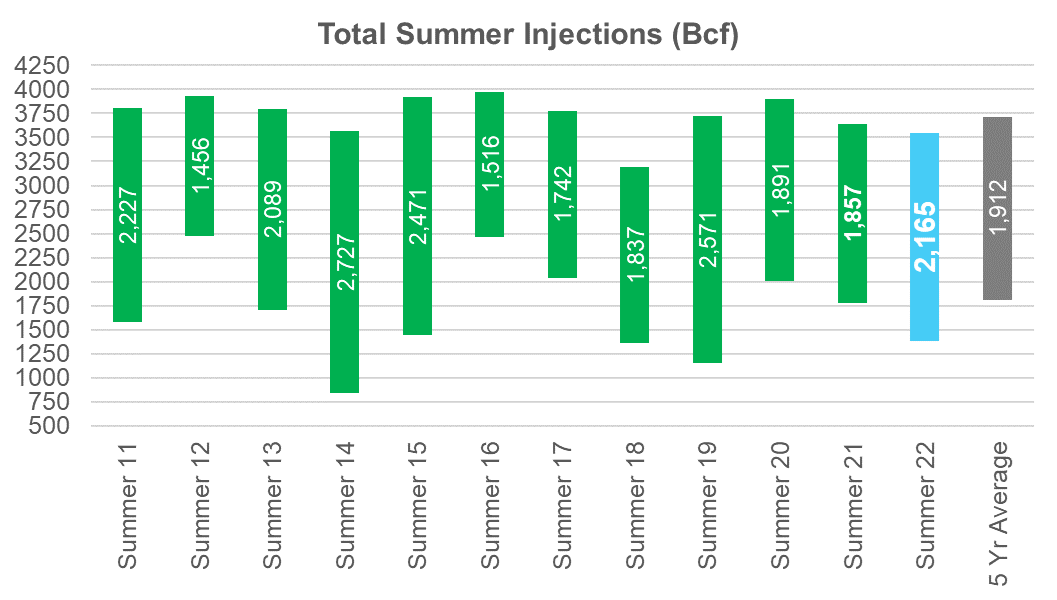

This week we by taking a look at how the summer finished off. We injected a total of 2165 Bcf, with the average summer injection over the last 5 years being 1912 Bcf. We would have been slightly behind the 5Yr average injection if it had not been for the Freeport outage. The Freeport LNG outage with starting on June 8th, added approximately 290 Bcf to domestic storage builds.

