Aramco. Other producers such as Kuwait, Iraq and Abu Dhabi are set to issue their official prices shortly. Two June Dubai partials traded in the window with Hengli and Mitsui buying from P66. April/May Dubai spreads are trading -5.76 and May/June spreads are trading -3.60.

A researcher at China’s biggest oil company said the country’s drillers should copy the hedging strategies of Mexico and shale firms in the U.S., which use financial derivatives to protect against falling oil prices. Most of China’s oil production is unhedged, leaving the stability of the sector exposed to global market fluctuations, according to Dai Jiaquan, director of the oil market research department at China National Petroleum Corp.’s Economics & Technology Research Institute. Chinese firms should use derivatives to ensure stable returns on the crude they sell, Dai said in a panel interview published in CNPC-owned China Petroleum Daily. The process is easier with yuan-denominated futures on Shanghai International Energy Exchange, he said. “Now that Shanghai crude oil futures are listed and functioning well, it is necessary to make full use of financial means to hedge the risk of price fluctuations,” he said. Oil prices are down by about half so far this year, straining the finances of China’s state oil firms, which have all decided to trim spending. Derivatives could also help China’s government take advantage of lower prices to build its strategic reserves, Bai Ming, deputy director of the Ministry of Commerce’s international market research institute, said in the same panel interview. “If we want to expand our reserves, on the one hand, we can buy real oil, and on the other hand, we must purchase futures to lock in low-cost sources in advance,” he said.

China’s Sinopec increased its April utilization rate by about eight percentage points from March as more and more of its refineries raised crude runs to levels that were reported prior to the spread of COVID-19, a survey by S&P Global Platts showed. As a result, China’s throughput is likely to hit 12.5 million b/d in April, or 90% of the level achieved in January, after falling by about 3.3 million b/d in February, Platts data showed. The survey saw 16 refineries — accounting for 68% of Sinopec’s total refining capacity — lift their combination run rate to 80% in April, from the 72% polled in March and 64% in February, closing in on January’s rate of about 89% when the country had yet to be put under complete lockdown following the outbreak of the coronavirus. Seven of the polled Sinopec refineries raised their April operating rates to the level recorded in January and December. In contrast, only two had done so in March. Except for the Zangzhou refinery in central China, the rest of these seven refineries are along the developed coastal regions in the south and east of China, where demand rose at a faster pace than in the north and the landlocked west, where PetroChina’s refineries are located.

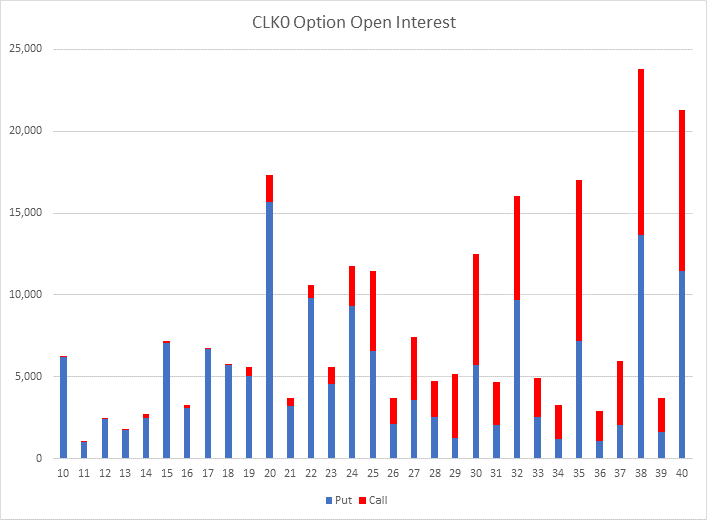

Vols are mixed with M20 Brent underperforming this morning after the whole curve moved lower yesterday. July calls in Brent still remain bid as more 25/40 fences continue to be seen (1k so far). In WTI M/U put rolls were bought helping to keep the back end bid. Z20 breakevens in WTI settled at .98 yesterday. Yesterday the WTI K20 24/22 put spread was actively bought on the screen in WTI as we approach option expiry on Thursday. All of that was new OI. K20 OI table is listed below.

Top stories listed below

China’s trade slump eases in March, but pandemic set to deepen export downturn – Reuters News

BOJ considering steps to ease funding strains in April – sources – Reuters News

BofA Fund Manager Survey Shows Highest Cash Levels Since 9/11

India extends world’s biggest lockdown as coronavirus cases cross 10,000 – Reuters News

Coronavirus not yet contained in Germany – Robert Koch institute – Reuters News

Spain Reports 3,045 New Virus Cases, Lowest Since March 20

India plans to fill strategic oil storage by the third week of May – Reuters News

Middle East Crude-Benchmarks fall; Asia’s spot discount for Sokol narrows – Reuters News

Socar Buys 3m Bbl of Saudi Crude for Star Refinery in Turkey

Caspian CPC Blend Crude Loadings to Rise to 5.73M Tons in May

Saudi Aramco Cuts Crude OSPs Again From Sidi Kerir for May

Asian Buyers to Submit Saudi Oil Nominations for May by Tuesday

Saudi OSP cuts a precursor for other Middle East producers to slash prices – Platts

