From: Wagner, Jonathan

Sent: Friday, September 07, 2018 6:43:35 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

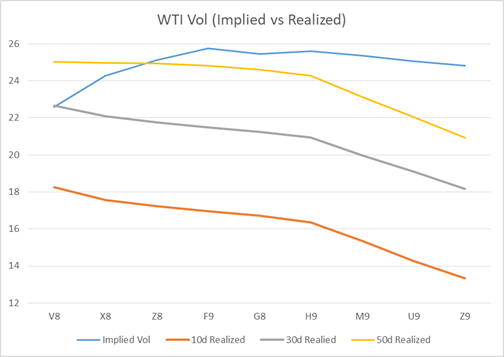

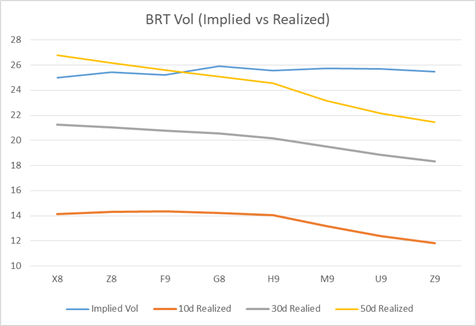

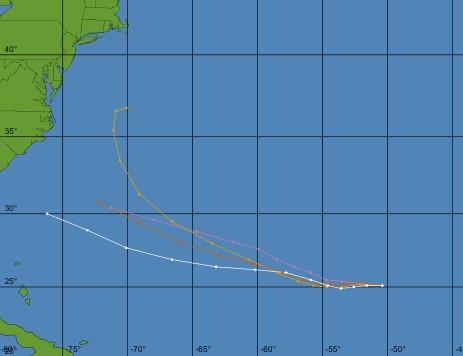

Good morning. Prices are quiet to start the day after the selloff seen post DOE’s on the larger than expected product builds. Front end gasoline spreads and cracks remain bid this morning as we watch the path of TS Florence for next week as there is a possibility that it will head towards the East Coast. US index futures and European equities are small in the red this morning with the dollar hovering around the 50d at 95 this morning. Middle east crude prices continue to gain as DME Oman’s premium to swaps hit $2 and Cash Dubai’s prem to swaps increased to +1.44. Two Nov Dubai partials traded in the window with Shell buying from Unipec and Reliance. Japan’s Cosmo Energy said today that they wont buy and Oct Loading cargos from Iran “for the time being” and there is nothing further out of the US / India meeting regarding future purchases. Vol structures continued to weaken yesterday as back end vols remain bid on solid Brent put / put spread buying as hedging continues to ripple through the market. M9 and U9 Brent saw the largest flow with the 65/60 put spread trading in good size. In the front there was good interest to sell vol in Brent as breakevens continue to look rich. We have seen interest to roll front end calls out the curve. Skew was quiet yesterday puts unchanged and wingy brt call skew slightly bid. This morning front end brent vol is already being offered with X8 trading down 1% to 24%

Top stories listed below

Middle East Crude-Benchmarks extend gains amid thin trade – Reuters News

Japan’s Cosmo Energy Won’t Buy Oct.-Loading Iranian Oil Cargo

Protesters torch political party offices in Basra’s fourth night of violence – Reuters News

U.S. targets Syria oil delivery networks with new sanctions – Reuters News

China LNG demand seen up by 25 pct in 2018 -Qatar energy minister – Reuters News

China Qingdao Crude Port Stocks Fall, Still Near Record: SCI99

Several tankers stalled outside Sabine Pass by draft restrictions – Reuters News

Taiwan prices first multi-month WTI tender off Argus

Venezuela to reorganize PdV amid crisis – Argus

Schlumberger, Halliburton Are Said to Bid on Kuwait Oil Work

Open interest in long-dated WTI futures collapsed due to shale: US CFTC – Platts

Canada Heavy crude discount widens again – Reuters News

U.S. Cash Crude-Coastal grades rise to two-month highs on wider WTI/Brent spread – Reuters News

U.S. Cash Products-East Coast jet fuel falls in volatile month of trade – Reuters News

U.S. oil refiners’ weekly capacity seen up 406,000 bpd -IIR – Reuters News

BP Whiting Refinery Is Said to Plan 3Q-4Q 2019 FCC Turnaround

ATLANTIC GASOLINE: U.S.-Bound Flow Set to Rise; Storm Approaches

Total books first Saudi Arabia-USAC gasoline cargoes in 3 years – Platts

China’s Sinochem to import rare MR cargo of 92 RON gasoline from Singapore – Platts

