From: Wagner, Jonathan

Sent: Sunday, September 09, 2018 4:38:08 PM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Weekend Rundown

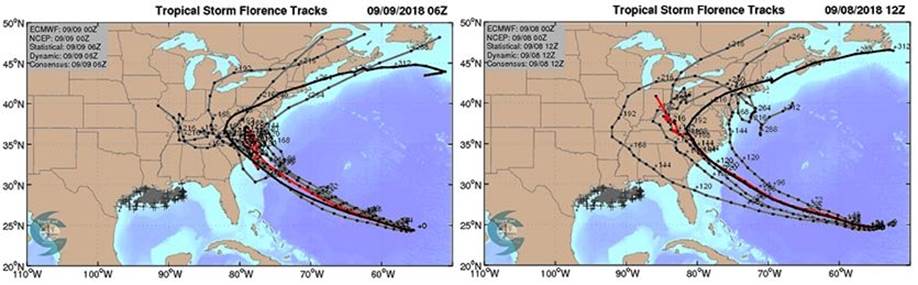

Good afternoon. First of all I want to wish you all a L’Shana Tovah (Happy New Year) as we welcome year 5779. In Iran today Foreign Minister Zarif was keeping busy on twitter wishing a happy new year as well. "As the sun gives way to the moon, I wish all my Jewish compatriots and Jews worldwide a very Happy New Year filled with peace and harmony. Happy Rosh Hashanah," Zarif said in his tweet. In Iraq, production continues to be unaffected by Riots as the country is currently producing 4.36m b/d with a current capacity of 4.75mb/d. Iraq has restarted their Salahuddin-2 unit @ their Baji oil refinery and currently refining capacity now stands at more than 700k b/d. Iraq has also released their latest OSP’s hsowing Oct Basrah Light at -.15/bbl and Basrah Heavy at -3.35/bbl to Asia. In the US Tropical Storm Florence continues to head towards East coast with current winds of 75mph. Products were well bid on Friday due to Bayway’s latest headline that that will be shutting their 145k b/d FCC until the end of September. For the upcoming week, the EIA releases its monthly Short-Term Energy Outlook on Tuesday, followed by OPEC’s monthly report Wednesday. The IEA is due to publish its monthly market report Thursday morning.

