This was quite the week with the Freeport event grabbing all headlines. The explosion looks isolated to the storage tank area of the facility and the incident did not impact any of the liquefaction trains.

Freeport LNG has formally published a filing with the Texas Commission on Environmental Quality (TCEQ), citing that on June 8 at 11:40 am, an incident occurred, and it “became necessary to bring the Liquefaction Trains 1, 2, and 3 down due to an in-plant incident that resulted in a fire in the liquefaction delivery system.” [this comes from a note the Criterion Research team sent to clients on Thursday]. We read this as confirmation the location of the incident is post-liquefaction.

The prompt month contract cratered on Wednesday as fear set in that the Freeport facility could be shut down for a prolonged period. With little news, we saw price recover after the release of the Thursday storage report.

The market looks to have shaken off the impact and believes that the facility will be back in short order. I assume that this is based on reviewing the location of the explosion and the quick dissipation of the fire.

Here is an aerial view of where the explosion took place.

Source: @RonH

The only other definitive piece of information we have at the moment is that the plant will be shut down for at least 3 weeks while federal and state investigators look into possible explanations for the blast. Luckily, no injuries or pollution have been reported, and all employees at the plant have been accounted for – otherwise, this could have been a deeper and longer investigation.

Freeport LNG handles 20 percent of America’s LNG exports, and being offline will have supply ramifications for an already tight global natural gas market. Below are some comments from Ruth Liao of ICIS on LinkedIn:

Asia spot LNG prices jumped up 4% as a result of the Freeport #LNG fire. On 9 June, July ICIS East Asia Index (EAX) rose to $24.65/MMBtu and August to $24.85/MMBtu, both up $1.00/MMBtu from the previous day. The ICIS TTF July ’22 contract was trading around $26.84/MMBtu on 9 June, up almost 9% from the previous day’s close.

The unexpected Freeport LNG fire and subsequent shutdown of three weeks means that there is at least 13 LNG cargoes removed from the global market from the initial period. This is going to tighten prompt supply, particularly in the Atlantic, as a majority of the cargoes have been destined for Europe. We could see the discount narrow or disappear to the ICIS #TTF benchmark for Europe cargoes.

As much as 80% of the cargoes that loaded in March from Freeport LNG went to Europe, including Turkey, according to LNG Edge. In April, 70% of cargoes went to Europe, while in May, it was around 56%, although three cargoes loaded at the end of May are still on the water, so the May figure will be updated.

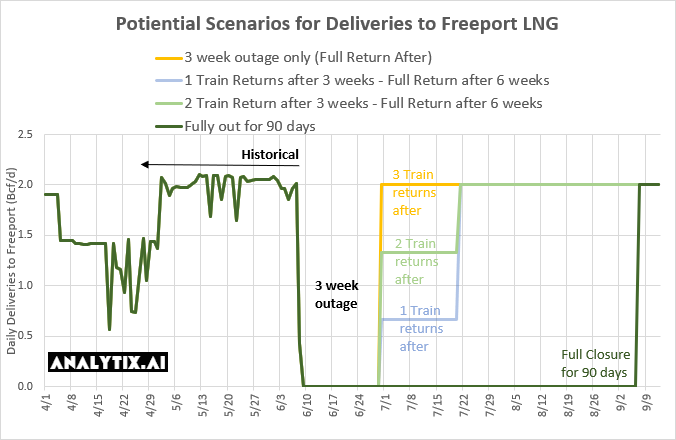

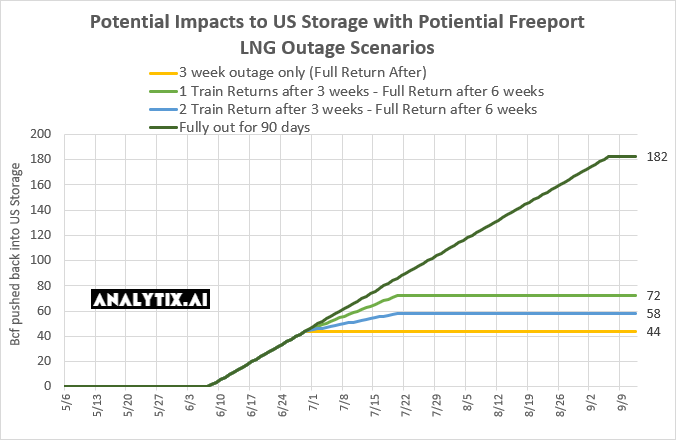

So what’s the potential impact on US balances? Below are a few scenarios we built out on the impact on US balances/storage.

