We had another wild week of cash and futures prices, and this weekend we finally enter the cold weather we had been expecting.

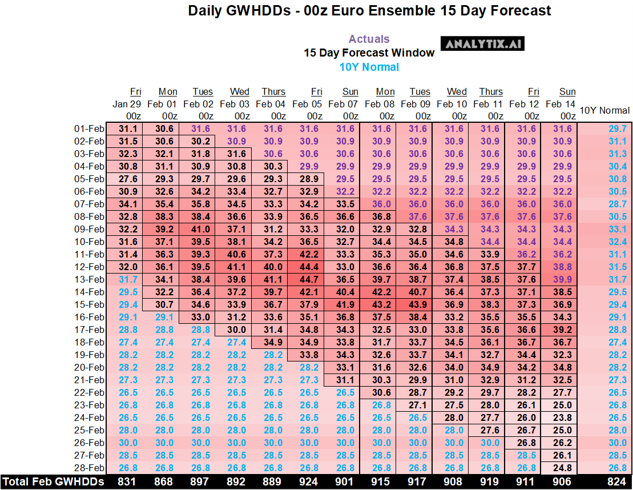

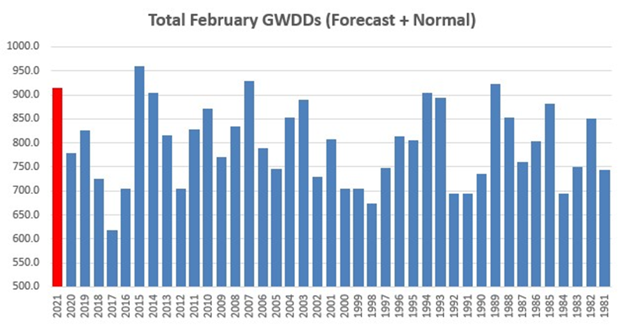

Here is a recap of how the 00z Euro Ensembles changes since Jan 29th. As can be seen, there have been big shifts in the duration of the cold, the peak day of the cold, and the intensity of the cold. Overall Feb is now set to be one of the coldest on record, only behind 2007 and 2015.

[Note: we made a +5 adjustment to the Bloomberg Euro EN data to line up with the rest of the industry GWHDD estimates]

This from Bespoke Weather on Friday

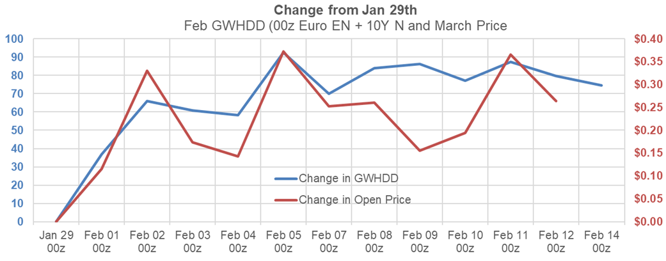

With every move in weather, price reacted accordingly. Here we pinged the weather and price to the Jan 29th 00z and opening price.

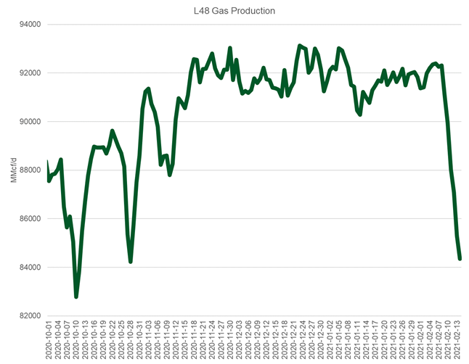

As natural gas consumption for heating soars during cold events, production freeze-offs intensify the situation by limiting supplies at a crucial time for the market – hence the ridiculous cash price observed in the markets on Friday. I believe the record goes to OGT which traded at $400/MMBtu on screen.

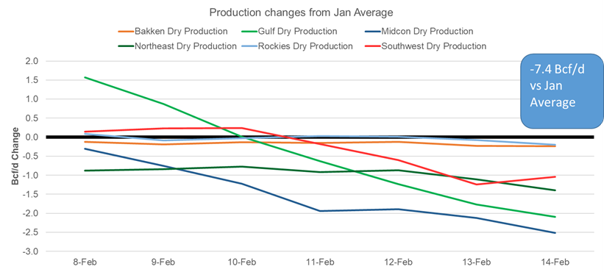

Freeze-offs occur when temps drop below 32°F (0°C) in producing fields, causing water and other liquids in above-ground gathering lines at the wellhead to freeze and block the flow of natural gas. Typically producers in colder climates such as WestCan and the Appalachian have installed glycol units that help prevent production losses during the winter months. The producing areas in warmer parts of the country on average are more vulnerable to freeze-offs because producers there have less incentive to prepare for them – hence the large drop off in production from the Gulf and Midcon regions this week.