Singapore 180 CST HSFO cash differential hits 5-month low on higher supply – Platts

|

Implied Vol |

Realized Vol |

||||||

|

WTI Vol |

6-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

V8 |

22.6 |

-1.27 |

0.97 |

18.25 |

22.66 |

25.04 |

|

|

X8 |

24.26 |

-0.17 |

1.04 |

17.57 |

22.08 |

24.97 |

|

|

Z8 |

25.11 |

0.02 |

1.07 |

17.23 |

21.74 |

24.93 |

|

|

F9 |

25.76 |

0.29 |

1.09 |

16.97 |

21.49 |

24.80 |

|

|

G8 |

25.44 |

0.39 |

1.08 |

16.73 |

21.25 |

24.60 |

|

|

H9 |

25.61 |

0.55 |

1.08 |

16.37 |

20.95 |

24.28 |

|

|

M9 |

25.36 |

0.57 |

1.06 |

15.35 |

19.99 |

23.13 |

|

|

U9 |

25.07 |

0.54 |

1.03 |

14.27 |

19.10 |

22.04 |

|

|

Z9 |

24.82 |

0.57 |

1.02 |

13.33 |

18.16 |

20.92 |

|

Implied Vol |

Realized Vol |

||||||

|

BRT Vol |

6-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25 |

-0.43 |

1.21 |

14.12 |

21.28 |

26.79 |

|

|

Z8 |

25.42 |

-0.14 |

1.22 |

14.29 |

21.04 |

26.19 |

|

|

F9 |

25.21 |

0.03 |

1.21 |

14.34 |

20.79 |

25.63 |

|

|

G8 |

25.93 |

0.14 |

1.24 |

14.21 |

20.56 |

25.07 |

|

|

H9 |

25.54 |

0.17 |

1.22 |

14.05 |

20.18 |

24.54 |

|

|

M9 |

25.72 |

0.34 |

1.22 |

13.20 |

19.49 |

23.15 |

|

|

U9 |

25.7 |

0.43 |

1.20 |

12.41 |

18.86 |

22.17 |

|

|

Z9 |

25.47 |

0.43 |

1.18 |

11.82 |

18.31 |

21.46 |

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE Trade Recap

BRT X18 77 Put x77.60 TRADES 145 1,000x 45d

BRT X18 77 Put x77.50 TRADES 151 400x 43d

BRT Z18 77 Put x77.10 TRADES 281 750x 47d

BRT X18 76/74 1×1.5 Put Spread TRADES 34 600x

BRT X18 85 Call vs F19 90 Call LIVE TRADES 31 500x

BRT Z/F19 90 Call Roll LIVE TRADES 23 500x

BRT G19 60/63 Put Spread x76.50 TRADES 22 750x 3d

BRT F/M19 ATM Call Roll x75.00/74.00 TRADES 247 500x 53d/53d

BRT G19 60/63 Put Spread x76.50 TRADES 22 750x 3d

BRT M19 60/55 1×2 Put Spread TRADES Flat 700x

BRT H19 70 Put x75.00 TRADES 274 800x 28d

BRT M19 65/75 Put Spread x75.50 TRADES 352 850x 22d

BRT M19 ATM Call x75.50 TRADES 605 350x; 606 500x 60d

BRT M19 65/70/75/80 Iron Condor x75.50 TRADES 376 1,100x6d

BRT M/Z19 ATM Call Roll x74.00/72.50 TRADES 182 500x 59d/61d

BRT U19 65/60 Put Spread x74.50 TRADES 132 1,500x 5d

CME Trade Recap

WTI V18 68 Put vs BRT X18 75 Put TRADES 20 2,500x

WTI X18 65/63 1×2 Put Spread x68.65 TRADES 10 500x 5d

BRT Z18 78 Call x77.10 TRADES 248 350x; TRADES 246 450x 47d

WTI F19 80 Call TRADES 42 900x

BRT M19 65/75 Put Spread x75.50 TRADES 352 550x 22d

CSO/ARB/APO Trade Recap

WTI CSO F/G19 0.25/Flat 1×2 Put Spread TRADES 1 500x

ARB Z18 -8.00 Put TRADES 138 1,000x; TRADES 135 200x

WTI APO Z18 60/64/68 Put Fly x67.90 TRADES 62 200x 4d

WTI APO 60/55 1×2 Put Spread TRADES 35 500x

WTI APO X18 67/72/77 Call Fly x67.30 TRADES 110 200x

TS Florence

Middle East Crude-Benchmarks extend gains amid thin trade – Reuters News

Middle East crude benchmarks extended gains on Friday with DME Oman’s premium to Dubai swaps nearing $2 a barrel, while cash Dubai’s premium also rose amid thin trade. Trade in November-loading cargoes is expected to kick off next week with some traders expecting most grades to be sold at premiums to their respective OSPs as refiners snap up cargoes to meet peak winter demand. Three Dubai crude cargoes loading in November have been sold earlier this week at single-digit discounts to the grade’s official selling price (OSP), traders said.

WINDOW: Cash Dubai’s premium to swaps rose 5 cents to $1.44 a barrel after Shell bought two November partials from Reliance in the only trades on Friday.

Japan’s Cosmo Energy Won’t Buy Oct.-Loading Iranian Oil Cargo

Cosmo Energy has no plans to buy Oct.-loading Iranian oil cargo “for the time being”, co. spokesman Tomohiro Tamura says by phone.

