From: Wagner, Jonathan

Sent: Sunday, September 23, 2018 3:59:52 PM (UTC-06:00) Central Time (US & Canada)

To: Wagner, Jonathan

Subject: ION Weekend Rundown

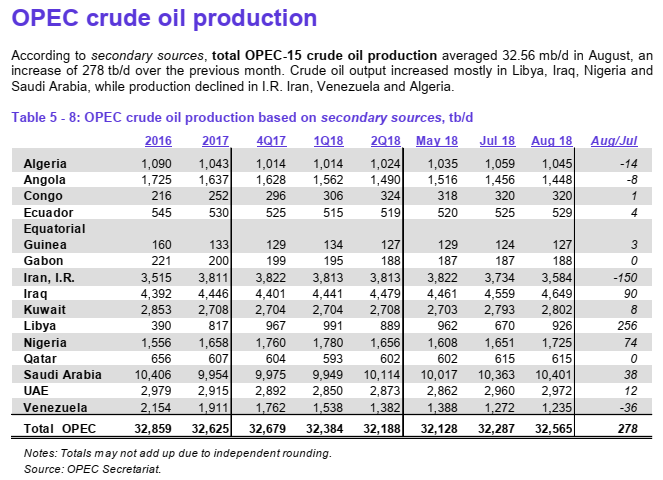

Good evening. JMMC / OPEC+ members met today in Algiers and while they agreed not to officially raise output levels today, they were all in agreement to remain committed to get compliance of pledge output cuts back to 100% (down from the 129% reported as of the end of August). Russian minister Novak said that there is still much to do to maintain balance in the oil market as “big uncertainties” lie ahead. Saudi oil minister Al-Falih said that they would do “whatever is needed” to return compliance to that figure even is demand for their crude increased. Saudi specifically stated that they are producing more this month than they did in August and expect production to continue to grow into October. He said that they would meet demand even if it meant pumping 10.9m b/d. Kuwaiti oil minister said that once field maintenance has been completed production would also be moving higher. Note that Kashagan production has been reduced due to maintenance. There was also comments on the shared Saudi / Kuwaiti fields which could possible see a restart in early 2019 (they have been talking about this for years now). Russia said that their production is slightly above Aug levels which came in at 11.21. Libya production continues to grow with avg 2018 production now over the 1m b/d figure. Even with military clashes and the constant interruption of fields, their production recently hit 1.278m b/d. Venezuela said that they are pumping 1.5m b/d (secondary source OPEC data points to that figure being 1.235 as of Aug) and they hope to achieve a production figure of 2m b/d by the end of ’18. Iran said that they are currently producing 3.8m b/d (secondary source opec data has that at 3.584m b/d as of Aug) and for the first time said that they are happy about OPEC+ cooperation. Iran’s OPEC Governor Ardebili said that they continue to believe they will export oil and they will not be giving any discounts for their barrels. He stated “If Iran’s oil exports decline, other OPEC members can make efforts to balance market.” OPEC+ members also spoke about the future hoping to have cooperation extend past the end of ’18 although they are not in a position to decide what the future holds. OPEC is estimating at that non OPEC production will grow by 2m b/d in ’19 and that next year holds the prospect for an increase in inventory. According to Al-Falih, OPEC+ has seen slight increase in inventories over past weeks; “We will do what is necessary” to keep oil market balanced; “Inventories are our steering wheel to guide the industry into stability.” Also in the news today was a comment from Secretary of State Pompeo that President Trump is willing to meet with Iran’s Rouhani at the UN this week. “He’s happy to talk with folks at any time,” Pompeo said on NBC’s “Meet the Press,” one of two appearances on Sunday political talk shows. “The president’s been pretty clear about that.” The onus is on Rouhani to reach out, Pompeo added. Trump will address the United Nations General Assembly on Tuesday and host a meeting of the UN Security Council on Wednesday. Depending on the agenda that Trump sets for the Security Council meeting, Iran’s president may be in the room. This week’s possible meeting also comes at a critical time as Iran has blamed the US for the violent killings during their military parade on Saturday.

At the most recent OPEC meeting held in June, ministers voted for an added 1m b/d of supply while approximately 600k of real bbls being added. Here are both the May production figures and the approximate distribution of how those 600k bbls would be added. Below these two tables is the most recent OPEC production data (aug secondary source data). If you added Russia’s Aug production of 11.21m b/d and Oman’s 975k b/d these nations have added a total of 872k b/d since May. While other nations have increased output (Nigeria, Libya), the real question at hand is how much more can these nations add in the event of a further decline in Iranian exports. The UAE said they were producing close to their capacity of 3.5m b/d (I’ll believe it when I see it), Russia said they could continue to add, and Saudi said they will produce whatever is necessary given they have 1.5m b/d of spare capacity left… What will remain to be seen is does the market recover and make a move back to 80 on the fact that we sold off Friday thinking 500k of supply was going to come back quickly, or does these threats by Saudi really put a cap on the market if they possibly can make up for further shortfall. Personally, I’d like think it’s the former rather than the later. And if Trump does actually meet with Rouhani…. Then I just want to own the wings as they both look cheap in the grand scale of things.

