What a week, especially for the folks in Texas. On Friday, things started nearing normal and weather turn warmer and power was restored to most of Texas.

Around noon on Friday, the ERCOT officials lifted emergency conditions and said they were completely back to normal operations as of now. That being said, ERCOT acknowledged last week that it came within “seconds” or “minutes” of losing control of the grid, with the potential for a catastrophic meltdown that could have taken weeks or months to reverse. ERCOT is coming under fierce criticism from Texas Governor Greg Abbott and others.

We are hearing that ERCOT never assessed the risk of well freeze-offs, even though freeze-offs do occur in Texas each year when the weather is not nearly as harsh. Big oversight.

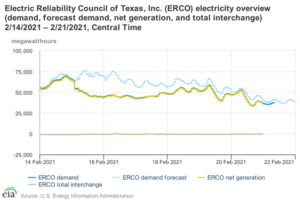

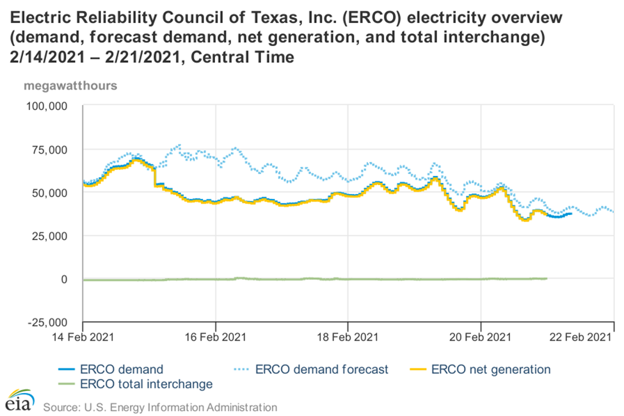

The chart below from the EIA shows events of the past week in the ERCOT power region. There was a severe mismatch was between generation and the ERCOT demand forecast – hence the lengthy blackouts. As of this morning, things are near normal. Poweroutage.us shows a total of 175,000 households without power across the country. Texas now only has 31,000 outages.

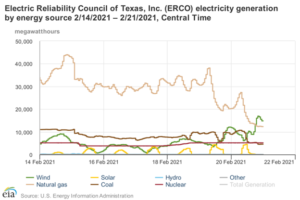

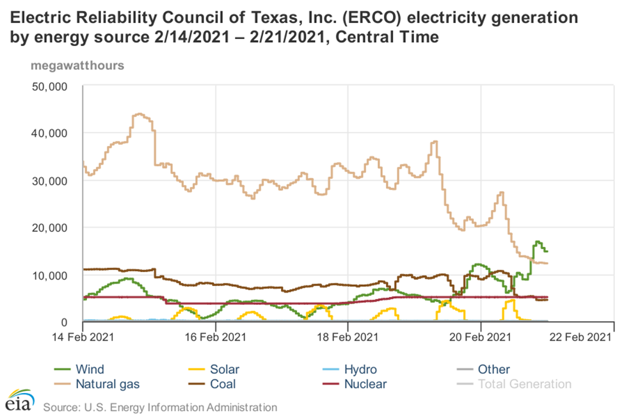

Here is a look at the generation stack last week. As can be seen, the lack of wind and poor availability of natural gas (well and midstream freeze-offs + de-energized processing facilities due to power outages) was the cause of the blackouts. Starting Friday, the power system was better balanced with dropping demand and based plants (wind, nuke, and coal) returning. Yesterday, we saw coal and wind resuming (with the warming temps) giving natgas gen some relief.

EIA ERCOT hourly data can be found here: https://www.eia.gov/beta/electricity/gridmonitor/dashboard/electric_overview/balancing_authority/ERCO

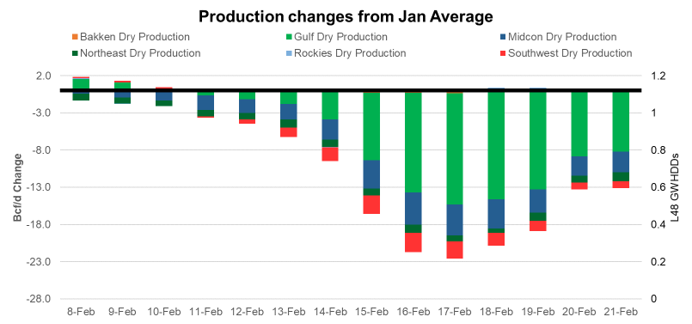

Production freeze-offs won’t be well understood until this upcoming storage report, and that is because most of the production (unlike other states) is received onto intrastate pipelines in Texas. The visibility of daily production is not as transparent as we have in other regions like the Northeast. The peak level appears to be about 22-23 Bcf/d on Feb 17th, and the recovery has been slow. The latest BNEF numbers for today show current production in the L48 at 79 Bcf/d, which still puts 12-13 Bcf/d of production offline. The recovery of production this week will be important.

Since TX production is not fully visible, our belief is that the freeze-offs are not as deep as indicated by the numbers reported by all the vendors.