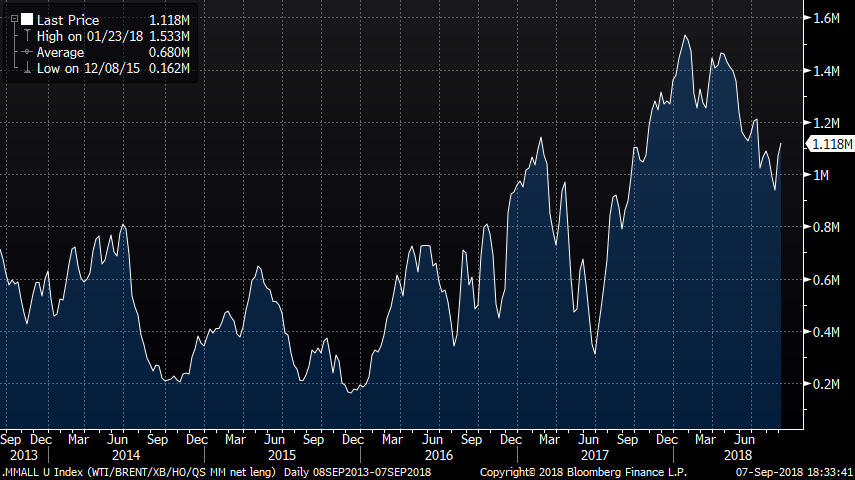

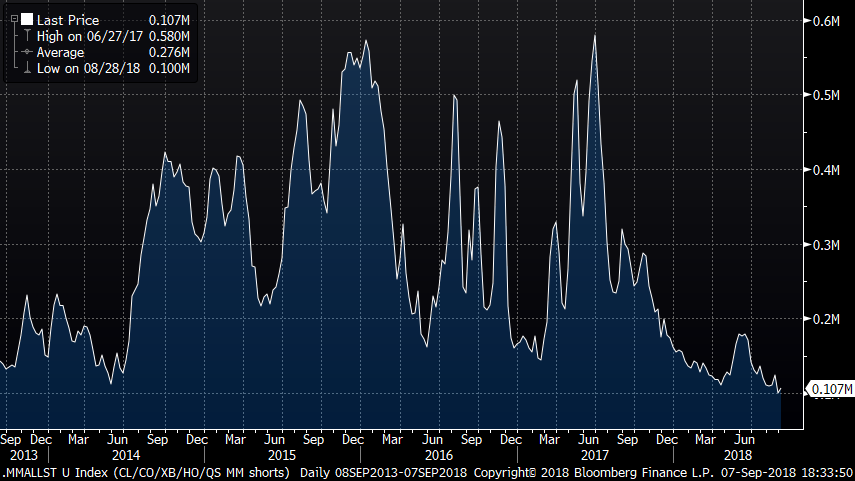

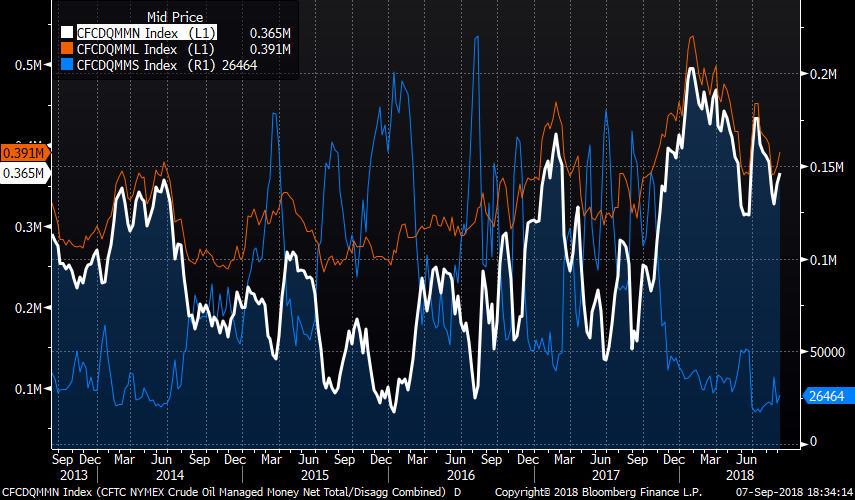

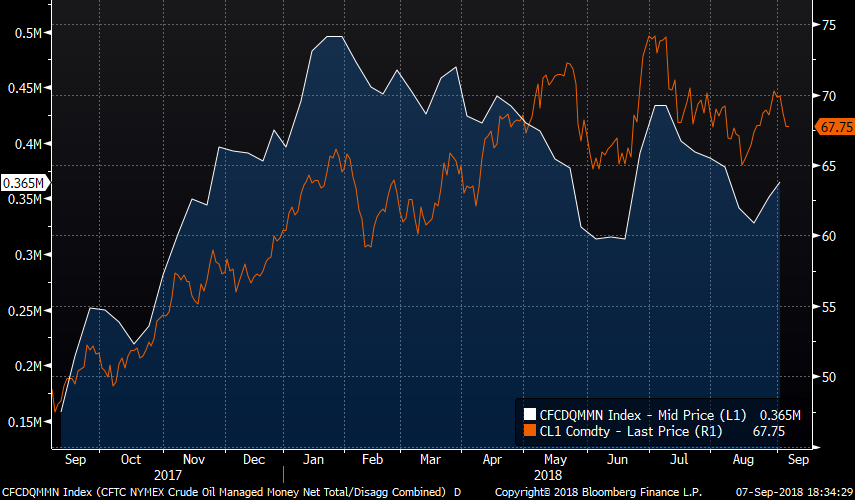

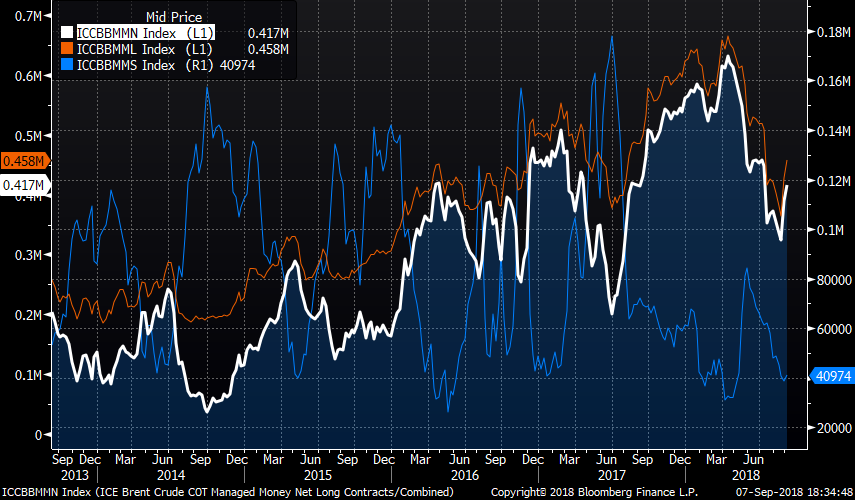

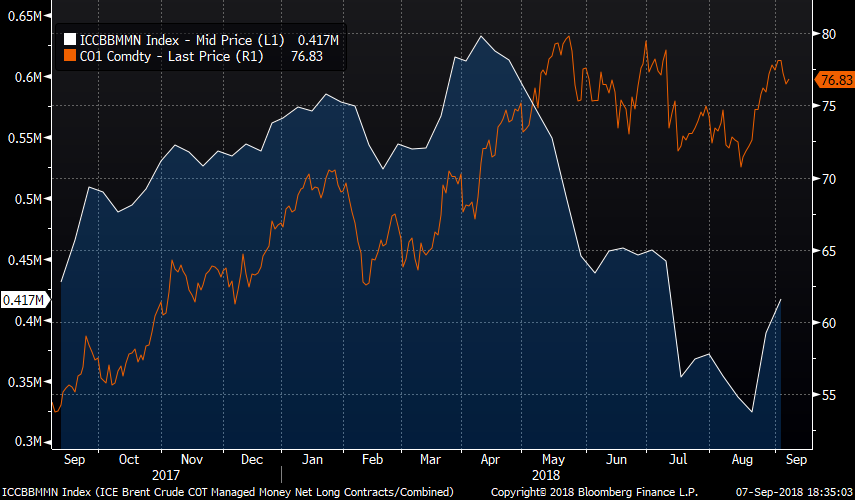

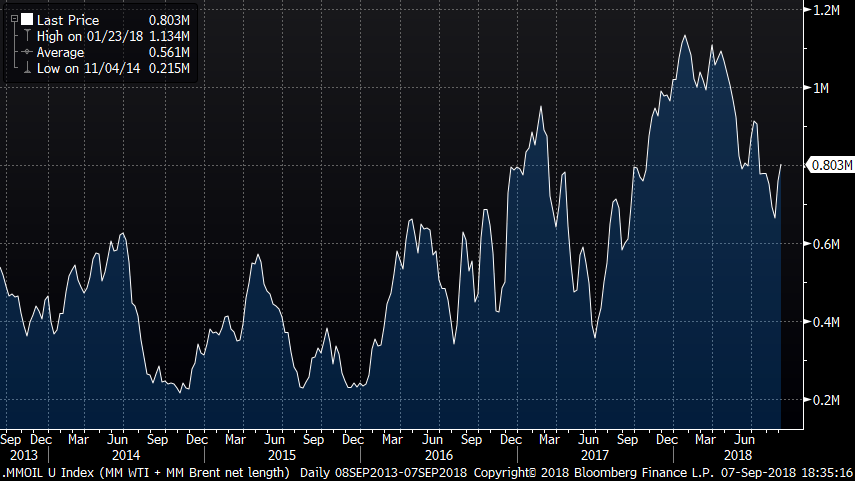

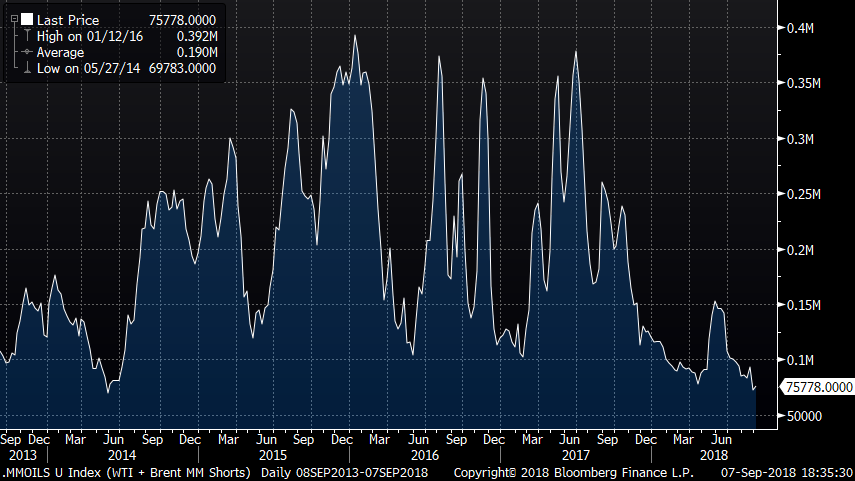

COT data released Friday showed another weekly increase in aggregate Brent and WTI Managed money net length. MM increased by 50,226 last week with all of it coming in the form of new length. Over the past 2 weeks WTI and Brent managed money net length has increased by 144k lots (+125k of new length). WTI commercial positioning declined by 9k lots last week and increase seen in producer and swap dealer shorts. Brent commercial positioning declined by 10k lots as well. In products, Rbob managed money net length fell by 3700 lots while ULSD and gasoil MM net length increased by 3600 and 3900 lots respectively.

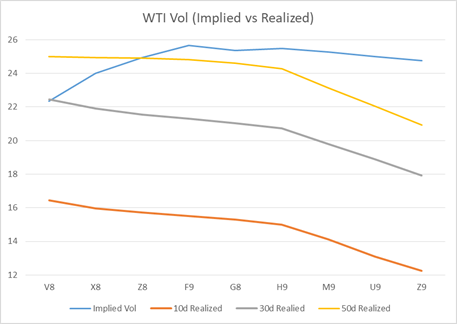

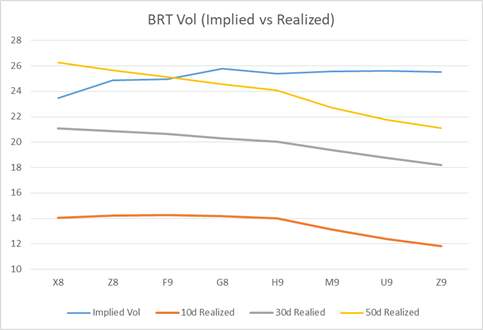

Vols were bid in C19 in both WTI and Brent week over week as good interest to own put spreads were seen in the M9-Z9 Brent bucket. Producer flow in WTI continues to be seen with good chucks of fences and three ways going through earlier in the week. Front end put skew continues to grind lower while out the curve in Brent wingy put skew also has been griding lower as the large put spreads going through are buying the near atm’s and selling the wings. Bal ’18 Risk reversals in both WTI and Brent show put skew on the low of the year (charts below). Wingy q1 call skew is off its high but doesn’t appear to look “cheap” at these levels. Front end brent vols were under pressure late in the week as breakevens fell from the mid 1.20’s to 1.14 on Friday in X8. Z8 Breakevens are still trading at 1.20. Post close Friday front end vols were actually bid as there was interest to own Brt X8 atm calls.

Strengthening Hurricane Florence blasts toward U.S. East Coast – Reuters News

Florence intensified into a hurricane on Sunday and is expected to strengthen rapidly as it churns across the Atlantic Ocean toward the U.S. East Coast, where it could make landfall by the end of the week. With winds at 75 miles per hour (120 km per hour), Florence became a Category 1 hurricane and was expected to develop within a day into a major storm, defined as Category 3 or higher, according to the National Hurricane Center (NHC) in Miami. "Make your plans now," South Carolina Governor Henry McMaster urged residents during a Sunday afternoon news conference. "Presume that a major hurricane is going to hit right smack dab in the middle of South Carolina." Forecasters were also tracking two more storms further out in the Atlantic, with Tropical Storm Isaac expected to become a hurricane later on Sunday as it barreled toward the Caribbean. U.S. residents from South Carolina to Virginia were warned that Florence posed an increasing risk of life-threatening coastal storm surge, as well as flooding from heavy rainfall inland. On its current trajectory, winds from the hurricane could reach the southeastern United States late on Wednesday or Thursday, with Florence possibly making landfall around the Carolinas on Thursday or Friday. The slow-moving storm system could further stall over the region, dumping rain and causing significant flooding, the National Weather Service said. McMaster said he has asked U.S. President Donald Trump to declare a federal emergency in the state in anticipation of the storm’s arrival. North Carolina Governor Roy Cooper also urged his state’s residents to get ready, noting the storm already was generating swelling waves and life-threatening currents along its coast. "Everyone in North Carolina needs to keep a close eye on Florence and take steps now to get ready for impacts later this week," Cooper said in a statement on Sunday. The governors of Virginia, North Carolina and South Carolina have declared states of emergency. The storm’s center was 750 miles (1,200 km) southeast of Bermuda at 11 a.m. EDT on Sunday. It was on track to move between Bermuda and the Bahamas on Wednesday, the NHC said. Meanwhile, Tropical Storm Isaac, with maximum sustained winds of 65 mph (100 kph) on Sunday, was about 1,500 miles east of the Windward Islands, forecasters said. The forecast showed Isaac tracking south of Puerto Rico as it strengthened into a hurricane. A third storm, Helene, off the Cabo Verde Islands was also expected to become a hurricane later on Sunday but did not appear to pose an immediate threat to land.

Iraq Oil Output at 4.36m b/d, Unaffected by Riots: Minister

Iraq producing about 4.36m b/d of crude as agreed with OPEC and has capacity to pump about 4.75m b/d, Oil Minister Jabbar al-Luaibi tells reporters at news conference in Baghdad.

- Situation in south improving; energy installations not affected by protests

- “Output continued in the past days normally despite the difficult situation”

- Iraq restarted the Salahuddin-2 unit of Baiji oil refinery, north of Baghdad, on Sunday; unit processing 70k b/d

- Iraq refining capacity currently at more than 700k b/d after Salahuddin-2 unit restart: Deputy Oil Minister Fayyad Al-Nima tells Bloomberg at same event

- Country’s refining capacity to reach 800k b/d after Salahuddin-1 unit restarts at end of year or early next year, Al-Nima says

Iraq Sets Oct. Basrah Light Oil to Asia at 15c/Bbl Discount

Iraq sets October official selling price of Basrah Light crude at 15c/bbl discount and Basrah Heavy oil at $3.35/bbl discount to average of Dubai and Oman for Asian buyers, country’s State Oil Marketing Co., or SOMO, says in emailed statement.

- For Europe: (against Dated Brent/bbl)

- Basrah Light set at $4.00 discount

- Basrah Heavy at $6.95 discount

- Kirkuk at $2.75 discount

- For Americas: (against ASCI/bbl)

- Basrah Light at 50c discount

- Basrah Heavy at $3.10 discount

- Kirkuk at 55c premium

U.S. Wish for Zero Oil Imports From Iran Granted by South Korea

South Korea has become the first of Iran’s top-three oil customers to fulfill a hard-line U.S. demand that buyers cut imports to zero. The Asian nation didn’t import any crude from Iran last month, compared with 194,000 barrels a day in July, tanker-tracking and shipping data compiled by Bloomberg show. While bigger consumers China and India have curbed buying from the OPEC producer, South Korea’s gone one step further by halting purchases before the U.S. imposes sanctions on the Islamic republic on Nov. 4. Donald Trump’s administration made the demand over Iranian oil after the U.S. president in May withdrew from a 2015 deal that lifted many sanctions on the Middle East nation in exchange for restrictions on the country’s nuclear program. South Korea heeding that call may signal America’s clout over the North Asian nation. Trapped in a decades-long war in the Korean peninsula, the South’s government has relied on the U.S. to pressure the North’s leader, Kim Jong Un, to abandon its nuclear program. Political ties to America mean it can’t ignore Trump’s order for allies to adopt a tough policy on Iran, according to the Korea Energy Economics Institute. “Maintaining relations with the U.S. is of the utmost importance to South Korea,” Kim Jae-kyung, a research fellow at the institute said. “South Korea’s national security depends on its military alliance with America, which is prompting it to proactively reduce imports before the governments have completed negotiations.” The South Korean government’s official stance over Iranian sanctions is that it’s continuing talks with the U.S. in a bid to seek a waiver. While the Trump administration has softened its stance slightly, going from zero tolerance on purchases to saying it will consider exemptions, they are yet to be granted and buyers still face the risk of being cut off from the American financial system after the November deadline. “We will consider waivers where appropriate,” U.S. Secretary of State Michael Pompeo said at a press briefing in New Delhi on Thursday. But “it is our expectation that the purchases of Iranian crude oil will go to zero from every country or sanctions will be imposed,” he said. While the relationship between Trump and Kim was fraught in the initial phase of the U.S. president’s rule, diplomatic relations have since warmed, culminating in a historic summit between the two in Singapore in June. South Korean President Moon Jae-in said Trump deserves “great credit” for bringing the North to talks. Earlier this month, Kim told visiting South Korean envoys he was ready to accept “stronger measures” to restrict his nuclear program and wanted a declaration with the U.S. to formally end the Korean War.