China’s Big Oil Urged to Copy Mexican Hedge Amid Price Crash – Bloomberg

China’s March crude oil imports rose 4.5% y/y on stockpiling – Reuters News

Sinopec boosts refineries’ Apr crude run by 8 percentage points from Mar – Platts

Virus Could Halt Some Gasoline-Focused Refiners for Good: EA

Key Oil Flow for U.S. Crude Set to Reverse Amid Market Turmoil – Bloomberg

Troll no more: Energy Twitter group’s big short on shale comes good – Reuters News

Implied Vol Change This Morning

|

WTI Vol |

14-Apr |

Change |

BRT Vol |

14-Apr |

Change |

|

|

M0 |

96.89 |

-0.15 |

M0 |

105.99 |

-2.73 |

|

|

N0 |

69.04 |

0.53 |

N0 |

75.28 |

-0.44 |

|

|

Q0 |

56.68 |

-0.01 |

Q0 |

61.16 |

-0.11 |

|

|

U0 |

50.89 |

0.15 |

U0 |

51.76 |

-0.05 |

|

|

V0 |

47.17 |

0.40 |

V0 |

47.83 |

0.03 |

|

|

X0 |

44.71 |

0.60 |

X0 |

45.03 |

0.05 |

|

|

Z0 |

42.48 |

0.28 |

Z0 |

42.93 |

0.73 |

|

WTI M/U20 28/35 Put Roll x29.00/35.25 TRADES 123 300x; TRADES 125 300xs 26d/30d |

|

BRT M20 22/35 Fence x31.25 TRADES 50 500x 44d |

|

BRT M20 35 Call x31.50 TRADES 100 100x 30d |

|

BRT N20 25/40 Fence x34.45 TRADES 12 500x; TRADES 17 500x 46d |

|

BRT N20 45/50 Call Spread x34.45 TRADES 24 300x 5d |

|

BRT Q20 ATM Call x36.50 TRADES 405 250x 65d |

|

BRT X/Z20 40 Call Roll x39.60/40.00 TRADES 44 100x 64d/65d |

|

BRT M21 ATM Call x41.00 TRADES 585 100x 64d |

China’s trade slump eases in March, but pandemic set to deepen export downturn – Reuters News

The plunge in China’s exports and imports eased in March as factories resumed production, but shipments are set to shrink sharply over coming months as the coronavirus crisis shuts down many economies and puts the brakes on a near-term recovery. Financial markets breathed a sigh of relief after customs data on Tuesday showed overseas shipments fell 6.6% in March year-on-year, improving from a 17.2% slide in January-February, as exporters rushed to clear a backlog of orders after forced production shutdowns. Economists had forecast shipments to drop 14% from a year earlier. Yet, while the trade figures were not bad as feared, analysts say the export and overall growth outlook for the world’s second-biggest economy remains grim as the pandemic has brought business activity across the globe to a standstill. "The above-expectation March trade figures do not mean that the future is carefree," said Zhang Yi, Beijing-based chief economist at Zhonghai Shengrong Capital Management. Zhang said he expects first-quarter gross domestic product data on Friday will likely show a contraction of 8% – the first quarterly slump since at least 1992. Analysts’ forecasts for China’s first quarter GDP ranged widely between a contraction of 2% and 16%.

"A decline in exports throughout the second quarter has been the market consensus now and a drop of 20% or more is a high-probability event. For policymakers, more policies should be rolled out to address the possible societal issues stemming from mass-scale unemployment," Zhang said. The data showed imports slid 0.9% from a year earlier, also above market expectations of a 9.5% drop, which the customs attributed to improving domestic demand. They had fallen 4% in the first two months of the year. The better imports picture partly reflected shipments that were stuck in ports being cleared and catch-up demand as authorities eased restrictions. Yet, domestic consumption was far from robust with key imports such as iron ore dipping in March, underlining the broad economic strains. "Imports should hold up better given that domestic demand looks set to stage a further recovery in the coming months," said Julian Evans-Pritchard, senior China economist at Capital Economics. "But the quarter of China’s imports that feed into China’s export sector will continue to fall and hold back the recovery in imports." The overall trade surplus last month stood at $19.9 billion, compared with an expected $18.55 billion surplus in the poll and a deficit of $7.096 billion in January-February. Stock markets in Asia extended their gains after China’s trade report, while risk sensitive currencies including the Australian and New Zealand dollars as well as the pound pulled ahead, mainly on relief on the less gloomy data.

