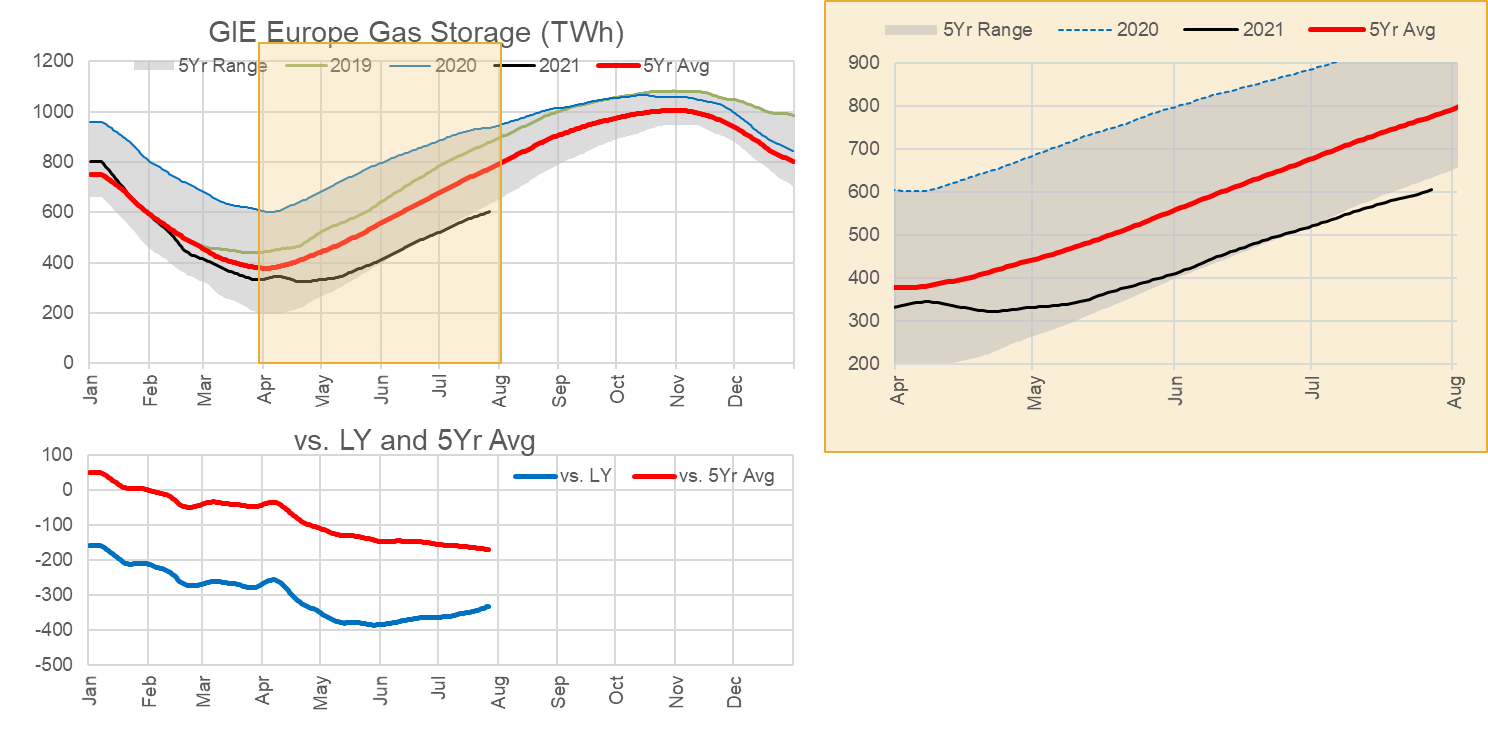

European gas prices have soared this spring with storage inventories remaining low after a brutally cold winter, warm summer, soaring carbon prices, and competition from Asia for LNG.

Current storage sits at 55% full. This is 29% lower than the same time last year, and 16% below the 5-year average level.

