From: Wagner, Jonathan

Sent: Thursday, September 06, 2018 6:30:31 AM (UTC-06:00) Central Time (US & Canada)

To: Curves

Subject: ION Morning Rundown

Good morning. Oil prices are relatively quiet to start the day as front end WTI/Brent arbs continue to grind lower (x8 is trading -9 this am). Asian equities finished the day lower with European and US equities trading roughly unchanged this morning as the $ hovers on its 50d moving avg of 95.05. API data released last night showed crude inventories falling by 1.17m bbls with Cushing stocks building 631k bbls. Gasoline stocks built by 1m bbls while distillate stocks built by 1.8m bbls. Refinery runs increased by 198k b/d and crude imports fell by 129k b/d to 8.2m b/d. Last week’s DOE numbers had total US crude imports at 7.485m b/d (2.9m b/d for padd 3). President Trump said yesterday that the US is not yet ready to make a deal with China over trade disputes and said talks would continue. China continues to say that they will be forced to take necessary retaliatory measures if the US continues to impose additional tariffs on their products. US representatives are in India this week having “very detailed conversations” regarding Iranian crude in the hope that India will fully comply with the US request to halt imports. According to a state department official, "We’re asking all of our partners, not just India, to reduce to zero oil imports from Iran and so I’m confident that will be part of our conversation with India." Argus reported yesterday that India imported approximately 523k b/d of oil from Iran in Aug (down 32% m/m). The August 2018 imports were still 56 percent higher than the same month last year. In Iraq, protests continue in Basra with the port Umm Qasr now blocked. This port is the main “lifeline” for grain and other commodity imports in Iraq. So far no oil production or exports have been impacted. Middle east crude price continue to climb with DME Oman’s Cash premium now at +1.86 over swaps and Dubai cash trading 1.39 over swaps. Six Dubai partials traded in the window with Shell buying from Unipec, Totsa, Reliance, and Lukoil. 1 Jan Dubai partial traded with Petro-Diamond buying for the second day in a row. Sep/Oct and Oct/Nov Dubai spreads continue to rally with both of them trading 60c backward today. Nov Brent/Dubai also continues to widen currently trading at 3.35/bbl. China’s Rongsheng is said to buy at least two shipments of Oman crude for Oct-Nov delivery (Rongsheng’s refining project in Zhejiang is expected to start production this year). Vols were mixed as the front finished the day weaker while there was still good interest out the curve in Brent to own M-Z puts as producer flow continues. The 66/60 put spread has been very popular over the past week with another 3100x trading in M9 yesterday. OI on the M9 66 put is now at 8600x as they started to be seen at the end of August (some went in U9 as well last week). The M9 75/60 1×2 in Brent was also active yesterday and so far this morning the M9 60/55 1×2 and 75/65 put spreads are trading. There has been upside interest seen on the screen buying Brent x8 80/83 call spreads and there was a seller earlier this morning on the Z8 78 call (800x traded). Both Wingy put and call skew was weaker in WTI yesterday while Brent skew was unchanged.

Top stories out this morning

Trump says not ready to make trade deal with China – Reuters News

China warns of retaliation if U.S. slaps new tariffs – Reuters News

Fed’s Bostic says risks balanced, U.S. rates should rise – Reuters News

U.S., India in "very detailed" talks about halting Iran oil imports-State Dept official – Reuters News

One dead, 25 injured in Basra protests as main Iraqi port closed – Reuters News

New clashes in Libya threaten oil infrastructure – Platts

U.S. November Deadline Scares Iran Oil Buyers From October Crude

Middle East Crude-Benchmarks hit multi-month highs on winter demand – Reuters News

Saudi Extra Light’s Premium to Heavy Oil Rises 50C M/M for Oct.

OPEC crude oil production rises to 32.89 mil b/d in Aug as cuts unwind: Platts survey

BRAZIL TANKER TRACKER: Oil Exports Rise to 4-Month High in Aug.

US independents raise their hedges – Argus

Commodities Finally Bring Relief for Banks as Revenues Rebound

Jefferies Says Oil-Supply Risk `More Acute’ Than Demand Concerns

`Perfect Storm’ in Oil Market Bullish for Oil Prices, MUFG Says

Magellan projects Permian Gulf Coast pipeline cost at $2 bln – Reuters News

U.S. Cash Crude-Grades strengthen as spread favors global benchmark – Reuters News

U.S. Cash Products-Gulf Coast gasoline falls on grade shift – Reuters News

Weak Gasoline/Strong Distillate Markets Ahead? – JBC

Imperial Restarting Units at Strathcona Refinery After Work

USCG Reopens Ports of Pascagoula and Mobile With Restrictions

Refining capacity, ‘scrubber’ uptake to balance marine fuel mkts in 2020 -Goldman – Reuters News

Singapore fuel oil inventories at two-week low as net imports shrink – Reuters News