JOBS, INCOME, EXPORTS PRESSURED

China, where the novel coronavirus first emerged late last year, has reported 82,249 infections and 3,341 deaths as of April 13. Worldwide, infections have surpassed 1.8 million with over 119,000 deaths. The pandemic’s sweeping impact on businesses and consumers has triggered an unprecedented burst of stimulus from policymakers in the past two months, with the World Trade Organization forecasting that goods trade would shrink more steeply this year than during the global financial crisis. Beijing is trying to restart its economic engines after weeks of near paralysis to contain the pandemic that had severely restricted business activity, flow of goods and the daily life of people. But as the virus rapidly spread to almost all of China’s trading partners, severely restraining overseas demand particularly in European and U.S. markets, Chinese factories’ export orders have been scrapped. Many privately-owned exporters have been forced to fire workers and warned about factory closures in not too distant future. UBS Economist Tao Wang predicted that exports would decline by 20% on-year in the second quarter and 12% for the whole of 2020. Wenzhou Juna Shoe Industry Co, which used to export 90% of its leather shoes to Russia, South Korea and Australia, had 30% of its orders cancelled last month, with clients delaying the shipments of another 20%, according to a report from China Central Television (CCTV) on Sunday. Half of its production lines were suspended overnight, said CCTV, citing the company manager Wan Jiayong. Customs spokesman Li Kuiwen also warned about the difficulties facing foreign trade. "Shrinking global demand is set to cause a shock to our country’s exports, and issues such as declining export orders have gradually emerged. The difficulties facing our foreign trade development cannot be underestimated," said Li. Indeed, both official and private factory surveys for March showed new export orders declined even further from February when production in the country was paused, with few signs of a strong near-term recovery. Analysts say consumer appetite would also remain depressed as many people are worried about the possibility of new infections, job security and potential cuts to wages as the economy struggles, analyst warned. "The sharp decline in exports and trade could put another over 10 million jobs related to exports at risk in the next couple of quarters," UBS’ Wang said.

BOJ considering steps to ease funding strains in April – sources – Reuters News

The Bank of Japan will discuss taking further steps to ease corporate funding strains at this month’s rate review to pump more money to small firms grappling with slumping sales due to the coronavirus outbreak, sources familiar with its thinking said. While discussions are still in initial stages, possible options on the table include further increases in purchases of corporate bonds and commercial paper (CP), and an expansion in the range of assets the central bank accepts as collateral in offering financial institutions loans, they said. "The focus for the BOJ is still crisis response, not what measures it can take to reflate the economy," one of the sources said on condition of anonymity due to the sensitivity of the matter. The BOJ next meets for a rate review on April 27-28. The central bank eased monetary policy last month by pledging to increase buying of risky assets, including corporate bonds and CP, and create a new loan program to assist funding of small firms hit by the health crisis.

BofA Fund Manager Survey Shows Highest Cash Levels Since 9/11

(Bloomberg) — BofA’s monthly fund manager survey shows cash levels jumping to 5.9% in April from 5.1% in March, the highest since the 2001 terrorist attacks.

Move triggers contrarian buy signal for risk assets, according to note

Most investors — 93% — expect a global recession in 2020; believe global GDP cuts are largely over, but global EPS downgrades just starting

Equity allocation is lowest since March 2009

In terms of bets on economic recovery, 52% believe it’ll be U-shaped, 22% say W-shaped, 15% say V-shaped

On balance sheets, 79% want companies to improve their financial strength, highest in 20 years; just 5% want corporate buybacks, lowest in 20 years

For biggest tail risk, 57% see second wave of the virus as top risk, followed by 30% fearing systemic credit event

India extends world’s biggest lockdown as coronavirus cases cross 10,000 – Reuters News

India extended on Tuesday a nationwide lockdown for its 1.3 billion people until May 3 as its prime minister warned of economic sacrifices to save lives as the number of coronavirus cases crossed 10,000. Sharp downward revisions to economic growth forecasts in the wake of the pandemic point toward sickening levels of unemployment, but Prime Minister Narendra Modi urged Indians to maintain the discipline shown in the first three weeks of the country’s lockdown. "That means until May 3, each and every one of us will have to remain in the lockdown," Modi said in a televised address to the nation. "From an economic only point of view, it undoubtedly looks costly right now; but measured against the lives of Indian citizens, there is no comparison itself." India’s neighbour, Pakistan, is also due to take a decision on its lockdown ending on Wednesday. Modi spoke as latest government data showed the number of people infected with coronavirus in India had reached 10,363, with 339 deaths. Although the numbers are small compared with hard-hit Western nations, health experts fear that is because of India’s low levels of testing, and actual infection levels could be far higher. Lacking testing kits and protective gear for medical workers, India has only tested 137 per million of its population, compared with 15,935 per million in Italy, and 8,138 in the United States. Health experts have warned that widespread contagion could be disastrous in a country where millions live in dense slums and the health care system is overstretched. So far, more than three-quarters of India’s cases are concentrated in about 80 of the country’s more than 700 districts, including the two big cities, New Delhi and Mumbai. Since Modi first imposed the lockdown in late March, the unemployment rate has almost doubled to around 14.5%, according data compiled by the Centre for Monitoring Indian Economy (CMIE), a Mumbai based private think-tank. The shutdown sparked an exodus of millions of workers from small industries like textiles and leather, and service industries like retail, tourism, construction and other sectors in urban areas to their villages. "I am well aware of the problems you have faced – some for food, some for movement from place to place, and others for staying away from homes and families," Modi said. Agriculture, which employs about 45% of India’s labour force, is still faring better though the sector has been hampered by disruptions to logistics.

SLIGHT EASING OF CURBS POSSIBLE

For next five days, the lockdown will be enforced even more strictly, Modi said, adding that the government could then ease some curbs in parts of the country which are not hotspots to allow some essential activities. But, the number of jobless is only going to get worse as India needs annual economic growth over 8% to absorb the millions of young people entering the work force each month. Most private economists, and the World Bank have revised down growth forecasts for the current year to between 1.5% to 2.8% as a result of the pandemic. Barclays Bank, in a note to clients on Tuesday, forecast zero growth in 2020. Presenting its annual budget in February, the government had factored in growth of up to 6.5% for the fiscal year through to March 2021, which now appears a broken dream.