- Co. to keep monitoring negotiations between Japan and U.S. govts

- In July, co. was said likely to halt Iran oil imports after taking July-loading cargoes

- Tamura declines to say whether co. loaded oil from Iran in Aug. or Sept. or when it last lifted oil from there

Protesters torch political party offices in Basra’s fourth night of violence – Reuters News

Hundreds of people took to the streets of Iraq’s southern oil city Basra on Thursday for a fourth day of violent protests, where residents, angry over the neglect of their city’s collapsing infrastructure, set fire to political offices. Ten demonstrators have been killed in clashes with security forces and dozens injured since a wave of protests began on Monday. Tens of security forces members have also been injured, some by a hand grenade, health and security officials said. Protesters on Thursday targeted several provincial government buildings, setting the headquarters of the local government on fire, and blocked main roads in the city centre. A protester died on Thursday night from burns sustained during the torching of the government headquarters, health and security sources said. People attacked the offices of the state-run Iraqiya TV and set fire to the headquarters of the ruling Dawa Party, the Supreme Islamic Council and the Badr Organization, whose leaders are all vying to form Iraq’s ruling coalition. Two more protesters died during those attacks, local security and health sources said. Protesters also set fire to the offices of a powerful Shi’ite militia, Asaib Ahl al-Haq, and those of the Hikma Movement about 100 km (60 miles) north of Basra, and stormed the house of the acting head of the provincial council. The provincial government headquarters was engulfed in flames, local police and military sources said. No protesters were near the building when the fire broke out in the afternoon, they said. Security forces, including members of the rapid response team, were expected to be patrolling in high numbers on Thursday. By nightfall, however, they were few and far between in the city centre and were not interfering heavily in protesters’ activities. Basra security officials announced a curfew from 10:30 p.m. (1930 GMT) to help quell the protests. A citywide curfew was originally planned for 3 p.m., but was cancelled minutes before it was due to come into force. An Iraqi security official in Basra said they were struggling to cope with the demonstrations. "We are still waiting for orders from the state’s highest authorities," he said. The port of Umm Qasr, the country’s main seaport and its principal lifeline for grain and other commodity imports, closed on Thursday. Port employees said all operations had ceased after protesters began blocking the entrance, which lies about 60 km (37 miles) from Basra, on Wednesday night. Trucks and staff were unable to get in or out of the complex. Oil exports, handled at offshore terminals, remained untouched by the unrest. Oil exports from Basra account for more than 95 percent of Iraqi state revenues.

RAGE

Southern Iraq, heartland of the Shi’ite majority, first erupted in unrest in July as protesters expressed rage over collapsing infrastructure, power cuts and corruption. Residents in Basra, a city of more than 2 million people, say the water supply has become contaminated with salt. A Health Ministry spokesman told a news conference in Baghdad that 6,280 people had been recently hospitalized with diarrhea because of the over salinated water. Public anger has grown at a time when politicians are struggling to form a government after an inconclusive parliamentary election in May. Residents of the south complain of decades of neglect in the region that produces the bulk of Iraq’s oil wealth. Leading political figures, embroiled in government formation negotiations in Baghdad, have scrambled to respond to the crisis, condemning rivals for inaction. Moqtada al-Sadr, a populist Shi’ite cleric whose electoral bloc came first in May’s election, called for an emergency televised session of parliament to discuss "radical" solutions to the crisis in Basra, a city "without water, electricity or dignity". Iraq’s second biggest city, Basra is a stronghold of Sadr, who has recast himself as an anti-corruption campaigner and has allied himself with incumbent Prime Minister Haider al-Abadi. The prime minister responded that he would be ready to attend a meeting of parliament with the ministers and officials concerned to try to find a resolution. Abadi has ordered the Interior Ministry to conduct an investigation into the protests and to instruct security forces not to use live ammunition. Parliament convened for the first time on Monday, but failed to elect a speaker as mandated, delaying its next meeting to Sept. 15.

U.S. targets Syria oil delivery networks with new sanctions – Reuters News

The U.S. Treasury Department said on Thursday it was imposing sanctions on four people and five entities it said facilitated petroleum shipments and financing to the Syrian government. It said in a statement the sanctions targeted Muhammad al-Qatirji and his trucking company, which it said facilitated fuel trade between the Syrian government and Islamic State militants. Qatirji has close relations with Syrian President Bashar al-Assad’s government and has worked directly with Islamic State, which has been driven out of much of the Syrian territory it once controlled, to provide it oil products, the statement said. Also targeted by sanctions was a fuel-procurement network that operates in Syria, Lebanon and the United Arab Emirates to secure deliveries to Syria, the statement said. "The United States will continue to target those who facilitate transactions with the murderous Assad regime and support ISIS," U.S. Treasury Secretary Steven Mnuchin said, referring to the militant group by an acronym. The Syria-based Qatirji Company has also shipped weapons to Syria from Iraq, the statement said. It said Abar Petroleum Service SAL, one of the entities involved in the multi-state fuel network, last year brokered shipments of petroleum products including gasoline, gasoil, and liquefied petroleum gas to Syria worth more than $30 million. Other components of the network were Adnan Al-Ali, Sonex Investments Ltd, Nasco Polymers & Chemicals, and Fadi Nasser, the U.S. statement said. "Lebanon-based Nasco Polymers and UAE-based Sonex Investments were designated for facilitating shipments to Syrian ports by serving as consignees and chartering the vessels," it said. Nasser, chairman of Nasco Polymers, has received millions of dollars for arranging delivery of thousands of tons of fuel to Syria, the statement said. UAE-based International Pipeline Construction was subjected to sanctions for being owned or controlled by Hesco Engineering, which facilitates payments originating in Syria, it said. The sanctions mean any property in the United States of those targeted will be blocked and Americans are prohibited from doing business with them.

