With the weather turning warmer this past week and eliminating the fear of a cool rest of Feb, the market has been in sell-off mode. At this point, most of the folks have written off winter. I can tell you that it feels and looks like early Spring in Calgary. So the conversation now shifts to the summer injections.

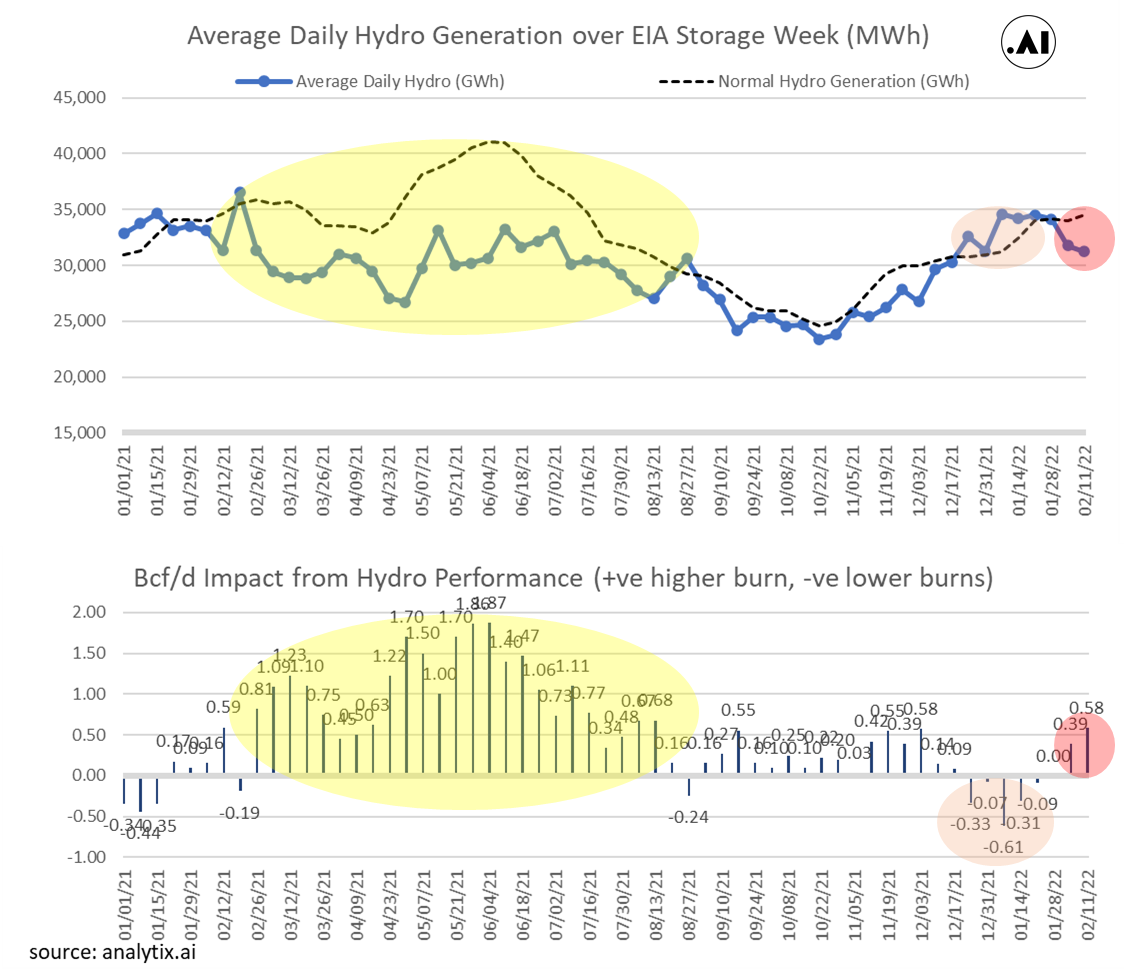

One of the major contributing factors to tight summer balances last year was the low hydro levels going into the summer. As seen in the chart below, we compare the actual hydro generation level to our expected level (based on past years). The yellow section highlights the low level of hydro last year, which resulted in higher natgas burns.