Singapore Weekly Fuel Stockpiles for Sept. 5 Rise 0.8% w/w

|

Implied Vol |

Realized Vol |

||||||

|

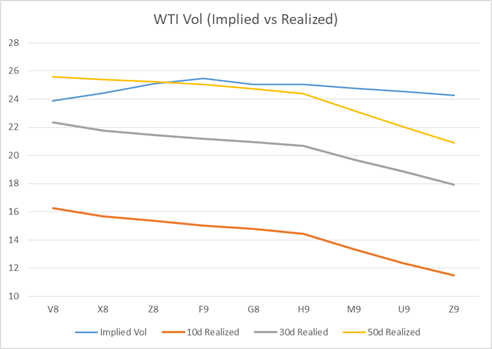

WTI Vol |

5-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

V8 |

23.87 |

-0.75 |

1.04 |

16.26 |

22.34 |

25.58 |

|

|

X8 |

24.43 |

-0.19 |

1.06 |

15.66 |

21.78 |

25.40 |

|

|

Z8 |

25.09 |

0.13 |

1.08 |

15.36 |

21.46 |

25.24 |

|

|

F9 |

25.47 |

0.25 |

1.1 |

15.04 |

21.19 |

25.03 |

|

|

G8 |

25.05 |

0.32 |

1.07 |

14.77 |

20.95 |

24.74 |

|

|

H9 |

25.06 |

0.31 |

1.07 |

14.43 |

20.67 |

24.39 |

|

|

M9 |

24.79 |

0.41 |

1.05 |

13.37 |

19.71 |

23.17 |

|

|

U9 |

24.53 |

0.25 |

1.02 |

12.34 |

18.86 |

22.04 |

|

|

Z9 |

24.25 |

0.25 |

1 |

11.48 |

17.94 |

20.89 |

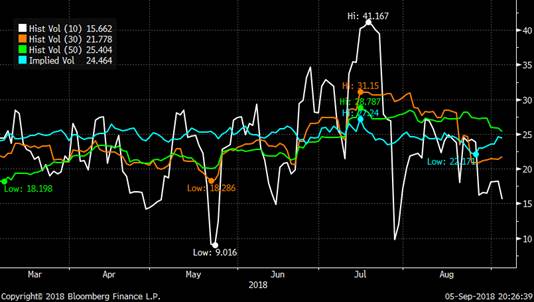

CLX8 Implied Vs Realized Vol

COX8 Implied vs Realized Vol

|

Implied Vol |

Realized Vol |

||||||

|

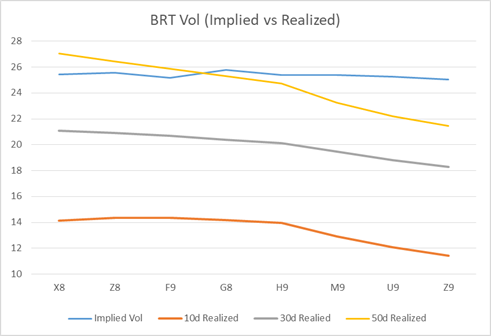

BRT Vol |

5-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.43 |

-0.3 |

1.24 |

14.12 |

21.10 |

27.06 |

|

|

Z8 |

25.56 |

-0.04 |

1.24 |

14.37 |

20.90 |

26.46 |

|

|

F9 |

25.18 |

0.1 |

1.22 |

14.37 |

20.68 |

25.88 |

|

|

G8 |

25.79 |

0.21 |

1.24 |

14.17 |

20.37 |

25.29 |

|

|

H9 |

25.37 |

0.24 |

1.22 |

13.97 |

20.12 |

24.74 |

|

|

M9 |

25.38 |

0.29 |

1.21 |

12.90 |

19.45 |

23.26 |

|

|

U9 |

25.27 |

0.12 |

1.19 |

12.07 |

18.82 |

22.21 |

|

|

Z9 |

25.04 |

0.11 |

1.17 |

11.45 |

18.28 |

21.45 |

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

WTI V18 ATM Call x69.00 TRADES 119 500x 52d

WTI Z18 ATM Call Roll x68.50/78.00 TRADES 8 1,000x 54d/54d

WTI Z19 45/40 Put Spread x65.00 TRADES 54 1,050x 4d

ICE Trade Recap

BRT X18 77/75 1×2 Put Spread x77.42 TRADES 15 600x 10d

BRT X18 85/87 1×2 Call Spread LIVE TRADES 2.5 1,000x

BRT Z18 78 Call x76.90 TRADES 244 500x

BRT Z18 90 Call x77.00 TRADES 24 500x 6d

BRT Z18 80/85 Call Spread x76.90 TRADES 106 500x 20d

WTI F19 68.50 Straddle TRADES 722 600x

WTI Z/F19 75 Call Roll x68.60/68.40 TRADES 40 500x 20d/24d

BRT G19 83 Call x76.70 TRADES 191 3,000x 30d

WTI H19 65/60 1×2 Put Spread x76.25 TRADES 14 1,000x 3d

BRT M19 60/75 1×2 Put Spread x75.50 TRADES 327 1,000x 19d

BRT M19 60/66 Put Spread x75.55 TRADES 131 2,800x 9d

CME Trade Recap

WTI V18 68 Put vs BRT X18 75 Put TRADES 11 2,500x

BRT X18 75 Put TRADES 96 2,500x

WTI Z18 60 Put x68.30 TRADES 55 1,000x 12d

WTI Z18 65 Put x68.50 TRADES 160 500x 27d

WTI Z18/M20 ATM Call Roll x65.00/63.00 TRADEs 62 250x 62d/62d

WTI M19 70 Call TRADES 395 1,000x; TRADES 398 750x; TRADES 400 750x; TRADES 396 1,000x

WTI M20 60/50 Put Spread x63.30 TRADES 324 200x 16d

BRT Z19 68/62 Put Spread x74.00 TRADES 198 500x 8d

WTI Z19 60/65/70/75 Call Condor x64.90 TRADES 124 500x 4d

BRT Z19 100/125 1×2 Call Spread x73.75 TRADES 56 500x 5d

WTI Cal20 80 American Call Strip TRADES 218 20x

CSO/ARB/APO Trade Recap

WTI CSO V/X18 0.50 Put (7A) TRADES 26 350x

WTI CSO 4Q18 Flat Put (WA) TRADES 6 500x

ARB Z18 -8.00 Put TRADES 127 500x; TRADES 125 500x

WTI APO Z18 68/73/78 Call Fly x68.30 TRADES 103 200x 6d

WTI APO 2H19 60/75 Fence x65.75 TRADES 143 100x 58d

Trump says not ready to make trade deal with China – Reuters News

U.S. President Donald Trump said on Wednesday that the United States was not yet ready to come to an agreement over trade disputes with China but he said talks would continue. The world’s two largest economies have slapped tariffs on $50 billion of each other’s goods in a tit-for-tat trade war, and Trump is considering imposing tariffs on another $200 billion in Chinese imports. "We’ve done very well in negotiations with China but we’re not prepared to make the deal that they’d like to make," Trump told reporters at the White House without elaborating on the details. "We’ll continue to talk to China. I have great respect for (Chinese) President Xi (Jinping)," Trump said. "But right now we just can’t make that deal." Washington has demanded Beijing improve market access and intellectual property protections for U.S. companies, cut industrial subsidies and slash a $375 billion trade gap. China has accused the Trump administration of applying hardline tactics and has called for more talks.

