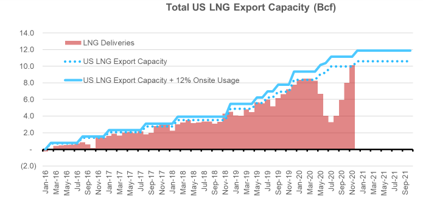

This weekend LNG feedgas levels hit a new record with all facilities starting to fire up towards their design capacity. Yesterday LNG feedgas levels hit 11.5 Bcf/d.

The Corpus Christi LNG terminal has been nominating an average of 2.2 Bcf/d over the last 7-days, with a peak of 2.26 Bcf/d observed this past week. The terminal has been authorized to commission Train 3, and the market has been looking for any indication of a significant ramp. The design capacity of Trains 1 & 2 is 0.66 Bcf, plus approximately 0.08 Bcf/d of onsite usage. So with all three terminals available, the max delivered gas should be 2.21 Bcf/d – which is approximately what we saw this past week.

In late October, Cheniere reported the Corpus Christi construction was 96.7% complete, with Train 3 ahead of schedule and within budget. The plants typically ramp up 3-5 months before they are slated for commercial use. In a separate FERC filing, Cheniere requested approval to commission LNG Storage Tank B.

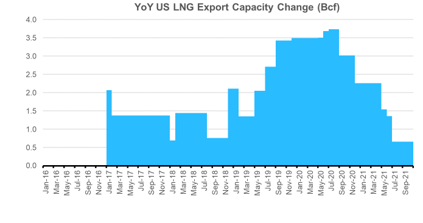

The current total LNG feedgas capacity from all US plants is approximately 11.9 Bcf/d, which includes Cheniere’s Corpus Christi T3. Yesterday’s nominations get us close to those levels.

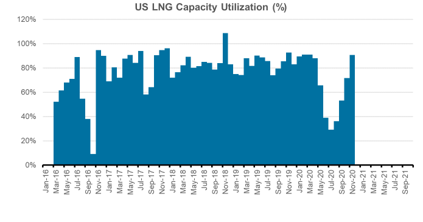

We do not expect to reach those peak levels this winter, as the expected utilization rate is 90% (those were the levels observed last winter on average).

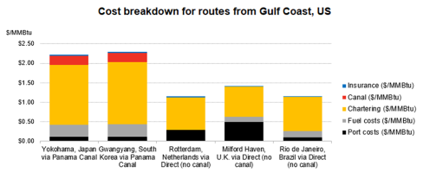

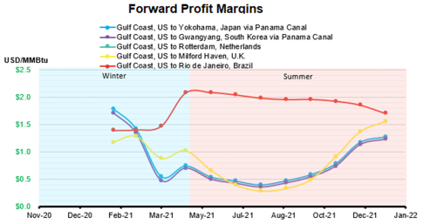

With LNG spread to Europe and Asia quite wide, we are expecting LNG levels to stay strong from the remainder of winter. Below are the US Gulf Coast netback to different major destinations.

Spot charter rates are currently $112,000/day and 1-year rates are $47,000/day. Using the spot rate, below is a chart showing the total cost breakdown to ship to major destinations. Asia is ~$2.25/MMBtu, while Europe and South American are ~$1.25/MMbtu.

With where current spreads are, the netbacks are positive with spot chartering rates applied for the first to the third month and 1-year time-charter rates applied thereafter; hence LNG economics says gas should move out of the US Gulf Coast.

Source: Calculated using the BNEF LNG calculator

On average for Dec through March we expect flows to LNG facilities to average 10.7 Bcf/d.

Beyond winter, the netbacks are currently positive for the summer despite expectations of tight US balances. We currently assume LNG flows to remain robust this summer – not at a 90% utilization but lower. Summer 17 utilization was 81%, and summer 18 utilization was 83%). With an 80% utilization, we should expect an average of 9.5 Bcf/d of feedgas delivered to US LNG facilities.

Fundamentals for the week ending Dec 4: Our early view for the upcoming storage report is a -77 Bcf withdrawal for the lower 48. This would take storage levels to 3862 Bcf. The industry estimates for this report is -99 to -65 according to The Desk. The range was fairly wide this week with it being the back end of the holiday week.

US natural gas dry production increased week on week with domestic production averaging 91.6 Bcf/d for the week. The was flat week on week, with some small adjustments from region to region. Demand was jumped by 10.8 Bcf/d week on week, with this past week cooler and less of a holiday week. Rescom consumption jumped by 7.7 Bcf/d, driven mainly by the Midwest and the Northeast.

Canadian imports rose last week averaging 5.3 Bcf/d. Mexican exports continue to hold steady at an average of 6.4 Bcf/d.

Deliveries to LNG facilities averaged 10.4 Bcf/d, up 0.7 Bcf/d week on week.

Expiration and rolls: UNG ETF roll starts on Dec 15th and ends on Dec 18th.

Jan futures expire on Dec 29th, and Jan options expire on Dec 28th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.