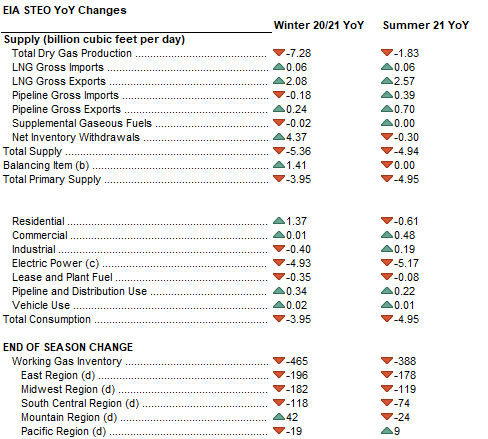

This week we review the latest Short Term Energy Outlook (STEO) issued by the EIA. There is lots of good data in the STEO report and most importantly it gives us an indication of what others in the market are seeing.

Below are the month over month changes in the report, and the change from their pre-COVID forecast – March 2020.

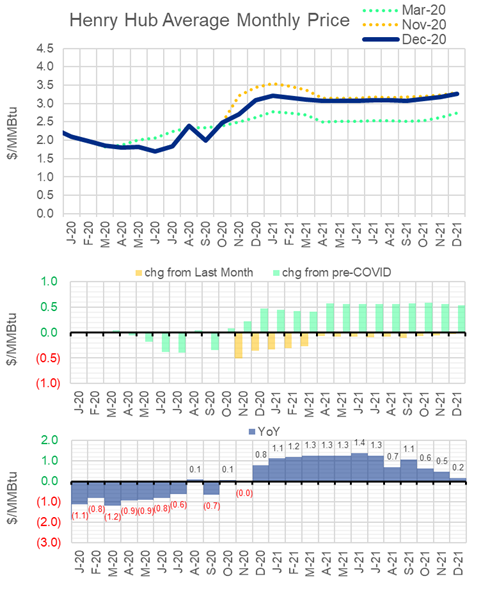

To start we look at the changes in their price forecast. The EIA decreased their outlook for prices for the balance of winter (Dec through Mar). The bal winter strip is expected to average $3.15, with the current NYMEX bal winter strip trading at $2.59/MMBtu. The winter strip is $0.31 lower than last month’s forecast.

The summer strip has also been stated slightly lower to average $3.08/MMBtu. This would put the summer price strip $1.08 or 54% above last year’s levels.

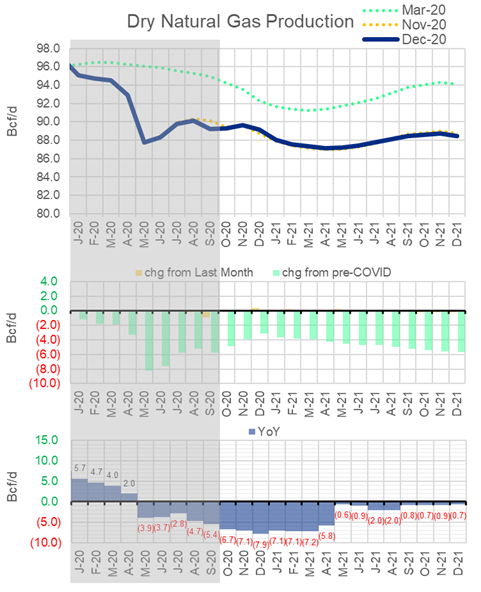

The EIA significantly jumped their production estimate for the rest of 2020, and 2021. This seems to be a combination of a higher price forecast this winter, and better well recoveries from newly drilled wells and available DUCs.

From bal winter (Dec through Mar), the EIA estimates production will continue to slowly decline through winter and average 88.0 Bcf/d. Production bottoms out in Apr 2021, after which it levels out and then increases in the back half of 2021. The average 2021 production level is 87.9 Bcf, or 3.0 Bcf/d lower than the current estimated 2020 production level. This estimated 2021 production level was flat month-on-month and continues to stay 4.7 Bcf/d lower than the pre-COVID scenario.

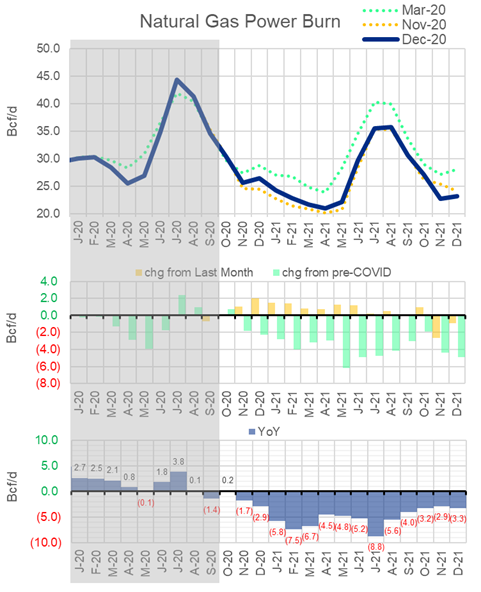

The month-on-month change in the price forecast has altered the EIA’s view on upcoming power burns.