China warns of retaliation if U.S. slaps new tariffs – Reuters News

China will be forced to retaliate if the United States implements any new tariff measures, China’s commerce ministry warned on Thursday, as the world’s two biggest economies remain locked in an intensifying trade war. Global markets were on edge after U.S. President Donald Trump threatened fresh tariffs on another $200 billion in Chinese imports. "If the United States, regardless of opposition, adopts any new tariff measures, China will be forced to roll out necessary retaliatory measures," ministry spokesman Gao Feng told a regular news conference. China will closely monitor the impact from any fresh tariffs and adopt strong measures to help Chinese or foreign firms operating in China to overcome difficulties, said Gao. The Trump administration is ready to move ahead with a next round of tariffs after a public comment period ends at midnight in Washington on Thursday, but the timing is uncertain, people familiar with the administration’s plans told Reuters. The new duties will start to hit consumer products directly, including furniture, lighting products, tires, bicycles and car seats for babies. China and the United States have already slapped tit-for-tat tariffs on $50 billion of each other’s goods, spooking financial markets in recent months as investors and policy makers worried the bitter trade war could derail global growth. Trump is demanding Beijing improve market access and intellectual property protections for U.S. companies, cut industrial subsidies and slash a $375 billion trade gap. Markets fear any fresh U.S. duties on Chinese imports will mark a major escalation in the trade dispute between the world’s two economic giants, potentially causing significant drag on global business investment, trade and growth. In August, China unveiled a proposed list of retaliatory tariffs on $60 billion of U.S. goods ranging from liquefied natural gas to certain types of aircraft, in response to the U.S. measures. Trump said on Wednesday that the United States was not yet ready to come to an agreement over trade disputes with China but he said talks would continue.

Fed’s Bostic says risks balanced, U.S. rates should rise – Reuters News

With the U.S. economy at full employment, inflation at the Federal Reserve’s 2-percent goal, and the economic risks balanced, the U.S. central bank needs to keep raising interest rates, a Fed policymaker said on Wednesday. “Now that the economy is standing on its own, it’s my view that we should be trying to move our policy back to a more neutral stance," Atlanta Federal Reserve Bank President Raphael Bostic told the Chicago Council on Global Affairs, adding that the process will probably need to run another 12 to 18 months. The simulative effects of recent tax cuts have yet to reach households, he said, so consumer spending, already quite strong, could increase when it does. On the other hand, he said, uncertainty on trade policy is holding back business spending. Those risks, he said, for now are "perfectly counterbalancing" each other.

U.S., India in "very detailed" talks about halting Iran oil imports-State Dept official – Reuters News

The United States and India are engaged in "very detailed conversations" over Washington’s request to completely stop India’s oil imports from Iran, a senior U.S. State Department official said on Thursday. U.S. President Donald Trump this year ordered the re-imposition of economic curbs on Iran after withdrawing his country from a 2015 nuclear deal between Tehran and six world powers. The United States has since been trying to persuade countries to economically isolate Iran. "We’re asking all of our partners, not just India, to reduce to zero oil imports from Iran and so I’m confident that will be part of our conversation with India," the official told reporters, as the foreign and defense heads of the two countries met in the Indian capital. "There are very detailed conversations taking place between the U.S. and India on just the technical issues related to going to zero and those conversations will continue." Despite Trump’s efforts, government officials in India, the world’s third biggest oil importer and Iran’s top oil client after China, have been talking about wanting to continue trade ties, especially for oil, with Iran. To lure Indian buyers, the Islamic nation has been offering extended credit terms and almost free shipping. India would not stop Iranian imports but would finalize its strategy on crude buys after this week’s high-level meeting of U.S. state and defense secretaries, Mike Pompeo and Jim Mattis, and India’s foreign and defense ministers, Sushma Swaraj and Nirmala Sitharaman, an Indian official told Reuters last month. In another sign of New Delhi’s desire to keep buying Iranian oil, Reuters reported this week that India had allowed its state refiners to use Tehran’s tanker and insurance cover after western and Indian shippers started winding down their Iran operations ahead of a Nov. 4 deadline. Nevertheless, India’s August oil imports from Iran plunged by a third as the state refiners waited for government permission to buy oil using Iranian tankers and cover.

One dead, 25 injured in Basra protests as main Iraqi port closed – Reuters News

Iraq’s main seaport closed down on Thursday following violent clashes between protestors and security forces in the southern city of Basra in which one demonstrator died and 25 more were injured the previous night. Southern Iraq, heartland of the Shi’ite majority, has erupted in unrest in recent weeks as protesters express rage over collapsing infrastructure, power cuts and corruption. Port employees said that all operations had ceased on Thursday morning at Basra port as the entrance was still blocked off and trucks and staff were unable to get in or out of the complex. Residents in Basra, a city of more than 2 million people, say the water supply has become contaminated with salt, making them vulnerable and desperate in the hot summer months. Hundreds of people have been hospitalized from drinking it. Overnight, protesters blocked the entrance to the nearby Umm Qasr port, the main lifeline for grain and other commodity imports that feed the country. They blocked the highway from Basra to Baghdad and set fire to the main provincial government building where they had been demonstrating for a third night. Public anger has grown at a time when politicians are struggling to form a new government after an inconclusive parliamentary election in May. Residents of the south complain of decades of neglect in the region that produces the bulk of Iraq’s oil wealth. Earlier on Wednesday, the third day of clashes, security forces sprayed tear gas and fired into the air to try to disperse demonstrators. According to health sources, the dead protester was struck in the head by a smoke grenade during the clashes. The deaths of five protesters in clashes with security forces on Tuesday added to the fury. Security and health sources said 22 members of the security forces had been injured in Tuesday’s violence, some by a hand grenade.

