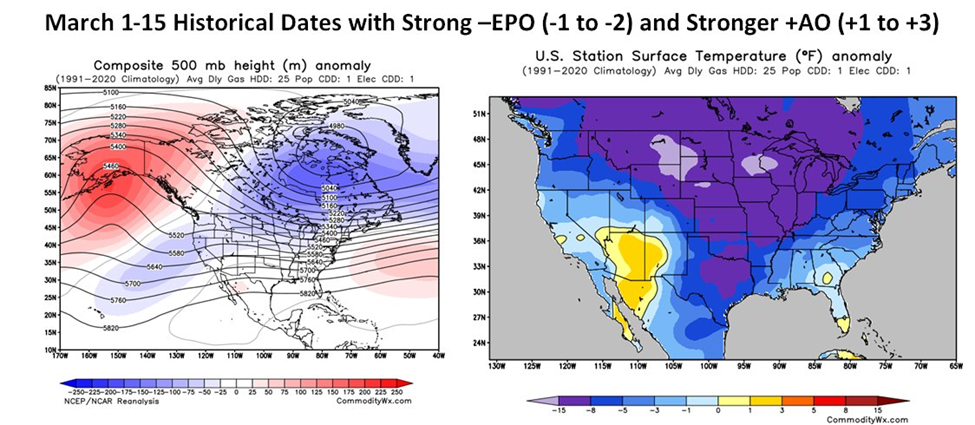

Although most vendors are sticking to an outlook for March related to the La Nina features, there are cool and warm signals.

Here is one point of view tweeted out by CWG on Friday.

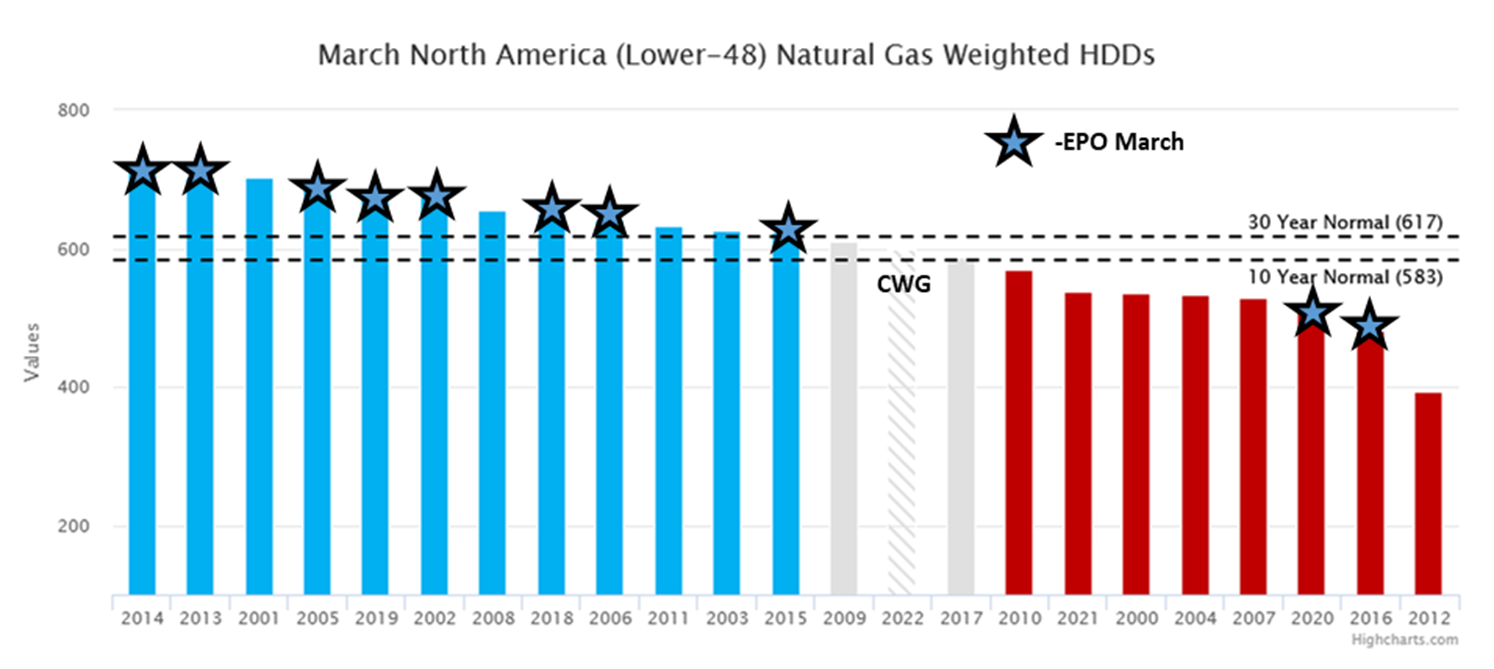

“Moderate -EPO and moderate-strong +AO combined are usually colder signals for U.S. in 1st half of March.”

