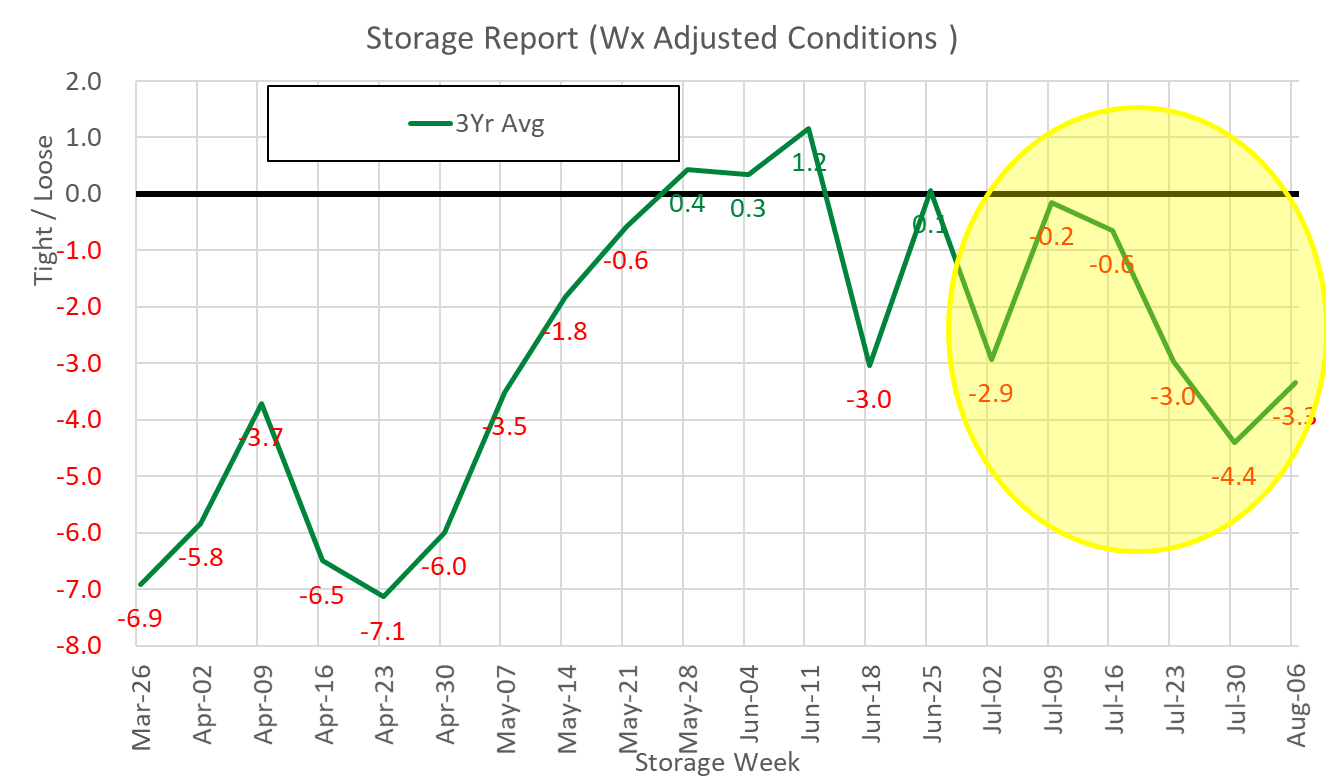

As we reported last week, the summer storage numbers have painted a tight S/D picture when compared to the past few years. This report from last week showed balances being 4 Bcf/d tighter (wx adjusted) versus the storage injections from April through August of last year. For our analysis below, we focus on the 3-year average storage picture to ensure we capture a more normal build scenario.