Under Pressure

It’s not the first time Trump has leaned on South Korea. He berated the Asian nation for a trade surplus in 2017, and named it in a currency watch list the year before. A South Korean government official responded that the country will look into whether there’s room to increase energy purchases from America, and a few months later the energy minister said it wants to include the U.S. in its import portfolio. While in New Delhi last week, Pompeo added that he would be “happy to see if it’s American products that are able to” fill in the gap of lost supply from Iran. But a switch may not be simple for refiners because the quality of all U.S. output isn’t similar to oil from the Persian Gulf state. “South Korea will comply with the U.S. sanctions on Iran for the multitude of reasons — national security, trade to name a few,” said WengInn Chin, a senior oil market analyst at industry consultant FGE in Singapore. “Companies will not want to risk any actions by the U.S. for breaching the sanctions. South Korean refiners will have to replace the volumes.”

Iran’s Zarif sends Jewish New Year greetings on Twitter – Reuters News

Iranian Foreign Minister Mohammad Javad Zarif tweeted Jewish New Year greetings to Jews in Iran and around the world on Sunday, as tensions mount between the Islamic Republic and Israel over Tehran’s regional role. "As the sun gives way to the moon, I wish all my Jewish compatriots and Jews worldwide a very Happy New Year filled with peace and harmony. Happy Rosh Hashanah," Zarif said in his tweet. Israel said last week it had carried out more than 200 attacks against Iranian targets in Syria in the past two years, and it signaled last Monday that it could attack suspected Iranian military assets in Iraq. Iran does not recognise Israel and warned last month it would hit U.S. and Israeli targets if it were attacked by the United States after President Donald Trump’s security adviser said Washington would exert maximum pressure on Tehran going beyond economic sanctions. Zarif, who has sent similar greetings in the past along with President Hassan Rouhani, also tweeted pictures of ceremonies held among Iran’s Jewish minority. Iran’s ancient Jewish community has slumped to an estimated 10,000 to 20,000 from 85,000 at the time of the 1979 Islamic Revolution, but is believed to be the biggest in the Middle East outside Israel.

Iran completes facility to build centrifuges – nuclear chief – Reuters News

Iran has completed a facility to build advanced centrifuges, Iran’s nuclear chief was quoted on Sunday as saying, as Tehran prepares to increase its uranium-enrichment capacity if the nuclear deal collapses after the United States exits. In June, Ali Akbar Salehi, the head of the Atomic Energy Organization of Iran, said the facility at the Natanz nuclear plant would be completed within a month. Salehi’s statement in June came days after Supreme Leader Ayatollah Ali Khamenei said he had ordered preparations to increase the country’s uranium enrichment capacity if the nuclear agreement with world powers collapsed. On Sunday, the official news agency IRNA quoted Salehi as saying: "(Ayatollah Khamenei) had ordered us to set up and complete a very advanced hall for the construction of modern centrifuges, and this hall has now been fully equipped and set up." Salehi said Iran’s announced plans to build nuclear reactors for ships, while staying within the limits set by its atomic deal with major powers, was "advancing well but would take 10 to 15 years to complete", IRNA said. "A third step (in reaction to the U.S. withdrawal) might be to suspend some of the limitations within the nuclear agreement, for example on the volume and level of enrichment," Salehi said, according to IRNA. "And the final scenario can be a complete exit from the nuclear accord, which I hope will never happen, with the help of (remaining signatories), because everyone would suffer," Salehi added. Iranian officials have said they would decide whether to quit the 2015 nuclear deal after studying a planned European package of economic measures that could help offset U.S. sanctions.

Iranian Guards claims missile attack on Iraq-based Kurd dissidents – Reuters News

Iran’s Revolutionary Guards fired seven missiles in an attack on Iraq-based Iranian Kurdish dissidents that killed at least 11 people on Saturday, the elite military unit was reported as saying by Iranian news agencies on Sunday. Iraqi Kurdish officials said Iran attacked the base of an Iranian Kurdish armed opposition group in northern Iraq on Saturday, killing at least 11 people and wounding scores more. "In a successful operation, the Guards’ aerospace unit, along with the army’s drone unit … targeted a criminal group’s meeting and a terrorist training centre with seven short-range surface-to-surface missiles," the Revolutionary Guards said in a statement carried by the semi-official news agency Fars. The statement said the attack was prompted by a decision of "group leaders to ignore serious warnings by officials of the Kurdistan Regional Government about Iran’s determination to dismantle their bases … and the need for an end to terrorist and aggressive actions against Iran". Armed Iranian Kurdish groups operate in remote and mountainous Iran-Iraq border regions. Despite sporadic clashes between Iranian forces and militants, there is little coordination between Iranian and Iraqi forces over security of an area that has also been used by Islamic State to enter Iran. The Democratic Party of Iranian Kurdistan, an armed opposition group fighting for greater autonomy for Iran’s Kurdish community, posted on Twitter pictures and video of explosions, as well as of the wounded, at its headquarters in Koya, in Iraq’s semi-autonomous Kurdistan region. Turkey has also ramped up air strikes on Kurdistan Workers’ Party (PKK) bases in northern Iraq this year. It routinely targets the PKK stronghold in the Qandil mountains, near the border with Iran, where Ankara suspects high-ranking members of the militant group are located.

Armed groups agree to maintain Tripoli ceasefire – U.N. – Reuters News

Armed groups vying for control of the Libyan capital have agreed to set up a mechanism to "consolidate" a recently agreed ceasefire, the United Nations’ Libya mission, UNSMIL, said on Sunday. On Tuesday, the United Nations persuaded various armed groups to halt fighting that had killed dozens in Tripoli, one of the many sites of unrest gripping the oil producer. "Parties agreed today to freeze their forces’ movements, a monitoring & verification mechanism to consolidate the ceasefire + development of a plan to withdraw armed groups from sovereign locations and critical infrastructure in #Tripoli," UNSMIL tweeted. At a meeting, UNSMIL Libya envoy Ghassan Salame urged the armed groups to address issues through understanding, not bloodletting, UNSMIL said, showing pictures of the event. It gave no further details. Tripoli is formally controlled by the internationally recognised Government of National Accord, but armed groups working with the GNA act with autonomy. Eastern Libya is controlled by a rival administration. The fighting started at the end of August because armed groups outside Tripoli had opposed a cartel of four “super militias” controlling access to state funds and foreign currency at a huge discount from the central bank. The ceasefire has largely held, allowing residents to buy food, as well as fuel for the generators that have been needed to provide power because of an electricity outage in western Libya.

Libya Is Said to Raise Oil Pumped to Harouge Tanks to 115k B/D

Crude pumped to Harouge Oil Operations storage tanks from Amal, Nafoura and Wintershall fields rises from 100k b/d last week, according to a person with direct knowledge, who asked not to be identified because the information isn’t public. Amal production rises to 32k b/d from 24k b/d, Nafoura to 32k b/d from 25k b/d last week and Wintershall is stable at about 50k b/d

|

|

7-Sep |

W/W % Change |

YTD % Change |

|

S&P 500 |

2,871.68 |

-1.03% |

7.41% |

|

Euro Stoxx 50 |

3,293.36 |

-2.93% |

-6.01% |

|

FTSE 100 |

7,277.70 |

-2.08% |

-5.33% |

|

DAX |

11,959.63 |

-3.27% |

-7.42% |

|

Nikkei |

22,307.06 |

-2.44% |

-2.01% |

|

Hang Seng |

26,973.47 |

-3.28% |

-9.85% |

|

CSI 300 |

3,277.64 |

-1.71% |

-18.69% |

|

DXY |

95.34 |

0.21% |

3.49% |

|

EUR |

1.16 |

-0.42% |

-3.77% |

|

GBP |

1.29 |

-0.31% |

-4.39% |

|

10 Year Yield |

2.94 |

2.29% |

22.18% |

|

Front Rolling WTI |

67.75 |

-2.94% |

12.13% |

|

Front Rolling Brent |

76.83 |

-0.76% |

14.89% |

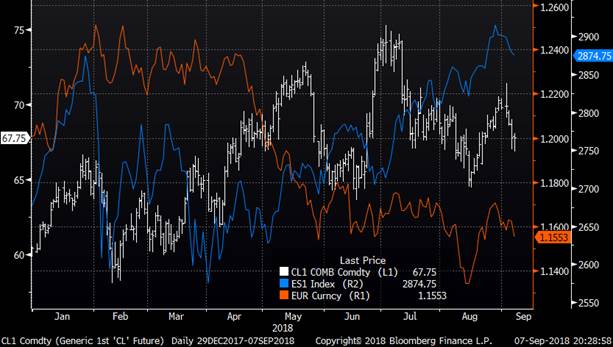

CL1 / ES1 / EUR (YTD)

CL1 / ES1 / EUR (YTD % Change)