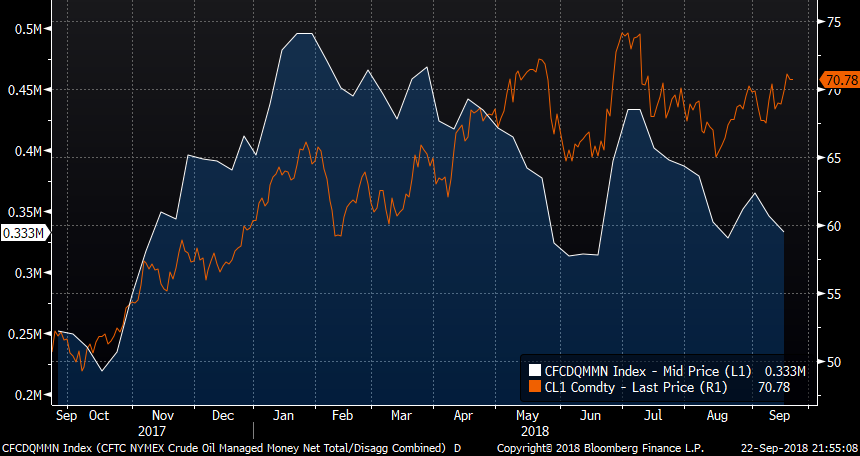

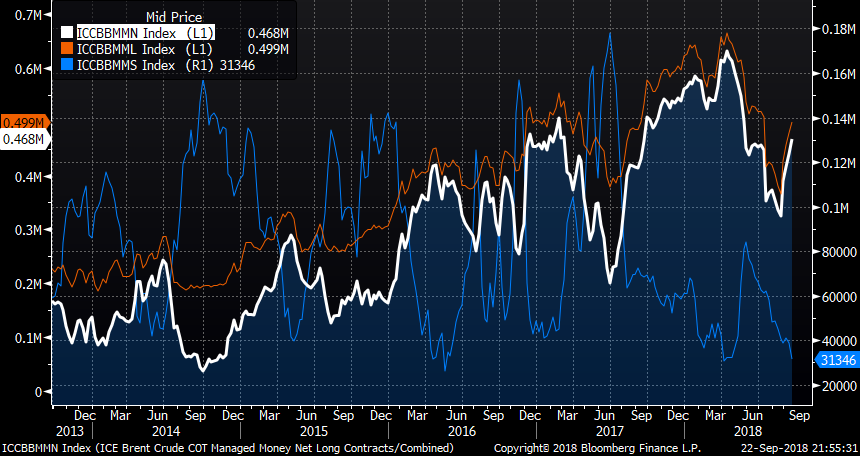

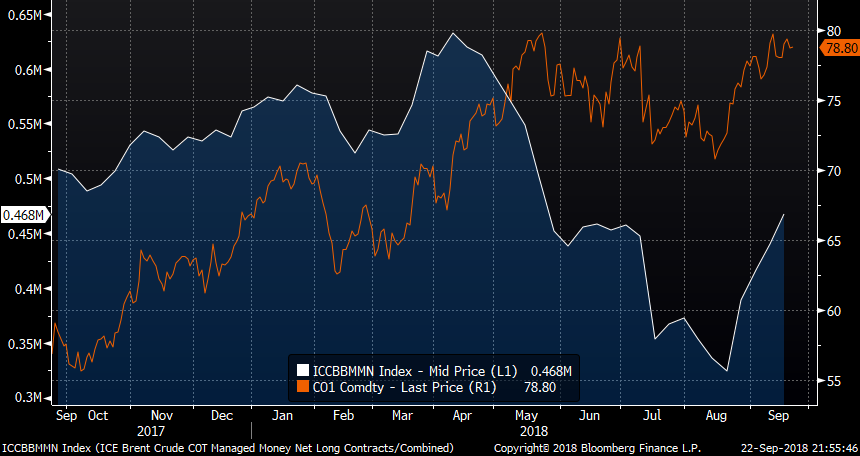

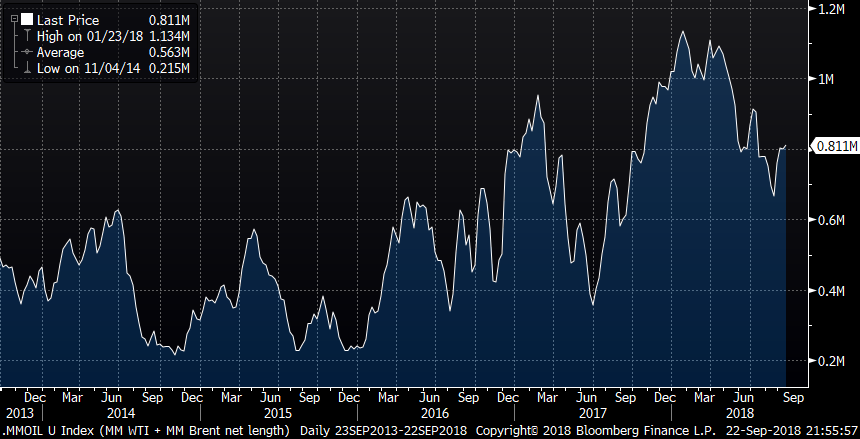

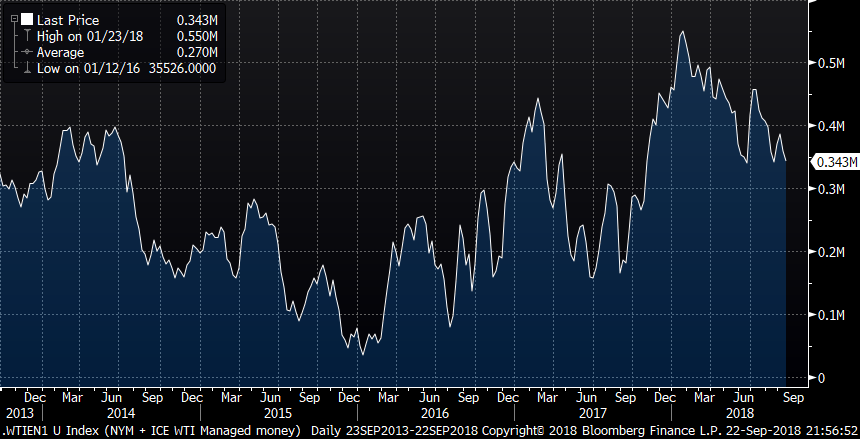

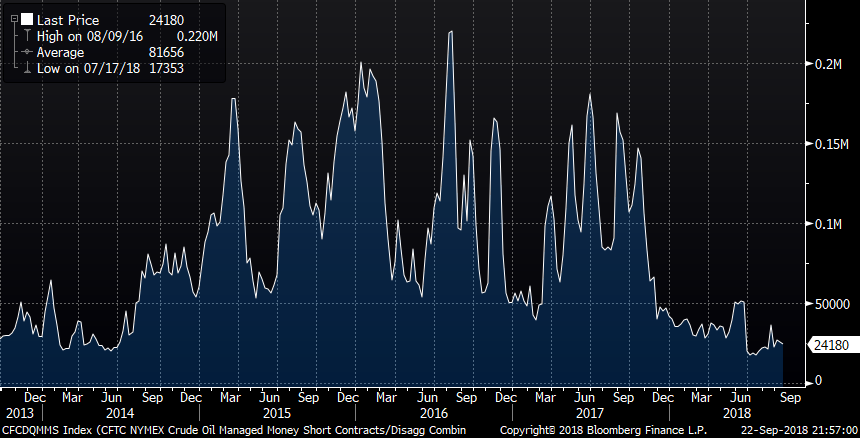

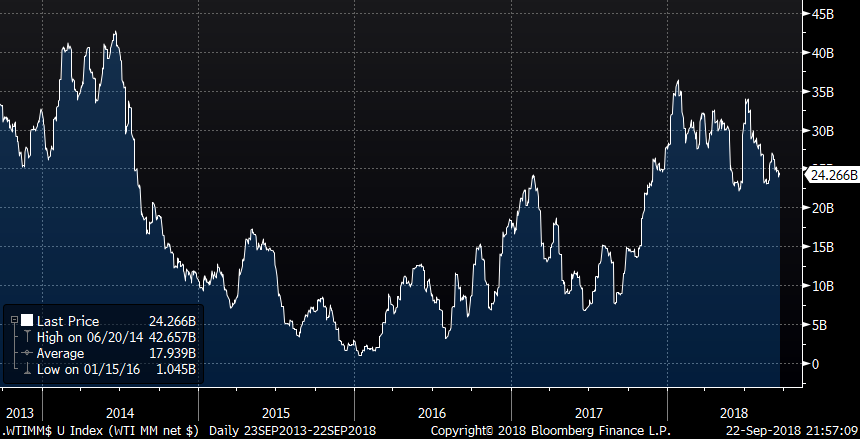

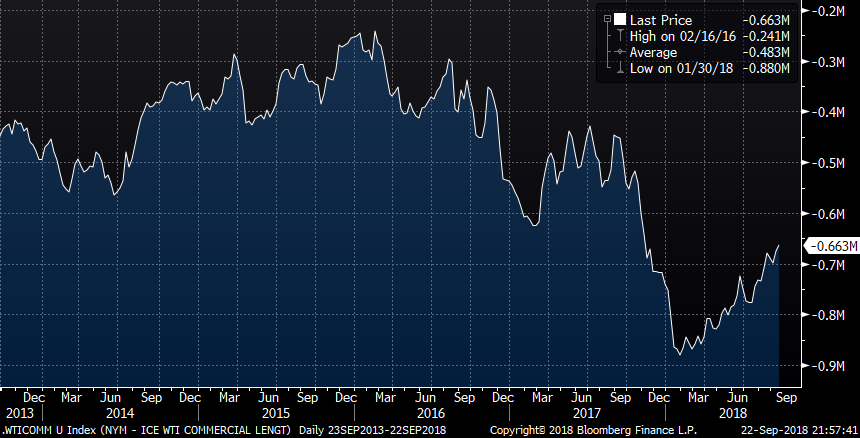

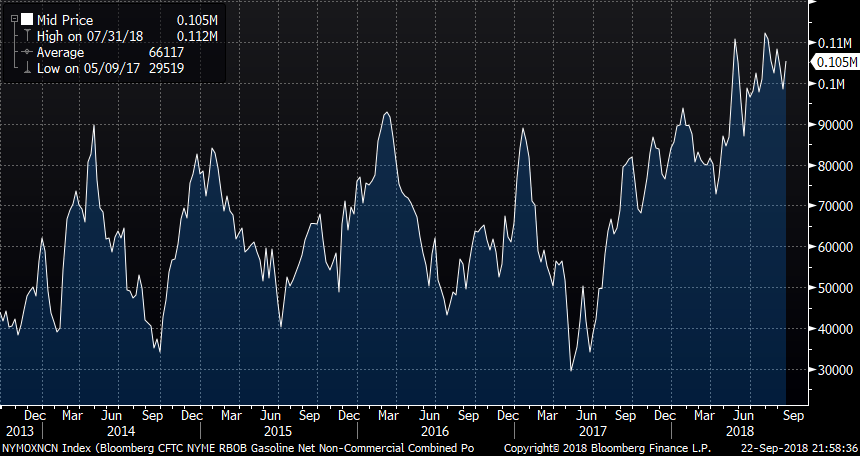

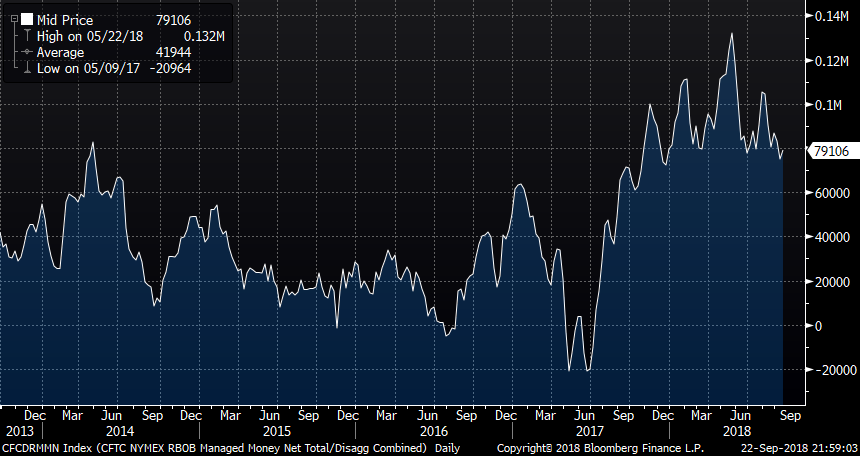

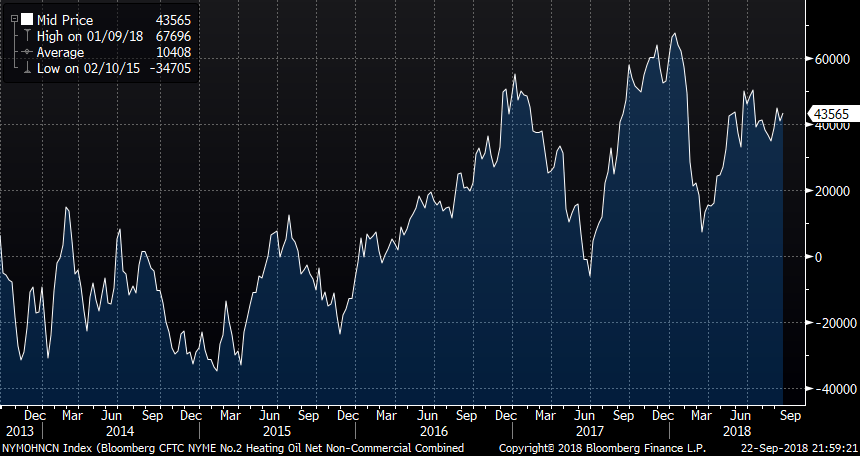

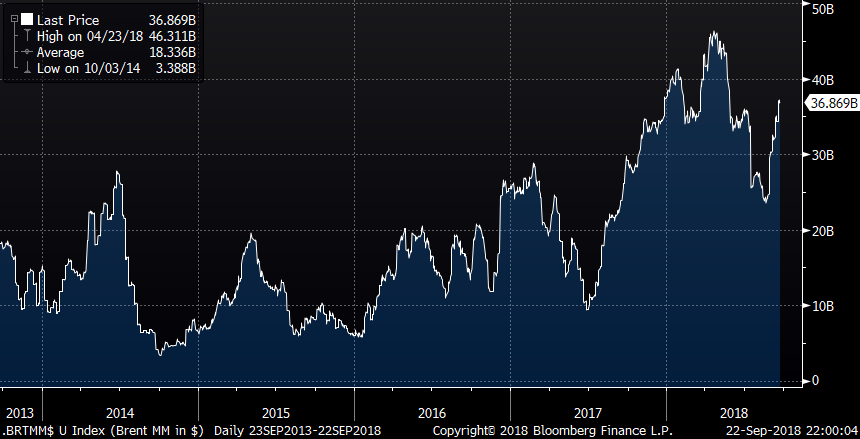

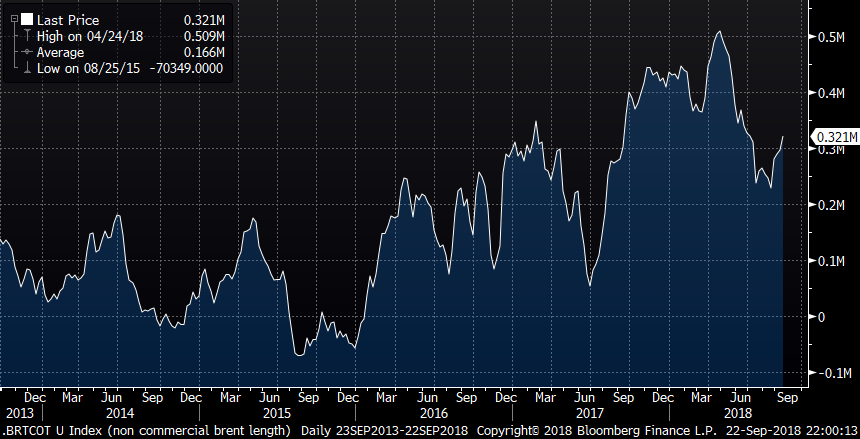

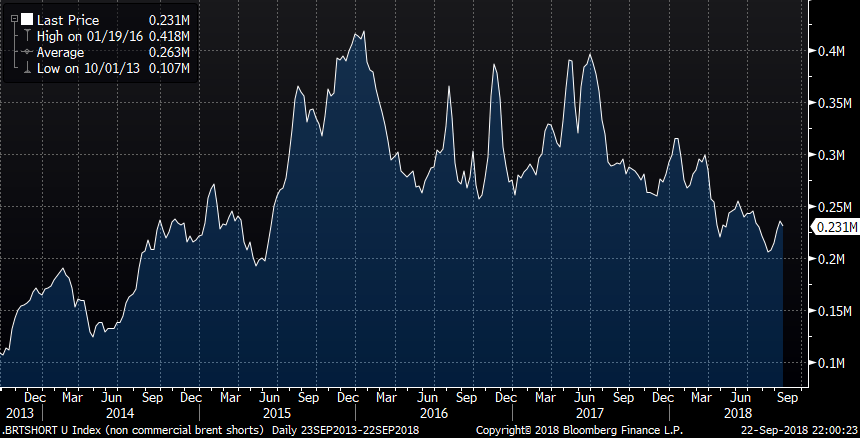

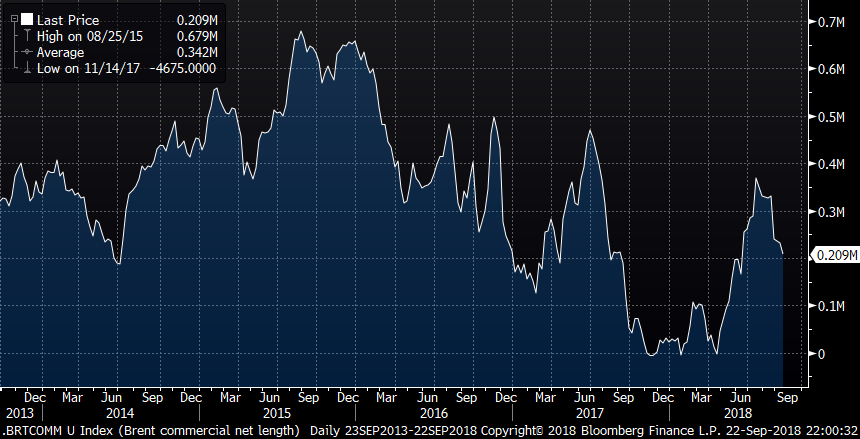

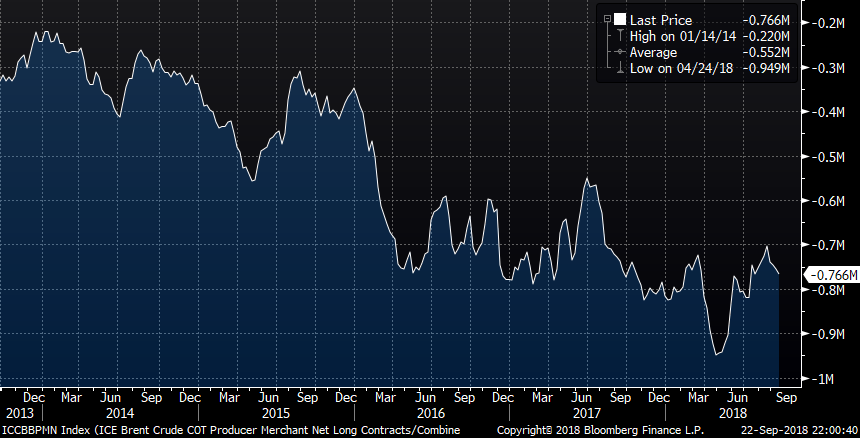

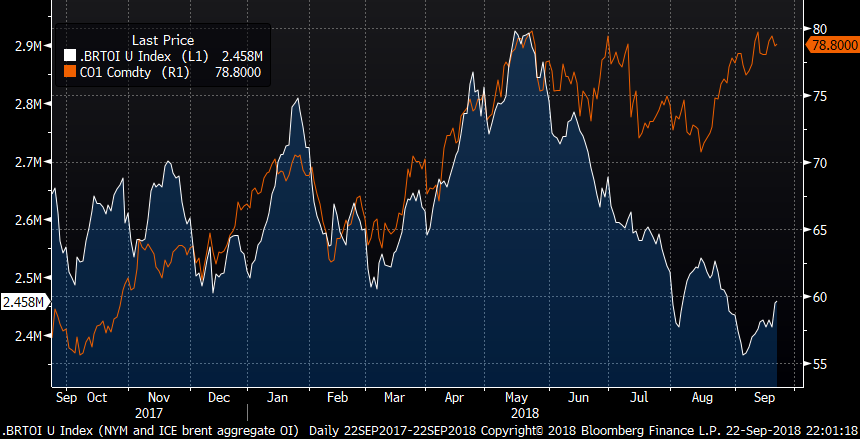

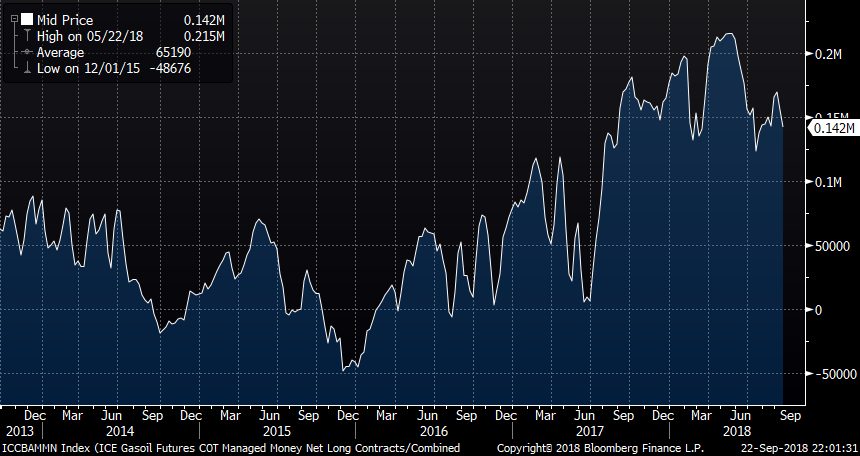

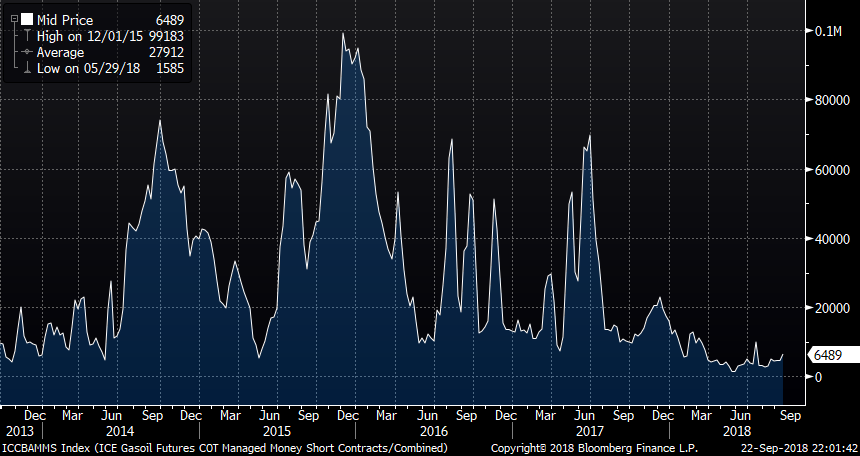

COT data released on Friday showed aggregate WTI and Brent managed money net length increasing by 15,866 (9,180 in new length and 6,686 in short covering). WTI managed money length declined by 15,974 while Brent managed money net length increase by 31,840. Over the past 4 weeks, ICE Brent managed money net length has increased by 144k lots. In products, Rbob managed money net length increased by 4,153 while Heat and Gasoil managed money net length fell by 3,553 and 12,624 lots respectively. With Brent prices almost back to the high, managed money net length is still 164k lots shy of where it was back in April. There continues to be good interest seen in upside in ’19 Brent as the M9 95’s were bought 2500x and the F9 85/95 call spread traded 4k post close. Nov Brent option expiry is on Tuesday and the $80 strike still has a chunky amount of OI (21k on the calls as of Thursday, as OI data for Friday has not been updated yet).

|

Country |

May Production (secondary source) |

|

Saudi Arabia |

9,987,000 |

|

Russia |

10,966,000 |

|

Kuwait |

2,701,000 |

|

UAE |

2,865,000 |

|

Oman |

969,000 |

|

Country |

Barrels a day increase (proposed in June) |

|

Saudi Arabia |

245,000 |

|

Russia |

160,000 |

|

Kuwait |

80,000 |

|

UAE |

80,000 |

|

Oman |

35,000 |

Top stories listed below

Saudi energy minister says OPEC/non-OPEC alliance ready to pump more in months ahead – Platts

OPEC raises U.S. oil supply outlook, sees lower demand for own crude – Reuters News

Saudi October Oil Output May Exceed 10.5m-10.6m B/D: Al-Falih

Novak: Russia Can Boost Oil Output Hundreds of Thousands of Bbls

U.A.E. Has Spare Oil-Output Capacity, Will Use It If Necessary

Iran Pumped 3.805m B/D of Crude in August: Kazempour

Pompeo: Trump open to talks with Iran at UN

Libyan crude output highest since Jul 2013 at ‘more than 1 mil b/d,’ says NOC chairman – Platts

Crude production in Saudi-Kuwait shared Neutral Zone could restart by Jan: Kuwaiti oil minister – Platts

Significance of attack on military parade in Iran – Reuters News

U.S. envoy Haley rejects Iran blame over parade attack – Reuters News

South Korea has bought no Iranian crude oil for about 3 months – SHANA – Reuters News

Saudi energy minister says OPEC/non-OPEC alliance ready to pump more in months ahead – Platts

Saudi energy minister Khalid al-Falih on Sunday rejected accusations by US President Donald Trump that OPEC was keeping oil prices elevated through anti-competitive behavior. OPEC has increased production "a good amount" since June, Falih noted, offsetting declines in member countries Iran and Venezuela, as well as non-OPEC Mexico. As a result, "markets are quite balanced today," he told reporters in Algiers just before chairing a meeting of the monitoring committee overseeing the OPEC/non-OPEC supply accord. "There is plenty of supply to meet any market need." OPEC pumped 32.89 million b/d in August, according to the latest S&P Global Platts survey of OPEC production, up 670,000 b/d from May, not including the Republic of Congo, which joined the organization in June. Trump on Thursday tweeted at OPEC for the fifth time, scolding the producer bloc as Brent crude futures traded in London just below $80/b, a level they would surpass briefly on Friday. Legislation has been