China LNG demand seen up by 25 pct in 2018 -Qatar energy minister – Reuters News

China’s demand for liquefied natural gas (LNG) is expected to grow by 20 percent to 25 percent in 2018 despite heightened trade tensions with the United States, Qatari Energy Minister Mohammed al-Sada said on Thursday. Al-Sada said demand from China, which displaced South Korea as the world’s second largest importer of LNG in 2017, was expected to show strong growth again this year after rising about 46 percent last year. "It looks like that growth is going to continue at 20, 25 percent, maybe more," he told Reuters ahead of a bilateral Qatar-Germany investment conference in Berlin on Friday. Overall global demand for LNG this year was expected to match the 11 percent jump seen in 2017, al-Sada said. Worldwide growth is driven by new LNG consumers as well as growth in existing markets such as China, which is buying more gas to wean the country off dirty coal to reduce pollution. Al-Sada said he hoped the United States and China would resolve their differences over trade and avert a trade war. "I think and hope that logic and rationalism will prevail," he said. "It is in the interest not only of the two countries, but also the rest of the world." China last month included LNG for the first time in its list of proposed tariffs on $60 billion worth of U.S. goods, signalling that it will not back down in a protracted trade standoff with Washington.

China Qingdao Crude Port Stocks Fall, Still Near Record: SCI99

Crude oil inventories at Qingdao port fell 2.15% w/w to ~22.65m bbls in week to Sept. 7, according to data by industry researcher SCI99.

- Last week, stockpiles rose to the highest since at least 2014, when data first became available

- Including Qingdao, stockpiles at 7 ports in Shandong rose 0.3% w/w to ~46.4m bbl, highest since May 25

- Fuel oil stockpiles at Shandong ports -8.6% w/w to 847.4k bbl

- Inventories at Qingdao -15% w/w to 337.6k bbl

Several tankers stalled outside Sabine Pass by draft restrictions – Reuters News

Several vessels, including two oil tankers and one for handling liquefied natural gas, were stalled and unable to enter the Sabine Pass shipping channel near the Texas-Louisiana border due to draft restrictions, the U.S. Coast Guard said on Thursday. Port Arthur’s Vessel Traffic Service implemented 32-foot restrictions on draft, or vessel depth, on Wednesday, after a 24-inch steel dredge pipeline was struck and pulled out to sea by a ship moving through the Sabine Pass Channel to the U.S. Gulf of Mexico, the Coast Guard said in a notice. As much as 1,000 feet of pipeline is missing, prompting the limits on vessel draft in order that surveys could be carried out to locate the displaced line, the Coast Guard said, adding it would reevaluate the restrictions as warranted. One liquefied petroleum gas (LPG) tanker was unable to leave Sabine Pass and several other vessels could not enter the channel, it said, declining to identify the other vessels. The restrictions are in place from Sabine Pass to the Sea Buoy. Vessels with drafts under 32 feet may still pass through the channel, the Coast Guard said. Sabine Pass was the first big LNG export terminal to enter service in the Lower 48 U.S. states in February 2016. It has four liquefaction trains operating, each capable of liquefying about 0.7 billion cubic feet per day of natural gas. One billion cubic feet of gas is enough to supply about five million U.S. homes for a day. Cheniere Energy Inc, which operates an LNG terminal at Sabine Pass, said its operations were not impacted by the incident. Gas flows into Cheniere’s export terminal slowed earlier this week. The amount of gas flowing into its Sabine Pass LNG terminal fell to 2.1 bcfd on Tuesday from 2.7 bcfd on Monday, according to Reuters data.

Taiwan prices first multi-month WTI tender off Argus

Taiwan’s state-owned CPC issued its first multi-month tender seeking solely West Texas Intermediate (WTI) crude and will use Argus’ WTI Houston benchmark to help price the term volume. The tender issued today is seeking 2mn bl of WTI delivered per month in the first and second quarters of 2019 to Kaohsiung or Sha-Lung, Taiwan, on VLCCs, or to a US Gulf coast lightering zone by way of four smaller tankers. The price of the term volume will be established by adding a fixed differential to Dated Brent plus November Argus WTI Houston and estimated freight costs after adjusting for the December Brent Swap and Argus’ Dated-to-Frontline (DFL) assessment. This will be the first time a Taiwanese refiner has purchased US crude on a term basis. It also marks the first Taiwanese tender priced against Argus’ key coastal crude assessment WTI Houston since US crude exports first traveled to the Asian country in October 2017. CPC has purchased almost 37mn bl of WTI since then, all through spot tenders that were priced against Dated Brent. The move to include WTI Houston indicates the company is seeking a reference price closer in value and quality to light sweet crude oil being physically delivered from the US Gulf coast.