Source: Analytix.AI

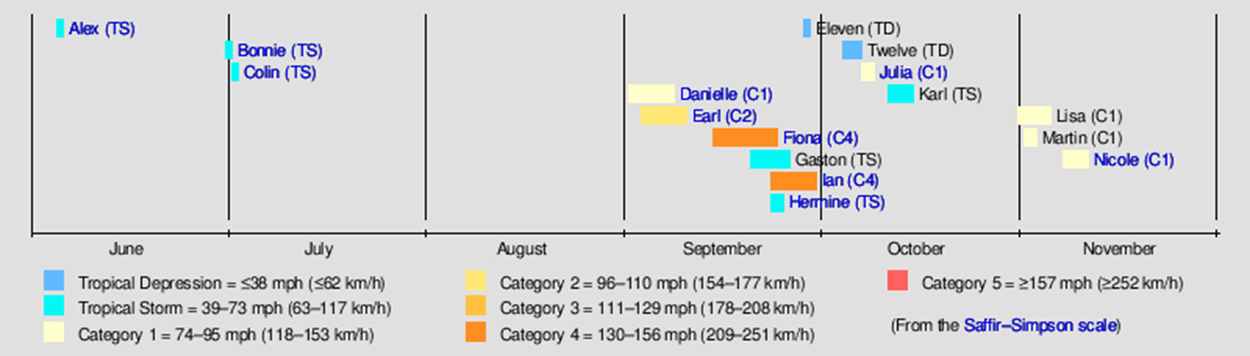

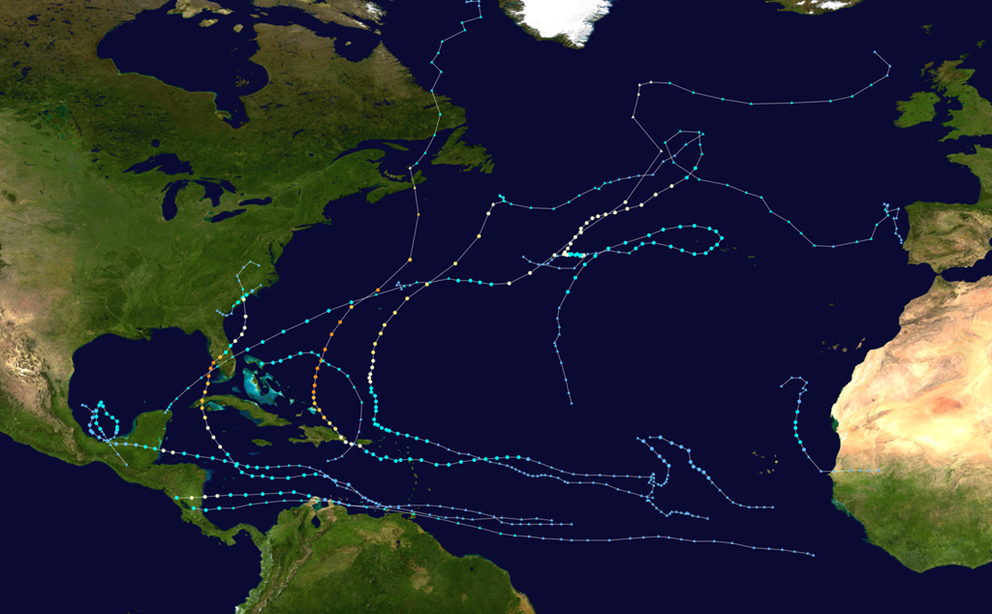

This year was also a very light hurricane season despite the strong forecast going in. In all there were 14 named storage, of which 8 turned into Hurricanes and 2 were being major Hurricanes

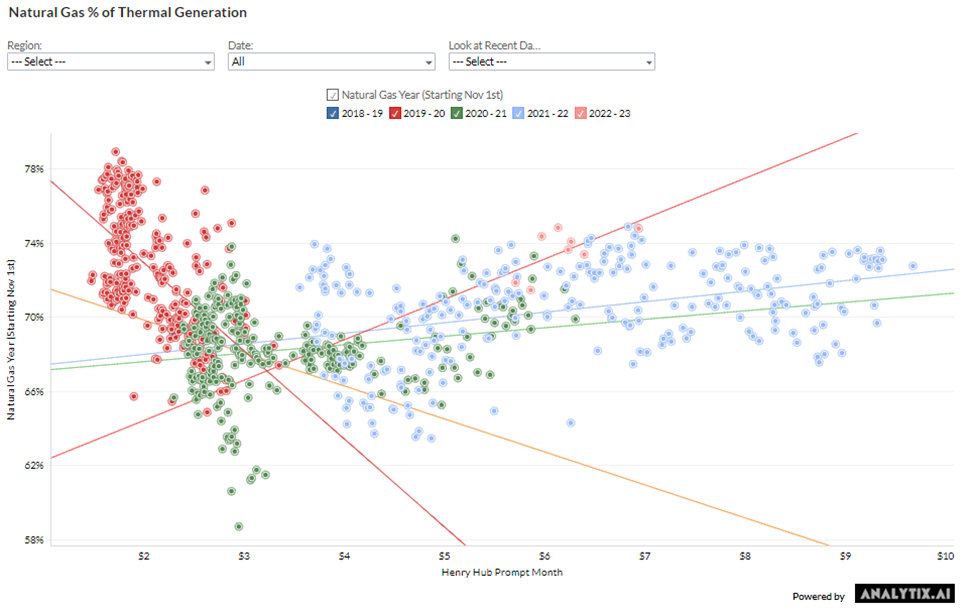

The last thing to note this summer is the wide range of prices. Typically the strong prices incent production to come on, and coal to gas switching to unwind. This year we did not see the same response. Production did finally come but not until the end of the season, and power burns remained elevated throughout the summer even when prices were in the $9 range. Here is a quick view of how strong gas performed, i.e. making up between 65-70% of the thermal generation. (click here to see this interactive chart : http://www.analytix.ai/natgas-gen–of-thermal-gen.html)

NatGas Storage Fundamentals:

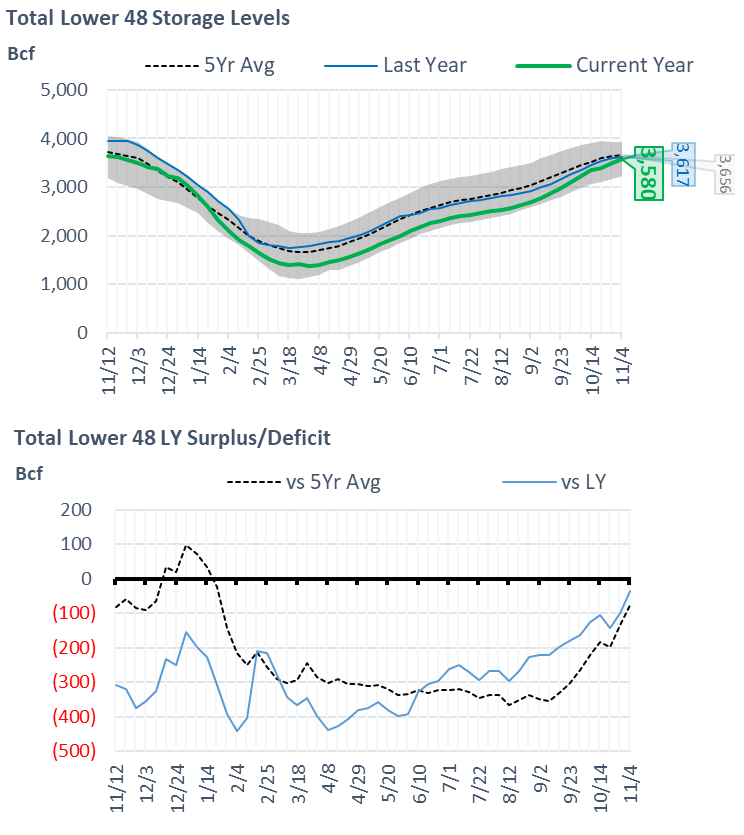

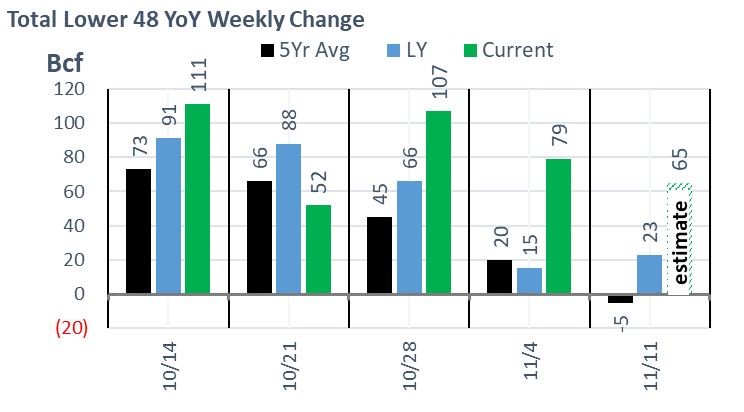

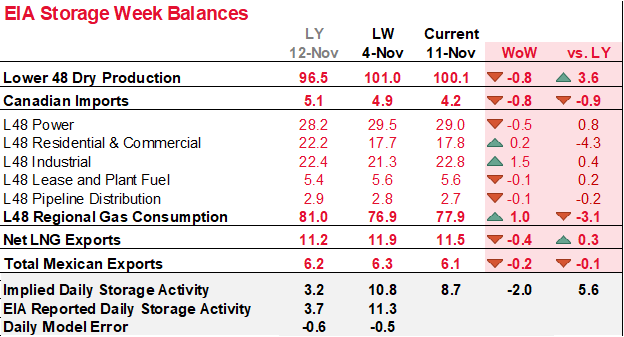

The EIA reported a +79 Bcf injection for the week ending November 4th, which came in very close to the market expectations of ~+81 and our estimate of +78. Both are S/D model and flow model showed a similar injection level, and therefore we were happy to see the number fall within the tight range of our expectations. This storage report takes the total level to 3580 Bcf, which is 37 Bcf less than last year at this time and 76 Bcf below the five-year average of 3,656 Bcf. This report continues the string of loose storage numbers to close the summer out.

Our fundamental storage model performed well this week, with the actual storage report coming in only 2 Bcf lower than our estimate. Here are the details we gather from the fundamentals:

- Total supply was lower for the reporting period with lower Canadian supply being the culprit. Imports from Western Canada dropped on average by 0.4 Bcf/d with some maintenance work along key lines with the Alberta Nova system. Adding to the internal pipe issues in Alberta, the Midwest was not calling for gas (cash price spread did cover variable costs) due to the warm weather.