“Most -EPO March outcomes in 2000s have verified colder than CWG’s current outlook. Two exceptions (2016, 2020) featured very strong global wind unlike this year’s negative levels. We may need to cool down our view by next week.”

Fundamentals for the week ending Feb 18:

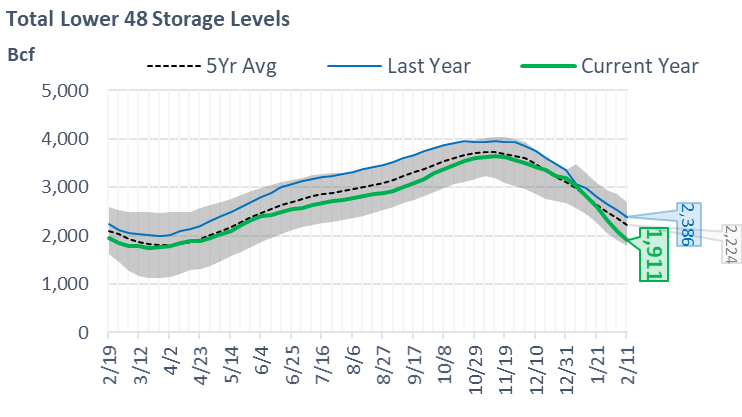

The EIA reported a -190 Bcf withdrawal for the week ending Feb 11th, which came in on the low end of the estimates range. After 4 consecutive 200+ Bcf weekly draws, this past week came in shy of that target. This leaves this winter season tied with the 2013/14 polar vortex year.

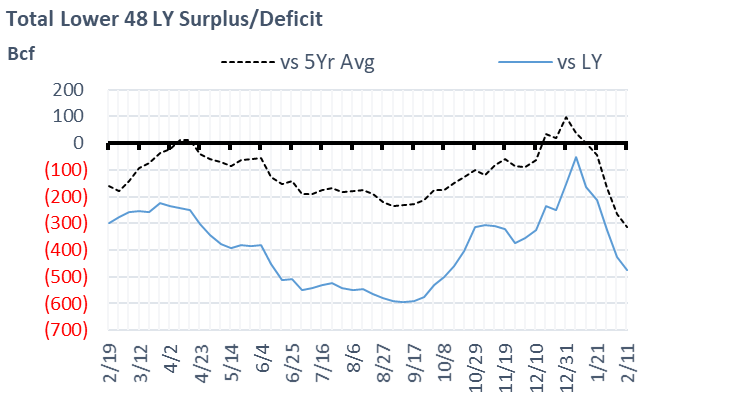

Storage levels are now approaching the 5 Yr low. After a warm start to winter, the new year has brought plenty of cool weather over key consumption and production regions. As a result, we have seen a very heavy drop in storage levels as seen in the chart below. With the latest short-range forecast, the end-of-season storage is now once again hovering between 1.3 and 1.35 Tcf exit.

In mid-December, storage levels got to a very comfortable range relative to LY and the 5Yr. That was short-lived as seen in the chart below.