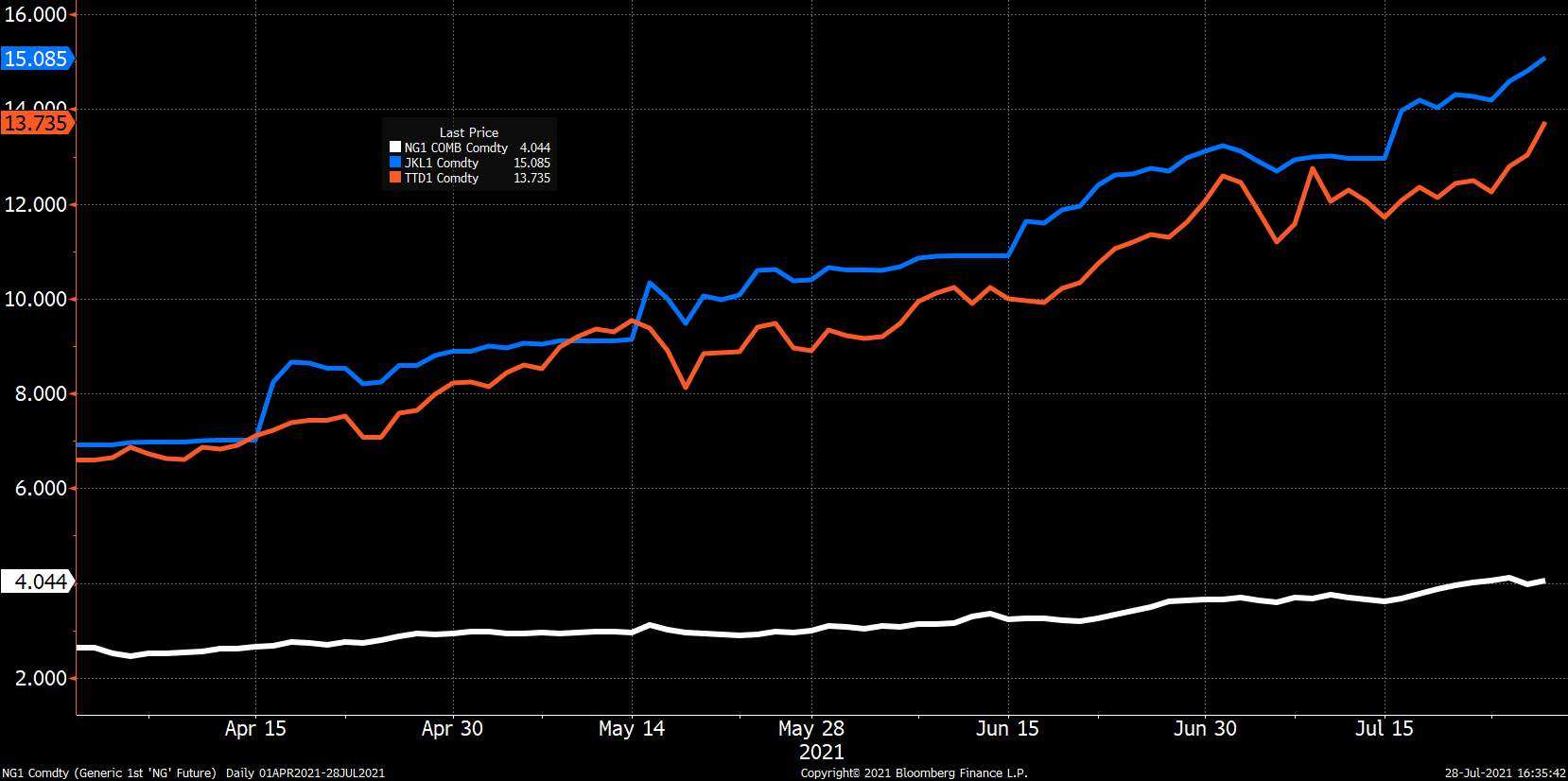

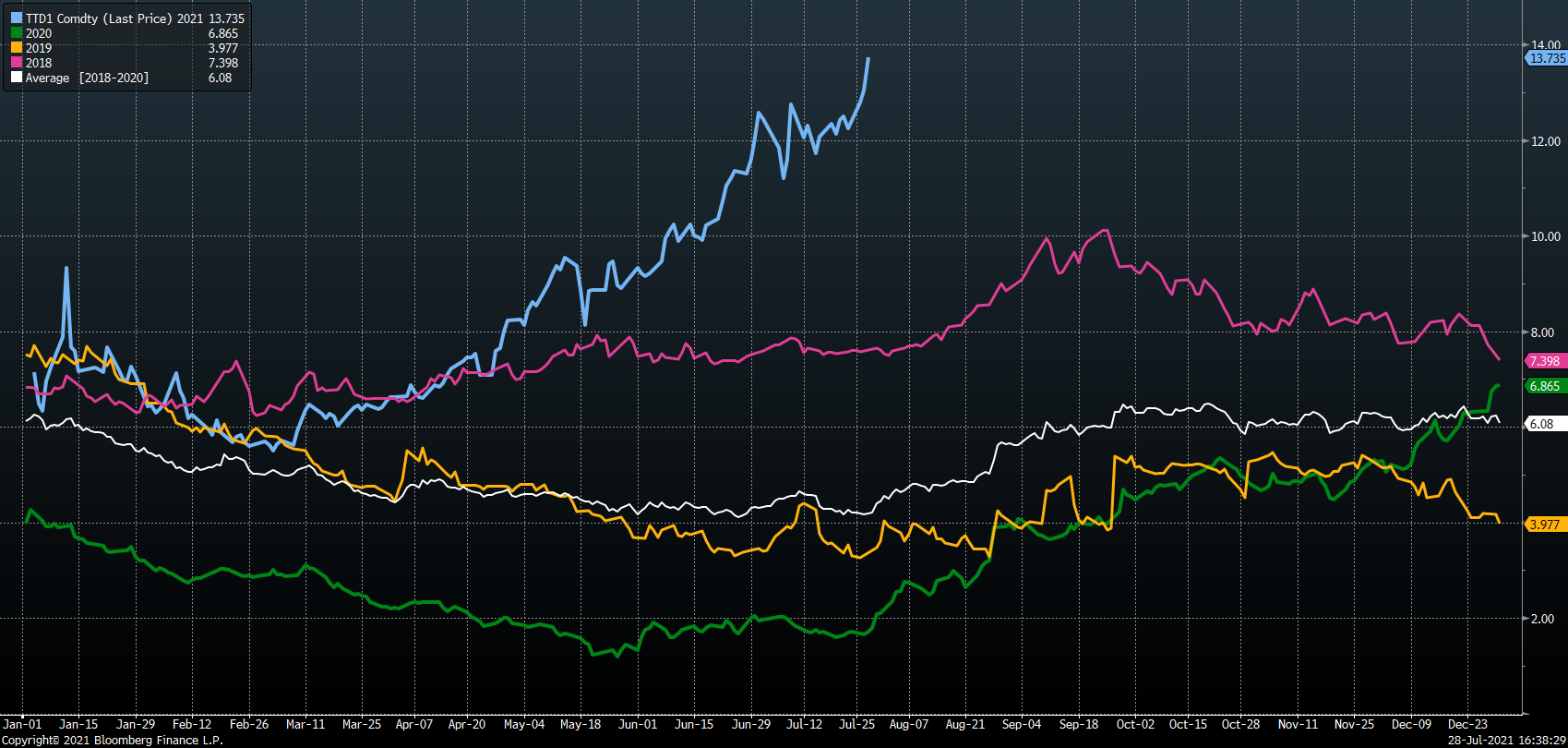

The current price sits well above Henry Hub, and at a multi-year high for this time of the year.

Front Month Henry Hub, TTF, and JKM

Front month TTF seasonality chart

The strong pricing is a positive for U.S. LNG exports, which is pushing itself into a market mix. The LNG arbitrage spread between the United States and Europe is wide open as seen in the chart above. That being said, strong Asia prices led by robust industrial demand are keeping the LNG flows limited to the European shores. Europe does rely on LNG, but the bulk of the natural gas is still transported through pipelines. Of these exporters, Russia is by far the largest and most influential country due to its sizeable energy industry and excess capacity. Although prices are favorable, Gazprom does not seem to be in a hurry to send extra volumes on top of the running contracts with European customers.

In 2020, Gazprom’s exports decreased from an average of 7.0 Bcf/d in 2019 to 6.0 Bcf/d. The majority of this gas transits from Russia to Belarus and Ukraine. Another 5.3 Bcf/d of capacity was added in 2011 with the completion of Nord Stream 1 (NS1) and the market is waiting for this to double to 10.6 Bcf/d when the disputed Nord Stream 2 (NS2) pipeline starts pumping gas at some point this year.

The US put sanctions on the NS2 project in 2019 and 2020, but the new administration recently waived them as it looks to build stronger relations with Europe. The US and Germany have reached a compromise, which means it could flow as early as late-Q3. Both countries pledged their support for Ukraine and agreed to sanction Russia if it uses the pipeline or energy supplies for geopolitical advantage.