The lower bal winter strip (Dec through Mar) has moved their burn forecast higher by 1.4 Bcf/d relative to their November report

Summer 21 power burn has not changed much month-on-month with their price forecast for that time frame remaining almost intact. The EIA is still expecting burns to average 28.8 Bcf/d or -5.2 Bcf/d summer-on-summer. This builds a more normal weather temperature profile, and prices Henry Hub prices settling $1.08 higher for the summer strip.

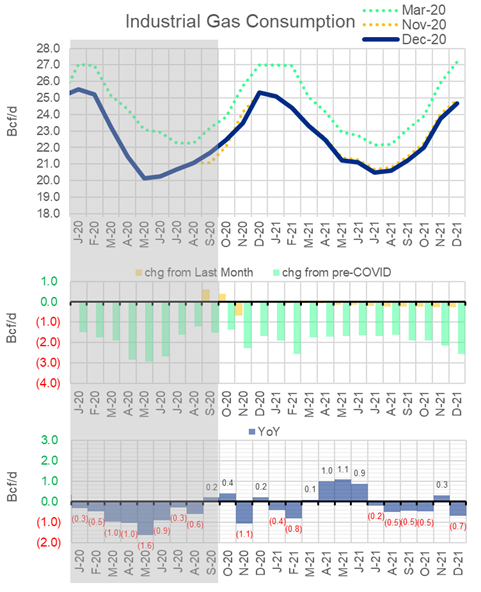

Industrial natural gas usage took a big hit in 2020 with COVID-related lockdowns. The EIA data show the Summer 2020 industrial load to be 1.2 Bcf/d lower than Summer 2019.

The industrial usage is not expected to report to normal levels (the pre-COVID March 2020 case) in their entire forecast period. As seen below, the industrial usage is only slightly higher by +0.2 Bcf/d for the upcoming summer.

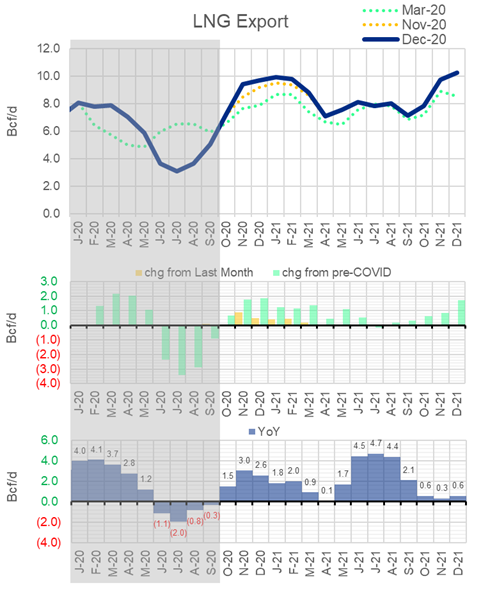

EIA shows show LNG exports moderately higher for the bal of winter than their November forecast. The new forecast has bal winter exporting 9.6 Bcf/d, which is +0.4 higher than where their forecast was last month. We assume the difference is accounting for the increase recently seen from Corpus Christie train 3 coming online.

The EIA’s summer view show exports averaging 7.6 Bcf/d, which is conservative compared to other market estimates. The view has not changed from the previous month’s forecast.

We should note this forecast is only for the exported volume and does not include any feedgas used onsite. We generally add 12% to account for the onsite gas usage at LNG facilities.

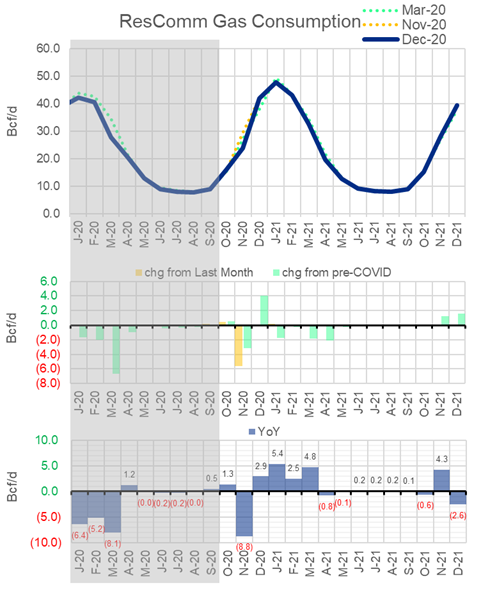

Fundamentals for the week ending Dec 11: Our early view for the upcoming storage report is a -119 Bcf withdrawal for the lower 48. This would take storage levels to 3729 Bcf. The industry estimates for this report range between -103 to -138 according to The Desk.

This will likely be the first triple-digit draw of the season. Supply was flat week on week, with domestic production being offset by higher net Canadian imports. The big change in the balances was the higher ResComm usage due to cooler temps and growing LNG exports. Deliveries to LNG facilities averaged 11.3 Bcf/d, up 0.9 Bcf/d week-on-week. Net the balance were tighter by 4.5 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Dec 15th and ends on Dec 18th.

Jan futures expire on Dec 29th, and Jan options expire on Dec 28th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.