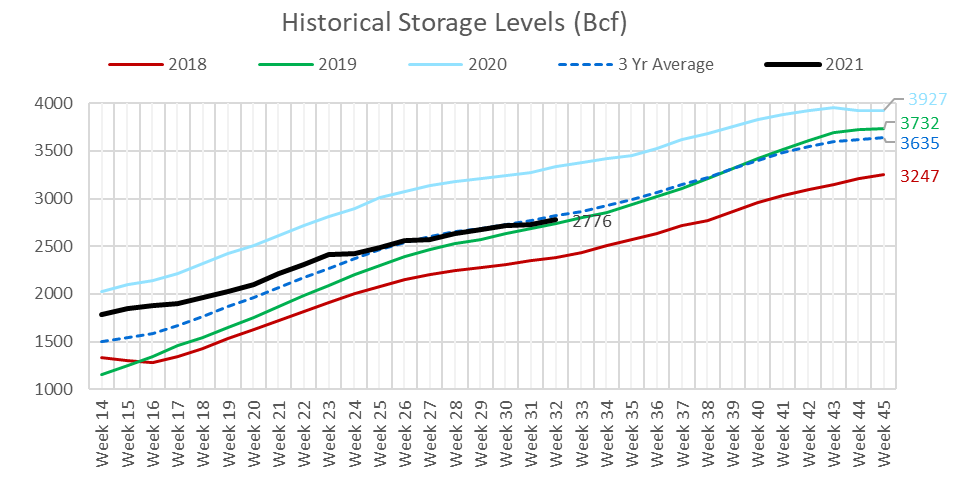

Let’s quickly define the start and end of the summer. Week 14 of the year or the first storage report period of April typically marks the start of the summer season, while week 45 marks the end of summer injection season. As just so we know where we currently are in the summer season – week ending Aug 6th is week 32.

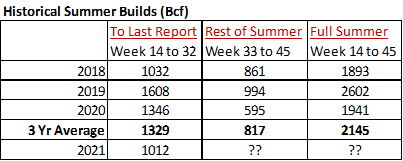

In the table below, we track the historical storage injections over the past 3 years and compare them to the current year.

As very clearly seen, this summer’s injections have been quite low relative to the 3Yr average but notably how close to 2018. This is somewhat of a coincidence that the storage activity is similar in the two years with the fundamental make-up being quite different. Production is 6-7 Bcf higher this year, but that gets canceled out with LNG higher by 6-7 Bcf/d. Also interestingly enough, total consumption is at a similar level in both summers despite prices averaging 45-50c higher this summer. We would have expected a big unwind in C2G switching this summer, but the retirement of coal generation plants over the past few years and lower coal production (due to halted mine operations during COVID) kept gas burns very strong. One last thing to note between the two years is the vastly different starting level. The 2018 summer injection started 449 Bcf lower than this current summer [At the end of week 14: 2018 = 1335 & 2021 = 1784].

