From: Wagner, Jonathan

Sent: Thursday, September 13, 2018 6:23:17 AM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Morning Rundown

Good morning. Oil price are lower to start the day with European equities mixed, US index futures in the green and China finally having a strong session on the back of possible trade war easing between China and the US. The dollar is marginally higher as well to start the day. The latest IEA monthly was released this morning showing OPEC crude supply increasing to a 9 month high in August of 32.63m b/d. A rebound in Libya, near record Iraqi output and higher volumes from Nigeria and Saudi Arabia outweighed a substantial reduction in Iran and a further fall in Venezuela. While producers continue to increase production the IEA warned that Brent prices could continue to rise above $80 as Iranian exports continue to fall and Venezuelan production is nearing the lowest volumes seen in a decade. The IEA shows global crude supply reaching a 100/m b/d as higher OPEC output offset seasonal declines from non-OPEC. non-OPEC supply was up 2.6 mb/d y-o-y, led by the US. Non-OPEC production will grow by 2 mb/d in 2018 and 1.8 mb/d in 2019. The IEA kept their 2018 and 2019 global demand estimates unchanged at 1.4m b/d and 1.5m b/d respectively as the pace of growth in q2 ’18 slowed due to weaker OECD Europe and Asian demand. The IEA shows OECD commercial stocks increasing by 7.9m bbls in July to 2.824m bbls which is only the 4th monthly increase in the last year. Preliminary data for August point to significant inventory builds in Japan and the US, and a fall in Europe. The IEA shows August global crude runs hit 83.5m b/d and will slow for seasonal maintenance before increasing in December to another record of 84.5m b/d. US refining is booming with runs almost reaching 18 mb/d in August, while Latin American activity continues to fall.

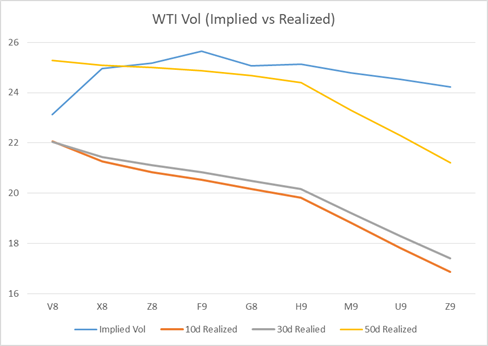

Middle east crude prices continue to move higher with Cash Dubai trading +1.49 over swaps and DME oman is trading +2.09 over swaps. Spot premiums for most grades have hit their highest level in months on the back of robust demand in Asia ahead of peak winter consumption. Japanese Co. Is Said to Sell Nov. Upper Zakum Oil at About +45c/Bbl and Thailand’s PTT Is Said to Buy Murban for Nov. at ~45C Premium. Indian Co. Is Said to Buy Nov. Qatar Marine Crude at +30-39C/Bbl. 20 Nov Dubai partials traded in the window with Mercuria, Chinaoil, Unipec, Totsa, and Reliance selling to Petro-Diamond, Shell, and BP. 1 Jan Dubai partial traded with Gunvor selling to Petro-diamond. Sep/oct Dubai spreads are trading 80c back while Oct/Nov spreads are trading 66c back. In the North Sea, sources are saying the Buzzard oil field still has not restarted (delayed by weather) and Glencore will send the Suezmax Dilong Spirit to China filled with Ekofisk in the second half of Sept. This ship will follow VLCC Sea Ruby which is en route to China after loading ~2m bbl of Ekofisk crude via 3 ship-to-ship transfers earlier this month. North Sea diffs finished lower yesterday as Glencore was seen offering forties (Glencore offers Sept. 24-26 Forties at Dated Brent -35c/bbl). WTI spreads and arbs are softer today after the large rally seen post stats with Cushing stocks drawing 1.2m bbls yesterday taking total inventory to 23.58m bbls. Index selling continues to be seen as today is day 4 of the monthly roll. Prompt grades were weaker yesterday on the Arb strength. Q4’18 WTI CSO’s were active yesterday with the .25/.50 call spread trading 2k and the .25/ flat 1×2 put spread trading 1k. There was also interest in the Z8 -12/-10 put spread in the Arb as well as the F9 6/12 fence on blocks. Front end vols were under pressure again yesterday while no real change seen yet so far this morning even on the px move lower. Put skew continues to grind lower making new ytd lows in the front while call skew was relatively unchanged yesterday. We did see interest in downside ratio put spread structures with interest looking to own wings. WTI / Brent put rolls continue to be seen with the X8 65 put in WTI vs the X8 75 put in brent trading 10k on blocks (bought WTI). Producers were active again yesterday as c19 and c20 prices continue to make new highs. APO puts and three ways were seen on blocks yesterday in WTI in ’19.

Top stories listed below

IEA Sees Iran Oil Supply Tumbling as Buyers Heed U.S. Sanctions

Venezuela Oil Output Could Fall to 1m B/d by Year-End: IEA

Global Refinery Runs Set for Record in December After Dip: IEA

Trans Mountain Troubles May Stunt Canada’s Long-Term Output: IEA

Brazil’s Disappointing Oil Supply Is Starting to Pick Up: IEA

Fuel Oil Cracks Soften in Aug. Amid Rising Supplies, IEA Says

Jet Fuel Demand Surges in India, China on Air Travel Boom: IEA

U.S. invites China to trade talks as tariffs loom -White House adviser – Reuters News

China says Beijing, Washington do not want to see trade war escalate further – Reuters News

Middle East Crude-Spot premiums hit months’ high on robust demand – Reuters News

Strong demand lifts Oman crude price near 5-year high – Platts

Spot premiums for Nov Murban crude oil hit 2018 high on Asia demand – sources – Reuters News

India’s ONGC sells Nov-loading Russian Sokol crude at highest premium in 4 months – sources – Reuters News

Iran floats surplus oil as demand falls ahead of U.S. sanctions – Reuters News

North Sea Buzzard oilfield yet to restart -trade source – Reuters News

Glencore to Ship Ekofisk Crude to China in 2H September

Azeri Light Crude Loadings From Supsa to Rise in Oct. After Work

Russia Sees Oil Flow via Baltic, Black Sea Ports Down 4% in 2019

China to Give Venezuela $5 Billion Loan as Maduro Visits Beijing

U.S. oil producers lock-in 2019, 2020 revenue as prices rally – Reuters News

U.S. Cash Crude-Coastal grades ease gains as WTI/Brent narrows – Reuters News

Canada Heavy Oil Falls to New Low as BP Whiting Shuts Unit

U.S. Cash Products-Group Three gasoline hits fresh 10-mth high on refiner buying – Reuters News

U.S. waives gasoline rules in Virginia, Georgia as Florence nears – Reuters News

Colonial will not change fuel specs ahead of Hurricane Florence – Reuters News

Asian naphtha crushed by supplies from Europe, cracker maintenance – Reuters News