filed in Congress that would allow the US to sue OPEC under antitrust law. "We protect the countries of the Middle East, they would not be safe for very long without us, and yet they continue to push for higher and higher oil prices! We will remember," wrote Trump on Twitter. "The OPEC monopoly must get prices down now!" Falih said Trump’s accusations were "of course not true." UAE energy minister Suhail al-Mazrouei reiterated OPEC’s oft-voiced stance that it does not target a specific oil price. "We are not concerned by external pressures," he told reporters. "We are an organization concerned with market equilibrium and not a political organization." Still, with supply risks ahead and price volatility returning, both ministers pledged that the OPEC/non-OPEC producer coalition would be boosting output in the coming months, though they outlined no specific plans or amounts before the meeting. The Algiers summit, attended by almost every delegation in the 25-country alliance, would involve discussions on those issues. Iran is expected to lose some 1.4 million b/d of supply as US sanctions go into force November 5, while economically reeling Venezuela and unstable Libya also present supply risks. Saudi Arabia holds about 1.5 million b/d of spare capacity, which it can tap "within days and weeks" and sustain, if needed, Falih said. The kingdom pumped 10.49 million b/d in August, according to the Platts survey, and has never produced above 10.7 million b/d. "Whatever is needed we will do," Falih said. "If it’s needed to produce that spare capacity, we will do that."

LOOKING BEYOND 2018

The coalition agreed June 23 on a collective 1 million b/d production increase by reducing over-compliance with cuts that had been in place since January 2017 to rescue the market from a more-than-two-year slump. But over-compliance actually increased to 129% in August from 109% in July, the monitoring committee reported, leaving the group some 500,000 to 600,000 b/d short of its production increase goal. "We will look at those numbers and try to understand what’s the reason for the deviation of the target," Falih said. "We understand that there are maintenance issues that have caused members to temporary cut productions, and we will make sure that those countries and others step in and reach the 100% compliance which will get us to the June decision." But even with the over-compliance, he insisted that the market was "adequately supplied." "I don’t know any refiner who was looking for oil that has not been able to get it," Falih said. "And I can tell you that Saudi Arabia has met the request of every customer from east to west." Falih also said the coalition is deliberating its production strategy beyond the end of this year, when the OPEC/non-OPEC pact is set to expire. Many market forecasts are projecting lukewarm demand growth in 2019, along with surging non-OPEC supplies. "We are also concerned about the global economy like anybody else," Falih said, citing geopolitical tensions, international trade disputes and emerging market pressures. "As we approach the end of this year, we must start working on our plans for collective action to keep the market balanced in 2019." OPEC is seeking to make permanent its alliance with its 10 non-OPEC partners, which include key producers Russia, Mexico, Kazakhstan, Oman, Azerbaijan, Malaysia and others. A draft charter was circulated to all members ahead of Sunday’s meeting. It calls for the coalition to meet at least once a year and to take unspecified measures as necessary to ensure the stability of the market. If approved by all the members, it could be signed at the OPEC/non-OPEC group’s next meeting December 4 in Vienna. Russian energy minister Alexander Novak said he was supportive of "discussing various formats of continuing this dialogue." "We need to give serious thought to expanding our cooperation beyond this year to tackle these challenges," he said. "All market participants, both producers and consumers, are expecting us to preserve our solidarity and our collective approach to market balancing."

