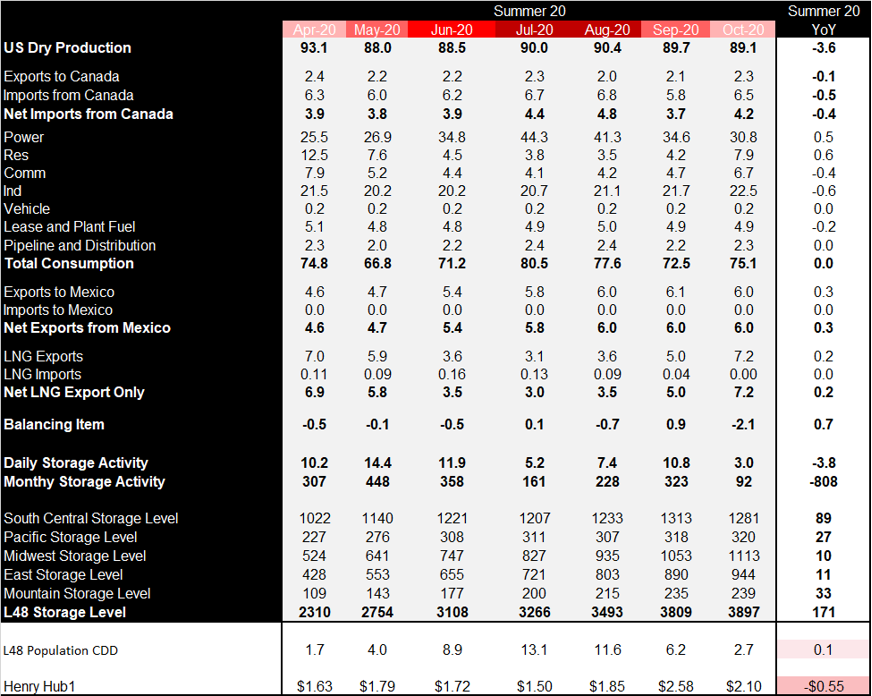

This week we review the latest monthly data supply and demand data from the EIA, which now completes our view of how the summer balances finished off.

Last summer we saw the global impacts from COVID-19 shutdowns weigh in on consumption and prices leading to one of the most erratic summers on record. Almost every line item in the balance was impacted with changing consumption habits and massive price swings.

Below is a quick summary of the balances, along with the summer-on-summer view.