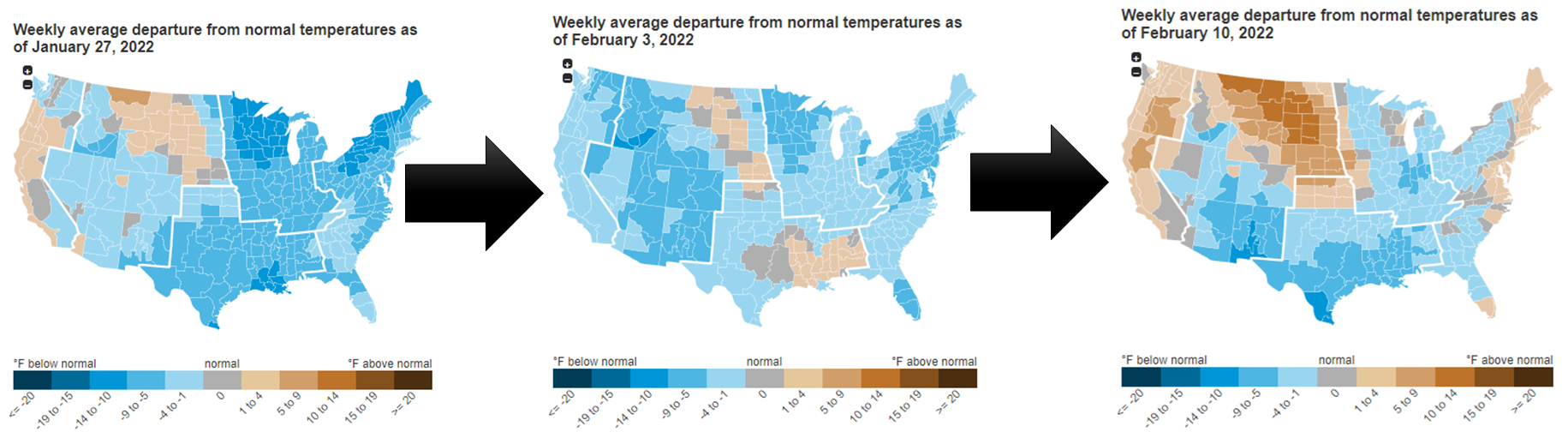

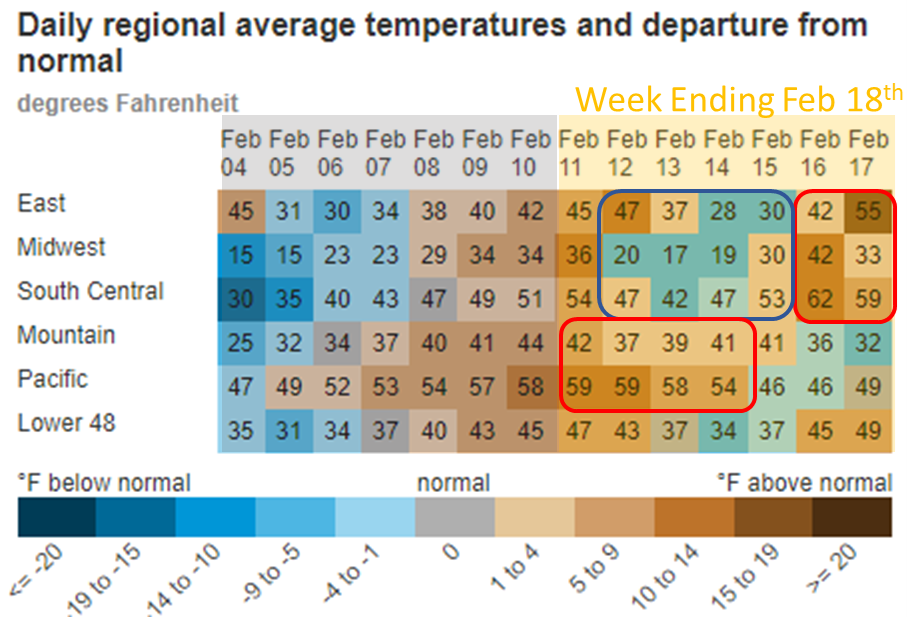

The temp change has been dramatic over the last few weeks. Midway through week ending Feb 11th, we saw a big shift from cooler-than-normal to warmer-than-normal weather. This change was largely across the entire country, but most apparent across the West Coast and Mountain regions. The change in weather led to overall consumption dropping by 6.4 Bcf/d. That being said, the overall balance was not that loose as the L48 struggled with production freeze-offs (SC to the NE) at the start of the week.

For the week ending Feb 18th, our early view is -118 Bcf. This reporting period will take L48 storage level to 1,793 Bcf (-448 vs LY, -311 vs. 5Yr).

Once again, we see total consumption dropping week-on-week. Temps were generally above normal at the L48 level except for a couple of days midweek. L48 GWHDD dropped by 3.6F relative to the previous week, which resulted in consumption dropping by 7.8 Bcf/d. The change in temp was the main contributor to the drop by lowering rescomm usage by 5.4 Bcf/d, but power was also a big piece.