OPEC raises U.S. oil supply outlook, sees lower demand for own crude – Reuters News

A steady rise in U.S. oil output will gather pace in the next five years, OPEC said on Sunday, predicting that demand for the producer group’s crude will decline despite a growing appetite for energy fed by global economic expansion.

"Declining demand for OPEC crude is a result of strong non-OPEC supply in the 2017–2023 period, most notably from U.S. tight oil," the Organization of the Petroleum Exporting Countries said in its long-term world oil outlook.

"The U.S. remains by far the most important source of medium-term supply growth, contributing … two-thirds of new supply, driven by surging tight oil output," it said. The United States has pushed oil output to record levels in recent years on the back of a shale revolution that allowed new technology to unlock reserves previously seen as uneconomic. U.S. sanctions on OPEC members Venezuela and Iran have helped pushed oil prices LCOc1 to their highest since 2014 at around $80 a barrel, also spurring U.S. producers to ramp up output. However, high gasoline prices for U.S. consumers could create a political headache for President Donald Trump, who on Thursday called again on OPEC to boost supply. OPEC said it had revised its growth outlook for non-OPEC crude and liquids to 2023, and was now expecting growth to be 4 million bpd higher than in last year’s report. It said non-OPEC would produce 66.1 million bpd of crude and liquids in 2023, up from 57.5 million bpd in 2017. The United States will increase tight oil production to 13.4 million bpd in 2023 from 7.4 million bpd in 2017, with total U.S. output reaching 20 million bpd, OPEC said. That would make the United States, once the largest crude importer, self-sufficient in oil. As a result of these tectonic changes, demand for OPEC crude is seen declining to 31.6 million bpd in 2023 from 32.6 million in 2017. In its 2017 report, OPEC had expected demand for its crude to be around 33 million bpd until the mid-2020s. "Demand for OPEC crude … only reaches current levels again in the late 2020s, when U.S. tight oil peaks. Thereafter, it should rise steadily, reaching nearly 40 million bpd by 2040," OPEC said. Demand for OPEC’s crude will drop in the mid-term despite a steady expansion in global oil demand. OPEC raised its forecast for growth in global oil demand. It now sees 2020 oil consumption reaching 101.9 million bpd, up 1.2 million bpd from last year’s report. Longer-term, oil demand is expected to increase by 14.5 million bpd to reach 111.7 million bpd by 2040, slightly higher than last year’s forecast. In the long run, OPEC still hopes to maintain a steady share in the global oil supply balance thanks to abundant and cheap-to-extract reserves. It said demand for its crude would rise by 7.3 million bpd to 2040 and for all its liquids by 10.5 million. "The share of OPEC crude in the global oil supply is expected to increase from 34 percent in 2017 to 36 percent by 2040," it said.

Saudi October Oil Output May Exceed 10.5m-10.6m B/D: Al-Falih

“If the demand is 10.5 or 10.6 we will produce 10.5 or 10.6. I think October will be more than this,” Saudi Energy Minister Khalid Al-Falih tells reporters in Algiers.

It’s highly unlikely OPEC+ will increase output in 2019, given outlooks for demand presented to Joint Ministerial Monitoring Committee

AL-FALIH: SAUDIS WOULD MEET DEMAND EVEN IF IT ROSE TO 10.9M B/D

SAUDI OIL OUTPUT WILL RISE IN SEP. AND AGAIN IN OCT.: AL-FALIH

Storage increases in Okinawa, Sidi Kerir, Rotterdam are to make sure oil is close to customers when needed, Saudi Energy Minister Khalid Al-Falih says at news conference in Algiers.

Saudi Arabia has met demand for every barrel of oil requested since June, with higher demand seen in the U.S., Asia and Europe

Demand for Aramco oil rose 400k-600k b/d since end of May

Novak: Russia Can Boost Oil Output Hundreds of Thousands of Bbls

Country has ability to boost output capacity by several hundreds of thousands of barrels a day in short-term, Russian Energy Minister Alexander Novak says in Bloomberg TV interview.

OPEC+ is ready to give the market all the oil it needs

Oil market well balanced now, or in a small deficit

OPEC+ will monitor market as it relates to Iran situation

Not ready to comment on plans of Iran’s oil buyers as it relates to U.S. sanctions on the country’s oil exports

No clarity on oil market needs

Russia will play its part in bringing oil market balance

Oil price should be acceptable to customers

Novak says he’s had no specific talks about Iran with his U.S. counterpart Rick Perry

U.A.E. Has Spare Oil-Output Capacity, Will Use It If Necessary

The U.A.E. is pumping at close to its maximum of 3.5m b/d, but still has some spare production capacity and will use it if the oil market requires, says Energy Minister Suhail Al Mazrouei.

Iran Pumped 3.805m B/D of Crude in August: Kazempour

Islamic Republic isn’t giving discounts on oil sales, Iran’s OPEC Governor Hossein Kazempour Ardebili says in Algiers.

Expects Iran to continue to export oil

If Iran’s oil exports decline, other OPEC members can make efforts to balance market

Compliance with pledged oil cuts was 118% for OPEC

He’s happy about OPEC+ cooperation

Pompeo: Trump open to talks with Iran at UN

Secretary of State Mike Pompeo said in an interview broadcast Sunday that President Trump would be willing to meet with Iranian President Hassan Rouhani during this week’s United Nations (U.N.) General Assembly gathering. "I think the president’s been pretty clear about that. He’s happy to talk with folks at any time," Pompeo said on NBC’s "Meet the Press." "If there’s a constructive dialogue to be had, let’s get after it," he added. But Pompeo expressed skepticism about a breakthrough in discussions between the U.S. and Iran, saying that the Iranians haven’t shown a willingness to change their behavior to assuage the concerns of U.S. officials. Pompeo’s interview was taped before Rouhani assailed the U.S. as a "bully toward the rest of the world," and reportedly blamed America and its allies for assisting in an attack on an Iranian military parade that left at least 25 people dead. Trump is set to meet with a half-dozen foreign heads of state during this week’s U.N. meetings in New York, though Iran is not on the list. The president will hold one-on-one discussions with the leaders of France, Israel, Egypt, South Korea, Japan and the United Kingdom. Trump said in July that he would be willing to meet with Iranian leaders without preconditions. The comments marked an abrupt shift in tone from his past comments about Tehran, including one just days earlier in which he warned Rouhani against threatening the U.S. Tensions between Iran and the U.S. have been heightened in the months since the Trump administration withdrew from the Iran nuclear deal, which offered Tehran sanctions relief in exchange for abandoning its nuclear program. The U.S. has since reimposed some of the sanctions lifted in the deal, crippling the Iranian economy.

Libyan crude output highest since Jul 2013 at ‘more than 1 mil b/d,’ says NOC chairman – Platts

Libya’s crude oil production is currently at its highest in more than five years despite current security challenges, the chairman of the state-owned National Oil Corporation said Sunday. Mustafa Sanalla, speaking to reporters ahead of an OPEC/non-OPEC monitoring committee meeting, said that production is the "highest since July 2013" without providing the exact figure but he said it was more than "1 million b/d." Sanalla also would not give more details on the current security situation in the country, which remains volatile. Libyan oil production has seen a rollercoaster ride after production was almost halved earlier this summer due to fighting between rival armed groups at key oil export terminals. Last week, NOC warned that the country’s oil and gas output at the Wafa field could be shut down due to a blockade that was initiated by the Libyan state guards at the airport connected to the field. Two weeks ago, NOC’s headquarters in Tripoli were attacked with two employees killed and serious damage being done to the office premises. Sanalla was evacuated from the building during the assault, and a number of staff were briefly held hostage before the entire HQ was retaken by government security forces. National elections planned for December further add to the unpredictability and uncertainty of Libya’s oil sector. Despite this backdrop Libyan exports have been very high. Preliminary tanker data shows that exports from the North African country were more than 1 million b/d for the first half of September, up from just under 900,000 b/d in August, according to S&P Global Platts trade flow software cFlow. The 120,000 b/d Zawiya refinery is shut this month due to power issues, freeing up more barrels for export.

Crude production in Saudi-Kuwait shared Neutral Zone could restart by Jan: Kuwaiti oil minister – Platts

Crude production in the Partitioned Neutral Zone shared by Saudi Arabia and Kuwait could restart as soon as January, eventually adding up to 400,000 b/d in supplies at full ramp-up, Kuwaiti oil minister Bakheet al-Rashidi said Sunday. The two countries were working to resolve "technical issues related to the environment," he said, in order to restart production from two fields that have been offline for almost four years due to a political dispute. "We are hoping by the end of this year, we complete the right solution and we might resume production next year," Rashidi told reporters just before an OPEC/non-OPEC monitoring committee meeting in Algiers. "I think within three to six months we will be able to resume this production." Saudi energy minister Khalid al-Falih, however, was more circumspect and did not provide any timeline, though he said the fields in question have a total capacity of 500,000 b/d. "We are talking to them," Falih said. "Inshallah, we hope we will resolve it in the very near future." Crude output in the Neutral Zone fields is shared equally between the two countries. The Khafji field is part of the Al-Khafji Joint Operations, owned 50:50 by Saudi Arabia’s Aramco Gulf Operations Co. and Kuwait Gulf Oil Co. Aramco, the field’s operator, unilaterally shut production down in October 2014, citing new government emissions standards for gas flaring. Japan’s Toyo Engineering earlier this month said it had been retained to begin preparations for a restart of Khafji in early 2019. The Wafra field is operated by KGOC and Saudi Arabian Chevron, and was shuttered in May 2015, with Chevron saying it had encountered difficulties in securing work and equipment permits. Sources have said the dispute involved a land-use issue at Wafra unrelated to oil production. Since the field closures, ties between the two countries have been strained somewhat over Kuwait’s attempt to mediate an ongoing diplomatic row involving Saudi Arabia and Gulf neighbor Qatar. With OPEC agreeing with Russia and other allies in late June to a 1 million b/d output boost, the Neutral Zone fields could play a vital role in supplying barrels to the market that could be tightened by US sanctions on Iran that snap back November 5, as well as Venezuela’s continued output decline due to economic crisis.

Significance of attack on military parade in Iran – Reuters News

A deadly assault on an Iranian Revolutionary Guards parade dealt a stunning blow to Iran’s security establishment, which has often said it can repel any threat no matter how big, even from the United States and its chief Middle East ally Israel. Saturday’s shooting attack, among the worst ever on the Guards, illustrated that Iran’s elite force, which answers directly to Supreme Leader Ayatollah Ali Khameni, can be vulnerable to guerrilla-style operations. Iran had enjoyed relative stability compared to Arab neighbors who have grappled with political and economic upheaval touched off by popular uprisings in 2011. The Guards have vowed to retaliate for the attack. (Full Story)

WHO WAS RESPONSIBLE?