PAKISTAN DECISION DUE

Facing an even more dire economic situation, neighbouring Pakistan is also due to decide on how to proceed once its lockdown ends on Wednesday and the expectation is some curbs would be lifted. "The business community is asking us that what are the safety measures they need to take, so that they can run their business… and generally we also agree with that, that we have to go to that direction," said Minister for Planning Asad Umar. The World Bank has warned that Pakistan along with Afghanistan is expected to fall into recession in fiscal 2020/21 and Prime Minister Imran Khan has sought debt relief from international lenders to combat the pandemic.

Coronavirus not yet contained in Germany – Robert Koch institute – Reuters News

A lower number of new coronavirus cases in Germany in recent days is likely due to less testing over Easter and the outbreak is not yet contained, the head of the Robert Koch health institute said on Tuesday. Germany’s number of confirmed coronavirus infections has risen by 2,082 to 125,098, data from the Robert Koch Institute showed earlier on Tuesday, marking the fourth daily decline in the number of new cases. Reported deaths rose by 170 to 2,969. The death rate is far lower than among other countries most affected, but the German authorities remain wary of lifting restrictions on public life. "We can’t speak of containment yet – we still have high numbers each day. We are seeing a slowdown," Robert Koch Institute President Lothar Wieler told a regular news conference. Urging Germans to wait and remain disciplined with social distancing measures, he estimated the virus reproduction or transmission rate, dubbed "R", in Germany was about 1.2 – meaning a person with the virus infects 1.2 others on average. "It is really in our interest that this R rate goes below 1, or is at 1. That is an important factor," Wieler added. In recommendations sent to Chancellor Angela Merkel and state governors on Monday, academics suggested public life may gradually return to normal if certain conditions are met including an infection rate stabilising at a low level. Germany has closed schools, shops, restaurants, playgrounds and sports facilities, and many companies have shut to aid the fight against the coronavirus. Merkel, who has said the position paper by the National Academy of Sciences Leopoldina will be important for her determination on the path forward, will discuss the recommendations with ministers on Tuesday. On Wednesday, she will hold a video conference with the state premiers to discuss a possible path out of the lockdown and how to manage the recession it is expected to cause. Economy Minister Peter Altmaier declined to name a date for the relaxation of restrictions. "The next few days will bring clarity," he said on breakfast television, adding that the government was keenly aware of the risks of lifting restrictions too early only to have to impose a full lockdown later. "If the impression arises that there is to-ing and fro-ing, it would damage trust in politics and harm the peoples’ willingness to be disciplined and to cooperate," Altmaier said. "We have to consider every step."

Spain Reports 3,045 New Virus Cases, Lowest Since March 20

Spain reported the lowest number of new coronavirus cases since March 20 as the government comes under pressure to relax some of the measures brought in to slow the outbreak. There were 3,045 new infections in the past 24 hours, taking the total to 172,541, according to Health Ministry data. The death toll rose by 567 to 18,056.

India plans to fill strategic oil storage by the third week of May – Reuters News

India plans to completely fill its strategic petroleum reserve (SPR) by the third week of May by moving about 19 million barrels into the sites by then, the managing director of the country’s SPR said on Tuesday. India is moving the oil to the SPR to help the country’s refineries reduce their excess crude as the lockdown to contain the outbreak of COVID-19, the respiratory disease caused by the new coronavirus, has dented transportation and industrial fuel consumption in Asia’s third-largest economy. India’s fuel demand in March declined by 17.8%, the lowest in over two decades. India will be diverting cargoes for loading in April already bought by refiners Indian Oil Corp IOC.NS, Bharat Petroleum BPCL.NS, Hindustan Petroleum HPCL.NS and Mangalore Refinery and Petrochemicals Ltd MRPL.NS. The refiners cut their crude processing after local fuel demand collapsed and are unable to store the excess oil themselves. "As of now the plan is to fill the caverns by (the third week of May), before the arrival monsoon rains. We are buying oil from state refiners," H.P.S. Ahuja, the managing director of the Indian Strategic Petroleum Reserves Ltd (ISPRL) said. ISPRL is responsible for building and filling of SPR sites. ISPRL wants to receive the cargoes before India’s monsoon begins in May as the single point mooring system that can unload very large crude carriers (VLCC) at the port of Mangalore, which will feed two SPR sites, is shut during the three-month rainy season. Reuters last month reported India planned to buy oil from the United Arab Emirates (UAE) and Saudi Arabia to fill its SPR to gain from low prices. "We are taking advantage of low oil prices," he said, adding most of these cargoes are linked to official selling prices (OSP) for April. Saudi Arabia drastically cut its OSPs for April to boost its oil sales after major producers failed to agree to extend a supply curtailment agreement that expired at the end of March. Ahuja said ISPRL hopes to receive the last oil cargo on May 21, while IOC supplied a VLCC containing oil from the UAE on Monday. The SPR is divided between three locations in southern India and can store about 37 million barrels of oil, equivalent to about 9.5 days of India’s oil demand. A portion of the SPR is already filled. The federal government has allocated about 38 billion rupees ($498.18 million) for the oil purchases, he said.

