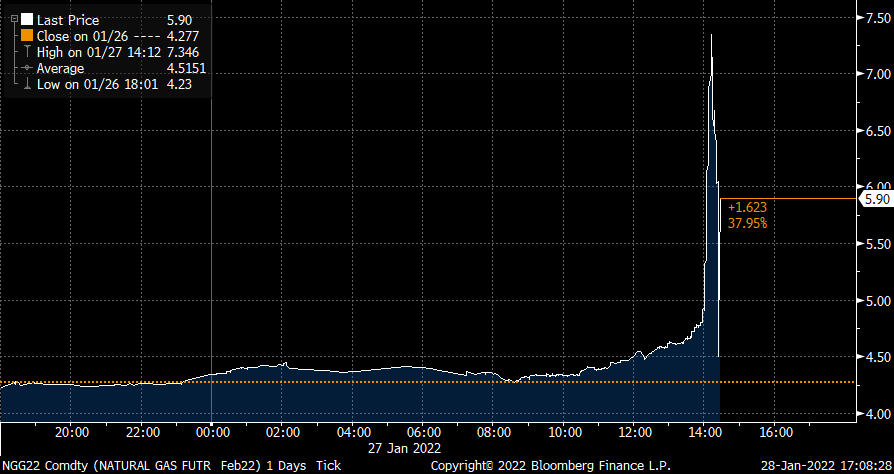

This week review some key updates on two major pipelines that impact global supply.

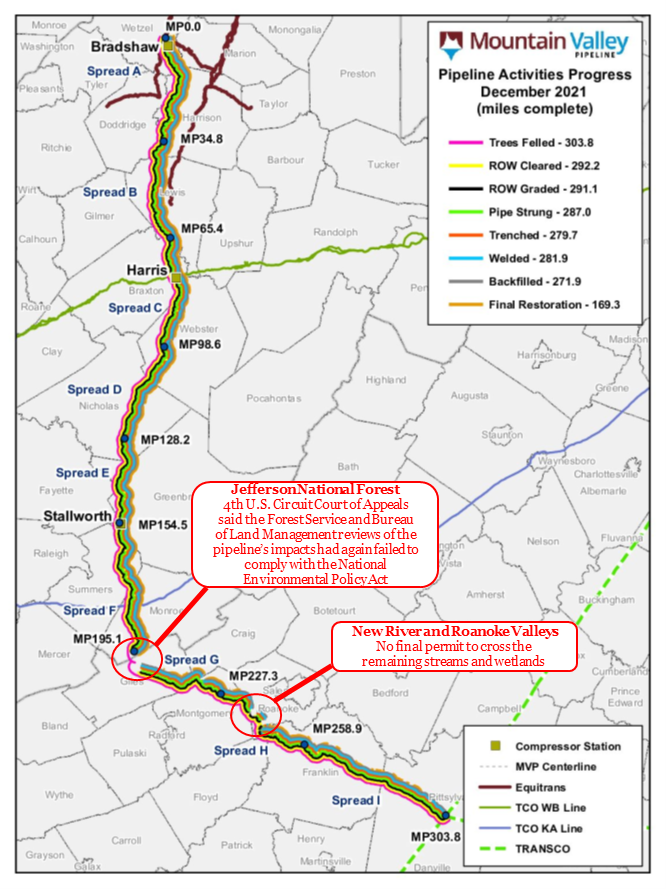

The first is the Mountain Valley Pipeline (MVP) in the Northeast US. The Mountain Valley Pipeline (MVP) project is a natural gas pipeline system that spans approximately 303 miles from northwestern West Virginia to southern Virginia. With a vast supply of natural gas from Marcellus and Utica shale production, the Mountain Valley Pipeline is expected to provide up to 2 Bcf/d capacity to markets along the Eastern Corridor by connecting to Appalachian production to Transco and Columbia Gas.

MVP once again hit major setback after a federal appeals court tossed out key approvals for the natural gas project. In an unanimous decision, a three-judge panel of the 4th U.S. Circuit Court of Appeals said the Forest Service and Bureau of Land Management reviews of the pipeline’s impacts had again failed to comply with the National Environmental Policy Act.

