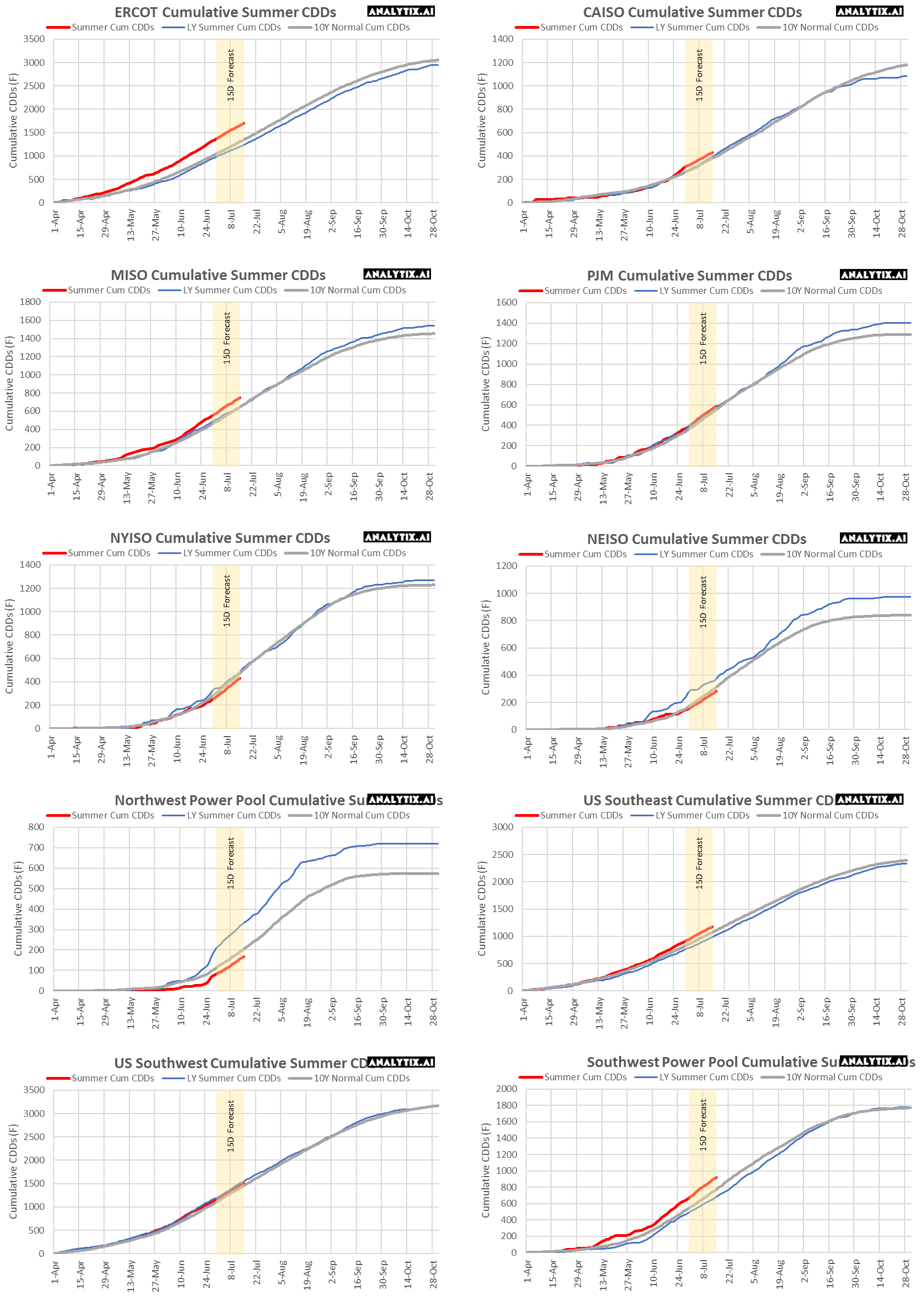

Happy Canada Day and July 4th. This week we start with a series of charts showing cumulative CDDs across all the major power ISOs. Q2 was quite extreme in many ways, and included in that was the weather intensity in some pockets of the country ahead of peak summer. See the chart below to get a perspective on where each market landed.