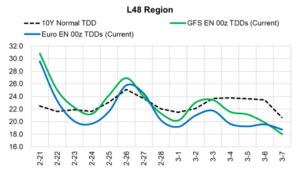

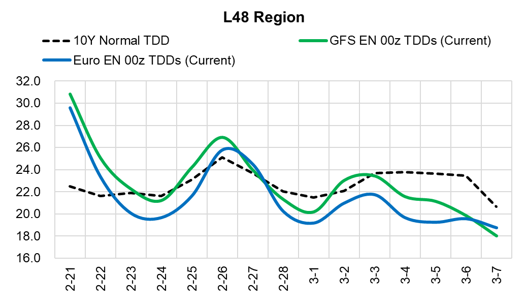

Finally, let’s look at where the short-term weather outlook stands. As of the current runs, we are to expect warmer weather through Mar 7 and winter activity to stay on a more northerly track.

This from BAMWX

“We are anticipating more of a La Nina-like atmospheric pattern to take hold late February into early March. Essentially what this means is more “clashing of airmasses” pattern with a better thermal gradient (ridge of high pressure) East. What this likely results in is a more northerly track with wintry weather across the Upper-Midwest and Great Lakes, while increasing the threat for rainfall and even strong storm opportunities to open Meteorological spring from the Deep South, Ohio Valley and points east,” said BAMWX’s Kirk Heinz.

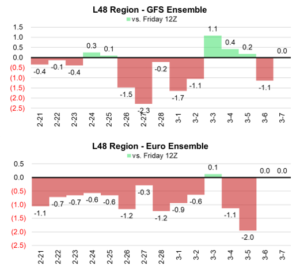

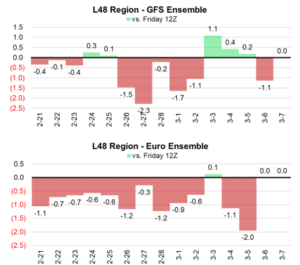

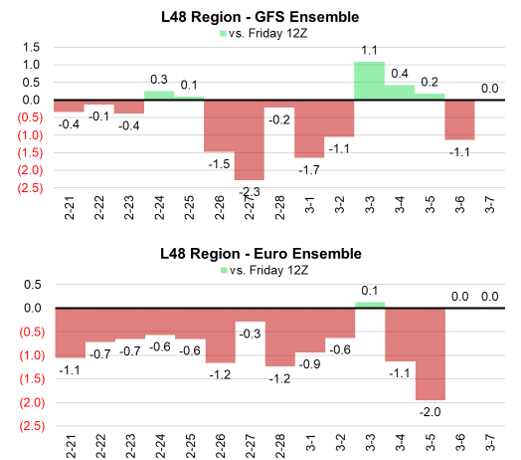

Here are the changes in the GFS Ensemble and Euro Ensemble since the Friday 12z run. Both showing a bearish trend. [GFS Ensemble: -7 GWHDDS, Euro Ensemble: -11 GWHDDS]

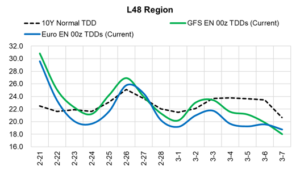

Here is how the 15D forecast looks in comparison to the 10Y Normal.

Fundamentals for the week ending Feb 19: The last week report of -237 Bcf finally got us below last year’s levels. We now sit at a -105 Bcf to last year. Our early view for the upcoming storage report is a -320 Bcf withdrawal for the lower 48. This would take storage levels to 1961 Bcf (-280 YoY, -143 vs 5Yr). The industry estimates for this report range between -365 to -291 according to The Desk. This week’s report is going to be one of the most interesting numbers on record, as it will give us more clarity into the events from last week.

For week ending Feb 19, supply off by an average of 13.9 Bcf/d from the previous week. The cold temps across the Rockies, Midcon, Texas, and NE (basically almost every major shale region) led to freeze-offs as we showed above. 85% of the drop came from the South Central, NM, and the Midcon region. We are hopeful that most of the production returns this week with weather normalizing, power outages returning, field staff getting back to rigs and operation centers, and process plants coming back online.

Temps were significantly cooler week-on-week – this was probably the largest week-on-week change we have ever seen. We recorded L48 GWHDD increasing by an average of +4.2 to 33.5. Overall, total gas consumption increased by an average of 7.2 Bcf/d to 121.4 Bcf/d. For this past week, Power was higher by 1.5 Bcf/d. This increase would have been much higher if we did not have the deep level of black-outs, specifically in Texas. RC and Industrial were both the notable movers. RC was higher by 6.9 Bcf/d WoW, while Industrial was lower by 0.8 Bcf/d WoW [cooler temps offset by black-outs].

Deliveries to LNG facilities averaged 4.9 Bcf/d, which was 5.8 Bcf/d lower than the previous week. LNG operators pulled back with mandates to turn operations lower, and sell gas into the strong cash markets. As of today, LNG is back to almost 8 Bcf/d of feedgas. Cheniere’s plants look to both have resumed high levels of operations this weekend. Looks like we are headed to business as usual this week with a number of LNG tankers lined up in the Gulf of Mexico.

Net the balance was tighter by 12.5 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Mar 15th and ends on Mar 18th.

Mar futures expire on Feb 24th, and Feb options expire on Feb 23th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.