Much of the 303-mile pipeline has been completed expect for a few key areas:

– A 3.5-mile section of the Jefferson National Forest in Giles and Montgomery counties. [from this latest ruling]

– Crossing through streams and wetlands in the New River and Roanoke valleys

We should note that the other approvals by the U.S. Fish and Wildlife Service and the FERC are also being challenged in court by opponents of the deeply controversial project.

So after the latest news, it’s fair to say that A summer 2022 in-service date is unrealistic. The company had been optimistic to commence the pipeline this year, but this ruling sends the permit back to the Forest Service and BLM for reconsideration. The first time the court did that, in July 2018, it took about two years for the agencies to approve a second permit — which now has also been found lacking by the Fourth Circuit.

Mountain Valley received this Certificate on October 13, 2017 and construction activities began in early 2018. With an estimated 20 linear miles of pipe remaining, MVP’s total project work is nearly 94% complete, which includes 55.8% of the right-of-way fully restored.

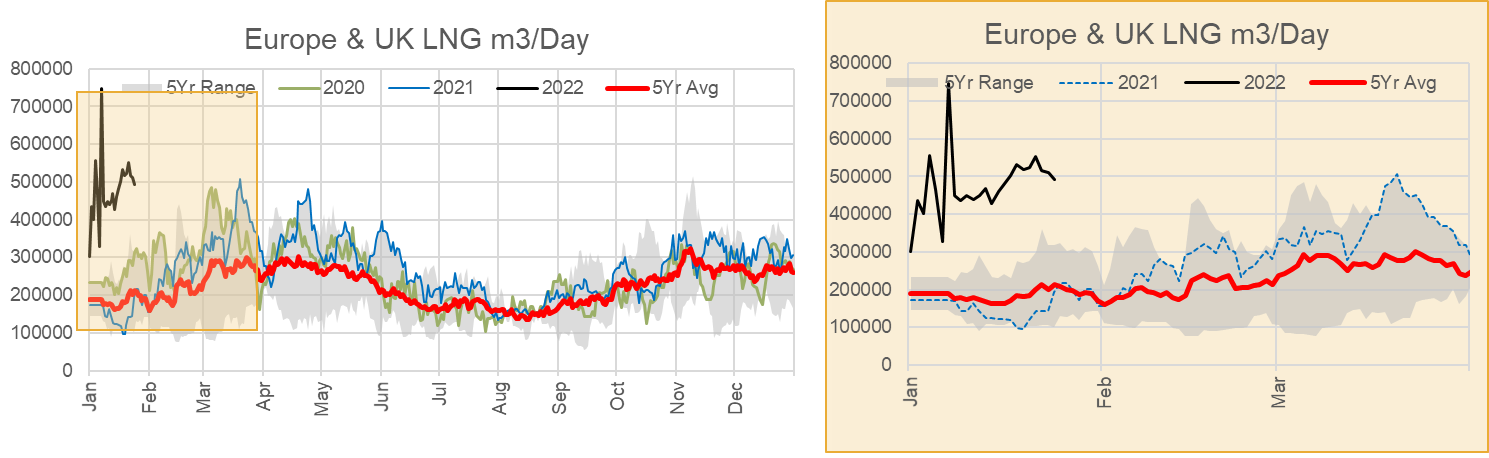

The next pipeline we discuss is Nordstream 2 which is one of the components raising tensions between the Western and Eastern powers. This past week, Nord Stream 2 launched a German subsidiary Gas for Europe [a to the point name]. The new company will become the owner and operator of the 54-kilometre section of the Nord Stream 2 Pipeline located in the German territorial waters and the landfall facility in Lubmin. The new entity is an independent transmission operator meeting the precondition issued by German regulator BNetzA in November 2021.

With this latest move, the timeline for the pipeline is still unknown.

The commencement of this pipeline is adding tensions to the US & Germany relationship. Germany’s view is that this is solely a commercial project, but NS2 does have geopolitical consequences. The project allows gas flows to bypasses Ukraine, and potentially cuts them out of the ~$2B in transit fees that Russia currently pays to send gas through its territory.

The pipeline is also now causing political division within Europe. Ukraine and Poland have opposed the pipeline while other nations are looking for solutions to moderation soaring gas prices. Ukraine’s President has asked the US Senate to approve the NS2 sanctions, while Germany has specifically asked that the US Congress not to propose sanctions.