Iran blamed the United States and its Gulf Arab neighbors for the bloodshed. But it has presented no evidence. An Iranian ethnic Arab opposition movement called the Ahvaz National Resistance, which seeks a separate state in oil-rich Khuzestan province, claimed responsibility for the attack. So did Islamic State, who also claimed responsibility for a 2017 attack at the Iranian parliament and the mausoleum of Ayatollah Ruhollah Khomeini, the founder of the Islamic Republic, which left 18 dead. Neither group has presented proof of their involvement. Arab opposition groups have a long list of grievances against Iranian leaders and their frustrations are growing. The city of Ahvaz, where the attack took place, is the capital of Khuzestan, a region bordering Iraq where the majority of Iran’s Arab minority lives. The community has long felt neglected by the Persian-dominated central government in Tehran. The area has been hit particularly hard by the economic problems afflicting the entire country and the unemployment rate in Khuzestan is 14.5 percent, higher than the national rate of 11.8 per cent. Poor living standards have been compounded by electricity shortages and a severe drought, which locals blame on mismanagement by the central government. Residents of Ahvaz have been forced to stay inside their homes on some days because of severe sandstorms linked to drought in the past year. Armed opposition groups have played on this discontent to attempt to drum up support for their actions which have included attacks on oil pipelines in the region. Civil rights activists say these violent attacks undermine their peaceful efforts to help the community and lead to widespread arrests. The Kurds in western Iran and the Baluch in the southeast, both prominent minority groups, also complain of central government neglect. Armed Kurdish opposition groups have clashed with the Guards in the border area with Iraq in recent months, leading to several dead and wounded on both sides. In early September, the Guards fired seven missiles at a base of a Kurdish opposition group in northern Iraq, killing at least 11 people.

WHAT HAS BEEN THE REACTION TO THE ATTACK AMONG IRAN’S RIVAL POLITICAL FACTIONS?

Such attacks tend to unite Iranian reformers and hardliners despite sharp differences over domestic and foreign policies. President Hassan Rouhani has pushed back against the growing economic and political influence of the Guards in recent years but, after the Ahvaz attack, it will be difficult for Rouhani to challenge them. The violence has led to a boost in support for the Guards, according to analysts, which they will likely use to silence their critics, including Rouhani. President Donald Trump’s decision to withdraw the United States from an international nuclear deal from Iran will also give hardliners more political leverage because they argued that the United States should not be trusted.

HOW WILL THE REVOLUTIONARY GUARDS REACT?

Senior commanders have said the Ahvaz attack was carried out by militants trained by Gulf states and Israel and backed by America. But it is unlikely that the Guards will strike any of these foes directly. They will probably present a show of strength by launching missiles at groups operating in Iraq or Syria that may be linked to the militants who carried out the attack. After the Tehran attack by Islamic State in 2017, the Guards launched missiles at militant groups in eastern Syria days later. And after a series of clashes with Kurdish opposition groups in recent months, the Guards unleashed missiles at a Kurdish opposition base in northern Iraq in early September. The Guards are also likely to enforce a tight security policy in Khuzestan province for the foreseeable future, arresting any perceived domestic opponents including civil rights activists.

U.S. envoy Haley rejects Iran blame over parade attack – Reuters News

U.S. Ambassador to the United Nations Nikki Haley on Sunday dismissed Iran’s assertion that Washington and its Gulf allies were to blame for a deadly parade attack and said Tehran should look closer to home. Before leaving for the United Nations on Sunday, Iranian President Hassan Rouhani accused other countries including the United States of provoking the shooting attack on a military parade that killed 25 people on Saturday. Haley dismissed his comments as rhetoric. "He’s got the Iranian people are protesting, every ounce of money that goes into Iran goes into his military, he has oppressed his people for a long time and he needs to look at his own base to figure out where that’s coming from," she told CNN’s "State of the Union." "He can blame us all he wants. The thing he’s got to do is look at the mirror." Iran’s Revolutionary Guards vowed on Sunday to wreak "deadly and unforgettable" vengeance for the attack, which killed 12 of their comrades. There has been a blizzard of furious statements from top Iranian officials blaming the United States and Gulf kingdoms for the bloodshed and threatening a tough response. "America wants to cause chaos and unrest in our country so that it can return to this country, but these are unreal fantasies and they will never achieve their goals," Rouhani said. Haley was asked about comments made Saturday night after the attack by President Donald Trump’s personal lawyer, Rudy Giuliani. He told an Iranian opposition group that U.S. sanctions on Iran are leading to economic pain that could lead to a "successful revolution." Giuliani has made similar comments before on Iran, and the State Department has said he does not speak for the administration. The U.N. ambassador, without mentioning Giuliani, told CNN, "The United States is not looking to do regime change in Iran." Trump administration policy does not seek a change of government even though it is reimposing sanctions that are crippling Iran’s economy after Trump pulled out of the 2015 Iran nuclear agreement. Haley said Washington was trying to counter Iranian malign activities in the region as Tehran continued to test ballistic missiles, support terrorism and sell arms.

South Korea has bought no Iranian crude oil for about 3 months – SHANA – Reuters News

South Korea has bought no Iranian crude oil for about three months following the reimposition of U.S. sanctions on Tehran, a spokesman for the Iranian oil ministry was quoted as saying on Sunday by the ministry news website SHANA.

"For about three consecutive months, South Korea has had no oil imports from Iran," said Kasra Nouri, according to SHANA. "South Korea is the first country to completely cut off oil imports from Iran following the unilateral U.S. sanctions against Iran."

|

|

21-Sep |

W/W % Change |

YTD % Change |

|

S&P 500 |

2,929.67 |

0.85% |

9.58% |

|

Euro Stoxx 50 |

3,430.81 |

2.58% |

-2.09% |

|

FTSE 100 |

7,490.23 |

2.55% |

-2.57% |

|

DAX |

12,430.88 |

2.53% |

-3.77% |

|

Nikkei |

23,869.93 |

3.36% |

4.85% |

|

Hang Seng |

27,953.58 |

3.42% |

-6.57% |

|

CSI 300 |

3,410.49 |

5.19% |

-15.39% |

|

DXY |

94.22 |

-0.74% |

2.28% |

|

EUR |

1.17 |

1.07% |

-2.13% |

|

GBP |

1.31 |

0.03% |

-3.26% |

|

10 Year Yield |

3.06 |

2.23% |

27.33% |

|

Front Rolling WTI |

70.78 |

2.59% |

17.15% |

|

Front Rolling Brent |

78.80 |

0.91% |

17.84% |

CL1 / ES1 / EUR (Year To Date)

CL1 / ES1 / EUR (Year To Date % Change)

