From: Wagner, Jonathan

Sent: Wednesday, September 05, 2018 6:35:48 AM (UTC-06:00) Central Time (US & Canada)

To: Curves

Subject: ION Morning Rundown

Good morning. Oil prices are weaker by 1% to start the day with products outperforming WTI and Brent flat px and front end gasoline cracks and spreads relatively unchanged. Chinese equities finished the day weaker by 2-2.5% last night and European shares are in the red this morning. Escalating trade fears in addition to emerging market weakness are contributing to the sell off. TS Gordon continues to weaken this morning after making landfall just west of the Alabama-Mississippi border. As of last night the BSEE accounted for 9% of GOM production offline with no refineries shutting in advance of the storm. TS Florence was upgraded to a hurricane this morning so we will continue to watch its patch as moves towards the US. Middle east crude prices moved higher today as Cash Dubai is now trading +1.25 over swaps. Eight Dubai partials traded in the window today with BP and Shell seen as buyers. Sep/Oct Dubai spreads are trading at 67c back while Oct/Nov spreads are trading at 56c back. Adnoc cuts premium of Murban crude’s Aug. OSP versus Dubai price by 62c/bbl from July. They set OSPs for Aug. sales of Murban, Das and Upper Zakum crude at $75.05, $74.45 and $73/bbl, respectively. Saudi just announced that they are cutting their OSP for Arab Light to Asia by 10c to a premium of $1.10/b to the Oman/Dubai avg. Kuwait continues to ramp up production of their super light grade already selling eight 500k bbls of the crude for October trading. They hope to have capacity of 200k b/d of the super light grade beginning next month. Kuwait’s new heavy crude production is expected to resume in May with output to reach 60,000 bpd by the end of 2019. According to Reuters ship tracking data, OPEC tanker exports were seen at 25.05m b/d in Aug up 830k b/d month over month. This figure was boosted by volumes out of Africa as Libyan exports increased by almost 300k b/d m/m (Nigerian exports were also the highest since March ’18). US official will be meeting in India this week to discuss the looming Iranian sanctions with relatively little clarity on Oct loading programs so far. Last night the economic times ran an article saying that India is likely to tell the US that they will not cut imports from Iran… we will have to wait and see on that. Vols were higher across the curve yesterday with front end Brent breakevens moving back towards 1.30. This morning Brent vols are underperforming WTI with the vol curve flat. Front end WTI skew was bid to the calls as wingy v8 risk reversals moved almost 2% to the call. Wingy put skew was offered across the bal of ’18 and 1h 19 in both brent and WTi and we did see interest late in the day to own wingy front end WTI put skew via a ratio put spread. Producers remain active in 19 and 20 as various fence structures and three ways were seen on blocks and the SDR.

Top stories listed below

OPEC’s Barkindo says oil demand to hit 100 mln bpd ‘much sooner’ than projected – Reuters News

Middle East Crude-Benchmarks extend gains; ADNOC cuts Aug OSPs – Reuters News

Kuwait to Start Pumping 120k B/D of Oil From Northern Fields

OPEC Oil Flows – OPEC tanker exports at 25.05 million bpd in August, up by 830,000 bpd m-o-m – Reuters News

Russia’s Oct ESPO Blend crude exports seen rising 13% on month to 2.7 mil mt – Platts

Iran forgoes plans to transfer funds from Germany after U.S. opposition -sources – Reuters News

Trump to chair U.N. Security Council meeting on Iran – Reuters News

BPCL Awaits India Govt Direction to Book Iran Oil for October

Crude Storage in ARA Falls to Lowest Since March: Genscape

Hyundai Oilbank Is Said to Buy N. Sea Forties for Nov.

Iran’s Crude Export Losses May Surpass 1.2M B/d in 1Q 2019: RBC

CANADA CRUDE-Heavy crude discount narrows as Oct cycle begins – Reuters News

U.S. Cash Crude-Coastal grades firm as Storm Gordon hits supply, WTI/Brent widens – Reuters News

U.S. Cash Products-Gulf Coast gasoline falls despite expected hurricane landfall – Reuters News

U.S. oil refiners’ weekly capacity seen up 406,000 bpd -IIR – Reuters News

Major China ports will impose ship emissions rules earlier than expected – Reuters News

EUROPE-WAF FUEL FLOWS: August Loadings Rise to Three-Month High

Japan’s JXTG shuts FCC at Sakai refinery due to typhoon damage – Reuters News

China’s Hengyi pushes back Brunei refinery start-up to Q2 2019 – sources – Reuters News