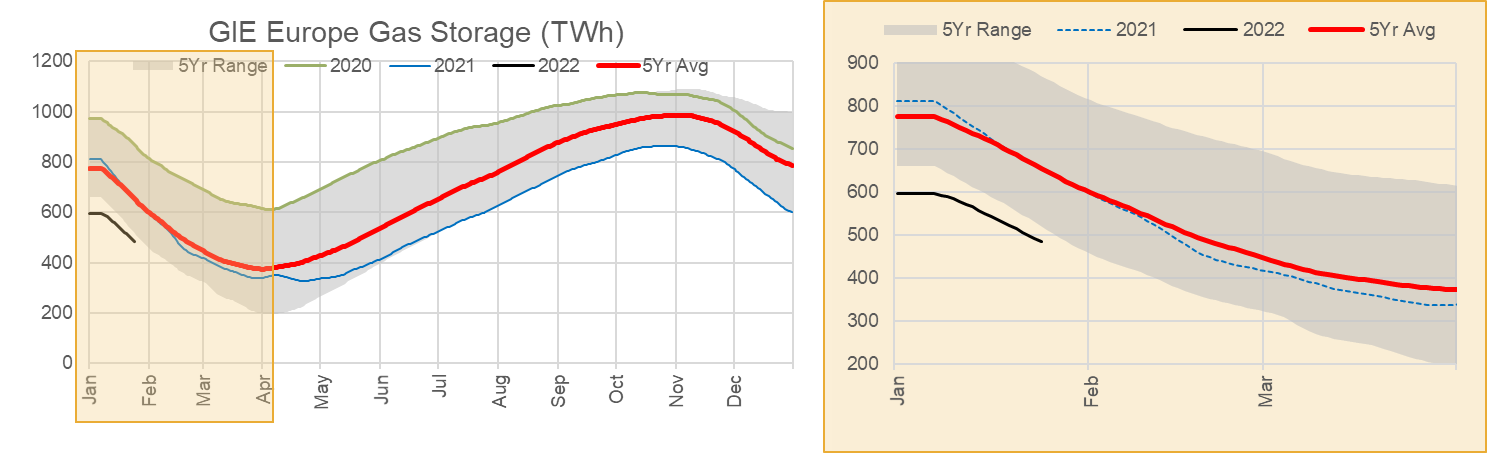

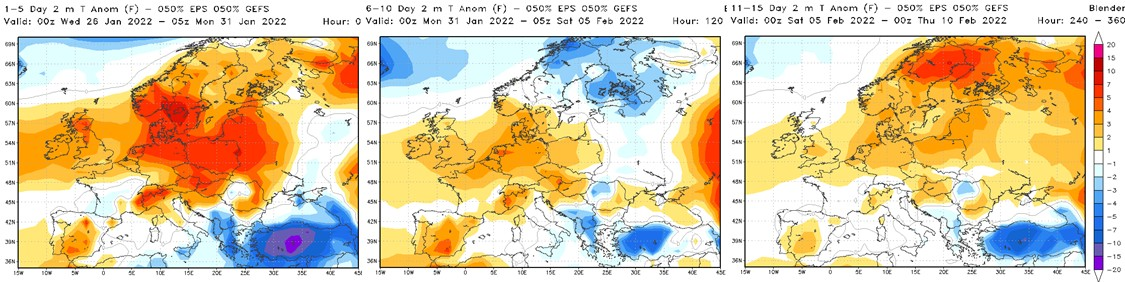

The European markets had been banking on NS2 to provide supply and price relief this winter, but even with the latest move the timeline is unknown. Weather has luckily been on Europe’s side this winter with warm temps in the outlook. That along with record level of LNG arriving, it appears Europe will make it through this winter.

Current European and UK storage levels sit at 42% full, or 15% behind last year.

This how the 15 day outlook looked midweek. This should help relieve some pressure.

Fundamentals for the week ending Jan 28:

The EIA reported a -219 Bcf withdrawal for the week ending Jan 21th, which was slightly above market consensus.