Daily Vol Change

|

WTI Vol |

6-Sep |

7-Sep |

Change |

BRT Vol |

6-Sep |

7-Sep |

Change |

|

|

V8 |

22.60 |

22.34 |

-0.26 |

X8 |

25.00 |

23.46 |

-1.54 |

|

|

X8 |

24.26 |

24.01 |

-0.25 |

Z8 |

25.42 |

24.87 |

-0.55 |

|

|

Z8 |

25.11 |

24.93 |

-0.18 |

F9 |

25.21 |

24.94 |

-0.27 |

|

|

F9 |

25.76 |

25.66 |

-0.1 |

G8 |

25.93 |

25.76 |

-0.17 |

|

|

G8 |

25.44 |

25.36 |

-0.08 |

H9 |

25.54 |

25.38 |

-0.16 |

|

|

H9 |

25.61 |

25.47 |

-0.14 |

M9 |

25.72 |

25.57 |

-0.15 |

|

|

M9 |

25.36 |

25.28 |

-0.08 |

U9 |

25.70 |

25.61 |

-0.09 |

|

|

U9 |

25.07 |

25.01 |

-0.06 |

Z9 |

25.47 |

25.51 |

0.04 |

|

|

Z9 |

24.82 |

24.76 |

-0.06 |

Weekly Vol Change

|

Implied Vol |

Realized Vol |

|||||||

|

WTI Vol |

31-Aug |

7-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

V8 |

22.85 |

22.34 |

-0.51 |

0.96 |

16.45 |

22.45 |

25.00 |

|

|

X8 |

23.56 |

24.01 |

0.45 |

1.03 |

15.97 |

21.89 |

24.95 |

|

|

Z8 |

24.08 |

24.93 |

0.85 |

1.06 |

15.73 |

21.56 |

24.92 |

|

|

F9 |

24.58 |

25.66 |

1.08 |

1.09 |

15.51 |

21.30 |

24.81 |

|

|

G9 |

24.27 |

25.36 |

1.09 |

1.08 |

15.31 |

21.05 |

24.60 |

|

|

H9 |

24.3 |

25.47 |

1.17 |

1.08 |

15.00 |

20.74 |

24.29 |

|

|

M9 |

24.05 |

25.28 |

1.23 |

1.06 |

14.12 |

19.79 |

23.13 |

|

|

U9 |

24.15 |

25.01 |

0.86 |

1.04 |

13.10 |

18.88 |

22.04 |

|

|

Z9 |

23.74 |

24.76 |

1.02 |

1.02 |

12.25 |

17.92 |

20.92 |

Front Rolling CL1 ATM Implied Vol

|

Implied Vol |

Realized Vol |

|||||||

|

BRT Vol |

31-Aug |

7-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

24.16 |

23.46 |

-0.7 |

1.14 |

14.07 |

21.11 |

26.25 |

|

|

Z8 |

24.79 |

24.87 |

0.08 |

1.2 |

14.24 |

20.86 |

25.67 |

|

|

F9 |

24.53 |

24.94 |

0.41 |

1.2 |

14.29 |

20.63 |

25.12 |

|

|

G9 |

25.26 |

25.76 |

0.5 |

1.24 |

14.17 |

20.31 |

24.58 |

|

|

H9 |

24.91 |

25.38 |

0.47 |

1.21 |

13.99 |

20.04 |

24.06 |

|

|

M9 |

24.85 |

25.57 |

0.72 |

1.21 |

13.13 |

19.36 |

22.70 |

|

|

U9 |

25.02 |

25.61 |

0.59 |

1.21 |

12.39 |

18.75 |

21.76 |

|

|

Z9 |

24.75 |

25.51 |

0.76 |

1.18 |

11.84 |

18.21 |

21.12 |

Front Rolling CO1 ATM Implied Vol

WTI Skew Change (w/w)

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

V8 |

2.4 |

1.8 |

0.95 |

0.45 |

22.34 |

-0.1 |

0.05 |

0.5 |

1 |

|

V8 (8/31) |

2.8 |

2.15 |

1.3 |

0.65 |

22.85 |

-0.35 |

-0.4 |

-0.2 |

0.1 |

|

|

-0.4 |

-0.35 |

-0.35 |

-0.2 |

-0.51 |

0.25 |

0.45 |

0.7 |

0.9 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

X8 |

2.2 |

1.6 |

0.95 |

0.45 |

24.01 |

-0.15 |

-0.05 |

0.45 |

1.1 |

|

X8 (8/31) |

2.55 |

1.95 |

1.2 |

0.6 |

23.56 |

-0.3 |

-0.3 |

0.1 |

0.7 |

|

Change |

-0.35 |

-0.35 |

-0.25 |

-0.15 |

0.45 |

0.15 |

0.25 |

0.35 |

0.4 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

2.6 |

1.95 |

1.25 |

0.7 |

24.93 |

-0.4 |

-0.45 |

-0.2 |

0.3 |

|

Z8 (8/31) |

3.05 |

2.35 |

1.5 |

0.8 |

24.08 |

-0.45 |

-0.55 |

-0.3 |

0.2 |

|

Change |

-0.45 |

-0.4 |

-0.25 |

-0.1 |

0.85 |

0.05 |

0.1 |

0.1 |

0.1 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

2.9 |

2.25 |

1.55 |

0.9 |

25.66 |

-0.5 |

-0.65 |

-0.5 |

-0.05 |

|

F9 (8/31) |

3.2 |

2.55 |

1.7 |

0.95 |

24.58 |

-0.6 |

-0.7 |

-0.5 |

0.05 |

|

Change |

-0.3 |

-0.3 |

-0.15 |

-0.05 |

1.08 |

0.1 |

0.05 |

0 |

-0.1 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.3 |

2.7 |

1.95 |

1.1 |

25.36 |

-0.7 |

-0.85 |

-0.75 |

-0.3 |

|

G9 (8/31) |

3.45 |

2.9 |

2.05 |

1.15 |

24.27 |

-0.75 |

-0.95 |

-0.7 |

-0.2 |

|

Change |

-0.15 |

-0.2 |

-0.1 |

-0.05 |

1.09 |

0.05 |

0.1 |

-0.05 |

-0.1 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.55 |

3.05 |

2.3 |

1.35 |

25.47 |

-0.85 |

-1.1 |

-1 |

-0.6 |

|

H9 (8/31) |

3.95 |

3.4 |

2.4 |

1.35 |

24.3 |

-0.85 |

-1.1 |

-0.95 |

-0.45 |

|

Change |

-0.4 |

-0.35 |

-0.1 |

0 |

1.17 |

0 |

0 |

-0.05 |

-0.15 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4.6 |

4 |

3 |

1.75 |

25.28 |

-1.15 |

-1.45 |

-1.35 |

-0.9 |

|

M9 (8/31) |

4.75 |

4.15 |

3.1 |

1.8 |

24.05 |

-1.15 |

-1.45 |

-1.3 |

-0.8 |

|

Change |

-0.15 |

-0.15 |

-0.1 |

-0.05 |

1.23 |

0 |

0 |

-0.05 |

-0.1 |

WTI Nov 25 Delta Put Skew

WTI Dec 15 Delta Risk Reversal (Put Prem)

WTI Feb 10 Delta Call Skew

Brent Skew Change (w/w)

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

X8 |

1.65 |

1.1 |

0.5 |

0.2 |

23.46 |

0.1 |

0.35 |

0.9 |

1.5 |

|

X8 (8/31) |

2.15 |

1.5 |

0.8 |

0.35 |

24.16 |

-0.1 |

0.05 |

0.45 |

0.95 |

|

Change |

-0.5 |

-0.4 |

-0.3 |

-0.15 |

-0.7 |

0.2 |

0.3 |

0.45 |

0.55 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

2.1 |

1.3 |

0.6 |

0.25 |

24.87 |

0.05 |

0.25 |

0.8 |

1.7 |

|

Z8 (8/31) |

2.55 |

1.6 |

0.85 |

0.4 |

24.79 |

-0.15 |

-0.1 |

0.3 |

1.1 |

|

Change |

-0.45 |

-0.3 |

-0.25 |

-0.15 |

0.08 |

0.2 |

0.35 |

0.5 |

0.6 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

2.95 |

1.75 |

0.85 |

0.4 |

24.94 |

-0.15 |

-0.2 |

0.2 |

1.1 |

|

F9 (8/31) |

2.95 |

2.1 |

1.1 |

0.5 |

24.53 |

-0.2 |

-0.2 |

0.1 |

0.5 |

|

Change |

0 |

-0.35 |

-0.25 |

-0.1 |

0.41 |

0.05 |

0 |

0.1 |

0.6 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

2.75 |

1.9 |

1.1 |

0.55 |

25.76 |

-0.3 |

-0.3 |

-0.05 |

0.6 |

|

G9 (8/31) |

3.15 |

1.9 |

1.15 |

0.65 |

25.26 |

-0.45 |

-0.65 |

-0.4 |

0.55 |

|

|

-0.4 |

0 |

-0.05 |

-0.1 |

0.5 |

0.15 |

0.35 |

0.35 |

0.05 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.15 |

2.25 |

1.45 |

0.85 |

25.38 |

-0.6 |

-0.7 |

-0.15 |

0.85 |

|

H9 (8/31) |

3.35 |

2.4 |

1.6 |

0.95 |

24.91 |

-0.65 |

-0.8 |

-0.45 |

0.45 |

|

|

-0.2 |

-0.15 |

-0.15 |

-0.1 |

0.47 |

0.05 |

0.1 |

0.3 |

0.4 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4.05 |

3.35 |

2.35 |

1.4 |

25.57 |

-0.95 |

-1.1 |

-0.6 |

0.2 |

|

M9 (8/31) |

4.25 |

3.55 |

2.5 |

1.4 |

24.85 |

-0.9 |

-1.05 |

-0.6 |

0.2 |

|

|

-0.2 |

-0.2 |

-0.15 |

0 |

0.72 |

-0.05 |

-0.05 |

0 |

0 |

Brent Nov 25 Delta Put Skew

Brent Dec 15 Delta Risk Reversal (Put Prem)