New clashes in Libya threaten oil infrastructure – Platts

Clashes between rival Libyan militias in Tripoli have reignited despite a UN-brokered ceasefire, threatening the supply of oil products in the capital, sources in the country said. The UN’s Support Mission in Libya announced a ceasefire deal late Tuesday, signed by the Government of National Accord, military leaders, security services and armed groups. But not all of Tripoli’s warring parties attended the meeting in Zawiya, an industrial city to the west of Tripoli. Two militias in the capital — the Seventh Brigade and Tripoli Revolutionaries Brigade — completely ignored the deal and had been fighting since the morning, the sources said. The renewed fighting left many in Tripoli skeptical that the ceasefire can hold for the other partners. It also added to the general uncertainty over Libya’s political future, which continues to cast a long shadow over oil exports. National elections planned for December add another layer of unpredictability. So far there has been no impact on the OPEC member’s upstream production, after more than a week of deadly clashes. Crude production has recovered to over two-month highs of 1 million b/d in the past few weeks. The capital’s refined product infrastructure has sustained significant damage, however. Clashes near Tripoli airport on Tuesday led to a fire at a tank farm operated by Brega Petroleum Marketing Co. Brega officials said they had not been able to assess damage at a key aviation fuel tank near Tripoli airport due to the intensity of the fire, which erupted Tuesday. The state-owned company, which is responsible for Libya’s domestic fuel distribution, suffered another attack Wednesday on one of its facilities. An armed group entered a warehouse located in eastern Tripoli and forcibly seized hundreds of gas cylinders. It is unclear if the attack was opportunistic or by one of the warring militias. Earlier this week, NOC and BPMC said they were developing alternative plans for the distribution of fuel should the clashes continue. In a statement, NOC said it would continue to provide all the necessary support to BPMC to ensure stable fuel supplies to all sites and retail stations.

U.S. November Deadline Scares Iran Oil Buyers From October Crude

The early-November deadline set by the U.S. to sanction Iran’s oil exports is now a warning sign that’s too close for buyers to neglect. JXTG Holdings Inc., Japan’s biggest refiner, and domestic rival Idemitsu Kosan Co. are both said to have skipped purchases of Iranian supplies loading in October. Bharat Petroleum Corp. is among Indian state-run refiners that haven’t booked any cargoes for the month either. All the companies are waiting for word from their respective governments, which are negotiating over imports with U.S. officials. Companies are declining to buy October cargoes from Iran because of the possibility that those shipments may arrive only after Nov. 4. That’s when the U.S. will reimpose sanctions targeting Iran’s exports in an effort to force renegotiation over the Middle East nation’s nuclear program. Most Asian buyers have until now been purchasing at least some supply from the OPEC producer each month after America announced its plan in May. After the November deadline, though, any entity trading with Iran risks being cut off from the U.S. financial system. The resumption of purchases by American allies such as Japan rests on the outcome of talks with President Donald Trump’s administration, which hasn’t yet announced any waivers from the sanctions. While spokespeople for JXTG and Idemitsu declined to comment on whether their companies nominated October-loading Iranian cargoes, they said the firms will follow any guidance received from the government after it completes talks with the U.S. Japan will continue to negotiate “tenaciously” to maintain crude imports from the Middle East nation, Minister of Economy, Trade and Industry Hiroshige Seko said earlier this week. State-run Bharat Petroleum, Indian Oil Corp. and Hindustan Petroleum Corp. are also yet to receive clarity from the government on future transactions with Iran, according to officials from the companies. America and India are still continuing discussions over the oil imports, a U.S. official told reporters in New Delhi on Thursday. Apart from refiners, shipowners whose vessels help ferry the Middle East nation’s supply, insurers who cover those cargoes as well as banks that help process payments for the crude are at risk from the sanctions, further complicating any trade with the Islamic republic. Iran, for its part, has said it will find “other ways” to keep its crude in the market. Discounts, bartering and smuggling are among the tactics the nation may lean on to maintain at least some of its oil exports flowing after U.S. sanctions resume. The nation set the pricing for September sales of its Light oil grade to Asia at the cheapest level in 14 years versus a similar Saudi variety. Some tankers are currently anchored off the United Arab Emirates, fully laden with Iranian condensate. They could be awaiting discharge at the Jebel Ali port for use in a domestic refining complex, or for a vessel-to-vessel transfer, according to traders and ship brokers. China — the biggest buyer of Iranian oil — has meanwhile increased Iranian crude imports via the Sino-Myanmar pipeline, Cinda Securities said last month. Its purchases delivered to Chinese ports via ships have fallen.

Middle East Crude-Benchmarks hit multi-month highs on winter demand – Reuters News

The Middle East crude benchmarks hit multi-year highs on Thursday, buoyed by robust Asia oil demand to meet peak winter consumption and on concerns about Iran supplies. DME Oman’s premium to swaps rose 16 cents to $1.86 a barrel while cash Dubai’s premium also climbed, underpinned by Shell’s purchases on window. A widening Brent’s premium to Dubai swaps also supported demand for Middle East and Russian barrels this month. Brent’s premium to Dubai swaps was at $3.35 per barrel, up 24 cents for November, the widest since July 10, according to Thomson Reuters data.

WINDOW: Cash Dubai’s premium to swaps rose 14 cents to $1.39 a barrel after Shell bought six November partials.

Saudi Extra Light’s Premium to Heavy Oil Rises 50C M/M for Oct.

Spread between Saudi Arabia’s Arab Extra Light and Arab Heavy at $3.15/bbl for Oct. sales to Asian customers, according to data compiled by Bloomberg.