Singapore fuel oil inventories slip despite surge in net imports – Reuters News

Singapore Weekly Fuel Stockpiles for Sept. 12 Fell 9.4% W/W

|

Implied Vol |

Realized Vol |

||||||

|

WTI Vol |

12-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

V8 |

23.13 |

-1.43 |

1.03 |

22.07 |

22.04 |

25.29 |

|

|

X8 |

24.97 |

0.02 |

1.11 |

21.27 |

21.44 |

25.10 |

|

|

Z8 |

25.17 |

-0.08 |

1.12 |

20.83 |

21.11 |

25.00 |

|

|

F9 |

25.64 |

-0.13 |

1.13 |

20.54 |

20.83 |

24.88 |

|

|

G8 |

25.06 |

-0.23 |

1.11 |

20.16 |

20.49 |

24.68 |

|

|

H9 |

25.13 |

-0.17 |

1.11 |

19.82 |

20.17 |

24.40 |

|

|

M9 |

24.78 |

-0.34 |

1.08 |

18.84 |

19.23 |

23.30 |

|

|

U9 |

24.54 |

-0.28 |

1.05 |

17.82 |

18.30 |

22.29 |

|

|

Z9 |

24.23 |

-0.21 |

1.03 |

16.87 |

17.40 |

21.22 |

|

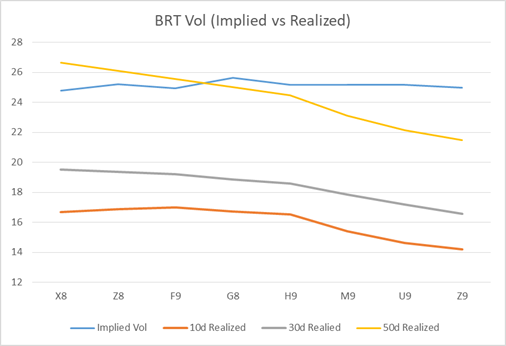

Implied Vol |

Realized Vol |

||||||

|

BRT Vol |

12-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

24.77 |

-0.53 |

1.25 |

16.68 |

19.54 |

26.66 |

|

|

Z8 |

25.21 |

-0.01 |

1.26 |

16.89 |

19.37 |

26.09 |

|

|

F9 |

24.93 |

-0.05 |

1.24 |

17.01 |

19.20 |

25.55 |

|

|

G8 |

25.65 |

-0.06 |

1.27 |

16.75 |

18.88 |

25.00 |

|

|

H9 |

25.17 |

-0.03 |

1.25 |

16.53 |

18.59 |

24.48 |

|

|

M9 |

25.16 |

-0.15 |

1.23 |

15.40 |

17.87 |

23.10 |

|

|

U9 |

25.18 |

-0.24 |

1.22 |

14.63 |

17.18 |

22.14 |

|

|

Z9 |

24.99 |

-0.18 |

1.19 |

14.22 |

16.58 |

21.47 |

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE/CME Mixed Clearing Recap

BRT X18 75/85 Fence x79.45 TRADES 6 200x; TRADES 7 800x

BRT Z18 73/85 Fence x79.00 TRADES 10 1,900x 36d

ICE Trade Recap

BRT M19 60/55 1×2 Put Spread TRADES 2 600x; TRADES 1 1,000x

BRT Z18 80/85/87 Call Fly x78.80 TRADES 116 1,200x 18d

WTI J19 65/55 1×2 Put Spread x68.45 TRADES 159 500x 9d

BRT X18 76.50/83 Fence TRADES 4 500x

BRT Z18 85 Call x78.90 TRADES 84 500x 20d

BRT M19 90/100 1×2 Call Spread TRADES 35 1,000x

BRT Z19 75/85 Call Spread x75.35 TRADES 411 500x 25d

BRT X18 83.50 Call x79.70 TRADES 34 1,500x 15d

BRT Z18 73/84 Fence x79.00 TRADES 29 500x 41d

BRT G19 84 Call x78.50 TRADES 210 3,000x 32d

BRT M19 90/110 Call Spread x77.50 TRADES 154 500x 18d

CME Trade Recap

WTI Z18 70 Call x69.20 TRADES 254 1,000x 49d

WTI V18 70 Call x69.80 TRADES 76 100x 47d; TRADES 75 750x 47d

WTI M19 85/95 1×2 Call Spread TRADES 20 2,000x

BRT X18 85 Call TRADES 20 5,000x; TRADES 18 4,000x

WTI M19 66 Put x68.10 TRADES 463 500x 33d

WTI X18 66/63 1×2 Put Spread TRADES 17 1,000x

WTI V18 67.50 Put x70.20 TRADES 11 2,000x 9d

WTI X18 66.50/73.50 Fence TRADES 6 500x; TRADES 4 250x

WTI Z18 68/74/80 Call Fly x69.75 TRADES 160 14d 500x

WTI X18 66.50/74 Strangle TRADES 165 829x

WTI X18 67/74 Fence TRADES 6 500x

WTI M19 ATM Call x68.50 TRADES 555 1,000x 60d

WTI X18 75 Call x70.50 TRADES 70 1,000x 20d

WTI Z/H18 75/80 Call Spread TRADES 2 1,000x

WTI Z18 76 Call x70.35 TRADES 98 2,000x 24d

WTI X18 65 Put vs BRT X18 75 Put TRADES 29 10,000x

WTI Z18 68 Put x70.10 TRADES 199 600x 37d

CSO/ARB/APO Trade Recap

WTI CSO V/X18 0.30 Call (WA) TRADES 6 100x

WTI CSO V/X18 0.50 Call (WA) TRADES 3 1,000x

WTI CSO V/X18 0.50/0.75 TRADES 2 250x

WTI CSO 4Q18 0.25/0.50 Call Spread (WA) TRADES 18 1,000x

WTI CSO 4Q18 0.25/0.50 Call Spread (7A) TRADES 18 1,000x

WTI CSO 4Q18 0.25/Flat 1×2 Put Spread TRADES 6 1,000x

ARB Z18 -10.00/-12.00 Put Spread TRADES 40 250x

ARB F19 -6.00/-12.00 Fence TRADES 13 200x

WTI APO 1Q19 55 Put TRADES 62 24x

WTI APO Cal19 ATM Call x67.50 TRADES 571 20x 60d

WTI APO Cal19 55/60 Put Spread vs 80 Call x68.00 TRADES 48 230x 30d

WTI APO Cal19 55 Put TRADES 176 3x

IEA Oil Monthly

Global oil demand growth estimates for 2018 and 2019 are unchanged at 1.4 mb/d and 1.5 mb/d, respectively. The pace of growth slowed sharply in 2Q18, caused by weaker OECD Europe and Asia demand. US gasoline demand growth eased due to higher prices.

Non-OECD demand remains resilient but there is a risk to the 2019 outlook from currency depreciation and trade disputes. Demand in China and India combined will grow by 910 kb/d in 2018, but the pace slows to 640 kb/d in 2019.

Global supply in August reached a record 100 mb/d as higher output from OPEC offset seasonal declines from non-OPEC. Nevertheless, non-OPEC supply was up 2.6 mb/d y-o-y, led by the US. Non-OPEC production will grow by 2 mb/d in 2018 and 1.8 mb/d in 2019.