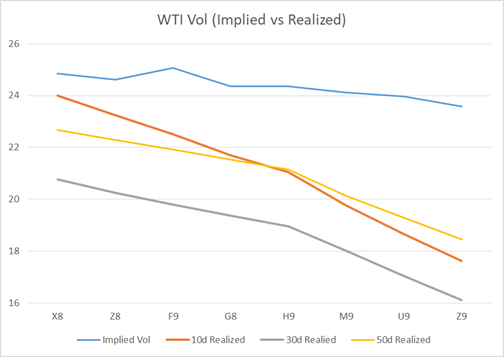

Daily Vol Change

|

WTI Vol |

20-Sep |

21-Sep |

Change |

BRT Vol |

20-Sep |

21-Sep |

Change |

|

|

X8 |

24.07 |

24.86 |

0.79 |

X8 |

21.20 |

21.34 |

0.14 |

|

|

Z8 |

24.36 |

24.61 |

0.25 |

Z8 |

23.83 |

24.31 |

0.48 |

|

|

F9 |

24.88 |

25.06 |

0.18 |

F9 |

23.91 |

24.05 |

0.14 |

|

|

G8 |

24.29 |

24.35 |

0.06 |

G8 |

24.99 |

24.89 |

-0.1 |

|

|

H9 |

24.32 |

24.35 |

0.03 |

H9 |

24.47 |

24.40 |

-0.07 |

|

|

M9 |

24.20 |

24.12 |

-0.08 |

M9 |

24.65 |

24.51 |

-0.14 |

|

|

U9 |

24.02 |

23.98 |

-0.04 |

U9 |

24.64 |

24.56 |

-0.08 |

|

|

Z9 |

23.67 |

23.59 |

-0.08 |

Z9 |

24.50 |

24.36 |

-0.14 |

Weekly Vol Change

|

Implied Vol |

Realized Vol |

|||||||

|

WTI Vol |

14-Sep |

21-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

25.19 |

24.86 |

-0.33 |

1.11 |

24.00 |

20.78 |

22.67 |

|

|

Z8 |

25.4 |

24.61 |

-0.79 |

1.1 |

23.25 |

20.26 |

22.29 |

|

|

F9 |

26.01 |

25.06 |

-0.95 |

1.11 |

22.51 |

19.81 |

21.93 |

|

|

G9 |

25.41 |

24.35 |

-1.06 |

1.08 |

21.69 |

19.37 |

21.53 |

|

|

H9 |

25.45 |

24.35 |

-1.1 |

1.08 |

21.06 |

18.97 |

21.15 |

|

|

M9 |

25.12 |

24.12 |

-1 |

1.05 |

19.77 |

18.01 |

20.14 |

|

|

U9 |

24.69 |

23.98 |

-0.71 |

1.03 |

18.65 |

17.05 |

19.29 |

|

|

Z9 |

24.31 |

23.59 |

-0.72 |

1.01 |

17.62 |

16.13 |

18.47 |

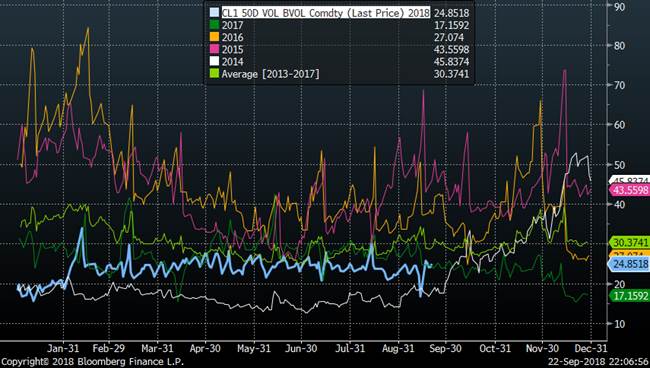

Front Rolling WTI ATM Implied Vol

|

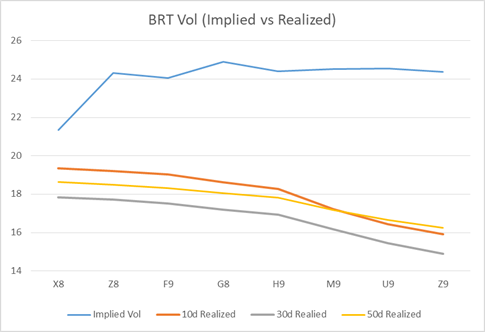

Implied Vol |

Realized Vol |

|||||||

|

BRT Vol |

14-Sep |

21-Sep |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

24 |

21.34 |

-2.66 |

1.06 |

19.35 |

17.84 |

18.64 |

|

|

Z8 |

25.01 |

24.31 |

-0.7 |

1.2 |

19.21 |

17.71 |

18.49 |

|

|

F9 |

24.87 |

24.05 |

-0.82 |

1.18 |

19.04 |

17.53 |

18.33 |

|

|

G9 |

25.74 |

24.89 |

-0.85 |

1.22 |

18.63 |

17.21 |

18.06 |

|

|

H9 |

25.35 |

24.4 |

-0.95 |

1.19 |

18.29 |

16.94 |

17.83 |

|

|

M9 |

25.39 |

24.51 |

-0.88 |

1.19 |

17.22 |

16.19 |

17.19 |

|

|

U9 |

25.34 |

24.56 |

-0.78 |

1.18 |

16.45 |

15.44 |

16.66 |

|

|

Z9 |

25.04 |

24.36 |

-0.68 |

1.15 |

15.92 |

14.88 |

16.26 |

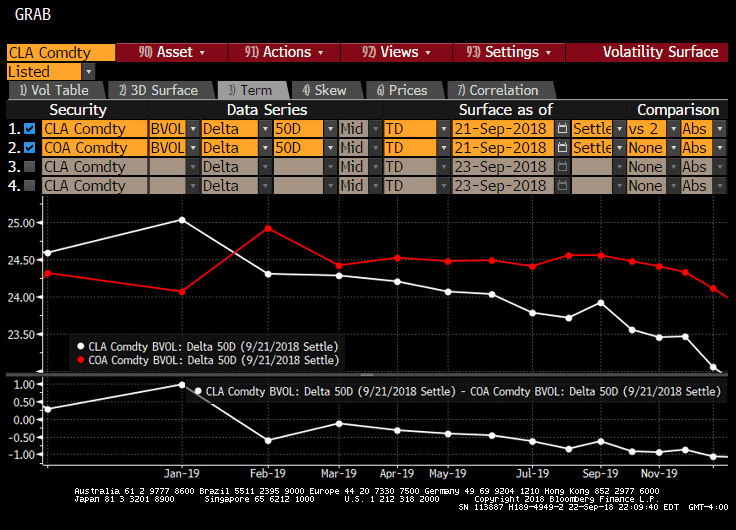

WTI vs Brent Implied ATM Vol Curve

WTI Weekly Skew Change

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

X8 |

2.45 |

1.9 |

1.1 |

0.55 |

24.86 |

-0.15 |

0 |

0.5 |

1.15 |

|

X8 (9/14) |

2.65 |

1.85 |

0.95 |

0.45 |

25.19 |

-0.1 |

0.15 |

0.85 |

1.75 |

|

|

-0.2 |

0.05 |

0.15 |

0.1 |

-0.33 |

-0.05 |

-0.15 |

-0.35 |

-0.6 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

3.1 |

2.25 |

1.35 |

0.7 |

24.61 |

-0.35 |

-0.4 |

-0.15 |

0.4 |

|

Z8 (9/14) |

3 |

2.15 |

1.25 |

0.65 |

25.4 |

-0.35 |

-0.35 |

0.05 |

0.65 |

|

Change |

0.1 |

0.1 |

0.1 |

0.05 |

-0.79 |

0 |

-0.05 |

-0.2 |

-0.25 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

3.25 |

2.45 |

1.6 |

0.85 |

25.06 |

-0.45 |

-0.55 |

-0.3 |

0.2 |

|

F9 (9/14) |

3.15 |

2.4 |

1.55 |

0.85 |

26.01 |

-0.5 |

-0.65 |

-0.45 |

0.05 |

|

Change |

0.1 |

0.05 |

0.05 |

0 |

-0.95 |

0.05 |

0.1 |

0.15 |

0.15 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.45 |

2.75 |

1.9 |

1.05 |

24.35 |

-0.6 |

-0.7 |

-0.5 |

0 |

|

G9 (9/14) |

3.55 |

2.85 |

1.95 |

1.1 |

25.41 |

-0.6 |

-0.8 |

-0.65 |

-0.2 |

|

Change |

-0.1 |

-0.1 |

-0.05 |

-0.05 |

-1.06 |

0 |

0.1 |

0.15 |

0.2 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.9 |

3.25 |

2.3 |

1.3 |

24.35 |

-0.75 |

-0.9 |

-0.7 |

-0.15 |

|

H9 (9/14) |

3.95 |

3.2 |

2.3 |

1.3 |

25.45 |

-0.75 |

-0.95 |

-0.85 |

-0.35 |

|

Change |

-0.05 |

0.05 |

0 |

0 |

-1.1 |

0 |

0.05 |

0.15 |

0.2 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4.5 |

3.8 |

2.75 |

1.55 |

24.12 |

-1 |

-1.3 |

-1.1 |

-0.5 |

|

M9 (9/14) |

4.6 |

3.95 |

2.9 |

1.65 |

25.12 |

-1 |

-1.3 |

-1.15 |

-0.7 |

|

Change |

-0.1 |

-0.15 |

-0.15 |

-0.1 |

-1 |

0 |

0 |

0.05 |

0.2 |

Brent Weekly Skew Change

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

X8 |

1.65 |

1 |

0.3 |

0 |

21.34 |

0.45 |

0.95 |

1.5 |

1.95 |

|

X8 (9/14) |

2.35 |

1.5 |

0.65 |

0.2 |

24 |

0.15 |

0.5 |

1 |

1.45 |

|

Change |

-0.7 |

-0.5 |

-0.35 |

-0.2 |

-2.66 |

0.3 |

0.45 |

0.5 |

0.5 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

2.2 |

1.35 |

0.65 |

0.25 |

24.31 |

0.1 |

0.4 |

0.95 |

1.8 |

|

Z8 (9/14) |

2.5 |

1.55 |

0.75 |

0.35 |

25.01 |

0 |

0.15 |

0.5 |

1.05 |

|

Change |

-0.3 |

-0.2 |

-0.1 |

-0.1 |

-0.7 |

0.1 |

0.25 |

0.45 |

0.75 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

3.3 |

1.9 |

1 |

0.5 |

24.05 |

-0.2 |

-0.25 |

0.1 |

1.1 |

|

F9 (9/14) |

3.65 |

2.05 |

1 |

0.5 |

24.87 |

-0.25 |

-0.35 |

-0.05 |

0.8 |

|

Change |

-0.35 |

-0.15 |

0 |

0 |

-0.82 |

0.05 |

0.1 |

0.15 |

0.3 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.3 |

2.55 |

1.6 |

0.8 |

24.89 |

-0.4 |

-0.3 |

0.1 |

0.75 |

|

G9 (9/14) |

3.25 |

2.15 |

1.3 |

0.65 |

25.74 |

-0.35 |

-0.4 |

-0.2 |

0.4 |

|

|

0.05 |

0.4 |

0.3 |

0.15 |

-0.85 |

-0.05 |

0.1 |

0.3 |

0.35 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.3 |

2.55 |

1.6 |

0.8 |

24.4 |

-0.4 |

-0.3 |

0.1 |

0.75 |

|

H9 (9/14) |

3.4 |

2.45 |

1.6 |

0.9 |

25.35 |

-0.5 |

-0.6 |

-0.25 |

0.45 |

|

|

-0.1 |

0.1 |

0 |

-0.1 |

-0.95 |

0.1 |

0.3 |

0.35 |

0.3 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4 |

3.3 |

2.25 |

1.25 |

24.51 |

-0.75 |

-0.85 |

-0.35 |

0.4 |

|

M9 (9/14) |

4.1 |

3.3 |

2.25 |

1.3 |

25.39 |

-0.85 |

-1.1 |

-0.8 |

-0.2 |

|

|

-0.1 |

0 |

0 |

-0.05 |

-0.88 |

0.1 |

0.25 |

0.45 |

0.6 |

WTI Most Actively Traded Options (Friday)

Brent Most Actively Traded Options (Friday)

9/21 ICE/CME Mixed Clearing Recap

WTI/BRT H19 ATM Call Roll x70.00/78.00 TRADES 23 300x 56d/55d

BRT X18 80 Call Switch TRADES Flat 5,000x

9/21 ICE Trade Recap

BRT H19 75/85 Fence x77.90 TRADES 24 800x 46d

BRT G19 86 Call x78.50 TRADES 130 700x 23d

WTI H19 85 Call x78.20 TRADES 201 500x 30d

BRT Z19 ATM Call x75.50 TRADES 762 650x 61d

BRT M19 95 Call x77.30 TRADES 103 1,800x 15d; TRADES 104 700x 15d

BRT Z18 79 Put x79.00 TRADES 235 750x 50d

BRT X18 82/85 Call Spread TRADES 8 8 500x

BRT M20 50 Put x73.25 TRADES 135 500x 10d

BRT Z/Z20 ATM Call Roll x71.50/75.50 TRADES 156 300x 65d/70d

BRT Z18 80 Call x78.15 TRADES 161 400x 40d

BRT Z18 82/85 Call Spread x78.15 TRADES 52 400x 14d

BRT X18 79/78 Put Spread TRADES 44 1,000x

WTI Z19 45/55 Put Spread vs 85 Call x67.00 TRADES 45 400x 26d

BRT F19 84 Call x77.75 TRADES 108 2,000x 24d

BRT M/Z19 ATM Call Roll x76.50/74.50 TRADES 183 500x 55d/55d

BRT X18 81/82 Call Spread LIVE TRADES 10 500x; TRADES 11 500x

BRT F19 85/95 Call Spread TRADES 74 4,000x

9/21 CME Trade Recap

WTI Z/Z19 70 Call Roll x70.75/67.50 TRADES 247 850x 58d/51d

WTI Z18 68/74/80 Call Fly x70.75 TRADES 189 500x 12d

BRT Z18 ATM Call x79.00 TRADES 236 250x 52d

WTI F19 70.50 Straddle TRADES 668 250x

WTI Z19 65/75 Fence x67.40 TRADES 219 800x 72d

WTI M19 ATM Call x69.50 TRADES 535 400x 60d

WTI Z/F19 80/83.50 Call Spread TRADES 1 1,000x

WTI X18 72 Call x71.35 TRADES 159 1,250x 47d

WTI F/M19 ATM Call Roll x70.00/68.50 TRADES 196 1,000x 52d/52d

9/21 CSO/ARB/APO Trade Recap

WTI CSO X/Z 18 0.50 Call (7A) TRADES 13 300x

WTI CSO X/Z18 1.00/1.50/2.00 Call Fly (WA) TRADES 6 2,000x

WTI CSO X/Z18-Z/F19 1.25 Call (WA) TRADES 6 250x

ARB X18 -8.00 Call TRADES 19 50x; TRADES 45 25x

ARB X18 -8.50 Call TRADES 55 25x; TRADES 80 25x

WTI APO Cal19 68/60 Put Spread vs 75 Call x68.70 TRADES 15 30x

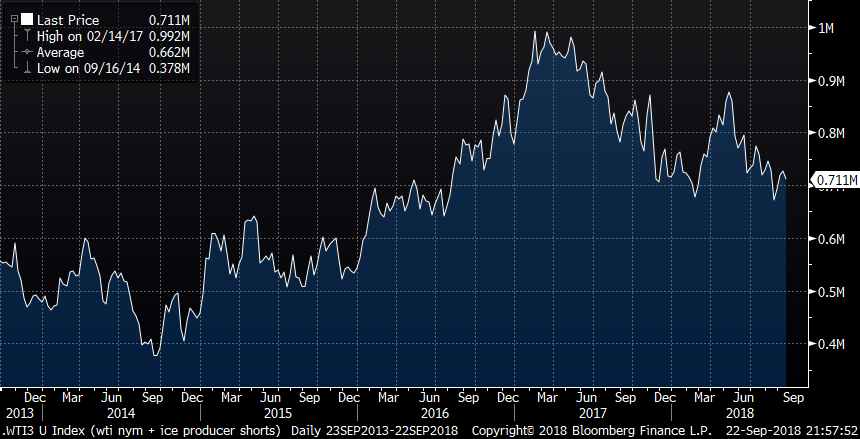

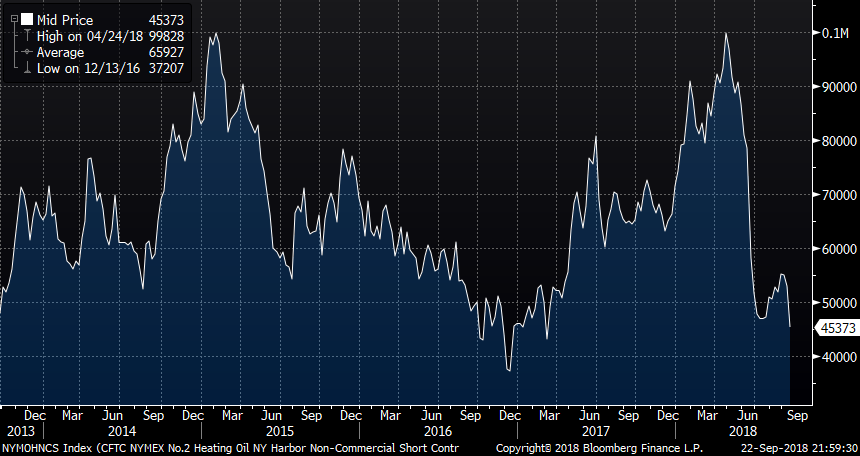

WTI / XB / ULSD Commitment of Traders (data through September 18th)