On a side note, Russia has elected not to book additional pipeline capacity to move natural gas through Ukraine to Europe this year beyond a transit agreement it has in place to move ~4 Bcf/d through Ukraine annually until 2024. This move is adding tension and could be a tool to get NS2 flowing soon. Germany is looking for Russian to extend the agreement past 2024. NS2 would provide additional European imports at a time when storage inventories are very concerning.

Fundamentals for the week ending July 30: This past week the EIA reported a +36 Bcf storage injection for week ending July 23. This report came in 6 Bcf below market consensus and 5 Bcf/d below above our estimate. The big factor in the market’s miss this week looks to be the lower renewable output.

For the week ending July 30th, our early view is +15 Bcf. The 5Yr average is a +30 Bcf injection. Our projected injection would take the L48 storage level to 2729 Bcf (-540 vs LY, -183 vs. 5Yr). The big item to look out for next week is how big the Salt storage draw is. With warmer temps in the South Central and low wind, we are expecting salt draws to be -12 Bcf. This would take salt storage levels to 257 Bcf, a big deficit to last year and even the 5Yr average.

Domestic production was once again flat to last week at 92.4 Bcf/d. There were no major surprises related to maintenance or critical events to report last week, but next week there are a couple of noteworthy pipeline events. First, TETCO is expected to resume service after being forced to reduce N-to-S flows by the PHMSA in late May. This FM event had originally triggered the price move higher.

There is also some major maintenance to begin on NGPL TEXOK GC at location 302-303 (North of Constraint)

Primary/SIP Firm transports will be scheduled to no less than 52% of contract MDQ through CS 303. AOR/ITS and Secondary out-of-path Firm transports are not available. Transports associated with storage injections and withdrawals will be impacted.

In our opinion, this maintenance is likely bearish as it can restrict flow to LNG facilities and Mexico.