OPEC crude supply rose to a nine-month high of 32.63 mb/d in August. A rebound in Libya, near record Iraqi output and higher volumes from Nigeria and Saudi Arabia outweighed a substantial reduction in Iran and a further fall in Venezuela.

From August’s record rate of 83.5 mb/d, global crude runs decline due to maintenance before surging in December to another record high of 84.5 mb/d. US refining is booming with runs almost reaching 18 mb/d in August, while Latin American activity continues to fall.

OECD commercial stocks rose 7.9 mb in July to 2 824 mb, only the fourth monthly increase in the last year. Stocks have been stable in a narrow range since March. Preliminary data for August point to significant inventory builds in Japan and the US, and a fall in Europe.

ICE Brent prices fell in August but recently have climbed to two-month highs near $80/bbl. Both ICE Brent and NYMEX WTI futures curves are backwardated. The Brent/WTI differential has widened by $5/bbl since early August due to relatively weaker US prices.

Tightening Up On The Way

Since the previous edition of this Report, the price of Brent crude oil fell close to $70/bbl and is now flirting with $80/bbl. Two reasons for the swing are that Venezuela’s production decline continues, and we are approaching 4 November when US sanctions against Iran’s oil exports are implemented. In Venezuela, production fell in August to 1.24 mb/d and, if the recent rate of decline continues, it could be only 1 mb/d at the end of the year. Evidence provided by tanker tracking data suggests that Iran’s exports have already fallen significantly but we must wait to see if the 500 kb/d of reductions seen so far will grow. (See Iran supply tumbles as buyers take heed of US sanctions).

If Venezuelan and Iranian exports do continue to fall, markets could tighten and oil prices could rise without offsetting production increases from elsewhere. Supply from some countries has grown since the Vienna meetings in June: last month Saudi Arabia and Iraq combined saw output increase by 160 kb/d. In Iraq’s case, exports have grown to such an extent that they are greater than Iran’s production, and there is still about 200 kb/d of shut-in capacity in the north of the country due to the ongoing dispute with the Kurdistan Regional Government. Based on our August estimates of production, OPEC countries are sitting on about 2.7 mb/d of spare production capacity, 60% of which is in Saudi Arabia. But the point about spare capacity is that, having been idle, it is not clear exactly how much, beyond what is widely thought to be "easy" to bring online, will be available to coincide with further falls in Venezuelan exports and a maximisation of Iranian sanctions. It is not just a question of volume; refiners used to processing Venezuelan or Iranian crude will compete to find similar quality barrels to maintain optimal refinery operations. Alternative supplies of lighter crude might not be ideal for this reason. Even before we factor in any further fall in exports from Venezuela or Iran, record global refinery runs are expected to result in a crude stock draw of 0.5 mb/d in 4Q18. Any draw will be from a basis of relative tightness: in the OECD, stocks at end-July were 50 million barrels below the five-year average.

If we are looking for additional barrels from elsewhere to help compensate for further export declines from Venezuela and Iran the picture is mixed. Brazil was supposed to be one of the big production success stories of 2018, but various problems have stymied growth to the extent that output will rise by only 30 kb/d this year versus a first estimate of 260 kb/d. On the upside, the United States continues to show stellar performance with total liquids output expected to grow by 1.7 mb/d this year and another 1.2 mb/d in 2019. However, companies are not adjusting their production plans, despite higher prices, due to infrastructure bottlenecks and this is unlikely to change in the near future. Even so, growth this year has returned to the extraordinary pace seen in 2014 during the first shale boom. Finally, Libyan production surged back in August to 950 kb/d, not far below the 1 mb/d level that was achieved for almost a year prior to the recent disturbances. However, as we have seen in the past few days with attacks on NOC headquarters, the situation is fragile.

As far as oil demand is concerned, following an increase of 1.4 mb/d in 2018, growth next year will be 1.5 mb/d. Even so, in 2018, we are seeing signs of weaker demand in some markets: gasoline demand is stagnant in the US as prices rise; European demand in the period May-July was consistently below year-ago levels; demand in Japan is sluggish notwithstanding very high temperatures and will be further impacted by the recent natural disasters. As we move into 2019, a possible risk to our forecast lies in some key emerging economies, partly due to currency depreciations versus the US dollar raising the cost of imported energy. In addition, there is a risk to growth from an escalation of trade disputes.

We are entering a very crucial period for the oil market. The situation in Venezuela could deteriorate even faster, strife could return to Libya and the 53 days to 4 November will reveal more decisions taken by countries and companies with respect to Iranian oil purchases. It remains to be seen if other producers decide to increase their production. The price range for Brent of $70-$80/bbl in place since April could be tested. Things are tightening up.

IEA Sees Iran Oil Supply Tumbling as Buyers Heed U.S. Sanctions

Iranian oil output fell 150k b/d to 3.63m b/d in August, lowest level since July 2016, IEA says in its monthly Oil Market Report.

- Decline came “as more buyers distanced themselves from Tehran ahead of looming U.S. sanctions”: IEA

- Exports of crude fell more sharply than production, down 280k b/d from July to 1.9m b/d, as top buyers China and India cut back sharply, IEA says citing Kpler; China cut back August purchases by 200k b/d and India by 380k b/d

- Korea, France haven’t lifted any Iranian crude since June

- Overall shipments down nearly 500k b/d since recent April/May peak

- One of National Iranian Oil Co.’s regular European customers is replacing Iranian crude barrel-for-barrel with Saudi grades

- NIOC may be starting to store oil at sea, while some production is also likely to have moved to on-land storage tanks

- Loss of Iranian barrels is benefiting CPC Blend, which has high naphtha yield and is attractive for refiners looking to replace condensate feedstocks

- Urals, Basra Light and Basra Heavy have also strengthened

Venezuela Oil Output Could Fall to 1m B/d by Year-End: IEA

Venezuela’s oil production could tumble to just 1m b/d by the end of the year, the International Energy Agency says in its monthly oil market report.

- August production fell to 1.24m b/d, a 20k b/d drop and about half the level seen in early 2016

- IEA sees output from mature, conventional oil fields dropping while upgraders in the Orinoco heavy oil belt are breaking down and running below capacity

- Venezuela’s oil exports were disrupted in late August after a tanker collision at the Jose terminal

- The country’s crude output declined after ConocoPhillips sought to seize PDVSA’s Caribbean assets, under an international court ruling, as compensation for the more than $2b the state-owned co. owed the U.S. firm

- “If Venezuelan and Iranian exports do continue to fall, markets could tighten and oil prices could rise without offsetting production increases from elsewhere”

Global Refinery Runs Set for Record in December After Dip: IEA

Global refinery runs are expected to reach a record 84.5m b/d in December, despite a decline in the coming months due to planned seasonal maintenance and following recent unplanned outages, IEA says in monthly Oil Market Report.