Singapore 10 ppm sulfur gasoil cash differential hits 2018 high on supply constraints – Platts

|

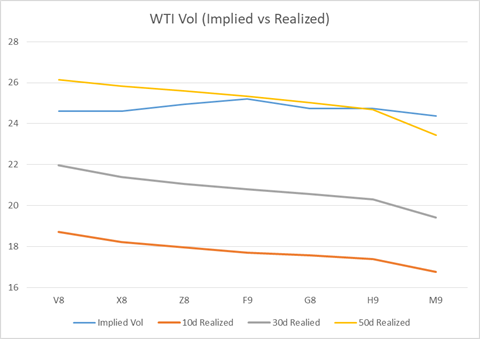

Implied Vol |

Realized Vol |

|||||||

|

WTI Vol |

31-Aug |

4-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

V8 |

22.85 |

24.62 |

1.77 |

1.09 |

18.70 |

21.97 |

26.14 |

|

|

X8 |

23.56 |

24.62 |

1.06 |

1.08 |

18.21 |

21.40 |

25.82 |

|

|

Z8 |

24.08 |

24.96 |

0.88 |

1.09 |

17.96 |

21.07 |

25.59 |

|

|

F9 |

24.58 |

25.22 |

0.64 |

1.1 |

17.70 |

20.81 |

25.34 |

|

|

G8 |

24.27 |

24.73 |

0.46 |

1.08 |

17.58 |

20.57 |

25.03 |

|

|

H9 |

24.3 |

24.75 |

0.45 |

1.07 |

17.40 |

20.30 |

24.68 |

|

|

M9 |

24.05 |

24.38 |

0.33 |

1.05 |

16.76 |

19.41 |

23.43 |

|

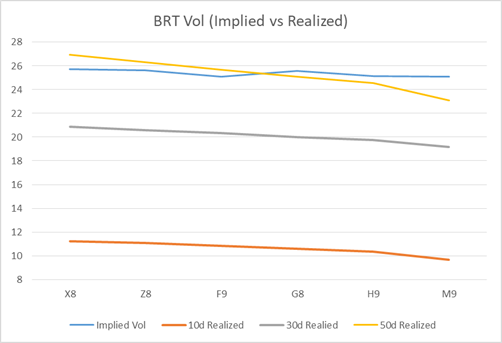

Implied Vol |

Realized Vol |

|||||||

|

BRT Vol |

31-Aug |

4-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

24.16 |

25.73 |

1.57 |

1.27 |

11.24 |

20.88 |

26.93 |

|

|

Z8 |

24.79 |

25.6 |

0.81 |

1.26 |

11.08 |

20.59 |

26.28 |

|

|

F9 |

24.53 |

25.08 |

0.55 |

1.23 |

10.85 |

20.32 |

25.68 |

|

|

G8 |

25.26 |

25.58 |

0.32 |

1.25 |

10.62 |

20.01 |

25.09 |

|

|

H9 |

24.91 |

25.13 |

0.22 |

1.22 |

10.37 |

19.75 |

24.52 |

|

|

M9 |

24.85 |

25.09 |

0.24 |

1.21 |

9.69 |

19.16 |

23.07 |

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

WTI U19 65/60 Put Spread x66.65 TRADES 184 1,350x 9d

WTI/BRT M19 ATM Call Roll x67.50/76.50 TRADES 62 1,500x 60d

ICE Trade Recap

BRT Z18 70/80 1×2 Call Spread x69.50 TRADES 201 1,300x 32d

BRT X18 ATM Call x79.50 TRADES 194 500x 52d

BRT X18 85 Call x79.20 TRADES 105 500x 23d

BRT H19 ATM Call x77.50 TRADES 486 500x 55d

BRT H19 90 Call TRADES 115 600x

BRT M19 55 Put TRADES 49 700x

BRT M19 90/100 1×2 Call Spread TRADES 30 1,000x

BRT M19 ATM Call x76.50 TRADES 606 600x 60d

BRT F19 78/72 1×1.5 Put Spread x77.75 TRADES 154 600x 20d

WTI H19 ATM Call x68.50 TRADES 450 500x 58d

BRT M19 75/70 Put Spread x76.40 TRADES 192 600x 12d

CME Trade Recap

WTI X18 68 Put x69.60 TRADES 163 500x 38d

WTI V18 75 Call TRADES 22 600x

WTI H19 50 Put x69.35 TRADES 23 1,000x 3d

BRT Z18 70/75 Put Spread x79.00 TRADES 95 700x 18d

WTI Z18-H19 62/77 American Fence Strip x69.50 TRADES 5 400x 40d

WTI H19 60/75 Fence x68.90 TRADES 58 600x 52d

WTI M19 70 Call TRADES 435 500x

WTI Z19 50/80 Fence x66.15 TRADES 34 500x 37d

WTI Z19 ATM Call x66.50 TRADES 682 500x 63d

WTI Z19 ATM Call x65.50 TRADES 683 700x 63d

WTI Z19 60/65/70/75 Call Condor x66.60 TRADES 118 500x 5d

WTI Cal19 80 American Call Strip TRADES 153 40x

WTI M20 45 Put x64.00 TRADES 155 100x 12d

CSO/ARB/APO Trade Recap

WTI CSO V/X18 0.25 Put (WA) TRADES 10 500x

WTI CSO 4Q18 1.25 Call (WA) TRADES 2 5,500x

WTI CSO 4Q18 Flat Put (WA) TRADES 5 1,000x

+WTI CSO X/Z18-Z/F19 1.50 Call (WA) TRADES 2.5 500x

WTI CSO Z/F19 1.00 Call (7A) TRADES 6 1,500x

ARB Z18 -8.00 Put TRADES 130 250x; TRADES 128 250x

ARB 2H19 -4.00 Call Strip TRADES 25 200x

WTI APO Cal20 55/70 Fence x64.00 TRADES 57 50x 68d

WTI APO Cal20 55/70 Fence x63.20 TRADES 6 50x 68d

WTI APO V19 69 Put x69.20 TRADES 205 100x 44d

OPEC’s Barkindo says oil demand to hit 100 mln bpd ‘much sooner’ than projected – Reuters News