Venezuela to reorganize PdV amid crisis – Argus

Venezuelan energy minister Manuel Quevedo created a new committee to reorganize struggling state-owned oil company PdV amid plummeting production and the imminent loss of its main overseas asset. The five-member committee has a mandate to "propose within 30 days whatever adjustments are necessary to PdV’s organization, administrative and functional structure, including fusions and liquidations" of PdV and its over 200 subsidiaries, according to a 4 September energy ministry resolution. The committee is authorized to propose personnel reductions and new hires that could affect PdV´s over 100,000 employees. PdV board member Miguel Quintana, currently vice president of engineering and planning, will head the committee and report directly to Quevedo, who is also PdV chief executive. The other four members are Jose Gregorio Gonzalez, Robert Perez, Hector Felizola and Henry Ardila. The energy ministry could not immediately provide information on the professional backgrounds of the four commissioners working under Quintana. The mandate runs through December 2018. The naming of a committee coincides with an unprecedented decline in Venezuelan crude production, which Argus estimates at around 1.2mn b/d, a third of the Opec country´s 1990s level. PdV´s refineries are also running at historically low levels or are off line altogether because of a shortage of parts and maintenance. PdV is currently in default on almost all of its debt, and is facing the loss of its US refining subsidiary Citgo to arbitration claimant Crystallex.

Schlumberger, Halliburton Are Said to Bid on Kuwait Oil Work

Schlumberger Ltd., Baker Hughes and Halliburton Co. are bidding to drill for oil in waters off Kuwait, according to a person familiar with the matter, as the Arab Gulf country prepares to award its first offshore services contract in a drive to boost output capacity. State-owned Kuwait Oil Co., which is responsible for exploration and production in the OPEC state, received bids from three foreign companies and expects to choose a winner by the end of the year, Emad Sultan, vice president for planning, said Wednesday. He didn’t specify the bidders. The person familiar, who named the three companies, asked not to be identified because the matter isn’t public. Representatives in the U.S. for Schlumberger, Halliburton and Baker Hughes declined to comment. The three companies, all with headquarters in the U.S., are the world’s biggest oil services providers. “We will try to award this contract as soon as possible over the coming few months, hopefully in December,” KOC’s Sultan said at a news conference in Kuwait City. “This contract will mark the launch of Kuwait offshore drilling.”

Six Wells

The winner would drill six exploration wells as part of a broader push by the Persian Gulf nation to expand its production capacity. The Organization of Petroleum Exporting Countries and allied producers are seeking to add 1 million barrels a day to global supply after cutting output for about a year and a half to curb a glut and shore up prices. Kuwait pumped 2.83 million barrels a day in August, an increase of 60,000 barrels from July, data compiled by Bloomberg show. KOC, a unit of Kuwait Petroleum Corp., can produce as much as 3.15 million barrels a day of all grades, Sultan said. KOC expects next month to begin producing 120,000 barrels a day at fields in northern Kuwait, Sultan said. It also plans to pump its first heavy crude in December and targets 60,000 barrels a day in output of heavy crude by the end of 2019, he said. Kuwait has exported 5 million barrels of its new super light oil since July, and KOC aims to be able to produce 200,000 barrels a day of the grade starting in October, he said. Super light has a rating of more than 45 on the American Petroleum Institute’s scale of oil density. KOC is conducting more seismic surveys to discover deposits of oil as well as natural gas, Sultan said. It plans to produce 500 million standard cubic feet a day of gas at northern Kuwaiti fields in October. The company also targets output capacity of 1 billion standard cubic feet a day of non-associated gas by 2030 compared with current production of 450 million, he said.