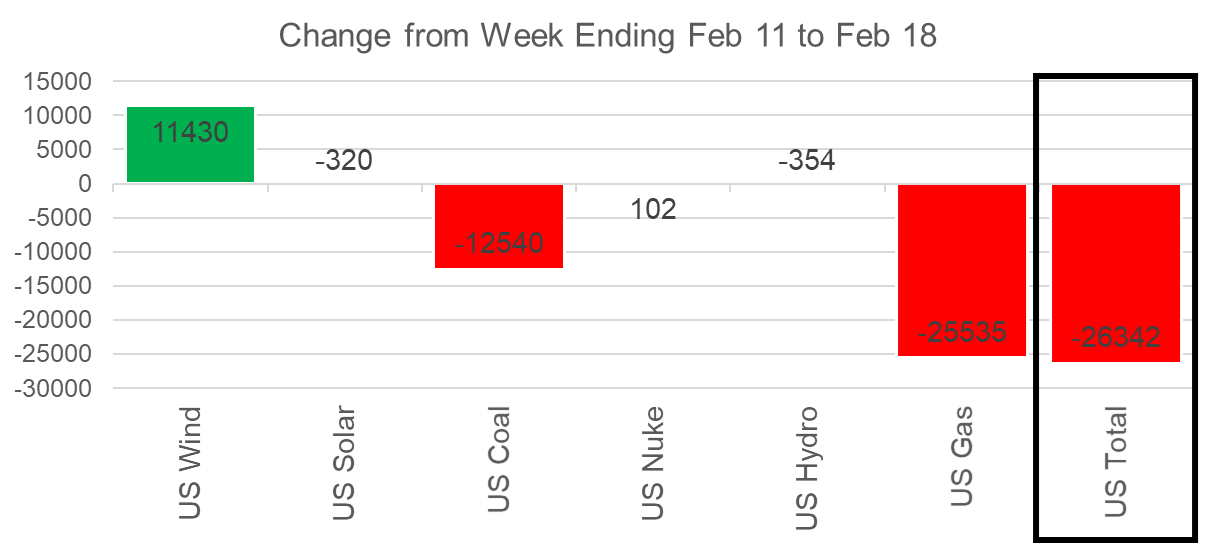

The overall power mix changed with the weather. The overall power load dropped by 5.5% or an average of 26.3 GWh as we are moving to less electric heat requirements (seasonally) and longer days. The wind was extremely strong last week at an average of 65 GWh. Here is the week-on-week change in the generation mix:

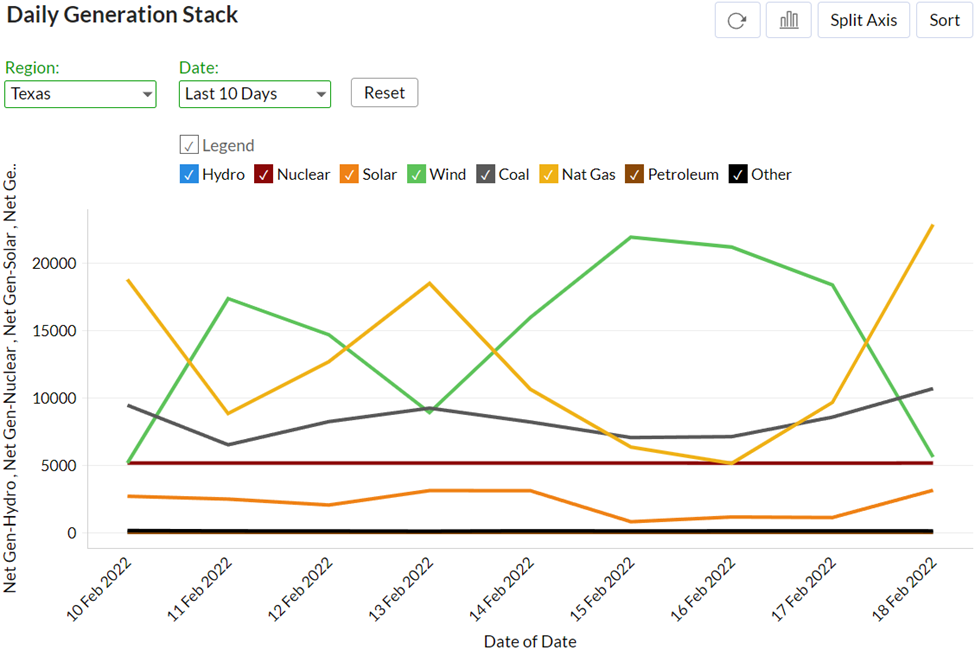

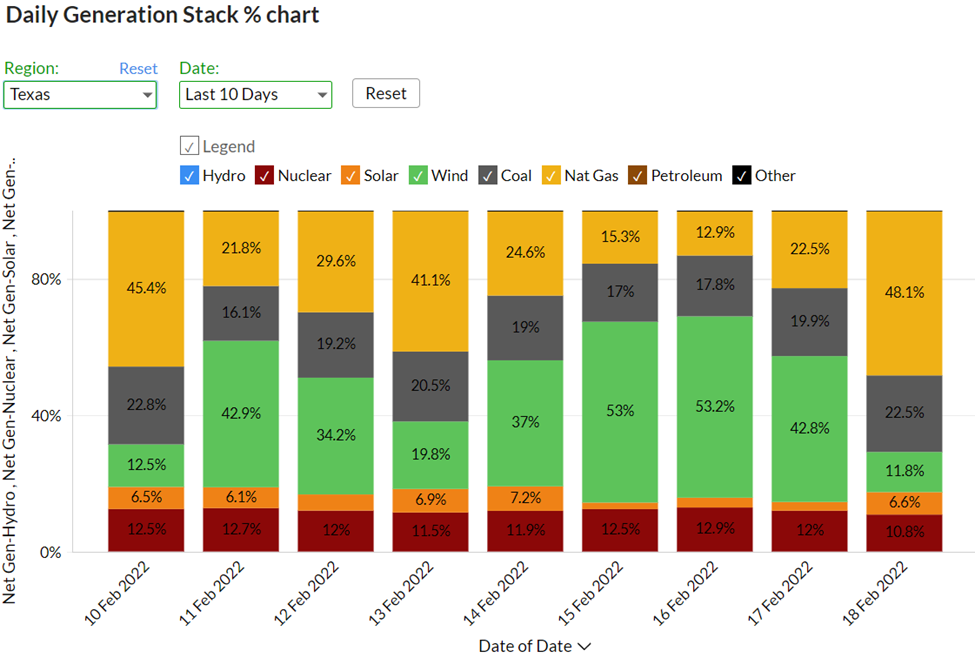

Wind generation volatility continues to impact gas markets. This past week, we saw a very strong level of wind across the country. Wind generation was 21.2% higher than the previous week and on a few days, it crossed 80GWh on average. Texas wind generation led the country which averaged 17.3 GWh through the week and peaked at 21.8 GWh on Feb 15th. These are some extremely strong levels that very quickly impact the gas burn level. As seen in the charts below, Wind generation exceeded 50% of the total power stack.

Here are charts from the Analytix.AI platform showing the role of wind and natgas gen over the last 10 days at the ERCOT region level.