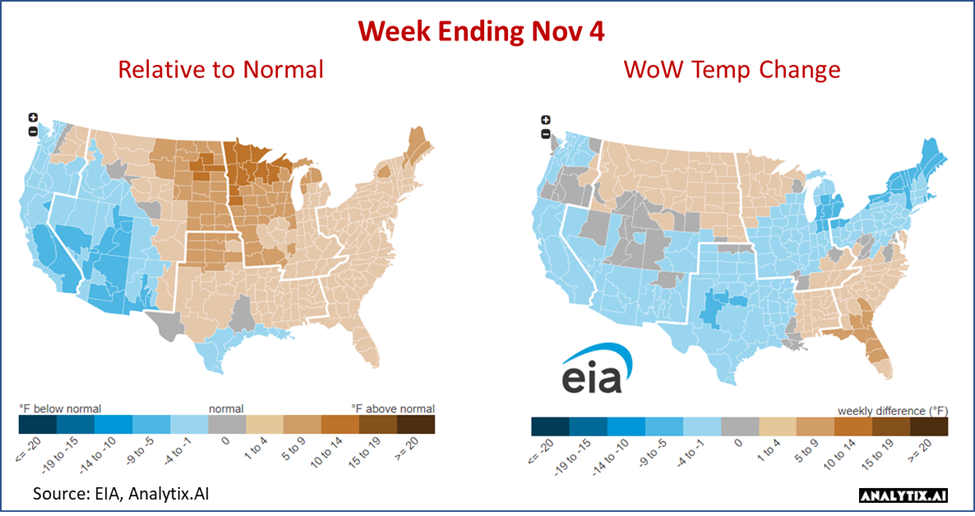

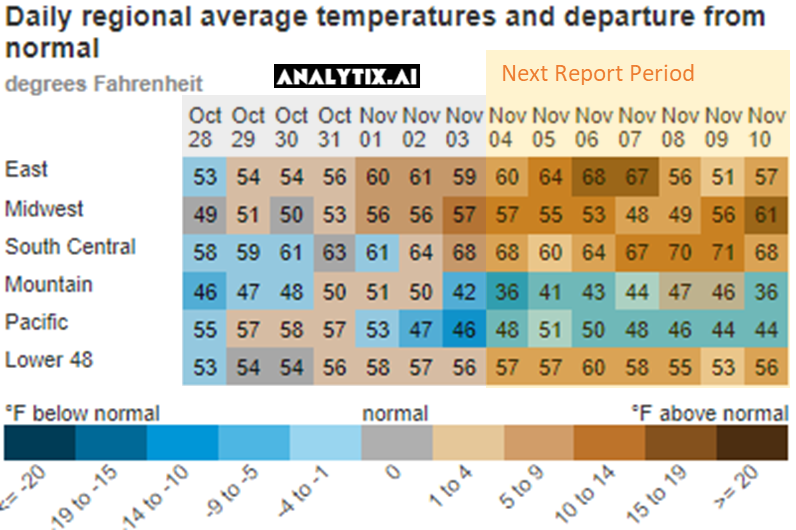

- National temps cooled week-on-week during the storage period. The cooling was expected due to the seasonal change, but overall temps finished the week much above normal for the majority of the country. At the national level, we saw HDDs increase by 1.4F which translated into +1.8 Bcf/d of RC demand. Here is a view of the temps by EIA region.

