Fundamentals for the week ending July 09: This past week the EIA reported a +16 Bcf storage injection for the week ending July 2nd. This report came in 10+ Bcf/d below market consensus and 6 Bcf/d below our estimate. This report once again suggests tighter balances relative to the past 4 weeks of storage reports. In fact, and the number was very much aligned with the +55 Bcf injection we saw a couple of weeks ago for week ending June 18th

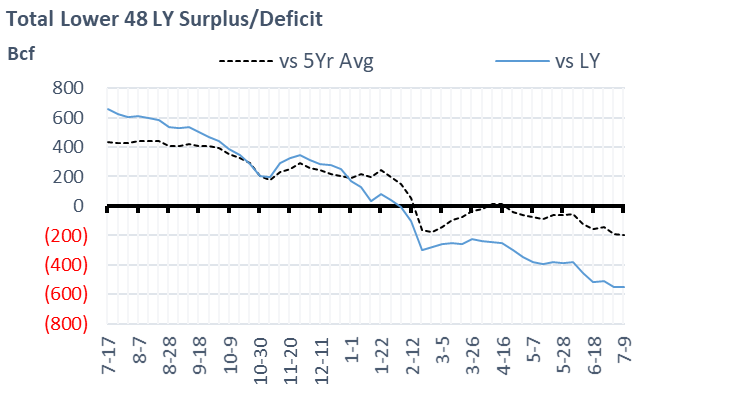

For the week ending July 9th, our early view is +50 Bcf. The 5Yr average is a +54 Bcf injection. Our projected injection would take the L48 storage level to 2624 Bcf (-548 vs LY, -194 vs. 5Yr). As seen in the chart below, the storage levels have gone from a major surplus to a notable deficit.

Domestic production was lower by 0.5 Bcf/d week-on-week with Texas and the Northeast showing lower volumes compared with the previous week. Northeast was lower the first 2 days of this storage week with the Markwest C3+ pipeline leak issue. That was luckily resolved quickly and with that, we saw production resume quickly. By July 4th, Northeast production had resumed back to above 34 Bcf/d. With rigs considerably lower, production has held very consistent this summer. Except for a few pipeline-related issues in June, production has held very steady between 91-93 Bcf/d. At that same time, front-month prices have shot up from ~2.50 to ~3.70 and so far have had no major impact on rigs or production levels. We could see a bump in production in Q4 and Cal22 with producers using this price rally as an opportunity to hedge future production.

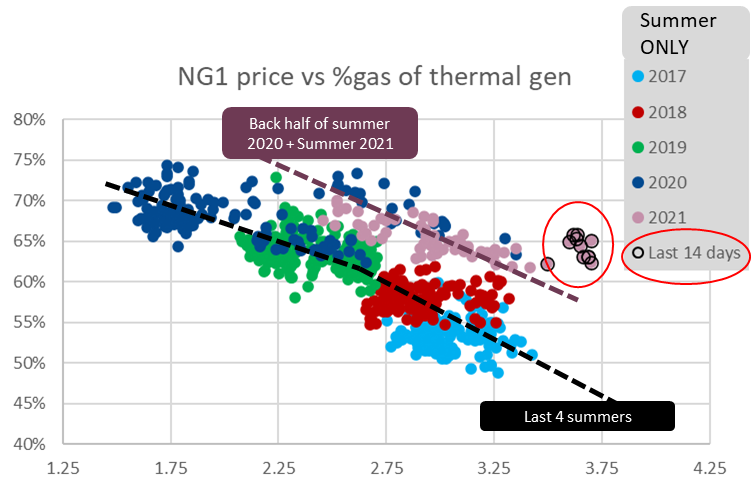

Total consumption was lower this week driven primarily by power burns and industrial usage. Total national temps were cooler week-on-week, but the 2nd consecutive week of lighter wind kept gas generation higher than it would have been. It is estimated that total average daily consumption dropped by 5.3 Bcf/d to 71.5 Bcf/d as a result of lower power burns and industrial load. This next chart shows how the coal to gas dynamic has changed since Q3 of 2020.

As expected, the nat gas generation share of thermal generation drops with higher natural gas prices in all years. The back half of last summer and this summer has displayed a unique C2G dynamic. The switching capability sits on new access altogether as seen in the chart below. Gas generation has fallen substantially as prices moved up over the past few weeks (that’s expected), but they remain higher than we would have seen in past years. We believe this is the effect of more retired coal in the past 12 months, although this is more complicated a good chunk of renewables was added in the back half of 2020 as well.

One more thing to note is the red circle which highlights the last 14 days. As noted above, the wind has been light over this time frame. The direct impact of low wind is gas generation filling the gap. With wind expected to return in the coming few weeks, we can expect power burns to slide and help put more gas into storage.

Deliveries to LNG facilities averaged 11.0 Bcf/d, which was -0.1 Bcf/d lower than the previous week. Overall LNG operations were flat across all plants, except for Freeport which looked to have a couple of small dips in operation.

Net the balance is looser by 5.0 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on July 14th and ends on July 19th.

August futures expire on July 28th, and August options expire on July 24th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.