The fear of low hydro for this coming summer was put to the side in late December with the West coast receiving a heavy round of much-needed rain and snow. This led to dramatically stronger reservoir and snowpack levels compared to just 2 weeks earlier and trending in the right direction for the upcoming summer season. This can be seen in the data above with strong hydro gen (orange area) in late-Dec and early Jan. A good data point is the snowpack level in the Sierra Nevada mountain range which sat over 150% in late-Dec.

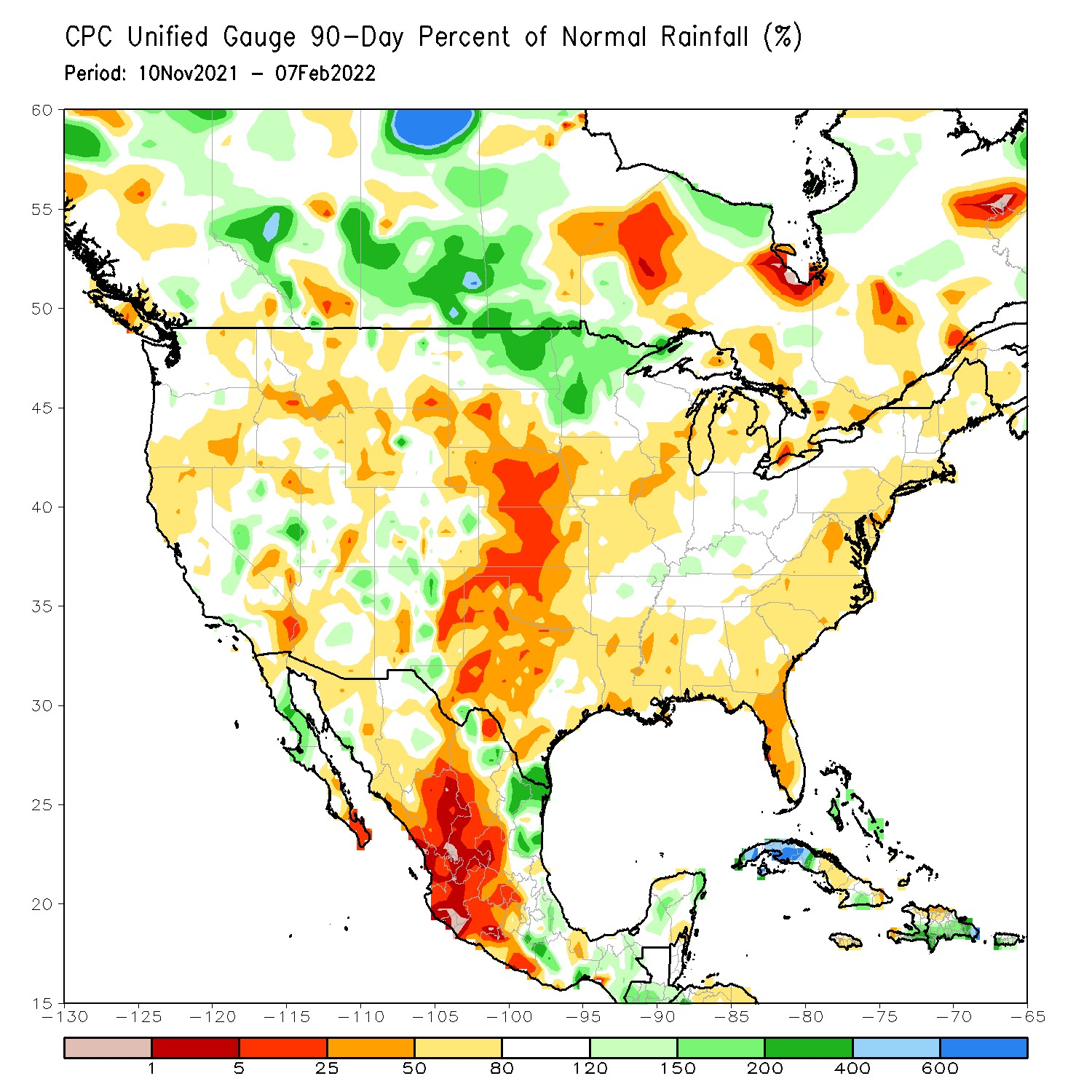

The situation has once again switched over to drought conditions with those precipitation events not continuing in the new year. Rainfall over the last 90 days has not been robust as seen in the CPC map below for Nov 10th to Feb 7th.