Middle East Crude-Benchmarks fall; Asia’s spot discount for Sokol narrows – Reuters News

Middle East crude benchmarks Oman and Dubai extended losses on Tuesday, dragged down by poor demand due to the coronavirus pandemic.

ASIA-PACIFIC CRUDE: Indian oil explorer ONGC Videsh has sold a cargo of Russian Sokol crude loading June 16-22 at a narrower discount of around $5.80-$6.00 a barrel to Dubai quotes, likely to Chinaoil, traders said. Indonesia’s Pertamina has offered May-loading Banyu Urip and Saharan Blend crude in a rare move to sell prompt cargoes due to falling domestic demand, traders said. It did not award a tender closed last week seeking condensate for June-July despite of low offers, traders said. Separately, Pertamina has issued another spot tender seeking sweet crude for delivery over the period of August to November.

WINDOW: Cash Dubai’s discount to swaps widened 96 cents to $10.92 a barrel.

Socar Buys 3m Bbl of Saudi Crude for Star Refinery in Turkey

Socar bought 3m barrels of Saudi crude for shipment in April, Ibrahim Ahmadov, a spokesman for the Azeri oil producer, said. The oil will feed Socar’s Star refinery in Turkey, Ahmadov said in response to questions from Bloomberg

Caspian CPC Blend Crude Loadings to Rise to 5.73M Tons in May

Caspian CPC Blend crude loadings for May set at 5.73m tons from the terminal near Russia’s Black Sea port of Novorossiysk, according to preliminary loading program seen by Bloomberg.

Equivalent to about 1.46m b/d

Compares with 5.31m tons, or 1.4m b/d scheduled for April

Loadings based on conversion rate of 7.905 bbl per ton

CPC loadings reached a record of 6.3m tons or 1.61m b/d in March

Final loading program for May will be released early next month

Saudi Aramco Cuts Crude OSPs Again From Sidi Kerir for May

Saudi Aramco cut official selling prices of all four grades again to new record lows from Egyptian port of Sidi Kerir for May, in line with big cuts in prices for other customer regions, according to a price list seen by Bloomberg.

Arab Light OSP set at $9.85 discount to ICE Brent, vs -$8.40 for April

Arab Extra Light also at -$9.85/bbl vs -$5.60/bbl

Arab Medium -$10.95/bbl vs -$10.20/bbl

Arab Heavy -$10.95/bbl vs -$10.50/bbl

Prices of all four crude grades from Sidi Kerir are 45c higher than those shipped from Ras Tanura in Persian Gulf for customers in Mediterranean, compared with 20c higher in April’s price list

Asian Buyers to Submit Saudi Oil Nominations for May by Tuesday

Saudi Aramco requested Asian customers submit their nominations for long-term contractual oil supplies for May-loading by Tuesday, according to traders who asked not to be identified.

Customers are also being asked to put in requests for grades sought for May as well as loading periods as the official selling prices were released later than usual

Long-term contractual buyers typically submit nominations and requests for particular grades and loading dates separately

Saudi OSP cuts a precursor for other Middle East producers to slash prices – Platts

Saudi Aramco’s decision to cut the official selling prices of its May-loading crude to Asian customers will pave the way for other Middle East producers to follow suit, continuing a tussle for market share initiated by Aramco in March, trade sources said Tuesday. Aramco on Monday slashed its Asia-bound May OSPs by $2.95/b-$5.50/b from the prior month’s OSPs — exceeding market’s expectations of $2-$3/b cuts as per a survey published by S&P Global Platts earlier this month. The cuts were made despite Saudi and OPEC+ members’ agreement to cut production by 9.7 million b/d cut for May and June 2020, with lesser cuts for the remainder of the year. "The OPEC output cut deal [can be considered] historic, but look at the steep price cuts [from Aramco]," a trading manager at South Korea’s GS Caltex in Seoul said. Acutely weak crude oil demand from major Asian importers will pitch competing Middle East crude grades against each other for best value in refinery valuations, traders indicated. "Saudi had to cut prices despite the OPEC+ production cuts, in order to stay competitive," a senior crude trader in Singapore said. "The [production] cuts are for 10 million b/d, but demand has declined [by] some 30 million b/d over these months so there is still competition to get to the customer," he added. The OPEC leader’s move on Monday has set the stage for widespread price cuts from other major crude exporters like the UAE, Kuwait, Iraq and Qatar, traders said. "Other producers have no choice, but to follow Saudi’s price cuts," the senior trader said, adding that low demand will still dictate market sentiment in April as it had in March. Producers that poll Asian term lifters for their input on OSPs were also likely to receive recommendations for strong price cuts in line with those by Aramco. "What can we recommend except follow the Saudis," a China-based source said.