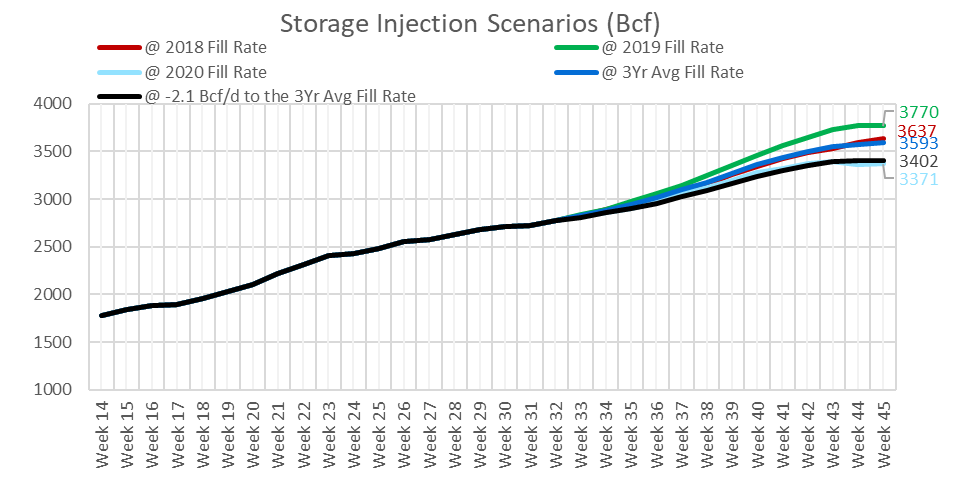

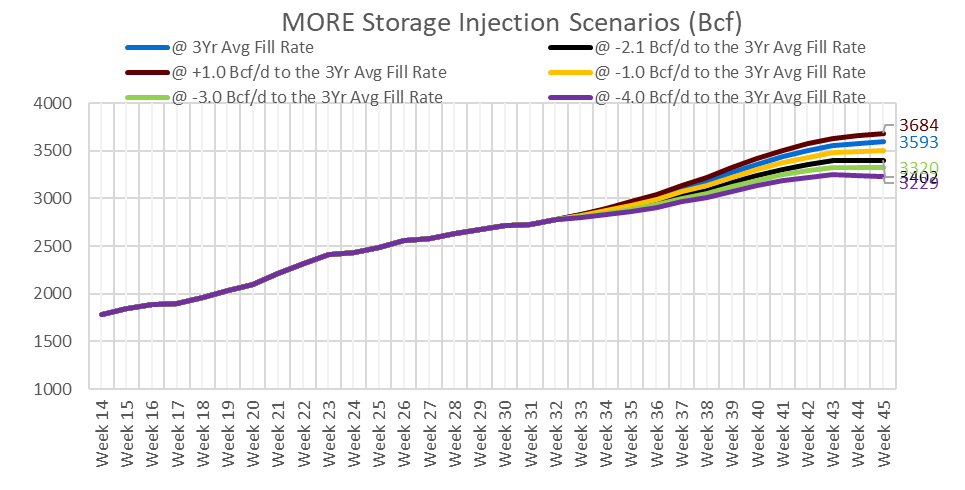

Today we’ll lay out several end-of-summer (EOS) storage level estimates based on historical injection rates. Our fundamental model points to an EOS level of ~3450 Bcf, which falls close to the -2.1 Bcf/d tight scenario – explained better below….

To start, here is how the EOS looks the past 3 years. There is a range of 680 Bcf between the 2018 end of summer (EOS) level of 3247 Bcf and the 2020 EOS of 3927 Bcf. The 3 Yr average level is 3635 Bcf. As seen, weekly injections should start to ramp up as the summer peak heat start to wind down.

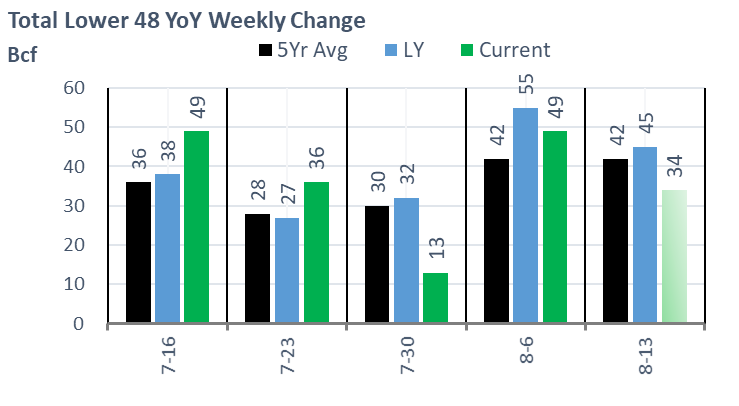

During the current summer, the storage number has been consistently tight versus past years. Although constantly tight, the level has fluctuated wildly due to the variability in wind generation. For example, the past 3 storage reports have been particularly tight on a weather-adjusted basis due to the lack of wind and this upcoming report should show a very different picture with strong wind. To get a good proxy of how recent storage builds compare to past years, we review the last 5 storage reports. This set of reports tells us that injections lag the 3Yr average injection rate by 2.1 Bcf (adjusted for weather variability) – or more simply put as “-2.1 Bcf/d to the 3yr Avg Fill Rate” .

In the chart below, we project storage out for the rest of 2021 with the actual injection rates from the past 3 years, the average of the past 3 years, and finally, the scenario where balances each day are tighter by -2.1 Bcf/d to the 3 year average build. With those 5 scenarios, EOS storage levels end up between 3371 and 3770 Bcf.

Lastly, we run out the EOS storage estimates with various tight and loose conditions around the 3Yr average injections for the rest of summer.