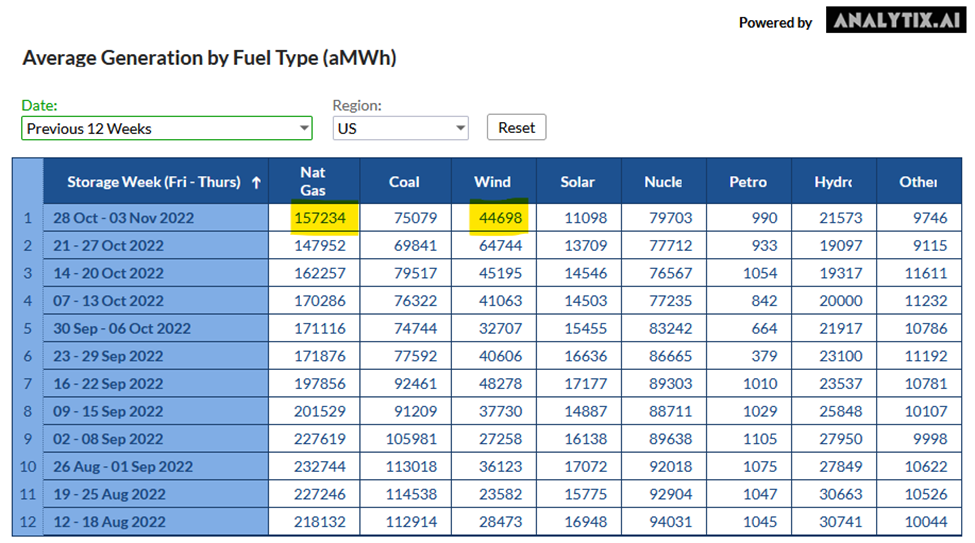

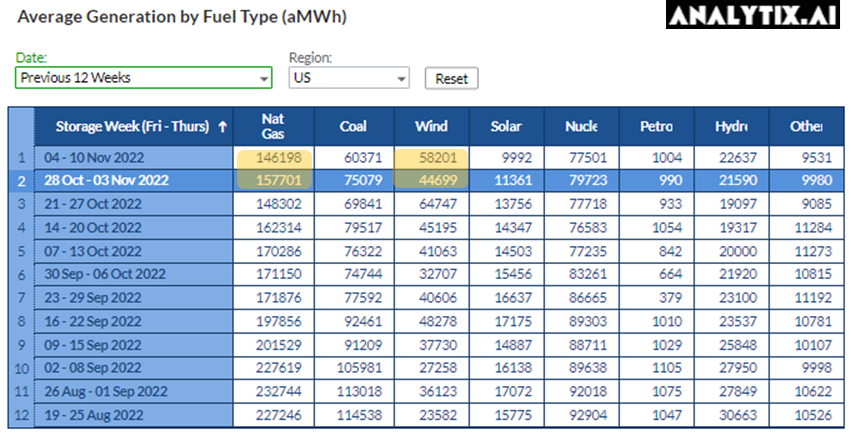

- Power burns increased this week, with wind and solar generation pulling back. Below are the average MWh by generation type for the past 12 storage weeks

Source: http://www.analytix.ai/generation-by-fuel-type.html

- LNG volumes were higher by 0.6 Bcf/d with the return of Cove Point from 4-week annual maintenance. LNG volumes would have been higher, but 4-day pipeline maintenance on NGPL reduced feedgas levels to Sabine.

Our estimate for week ending Nov 11th is +65 Bcf. This reporting period will take L48 storage level to 3,645 Bcf (+5 vs LY, -6 vs. 5Yr). Last year we injected only +23 Bcf during the same week. With the cold blast coming in this weekend, this will be the last injection week of the year.

Here is the full fundamental picture compared to last week and the same week last year. As can be seen, the higher demand associated with increasing HDDs and the return of Cover Point was the lead factors to a lower storage injection week-on-week.

Production: Domestic production was lower week-on-week with the weakness coming from multiple regions. The Northeast saw the largest drop this past week. We typically see a jump in production out of the region as cash prices firm up in the winter months, but we are not certain we see that this year. As we reported last week, the Northeast continues to suffer from a lack of drilling activity and an all-time low level of DUCs to rely on.

RC Consumption: With the warmth in all regions east of the Rockies, we did not see a considerable jump in RC demand. At the national level, we saw HDDs relatively flat. See the heat chart below to show just how warm most of the populated parts of the country were. This next week is going to be quite the opposite, where we expect to see a lot of blue. See the 6-10 and 8-14 day forecast here: http://www.analytix.ai/weather.html

Power Burns: Power burns dropped this past week with wind generation jumping above normal levels once again. Below are the average MWh by generation type for the past 12 storage weeks.

Source: http://www.analytix.ai/generation-by-fuel-type.html

LNG: LNG volumes were lower by 0.3 Bcf/d with Sabine Pass having lower feedgas levels due to continued operational volatility following the 4-day pipeline maintenance on NGPL. We should start to see feedgas levels at all plants increase as the weather cools this week.

Also in LNG news were some rumors that pushed the markets lower on Friday. The following tweet got the market jittery and we saw a quick sell-off. No specific source was noted.

Later in the day, Freeport finally came out with a press release saying it has not made any public statements on Friday and any tweets on their letterhead are false.

Here is a link to the PR: Freeport LNG Newsroom (newsrouter.com)

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.