PREMIUM CRUDES LOSE THEIR EDGE

Despite Aramco’s bigger-than-expected cuts, the cut in Arab Light OSP differentials were reflective of the negative gasoline and jet fuel crack spreads, a Japanese refiner said. Second month FOB Singapore 92 RON gasoline swap crack versus Dubai swap averaged minus $1.17/b in March, a sharp dip from the plus $7.48/b averaged in February, Platts data showed, while second month Singapore jet fuel crack swap against Dubai swaps averaged at a 17-year low of $4.89/b in March, and has slipped into negative territory for the first time ever in April. Aramco, which slashed the price of its Arab Extra Light to the same level as that of its lower value Arab Medium and Heavy crudes, has also set the precedent for other producers to crunch the premiums commanded by lighter grades, such as Abu Dhabi’s Murban or Qatar’s Land crudes, market sources said. "Quality spreads have crunched, and Murban’s [premium over medium grade] Upper Zakum is very likely to also be flat or around there," the first trader added. "Murban will likely be set similar to Saudi cuts [for Arab Extra Light], it cannot afford to be more expensive than AXL," the trader said. Murban is Abu Dhabi’s largest crude grade by production and is considered a premium grade for Asian refiners due to its high yield of naphtha and distillates. The grade is considered an unofficial reference for other light Middle East crude grades traded in the Asian spot market. But typically light sour crude premiums have been eroded as demand for transport fuels has plunged in recent months.

NO RUSH FOR BUYERS

Buyers, meanwhile, were in no rush to begin procurement for the current cycle, and were waiting for other producers to release their respective prices in order to gauge the best value among Middle East crude grades. they also expect near term demand destruction to peak at around 20 million b/d. "[We are] not in a hurry to buy, I am sure other producers will cut prices too," a Singapore-based crude oil trader with a state-owned Chinese company said. Market participants also noted the unsold April and May loading crude barrels available to Asian refiners. "Demand itself is not better, and there is lots of excess standing by if someone does show demand," the first trader said. The Dubai crude structure, tracked by market participants as a gauge of spot market sentiment for Middle East sour crude in Asia, has fallen further this month, averaging minus $9.15/b to-date in April, down from minus $3.11/b over March, Platts data showed on Tuesday. "Dubai structure is at a record low, the Asian product cracks too, gasoline is also [at a] record low, I think. Asian demand, that’s what matters the most for the producers," the Seoul-based trading source added.

China’s Big Oil Urged to Copy Mexican Hedge Amid Price Crash – Bloomberg

A researcher at China’s biggest oil company said the country’s drillers should copy the hedging strategies of Mexico and shale firms in the U.S., which use financial derivatives to protect against falling oil prices. Most of China’s oil production is unhedged, leaving the stability of the sector exposed to global market fluctuations, according to Dai Jiaquan, director of the oil market research department at China National Petroleum Corp.’s Economics & Technology Research Institute. Chinese firms should use derivatives to ensure stable returns on the crude they sell, Dai said in a panel interview published in CNPC-owned China Petroleum Daily. The process is easier with yuan-denominated futures on Shanghai International Energy Exchange, he said. “Now that Shanghai crude oil futures are listed and functioning well, it is necessary to make full use of financial means to hedge the risk of price fluctuations,” he said. Oil prices are down by about half so far this year, straining the finances of China’s state oil firms, which have all decided to trim spending. Despite the billions of dollars annually they pour into old, high-cost fields to keep China’s reliance on overseas oil in check, the country has still grown to become the world’s largest importer. Derivatives could also help China’s government take advantage of lower prices to build its strategic reserves, Bai Ming, deputy director of the Ministry of Commerce’s international market research institute, said in the same panel interview. “If we want to expand our reserves, on the one hand, we can buy real oil, and on the other hand, we must purchase futures to lock in low-cost sources in advance,” he said. CNPC declined to comment. Nobody answered calls to the country’s other two big state oil firms — China Petrochemical Corp., known as Sinopec, and China National Offshore Oil Corp. The listed units of all three firms didn’t immediately respond to requests for comment. The use of energy derivatives by Chinese firms has come under government scrutiny after Sinopec’s trading arm suffered an operating loss of nearly $700 million in 2018, which it blamed on “inappropriate hedging techniques” and “misjudgment” of prices. In January, the state asset regulator tightened rules on commodities derivatives trading, capping hedging at 80% of physical volume, down from 90%. It also reiterated that derivatives trading should be purely for the purpose of hedging, rather than speculation. Mexico’s hedging program, which includes using put options to set a price floor, has shielded it during every downturn over the last 20 years. It made $5.1 billion when prices crashed in 2009 during the global financial crisis, and it received $6.4 billion in 2015 and another $2.7 billion in 2016 as Saudi Arabia flooded the market. China produced about 3.8 million barrels a day of crude oil in 2018, compared to almost 2.1 million daily by Mexico, according to data from the BP Statistical Review of World Energy. Virtually all of China’s output is consumed domestically. Mexico has in the past hedged around 250 million barrels, or about 680,000 barrels a day, which is equal to nearly all its net oil exports.