Open interest in long-dated WTI futures collapsed due to shale: US CFTC – Platts

Open interest in NYMEX WTI contracts for delivery five or more years in the future has collapsed over the past decade, largely due to the growth of US shale oil, according to a US Commodity Futures Trading Commission report released Thursday. Open interest in these contracts peaked at 46,158 contracts, representing about 46.2 million barrels of oil, in 2008, and fell to 481 open contracts by the end of March 2018, representing just 481,000 barrels of oil, according to the report from the CFTC’s Market Intelligence Branch. The agency did not find a corresponding collapse in daily open interest in ICE Brent contracts that expire five or more years in the future, likely proving that US shale growth may have stymied in these longer-dated futures contracts. "The physical market for Brent oil is primarily driven by conventional oil field developments using more traditional oil rigs," the CFTC report states. "Tight oil is a unique feature of the US market, which suggests that the growth in tight oil production may have altered the way US oil market participants use the WTI futures market." NYMEX had listed oil futures contracts for consecutive delivery months for the first five years, and June and December contracts for the sixth year, until 2007 when it expanded the contract, ultimately listing contracts for delivery for up to nine years at a time. But the growth of US shale oil, where most oil from new wells can be extracted within 18 months to two years, reduced the need of US producers to hedge physical market crude activity beyond three years, according to the report. "Without sufficient quantities of oil to sell, [US producers] do not need to use futures contracts that far down the curve," the report states. Shale producers have more operational flexibility than with conventional production, which necessitated hedging output on a longer timeframe, the report said. In addition, the report found that market participants have grown reluctant to engage in long-term contracts due to speculative trading restrictions put in place after the 2008 financial crisis and due to the oil price collapse of 2014 and 2015. "While non-financial entities who are willing to take a speculative interest in crude markets remain free to do so, changes in financial regulations have been made to severely limit, if not outright prohibit, proprietary trading by financial institutions, which accounted for some of the liquidity on the back end of the oil futures curve prior to the shale boom," the report states.

Canada Heavy crude discount widens again – Reuters News

The Canadian heavy oil differential widened against the West Texas Intermediate (WTI) benchmark on Thursday:

- Western Canada Select (WCS) heavy blend crude for October delivery in Hardisty, Alberta, settled at $27.30 a barrel below the WTI benchmark crude futures, according to Shorcan Energy brokers. That compared with Wednesday’s settle of $25.15 under WTI.

- Differentials have weakened significantly in recent months as production in Canada surpassed pipeline takeaway capacity. While shipments by rail have picked up, volumes are not high enough to take away a glut of crude in storage.

- Demand is expected to rise in October, as refinery turnarounds wrap up, but supply will be near peak for the year, offering little relief to the buildup, said analysts at Tudor, Pickering, Holt & Co this week.

- The differential hit a near five-year wide level of $34.15 per barrel below WTI last month.

- Light synthetic crude from the oil sands for October delivery settled at $8.50 under WTI, compared with Wednesday’s settle of $7.00 under.

U.S. Cash Crude-Coastal grades rise to two-month highs on wider WTI/Brent spread – Reuters News

U.S. cash crude grades strengthened on Thursday, with coastal grades rising to fresh two-month highs as the spread between U.S. crude futures and global benchmark Brent widened for the fifth consecutive session, dealers said. U.S. crude’s discount to Brent widened 18 cents to minus $8.67 per barrel, strengthening demand for U.S. coastal crude grades as U.S. crude becomes cheaper compared with the international standard. Light Louisiana Sweet firmed to a $7 per barrel premium to U.S. crude, up 35 cents and reaching its highest level since June 20. Mars Sour strengthened to a $3.90 per barrel premium, up 28 cents and its highest level since June 14. West Texas Intermediate at East Houston, also called MEH, rose 35 cents to a $6.45 premium. Inland grades rose as U.S. government data showed the nation’s crude inventories declined last week. WTI Midland rose 88 cents to a $16.50 per barrel discount to U.S. crude. U.S. crude inventories fell by 4.3 million barrels last week, more than analysts’ expectations of a 1.3 million-barrel draw. At the Cushing storage hub, inventories rose by 549,000 barrels. Transportation bottlenecks and seasonal refinery maintenance has weighed on inland grades in recent months. However, planned turnaround activity at U.S. Gulf Coast refineries will remain light through October and November, though it will likely increase because of unplanned events, according to market intelligence firm IIR Energy. "Refinery margins are still high so they are going to wait around as long as they can and enjoy the benefits," one broker said. "We’re still at 96.6 percent refinery runs."

- Light Louisiana Sweet for October delivery rose 35 cents to a midpoint of $7 and traded between $6.75 and $7.25 a barrel premium to U.S. crude futures.

- Mars Sour rose 28 cents to a midpoint of $3.90 and traded between $3.75 and $4.05 a barrel premium to U.S. crude futures.

- WTI Midland rose 88 cents to a midpoint of $16.50 and traded between $17 and $16 a barrel discount to U.S. crude futures.

- West Texas Sour was unchanged at a midpoint of $17.25, trading between $17.50 and $17 a barrel discount to U.S. crude futures.

- WTI at East Houston, also known as MEH, traded at $6.30 and $6.60 over U.S. crude futures.

U.S. Cash Products-East Coast jet fuel falls in volatile month of trade – Reuters News