Source: www.Analytix.AI

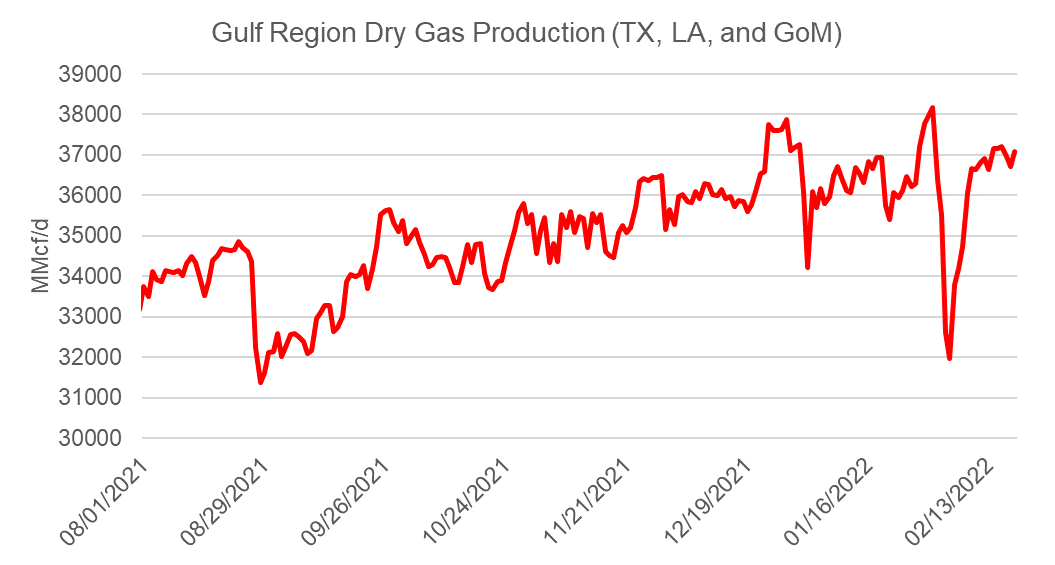

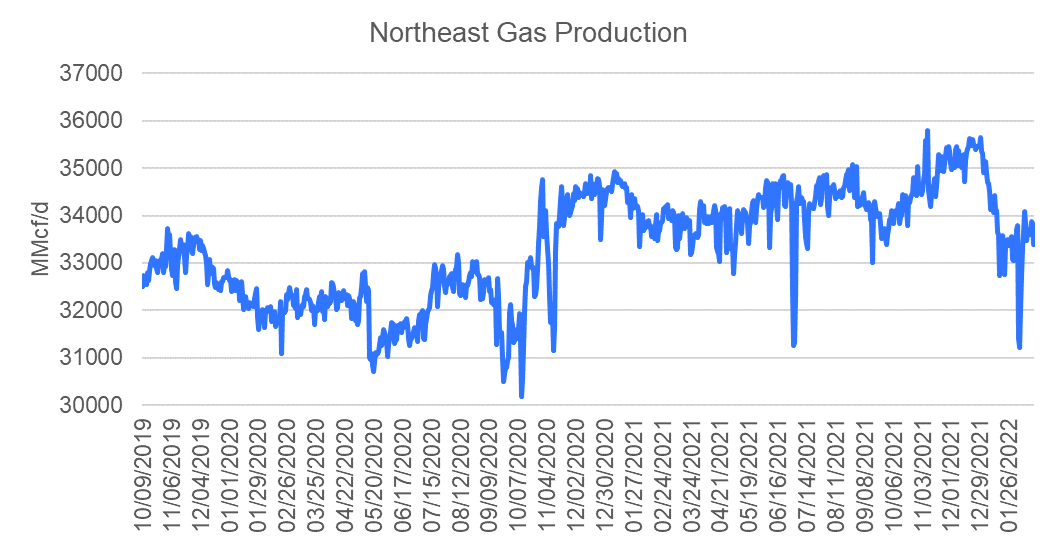

Domestic dry gas production was much higher week on week as some key shale regions recovered from heavy levels of freeze-offs. The key producing states in the South had production resume to normal levels.

The Appalachian basin still looks to be suffering from some freeze-offs.

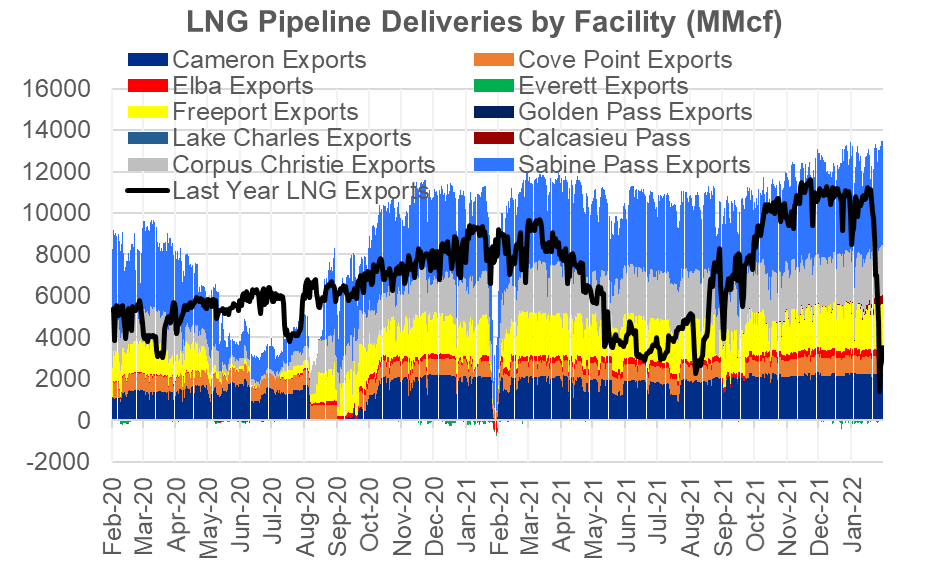

Deliveries to LNG facilities averaged 13.0 Bcf/d, which was +0.6 Bcf/d higher than the previous week. Both Freeport and Sabine operations resumed, and we also saw Calcasieu Pass LNG peak above 0.4 Bcf/d. The total US LNG deliveries peaked on Friday at 13.48 Bcf/d.

The Yiannis LNG Tanker was still docked at the Calcasieu facility on Friday but should be leaving soon as the facility has liquified enough gas to fill a tanker.

The net balance was 10.3 Bcf looser week-on-week.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.