China’s March crude oil imports rose 4.5% y/y on stockpiling – Reuters News

China’s crude oil imports in March rose 4.5% from a year earlier, according to official customs data, as refiners stocked up on cheaper cargoes despite falling domestic fuel demand and cuts in refining rates caused by the COVID-19 disease outbreak. China, the world’s top crude oil importer, took in 41.1 million tonnes of oil, according to the official data from the General Administration of Customs. That is equal to 9.68 million barrels per day (bpd). The official March figure in bpd compared to an average of 10.47 million bpd for the first two months of the year. Imports in the first quarter rose 5% from a year earlier to 127.19 million tonnes, customs said, equal to 10.2 million bpd. Reuters reported a higher import number earlier for March based on quarterly figures released in a customs statement and data from previous months. In the official data set, the customs department gave a lower figure for the quarterly imports. Refiners, including state majors and private plants, began slashing crude throughput in February as fuel demand collapsed amid a nationwide lockdown to contain the novel coronavirus. But independent plants, also known as "teapots", started cranking up production rates in March, as a plunge in oil prices triggered by the Saudi-Russia price war boosted margins. "Teapots started to book crude oil from late February when domestic virus transmission was easing. Some of the vessels have arrived in March and more will come in April," said Li Yan, senior analyst at Longzhong Information Group. Li also expected an increase in oil imports in late April and May as Chinese refineries scrambled to purchase cheap energy after oil prices collapsed. Chinese fuel demand has started to recover as companies resume operations and travel curbs are eased, although analysts expect demand across the full year to fall 19.1% from 2019 in what would be the steepest drop since at least 2004. Chinese companies also shipped 7.26 million tonnes of refined fuel products overseas in March, 0.7% above the year-earlier level, the customs data showed. In the first three months, China exported a total of 18.02 million tonnes of fuel products, up 9.6% from the same period last year. Customs will release detailed export data by product later in the month. Gasoline and aviation fuel led the growth in product exports in the first two months of year, with a year-on-year increase of 32% and 21%, respectively. Natural gas imports, including piped and liquefied natural gas (LNG), in the first quarter were 24.66 million tonnes, up 1.8% from a year earlier, customs said. In March, imports were 6.92 million tonnes, down 0.2% from a year earlier, according to the customs data. PetroChina, China’s top gas importer, cancelled some contracts in early March, including piped gas from Central Asia and LNG shipments, as a seasonal plunge in demand adds to the impact on consumption from the coronavirus outbreak.

Sinopec boosts refineries’ Apr crude run by 8 percentage points from Mar – Platts

China’s Sinopec increased its April utilization rate by about eight percentage points from March as more and more of its refineries raised crude runs to levels that were reported prior to the spread of COVID-19, a survey by S&P Global Platts showed. As a result, China’s throughput is likely to hit 12.5 million b/d in April, or 90% of the level achieved in January, after falling by about 3.3 million b/d in February, Platts data showed. The survey saw 16 refineries — accounting for 68% of Sinopec’s total refining capacity — lift their combination run rate to 80% in April, from the 72% polled in March and 64% in February, closing in on January’s rate of about 89% when the country had yet to be put under complete lockdown following the outbreak of the coronavirus. Seven of the polled Sinopec refineries raised their April operating rates to the level recorded in January and December. In contrast, only two had done so in March. Except for the Zangzhou refinery in central China, the rest of these seven refineries are along the developed coastal regions in the south and east of China, where demand rose at a faster pace than in the north and the landlocked west, where PetroChina’s refineries are located. Almost all the surveyed refineries saw an increase in April planned throughput, than in March, as gasoil and gasoline demand rose with the resumption of economic activity and as the number of fresh COVID-19 cases plateaued in China. Even the 260,000 b/d Gaoqiao Petrochemical in Shanghai, which had shut its No.3 FCC in April for maintenance, lifted its planned crude run slightly to 73% in April from 72% in March. Meanwhile, the 170,000 b/d Sinopec-SK Wuhan Petrochemical hiked its utilization rate by two percentage points on the month to 61% in April as Wuhan city is no longer under lockdown since early this month. Only the flagship 460,000 b/d Zhenhai Petrochemical in eastern China Ningbo reduced its April crude run to 65.6%, from 75% in March, as it has shut a 160,000 b/d CDU for maintenance. However, throughput recovery is likely to be capped as the outlets for export of oil products are limited in light of lockdowns across the world, which has sapped global demand, a Shandong-based Sinopec refiner said. Its peer, PetroChina, has cut a combination run rate in six refineries to 60% in April from 63.3% in March and 65% in February, with the heaviest reductions from the exporting PetroChina plants, Platts report previously. Independent refineries in Shandong province raised their average run rate to over 60% this week and are expected to up this to 70% by the end of this month, Platts reported. Platts will publish the final April throughput survey for about 19 of Sinopec’s refineries, 17 of PetroChina’s and one CNOOC refinery later this month.

Virus Could Halt Some Gasoline-Focused Refiners for Good: EA

Uncompetitive gasoline-focused refiners in the Atlantic Basin will probably close permanently because of the plunge in demand caused by the coronavirus pandemic, according to a report from Energy Aspects dated April 9.

Global gasoline demand will fall by 7.4m b/d y/y in April to less than 20m b/d

“Even once social distancing measures are eased, the gasoline market faces a challenging year as millions of job losses translate into lower demand in the U.S. and elsewhere“