Brent Feb 10 Delta Call Skew

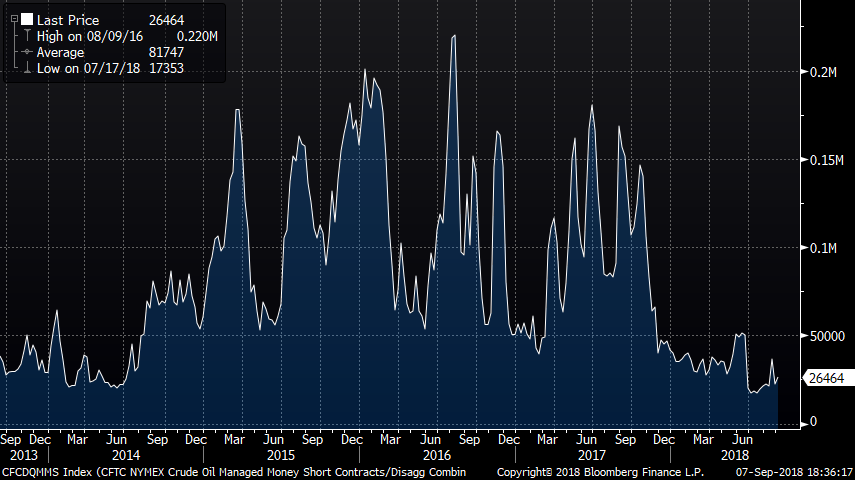

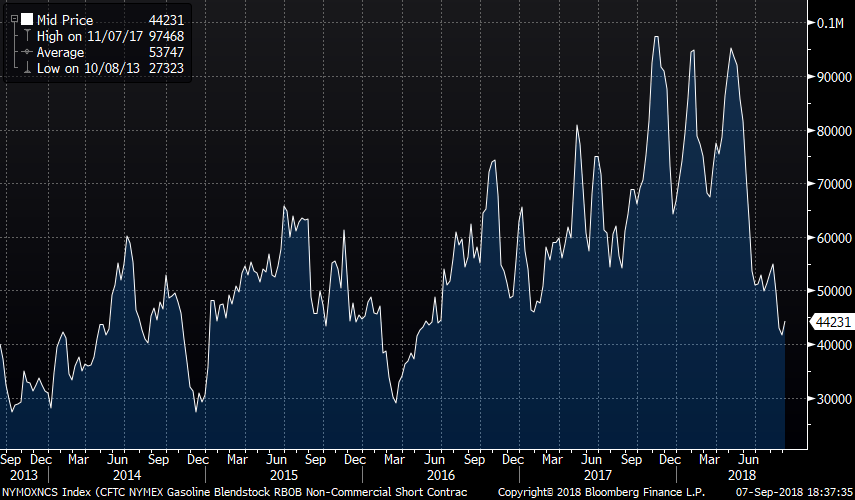

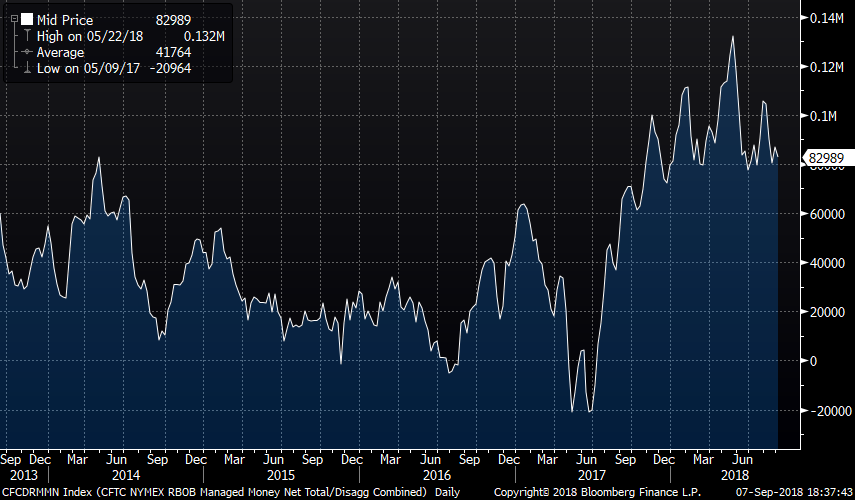

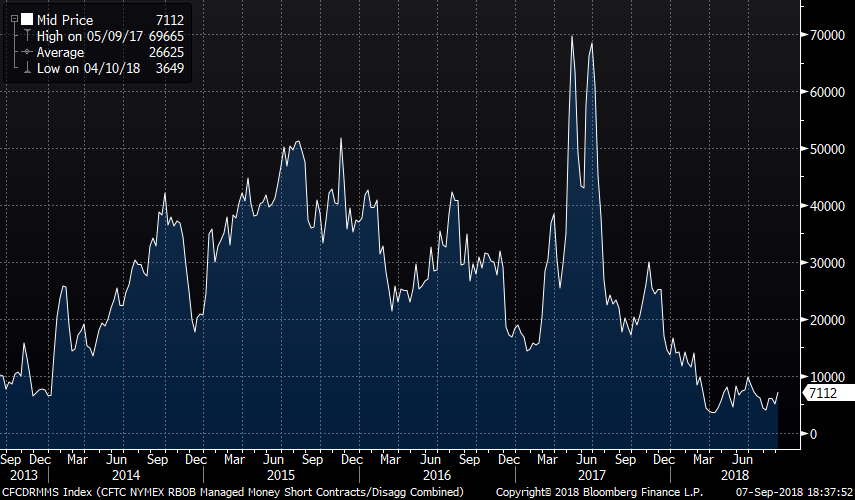

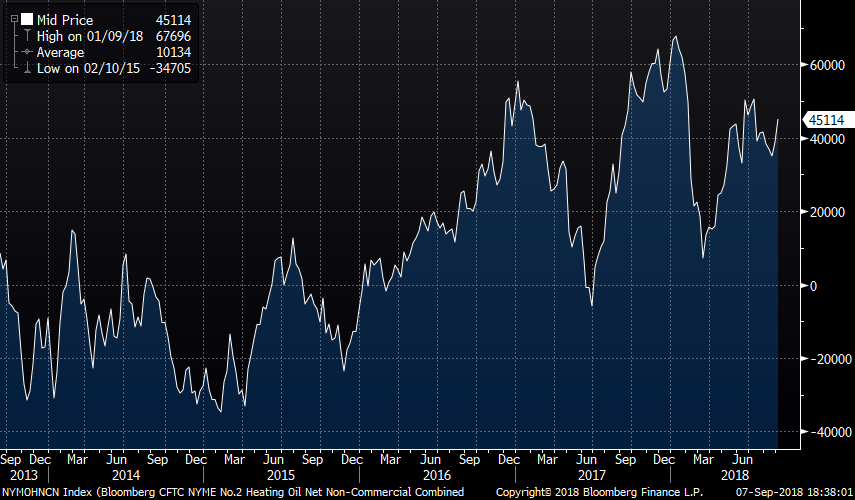

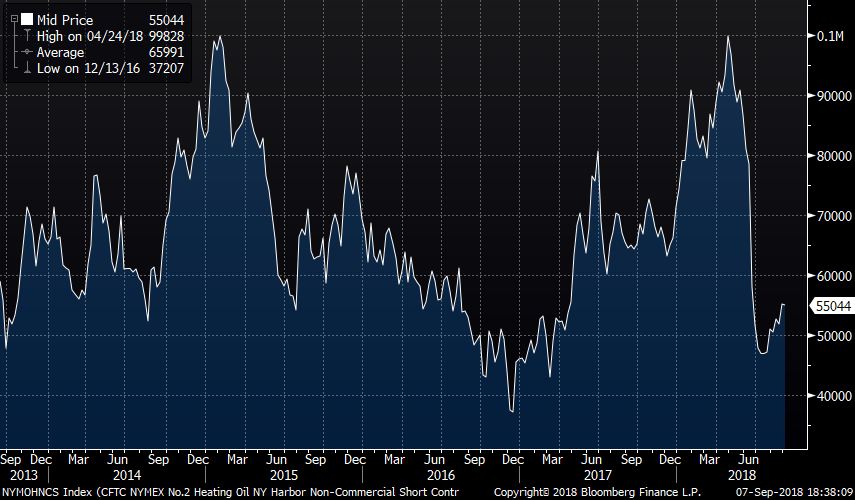

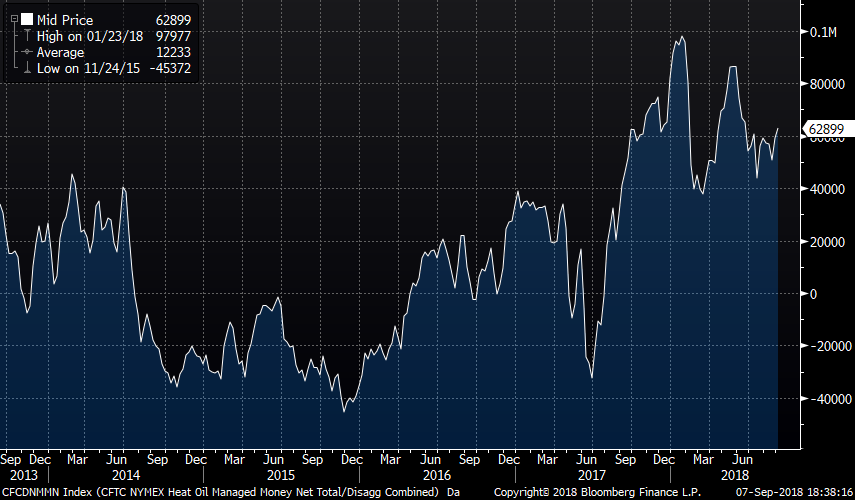

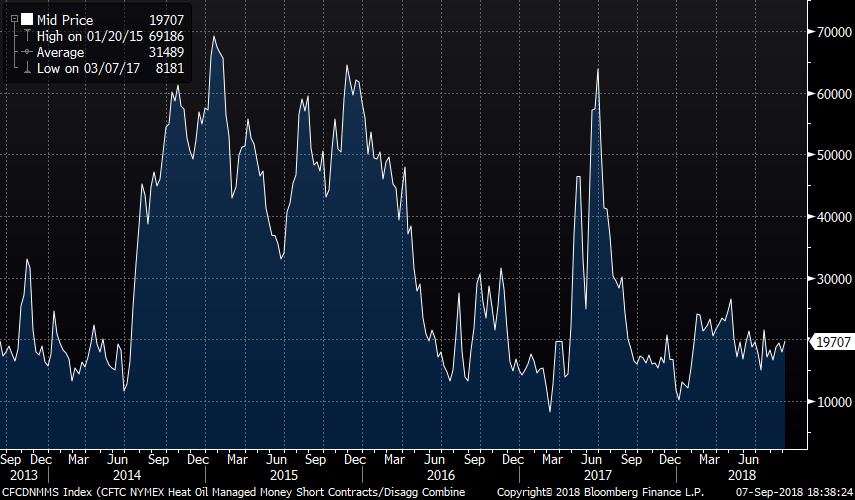

WTI / XB / ULSD Commitment of Traders (data through September 4th)

