NatGas Storage Fundamentals:

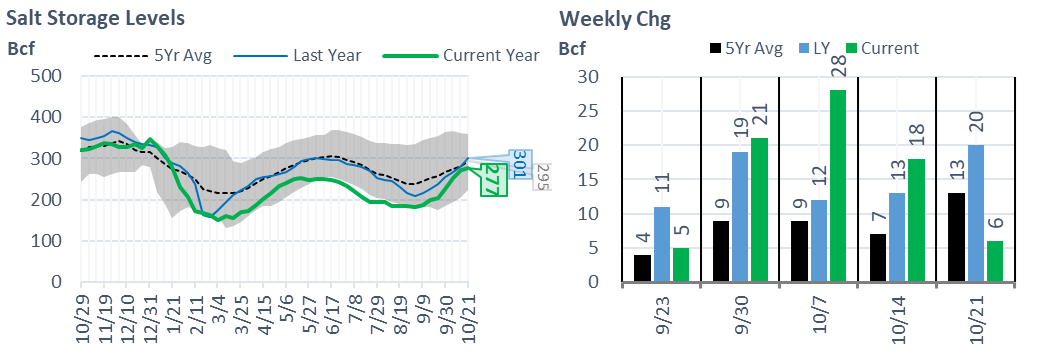

The EIA reported a +52 Bcf injection for the week ending Oct 21st, which came in lower than market expectations of +60 and our estimate of +58. This storage report takes the total level to 3394 Bcf, which is 142 Bcf less than last year at this time and 197 Bcf below the five-year average of 3,591 Bcf. After 5 consecutive triple-digit build, this one really disappointed the bears.

Noteworthy this week was the ultra-weak Salt storage injection compared to the past few weeks, and relative to the same week last year.

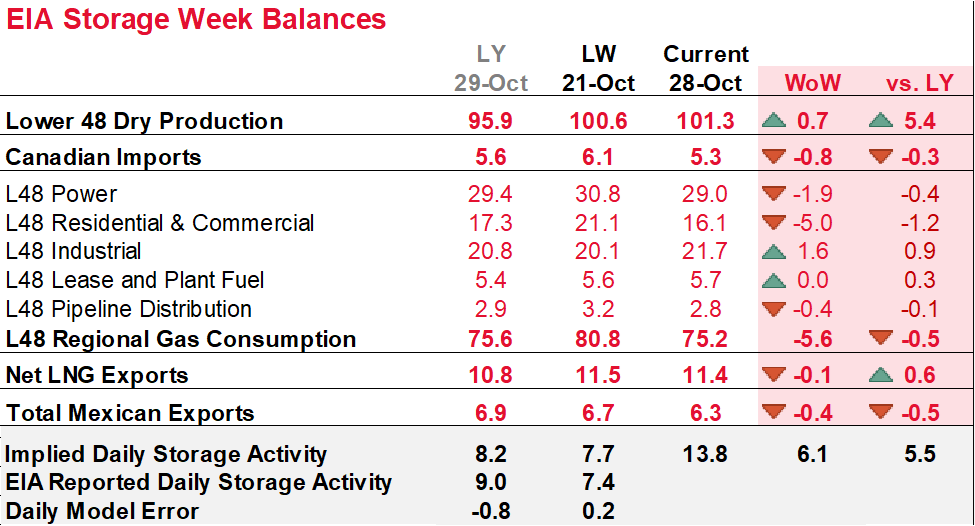

Our fundamental storage model overestimated injection for the reporting period by almost 1 Bcf/d. Here are the details we gather from the fundamentals, and it’s likely we missed the strength of RC demand as temps fiercely cooled everywhere except the Mountain and Pacific regions:

- Total domestic production fell by -1.4 Bcf/d across multiple regions. The most notable losses were in the Permian which saw production drop by as much at 1 Bcf/d. The drop in production in the region led to Waha cash strength.