Source: EIA, analytix.ai

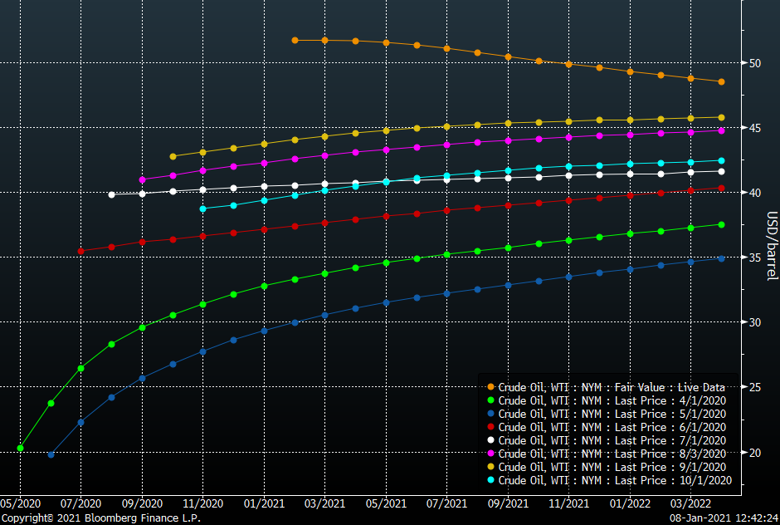

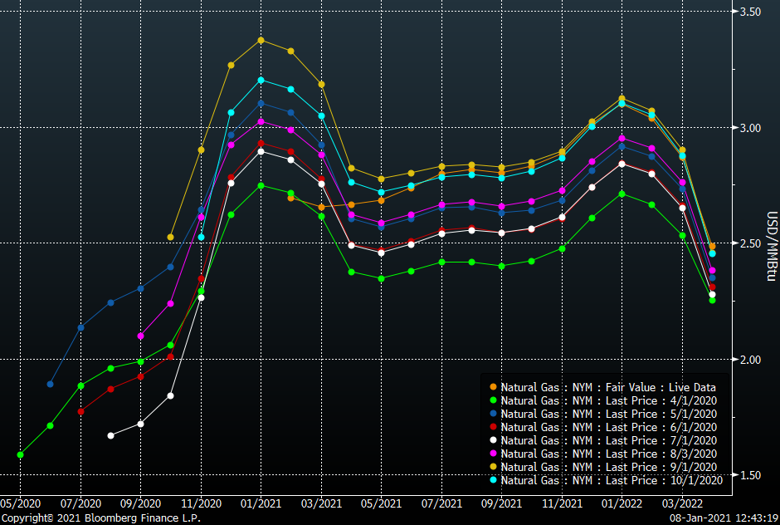

Simply looking at the Summer YoY change is not enough. With the oil prices war and COVID impacts hitting in Q2 2020, we saw major impacts to supply and power, commercial and industrial consumption at different points in the summer. To start, we take a look at how the oil and nat gas curves shifted throughout the summer.

The implication was massive from:

– reducing rigs leading to lower domestic associated gas and dry gas well production

– reshuffling the power stack

– altering LNG economics

Oil Curve

ORANGE LINE shows the latest curve

Nat Gas Curve

ORANGE LINE shows the latest curve

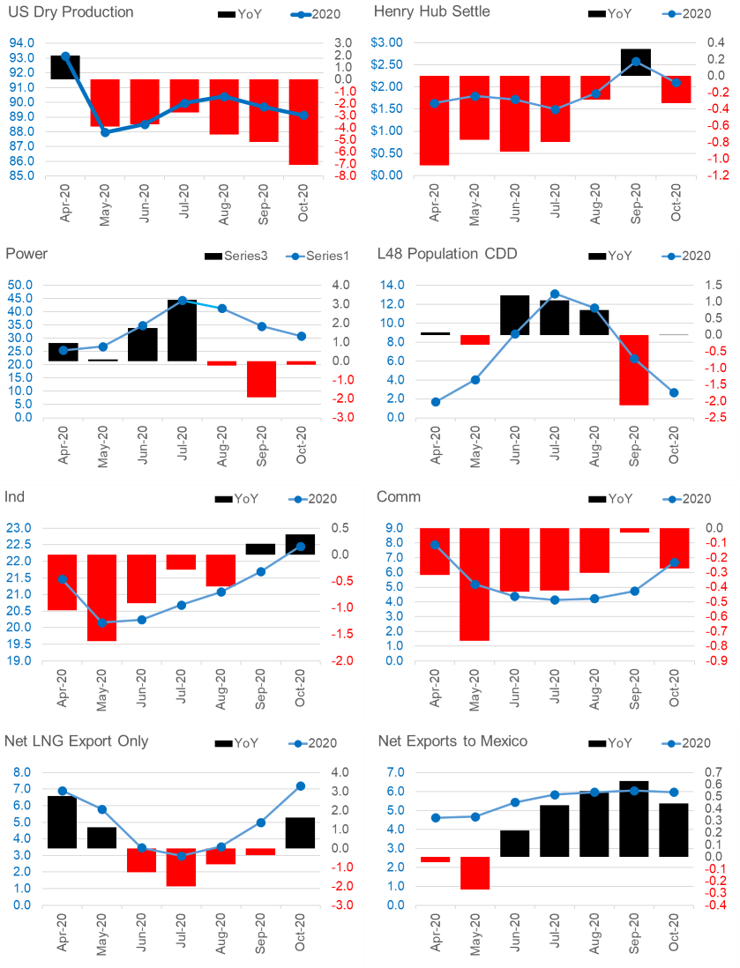

The following set of charts shows how all the major line items of the balances compared to Summer 2019.