OPEC Secretary-General Mohammad Barkindo said on Wednesday that world oil consumption would hit 100 million barrels per day later this year, "much sooner" than earlier projected. The Organization of the Petroleum Exporting Countries and other producers led by Russia last year began withholding 1.8 million barrels per day (bpd) of supplies to tighten the oil market and prop up prices that in 2016 fell to their lowest in more than a decade. Both Russia and OPEC leader Saudi Arabia have spoken about the need for a gradual increase in oil production as the goal of removing excessive oil stockpiles has now been achieved and the market has been broadly balanced. "The world will attain the 100 million barrels a day mark of consumption later this year, much sooner than we all earlier projected. Therefore stabilising forces which create conditions conducive to attracting investments are essential," Barkindo told an oil and power conference in South Africa’s Cape Town. He added that oil industry confidence was beginning to return and that OPEC was exploring ways of further institutionalizing a declaration of cooperation on oil output between OPEC and non-OPEC oil producers. "Going forward, the priority … is on ensuring stability is sustainable, spreading confidence in the industry and encouraging an environment conducive to the return of investments," he added.

Middle East Crude-Benchmarks extend gains; ADNOC cuts Aug OSPs – Reuters News

The Middle East crude benchmarks strengthened on Wednesday with DME Oman’s premium to swaps up 10 cents, while cash Dubai’s premium edged up supported by purchases from Shell and BP.

UAE: ADNOC has cut prices for all crude grades in August to ensure that its oil remains competitive in Asia after its light grades traded at the widest discounts since 2015 last month. ADNOC set the August retroactive official selling price (OSP) for its benchmark Murban crude MUR-OSP for sale to Asia at $75.05 per barrel, the company said on Wednesday. This puts the August Murban OSP’s premium to Dubai quotes at $2.56 a barrel, down 62 cents from the previous month. For Das, another light crude grade, the premium of its August OSP to Dubai quotes was cut by 67 cents from July to $1.96 a barrel. Last month, Middle Eastern light crude grades sold at discounts of as wide as 70 cent to 75 cents a barrel because of uncompetitive OSPs and stiff competition from arbitrage supplies. The premium of the August OSP for Upper Zakum to Dubai quotes fell 22 cents compared with the previous month to 51 cents a barrel, in line with spot trade levels last month. The price cuts were reasonable, several traders in Asia said.

WINDOW: Cash Dubai’s premium to swaps rose 4 cents to $1.25 a barrel.

Kuwait to Start Pumping 120k B/D of Oil From Northern Fields

Kuwait Oil Co. to start northern field output in October, also to produce 500m scf/d of gas from northern fields in same month, Emad Sultan, VP for planning, says at news conference in Kuwait City.

KOC to start pumping heavy oil in January, ramping up output to 60k b/d by end-2019

State-run co. to award 1st offshore drilling contract in December; has received bids from 3 foreign cos.: Sultan, without identifying bidders

KOC plans to drill 6 undersea exploration wells

Kuwait exported 5m bbl of super light oil since July; KOC to have production capacity of 200k b/d of super light crude beginning October

Super light grade has rating of more than 45 on American Petroleum Institute’s scale of oil density

KOC’s current oil-production capacity is 3.15m b/d

OPEC Oil Flows – OPEC tanker exports at 25.05 million bpd in August, up by 830,000 bpd m-o-m – Reuters News

OPEC seaborne crude oil exports recovered strongly, above 25 million bpd in August, following a sharp drop in July. The group’s exports were supported by rising shipments predominately out of Africa, along with quantities out of the Middle East supporting the rebound, albeit at a lower magnitude, as lower volumes from Iran put a cap on exports from the Gulf. Exports from Africa were buoyed by a recovery in Libyan departures and a substantial rise in Nigerian shipments, which rose to their highest since March 2018, a five-month high. In the Middle East, Iran’s exports declined below the two million bpd mark for the first time since January 2018, an eight month low, as appetite wanes, on the back of reviving US sanctions.