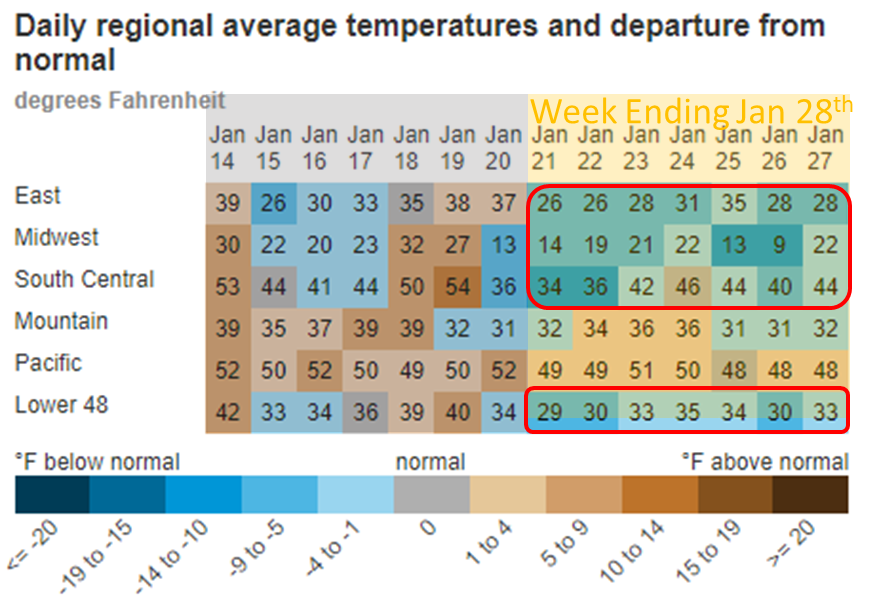

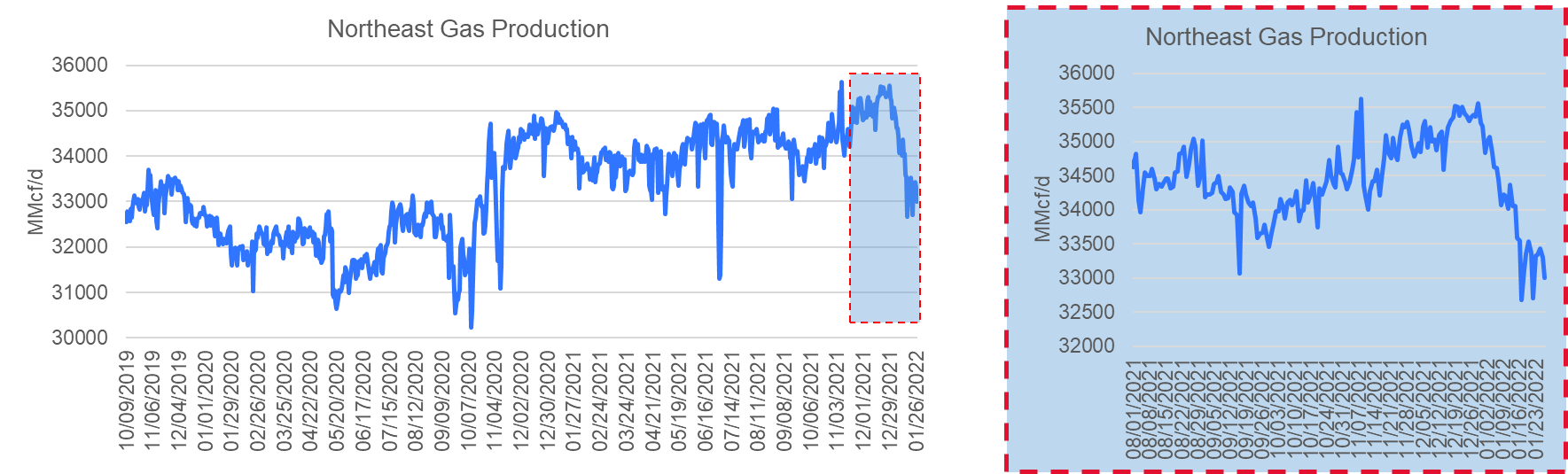

The cooler weather remained over the Midwest and Northeast leading to total gas consumption keeping strong for most of the week. The average daily consumption over the week was 114.5 Bcf/d or 2% higher week-on-week. The cooler weather concentrated over the Marcellus/Utica has continue to keep production volumes low out of that basin.