- That’s 50c m/m increase from $2.65/bbl for Sept. and the first gain in four months

- Previously, the premium rose 20c m/m for June

- Arab Light’s premium to Heavy grade at $2.45/bbl for Oct., rising 40c m/m for the first gain since May

OPEC crude oil production rises to 32.89 mil b/d in Aug as cuts unwind: Platts survey

OPEC’s crude oil production in August, not including newest member Congo, rose to a 10-month high, with Iraq surging to record output and Libya recovering from militia fighting, more than offsetting Iran’s slide as the sanctions-hit country struggles to keep its customers, according to the latest S&P Global Platts survey. The 15 members of OPEC pumped 32.89 million b/d in the month, the survey found. Taking away Congo, which joined the organization in June, OPEC’s August output of 32.57 million b/d is the highest since it produced the same amount in October 2017, as it unwinds supply cuts that have been in place since January 2017. Pressure from US president Donald Trump to moderate oil prices, plus fears of an overtightening market due to US oil sanctions on Iran that go into effect in November, prompted OPEC and 10 allies to agree June 23 in Vienna to reduce overcompliance with their cuts and increase output by 1 million b/d in the months ahead. The 12 OPEC members with firm quotas achieved 115% compliance in August, according to Platts calculations. Libya and Nigeria are exempt, while Congo has yet to be given an allocation. Iranian production has already begun to suffer in advance of the sanctions, falling to 3.60 million b/d in August, the lowest in more than two years, according to the survey. Oil exports from the country plunged 17% from July, as key buyers China and India significantly cut their purchases, data from Platts trade flow software cFlow showed. Platts Analytics estimates that some 1.4 million b/d of Iranian oil is expected to leave the market by November. Meanwhile, Iraqi production swelled to 4.68 million b/d in August, up 110,000 b/d from July and the highest recorded in the 30-year history of the Platts OPEC survey, as exports from both the country’s southern port of Basra and through the Turkish port of Ceyhan saw increases. Saudi Arabia, OPEC’s biggest producer and the world’s largest crude exporter, pumped 10.49 million b/d in August, the survey found. That is far above its quota of 10.06 million b/d under the supply cut agreement, but below the 10.8 million to 11 million b/d that it had signaled it would produce at the June meeting. Kingdom officials have said demand for Saudi crude has yet to require such levels of production just yet, but added that they stand ready to supply the market as needed.

LIBYA RISES, VENEZUELA FALLS

Libya added the most barrels in August within OPEC, as output recovered to 940,000 b/d with the lifting of force majeure in July on loadings from the country’s eastern ports, which had been blockaded for about a month by a militia group, as well as the ramping up of production from the Sharara field after the kidnapping of some workers there in mid-July was resolved. Libyan production in July was 670,000 b/d, the lowest it had been since April 2017. Nigeria increased its production by 70,000 b/d in August, according to the survey, with loadings up in the month. Venezuela continued its production decline, as output slumped to 1.22 million b/d in August, a year-on-year plunge of 680,000 b/d, the survey found. The country is in the throes of an economic crisis that has impaired its ability to maintain its oil facilities, pay workers and afford diluent to produce its extra heavy crude from the Orinoco basin. August output was also affected by a tanker collision at the Jose terminal late in the month that led to its shuttering for repairs. But a settlement reached August 20 with ConocoPhillips over $2 billion owed to it by Venezuelan state oil company PDVSA provides some hope that the country’s crude exports could rise in the weeks ahead. ConocoPhillips had been seeking to seize PDVSA’s assets in the Caribbean under an international court ruling which had severely impaired the Venezuelan company’s ability to export crude. The Platts OPEC figures were compiled by surveying OPEC and oil industry officials, traders and analysts, as well as reviewing proprietary shipping data. A six-country monitoring committee overseeing the OPEC/non-OPEC supply accord will meet September 23 in Algiers to assess market fundamentals and potentially make output policy recommendations.

OPEC PRODUCTION (IN MILLION B/D)

|

COUNTRY |

AUG |

JUL |

CHANGE |

|

Algeria |

1.06 |

1.07 |

-0.01 |

|

Angola |

1.46 |

1.45 |

0.01 |

|

Congo |

0.32 |

0.31 |

0.01 |

|

Ecuador |

0.53 |

0.53 |

0 |

|

Equatorial Guinea |

0.13 |

0.12 |

0.01 |

|

Gabon |

0.2 |

0.18 |

0.02 |

|

Iran |

3.6 |

3.72 |

-0.12 |

|

Iraq |

4.68 |

4.57 |

0.11 |

|

Kuwait |

2.8 |

2.78 |

0.02 |

|

Libya |

0.94 |

0.67 |

0.27 |

|

Nigeria |

1.87 |

1.8 |

0.07 |

|

Qatar |

0.62 |

0.62 |

0 |

|

Saudi Arabia |

10.49 |

10.63 |

-0.14 |

|

UAE |

2.97 |

2.97 |

0 |

|

Venezuela |

1.22 |

1.24 |

-0.02 |

|

TOTAL |

32.89 |

32.66 |

0.23 |

BRAZIL TANKER TRACKER: Oil Exports Rise to 4-Month High in Aug.

Brazil, Latin America’s largest oil producer, raised oil exports to highest since April, according to shipping reports and ship-tracking data compiled by Bloomberg.

- Total exports were +6.1% m/m to 1.015m b/d in Aug.

- Shipments rose after an Aug. 20 fire hit Replan, the country’s largest refinery

- Replan restarted at 50% capacity Aug. 29; refinery processes 93% domestic oil

- Top 3 buyers of Brazilian crude:

- To China +21% m/m to 522.6k b/d

- To U.S. -29% m/m to 139.3k b/d, where most cargoes went to USWC

- To Chile +37% m/m to 125.8k b/d

- Lula is top exported grade, followed by Sapinhoa, Iracema

US independents raise their hedges – Argus

US independent producers are stepping up hedging of oil and natural gas production as a safety net for stable cash flow, despite some losing money from derivatives in the second quarter. US producers’ hedging plans have increased slightly, with 52pc of their 2018 output covered compared with 49pc as of March, "even with oil futures above long-term management budgets of broadly $50-$55/bl," US bank Goldman Sachs says. Producers are hedging at an average price of $58/bl this year, below the $70/bl touched this week. "Hedging [for 2019] has remained around normal levels" of up to 23pc of oil production against 16pc in the first quarter.