Middle East exporters followed mixed trends last month, with exports declining from Iran and Kuwait, while the remaining OPEC members in the Middle East Gulf saw volumes rise higher or stay relatively flat. Kuwaiti and Iranian crude oil exports declined below the two million bpd mark at 1.93 million bpd and 1.76 million bpd respectively. Crude shipments out of Kuwait fell below the two million bpd range for the first time since September 2017, almost a year ago, while Iranian exports hit a seven month low as Asian and European lifting softened. Elsewhere in the Gulf, exports from the UAE rose to an eight month high of 2.8 million bpd, while Saudi crude exports rose to above seven million bpd, from 6.85 million bpd previously.

Crude oil exports from OPEC’s African members soared to a five month high at 5.45 million bpd, supported by a strong recovery in Libyan exports, which rose to 830,000 bpd, from 540,000 bpd in July. Additionally, the continent’s exports were also supported by a rise in Nigerian departures, which totaled at two million bpd, highest level since March 2018. The two countries added a combined 550,000 bpd compared to July levels, supporting the monthly increase of 600,000 bpd in OPEC’s African exports of crude oil.

Departures from Americas were seen down by 140,000 bpd m-o-m to a total of 1.67 million bpd as Ecuadorian volumes dropped by 60,000 bpd m-o-m, while Venezuelan exports eased to 1.29 million bpd, down by almost 80,000 bpd.

Condensate exports from OPEC declined last month, standing at 700,000 bpd, from a final assessment of 870,000 bpd the month prior. The drop came predominately from a sharp drop in Algerian volumes, which more than halved, standing at just 120,000 bpd, down from 270,000 bpd previously, which however was an unusual spike. Interestingly, Libyan condensate quantities more than doubled last month, at 110,000 bpd, from 50,000 bpd in July.

Russia’s Oct ESPO Blend crude exports seen rising 13% on month to 2.7 mil mt – Platts

Russia’s exports of the medium sweet ESPO Blend crude in October are expected to total 2.7 million mt, up 12.5% from September, the latest monthly loading program showed. ESPO Blend’s October program runs from September 29 to November 1 and will comprise 27 cargoes of 100,000 mt each, according to the program. In comparison, the September program, which runs from August 30 to October 1, comprises 24 cargoes of 100,000 mt each, or 2.4 million mt in total. The October-loading rate will average 582,088 b/d, up from 533,091 b/d scheduled for September. The program shows that state-owned Rosneft holds 11 cargoes for October, up from 10 seen in the September program and has not yet issued a tender for the October-loading program, market sources said. Russia’s Surgutneftegaz holds seven cargoes for October loading, similar to the September-loading program. Surgut has sold all of its October-loading cargoes via two tenders, sources said. Two 100,000 mt cargoes for loading over September 30-October 6 and October 4-9 were sold to a Chinese trading house at a premium of around $2.50-$2.60/b to Platts front-month Dubai crude assessments. Surgut also sold its remaining five cargoes for loading over October 12-16, October 16-20, October 21-25, October 25-29 and October 27-31 through tender to a Chinese trading house at a premium of $3.60-$3.70/b to Dubai, said sources. Small producers including Swiss-based Tenergy will hold a total of six cargoes, unchanged from the previous month and Lukoil will hold one cargo, according to the program. Russia’s Gazprom Neft holds two cargoes according to the program and has sold a cargo loading over October 3-13 through tender to an unknown buyer at a premium of around $2.60-$2.70/b to Dubai, market sources said. Overall, October-loading ESPO Blend cargoes were sold at premiums of around $2.50-$3.70/b to Dubai, up from premiums of $2-$2.30/b to Dubai for September, due to strong buying interest from China and some specific loading date requirements, market sources said. "ESPO moved higher in the first half of October due to a shortage of available cargoes," a Singapore-based trader said. "A lot of the early October scheduled cargoes are due for direct supply to China for term deals there, so [a] lack of available [spot] cargoes pushed [the] market higher," the trader added. "The premiums for ESPO are extremely expensive for October loading due to strong buying interest. Premiums are expected to stabilize a bit next month," another Singapore-based trade source said.

Iran forgoes plans to transfer funds from Germany after U.S. opposition -sources – Reuters News

Iran is forgoing plans for now to transfer about 300 million euros ($347 million) in funds held in Germany to Iran after strong opposition from the United States, two sources with knowledge of the matter said on Wednesday. The funds are held at the Hamburg-based Europaeisch-Iranische Handelsbank (eihbank). The bank was not immediately available for comment. The U.S. ambassador to Germany had been urging Berlin to stop Iran withdrawing large sums of cash from bank accounts in Germany to offset the effect of new U.S. sanctions imposed after Washington withdrew from a 2015 nuclear deal. "Iran is the world’s leading state sponsor of terrorism. We must be vigilant," Ambassador Richard Grenell said on Twitter on Wednesday in reaction to news that Iran was dropping its bid to move the money. The development was earlier reported by the German daily Sueddeutsche Zeitung and the broadcasters NDR and WDR. Washington has announced new sanctions on Iran and ordered all countries to stop buying Iranian oil by November and foreign firms to stop doing business there or face U.S. blacklists. Iran argues it needs the cash for Iranian citizens travelling abroad since they cannot access recognized credit cards.