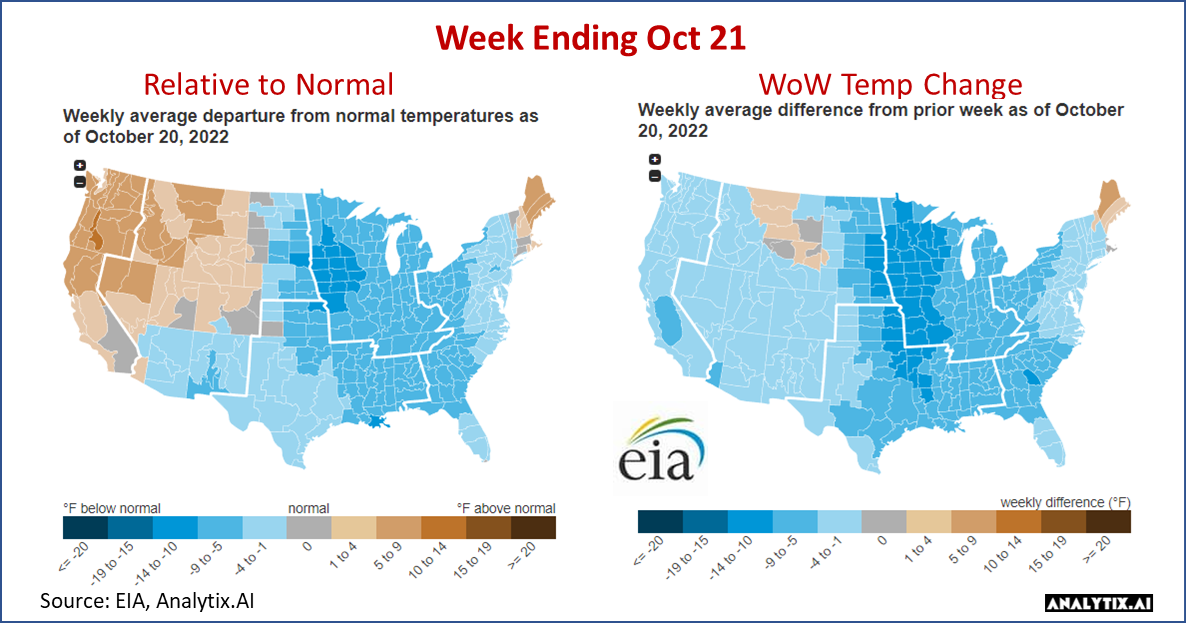

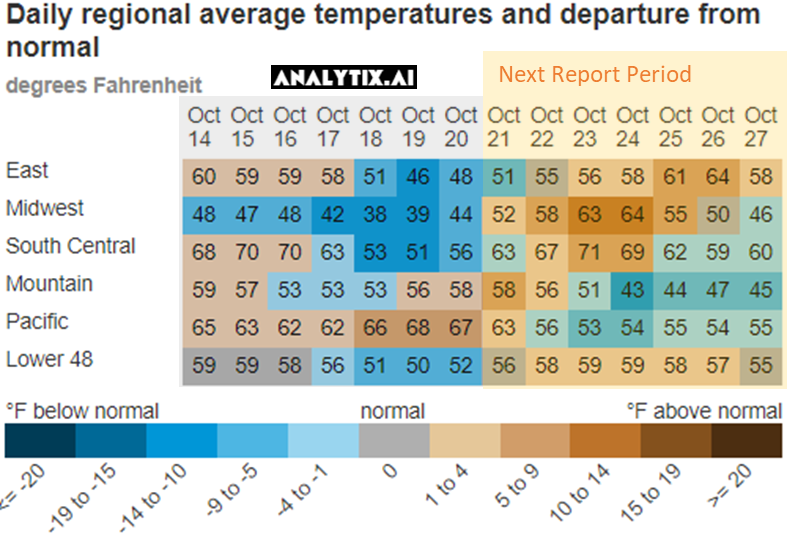

- Gas consumption rose once again with the cooler temps starting to set in across much of the country. The heavily populated Midwest and Northeast finished the period much below normal leading to a pick up in RC gas consumption. During the reporting week, HDDs at the national level rose by 3.9F. Here is a view of the temps by EIA region.