Current hedged prices of $60/bl for 2019 are slightly below the forward price of $63/bl, which may add some restraint against increased drilling, the bank adds. The majority of production growth this year is coming from well-hedged firms, although this is less the case in 2019, the bank says. The increase in 2018 hedged oil production comes despite some producers reporting losses from their hedging last quarter as a result of higher-than-expected crude prices. Pioneer Natural Resources, one of the most well-hedged onshore operators, made a non-cash mark-to-market derivative loss in April-June of $170mn because of the increase in Nymex oil prices, chief financial officer Richard Dealy says. This compares with a gain of $71mn a year earlier. Pioneer has kept its hedge book largely unchanged for the rest of this year and 2019, with about 85pc of its 2018 oil production covered. Whiting Petroleum made a non-cash loss of $50mn against a gain of $16mn in the second quarter of 2017. Whiting has marginally raised its hedging to 72pc from 70pc at the start of this year. Hess has continued to hedge its 2019 and 2020 output to protect its cash flow, as the firm is in the middle of funding the large ExxonMobil-operated Guyana project. "When we get to the free cash flow phases of Guyana we will be in a different position, and hedging may fall as we move forward," Hess chief financial officer John Rielly says. An unintended consequence of hedging losses is increased capital discipline, Goldman Sachs says. Investors have pressured independents to manage their budgets within cash flows as the industry’s share performance has lagged rises in crude prices and broader financial markets. A lack of gains from oil market upside is making the industry execute plans at a WTI price of $50-$60/bl, the bank says.

Peer pressure

An exception is Continental Resources, which removed all its oil hedges in 2014 on a prediction that the crude price slump was temporary. The firm was exposed to the price collapse in 2015 and 2016 but is now benefiting from the recovery. "We appear to be the only unhedged oil producer in our peer group able to fully participate in the higher oil prices today," chief executive Harold Hamm says. Permian producers are also taking on hedges to protect the difference between the region’s crude prices and benchmark WTI. Prices in the basin are under pressure because of pipeline constraints limiting oil exports from the region. Large producers have about 60pc of their Permian oil output in 2019 "protected against a basis blowout", US bank Tudor Pickering Holt says, while small and mid-sized independents have about 45pc. Apache is currently exposed to Midland basis price movements for just under 60pc of its 2018 oil output, which will increase by another 10pc next year if it does not take any further hedges later, chief financial officer Stephen Riney says. Energen, which is being acquired by Diamondback, took on differential hedges out to 2020 in the second quarter in case supply bottlenecks do not alleviate until then. "We thought it prudent to go ahead and take a decent hedge position," chief executive James McManus says.

Commodities Finally Bring Relief for Banks as Revenues Rebound

Commodities revenue at major investment banks is showing signs of recovery. Combined income at 12 top banks including Goldman Sachs Group Inc. and JPMorgan Chase & Co. jumped 38 percent to $2.1 billion in the first half, according to analytics firm Coalition Development Ltd. That may signal a turnaround after years of poor results brought about by regulatory scrutiny, curbs on proprietary trading and falling investment by hedge funds. The year-on-year rebound is partly because of one-off gains in energy and industrial metals, Coalition said in a report Thursday. Oil has been among the best-performing commodities this year on OPEC supply curbs and potential disruptions from U.S. sanctions on Iran. Commodities volatility has also picked up after several years of declines. The Coalition data is also likely to reflect a recovery in performance at Goldman Sachs Group Inc.’s commodities business, which in 2017 suffered its worst year since the bank went public in 1999. Goldman this year highlighted an improvement at the unit, saying risk-taking in raw materials had increased. Coalition, which tracks commodities revenues at top Wall Street and European banks, doesn’t comment on specific firms. The research company monitors activities related to power, gas, oil, metals, coal and agriculture. Other banks tracked by the firm include Morgan Stanley, Societe Generale SA, UBS Group AG and HSBC Bank Plc. The analysis doesn’t include Australian, Canadian or emerging-market banks that have a large presence in commodities.

Jefferies Says Oil-Supply Risk `More Acute’ Than Demand Concerns

Brent’s forward price curve reflects a tightening market, leading us to believe that oil-supply risks are “more acute” than demand-side concerns, says Jefferies in Sept. 6 note.

- Brent now in backwardation with prices seen exceeding $80/bbl in near term

- Effects of declining Iranian exports being felt in the market; fall in Venezuelan output has not hit bottom while Libya and Nigeria remain susceptible to interruptions

- U.S. output growth could be limited until late-2019 due to infrastructural constraints around Permian basin

- On the demand side, falling refining margins in Singapore highlight demand risks in China and Southeast Asian emerging markets

- Jefferies cuts 2018 oil-demand growth estimates to 1.5% from 1.8%; forecast falls to 1.6% from 1.7% for 2019

- Devaluation of emerging market currencies also major concern to oil-demand growth

- In 4Q, oil market will be dealing with either under-supply or dwindling spare capacity, or both

- Minimal spare capacity, below-average inventories and foreseeable supply interruptions create a political risk premium that’s likely to be reflected in oil prices

- Jefferies maintains 4Q Brent forecast at $85/bbl

`Perfect Storm’ in Oil Market Bullish for Oil Prices, MUFG Says

The combination of geopolitical supply-side risks, limited capacity from some OPEC members and tangible U.S. output risks stemming from current hurricane season all suggests that “perfect storm” is increasingly bearing fruit, Ehsan Khoman, head of MENA research and strategy at MUFG Bank, writes in Sept. 6 note.