In the three scenarios, we assume the best case is the full facility is out for 21 days, while the worst case is the full facility is out for 90 days. The in-between scenarios assume partial recovery of the plant after 21 days.

For the past 30 days, the average delivery to Freeport has been ~2.0 Bcf/d. Assuming that the facility pushes back this amount into the domestic market, our 3 scenarios show the impact on end of season storage being between +44 Bcf and +182 Bcf.

** These are just scenarios to give an idea of how things could proceed.

We believe one of the partial recovery scenarios is the most likely outcome. We base this on the location of the explosion/fire in the plant and the quick time it took to get under control. As mentioned, the issues look far from the 3 liquefaction trains, and more related to an inlet pipe to one of the storage tanks.

We are not entirely sure how the engineering works, but hear that the storage tanks could be bypassed if the issue was there. A good case study is Cheniere’s Sabine Pass facility. The PHMSA ordered Cheniere to shut two LNG storage tanks on Feb 8, 2018, after a crack was discovered in one tank that leaked fuel into an outer layer a few week earlier. With two of five storage tanks out for over 3 years, the facility has been running at optimal levels over that period. In fact, the facility has run well above design capacity on many occasions. Each one of the storage tanks at Sabine Pass carries 3.3 Bcf.

Coincidentally on Wednesday, the regulators finally authorized Sabine to return one of the two tanks.

The tanks at Freeport are of similar size (3 tanks x 3.3 Bcf), and therefore there is the potential for the plant to be functional at a partial level at least without one of the storage tanks.

NatGas Storage Fundamentals:

All the regions looked relatively fair to us, except the Midwest which reported injections 5 Bcf lower than we were expecting. Total scrapes for the region were similar to week ending May 27th, but the reported levels came in 4 Bcf lights week-on-week.