- Runs estimated to fall to 81.8m b/d in September and 81.7m b/d in October, down from 83.5m b/d in August; forecast at 83.3m b/d in November

- Recent unplanned outages include fire at Germany’s Vohburg refinery and fire at largest Petrobras plant in Brazil

- Run-rate growth was centered in East-of-Suez region from January-August, while Atlantic Basin throughput declined by average 300k b/d during period

- Growth to be more evenly split from September-December, with each region contributing ~500k b/d

- Record run rates in U.S. should lead growth in the West

Trans Mountain Troubles May Stunt Canada’s Long-Term Output: IEA

A Canadian court’s decision to nullify approval of the Trans Mountain Expansion Project will increase crude-by-rail transport in the near term and will likely have a “negative impact on Canadian output growth in the longer term,” the International Energy Agency says in Monthly Oil Market Report.

- Project would expand capacity of an existing pipeline running from Edmonton to Vancouver for export; federal appeals court in August overturned approval by National Energy Board and federal government

- “The court decision is another blow to Canada’s oil producers, who say the expanded pipeline is needed to address bottlenecks that have sharply reduced prices for their crude”

- Western Canada Select discount to WTI at Cushing deepened to $33.50/bbl on Wednesday, widest since November 2013

- Court ruling places greater emphasis on Enbridge’s planned Line 3 expansion and TransCanada’s planned Keystone XL project

Brazil’s Disappointing Oil Supply Is Starting to Pick Up: IEA

Output so far this year is down vs 2017 and will expand by far less in 2018 than initially estimated, IEA says in monthly report.

- Production growth will be 30k b/d in 2018, down from initial estimate of 260k b/d: IEA

- Still a “a rebound is in sight” with Petrobras, international partners starting up seven new production systems this year followed by two more during 2019

- Two FPSOs that were due to come on stream this year are ramping up and two more arrived in August

- New installations have capacity to produce as much as 1.35m b/d

- Still, investments in new field developments in pre-salt area are coming at the expense of spending on post-salt layer operations

- Annual decline rates from both Campos Basin and onshore fields running at 14%, meaning 200k b/d lost to natural decline

Fuel Oil Cracks Soften in Aug. Amid Rising Supplies, IEA Says

Cracks for high-sulfur and low-sulfur fuel oil fell in August as demand came off and supplies increased, IEA says in its monthly report.

- Inventories in Singapore and Europe rose last month

- Anticipated reductions in supply from Iran saw fuel oil futures curves move into steep backwardation

- Cracks peaked in Aug. on strong demand for power generation

- In the Middle East air conditioner use has been boosted by high temperatures

- In South Korea, some power producers have increased use of fuel oil, as opposed to coal, to meet tighter government policy on pollution

- Bunker fuel demand has been strong

Jet Fuel Demand Surges in India, China on Air Travel Boom: IEA

Chinese and Indian jet fuel/kerosene demand is ramping up, fueled by rapid growth in air transport, IEA says in monthly Oil Market Report.

- China’s kerosene demand rose by ~10% over past 3 years; similar growth in India, “the world’s fastest growing domestic aviation market”

- Air passenger traffic +20.5% in India, +13.5% in China, from January-July, IEA says, citing IATA data on domestic revenue passenger kilometers

- Indian market supported by lower airfares since 2014, economic growth and increased airport connectivity

- Govt plans to construct ~100 new airports by 2035

- India’s jet kerosene demand expected to reach 680k b/d this year, vs 620k b/d in 2017

- China to become world’s largest aviation market by 2022, due to expanding middle class, continued govt support for airport construction

- Kerosene demand expected to reach 775k b/d this year, vs 710k b/d in 2017

U.S. invites China to trade talks as tariffs loom -White House adviser – Reuters News

The Trump administration has invited Chinese officials to restart trade talks, the White House’s top economic adviser said on Wednesday, as Washington prepares to further escalate the U.S.-China trade war with tariffs on $200 billion worth of Chinese goods. Larry Kudlow, who heads the White House Economic Council, told Fox Business Network that U.S. Treasury Secretary Steven Mnuchin had sent an invitation to senior Chinese officials, but he declined to provide further details. "There’s some discussions and information that we received that the Chinese government – the top of the Chinese government wished to pursue talks," Kudlow said. "And so, Secretary Mnuchin, who is the team leader with China, has apparently issued an invitation." Two people familiar with the effort said Mnuchin’s invitation was sent to his Chinese counterparts, including Vice Premier Liu He, the top economic adviser to Chinese President Xi Jinping, for talks in coming weeks. Asian shares advanced on Thursday on hopes that a deal could be struck in the bitter tariff dispute between the world’s two largest economies. In China, the yuan jumped and stocks rose. The Trump administration is preparing to activate tariffs on $200 billion worth of Chinese goods, hitting a broad array of internet technology products and consumer goods from handbags to bicycles to furniture. It was unclear whether any U.S.-China talks would delay the duties. Kudlow earlier told reporters outside the White House that communications with Beijing had "picked up a notch" and added he saw that as "a positive thing." "I think most of us think it’s better to talk than not to talk, and I think the Chinese government is willing to talk," Kudlow said. Asked if the Trump administration would like to have additional trade talks with China, Kudlow said: "If they come to the table in a serious way to generate some positive results, yes, of course. That’s what we’ve been asking for months and months." But he cautioned: "I guarantee nothing." The timing and location of the proposed meeting were unclear, the sources familiar with the matter said. Mid-level U.S. and Chinese officials met on Aug. 22 and 23 with no agreements. A U.S. Treasury spokesman did not respond to requests for comment. The invitation was first reported by the Wall Street Journal. A meeting among Cabinet-level officials could ease market worries over the escalating tariff war that threatens to engulf all trade between the world’s two largest economies and raise costs for companies and consumers.

CONCERNS OF ESCALATION

So far, the United States and China have hit $50 billion worth of each other’s goods with tariffs in a dispute over U.S. demands that China make sweeping economic policy changes, including ending joint venture and technology transfer policies, rolling back industrial subsidy programs and better protecting American intellectual property. U.S. President Donald Trump said last week that in addition to preparing tariffs on the further $200 billion worth of goods, he had tariffs on an additional $267 billion worth of goods ready "on short notice if I want." China has threatened retaliation, which could include action against U.S. companies operating there. U.S. business groups are escalating their fight against Trump’s tariffs, with over 60 industry groups launching a coalition to put political pressure on the Trump administration to seek alternatives to tariffs. The negative impact of the tariffs on U.S. firms has been "clear and far reaching", according to a joint survey by AmCham China and AmCham Shanghai. More than 60 percent of U.S. companies polled said the U.S. tariffs were already affecting their business operations, while a similar percentage said Chinese duties on U.S. goods were having an impact on business.

China says Beijing, Washington do not want to see trade war escalate further – Reuters News

China’s commerce ministry believes China and the United States do not want to see their trade war escalate further, it said on Thursday. The two countries have been in constant communication on trade issues, ministry spokesman Gao Feng told reporters. China and the United States are discussing details on future talks, he said.