WTI NYM Net large Spec decreased by 19,010 last week (18,267 in long liquidation and 743 in new shorts)

WTI NYM Managed money net position decreased by 13,219 last week (14,652 in long liquidation and 1,433 in short covering)

WTI NYM Commercials positions increased by 12,436 last week (6,066 in new length and 6,370 in short covering)

WTI NYM Producer/Merchant/Processor/User Shorts decreased by 18,600 last week

WTI NYM Swap Dealer Shorts decreased by 5,280 last week

WTI ICE Net large Spec increased by 2,421 last week (2,330 in new length and 91 in short covering)

WTI ICE Managed money net position decreased by 2,755 last week (639 in long liquidation and 2,116 in new shorts)

WTI ICE Commercials positions decreased by 254 last week (1,857 in new length and 2,111 in new shorts)

WTI ICE Producer/Merchant/Processor/User Shorts increased by 3,536 last week

WTI ICE Swap Dealer Shorts increased by 915 last week

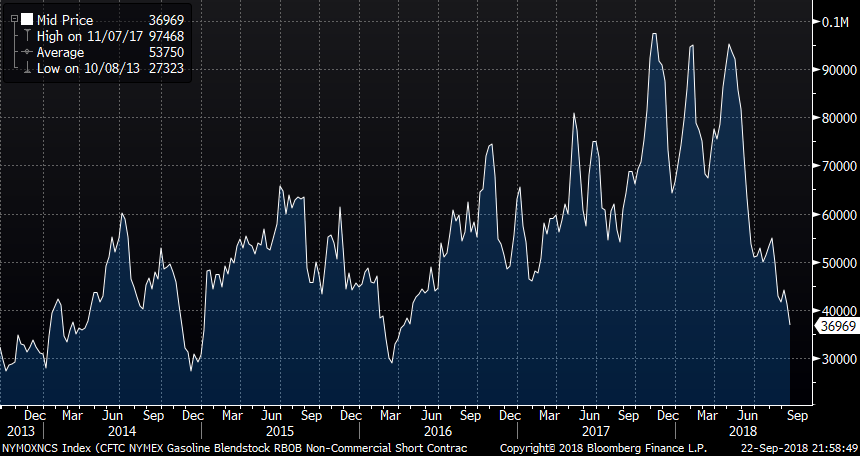

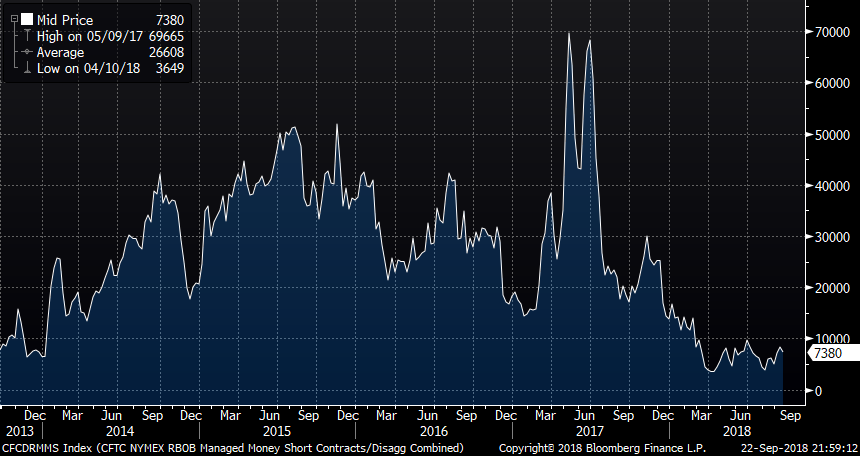

RBOB Net large Spec increased by 6,927 last week (2,761 in new length and 4,166 in short covering)

RBOB Managed money net position increased by 4,153 last week (3,153 in new length and 1,000 in short covering).

ULSD Net large Spec increased by 2,547 last week (4,988 in long liquidation and 7,535 in short covering)

ULSD Managed money net position decreased by 3,553 last week (4,192 in long liquidation and 639 in short covering)

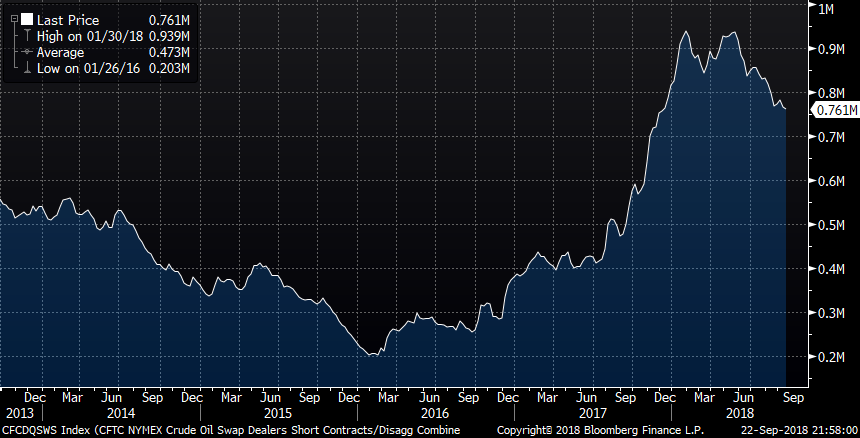

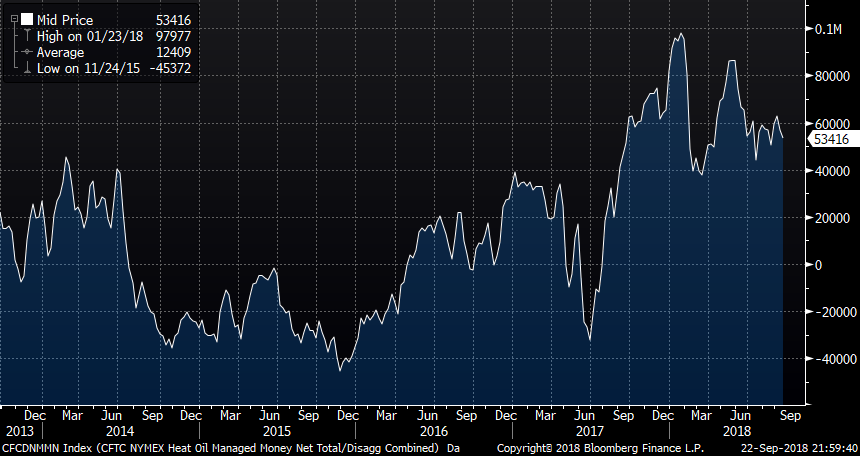

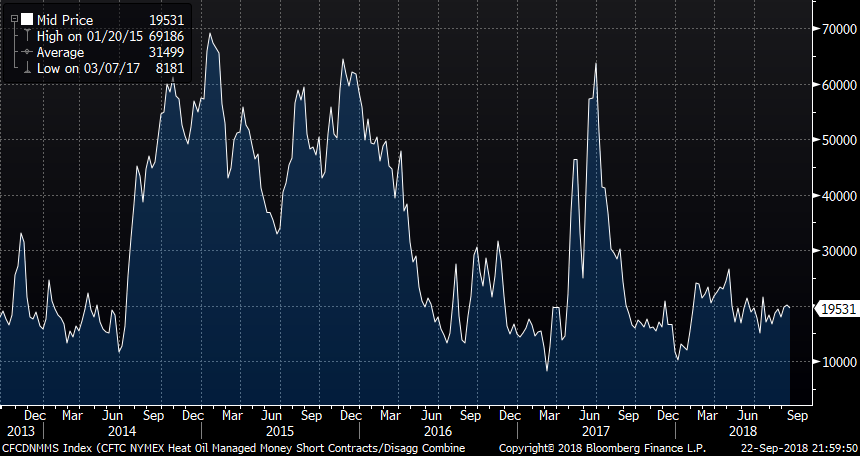

Brent / Gasoil COT Data (data through September 18th)

ICE Brent Managed money net position increased by 27,804 last week (20,530 in new length and 7,274 in short covering)

ICE Brent Net large Spec increased by 24,870 last week (19,571 in new length and 5,299 in short covering)

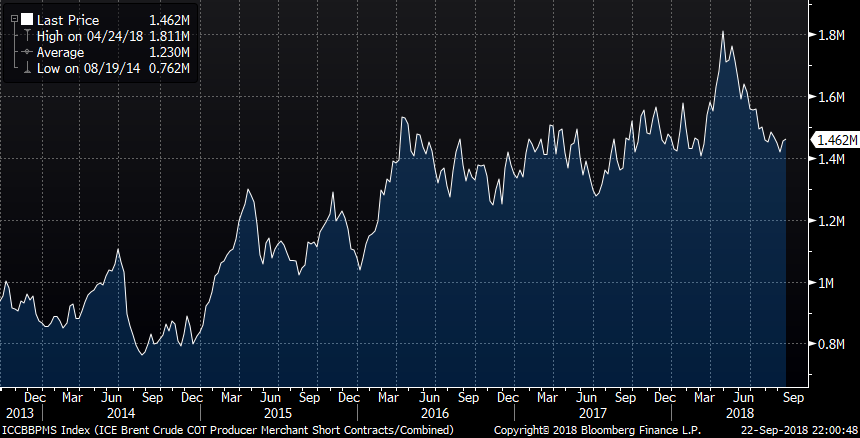

ICE Brent Producer/Merchant/Processor/User net positioning decreased by 10,276 with 1,902 in long liquidation and 8,374 in new shorts

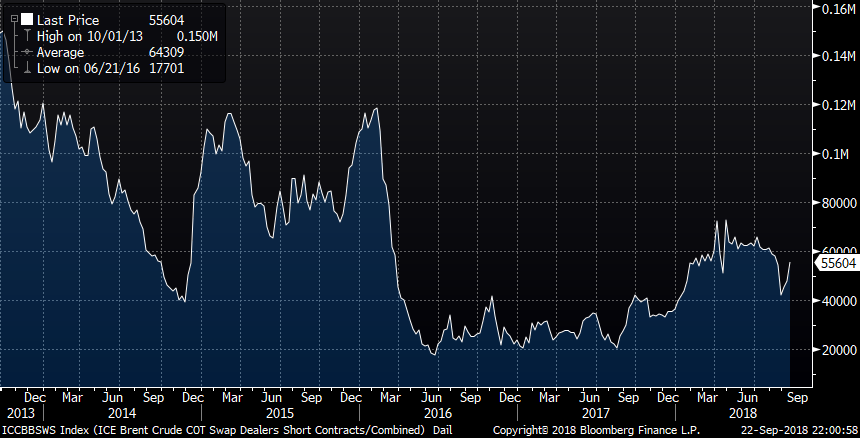

ICE Brent Swap Dealers net length decreased by 13,367 with 5,769 in long liquidation and 7,598 in new shorts

NYM Brent Net large Spec increased by 2,595 last week (1,737 in new length and 858 in short covering)

NYM Brent Managed money net position increased by 4,036 last week (3,941 in new length and 95 in short covering)

NYM Brent Commercials positions decreased by 2,269 last week (2,498 in new length and 4,767 in new shorts)

NYM Brent Producer/Merchant/Processor/User Shorts increased by 210 last week

NYM Brent Swap Dealer Shorts increased by 3,252 last week

ICE Gasoil Managed money net position decreased by 12,624 last week (11,038 in long liquidation and 1,586 in new shorts)