U.S. East Coast jet fuel cash differentials fell on Thursday after two consecutive days of gains for the product, whose price has swung wildly in the last month, market participants said. Jet fuel fell 0.25 cent a gallon to 0.75 cent per gallon below the heating oil futures benchmark on the New York Mercantile Exchange, traders said. The fuel had trended downward since hitting a 3-month high of 4.50 cents per gallon above futures on Aug. 17. M2 conventional gasoline in the region fell 2.25 cents a gallon to trade at 9.00 cents per gallon above the gasoline futures contract. The grade shot up on Tuesday, the first trading day of the October futures contract on NYMEX, and hit a more than 11-month high. Since then, it has pulled back as market participants adjust positions. On the Gulf Coast, M3 conventional gasoline fell a half penny to trade at 1.00 cent per gallon above futures, market participants said. 54-grade jet fuel in the region fell 1.25 cents per gallon to 5.75 cents per gallon below futures, its lowest since July 5. In the Midwest, Group Three gasoline gained a penny to trade at 6.00 cents per gallon above futures, traders said. On Wednesday, a refiner buying gasoline in the region prompted more buyers to seek the fuel in Thursday’s session, raising prices. U.S. gasoline stocks rose by 1.8 million barrels in the week to Aug. 31, the Energy Information Administration said on Thursday, compared with analysts’ expectations in a Reuters poll for a 810,000-barrel drop. Distillate stockpiles rose by 3.1 million barrels, versus expectations for a 742,000-barrel increase, the EIA data showed. Refinery crude runs rose by 81,000 barrels per day, EIA data showed. Refinery utilization rates rose by 0.3 percentage point to 96.6 percent of total capacity. The RBOB futures contract on NYMEX lost 1.38 cents to settle at $1.951 a gallon on Thursday. NYMEX ultra-low sulfur diesel futures fell 2.54 cents to settle at $2.2091 a gallon. Renewable fuel (D6) credits for 2018 traded between 21 and 22 cents each on Thursday, slightly higher than 21 cents each on Wednesday, traders said. Biomass-based diesel credits (D4) traded at 41 cents each on Thursday, little changed from 41.25 cents each on Wednesday, traders said.

U.S. oil refiners’ weekly capacity seen up 406,000 bpd -IIR – Reuters News

U.S. oil refiners are estimated to have 257,000 barrels per day (bpd) of capacity offline in the week ending Sept. 7, increasing available refining capacity by 406,000 bpd from the previous week, data from research company IIR Energy showed on Friday. IIR expects offline capacity to rise to 589,000 bpd in the week to Sept. 14 and then to 929,000 bpd in the week after. The following are IIR weekly figures for offline capacity (in thousands of bpd):

|

Week ended Friday |

Sept. 7 |

Sept. 5 |

Sept. 3 |

|

9/21/18 |

929 |

– |

– |

|

9/14/18 |

589 |

589 |

486 |

|

9/07/18 |

257 |

257 |

210 |

|

8/31/18 |

663 |

663 |

663 |

|

8/24/18 |

673 |

673 |

673 |

|

8/17/18 |

456 |

456 |

456 |

BP Whiting Refinery Is Said to Plan 3Q-4Q 2019 FCC Turnaround

BP’s Whiting refinery in Indiana plans to start a turnaround on FCC 600 in September 2019, people familiar with operations say.

- Whiting last conducted turnaround in 2014 on FCC 600, smaller of two FCC units at refinery

- Separately, BP Whiting is said to have turnaround mid-September to early-November this year that includes largest crude unit

- Refinery capacity 413.5k b/d

ATLANTIC GASOLINE: U.S.-Bound Flow Set to Rise; Storm Approaches

European gasoline shipments bound for U.S. in next 2 weeks are set to increase, according to median estimate in Bloomberg survey of 3 shipbrokers, 1 owner.

- 19 charters are booked or anticipated in next 14 days on route that usually hauls gasoline