Middle East Crude-Spot premiums hit months’ high on robust demand – Reuters News

The Middle East crude market strengthened on Thursday with spot premiums for most grades hitting their highest in months on the back of robust demand in Asia ahead of peak winter consumption. Medium sour grades are supported by falling exports from Iran. At least four Qatar Marine cargoes have sold at 35-40 cents a barrel above its official selling price while Banoco Arab Medium was heard traded at 20-30 cents above its OSP, traders said. Al-Shaheen crude has also traded prior to Qatar Petroleum’s tender which closed on Thursday, although details remained sketchy. Strong demand for distillates-rich grades pushed up Murban and Sokol premiums. Thailand’s PTT bought a Murban cargo via a tender at a premium between 40 cents and 50 cents to the grade’s OSP from Total, they said. This is the highest premium since trade registered in December 2017. India’s ONGC Videsh has sold a cargo of Russian Sokol crude loading in November at the highest premium in four months, sources said. The 700,000-barrel cargo loading on Nov. 8-14 was sold to Glencore via a tender at $5.10-$5.20 a barrel above Dubai quotes, they said, some $1.30 higher than ONGC’s last deal.

WINDOW: Cash Dubai’s premium to swaps rose 2 cents to $1.49 a barrel after Shell and Petro-Diamond bought most of the November partials.

Strong demand lifts Oman crude price near 5-year high – Platts

Strong demand from Asian end-users lifted cash Oman crude values to the highest in almost five years on Wednesday. November cash Oman crude was assessed at a premium of $2.02/b to same-month Dubai crude swap, the highest since November 29, 2013, when it was at a $2.29/b premium, S&P Global Platts data showed. Meanwhile, November cash Oman crude’s spread to same-month cash Dubai crude rose to 55 cents/b on Wednesday, the widest spread between the two since March 22 when it was at 59 cents/b. Oman crude’s strength came amid strong demand from Asia, particularly buyers in China, on the back of healthy refining margins while arbitrage economics for Brent-linked crudes were seen as unattractive due to the widening Brent/Dubai exchange of futures for swaps. The Brent/Dubai EFS was assessed at $3.43/b on Wednesday, the highest since July 10 when it was at $3.49/b, Platts data showed. "Arbitrage is closed and [Chinese] teapot demand is strong," a North Asian crude oil trader said. China is the biggest importer of Omani crude with an estimated 84% of Oman’s total crude exports in July destined for China, latest data from the country’s ministry of oil and gas showed. In total, Oman exported about 24.1 million barrels of crude in July, equivalent to an average 776,800 b/d. Traders have said that the ongoing trade war with the US has meant China’s crude demand has returned to traditional sources in the Middle East. "There is also the Iran issue and new refineries coming online in China… there’s many bullish news coming to the market," another crude oil trader said. Healthy refining margins have also supported buying interest, particularly for middle distillate-rich crudes, traders have said. Second-month gasoil and jet fuel crack spread against Dubai crude swap have averaged $16.54/b and $16.57/b, respectively, for September to date, the highest since May 2014 and April 2014, Platts data showed.

Spot premiums for Nov Murban crude oil hit 2018 high on Asia demand – sources – Reuters News

- Spot premiums for November-loading Abu Dhabi Murban crude oil have hit the highest in 2018 so far on robust demand in Asia, trade sources said on Thursday

- Thailand’s PTT bought a cargo via a tender at a premium between 40 cents and 50 cents to the grade’s official selling price, they said

- This is the highest premium since trade registered in December 2017 MUR-1Madn-

- A sharp reduction in the oil’s OSP and strong refining margins for middle distillates buoyed demand for sour grades ahead of peak winter consumption season, the sources added

India’s ONGC sells Nov-loading Russian Sokol crude at highest premium in 4 months – sources – Reuters News

- India’s ONGC Videsh has sold a cargo of Russian Sokol crude loading in November at the highest premium in four months, boosted by robust demand in Asia ahead of peak winter consumption, trade sources said on Thursday

- The 700,000-barrel cargo loading on Nov. 8-14 was sold to Glencore via a tender at $5.10-$5.20 a barrel above Dubai quotes, they said, some $1.30 higher than ONGC’s last deal

- Sokol last traded at premiums above $5 a barrel for July-loading cargoes

Iran floats surplus oil as demand falls ahead of U.S. sanctions – Reuters News

Two tankers carrying Iranian condensate, a type of ultra-light oil, have been floating off the United Arab Emirates for about a month as demand for the oil fell ahead of U.S. sanctions. The tankers, carrying about 2.4 million barrels of South Pars condensate combined, have been floating off the UAE since August after South Korea halted imports from Iran while China’s demand dropped during summer, according to several industry sources and shipping data. The build-up in Iranian oil supplies underscores the pressure that Iran is facing as Washington aims to bring Iranian oil exports down to zero to force Tehran to re-negotiate a nuclear deal. The Very Large Crude Carrier (VLCC) Felicity loaded condensate at Iran’s Assaluyeh port in early August and then set sail for Jebel Ali in the UAE, shipping and trade flows data on Thomson Reuters Eikon showed. It arrived at the ship-to-ship transfer area off Dubai on Aug. 7 and has been anchored there since. Similarly, the Suezmax tanker Salina also loaded oil at Assaluyeh and has been circling in the same area off Dubai since Aug. 17, according to the data. Oil processors in South Korea, Iran’s top customer for South Pars condensate, halted Iranian oil liftings in July as banks, insurance and shipping companies wound down business related to Iran before U.S. sanctions the country’s petroleum sector kick in on Nov. 4. China typically cuts South Pars condensate imports sharply during the summer months between the second and third quarter because of its foul smell, the sources said. The condensate contains high levels of a sulphurous compound known as mercaptans that require additional processing by refiners to remove. "Taking a cargo to China now when China may not want its arrival dates means it may lose a cargo to India," a U.S.-based trader said. "So the cargoes will stay in place until they need to leave on agreed delivery period." Emirates National Oil Company (ENOC), another buyer of Iranian condensate, has been asked by the UAE government replace Iranian supply with imports from other countries, one of the sources said. The UAE authorities are cracking down on oil and financial activities linked to Iran before the sanctions take effect. The National Iranian Oil Co and ENOC did not respond to requests for comment. The number of ships loaded with Iranian oil and anchored off the loading port of Kharg Island and the Souroush oil field has also risen as Iran’s pool of buyers shrank, the data showed. Three supertankers capable of carrying 2 million barrels, the Happiness I, MT Hedy and Humanity, have floated for 10 days or more while another four have been there for less than a week. Iran’s August crude and condensate exports fell to 67.7 million barrels, the lowest since April 2017, according to data from Thomson Reuters Oil Research and Forecast.

North Sea Buzzard oilfield yet to restart -trade source – Reuters News

- The Buzzard oilfield in the North Sea did not restart on Wednesday evening as hoped, a trade source familiar with the matter said on Thursday

- The field was initially due to restart over the weekend after planned maintenance that began in early September

- Bad weather is part of the reason for the delay, the source said

- Buzzard normally pumps about 150,000 barrels of oil per day and is the largest contributor to Forties, one of the five North Sea crudes that set the Brent global benchmark

- Field operator Nexen did not respond to an emailed request for immediate comment

Glencore to Ship Ekofisk Crude to China in 2H September

Glencore charters Suezmax Dilong Spirit to sail from Ekofisk terminal Teesport on Sept. 19-20 for Chinese port of Ningbo, according to shipping fixtures.