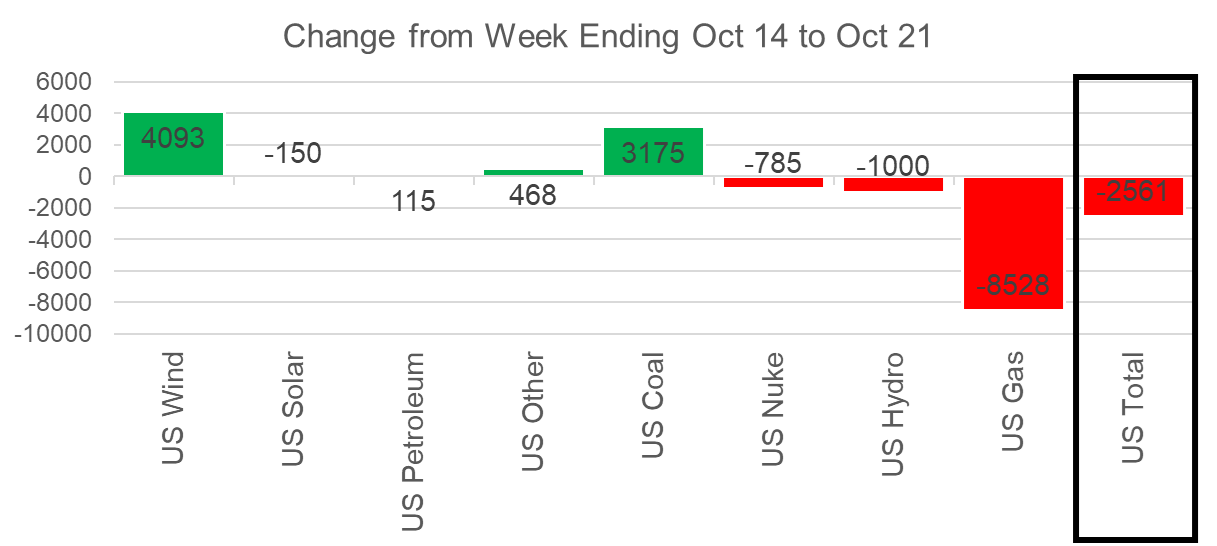

- With CDDs quickly diminishing, power loads remained flat once again. As usual, the power mix did change. Natural gas generation dropped by 8.5 aGWh, as Wind and Coal generation picked up.