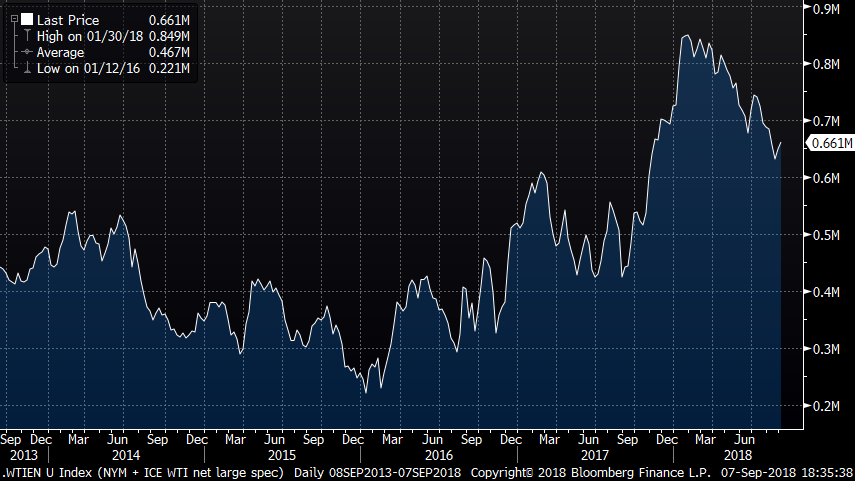

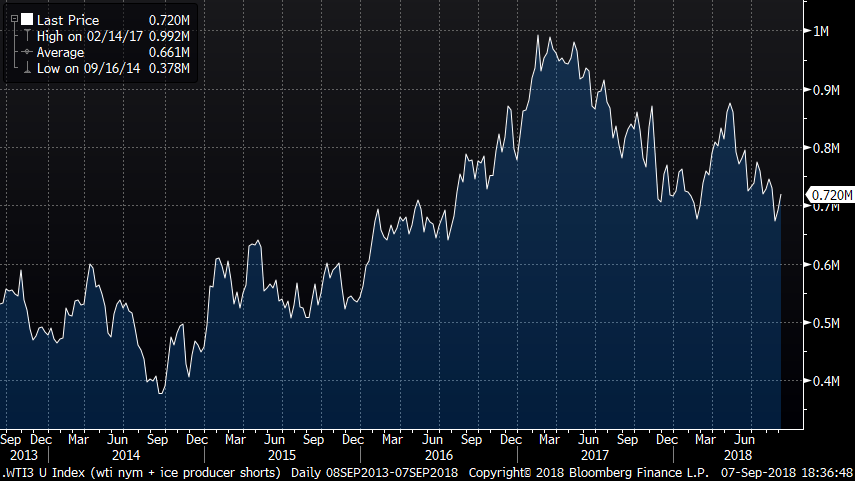

WTI NYM Net large Spec increased by 11,788 last week (14,939 in new length and 3,151 in new shorts)

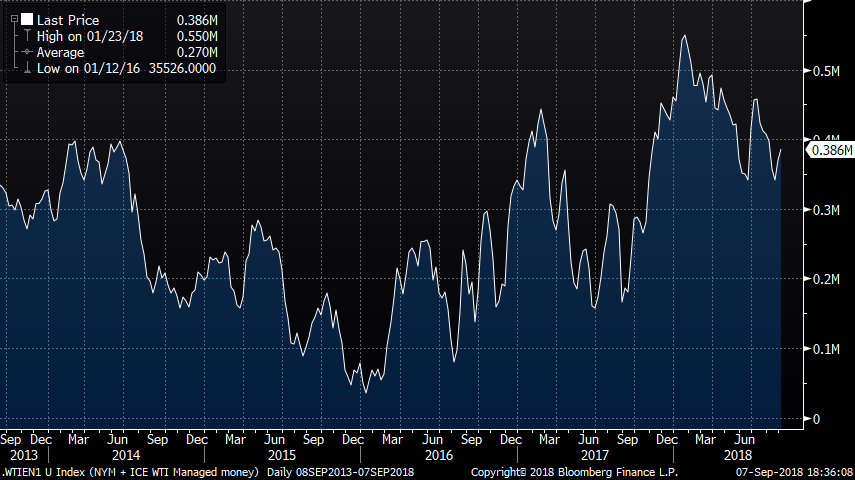

WTI NYM Managed money net position increased by 13,529 last week (17,684 in new length and 4,155 in new shorts)

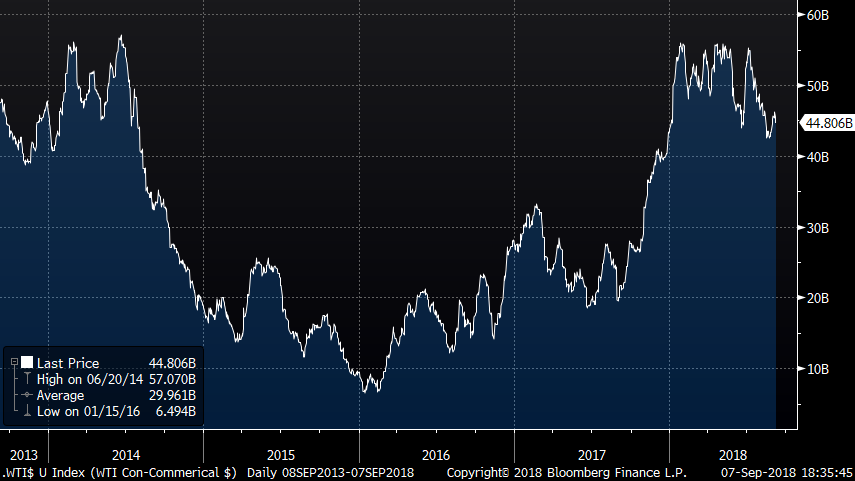

WTI NYM Commercials positions decreased by 8,749 last week (41,836 in new length and 50,585 in new shorts)

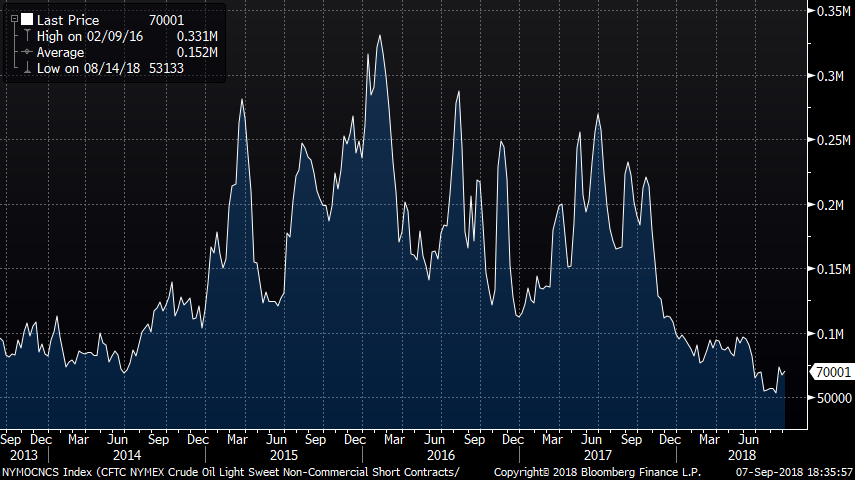

WTI NYM Producer/Merchant/Processor/User Shorts increased by 22,959 last week

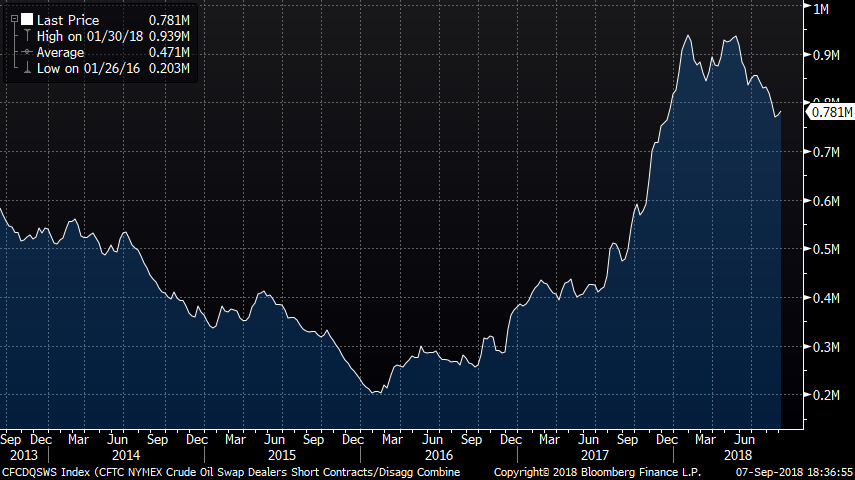

WTI NYM Swap Dealer Shorts increased by 7,607 last week

WTI ICE Net large Spec increased by 226 last week (1,451 in long liquidation and 1,677 in short covering)

WTI ICE Managed money net position increased by 3,105 last week (133 in long liquidation and 3,238 in short covering)

WTI ICE Commercials positions decreased by 236 last week (9,152 in new length and 9,388 in new shorts)

WTI ICE Producer/Merchant/Processor/User Shorts increased by 4,772 last week

WTI ICE Swap Dealer Shorts decreased by 387 last week

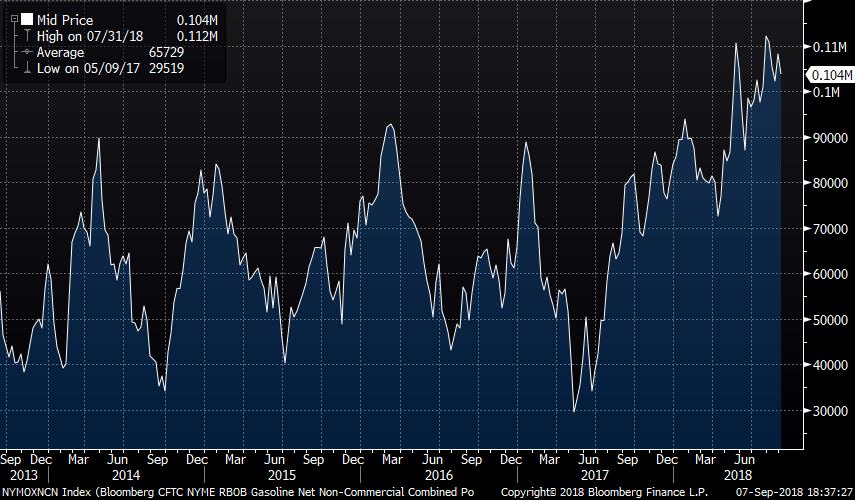

RBOB Net large Spec decreased by 4,440 last week (1,902 in long liquidation and 2,538 in new shorts)

RBOB Managed money net position decreased by 3,733 last week (1,680 in long liquidation and 2,053 in new shorts).