- Vessel will follow VLCC Sea Ruby which is en route to China after loading ~2m bbl of Ekofisk crude via 3 ship-to-ship transfers earlier this month

- Tanker booked by Glencore at cost of $3.2m: fixtures

- Shipment will lift North Sea benchmark flows to Asia to ~9m bbl in September, vs ~10m bbl in August

Azeri Light Crude Loadings From Supsa to Rise in Oct. After Work

Loadings to reach 3 shipments in October, from 2 in September, according to program seen by Bloomberg.

- October loadings ~61k b/d, vs 43k b/d this month

- Shipments curtailed in September by maintenance work at the Supsa terminal from Aug. 23-Sept. 15, port agents said

- BP operates Baku-Supsa pipeline, which carries Azeri Light from Caspian Sea to Georgia’s Black Sea port of Supsa

Russia Sees Oil Flow via Baltic, Black Sea Ports Down 4% in 2019

Preliminary crude supplies via Russia’s Primorsk port, in the Baltic Sea, are seen at ~37m tons next year based on plans submitted by oil companies to pipeline operator Transneft, Vice President Sergey Andronov tells reporters in Kozmino port, Russia.

- Volumes seen slightly down vs 38.7m tons expected this year, after sharp drop from 44m tons in 2017

- Another Baltic Sea port, Ust-Luga, may load ~25m tons next year vs 26.3m tons expected this year and 32.7m tons in 2017

- Black Sea’s Novorossiysk port seen loading ~26m tons in 2019 vs est. 26.95m tons this year and 30.6m tons in 2017

- Combined loading in 3 ports may reach ~88m tons next year vs almost 92m tons seen for 2018 (down >4% y/y) and ~107m tons in 2017: Bloomberg calculations based on Transneft data

- Oil deliveries to Russia’s ports in Baltic and Black Seas decreased this year amid boost in shipments to China via pipeline

- Oil deliveries via Kozmino port off Pacific coast seen little changed y/y at ~31.5m tons; 2017 loadings were 31.7m tons: Andronov

- Overall oil shipments via Transneft network seen at ~483m tons in 2019 vs ~479m tons expected this year

- Shipments to Russian refineries seen at 254.6m tons vs 250.4m tons this year

- Export deliveries via Transneft system seen at 228.3m tons vs 228.5m tons in 2018

China to Give Venezuela $5 Billion Loan as Maduro Visits Beijing

China agreed to extend a $5 billion credit line to cash-strapped Venezuela, the country’s finance minister said, as President Nicolas Maduro headed to Beijing. Venezuelan Finance Minister Simon Zerpa told Bloomberg News on Thursday that the country would pay back the loan with either cash or oil. The countries were expected to sign what Zerpa described as a strategic alliance on gold mining. “Venezuela has a great alliance with China,” Zerpa said. The finance minister was speaking in Beijing ahead of a state visit by Maduro, who’s seeking greater Chinese support to weather a financial crisis that has led to unrest, assassination attempts and the collapse of the country’s currency. Maduro has halted most payments on Venezuela’s foreign debt and owes more than $6 billion to bondholders, cutting off most sources of new financing. China and Venezuela are finalizing agreements and would release details in a timely manner, Chinese foreign ministry spokesman Geng Shuang told reporters in Beijing on Thursday. Any financing cooperation would be in line with international norms, he said. “The domestic situation is getting better and Venezuela’s government is actively promoting economic and financial reform,” Geng told reporters. Zerpa said he met with Chinese Vice President Wang Qishan, as well as various ministers, while in Beijing. Venezuela “continues to look for a mutually agreed upon solution” with foreign bondholders, Zerpa said. The Trump administration, which is engaged in a trade war with China, had considered military action to end the long-running crisis in Venezuela. The U.S. held at least three meetings meetings with Venezuelan military officers before deciding not to help them overthrow Maduro, the New York Times reported Saturday.

U.S. oil producers lock-in 2019, 2020 revenue as prices rally – Reuters News

U.S. shale producers are locking in prices for their production as much as three years into the future in a sign that strong domestic crude pricing is nearing a peak, according to market sources familiar with money flows. U.S. crude prices for 2019 and 2020, based on an average of each year’s monthly contracts, have climbed this week above $68 and $64 a barrel, respectively, the highest levels in over three years. The rally comes even as front-month prices CLc1 have dropped from the 3-1/2-year highs touched during the summer. "Hedging activity has picked up considerably over recent weeks and this will continue to be the case as producers begin to frame budgets for next year," said Michael Tran, commodity strategist at RBC Capital Markets, noting the rally in forward prices are encouraging the producer bets. Hedging can reduce risks associated with volatility in oil prices, acting as an insurance contract to lock in a future selling price and fix spending plans. Such longer-term bets signal U.S. producers will continue to expand output, keeping a lid on prices, according to crude traders and brokers. The nation’s output this year has climbed above 10 million barrels per day (bpd), close to top producers Russia and Saudi Arabia. That output is forecast to grow next year by 840,000 bpd to average 11.5 million bpd. There was a large uptick in crude swap activity last week, with just shy of 8 million barrels changing hands in a day, an energy derivatives broker said, signaling strong hedging interest. Swaps are a type of contract that allow producers to lock in or fix the price they receive for their oil production. Almost 80 percent of the swap activity was split evenly between calendars 2020 and 2019, and the remaining 20 percent for this year, the broker said, adding that there was a small amount of calendar 2021 activity during the week. The market sources declined to say which oil companies were actively hedging in recent weeks. The move to hedge at these levels could prove risky for producers in a market where the price of oil for immediate delivery is higher than for later deliveries. Many U.S. shale producers hedged second-quarter production at about $55 a barrel, which backfired as U.S. crude climbed to more than $70 a barrel last quarter, the highest level since 2014. As a result, producers are using more "collars," a financial instrument that provides price protection on the downside while allowing them to share in some of the upside if prices rally. "We’ve been building a lot of collar structures," Christian Kendall, chief executive of Denbury Resources Inc DNR.N said last week, noting that the instruments will protect its production at about $60 a barrel and provide upside if oil rises to the high $70s per barrel. Denbury is nearly 50 percent hedged for 2019 and will add hedges to get to 60 percent to 70 percent of production, Kendall said. Meanwhile, oil companies that drill in the Permian Basin of West Texas and New Mexico, where local prices are $14 below futures because of full pipelines, are turning to a type of hedge geared to protecting them against regional weaknesses. "We have done an extensive amount of basis hedging," said Javan Ottoson, chief executive of SM Energy Co SM.N, which reported 11.2 million barrels of 2019 Permian oil production covered by basis hedges compared with 6.9 million barrels of 2018 production similarly covered at this time last year. Permian producers increased their 2020 oil-basis hedge positions by more than fourfold last quarter over the prior quarter with Concho Resources Inc and Energen Corp leading the surge, said consultancy Wood Mackenzie. For 2019, Midland-Cushing basis hedging rose by 52 percent and the consultancy attributed the sharp increases to worries that new pipelines may be delayed past their planned startups beginning in 2019. Open interest in U.S. crude futures for delivery in 13 months to 36 months and beyond has grown in almost every month so far in 2018, CME Group Inc said. Oil producers are "saying ‘we’re comfortable with our hedging in the front; we have appropriate hedges in place but what’s going to happen next,’" said Owain Johnson, managing director of energy research and product development at CME Group.