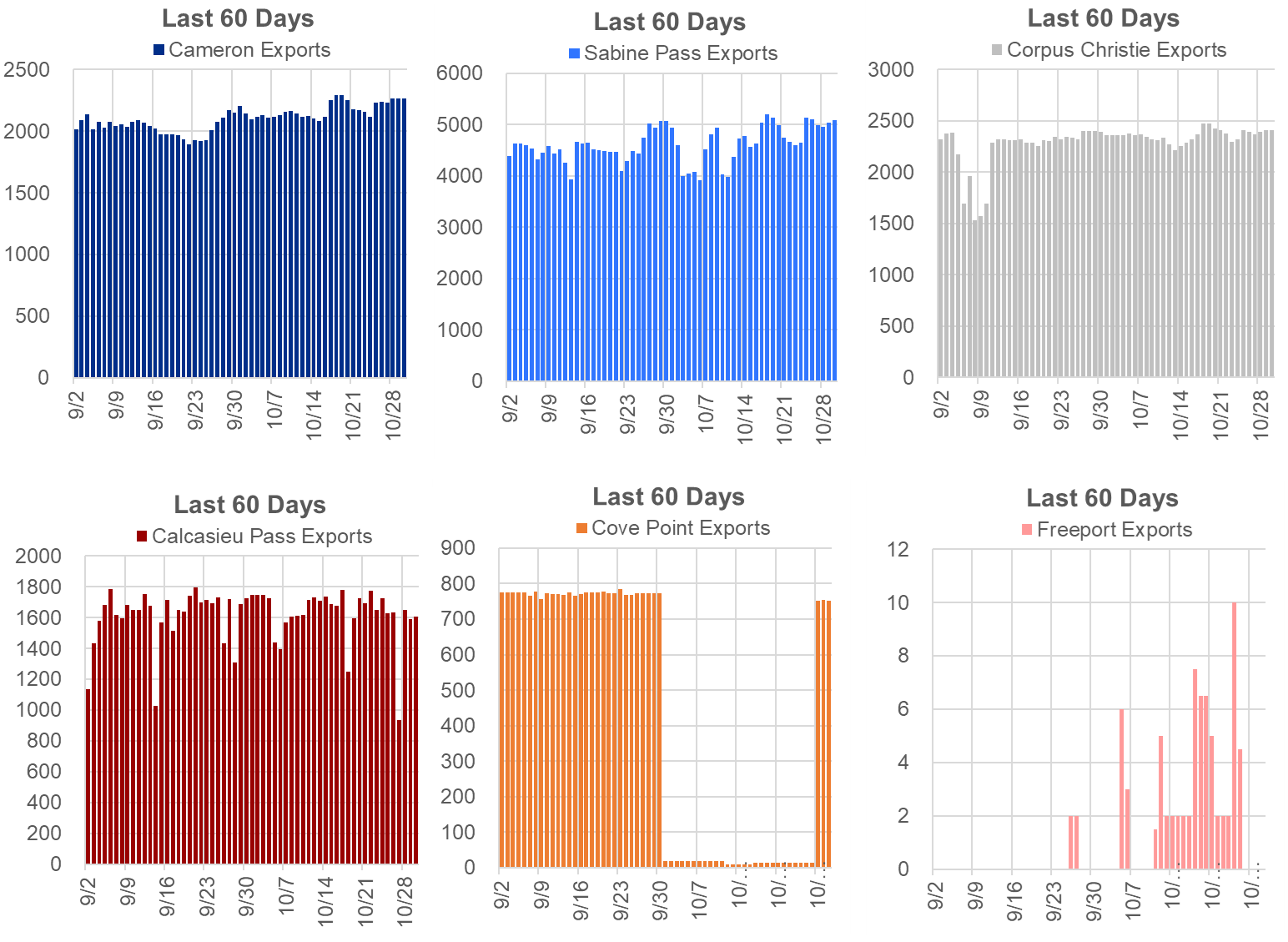

- LNG feedgas also moved higher with Sabine Pass starting to operate at higher levels as temps cool along the Gulf Coast.

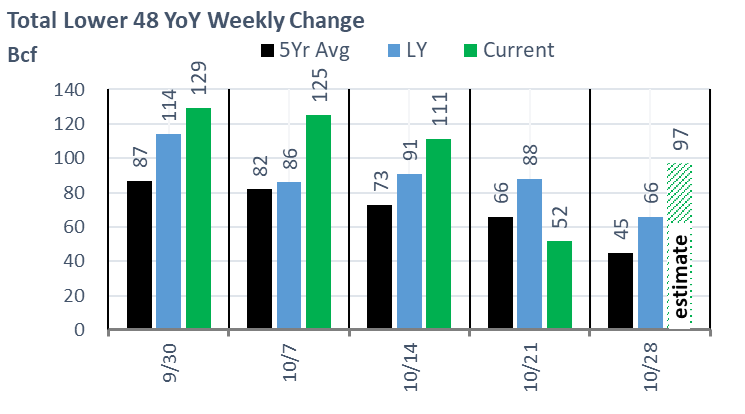

We calculate this reported injection to 2.8 Bcf/d loose YoY – (wx adjusted). [We compare this report to LY’s rolling 5-week regression centered around week #42]

Although this report is still loose relative to last year, it is much tight with respect to much of September and October.

Our estimate for week ending Oct 28th is +97 Bcf. This reporting period will take L48 storage level to 3,491 Bcf (-111 vs LY, -145 vs. 5Yr). Last year we injected only +66 Bcf during the same week. We had been expecting one last triple-digit build, but last Thursday’s tighter than expected report made us adjust lower.