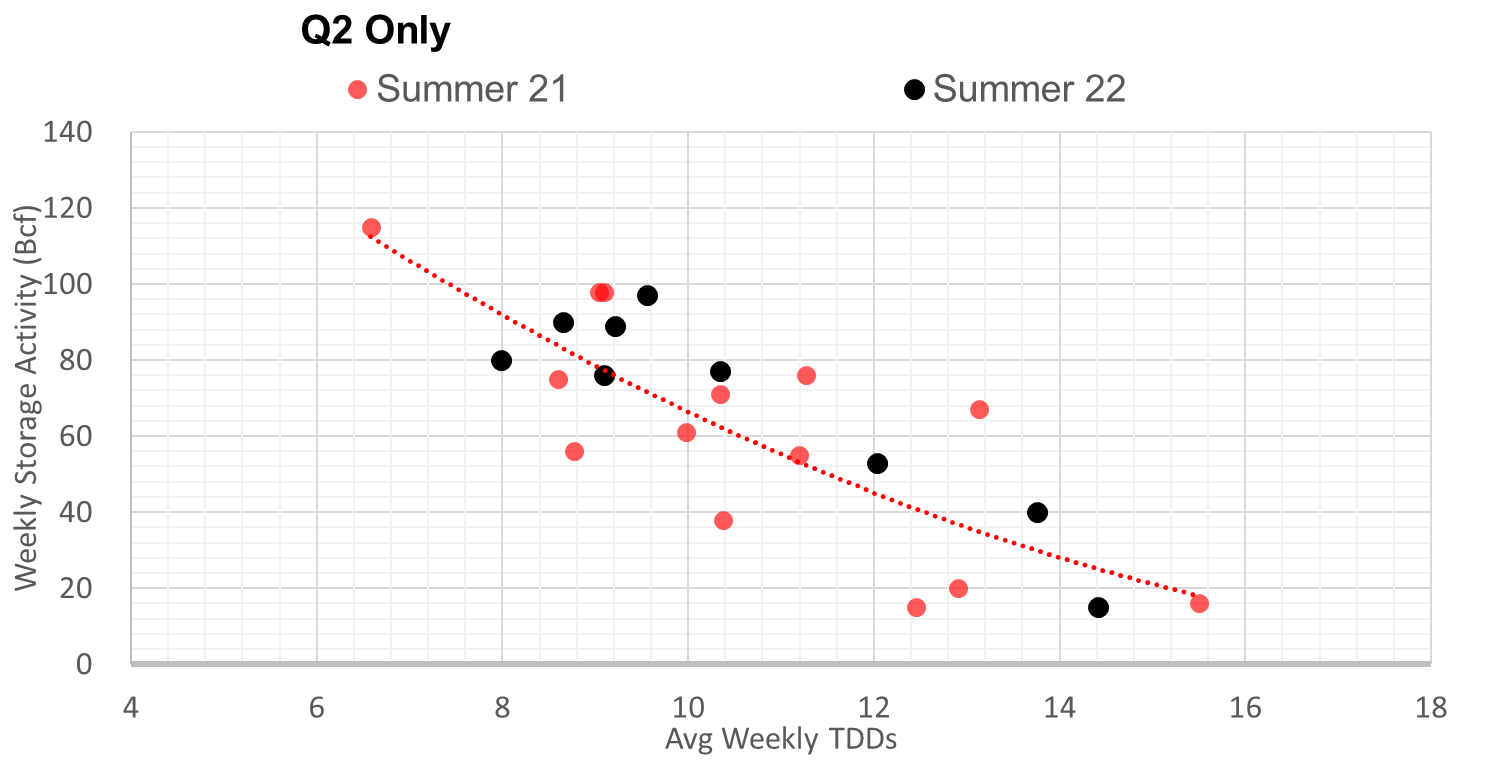

Overall, we estimate this +97 Bcf injection is ~3+ Bcf/d loose vs last summer (wx adjusted). If we were to focus solely on the injection and weather relationship in Q2 2021 then this number was about 3.5 Bcf/d looser (wx adjusted). See the chart below.