ULSD Net large Spec increased by 6,166 last week (6,096 in new length and 70 in short covering)

ULSD Managed money net position increased by 3,655 last week (5,429 in new length and 1,774 in new shorts)

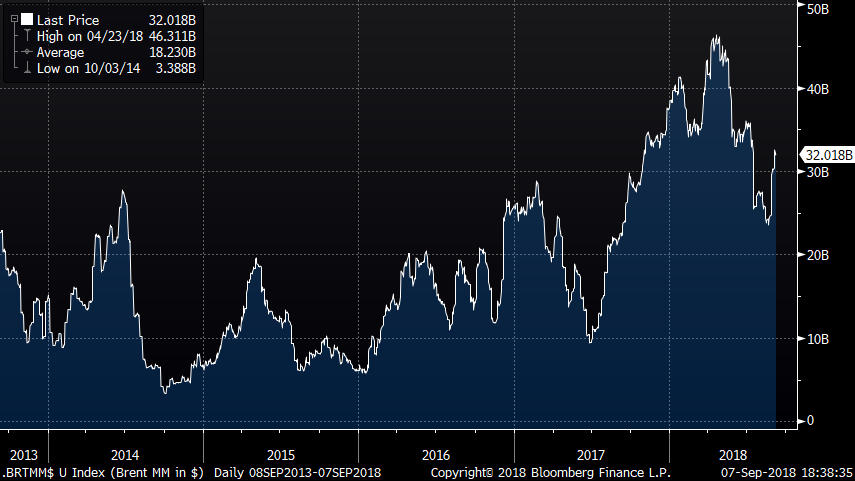

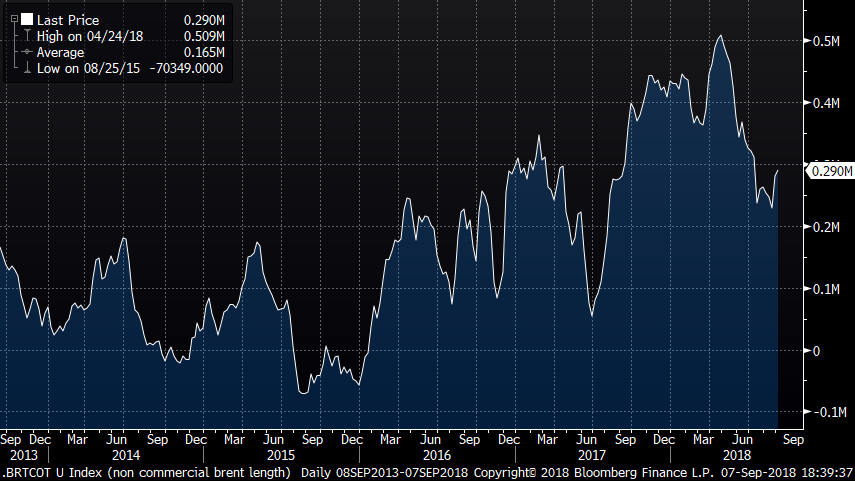

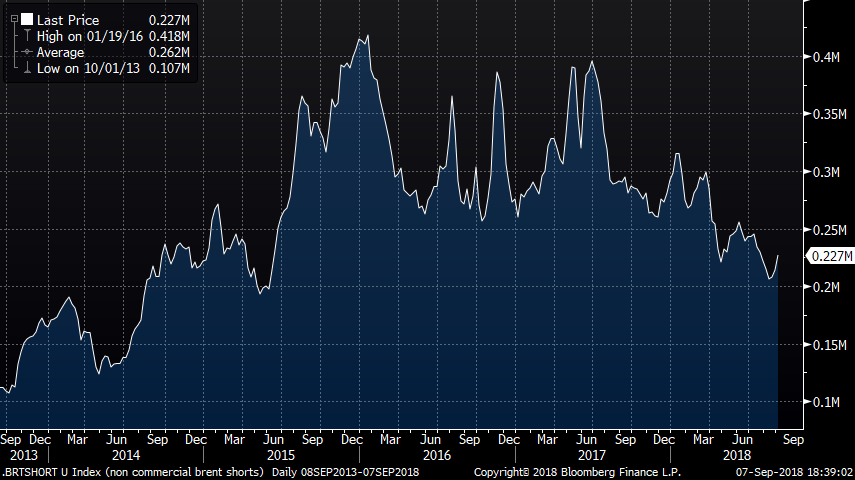

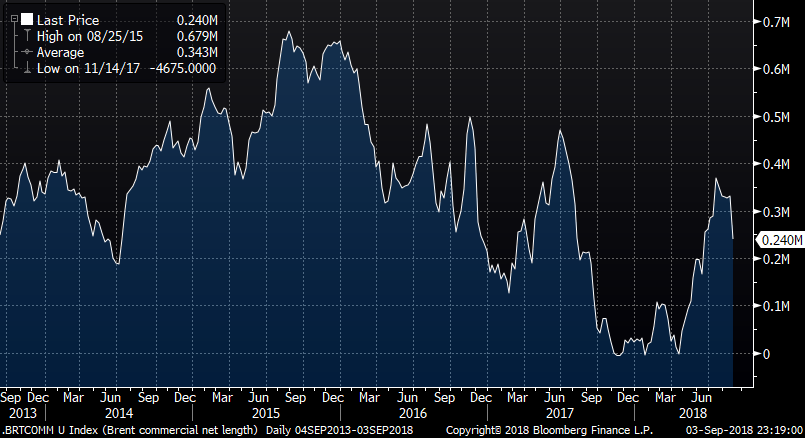

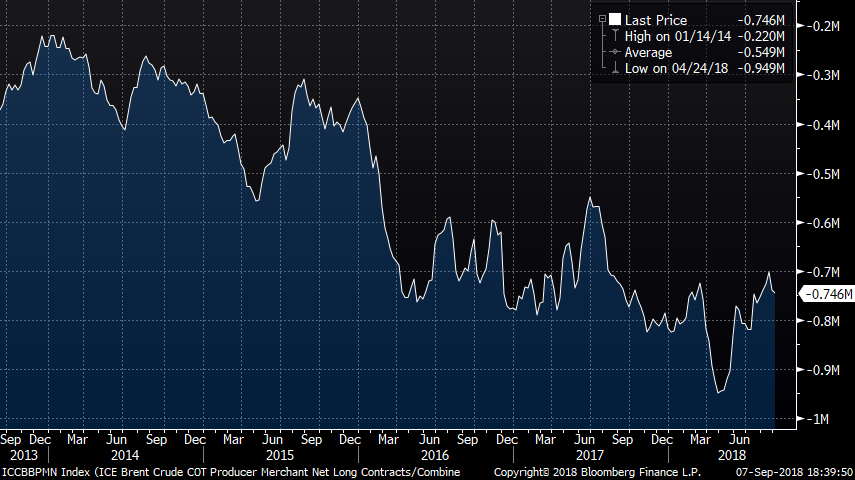

Brent / Gasoil COT Data (data through September 4th)

ICE Brent Managed money net position increased by 27,676 last week (29,777 in new length and 2,101 in new shorts)

ICE Brent Net large Spec increased by 9,265 last week (22,116 in new length and 12,851 in new shorts)

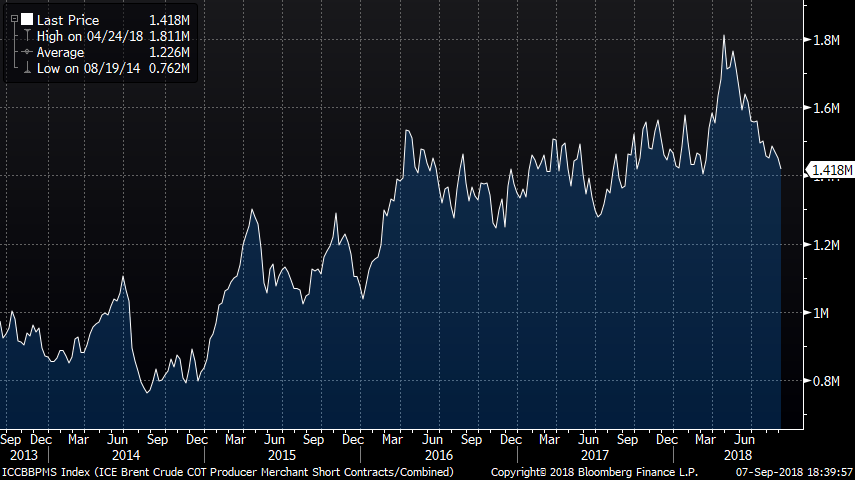

ICE Brent Producer/Merchant/Processor/User net positioning decreased by 6,303 with 37,775 in long liquidation and 31,472 in short covering

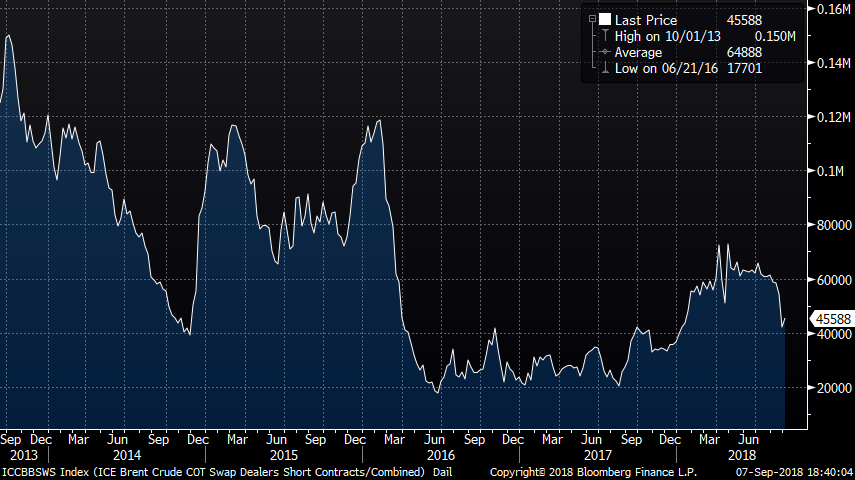

ICE Brent Swap Dealers net length decreased by 2,058 with 1,441 in new length and 3,499 in new shorts

NYM Brent Net large Spec increased by 8,406 last week (3,499 in new length and 4,907 in short covering)

NYM Brent Managed money net position increased by 5,916 last week (3,503 in new length and 2,413 in short covering)

NYM Brent Commercials positions decreased by 8,286 last week (3,555 in long liquidation and 4,731 in new shorts)