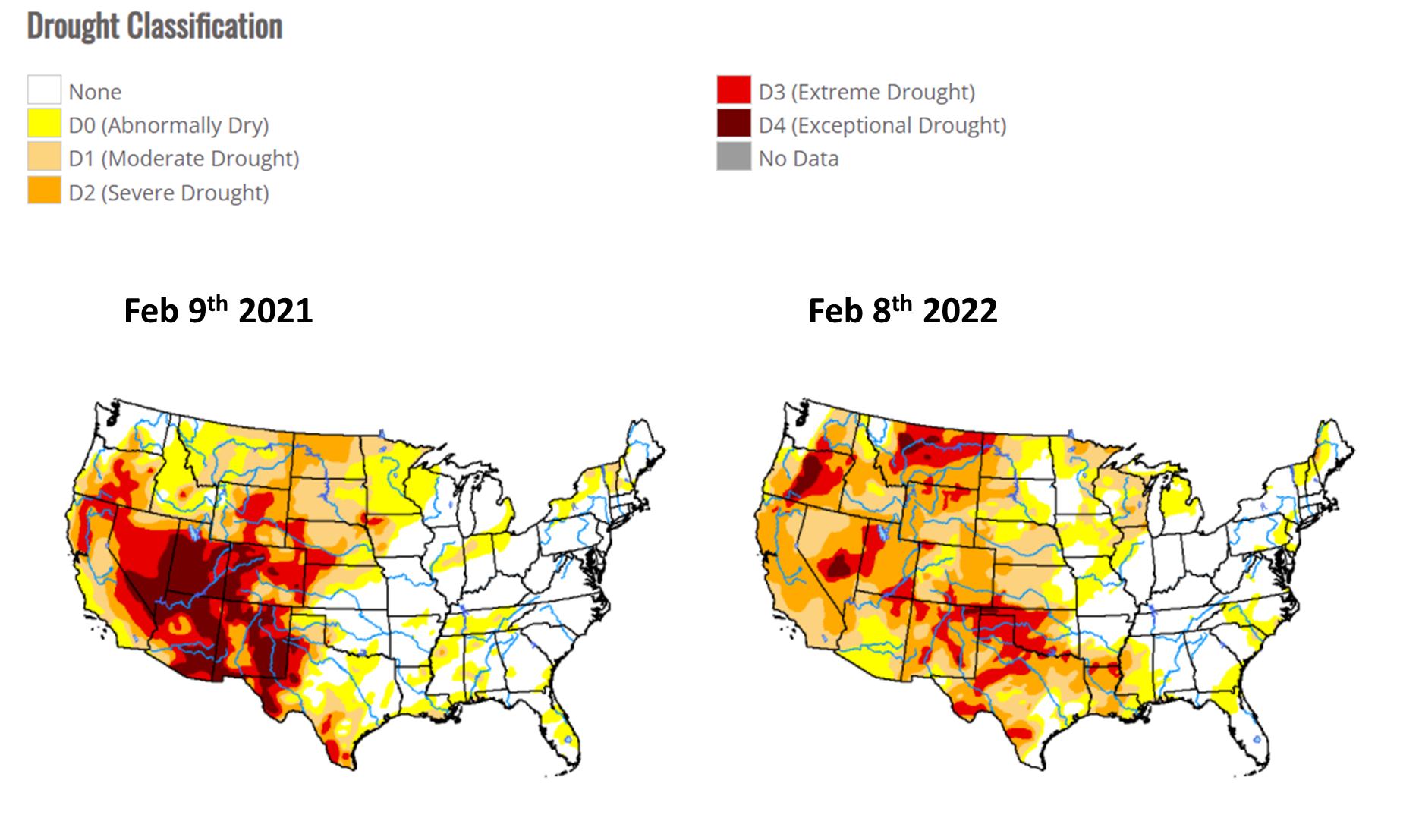

As a result here is how the drought conditions currently look across the US. We are not in an extreme situation like last year, but any rain that does fall will be soaked up by the very dry ground conditions; hence current conditions lead us to believe we will once again experience low hydro output this summer.