Trump to chair U.N. Security Council meeting on Iran – Reuters News

U.S. President Donald Trump will chair a U.N. Security Council meeting on Iran this month to spotlight its "violations of international law" during the annual gathering of world leaders in New York, U.S. Ambassador Nikki Haley said on Tuesday. The United States, which holds the council presidency for September, has unsuccessfully pushed the Security Council to call out Iran. Haley has regularly attacked Iran, accusing it of meddling in the wars in Syria and Yemen. Haley told reporters Trump was chairing the meeting "to address Iran’s violations of international law and the general instability Iran sows throughout the entire Middle East region." Diplomats said Iran could request to speak at the Sept. 26 meeting, the high-level week of the U.N. General Assembly. Iranian President Hassan Rouhani is expected to address the assembly on Sept. 25. The Iranian U.N. mission did not immediately respond to a request for comment. Haley said the United States would not object to Rouhani speaking. Russia’s Deputy U.N. Ambassador Dmitry Polyanskiy said the Iran meeting should focus on the implementation of a 2015 resolution on Iran. "We very much hope that there will be views voiced in connection with the U.S. withdrawal" from a 2015 international nuclear deal, Polyanskiy told the council. Trump in May withdrew from the accord between Iran and six world powers aimed at stalling Tehran’s nuclear capabilities in return for lifting some sanctions. Trump ordered the reimposition of U.S. sanctions suspended under the deal. Iran is still subject to a U.N. arms embargo and other restrictions contained in the resolution, which enshrines the nuclear deal. European powers have been scrambling to salvage the accord. In February, Russia vetoed a U.S.-led bid for the Security Council to call out Tehran for failing to prevent its weapons from falling into the hands of Yemen’s Houthi group, a charge Tehran denies Several council members on Tuesday also expressed opposition to Haley’s plan to convene a meeting on Wednesday on Nicaragua. More than 300 people have been killed and thousands injured in crackdowns by police and armed groups on protests over government plans to cut welfare benefits. The protests developed into broader opposition against President Daniel Ortega. China, Russia, Bolivia and others said the situation in Nicaragua was not a threat to international peace and security and therefore should not be discussed by the council. Bolivia is expected to try to block the meeting on Wednesday but does not have the minimum nine votes required to do so, diplomats said.

BPCL Awaits India Govt Direction to Book Iran Oil for October

Bharat Petroleum hasn’t booked any Iranian oil cargoes for October as co. awaits clarity from government on future transactions, Refineries Director R. Ramachandran says by phone.

Iranian cargoes weren’t sought for September as well after fire shut hydrocracker unit in Mumbai last month, reducing need for high-sulfur crude

Unit remains shut, no decision taken yet on restart date

Expect some clarity on Iran issue from U.S.-India dialogue due this week

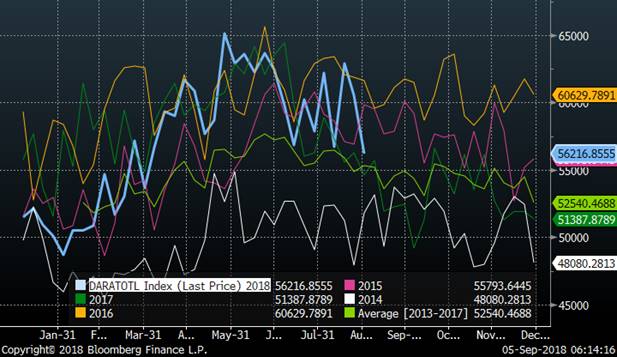

Crude Storage in ARA Falls to Lowest Since March: Genscape

Crude inventories in Europe’s ARA region fell 4.3m bbl in week ended Aug. 31 to 56.2m bbl

Hyundai Oilbank Is Said to Buy N. Sea Forties for Nov.

South Korean refiner buys 2m bbl of Forties grade for November arrival, according to traders who asked not to be identified. Co. bought ~4m bbl of N. Sea Forties crude for Oct. arrival in its last reported purchase of the grade

Iran’s Crude Export Losses May Surpass 1.2M B/d in 1Q 2019: RBC

Iran’s response to the U.S. sanctions will play an important role in determining the potential upward trajectory of oil prices, RBC analysts including Helima Croft say in Sept. 4 note.

RBC estimates that cumulative Iranian export losses from re-imposed U.S. sanctions will exceed 1.2m b/d during 1Q 2019

That surpasses what the Obama U.S. administration managed to take off the market

“Though the Trump administration will likely fall short of the stated goal of fully removing Iran from the market, the losses will nonetheless be very meaningful and exceed initial market expectations about the effectiveness of U.S. sanctions”

Currently, Iranian oil exports stand at a 3-year low of 1.7m b/d; European, Japanese and South Korean cos. have curbed Iranian crude purchases; India is also expected to make significant cuts in bid to secure a waiver from the U.S.