U.S. Cash Crude-Coastal grades ease gains as WTI/Brent narrows – Reuters News

U.S. coastal grades weakened from the highest levels in nearly three months on Wednesday as U.S. crude’s discount to Brent narrowed, dealers said. Coastal grades including Light Louisiana Sweet (LLS), Mars and WTI at East Houston, known as MEH, had firmed to the highest levels since mid-June on Tuesday. But grades came under pressure as U.S. crude’s discount to global benchmark Brent narrowed from over $10 a barrel, the biggest discount since June 19, touched on Tuesday. Coastal grades typically firm when the spread widens because it makes U.S. crude cheaper compared to Brent, boosting export demand. Meanwhile, U.S. crude inventories fell 5.3 million barrels in the week to Sept. 7 to 396.2 million barrels, the lowest level since February 2015, and about 3 percent below the five-year average for this time of year, the Energy Information Administration said. Analysts had forecast a decrease of 805,000 barrels. Inland grades were mixed, with WTI Midland trading near $14 per barrel below U.S. crude futures. Limited pipeline takeaway capacity out of the Permian basin, the largest oilfield in the U.S., has weighed on WTI Midland and West Texas Sour (WTS) differentials for months, but signs of moderating growth have helped prices strengthen in recent days.

- Light Louisiana Sweet for October delivery fell 95 cents to a midpoint of $7.25 and traded between $7 and $7.50 a barrel premium to U.S. crude futures.

- Mars Sour fell 75 cents to a midpoint of $3.75 and traded between $3.50 and $4 a barrel premium to U.S. crude futures.

- WTI Midland rose 25 cents to a midpoint of $14 a barrel discount and traded between $13.50 and $14.50 a barrel discount to U.S. crude futures.

- West Texas Sour fell 25 cents to a midpoint of $14.5 a barrel discount and was seen bid and offered between $15 and $14 a barrel discount to U.S. crude futures.

- WTI at East Houston, also known as MEH, traded at $6.85, $6.80 and $6.75 a barrel over WTI.

Canada Heavy Oil Falls to New Low as BP Whiting Shuts Unit

- Western Canadian Select falls $2.50 to $33.50/bbl discount to WTI futures at 1:44 p.m. Calgary time, lowest since Nov. 2013, data compiled by Bloomberg show

- BP Whiting refinery in Indiana, biggest in U.S. Midwest, has shut 75k b/d crude unit, smaller of 3, for 5-6 days of minor repairs, person familiar with operations says

- Shutdown happens prior to start of multi-unit turnaround staring mid-Sept. to early Nov.

- Edmonton Mixed Sweet crude at a $19/bbl discount to WTI, unchanged from Tuesday when it reached biggest discount in data back to 2014

- Synthetic crude weakens 50c to $13/bbl discount, biggest in almost 5 years

- Edmonton condensate discount narrows $1.50 to $10/bbl

- WCS absolute price $36.87/bbl, up 0.5% over past year vs. 46% gain for WTI

U.S. Cash Products-Group Three gasoline hits fresh 10-mth high on refiner buying – Reuters News

U.S. Group Three gasoline cash differentials rose to a more than 10-month high on Wednesday as refiners actively bought in the region, market participants said. Group Three gasoline gained 0.50 cent a gallon to trade at 7.50 cents per gallon above the gasoline futures benchmark on the New York Mercantile Exchange, traders said. The product has not traded that high since Nov. 3. Elsewhere in the Midwest, Chicago ultra-low sulfur diesel lost three-quarters of a cent to trade at 0.75 cent per gallon below the heating oil futures contract. In New York Harbor, F2 RBOB lost a penny to trade at 11.00 cents per gallon above futures, traders said. The summer-grade F2 is being phased out as the market transitions toward fuel that meets environmental regulations that shift seasonally. On the Gulf Coast, A3 CBOB gasoline lost half a penny to trade at 2.75 cents per gallon below futures, traders said. M3 conventional gasoline also fell half a cent, trading at 1.25 cents per gallon above futures. U.S. gasoline stocks rose 1.3 million barrels, the Energy Information Administration said on Wednesday, slightly below analysts’ expectations. Distillate stockpiles, which include diesel and heating oil, rose by 6.2 million barrels, versus expectations for a 1.4 million-barrel increase, the EIA data showed. Refinery crude runs rose by 210,000 bpd and utilization rates increased 1 percentage point to 97.6 percent of total capacity, EIA data showed. The RBOB futures contract on NYMEX gained 2.06 cents to settle at $2.0348 a gallon on Wednesday. NYMEX ultra-low sulfur diesel futures rose 0.57 cent to settle at $2.2577 a gallon. Renewable fuel (D6) credits for 2018 traded at 22.5 cents each on Wednesday, little changed from Tuesday, traders said. Biomass-based diesel credits (D4) fetched 43 cents each, also little changed from Tuesday, traders said.

U.S. waives gasoline rules in Virginia, Georgia as Florence nears – Reuters News

The U.S. Environmental Protection Agency said late on Wednesday it has temporarily waived air pollution regulations on gasoline in Georgia and Virginia as fuel supplies dip with the approach of Hurricane Florence. The agency approved waiver requests because it determined that "extreme and unusual fuel supply circumstances exist in portions of Virginia and Georgia as a result of the approaching hurricane," it said in a release. A day earlier, the EPA approved similar waivers for North Carolina and South Carolina. EPA waived through Sept. 15 rules on federal Reid vapor pressure requirements and through Sept. 30 rules on reformulated gasoline and the blending of reformulated gasoline blendstock. Officials in Virginia, North Carolina, and South Carolina this week warned retailers against price gouging, citing penalties for violating state of emergency rules against excessive price increases. Hurricane Florence has pushed up gas prices and stations in the Southeastern evacuation zones have experienced a run on fuel supplies. Gas prices in South Carolina have climbed by about 8 cents to nearly $2.59 a gallon from a week earlier, according to motorists’ advocacy group AAA. Early Tuesday, nearly 6 percent of Wilmington, North Carolina stations reported running out of supplies, said retail tracking service GasBuddy. The center of Florence, a slow-moving Category 3 hurricane on the five-step Saffir-Simpson scale, is expected to strike North Carolina late Thursday or early Friday and could drift southwest along the coast before turning inland, according to the National Hurricane Center in Miami. More than 1 million people have been ordered to evacuate the coastlines of the Carolinas and Virginia.