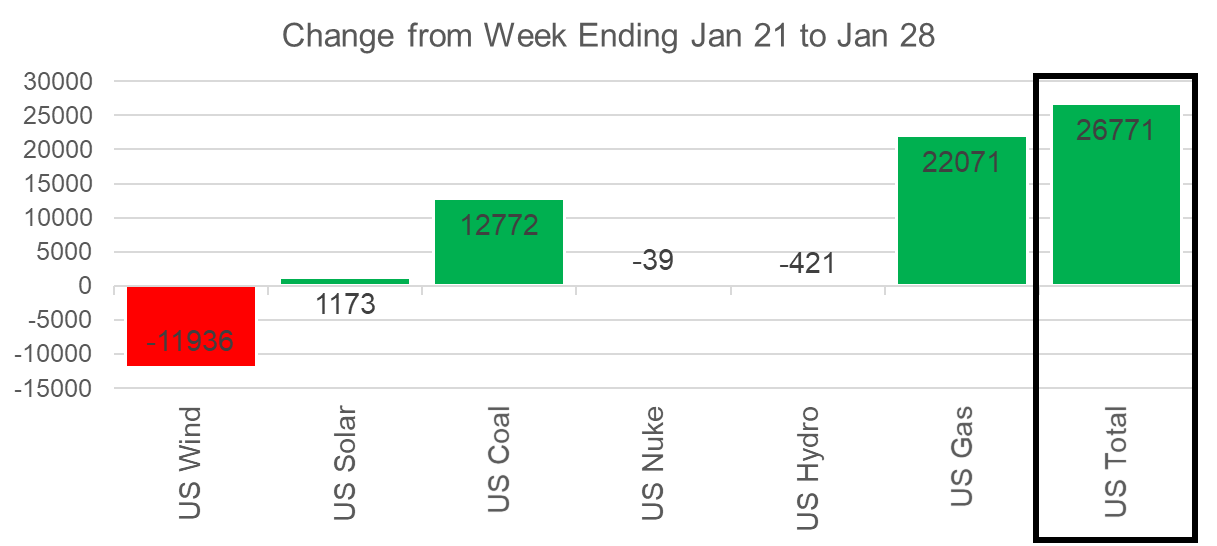

As we noted last week, the overall power level was quite consistent to the prior week. The power mix did change slightly with coal rising and other gen types gave up some ground.

For the week ending Jan 28th, our early view is -271 Bcf. This reporting period will take L48 storage level to 2,320 Bcf (-328 vs LY, -171 vs. 5Yr).

Total consumption once again did rise with temps cooling further relative to the week prior. The cooler weather remained over a good portion of the country leading to total gas consumption peaking around 129 Bcf on Jan 21st. To put this level into perspective – these are levels we saw during Winter Storm Uri last year.

The overall power mix changed substantially week-on-week, with overall power load rising by 5.6% or an average 26.7 GWh. During the week, we also saw a big drop in wind that took levels 11% below our “calculated expected”. This was the first after 7 consecutive weeks where wind performance was below the expected levels. Coal gen and natgas gen filled the gap this past week. Here is the L48 weekly generation change.

Domestic dry gas production continues remain low relative to the levels we saw before the holidays (~96.5 Bcf/d). The cooler temps and heavy snow continued to put pressure on Appalachian production which came in approximately 0.1 Bcf/d lower week-on-week. This week we also see 0.5 Bcf/d lower production out of the South Central as a result of cooler temps hitting the region last week.

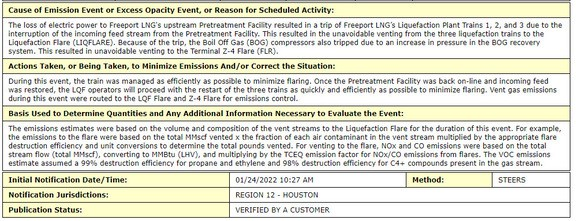

Deliveries to LNG facilities averaged 12.5 Bcf/d, which was -0.4 Bcf/d lower than last week. Sabine looked to be operating train 6 all week, but Freeport ran into some electrical issues (lost power to the pretreatment plant) that took down train 1-3 for a couple of day.

The net balance was 5.5 Bcf tighter week-on-week.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.