- That offers bullish upside risks for near-term oil prices

- “We view that the most prominent market concern surrounds the disruptions to Iranian oil supply, both in terms of scale and scope which will test oil markets”

- Renewed geopolitical supply-side risks, stemming from Iran, are back at forefront of investors’ minds and will likely drive oil markets in coming weeks

- Libya, Venezuela are other sources of potential oil supply disruptions

- Supply crunch risks also exist due to limited spare capacity

- Saudi Arabia and other OPEC+ producers likely to offset lost Iranian oil

- Focus is on raising oil production, primarily for geopolitical reasons with expectations of closer Saudi-U.S.-Russian oil market management in foreseeable future

- Bank maintains medium-term bearish outlook as higher prices may prompt increase in shale production

Magellan projects Permian Gulf Coast pipeline cost at $2 bln – Reuters News

Magellan Midstream Partners LP on Wednesday projected it would spend about $2 billion to construct a proposed crude oil pipeline from the Permian Basin in West Texas to the U.S. Gulf Coast. "We have binding commitments that give us very attractive economics. But what we don’t know is the full demand," which would dictate the project’s final cost, Michael Mears, Magellan’s chief executive, said at the Barclays energy conference in New York. The project cost for the Permian Gulf Coast pipeline will be clear after shippers commit to volume capacity during the so-called open season, Mears said. The bidding process for additional shipper commitments will be launched later this week. Production in the Permian basin, the biggest oil-producing region in the United States, has outstripped its pipeline transport, sending regional crude prices last month to the lowest levels in six years. The 600-mile Permian Gulf Coast pipeline is expected to begin operation in mid-2020. Magellan and co-investors Energy Transfer Partners LP, MPLX LP and Delek US Holdings Inc will construct the pipeline. Magellan said it is also is considering new refined products and crude oil investments in Texas, including additional pipeline, storage and export capabilities. The Tulsa-based company expects to spend about $2.5 billion from 2018-20 on construction projects currently under way, primarily related to refined products, marine storage and the Permian Gulf Coast project.

U.S. Cash Crude-Grades strengthen as spread favors global benchmark – Reuters News

U.S. cash crude grades mostly firmed on Wednesday as the spread between U.S. crude futures and global benchmark Brent widened for the fourth consecutive session, dealers said. Tropical Storm Gordon passed over the U.S. Gulf Coast’s vast network of oil and gas infrastructure with no immediate reports of damage, easing market worries about a possible impact to crude oil supplies, traders said. As a result, Brent outperformed U.S. crude, which fell 1 percent. "There were two platform areas evacuated, but they’re already back out there," one trader said. "No damage done." The Brent/WTI spread widened 24 cents to minus $8.85 per barrel, the widest since June 20. When the spread widens, U.S. crude becomes cheaper compared with the international standard, typically increasing demand for exports of U.S. coastal grades and lowering demand for imports. Mars Sour firmed by 43 cents to a $3.63 per barrel premium to U.S. crude, the strongest since June 14. It traded as high as a $3.65 per barrel premium. Louisiana Light Sweet also climbed to a fresh two-month high, up 15 cents to a $6.65 per barrel premium. U.S. crude oil inventories declined last week, falling by 1.17 million barrels to 404.5 million barrels, according to oil industry trade group American Petroleum Institute. Analysts had expected a 1.3-million-barrel draw. Stockpiles at the U.S. storage hub Cushing rose by 631,000 barrels, the API said. Inland grades firmed on Wednesday, with West Texas Intermediate at Midland strengthening to a $17.38 per barrel discount to U.S. crude futures. But WTI Midland is close to six-year lows, still under pressure from crude oil bottlenecks in the Permian Basin, the biggest oil field in the United States. Oil company executives on Wednesday said drilling in the West Texas and New Mexico oil field is likely to slow in part because of these bottlenecks.

- Light Louisiana Sweet for October delivery rose 15 cents to a midpoint of $6.65 and traded between $6.50 and $6.80 a barrel premium to U.S. crude futures.

- Mars Sour rose 43 cents to a midpoint of $3.63 and traded between $3.50 and $3.75 a barrel premium to U.S. crude futures.

- WTI Midland rose 12 cents to a midpoint of $17.38 and traded between $17.75 and $17 a barrel discount to U.S. crude futures.

- West Texas Sour rose 38 cents to a midpoint of $17.25 and traded between $17.50 and $17 a barrel discount to U.S. crude futures.

- WTI at East Houston, also known as MEH, traded at $5.85 to $6.35 per barrel over U.S. crude futures.

U.S. Cash Products-Gulf Coast gasoline falls on grade shift – Reuters News

U.S. Gulf Coast gasoline cash differentials fell on Wednesday as A3 and M3 became the dominant grades for trading in the region, market participants said. A3 CBOB gasoline lost 2.50 cents a gallon to trade at 4.75 cents per gallon below the gasoline futures benchmark on the New York Mercantile Exchange, traders said. M3 conventional gasoline fell 4.25 cents a gallon to trade at 1.50 cents per gallon above futures. The market had been focused on A2 and M2 grades earlier this summer, but is transitioning toward fuel that meets environmental regulations that shift seasonally. Prices in the region were largely unaffected by Tropical Storm Gordon during the session. The storm did not become a hurricane as had been forecast and weakened into a depression on Wednesday, just hours after making landfall near the Alabama-Mississippi border, helping to keep production and refining operations running unimpeded at most energy facilities in the Gulf and along the Louisiana coast. In New York Harbor, F2 RBOB gained 4.00 cents to trade at 19.00 cents per gallon above futures as the market adjusted a few days after the September gasoline futures contract expired on NYMEX. The product has not traded that high since Sept. 14. F4 was also seen trading in the region and was done at 0.35 cent a gallon above futures, market participants said. In the Midwest, Chicago CBOB gasoline lost 1.50 cents a gallon to trade at 5.75 cents per gallon above the futures benchmark. Chicago ultra-low sulfur diesel fell a quarter of a penny to trade at 1.75 cents per gallon above the heating oil futures benchmark. Trade began on the second cycle for September delivery into the Buckeye complex. The RBOB futures contract on NYMEX fell 2.94 cents to settle at $1.9648 a gallon. NYMEX ultra-low sulfur diesel futures lost 2.02 cents to settle at $2.2345 a gallon. Renewable fuel (D6) credits for 2018 traded at 21 cents each on Wednesday, unchanged from Tuesday, traders said. Biomass-based diesel credits (D4) traded at 41.25 cents each, up slightly from 41 cents each on Tuesday, traders said.