WTI + Brent Managed Money net position increased by 15,866 last week (9,180 in new length and 6,686 in short covering)

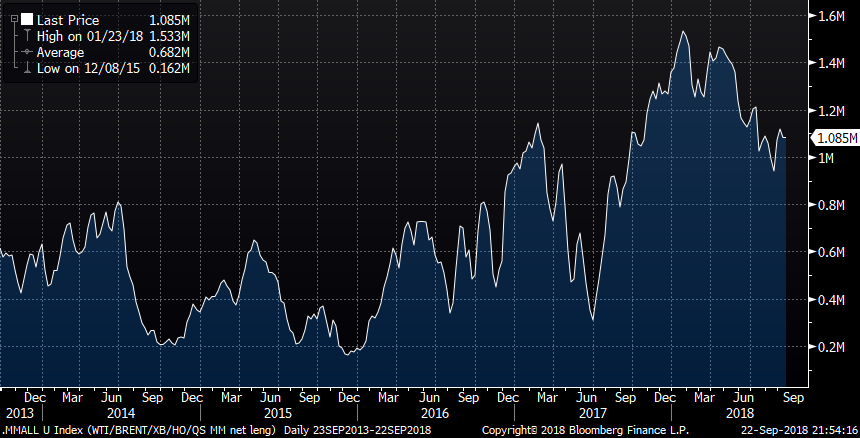

CL / BRT / XB / HO / QS Managed money net length

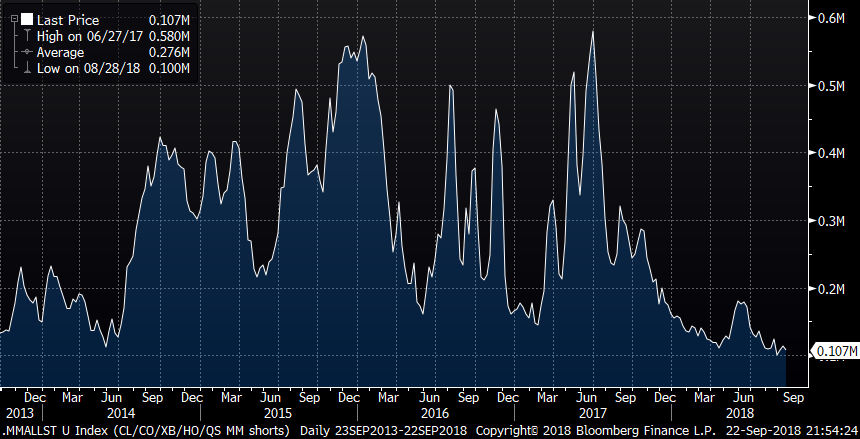

CL / BRT / XB / HO / QS Managed money short position

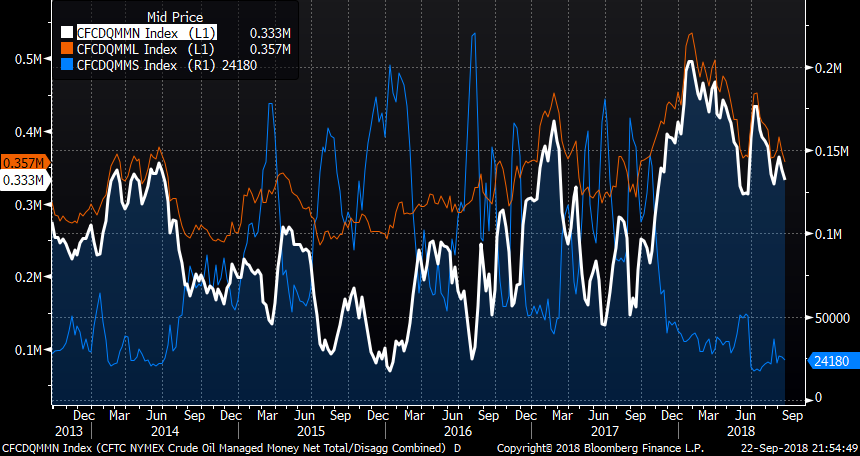

Nymex WTI Managed money Longs, shorts and total

Nymex WTI managed money net length vs CL1 (price)

ICE Brent Managed money Longs, shorts, and total

ICE Brent managed money net length vs CO1 (price)

WTI + BRENT Managed Money net length

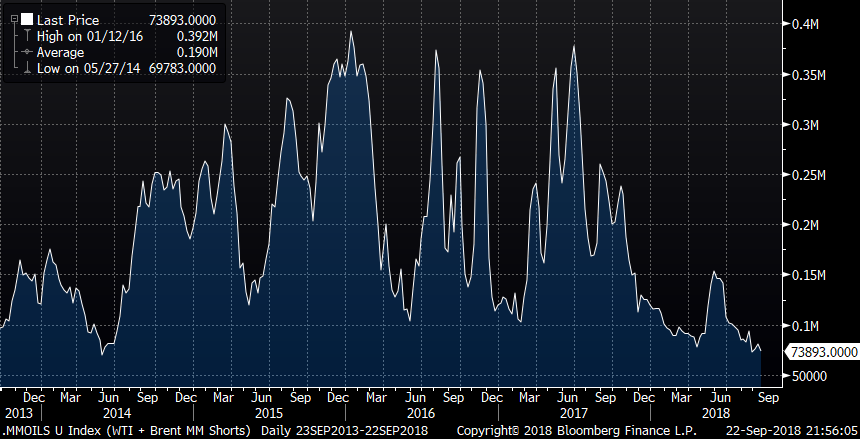

WTI + BRENT Managed Money Shorts

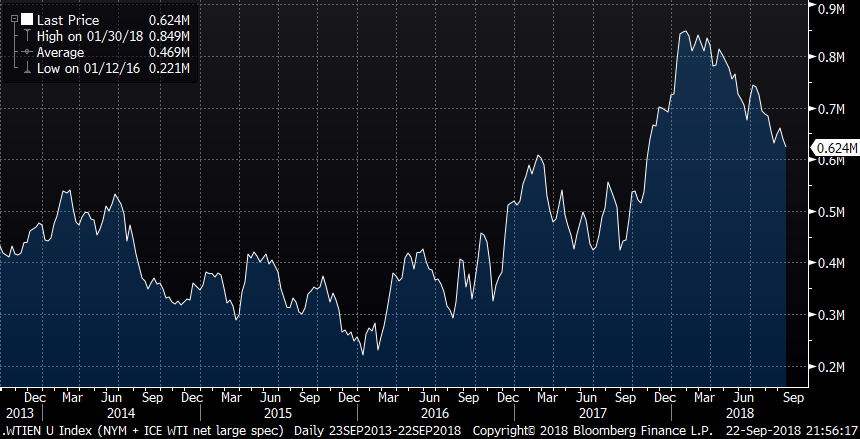

NYM + ICE WTI Non-Commercial net length

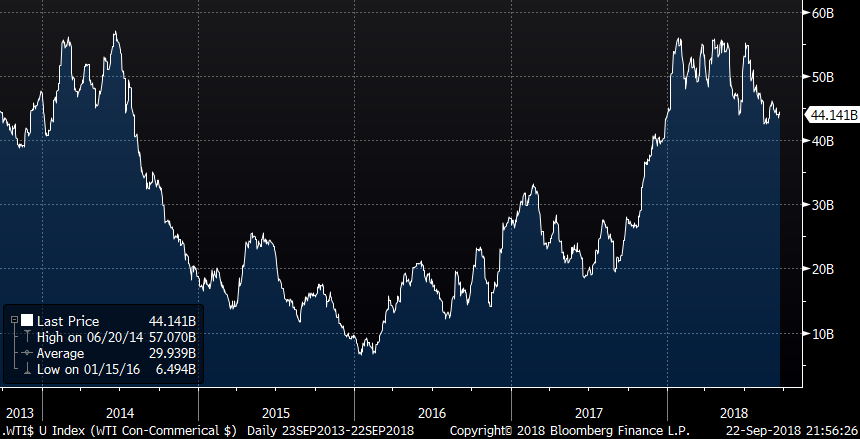

NYM + ICE WTI Non-Commercial Net Length in $

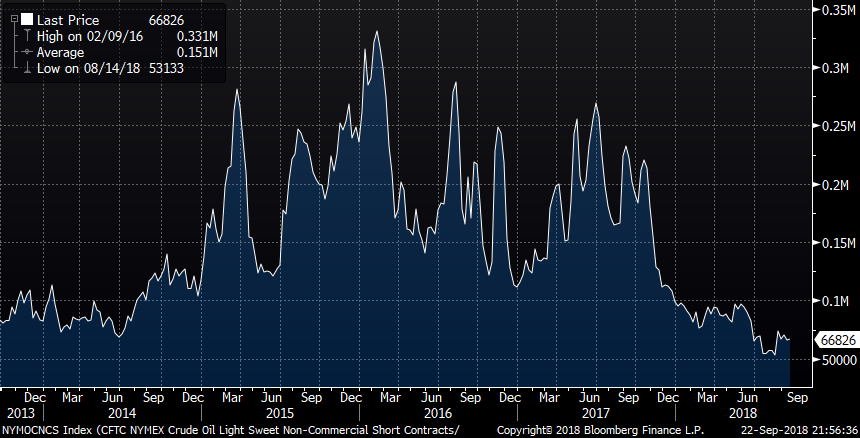

NYM WTI Non-Commercial Shorts

NYM + ICE WTI Managed Money Net Length

NYM WTI Managed Money Shorts

NYM + ICE WTI Managed Money Net Length in $

NYM + ICE WTI Commercial Net Length

NYM + ICE WTI Producer/Merchant/Processor/User Short Positions

Nymex WTI Swap Dealer Short Position

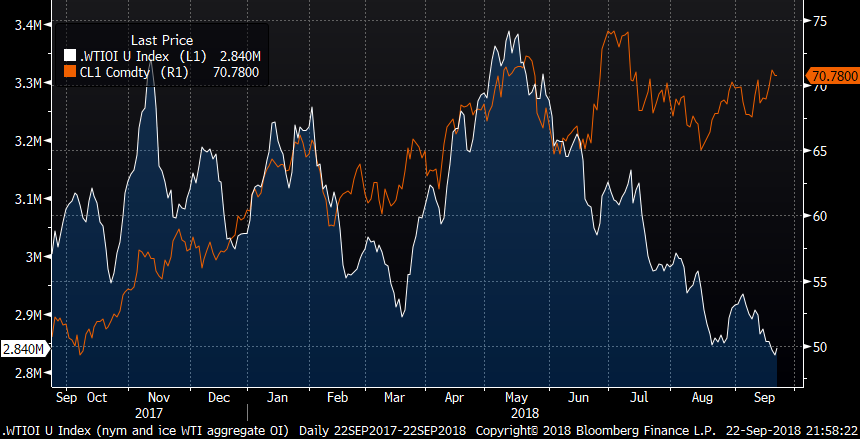

WTI aggregate futures OI vs Price

Rbob Non-Commercial Net Length

Rbob Non-Commercial Shorts

Rbob Managed Money Net Length

Rbob Managed Money Shorts

ULSD Non-Commercial Net Length

ULSD Non-Commercial Shorts

ULSD Managed Money Net Length

ULSD Managed Money Shorts

Brent Managed Money net length in $

Brent Non-Commercial net length:

Brent Non-Commercial short position :

Brent Commercial Net Length

Brent Producer / Merchant Net Length

Brent Producer / Merchant shorts

Brent Swap Dealer Shorts

Brent Aggregate Futures OI vs Price

Gasoil Managed Money Net Length

Gasoil Managed Money Shorts

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.