(Open the PDF to get a closer look, and email me if you want the actual numbers and deltas)

NatGas Storage Fundamentals:

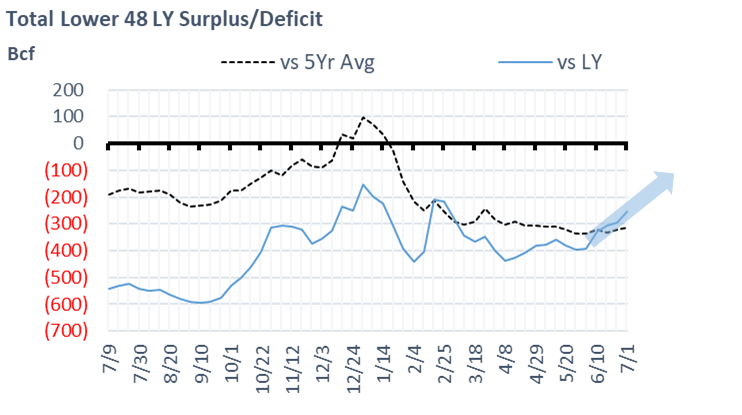

The EIA reported a +82 Bcf injection for the week ending June 24th, which came in much higher than the market consensus once again. That’s now two extremely bearish EIA storage prints in a row, which help verify the looseness. The expectations were for the mid-70s had already built in the full impact of the Freeport outage and the Juneteeth holiday – hence there is some other factor that most vendors have been missing in their S/D. We believe it’s about 1 Bcf/d of Texas production as we have eluded to in past reports. As reported

This storage report takes the total level to 2251 Bcf, which is 296 Bcf less than last year at this time and 322 Bcf below the five-year average of 2,573 Bcf. Overall, we estimate this +82 Bcf injection is ~2.7 Bcf/d loose vs last summer (wx adjusted).

This week we are unable to share details on generation with no update to the EIA 930 dataset from the EIA. The EIA is experiencing some major IT issues halting the update of many key datasets.

The report helped trigger a sell-off like no other, before a decent recovery after hours. The Aug contract bottomed at $5.357, settled the day at $5.505, and then make a recovery overnight.

There were a few issues that pushed prices around on Thursday and Friday:

1) the bearish storage report,

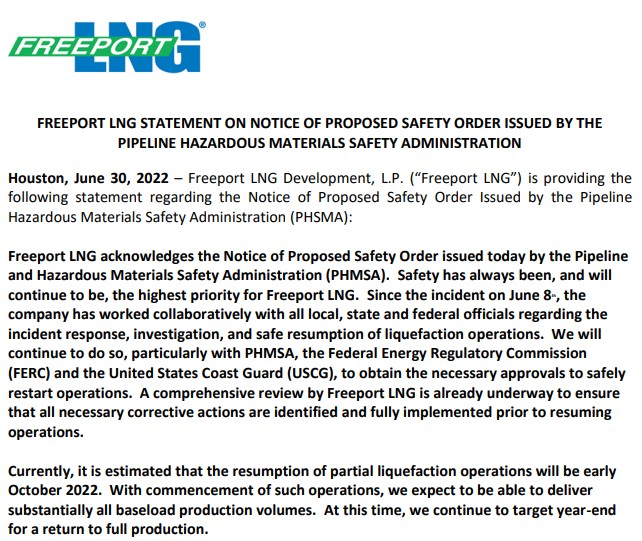

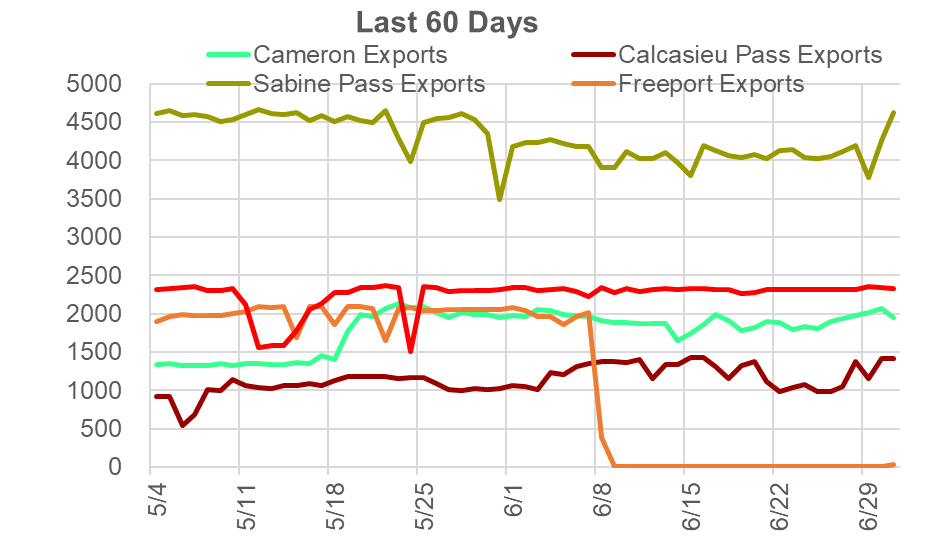

2) the bearish PHMSA Proposed Safety Order on Freeport which eluded to a longer outage time for the facility. The PHMSA sent a notice to Freeport saying a preliminary investigation found that conditions at the terminal appeared unsafe. Early data shows that 300 feet of vacuum insulated pipe experienced an “overpressure issue” due to an isolated pressure safety valve. The incident happened in an insulated pipe with a diameter of 18 inches which is a component of the system used to distribute LNG across the storage tank area. Before LNG transfer operations can restart, other pipes in those locations will need to be repaired or replaced. It also required Freeport to hire a third party to assess the damage and establish a plan for the return to service. The kicker is that PHMSA must approve the restart, which set of fear that this timeline could be extended well into 2023.

3) the neutralizing late-day Freeport press release eluding to a partial restart in early Oct. This report might be overly optimistic by some, but it states a very clear timeline and plant throughput.

The way I read this is that there is the possibility of bypassing the impacted area of the facility to get a quick restart.

For the week ending July 1st, our early view is +68 Bcf. This reporting period will take L48 storage level to 2,351 Bcf (-253 vs LY, -314 vs. 5Yr). This upcoming report should help reduce the deficit vs last year with only 25 Bcf injected during the same week last year.

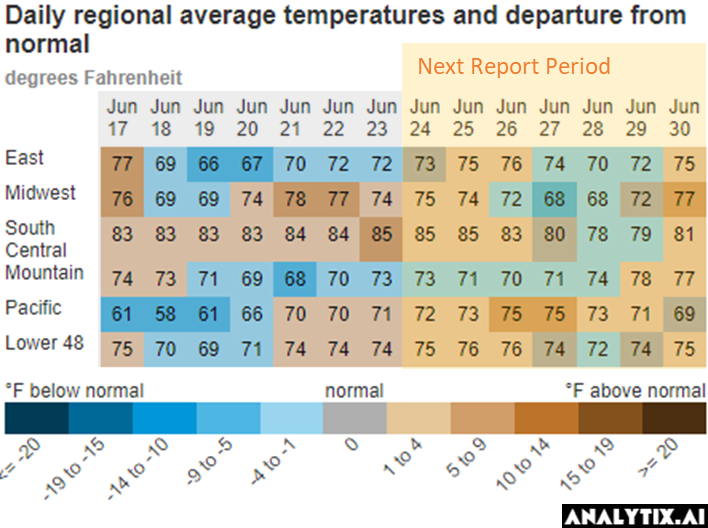

During the past week, heat continue across much of the country except for the Mountain region. The net result was a jump in population wt. CDDs by 2.2F relative to the previous week.