“That leaves China as the biggest wildcard”

RBC’s base case is that Iran will be left with ~800k-1m b/d of exports if China roughly maintains current levels and India continues to buy at lower levels

Bank’s base case is that the Persian Gulf state will opt for an approach of contained escalation in response to sanctions

Iran may resume suspended nuclear activities while continuing to allow international inspectors to visit declared sites

Venezuela, Iran “represent a very real supply gap risk of nearly two million barrels, and we continue to caution that an additional 500k b/d is credibly at risk for periodic outages in Libya and Nigeria”

While Saudi Arabia has ramped up output by more than 280k b/d since May, questions remain over how much more it can easily produce and about its willingness to risk another contraction in prices given its own domestic revenue requirements

CANADA CRUDE-Heavy crude discount narrows as Oct cycle begins – Reuters News

The Canadian heavy oil differential narrowed against the West Texas Intermediate (WTI) benchmark on Tuesday as the October cycle began:

•Western Canada Select (WCS) heavy blend crude for October delivery in Hardisty, Alberta, settled at $25.10 a barrel below the WTI benchmark crude futures, according to Shorcan Energy brokers. That compared with Friday’s settle of $32.25 under WTI.

•Differentials have weakened significantly in recent months as production in Canada surpassed pipeline takeaway capacity.

•While shipments by rail have picked up, they are nowhere near what producers need to take away the glut of crude sitting in storage, leading to weaker pricing and continued volatility, said Iqbal Gill, Head of Hydrocarbon Supply with BarrelTex.

•The spread is also being impacted by maintenance plans for BP Plc’s Whiting refinery that will commence in a few weeks and last to late October, analysts said last week. The refinery is the largest single consumer of Canadian heavy oil.

•The differential hit a near five-year wide level of $34.15 per barrel below WTI last month.

•Light synthetic crude from the oil sands for September delivery settled at $4.05 under WTI, compared with Friday’s settle of $5.75 under.

U.S. Cash Crude-Coastal grades firm as Storm Gordon hits supply, WTI/Brent widens – Reuters News

U.S. coastal cash crude grades strengthened to the highest levels in over two months on Tuesday as Tropical Storm Gordon moved through the U.S. Gulf of Mexico, prompting companies to take oil production and drilling rigs offline as some seaports closed, dealers said. A wider spread between U.S. crude and Brent also contributed to strength in the coastal grades, traders said. Gulf crude producers shut off 9 percent of the region’s oil and gas output, the U.S. Bureau of Safety and Environmental Enforcement said. By comparison, oil companies shut off 92 percent of crude production last October when Hurricane Nate approached the Gulf. Light Louisiana Sweet, Mars Sour and WTI at East Houston, also known as MEH, each rose to their highest since mid-June. LLS traded at a $6.55 per barrel premium to U.S. crude futures, up 65 cents from Friday. Reuters did not capture prices on Monday because of the Labor Day weekend. Mars traded at a $3.20 premium, up 28 cents. MEH traded as high as a $6.35 per barrel premium, up about 65 cents. "We have a lot of (well) shut-ins, a couple rigs, a couple ports are closed to incoming vessels," one broker said. "But right now it’s a Category 1 (hurricane). I can’t see why that scares anyone. But there’s always (Hurricane) Katrina in the back of people’s minds." Coastal grades have mostly strengthened over the past two months as the spread between U.S. crude futures and global benchmark Brent has widened. On Tuesday, the spread widened 16 cents to minus $8.61 per barrel. Coastal grades typically strengthen when the spread widens because U.S. crude becomes cheaper relative to Brent, driving demand for exports and keeping imports subdued. Inland grades were unchanged, but crude oil inventories at the U.S. storage and delivery hub in Cushing, Oklahoma rose to 27.4 million barrels in the week through Aug. 31, up by about 753,000 barrels, dealers said, citing Genscape data.

•Light Louisiana Sweet for October delivery rose 65 cents to a midpoint of $6.50 and traded between $6.25 and $6.75 a barrel premium to U.S. crude futures.

•Mars Sour rose 28 cents to a midpoint of $3.20 and traded between $3 and $3.40 a barrel premium to U.S. crude futures.

•WTI Midland was unchanged at a midpoint of $17.5, trading between $17.75 and $17.25 a barrel discount to U.S. crude futures.

•West Texas Sour was unchanged at a midpoint of $17.63, trading between $18 and $17.25 a barrel discount to U.S. crude futures.

•WTI at East Houston, also known as MEH, traded at $6.10 and $6.35 per barrel over U.S. crude futures.

