From: research

Sent: Sunday, May 24, 2020 10:56:51 AM (UTC-06:00) Central Time (US & Canada)

To: research

Subject: Weekend Market Report – May 24, 2020

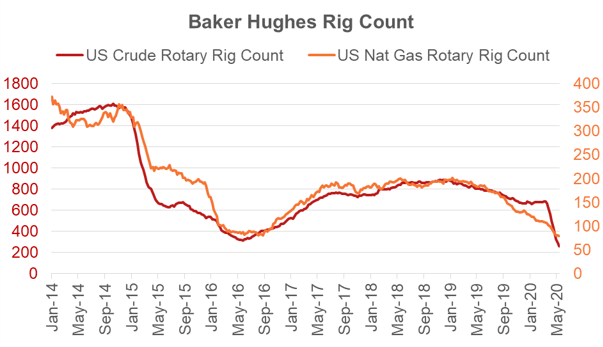

Baker Hughes reported another drop in rig counts on Friday. Total oil rigs fell by 21 to 237 this week, while natural gas rigs stayed flat. The massive drop in rigs has led to oil and natural gas production falling at one of the fastest paces ever observed due to the steep decline rates associated with shale wells.

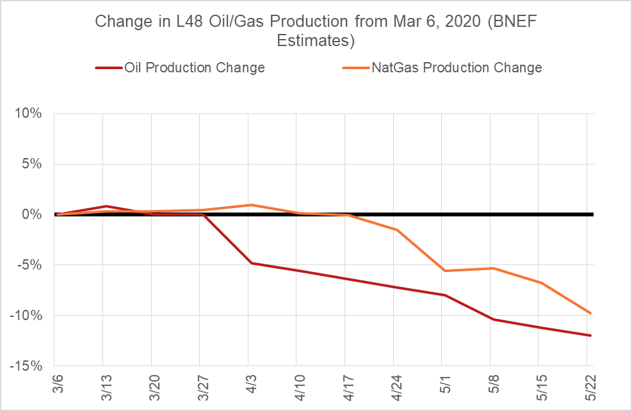

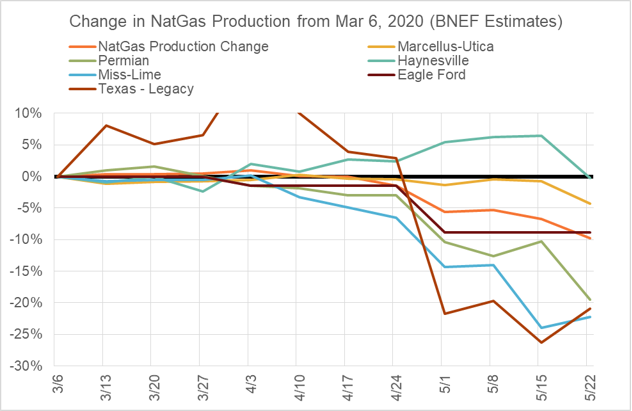

Here are some stats we compiled on the past 12 weeks. This takes us back to week ending Mar 6th – pre-covid in North American (major impacts) and before the global oil price war was triggered.

Oil Rigs lower by 445, or 65%

Natural Gas Rigs lower by 30, or 28%

Frac Spread Count lower by 272, or 86%

L48 Oil Production lower by 1.5 mmbbls/d, or 12%

L48 Nat Gas Production lower by 8.92 Bcf/d, or 10% (BNEF estimates)

Oil Prices (36 month strip) down by $7.64/bbl, or 17%

Nat Gas Prices (36 month strip) higher by $0.23/bbl, or 10%

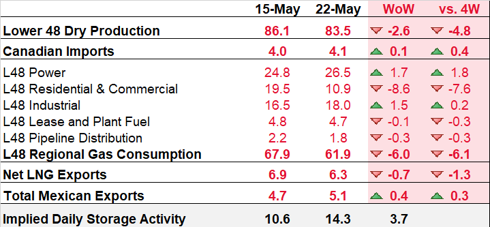

Fundamentals for week ending May 22:

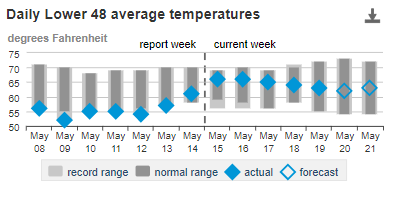

Looking forward to next week’s report for week ending May 22, we see a triple digit build once again. Weather recovered to more normal levels resulting in overall demand dropping by 6.0 Bcf/d week-on-week. Although, this looseness was offset by production dropping 2.6 Bcf/d drop from the previous week. Our early for the next report currently stands at +108 Bcf.

US natural gas dry production averaged 83.5 Bcf/d for the week. Average weekly production is 4.8 Bcf/d lower than 4 weeks ago.

Canadian imports were lower last week averaging 4.1 Bcf/d.

Mexican exports stayed flat to average 5.1 Bcf/d.

Deliveries to LNG facilities decreased week-on-week to 6.3 Bcf/d with Sabine dropping in-take to an average of 2.1 Bcf/d.

Expiration and rolls: UNG ETF roll starts on June 12th and ends on June 17th.

June futures expire on May 27th, and May options expire on May 26th.

Het Shah

Bloomberg IM: Het Shah

enelyst DM: @het.co

Tel: 917-975-2960

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.