Source: https://droughtmonitor.unl.edu/

Fundamentals for the week ending Feb 11:

The EIA reported a -222 Bcf withdrawal for the week ending Feb 4th, which was within the range of estimates. This week’s number helps verify the previous week’s -268 draw which was quite bearish relative to expectations. As we indicated last week, it appears the non-linearity of the weather & demand relationship is not modeled well at the cooler weather extremes [i.e. demand doesn’t grow as fast at extreme cool temps].

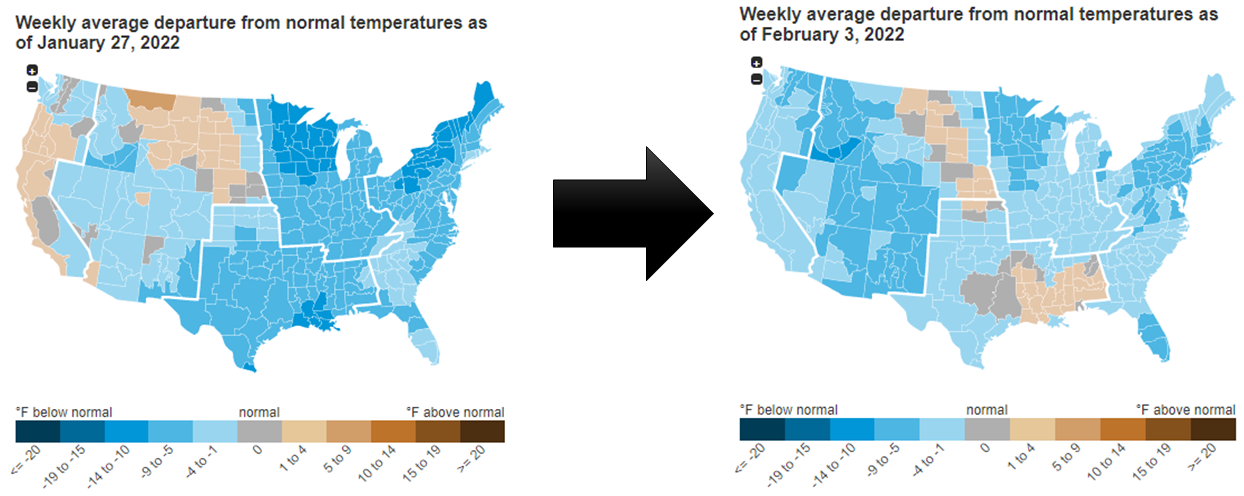

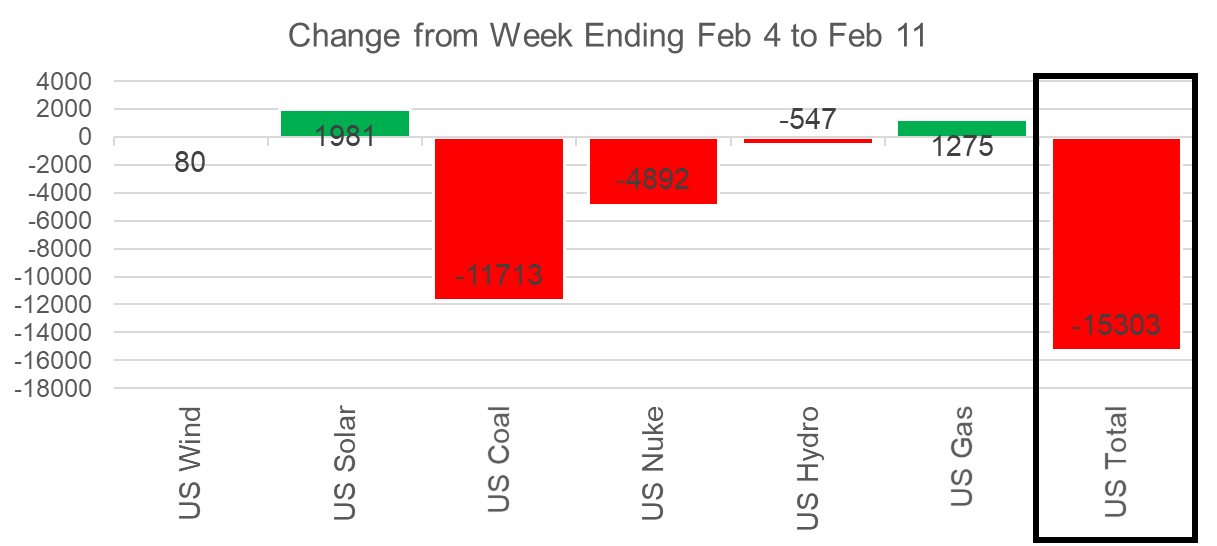

As the rescomm consumption came off with the weather change, we saw the overall power load drop as well. The overall power load dropped by 3.7% or an average of 18.6 GWh. During the week, we also saw wind recover with a performance of 