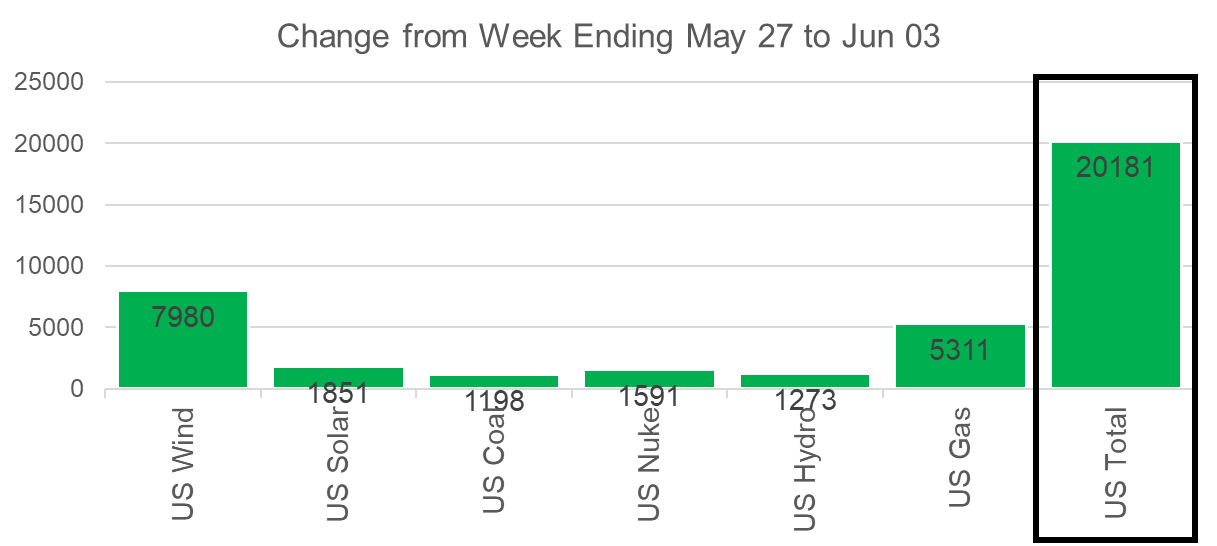

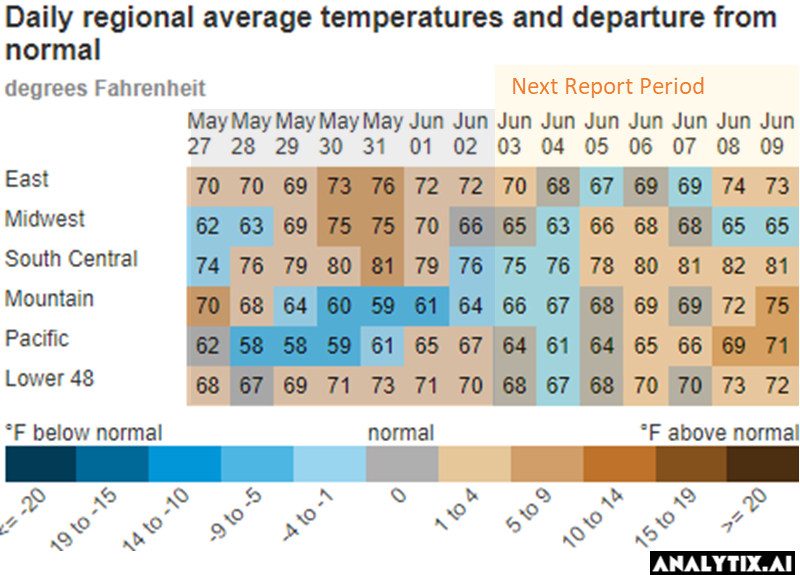

The higher injection week-on-week was due to a combination of reasons. The reported week was a holiday week, with strong wind and strong production. Temps did warm up East of the Rockies. At the L48 level, GWHDD hit rock bottom, while population wt. CDDs increased by 2.1F. This is more of drop in rescomm usage versus the increase in power burns.

The rising temp in the ERCOT and MISO markets also increased overall power loads. All generation types contributed to meet the power load, but wind and natgas were the major backers.

For the week ending June 3rd, our early view is +86 Bcf. This reporting period will take L48 storage level to 2,085 Bcf (-340 vs LY, -333 vs. 5Yr).