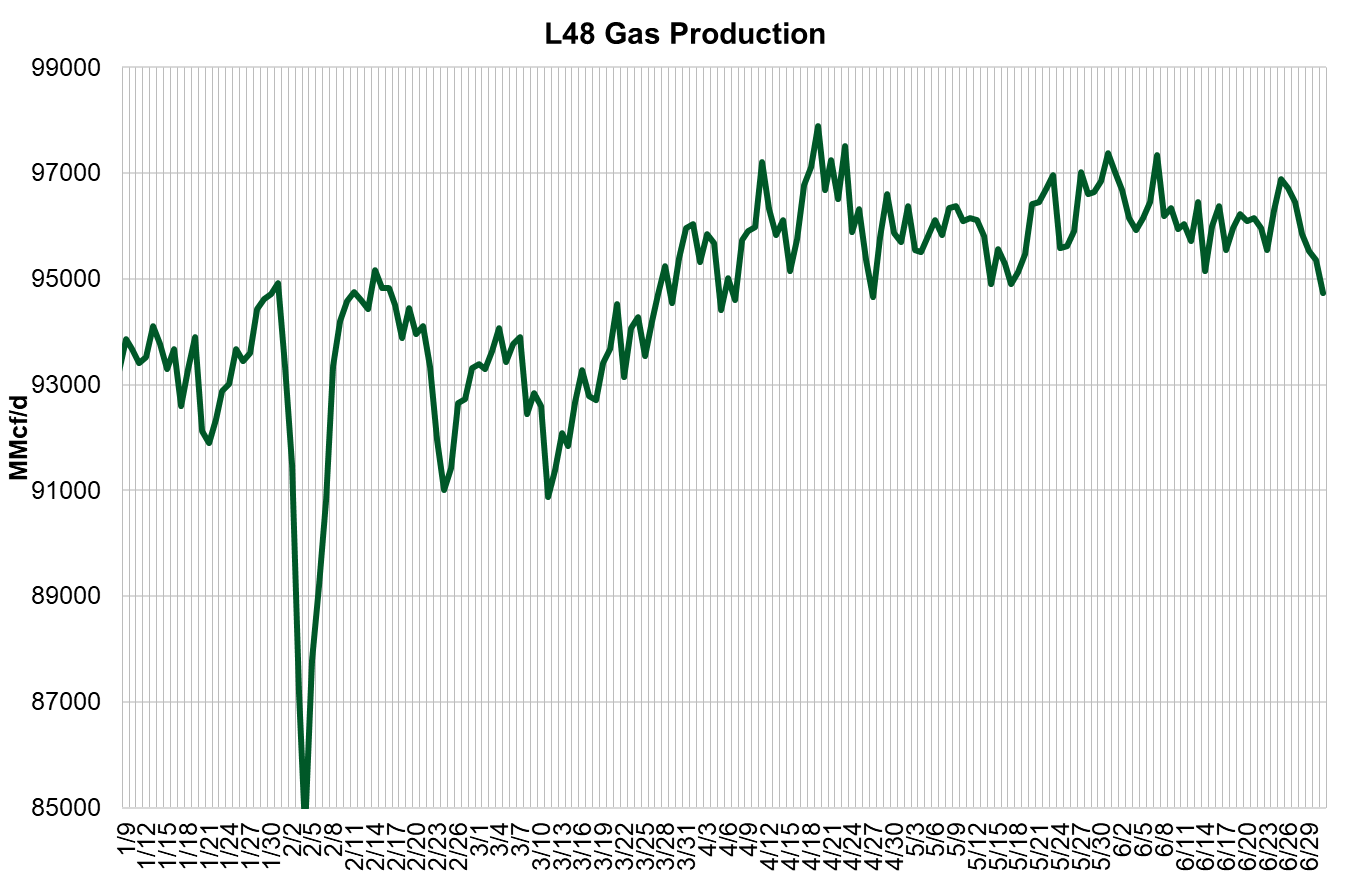

Domestic dry gas production was slightly higher week-on-week, with the Midcontinent and Northeast adding more supply that was lost in the South Central. Domestic production has been essentially flat (with some noise) despite the large increase in rig counts. The weak completion has been bringing on just enough new wells to offset the deep shale well declines.

Deliveries to LNG facilities averaged 10.6 Bcf/d last week which is flat with the previous week. We anticipate stronger LNG deliveries overall next week with signs of life coming from Sabine Pass and Calcasieu Pass at the end of the week. Both facilities started to ramp higher leading to overall delivery levels hitting 11.5+ Bcf/d.

The net balance was -1.8 Bcf/d tighter week-on-week.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.