Key Oil Flow for U.S. Crude Set to Reverse Amid Market Turmoil – Bloomberg

The latest sign that the oil market has gone off-kilter: crude oil is once again set to move from the U.S. Gulf Coast to Cushing, Oklahoma. Enterprise Interstate Crude LLC, a subsidiary of Enterprise Products Partners LP, said in a filing to regulators Monday that it planned to start a temporary service using leased pipeline capacity after receiving interest from at least one shipper to move oil to the inland storage hub. Enterprise’s 2012 reversal of the Seaway pipeline to carry crude to the coast from Cushing, the delivery point for West Texas Intermediate futures, was a watershed moment for the U.S. shale boom, as the center of the country no longer needed to rely on overseas supplies. The reversal allowed growing supplies of low-cost U.S. and Canadian oil to displace seaborne imports, and helped the country become one of the world’s leading suppliers after export restrictions were loosened in 2015. It also led to a substantial narrowing of prices for WTI and the global benchmark Brent, one of the most widely traded crude spreads in the world. The filing doesn’t say which pipeline Enterprise intends to use, but it does say it plans to ship from its station in Katy, Texas, which is on the Seaway system. Seaway has two pipelines with a combined capacity of 850,000 barrels a day, and is jointly owned by Enterprise and Enbridge Inc. An Enterprise spokesman didn’t immediately return an emailed request for comment sent after normal business hours. Measures to stem the Covid-19 outbreak have crushed fuel demand, with gasoline consumption down almost half from a year ago. Refineries in the Gulf Coast and elsewhere have been forced to cut operations to a minimum just as a price war between Saudi Arabia and Russia flooded the world with crude. “Given the current turmoil in the crude oil market, including impacts on both refinery and export demand, there is strong market interest to access the Cushing storage market,” Enterprise wrote in the filing.

Troll no more: Energy Twitter group’s big short on shale comes good – Reuters News

Just like the street hustler turned commodities broker in the 1980s comedy "Trading Places" for which he named his twitter account, @WillRayValentin (BRV) is an outsider making waves in the world of energy stocks trading. A petroleum engineer by background, BRV is a member of the ‘Energy Fintwit’ (EFT) community on Twitter made of oil industry insiders – engineers, geologists and former traders – who have gained notoriety and thousands of followers for their unabashed bearish tweets about the U.S. shale industry. As U.S. crude oil prices halved in March under the weight of recession fears and a price war, many of the group’s members had a field day as their ‘shorts’ on U.S. shale companies – bets that their stock prices would fall – paid off. BRV’s own trading account, which he shared with Reuters, showed he pocketed $4 million in just one week between March 9 and March 16. "I’ve made a lot more money shorting energy stocks than my entire career working 9-5. It was like picking money up off the street," BRV told Reuters in a phone interview. Like many others, he will not reveal his name, citing fears of industry retribution. With their invective-laden diatribes against oil executives, memes and cartoons, posts by the likes of BRV, @HalliBu78316368 (Halli Burton) or @EnergyCynic (Energy Cynic), have gotten greater attention last year following some prescient calls. "If you want to know the real narrative in energy, particularly the bear arguments on investor relations, you have to be on Twitter," said Ethan Bellamy, energy sector analyst at RW Baird, one of some half a dozen analysts and investors who told Reuters following the group is now part of their routine. Its most prominent member is @Mr_Skilling (Mr. Skilling), whose alias is an ironic tribute to Jeff Skilling, a former executive jailed for his role in the accounting scandal that brought down energy trading giant Enron nearly two decades ago. Mr. Skilling counts journalists, analysts and politicians among his roughly 9,000 followers, more than some well-regarded industry analysts. Jeff Skilling’s lawyer did not respond to requests for comment. Dan Pickering, founder and CIO at Pickering Energy Partners, and a 30-year energy sector veteran said posts by "guerilla activists" like Mr. Skilling do factor in his analysis. “There are absolutely institutional investors that follow this space. I’ve gotten questions about Mr. Skilling from my investor base." One of the group’s most prescient calls was an Oct. 31 report in which @EnergyCredit1, BRV and @Oil_Gonif set a $0 price target for Whiting Petroleum Corp WLL.N, warning about its high leverage and underperforming wells. On April 1, the oil producer filed for bankruptcy, but at the time of the report, 30 out of 31 brokerages polled by Refinitiv had a "hold" or better rating for the stock. Mr. Skilling’s months-long battle with Tallgrass Energy LP TGE.N, over guarantees of higher payouts for its management in a takeover by Blackstone BX.N last year, also helped raise his and the group’s profile. Under fire from investors, the pipeline operator’s CEO stepped down and Blackstone ultimately offered concessions to the company’s common shareholders. Tallgrass did not respond to requests for comment.

YOU’VE BEEN WARNED

The group’s members acknowledge they could not have anticipated the coronavirus outbreak and the extent of the oil market rout, but they say the crash validates the argument they were making when oil was at $60, which is that many U.S. shale operators were unfit to survive a major shock. "When oil was at $100 it was more difficult to identify the bad companies," says Halli Burton, whose Twitter profile declares she is the "VP of SHIT-Shale Health Investment Trust". "We are finally at a point today where we can start recognizing good and bad companies." Not everyone agrees. The U.S. shale industry is by its nature a higher-cost supplier, which meets demand low-cost producers cannot satisfy when markets are strong, so it is bound to suffer in a slump, and just to blame the managers is too simplistic, the argument goes. Still, for over a year now, there are signs of the group’s arguments easing into the mainstream. In November, analysts at Wolfe Research noted a rising volume of ‘peak shale’ tweets about rapidly slowing U.S. production growth signaling growing concerns about the sector’s outlook. UBS analysts, conscious that investors and industry executives at its annual conference were desperate to establish Mr. Skilling’s true identity, last September promised him all the Presidente margaritas he needed at a Houston Chilli’s restaurant if he would only turn up to meet the fans. As expected, Skilling did not show.

Jonathan Wagner

Ion Energy Group

180 Maiden Lane 25th Floor

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

![]()

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.