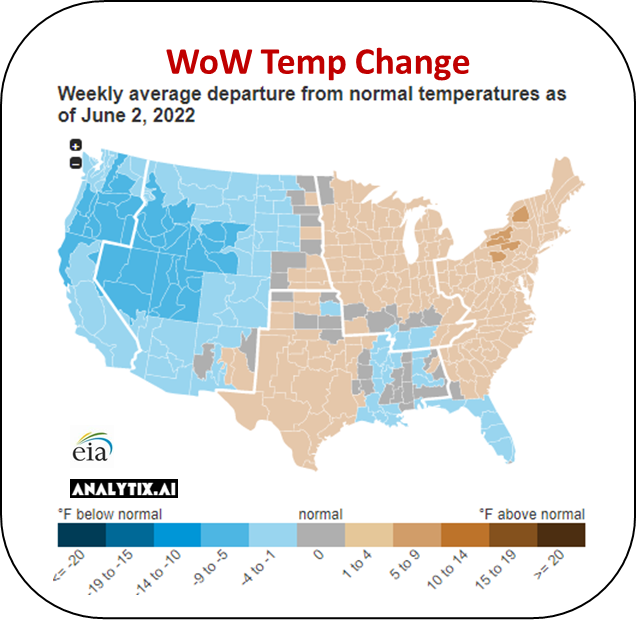

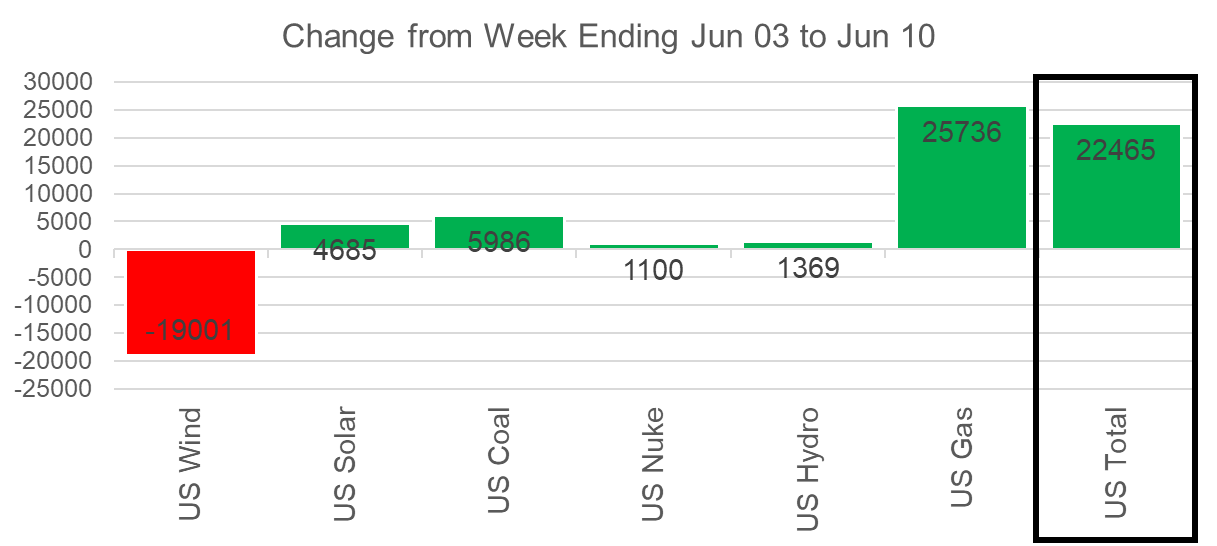

During the past week, we saw the heat pick up from California to Texas. The net result was the L48 GWHDDs were slightly lower, while the population wt. CDDs were all flat.