In the next section, we focus on LNG

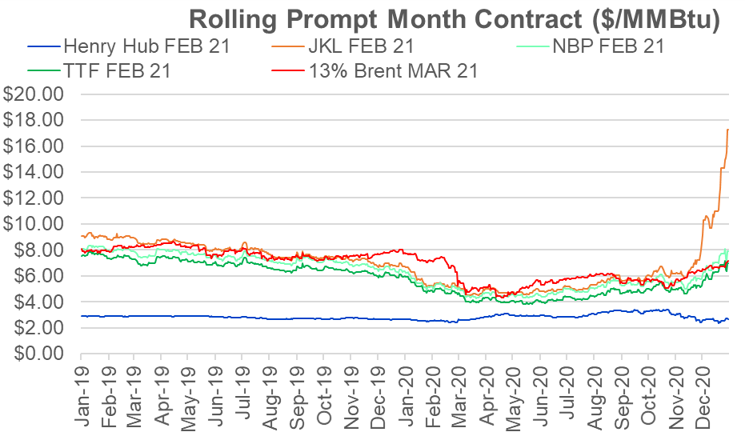

The rally in liquefied natural gas shows no signs of slowing as a cold snap is forcing Asian utilities to pay prices never seen before.

The spot rally is being driven by cooler winter conditions in Asia, supply outages in Qatar, Australia, and Malaysia, high tanker rates, and Panama canal congestion.

For Feb, there are up to 10 cargo cancellations rumored despite the strong LNG economics.

The reason for the latest US cancellations, following only as many as two for January and none for December, appears to be a lack of shipping availability and aggressively high charter rates.

Last week, Exxon sold a spot cargo for the 2nd half of Jan to Kyushu Electric Power Co. for the mid-$30/MMbtu level. This comes after hearing of another couple of spot deals done in the mid $20s. The Exxon cargo came with a hefty premium to spot levels because it was sold so close to the delivery period.

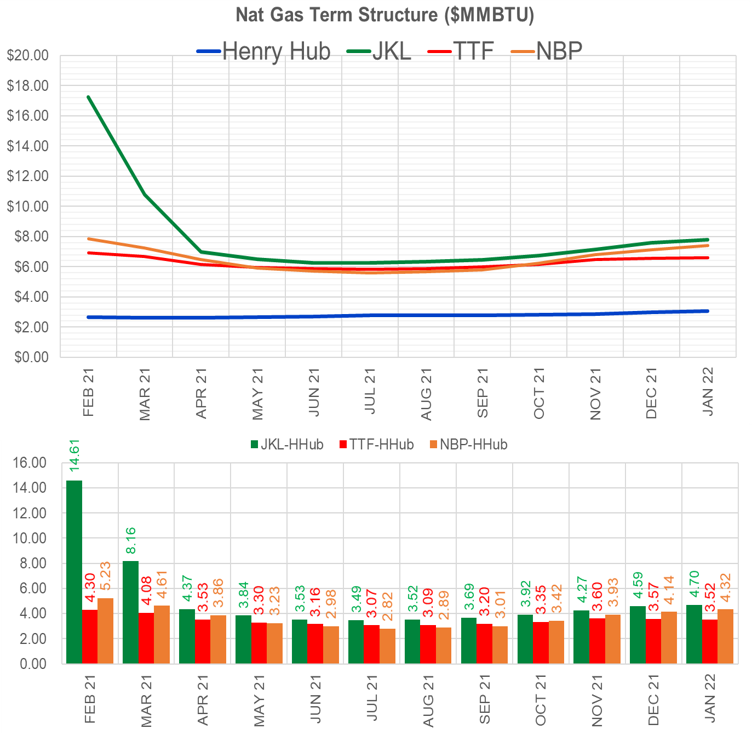

The higher spot prices are dragging the forwards higher. The JKM Feb contract closed near $20/MMBtu. The high prices in Asia are pushing TTF and NBF prices in Europe higher this week as well.

The US to global market spreads look strong throughout the next 12 months. Spreads to Asian hover above $3.50 all summer, while spreads to Europe are above $3.00/MMBtu. This looks to be enough to make US exports economical at 1yr tanker rates.

Fundamentals for the week ending Jan 8: Our early view for the upcoming storage report is a -120 Bcf withdrawal for the lower 48. This would take storage levels to 3565 Bcf (+269 YoY, +209 vs 5Yr). The industry estimates for this report range between -158 to -113 according to The Desk.

For this past week, supply was flat week on week, ie. Both domestic production and net Canadian imports. The big change in the balances was the lower ResComm and Industrial usage as warmer than normal temps started off the year. Deliveries to LNG facilities averaged 10.9 Bcf/d, down 0.1 Bcf/d week-on-week. Net the balance were looserby 1.5 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Jan 15th and ends on Jan 19th.

Feb futures expire on Jan 27th, and Jan options expire on Jan 26th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.