Here is the full fundamental picture compared to last week and the same week last year. As can be seen, the higher week-on-week storage injection comes with moderating temps.

Production: Domestic production dropped this past week with dropped across multiple regions. The big moves lower came from West Texas, which had planned and unplanned maintenance on two outgoing Kinder Morgan pipelines. El Paso has had on/off maintenance that flows gas westbound, while Gulf Coast Express had unplanned work that reduced flows to the gulf coast for a couple of days. This weekend it appears that flows have resumed higher.

RC Consumption: Cooling at the national level took a pause this past week, with the East and Midwest finishing warmer than normal. At the national level, we saw HDDs drop by 2.7F which translated into -5.0 Bcf/d of RC demand.

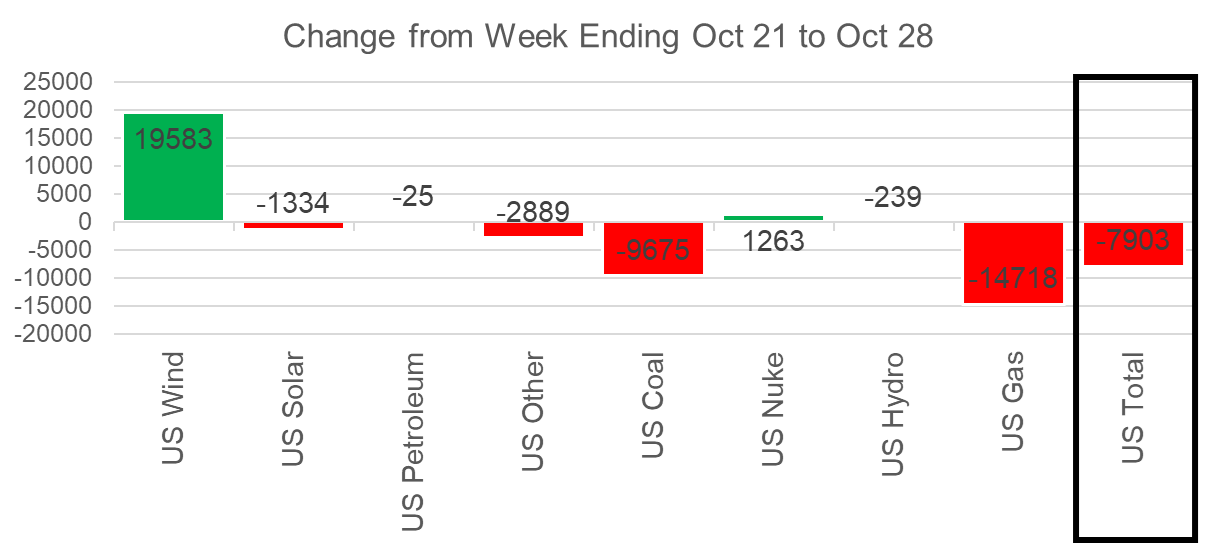

Power Burns: Power burns head to their seasonal lows with CDDs rapidly fading. The overall reduction in power load was 7.9 aGWH or 1.9%.