18% above our expected level. With overall power load lower and wind recovering, we saw overall natgas gen power burns drop by 18.5 GWh on average. Using a 7.5HR gas plant, this equates to power burns being lower by 3.8 Bcf/d over the week.

For the week ending Feb 11th, our early view is -206 Bcf. This reporting period will take L48 storage level to 1,895 Bcf (-491 vs LY, -329 vs. 5Yr).

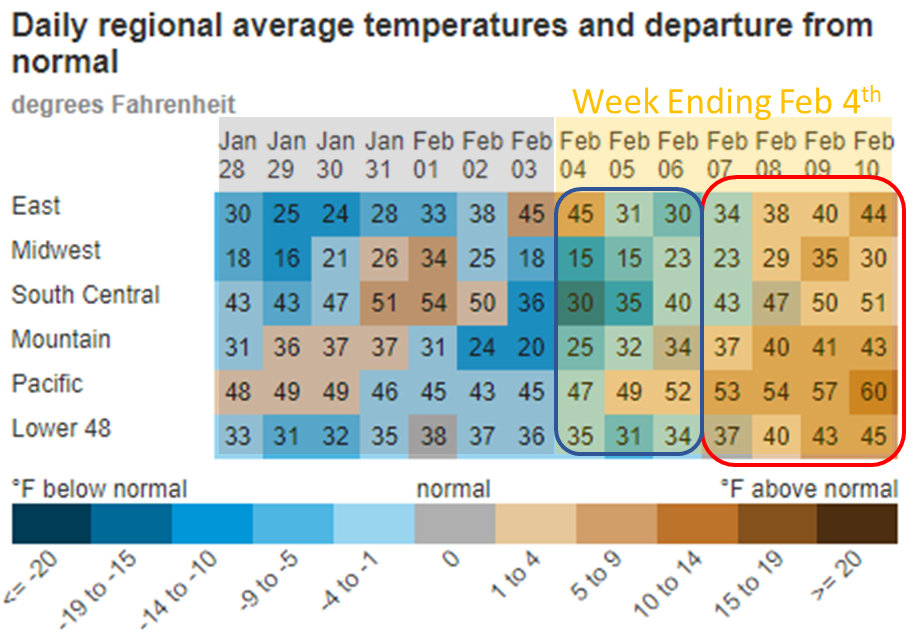

Once again, total consumption remained strong but lower week-on-week. Last week’s levels are in line with the first few weeks of January. Midweek we saw a big shift from cooler-than-normal to warmer-than-normal weather. This change was largely across the entire country which led to a L48 GWHDD dropping by 3.3F compared to the previous week. This resulted in total consumption dropping by 4.3 Bcf/d.