- Compares with 17 last week; 5-year seasonal avg also at ~17 charters

- Includes 8 booked cargoes vs 7 last week

- Plus 11 anticipated charters vs 10 last week

- Another 19 ships are available vs 25 previously

Total books first Saudi Arabia-USAC gasoline cargoes in 3 years – Platts

French oil giant Total has booked four cargoes of gasoline from Saudi Arabia to the US Atlantic Coast, including one set to deliver September 8, in the first such voyages in at least three years, market sources said Friday. Total fixed the Medium Range tanker Archon at a lump sum rate of $1.35 million to load 35,000 mt (295,750 barrels) of gasoline over July 17-20 in Jubail in Saudi Arabia, according to S&P Global Platts trade flow software cFlow and shipping fixtures. The vessel delivered 35,472 mt of summer-grade RBOB from Jubail at Perth Amboy in New Jersey on August 21, according to cFlow and market sources. It was the first delivery of gasoline from Saudi Arabia to the USAC since August 2015, when Platts began tracking US Customs data. "It is rare," a US trader said. Saudi Aramco Total Refining and Petrochemical Co. or SATORP has a 400,000 b/d refinery in Jubail, and is a joint venture between state-owned oil giant Aramco (62.5%) and Total (37.5%). "Total probably took the cargo from its SATORP refinery as that quality of gasoline can be sold to the US," said a Singapore-based trader with a Middle Eastern refiner. Another tanker, the Torm Ismini, was fixed by Total for a Jubail-New York voyage at a lump sum rate of $1.94 million, confirmed a source close to the matter. The LR1 tanker sailed from Jubail with 60,000 mt of gasoline on August 7 and was slated to arrive at New York on September 8. Total has also fixed the Torm Platte to carry 35,000 mt of gasoline from Jubail to the USAC, loading September 8, at a lump sum rate of $1.35 million, according to shipping fixtures. It has also placed the Glenda Meryl on subjects to carry 35,000 mt of gasoline from Jubail to the USAC, loading September 16, at a lump sum rate of $1.35 million, shipping sources said. USAC gasoline imports rose 58,000 b/d to 902,000 b/d in the week ended August 31, the highest in more than a year, latest US Energy Information Administration data showed. The region’s weekly imports were last higher on August 4, 2017, at 910,000 b/d. US market sources said a slate of refinery turnarounds in Canada and the USAC were likely making the unusual shipments viable. "I think because of turnarounds, the arbs were open a few weeks or months ago, and things got booked," a second trader said. Turnarounds planned for September/October include Monroe Energy’s 190,000 b/d refinery at Trainer in Pennsylvania and PBF’s 182,800 b/d facility at Delaware City and 160,000 b/d one at Paulsboro in New Jersey, US market sources said. Planned work is also currently being carried out at Irving Oil’s 300,000 b/d refinery at Saint John in New Brunswick, sources said. USAC refinery utilization rates have averaged 2.49 percentage points lower in the third quarter of each year than in Q2 over the past five years, EIA data showed. The upcoming turnarounds have has also caught the attention of suppliers from the US Gulf Coast. The value of space on Colonial Pipeline’s gasoline-only Line 1 flipped to positive on August 30 for the first time in four months, indicating an arbitrage from the USGC to the USAC was open. The 1.37 million b/d Line 1 carries gasoline from Pasadena in Texas to Greensboro in North Carolina, where it connects with the multi-product Line 3 to deliver product up to Linden in New Jersey.

China’s Sinochem to import rare MR cargo of 92 RON gasoline from Singapore – Platts

State-owned Chinese trader Sinochem has bought an MR cargo of 10 ppm 92 RON gasoline from Shell for loading from Singapore and delivery to China, several Singapore-based sources said Friday. The rare move follows an open arbitrage window, high domestic demand, and the availability of import quotas. "Product imports would yield a high profit after taxes and fees as China tightening emissions requires more high quality fuels that meet National Phase 6 standards. This has encouraged Chinese oil companies to buy from the Asian market," a Beijing-based trader said. Wholesale 92 RON 10 ppm gasoline was offered at a post-tax price of Yuan 8,900/mt ($153.16/b) in Guangzhou on Friday, capital of Guangdong province in Southern China, according to local traders. The price was Yuan 400/mt higher than a week ago due to tight supply ahead of the peak consumption period over September-November. The wholesale price translates into $94.78/b excluding taxes and fees. Meanwhile, Platts assessed FOB Singapore 10 ppm 92 RON gasoline at $85.65/b on Thursday, offering an opportunity for arbitrage from Singapore to China. Beijing awarded import quotas for 300,000 mt of gasoline and 500,000 mt of gasoil to the state-owned Sinochem and Sinopec recently. This was to ensure sufficient supply ahead of the deadline for adopting National Phase 6 emission standard, similar to Euro 6, across the country from January 1, market sources said. Sinochem was able to import the gasoline cargo as a result. Late last month, it fixed a 40,000 mt cargo of gasoil cargo from the Asian market for delivery to South China’s Guangdong province in early September, Platts reported earlier.

Singapore 180 CST HSFO cash differential hits 5-month low on higher supply – Platts

The Singapore 180 CST high sulfur fuel oil cash differential fell to a five-month low Thursday due to an increase in supply of low-viscosity cargoes, S&P Global Platts data showed. The cash differential was assessed at 98 cents/mt at the close of Asian trade Thursday, the lowest since March 29 when it was at 50 cents/mt, Platts data showed. The 180 CST HSFO grade was assessed at $440.18/mt Thursday, down $2.72/mt day on day. While both 180 CST and 380 CST grades are weakening with more arbitrage cargoes coming into Singapore, fuel oil traders said low-viscosity cargoes — mainly from the Middle East and India — have been heading to Singapore at a faster rate than high-viscosity grades. Singapore is expected to receive more than 4 million mt of arbitrage supply from Europe and the US in September, up from monthly volumes of 3.5 million-4 million mt in July and August, trade sources said. This has also pressured down the cash differential for 380 CST HSFO to $3.22/mt Thursday, the lowest since July 5 when it was assessed at $3.10/mt, Platts data showed. Meanwhile, market participants are expecting bunker fuel premiums to ease this month, as fuel oil supply increases and cargo differentials weaken. "Ex-wharf premiums [to Mean of Platts Singapore 380 CST HSFO assessments] are likely to come off gradually with more cargoes expected," a Singapore bunker fuel trader said. Earlier in August, bunker fuel premiums had stayed largely supported amid concerns over off-spec fuel oil in Singapore, sources said. Spot ex-wharf 380 CST bunker fuel premiums to MOPS 380 CST HSFO had averaged $9.69/mt in August, up from an average of $6.77/mt in July, Platts data showed. Premiums or discounts for physical bunker fuel reflect the price that buyers are willing to pay relative to the published benchmark HSFO values.

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986