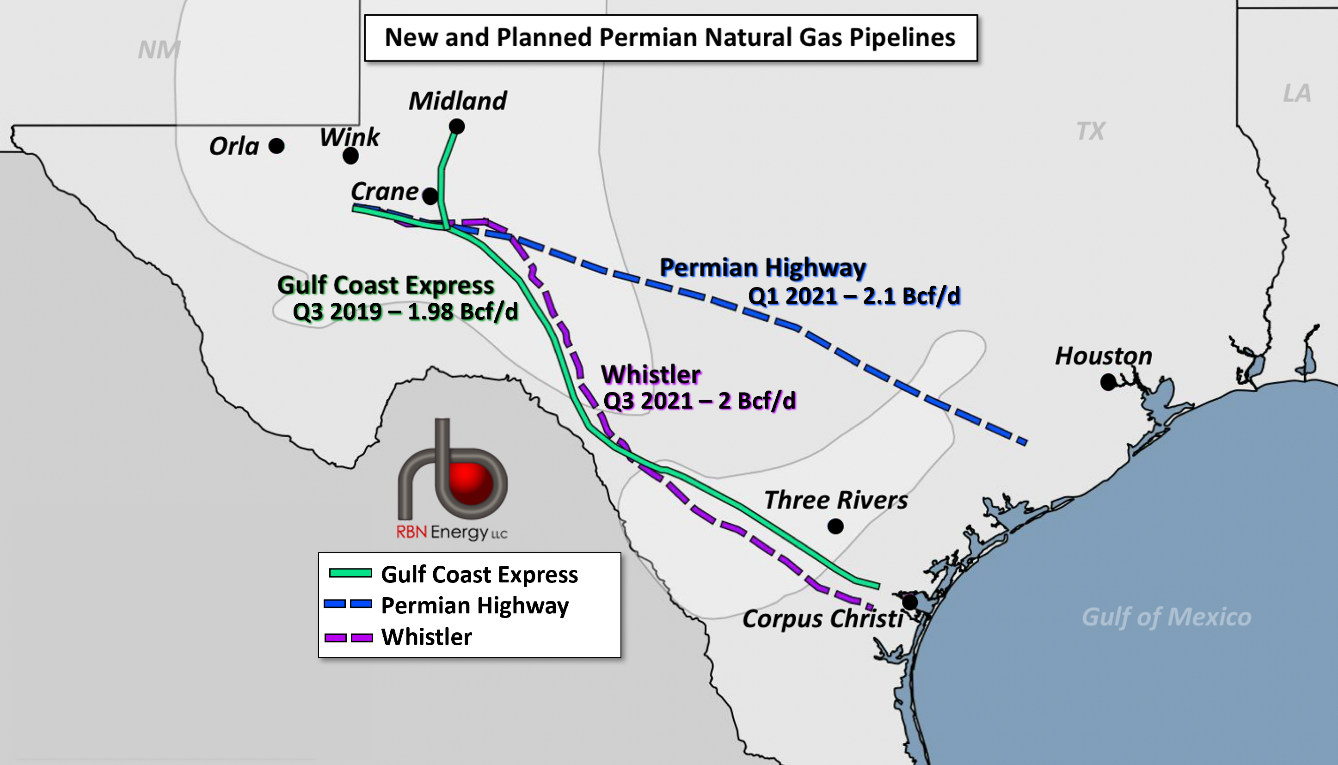

We also think the Whistler pipeline could start flowing this month. This pipeline is owned by Kinder Morgan and carries 2 Bcf/d from the West Texas to East Texas. Since this is an intrastate pipeline, we have no visibility into nomination data. We think it could be likely the flows start to coincide with the restriction in the NGPL southbound flows through location 302.

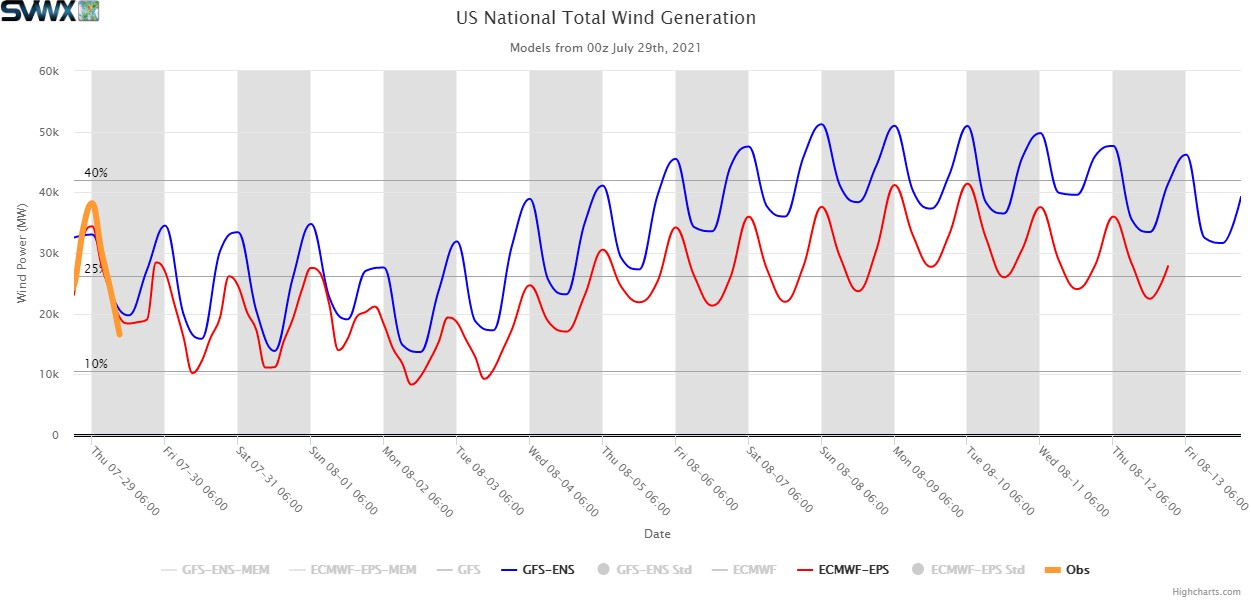

Total consumption was higher this week, primarily driven by power burns. Total national temps were higher by 1.1F week-on-week. Total national power generation was higher by 4.5%, of which natgas gen made up more than half the increase. We approximate natgas generation was higher by 2.4 Bcf/d. Wind gen was also higher by 13+% to a daily average of 30 GWh nationwide, but this is still much lower than we have observed in past years. The upcoming wind is still expected to be low until mid-week, after which it rises to seasonal levels.

On the consumption side, industrial demand was also notably higher by 1.4 Bcf/d.

Deliveries to LNG facilities averaged 10.8 Bcf/d, which was +0.3 Bcf/d higher than the previous week. The increase comes with both of Cheniere’s plants, Sabine Pass and Corpus Christie, increasing feedgas levels relative to the previous week.

Net the balance is tighter by 3.4 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Aug 13th and ends on Aug 18th.

Sept futures expire on Aug 27th, and August options expire on Aug 26th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.