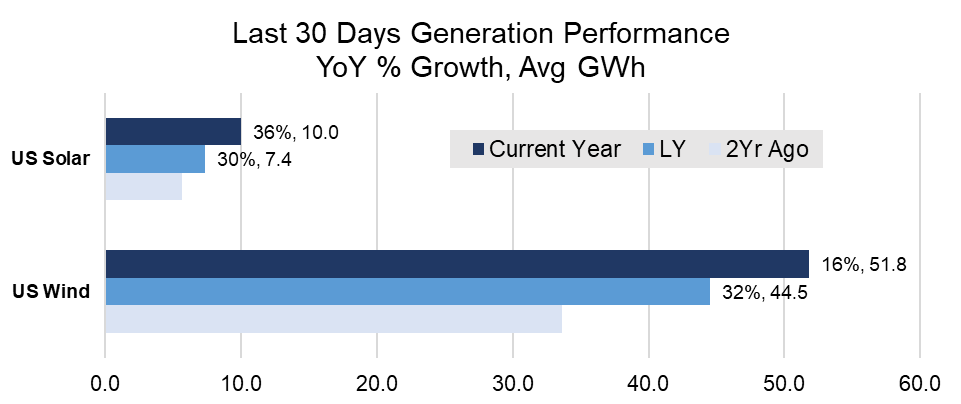

To put the wind figure into perspective, we compare the last 30 days of wind & solar performance vs the same range in the last two years. As can be seen, the pace of capacity installation is bringing wind and solar to a sizable level. When looking at just the last 30 days, the combination of the wind & solar generation level (not available capacity) currently takes it to 13% of the total power stack.