Colonial will not change fuel specs ahead of Hurricane Florence – Reuters News

A major pipeline operator that sends gasoline to the U.S. Southeast said on Wednesday it does not expect to take full advantage of a government waiver aimed at ensuring adequate fuel supplies to the region. On Tuesday, the U.S. Environmental Protection Agency (EPA) waived federal regulations requiring the use of low-volatility conventional gasoline for fuel sold in areas of North and South Carolina in anticipation of potential fuel shortages. The waiver would allow suppliers to ship off-season fuels if available. But Colonial Pipeline said in a notice that shippers will not be able to deliver off-season CBOB fuel authorized by the waiver. The pipeline is moving summer-grade CBOB gasoline, and off-season fall or winter barrels of the fuel would not get to areas affected by Hurricane Florence before the Sept. 15 waiver expires, it said. Hurricane Florence, the strongest storm to hit the region in decades, is expected to strike the coast of North Carolina late Thursday or early Friday. Gasoline requirements shift seasonally to meet environmental standards, and the waiver effectively allows the sale of winter- and summer-grade fuel. The EPA waiver also allows for the blending of reformulated gasolines with other blendstocks or oxygenates. The waiver of the prohibition is effective through Oct. 1. Colonial, which sends fuel from the Gulf Coast to the Northeast, was operating normally on Wednesday and preparing for potential flooding and loss of power due to Hurricane Florence, the operator said in a notice to shippers. Colonial has generators on standby to be delivered in the event of a power loss along the line. If the storm affects remote sections of the pipeline, there would be likely no impacts to gasoline and products supply in the Northeast, said Patrick DeHaan, head of petroleum analysis at tracking firm GasBuddy. DeHaan added he did not expect widespread gasoline shortages due to the storm.

Asian naphtha crushed by supplies from Europe, cracker maintenance – Reuters News

Plentiful supplies from Europe have crushed the Asian naphtha market this week, sending spot prices in Taiwan into discount levels and flipping the forward price structure into contango for the first time since July 2017. The bearishness could last at least another month as there are no signs the abundant supplies will ease, especially with reduced demand from petrochemical units that have shut for planned maintenance, trade and industry sources said. This month, South Korea’s Lotte Chemical and Japan’s Idemitsu Kosan will each shut a cracker for maintenance. The maintenance period at Lotte Chemical’s 1 million tonnes-per-year (tpy) cracker alone would easily wipe out 250,000 tonnes of naphtha demand. But cargoes arriving from Europe and the Mediterranean this month would reach some 1.7 million tonnes, the highest monthly eastbound volumes in more than five months. In addition to this, Middle East supplies will top 3.2 million tonnes this month versus August at 2.3 million-2.4 million tonnes, according to a weekly report by Thomson Reuters Oil Research. And while cargoes from Europe and the Med arriving in October could fall to 1.3 million tonnes, that would still outpace arbitrage demand for such shipments capped at about 1 million tonnes, said an industry source who monitors the Asia-bound shipments closely. It usually takes about 30 to 35 days for cargoes to arrive in Asia from Europe via the Suez Canal. Also, amid these shipments overloading Asia came offers from Abu Dhabi National Oil Company , which usually does not sell spot cargoes since most of its volumes are tied up in long-term contracts. ADNOC offered a spot cargo for October loading from Ruwais, almost immediately after selling a parcel for September loading. To find homes for the surplus volumes, sellers have had to offer cargoes at discounts to win over buyers, pushing the forward market into contango. Asia’s top naphtha buyer Formosa Petrochemical Corp 6505.TW, for instance, inked a spot deal on Tuesday for 100,000 tonnes of naphtha for second-half October arrival at Mailiao at discounts of about $3 a tonne to its own price formula on a cost-and-freight (C&F) basis. This was the first discount the Taiwan company had paid for open-specification naphtha since February. South Korea’s Yeochun NCC (YNCC)had already paid a discount for naphtha as early as Aug. 28. Naphtha is not only used to make petrochemical products such as plastics and polyester, but it is also used as a blending component for gasoline. Thus, recent weakness in Europe’s gasoline market also explains the movement of naphtha to Asia, said consulting and research firm JBC Energy in a note this week. "Despite the overhang in Asia, there seems to be a need for the West to push cargoes over," said a Singapore-based trader who tracks deals and Asia-bound cargoes closely.

Singapore fuel oil inventories slip despite surge in net imports – Reuters News

Despite a more than three-fold increase of fuel oil net imports into Singapore, onshore inventories dipped to a three-week low of 15.943 million barrels, or about 2.38 million tonnes, in the week ended Sept. 12, official data showed on Thursday.

– Singapore’s weekly onshore fuel oil inventories were down 1 percent, or 125,000 barrels, or about 19,000 tonnes in the week ended Wednesday, data from International Enterprise (IE) Singapore showed.

– Net imports of fuel oil into Singapore in the week ended Sept. 12 were at a two-week high of 1.293 million tonnes, over four-fold from a five-week low of 286,000 tonnes in the week before, the data showed.

– Singapore fuel oil net imports have averaged 774,000 tonnes per week in 2018.

– This week’s onshore fuel oil inventories were 32 percent lower than a year ago.

– Singapore’s net exports of fuel oil to Hong Kong topped the week ended Sept. 12 at 67,000 tonnes, followed by China at 47,000 tonnes and Thailand at 20,000 tonnes.

– The largest net imports into Singapore originated from Iraq at 341,000 tonnes, a seven-week high, followed by the United States at 194,000 tonnes, the Netherlands at 161,000 tonnes and Latvia at 127,000 tonnes.

– Fuel oil inventories in Singapore have averaged 19.312 million barrels, or 2.882 million tonnes, a week since the start of 2018, compared with 23.552 million barrels, or 3.515 million tonnes, in 2017.

Singapore Weekly Fuel Stockpiles for Sept. 12 Fell 9.4% W/W

- Total stockpiles 36.6m bbl, -9.4% w/w

- Light Distillates 11.4m bbl, -12.6% w/w

- Middle Distillates 9.3m bbl, -18.0% w/w

- Residues 15.9m bbl, -0.8% w/w

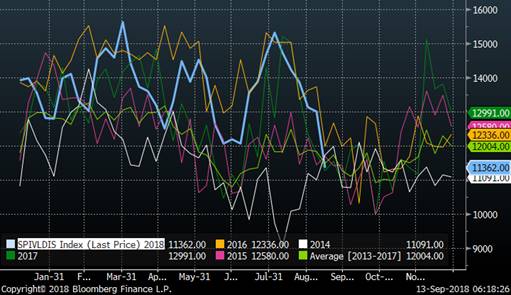

Singapore Light Distillate Stocks

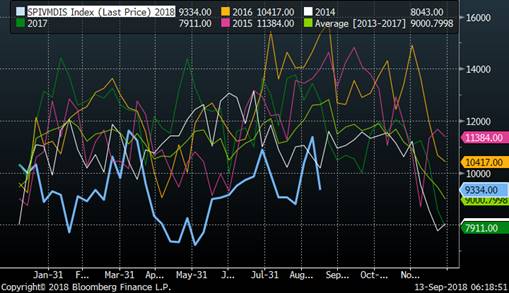

Singapore Middle Distillate Stocks

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTC); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTC waives no privilege or confidentiality due to any mistaken transmission of this email.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTC); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTC waives no privilege or confidentiality due to any mistaken transmission of this email.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTC); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTC waives no privilege or confidentiality due to any mistaken transmission of this email.