These scenarios should allow you to better gauge where we end up for EOS based on your belief of how tight the natgas market actually is. With those 6 scenarios, EOS storage levels end up between 3229 and 3684 Bcf.

For the week ending Aug 13th, our early view is +34 Bcf. The 5Yr average is a +42 Bcf injection. Our projected injection would take the L48 storage level to 2810 Bcf (-559 vs LY, -189 vs. 5Yr).

Domestic production has been relatively flat most of this summer. This past week, dry production was higher by 0.4 Bcf/d to 92.3 Bcf/d. This small increase was essentially a return of production in TX and the Midcontinent after a small drop during the week ending July 30th.

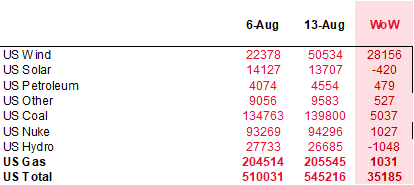

The big moving piece this week was consumption, specifically power burns. This past week was the hottest summer week at the national level. Total national power generation was higher by 6.9%, but surprisingly a major increase in power burns was muted with a big bump in wind generation. We approximate natgas generation was higher by 2.7 Bcf/d but would have been much higher if it was not for the wind gen jumping 126% week-on-week.

Average Hourly US Power Generation over the Week (MWh)

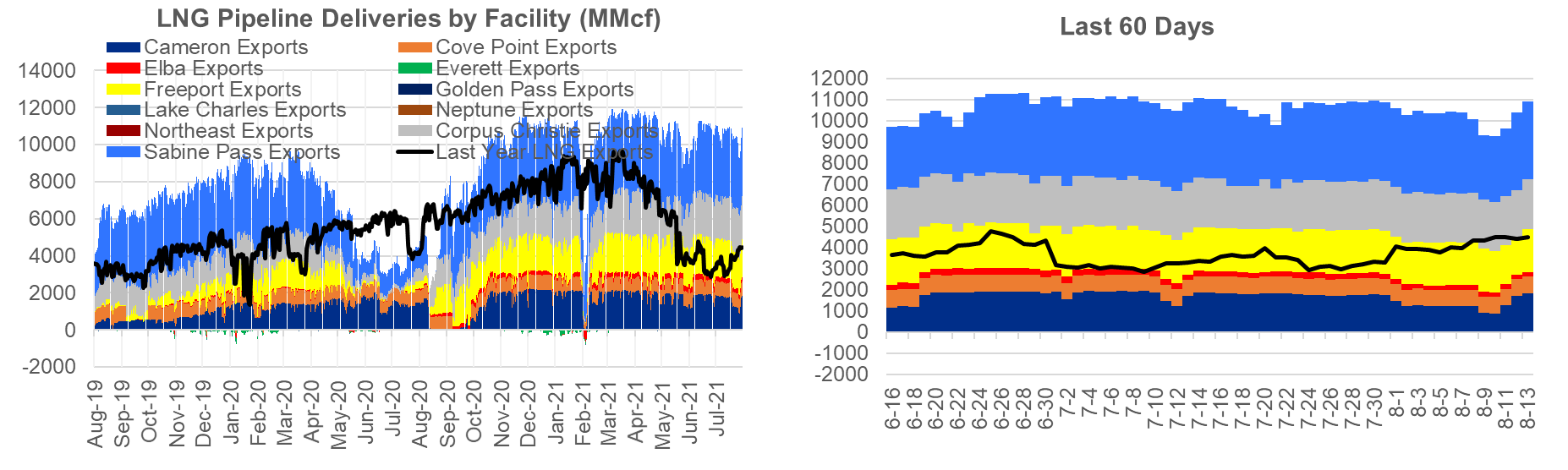

Deliveries to LNG facilities averaged 9.9 Bcf/d, which was -0.6 Bcf/d lower than the previous week. The drop was a result of multiple LNG facilities having feedgas declines. A train at Cameron had maintenance for most of the week, while Freeport and Sabine had minor fluctuations. As of this weekend, LNG feedgas flows are back to more normal levels.

The net balance is tighter by 1.5 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Aug 13th and ends on Aug 18th.

Sept futures expire on Aug 27th, and August options expire on Aug 26th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.