U.S. Cash Products-Gulf Coast gasoline falls despite expected hurricane landfall – Reuters News

U.S. Gulf Coast gasoline cash differentials fell on Tuesday, market participants said, despite a hurricane that was expected to come ashore near the border between Louisiana and Mississippi. Tropical Storm Gordon, which is expected to strengthen into a category 1 hurricane with winds of at least 74 miles per hour (119 km/h), has shifted eastward, reducing its threat to major production areas and most Gulf Coast refineries. The ports of Gulfport and Pascagoula, Mississippi, and Mobile, Alabama, were closed to all traffic on Tuesday, the U.S. Coast Guard said in a statement. New Orleans-area ports were operating under an advisory that called for gale-force winds within 24 hours. A2 CBOB gasoline in the Gulf Coast lost 0.50 cent a gallon to trade at 2.25 cents per gallon below the futures benchmark on the New York Mercantile Exchange, traders said. M2 conventional gasoline also fell a half penny, trading at 5.75 cents per gallon above futures. Royal Dutch Shell Plc was restarting on Tuesday the hydrocracker at its 218,200 barrel per day (bpd) Norco, Louisiana, refinery, said sources familiar with plant operations. Shell has no plans to idle the Norco or the 209,797 bpd Convent, Louisiana, refineries due to Tropical Storm Gordon. In the Midwest, Group Three gasoline climbed 12.50 cents a gallon to trade at 5.50 cents per gallon above futures as the product rolled to trade against the October futures contract. The September gasoline futures contract expired on Friday. In New York Harbor, M2 conventional gasoline gained 14.00 cents a gallon to trade at 15.00 cents per gallon above futures, as the product also rolled to trade against the October contract, traders said. F2 RBOB rose 12.75 cents a gallon to trade at 15.00 cents per gallon above futures. The gasoline futures contract on NYMEX fell 0.28 cent to settle at $1.9942 a gallon on Tuesday. NYMEX heating oil futures gained 1.16 cents to settle at $2.2547 a gallon. Renewable fuel (D6) credits for 2018 traded at 21 cents each on Tuesday, up slightly from 20.5 cents each on Friday, traders said. Biomass-based diesel credits (D4) traded at 41 cents each, down from 42 cents each on Friday, traders said.

U.S. oil refiners’ weekly capacity seen up 406,000 bpd -IIR – Reuters News

U.S. oil refiners are estimated to have 257,000 barrels per day (bpd) of capacity offline in the week ending Sept. 7, increasing available refining capacity by 406,000 bpd from the previous week, data from research company IIR Energy showed on Wednesday. IIR expects offline capacity to rise to 589,000 bpd in the week to Sept. 14. The following are IIR weekly figures for offline capacity (in thousands of bpd):

|

Week ended Friday |

Sept. 5 |

Sept. 3 |

Aug. 31 |

|

9/14/18 |

589 |

486 |

486 |

|

9/07/18 |

257 |

210 |

210 |

|

8/31/18 |

663 |

663 |

606 |

|

8/24/18 |

673 |

673 |

643 |

|

8/17/18 |

456 |

456 |

448 |

|

8/10/18 |

364 |

364 |

364 |

Major China ports will impose ship emissions rules earlier than expected – Reuters News

Major ports around the Yangtze River Delta will impose tighter rules on emissions from vessels in and around the ports starting on Oct. 1, a newspaper run by China’s Ministry of Transport said in a report. The ports affected are Shanghai, the world’s biggest container port, as well as ports in Jiangsu and Zhejiang provinces. The report in the China Water Transport newspaper was dated Aug. 24. That is earlier than the implementation date of Jan. 1, 2019 announced previously. China’s Ministry of Transport announced in July it would extend its emission control areas (ECA) to include the country’s entire coastline from 2019. China’s ECAs limit the sulphur content of the fuel ships can burn while operating in the ECAs to 0.5 percent.

EUROPE-WAF FUEL FLOWS: August Loadings Rise to Three-Month High

Volumes of fuels such as gasoline bound for West Africa from Europe in August rose to highest level since May, vessel-tracking and fixture data compiled by Bloomberg show.

A total of 43 product tankers loaded 1.77m tons of fuels for West Africa last month, equating to ~57k tons a day

Compares with 37 product tankers hauling 1.45m tons, or ~47k tons/day in July

So far in September, at least 5 WAF-bound vessels carrying 224k tons have loaded in Europe; another 10 ships hauling 416k tons are scheduled to load

Shipments this year peaked at 89k tons/day in February and 86k tons/day in March: data compiled by Bloomberg

Japan’s JXTG shuts FCC at Sakai refinery due to typhoon damage – Reuters News

Japan’s JXTG Nippon Oil & Energy Corp 5020.T said it shut the 46,000 barrels-per-day (bpd) fluid catalytic cracking (FCC) unit at its Sakai refinery in Osaka, western Japan, on Tuesday due to typhoon damage to a part of the cooling tower. The sole 135,000 bpd crude distillation unit (CDU) and other refining and petrochemical units at the refinery were continuing operations, with no disruptions to product supplies to the region, a company spokesman said. The company has been examining the schedule for the repair work on the cooling tower and the FCC restart, he added. A powerful typhoon killed at least nine people in western Japan and an airport company started to transfer some 3,000 stranded passengers by boats, public broadcaster NHK said on Wednesday, and more than a million homes were without power.