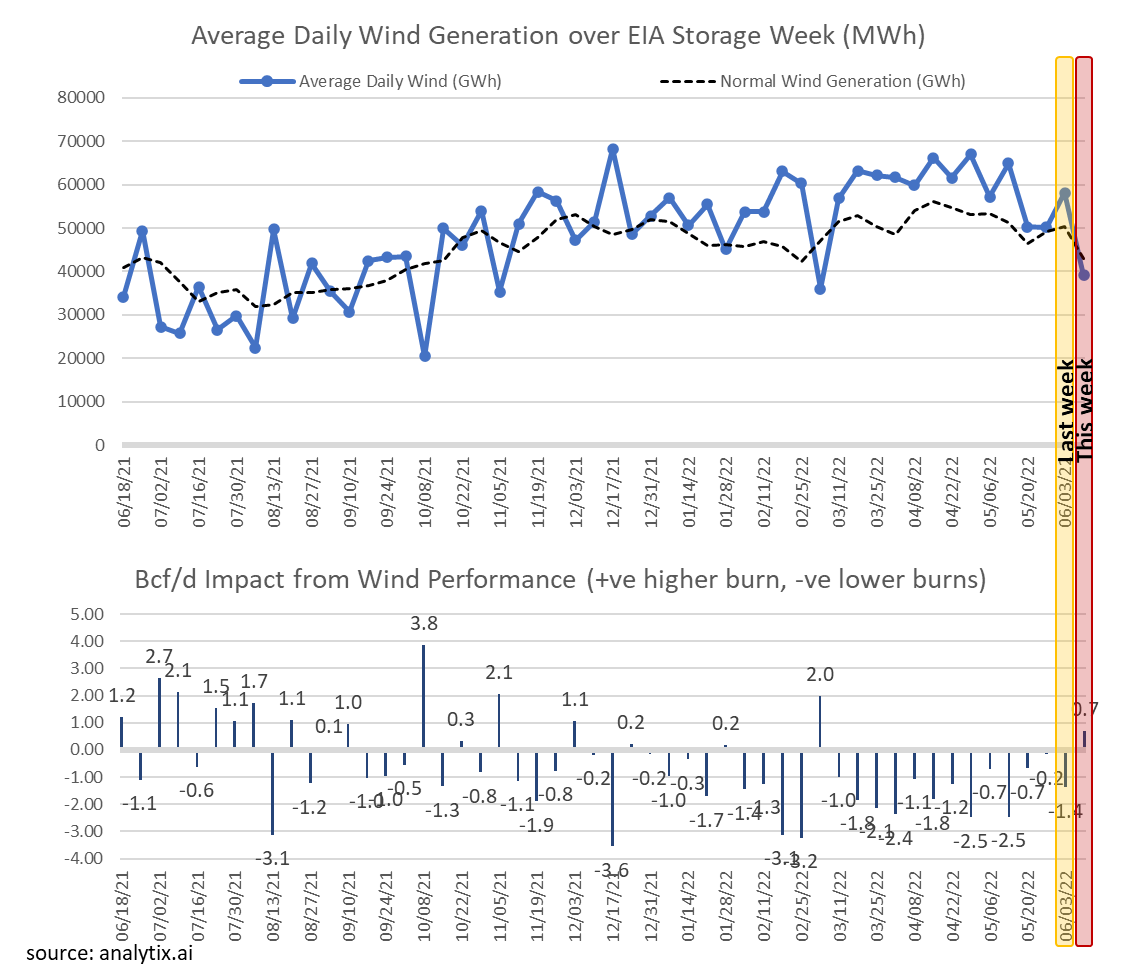

Power load was 4.8% higher week-on-week with the temps looking almost the same at the national level. Natural gas gen jumped by an average of 26 GWh (15%) to keep up with the increasing load and the big drop in wind. Wind gen dropped by 19 GWh week-on-week to an average hourly output of 39.1 GWh.

By our calculation, this is the first week wind gen underperformed since early March.

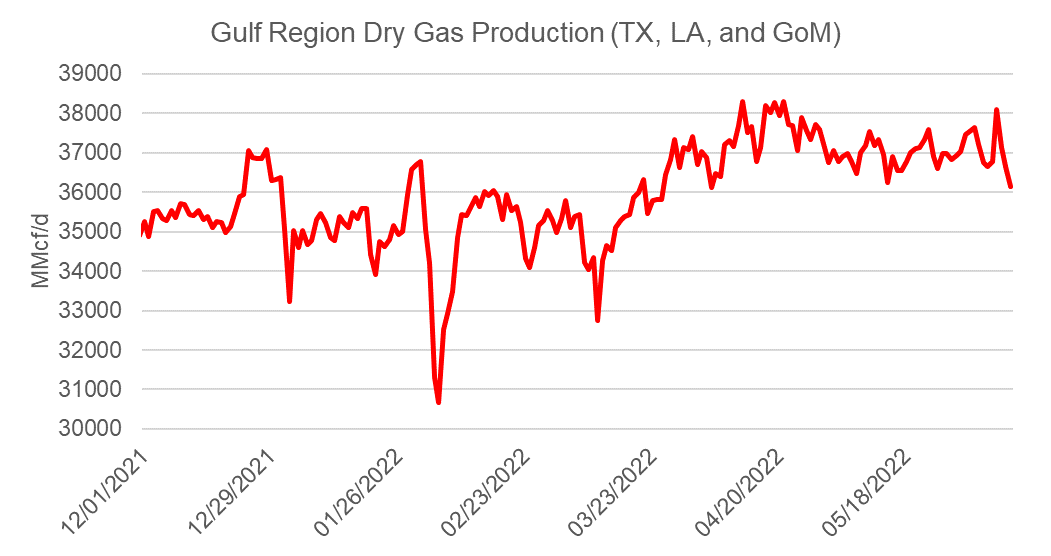

Domestic dry gas production was lower by 0.4 Bcf/d WoW. The production looked to gain some momentum for GD7, but the back half of the week did not support that view. The weakness in the back half of the week mainly came from Texas.

