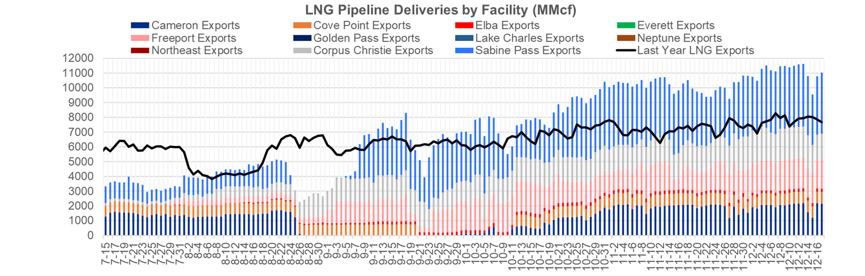

US LNG feedgas continues to trend near all-time highs, with a peak of 11.6 Bcf/d set on December 13th. The average this month has been 11 Bcf with some issues at Sabine and Cameron taking lower volumes for a couple of days. Cameron volumes were lower due to utility plant trip knocking them offline. Sabine volumes were supposedly lower due to fog issues backing up tanker arrivals.

The strong netbacks to Asia have been the major push to these LNG levels, but coming winter weather and commissioning volatility at Corpus Christi T3 suggests we could see downside to feedgas demand through the next 6 weeks.

This month’s volumes are higher by 3.2 Bcf/d YoY, and 0.9 Bcf/d higher than November.

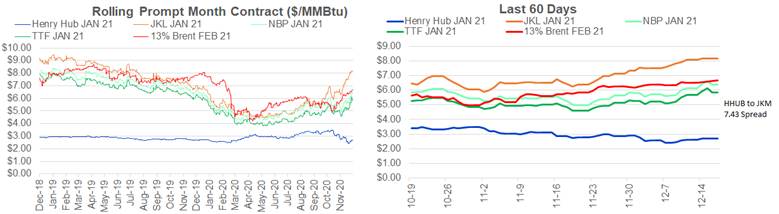

This past week Platts JKM spot was assessed at $12.40/MMBtu, its highest level in recent history. The forwards do not show the same level of prices. The prompt JKM contract (Feb) currently is priced above $10/MMbtu.

The spot rally is being driven by cooler winter conditions in Asia, supply outages in Qatar, Australia, and Malaysia, high tanker rates, and Panama canal congestion. The high prices in Asia seemed to have pushed the mini bull run in Europe this week as well.

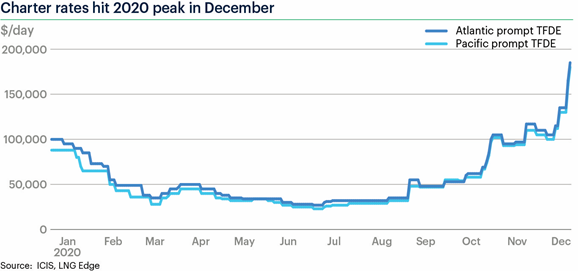

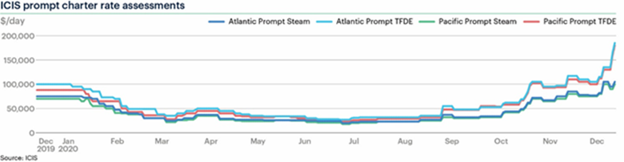

Platts suggest that the shipping availability constraints are pushing daily Atlantic Basin charter rates to $150,000/day, with a 135% ballast rate. Additionally, market chatter suggests that there are no ships available for the prompt month and that incremental January demand in Asia might only be satisfied with physically swapped cargos.

Here is a chart from ICIS showing TFDE (Tri-Fuel Diesel-Electric) tanker charter rates this past year. ICIS mention on an enelyst chat that “no fixtures were done at the ultra-high levels due to the limited availability of tonnage”

For the prompt month (Feb), TFDE-propelled tonnage stands around $185,000/day in the Atlantic basin and at $180,000/day in the Pacific basin.

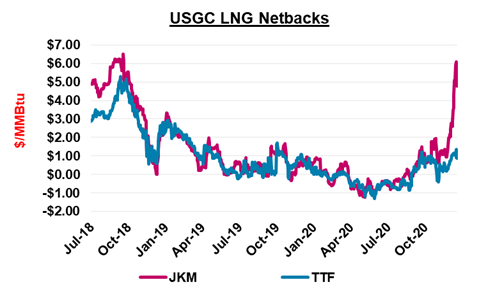

Here is a view of US LNG netbacks to Asia and Europe from Platts. The netback broke over $6/MMBtu on December 15 for the February delivery period. These are the highest spreads observed since the fall of 2018 and a massive reversal from the summer lows where netbacks were negative.

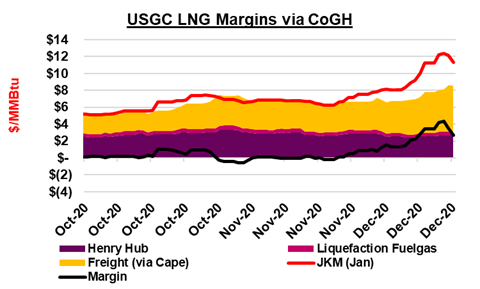

The above netback considers the journey through the Panama Canal. But with congestion there, some tankers have gone around the Cape of Good Horn. Even with the longer journey at the higher daily tanker rates, a US LNG cargo delivered to the JKM is is still in the money. In fact, the netback still exceeds that to Europe.

Fundamentals for the week ending Dec 18: Our early view for the upcoming storage report is a -161 Bcf withdrawal for the lower 48. This would take storage levels to 3565 Bcf (+269 YoY, +209 vs 5Yr). The industry estimates for this report range between -175 to -123 according to The Desk.

This past week was the first triple-digit draw of the season, and our 4 week forecast show no relief. Based on the current weather forecast and 10Y normals after, we are expecting weekly storage draws ranging from 154 to 263 Bcf .

For this past week, supply was flat week on week, ie. Both domestic production and net Canadian imports. The big change in the balances was the higher ResComm usage as cooler temps and massive storm storms blanket the Northeast. Deliveries to LNG facilities averaged 10.9 Bcf/d, down 0.3 Bcf/d week-on-week. Net the balance were tighter by 5.0 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Dec 15th and ends on Dec 18th.

Jan futures expire on Dec 29th, and Jan options expire on Dec 28th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.