China’s Hengyi pushes back Brunei refinery start-up to Q2 2019 – sources – Reuters News

The start-up a refinery-petrochemical project in Brunei by China’s Hengyi Industries International Pte Ltd will likely be delayed by a few months to the second quarter of next year, four industry sources said on Wednesday. The project, at Brunei’s Muara Besar island and which includes a 175,000-barrels-per-day (bpd) refinery, was expected to be mechanically completed by end-2018, with operations slated for the first quarter of next year. Construction is now expected to be finished by the first quarter of 2019, with the first crude oil cargo to be delivered to the plant at the end of that period, one of the sources said. Reasons for the delay were not immediately clear, but new refineries often face start-up delays. Trial runs at the crude distillation unit (CDU) will start around April-May and operation could begin in the second or third quarter of next year, the source said. Hengyi Industries International plans to import Middle East crude for the refinery’s first cargo, although this will largely depend on economics at the time of importing, the source said. The company is the trading arm of privately-run Chinese company Hengyi Group, which is a major synthetic fibre producer in China and owns Shenzhen-listed Hengyi Petrochemical. The Brunei refinery-petrochemical project will produce gasoline, diesel and jet fuel, the sources said. It will not produce any fuel oil for export.

Singapore 10 ppm sulfur gasoil cash differential hits 2018 high on supply constraints – Platts

A combination of tighter supply and steady demand for gasoil drove the benchmark FOB Singapore 10 ppm sulfur gasoil cash differential to its highest so far this year, rising 9 cents/b to a premium of 62 cents/b to the Mean of Platts Singapore Gasoil assessments at the Asian close Tuesday. The 10 ppm sulfur gasoil cash differential was last higher on December 29, 2017, at MOPS Gasoil assessments plus $1.06/b, S&P Global Platts data showed. Asia’s gasoil market has been on an upward trajectory since the end of July, with traders saying this week that the momentum might continue through much, if not all, of September. "I don’t think the strength in the market is demand driven … demand is kind of steady, but supply is very tight. Prompt barrels are needed, and will continue to be needed," a trader said Wednesday. Agreeing, another trader said this week that regional supplies were seen tightening. "I think it’s more of a supply constraint that is pushing up the [gasoil] market. From Japan, some refiners are beginning their autumn turnarounds, and at the same time, the winter kerosene demand season is coming, so refiners may tweak more of their production towards jet fuel/kerosene," a trader said Tuesday. While the change in production would not be huge as domestic refiners generally face constraints with regards to refinery configurations, any shortfall in gasoil production in an already thin market would be felt, the source added. Market participants also said this week that the strength in the Asian gasoil market would be sustained for now. "For the strength [in the gasoil market] that we’re seeing in September now, yes, I think it will continue — if you look at forward supply, barrels look tight with [sale of] Indian barrels starting kind of late, so for end-September loading barrels, they’ll only arrive in H1 October," the first trader said. Platts previously reported that there had been a spate of refinery issues in India over August, namely a fire at Bharat Petroleum Corp Ltd’s refinery in Mumbai, and the shutdown of a fluid catalytic cracker at Reliance Industries Limited’s export-oriented refinery in Jamnagar. Market sources said at the time that both these refinery incidents might have affected the volume of gasoil production at BPCL and RIL, and that other Indian refiners would have likely stepped in to supply the domestic market, resulting in less spot volumes available for export. The strength in the physical market has also been mirrored in the paper market, with the momentum on the front-month market structure remaining firm after leaping out of contango terrain in late July. At the Asian close Tuesday, the front-month gasoil backwardation had steepened to a near one-year high of 72 cents/b. Platts data showed that the front-month gasoil market structure was last higher on September 8, 2017, at 87 cents/b. A backdated market structure refers to a product being able to command higher prices for prompt dates, rather than for later dates. Further bullish sentiment could also be seen further down the curve with the gasoil Q4/Q1 quarterly spread assessed at $1.22/b at the Asian close Tuesday, marking a near seven-month high. The last time the prompt quarterly spread was assessed higher was on February 6, 2018 at $1.26/b. Meanwhile, the buoyant Asian gasoil market has contrasted sharply with a beleaguered Asian jet fuel/kerosene market, which has been characterized by overwhelmingly lackluster demand on closed arbitrage opportunities for the trans-Pacific and Middle East/India-Northwest Europe routes. The physical regrade, a measure of the relative strength of that Asian jet/kerosene fuel can command over Asian gasoil, hit a near 11-month low at the Asian close Tuesday. At 0830 GMT, the spread between FOB Singapore jet fuel/kerosene and 10 ppm sulfur gasoil stood at minus $2.31/b. The last time the spread was deeper in discount was on October 13, 2017, at minus $2.43/b, Platts data showed.

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986