This chart below shows the production in the major producing areas vs the Jan Average. You see the deep level of freeze-offs starting Feb 8th.

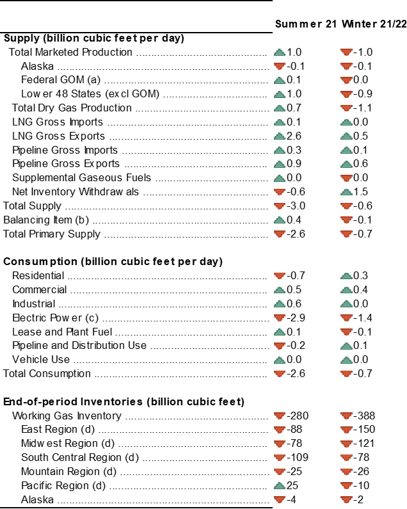

This week we also review the latest Short Term Energy Outlook (STEO) issued by the EIA.

This table shows the output of the February STEO report, i.e. Summer 21 vs. Summer 20 & Winter 21/22 vs. Winter 20/21.

Fundamentals for the week ending Feb 12: The last week report of -171 Bcf finally got us below last year’s levels. We now sit at a -9 Bcf to last year. Our early view for the upcoming storage report is a -236 Bcf withdrawal for the lower 48. This would take storage levels to 2282 Bcf (-104 YoY, +58 vs 5Yr). The industry estimates for this report range between -302 to -230 according to The Desk.

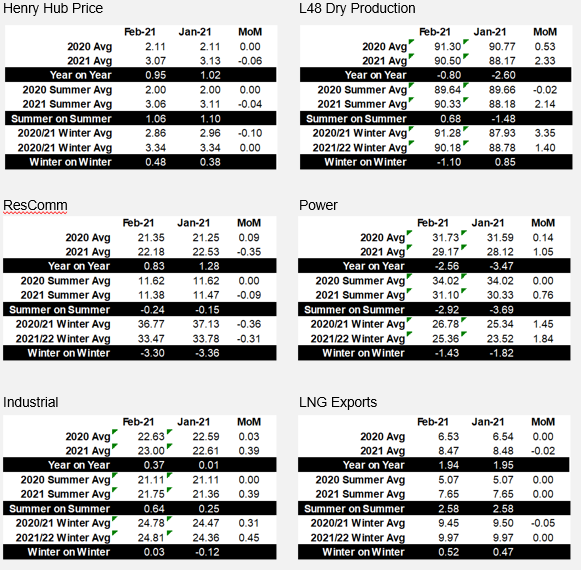

For week ending Feb 12, supply started to drop during the back half of the week. The cold temps across the Rockies, Midcon, Texas, and NE (basically almost every major shale region) led to freeze-offs as we showed above. We estimate a peak drop in production of 7-8 Bcfd (today is 7.2 Bcfd). We expect most of the freeze-off production to returns as we come back from the long weekend. The drop in production for this upcoming storage report was minimal (only -0.7 Bcf/d week-on-week). The real impacts of the freeze-offs will be seen in the report for week ending Feb 19.

Temps were significantly cooler week-on-week. We recorded L48 GWHDD increasing by an average of +2.1 to 29.3. Overall, total gas consumption increased by an average of 7.6 Bcf/d to 115.3 Bcf/d. This has been the coldest and highest consumption week on record this winter. Next week is surely setting up to be higher. For this past week, Power was essentially flat despite cooler temps and wind crumbling in the back gas off the week. RC and Industrial were both the notable movers. RC was higher by 5.0 Bcf/d WoW and Industrial 2.6 Bcf/d WoW.

Deliveries to LNG facilities averaged 10.7 Bcf/d, flat to last week. The week started with LNG feedgas deliveries at 11.1 Bcf but gradually decreased throughout the week. The market consensus is that LNG facility operators opted to sell their flows into the strong cash markets.

Net the balance was tighter by 8.5 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Feb 10th and ends on Feb 16th.

Mar futures expire on Feb 24th, and Feb options expire on Feb 23th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.