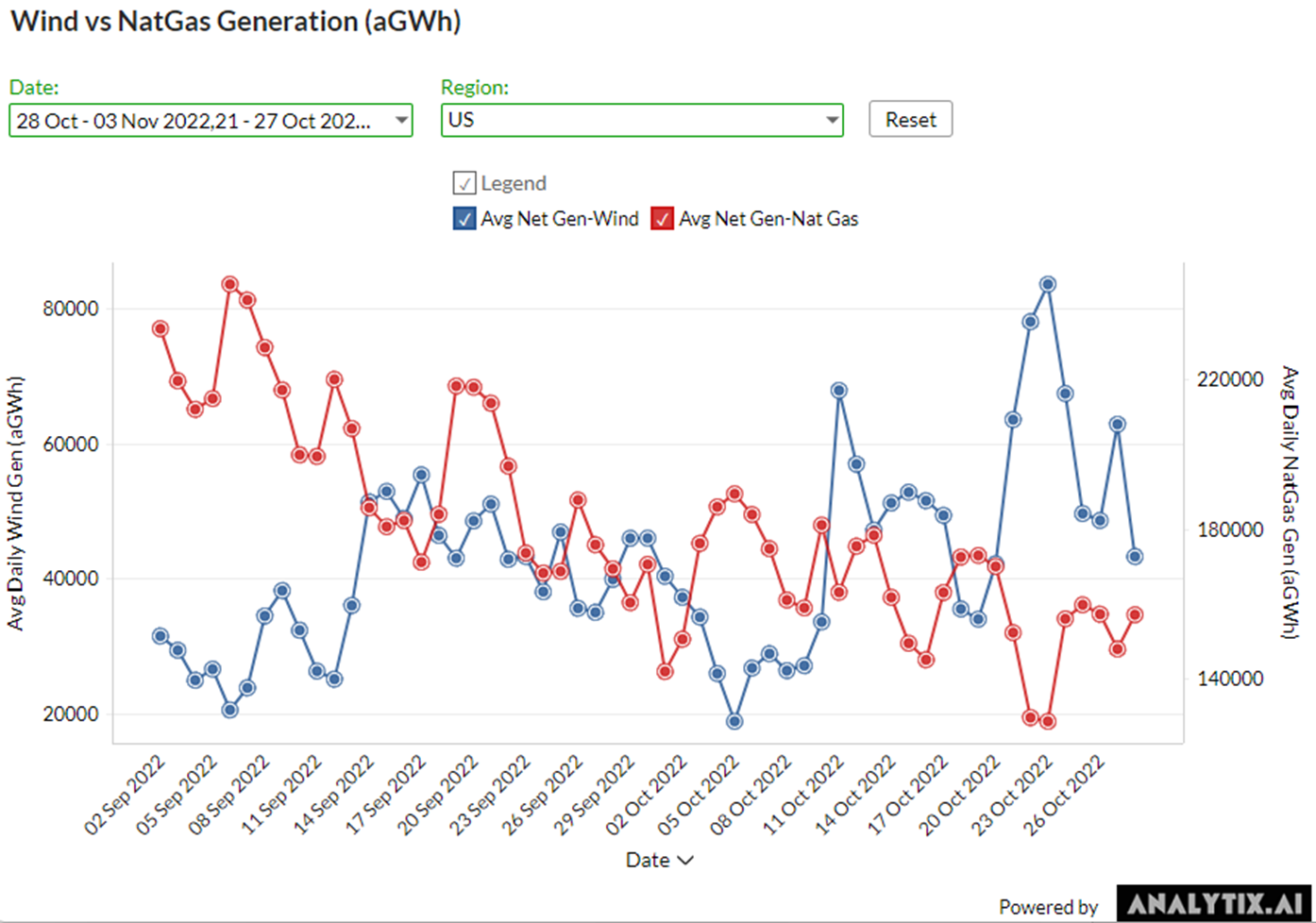

The big story from the power markets was the jump in wind generation. We saw wind explode to 64.7 aGWh. Naturally, this pushed natural gas generation lower by 14.7 aGwh and reduced burns by ~2.5 Bcf/d. The chart below is from the analytix.ai platform. It clearly shows the dance between wind and natgas each week.

LNG: This past week, LNG feedgas were relatively flat. We were looking for the return of Cove Point, but that did not happen until Friday (which technically falls in the storage report for week ending Nov 4th).

The plant which typically consumes 0.75 Bcf/d LNG feedgas, had a maintenance that lasted about a week longer than in past years. Over the last 4 weeks, the market for the Northeast has dramatically changed. Prices have fallen almost 40% in that time.

In other LNG news, tankers continue to wait for the Freeport start-up. Feedgas to the plants has also started to look more consistent. The levels are quite minimal but could signal a start-up in early to mid-November.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.