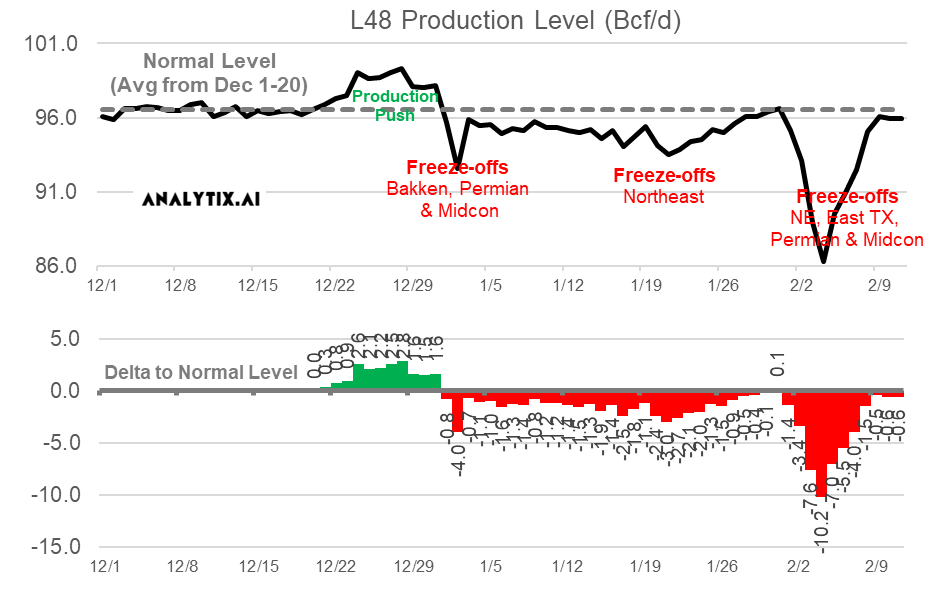

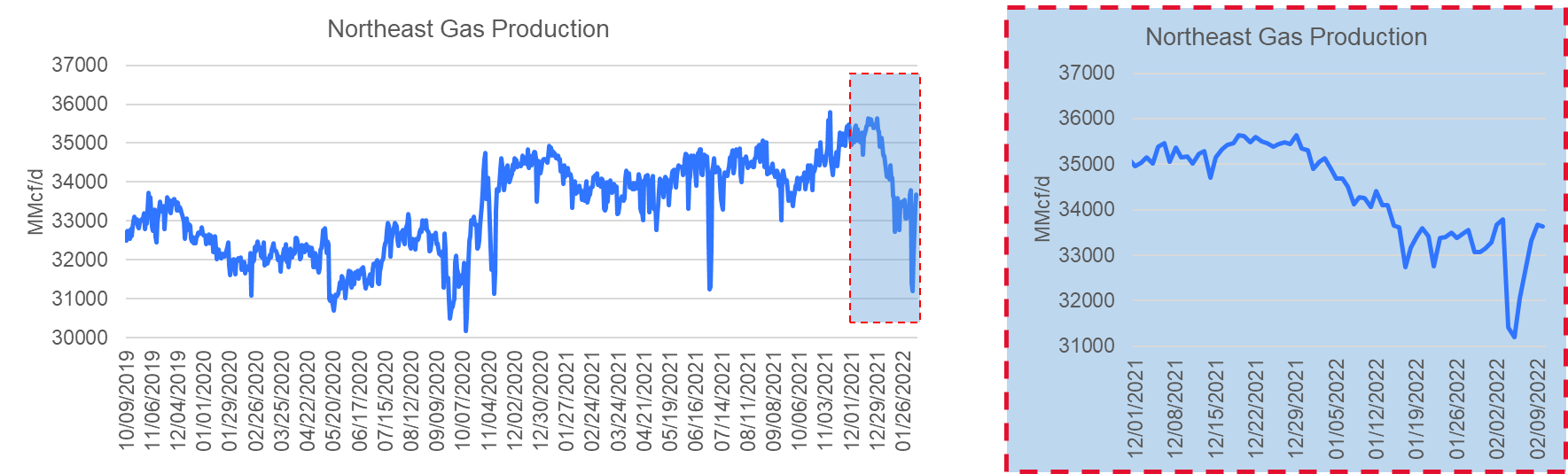

Domestic dry gas production was overall down significantly week on week, with the cooler weather blanketing most key production areas at the start of the storage week. Feb 4th saw the largest impact from Freeze-offs as cooler weather slid into Texas and the Midcontinent. That being said, the cool weather was short-lived and so were the freeze-offs. With no damage to any energy infrastructure, production returned very quickly. The daily production ranged 10 Bcf/d through the week (from 86.3 on Feb 4th to 96 Bcf/d on Feb 10th).

The Appalachian basin still looks to be suffering from some freeze-offs. With cool weather hitting the region over 3 weeks ago, the freeze-off recovery is not quick. That being said, the weather has already warmed up and is expected to stay this way for the foreseeable future. Overall regional production looks fair at 35 Bcf/d; hence we expect another 1.5 Bcf/d to return in short order. This could take overall L48 production back to levels we observed at the end of December.

Deliveries to LNG facilities averaged 12.4 Bcf/d, which was +0.3 Bcf/d higher than the previous week. Both Freeport and Sabine operations were low during the week, but returned this weekend. For Sabine, the lower receipts were timed with some maintenance on feeder pipe NGPL.

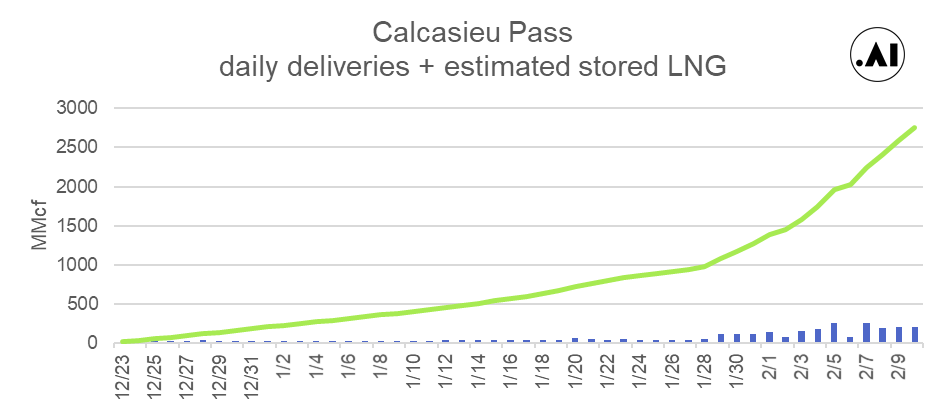

Calcasieu Pass deliveries have been hovering around 0.2 Bcf/d all week. Yiannis LNG Tanker docked at the facility on Monday and is still there. When we add up all the receipts [less 12% used onsite] from since Jan 1st (that’s when it looked like the facility started proper operations), it appears the facility has about 2.7-2.8 Bcf stored on site. We estimate there to be enough for a full tanker this week.

The net balance was 2.0 Bcf looser week-on-week.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.