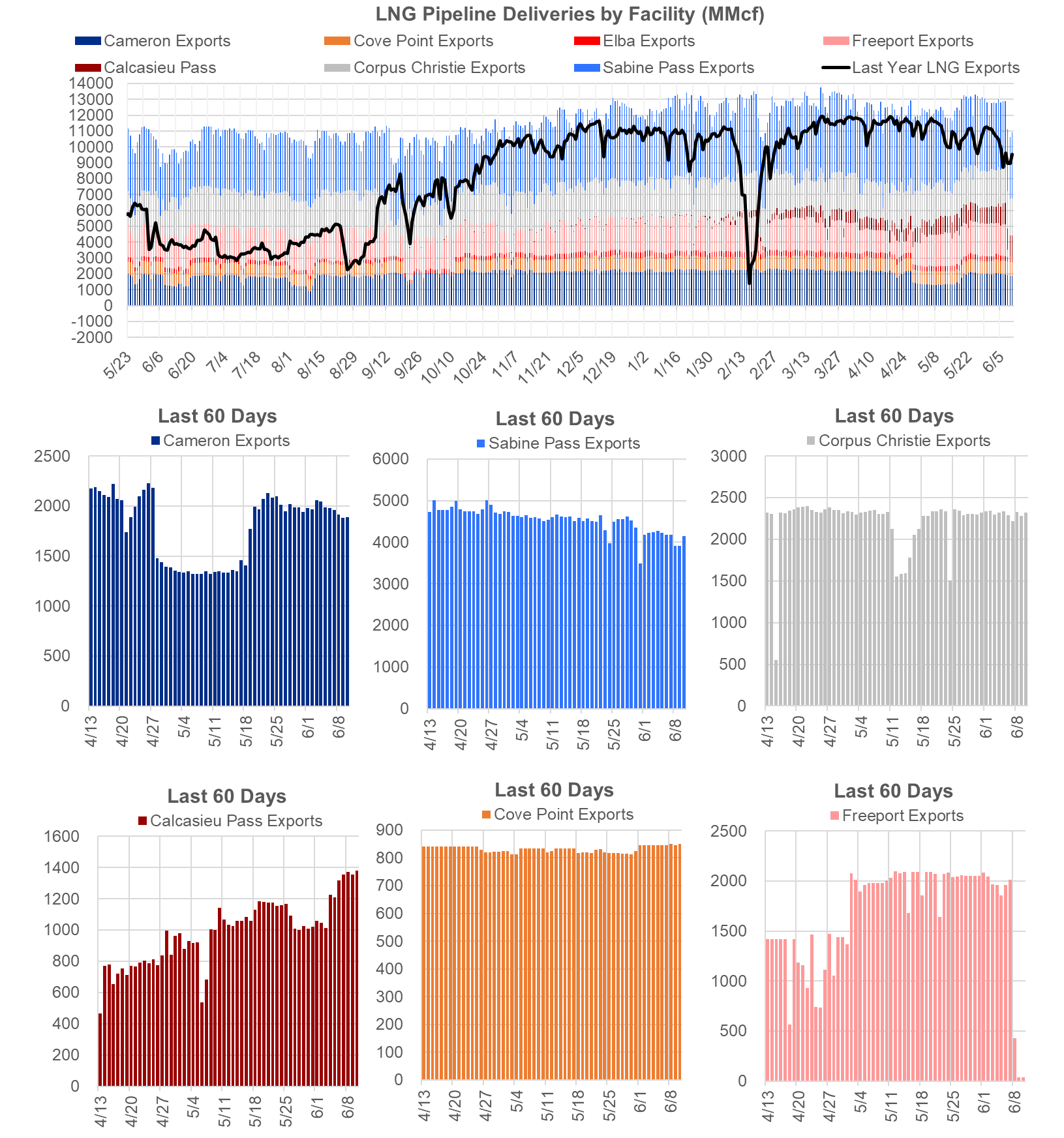

Deliveries to LNG facilities averaged 12.3 Bcf/d last week. Other than the Freeport event, we saw Calcasieu Pass continue to ramp up to 1.38 Bcf/d on Friday. The facility looks to be ahead of schedule in deploying its next phase of blocks.

The net balance was -1.8 Bcf/d tighter week-on-week.