Weak Gasoline/Strong Distillate Markets Ahead? – JBC

Middle distillate cracks are at or near year highs while gasoline cracks are wakening, suggesting that refiners need to adjust yields quickly to avoid imbalances over the next few months, Vienna-based JBC Energy says:

"Middle distillate cracks are very strong whilst gasoline is rather poor even versus seasonal averages. In Asia, diesel cracks are at ytd highs with market sources citing supply issues. That there is no particular weakness in overall margins – which have also come under pressure from plummeting fuel oil cracks – tells us once more that we don’t yet have an overall issue with too high crude intake but that problems still exist in distributing product supply effectively."

"We would increasingly see weak mogas/ULSD spreads as an important indicator that refiners are failing to raise gas oil yields enough to keep up with the pace of demand. While there is still a chance in the autumn maintenance cycle to recalibrate capacity further, current price spikes appear to bode well for winter middle distillate cracks. On the gasoline side, there have been seasonal demand declines and still sparse indications of any rebound in demand growth. This coupled with a winter where it appears as though gasoline yields will not be effectively constrained, and already high inventories, suggest we could be in for quite a weak light distillate period in the coming months."

Imperial Restarting Units at Strathcona Refinery After Work

Alberta refinery to experience greater-than-normal flaring, steam venting over next 2 days as units resume operation, Keri Scobie, refinery P&GA manager, says in email. Scobie declines to identify units or give further details. Imperial Strathcona refinery can process 187k b/d

USCG Reopens Ports of Pascagoula and Mobile With Restrictions

U.S. Coast Guard reopens the ports of Pascagoula and Gulfport in Mississippi and Mobile in Alabama with vessel draft restrictions after Tropical Storm Gordon, agency says in bulletin. Ports of Mobile and Pascagoula have draft restrictions of no more than 12 feet, and Gulfport of no more than 30 feet

Refining capacity, ‘scrubber’ uptake to balance marine fuel mkts in 2020 -Goldman – Reuters News

New oil refining capacity and an increase in the number of ships adding cleaning systems to their smokestacks will help marine fuel markets find balance once new sulphur regulations kick in, Goldman Sachs said. To combat air pollution, the United Nations’ shipping agency has set global regulations to cap sulphur content in marine fuel at 0.5 percent from 2020, down from 3.5 percent now. Ships without sulphur-stripping technologies, or scrubbers, would have to burn costlier low-sulphur fuels such as marine gasoil or low-sulphur fuel oil to comply with the clean air rules. "We expect scrubber installations to rise quickly, with scrubbed ships keeping a third of current high-sulphur fuel in compliant use," Goldman said in a note on Thursday. "Ongoing refinery capacity additions and the redirection of fuel oil and crude flows should go a long way to balancing the global fuel markets, with more onerous utilization and yield shifts making up the difference," the bank said. Shippers and refiners were initially slow to make investment decisions to comply with the upcoming sulphur cap due to uncertainty around the enforcement of the rules and costs of compliance. Goldman forecasts scrubber installations at 3,125 in 2020 and 4,450 in 2022. It expects scrubbed high-sulphur fuel oil (HSFO) consumption at a total of 1 million barrels per day (mbpd) by 2020 and 1.4 mpbd by 2025. The global shipping industry burned a total of 3.3 million barrels per day (mbpd) of high-sulphur marine fuels in 2017, according to the bank. Goldman’s forecasts for higher than expected HSFO consumption mirrors similar outlook revisions from other energy researchers in August amid changing attitudes to scrubbers from shippers. "At an 80 percent compliance rate, we model that the market can reach equilibrium at a distillate-HSFO spread near current forwards, although at higher distillate cracks," Goldman Sachs said. "We highlight, however, that this regulation’s costs may end up varying sharply with global growth and oil prices."

Singapore fuel oil inventories at two-week low as net imports shrink – Reuters News

Onshore inventories of fuel oil dropped to a two-week low of 16.068 million barrels, or 2.398 million tonnes, in the week ended Sept. 5, pulled down by lower net imports into Singapore, official data showed on Thursday.

– Singapore’s weekly onshore fuel oil inventories were down 4 percent, or 593,000 barrels, or about 89,000 tonnes in the week ended Wednesday, data from International Enterprise (IE) Singapore showed.

– Net imports of fuel oil into Singapore in the week ended Sept. 5 were at a five-week low of 286,000 tonnes, down from a 15-month high of 1.614 million tonnes in the week before, the data showed.

– Singapore fuel oil net imports have averaged 760,000 tonnes per week in 2018.

– This week’s onshore fuel oil inventories were 39 percent lower than a year ago.

– Singapore’s net exports of fuel oil to Hong Kong topped the week ended Sept. 5 at 228,000 tonnes, a 12-week high, followed by China at 145,000 tonnes and Malaysia at 50,000 tonnes.

– The largest net imports into Singapore originated from the United States at 224,000 tonnes, followed by Russia at 215,000 tonnes, the United Arab Emirates at 86,000 tonnes and the Netherlands at 59,000 tonnes.

– Fuel oil inventories in Singapore have averaged 19.406 million barrels, or 2.896 million tonnes, a week since the start of 2018, compared with 23.552 million barrels, or 3.515 million tonnes, in 2017.

Singapore Weekly Fuel Stockpiles for Sept. 5 Rise 0.8% W/w

- Total stockpiles 40.5m bbl, +0.8% w/w

- Light Distillates 13.0m bbl, -1.0% w/w

- Middle Distillates 11.4m bbl, +9.9% w/w

- Residues 16.1m bbl, -3.6% w/w

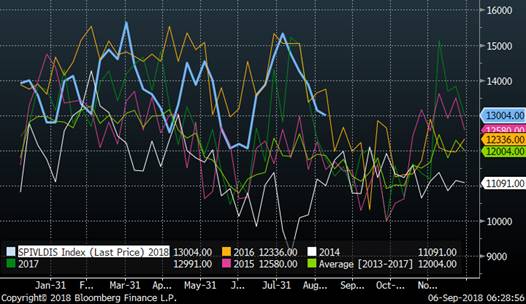

Singapore Light Distillate Stocks

Singapore Middle Distillate Stocks

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986