NYM Brent Producer/Merchant/Processor/User Shorts increased by 1,186 last week

NYM Brent Swap Dealer Shorts increased by 239 last week

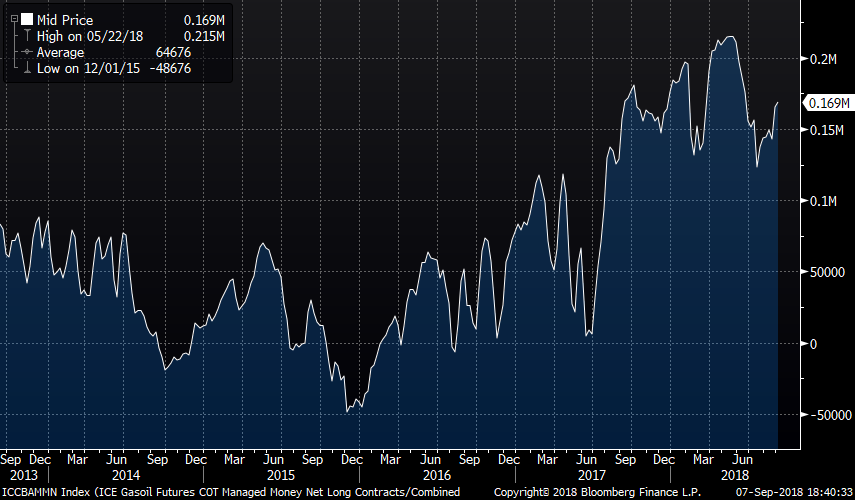

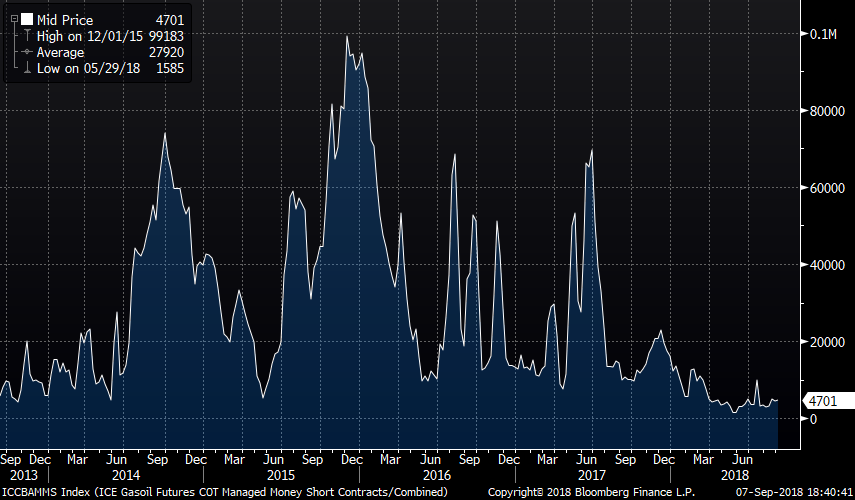

ICE Gasoil Managed money net position increased by 3,958 last week (4,284 in new length and 326 in new shorts)

WTI + Brent Managed Money net position increased by 50,226 last week (50,831 in new length and 605 in new shorts)

CL / BRT / XB / HO / QS Managed money net length

CL / BRT / XB / HO / QS Managed money short position

Nymex WTI Managed money Longs, shorts and total

Nymex WTI managed money net length vs CL1 (price)

ICE Brent Managed money Longs, shorts, and total

ICE Brent managed money net length vs CO1 (price)

WTI + BRENT Managed Money net length

WTI + BRENT Managed Money Shorts

NYM + ICE WTI Non-Commercial net length

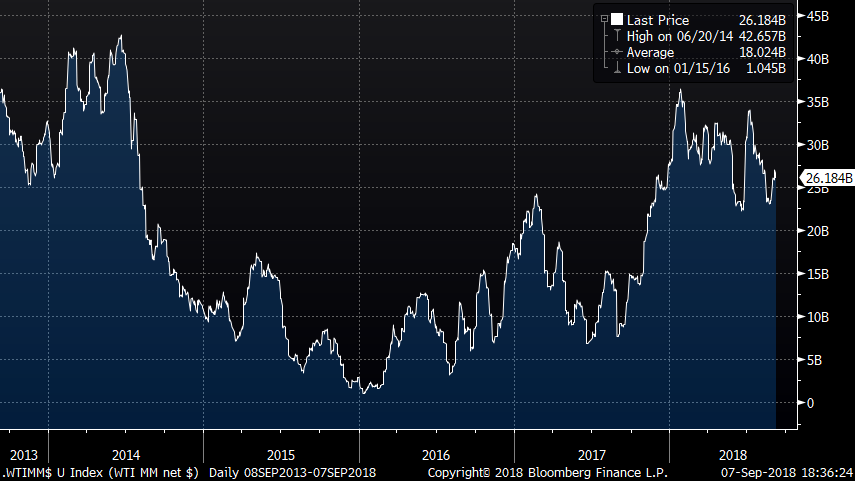

NYM + ICE WTI Non-Commercial Net Length in $

NYM WTI Non-Commercial Shorts

NYM + ICE WTI Managed Money Net Length

NYM WTI Managed Money Shorts

NYM + ICE WTI Managed Money Net Length in $

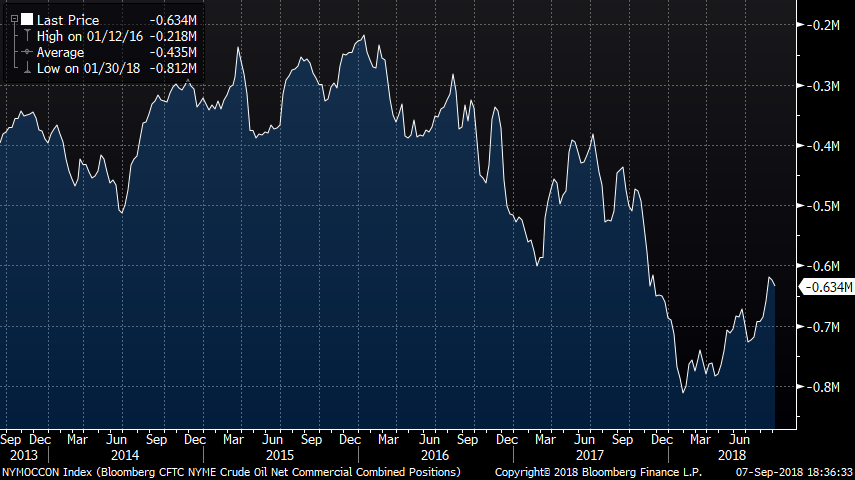

NYM WTI Commercial net length

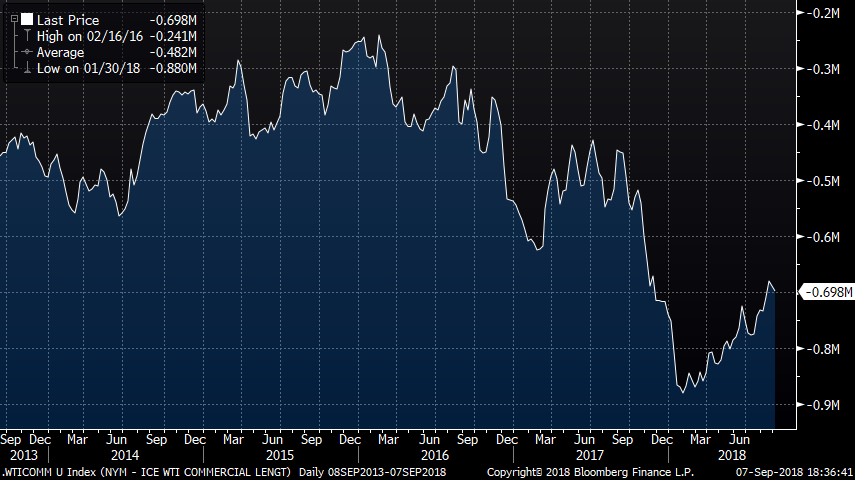

NYM + ICE WTI Commercial Net Length

NYM + ICE WTI Producer/Merchant/Processor/User Short Positions

Nymex WTI Swap Dealer Short Position

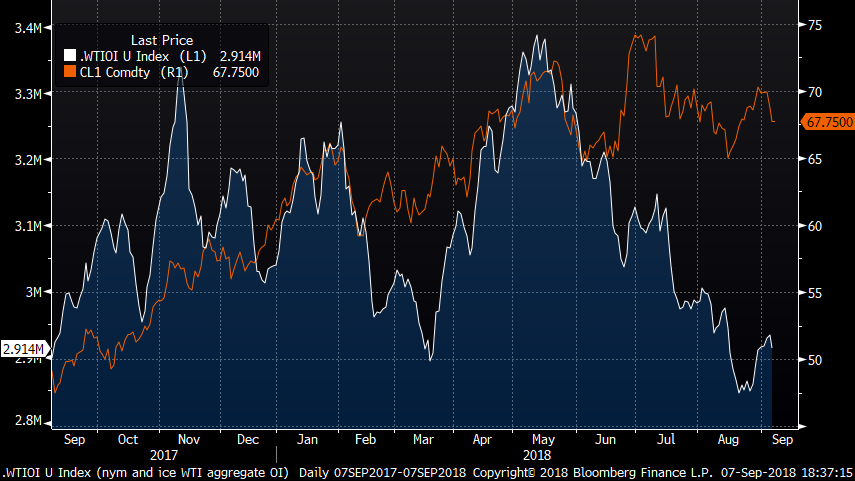

WTI aggregate futures OI vs Price

Rbob Non-Commercial Net Length

Rbob Non-Commercial Shorts

Rbob Managed Money Net Length

Rbob Managed Money Shorts

ULSD Non-Commercial Net Length

ULSD Non-Commercial Shorts

ULSD Managed Money Net Length

ULSD Managed Money Shorts

Brent Managed Money net length in $

Brent Non-Commercial net length:

Brent Non-Commercial short position :

Brent Commercial Net Length

image066.png@01D443DC.B6D5FB90“>

image066.png@01D443DC.B6D5FB90“>

Brent Producer / Merchant Net Length

Brent Producer / Merchant shorts

Brent Swap Dealer Shorts

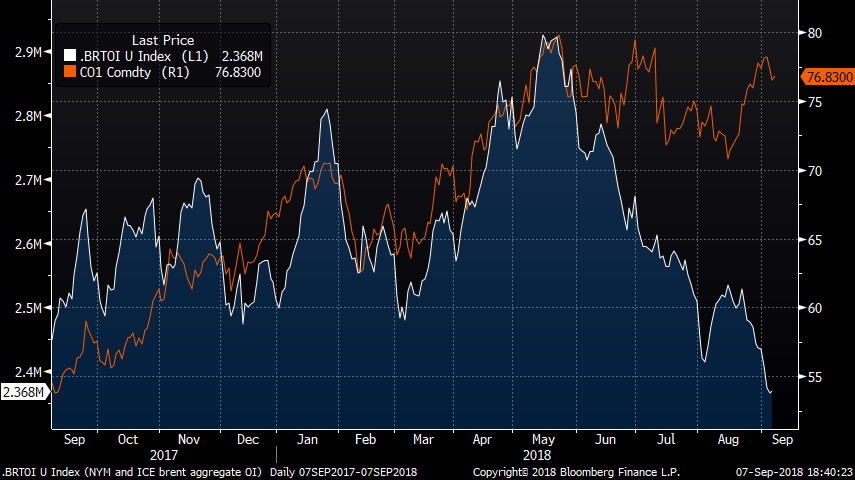

Brent Aggregate Futures OI vs Price

Gasoil Managed Money Net Length

Gasoil Managed Money Shorts

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986