Natural gas exports to Mexico are critical to keep supply and demand balanced in the US. Over the past 5 years, we have seen exports increase substantially as new pipelines allow cheap US nat gas to flow to growing Mexican markets.

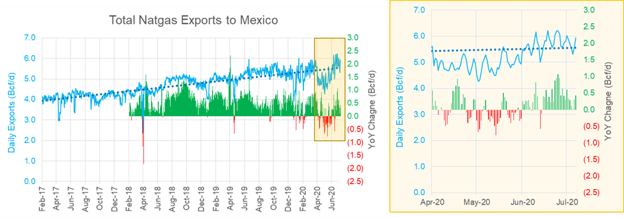

This June total exports reached 6 Bcf/d after a drop in exports related to COVID-19 demand destruction. Unlike the U.S. and Canada, Mexico has virtually no winter heating demand. The majority of gas demand is used to fuel industrial load and the growing power generation to meet air conditioning demand.

Despite demand destruction related to COVID-19 (as seen in the red bars below), year-to-date Mexican exports have increased by 0.25 Bcf/d on average. For June the YoY growth was 7%, or 0.375 Bcf/d.

Mexico continues to build out its natural gas system and power generation fleet. Despite delays in almost every major project, each new piece of infrastructure adds new structural demand.

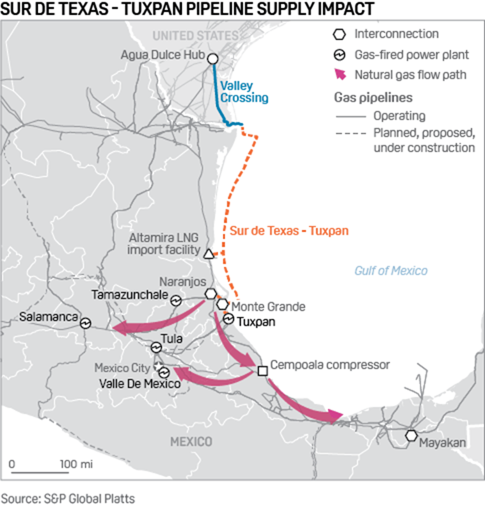

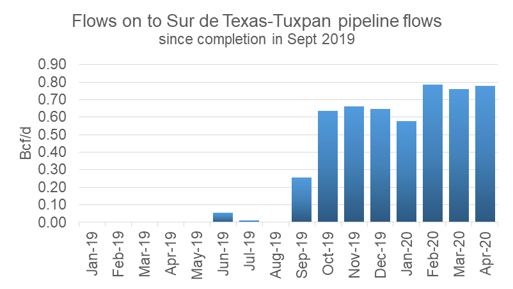

The last major project was Sur de Texas-Tuxpan pipeline which was completed in September 2019. The underwater Sur de Texas-Tuxpan Pipeline is designed to move 2.6 billion cubic feet of natural gas per day. The 42-inch and 480-mile pipeline begins in the Gulf of Mexico a few miles east of Brownsville and continues underwater to power plants in the coastal cities of Altamira, Tamaulipas and Tuxpan, Veracruz.

This pipeline is still operating well under capacity as it waits for the build out of other pipelines to move natural gas to other destinations further inland. During the first 4 months of this year, the pipeline flows averaged 0.73 Bcf/d or 28% of the pipelines capacity.

Source: EIA

Looking into this summer, the expectation is that exports to Mexico will continue to grow with the completion of more pipeline systems. EIA reported this week that the southern-most segment of the Wahalajara system, the Villa de Reyes-Aguascalientes-Guadalajara (VAG) pipeline began operations in June 2020. This is connecting new demand markets in Mexico to U.S. natural gas pipeline exports.

The Wahalajara system is a group of new pipelines that connects the Waha hub in western Texas, a major supply hub for Permian Basin natural gas producers, to Guadalajara and other population centers in west-central Mexico. The Wahalajara system provides U.S. natural gas to meet growing demand from Mexico’s electric power and industrial sectors. With the 0.89 billion cubic feet per day (Bcf/d) VAG pipeline entering service, EIA expects utilization of the Wahalajara system to quickly ramp up, resulting in increased U.S. natural gas exports to Mexico out of western Texas and additional takeaway capacity out of the Permian Basin.

Source: Gasfundamental.com

1 – Road Runner

2 – Tarahumara

3 – El Encino – La Laguna

4 – La Laguna – Aguascalientes

5 – Villa De Reyes – Aguascalientes – Guadalajara

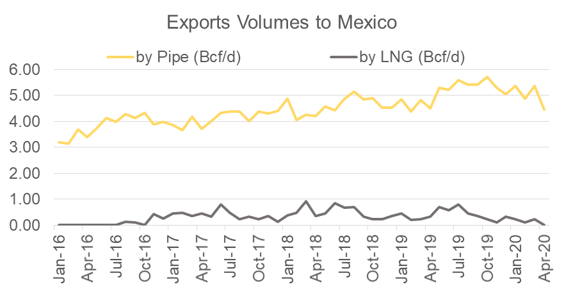

The addition of the VAG pipeline, the Tula-Villa de Reyes pipeline (late-2020) and new nat gas fired generation will likely increase US to Mexico exports. The increased pipeline deliveries will also help displace higher-cost LNG imports into Mexico’s Manzanillo terminal.

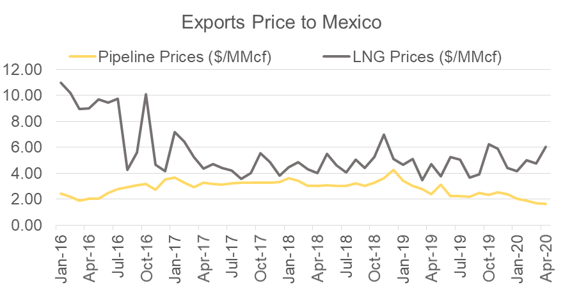

Here is a look at average volumes moved to Mexico via Pipeline and LNG.

The price of pipeline gas is significantly lower than that via LNG; hence with more pipeline infrastructure we are likely to see LNG volumes disappear.

Some good sources for Mexico data:

Mexico’s Secretaría de Energía Status of Pipelines (Spanish)

https://www.gob.mx/cms/uploads/attachment/file/338955/Estatus_de_gasoductos_junio_2018.pdf

EIA – U.S. Natural Gas Exports and Re-Exports by Point of Exit

https://www.eia.gov/dnav/ng/NG_MOVE_POE2_A_EPG0_ENP_MMCF_M.htm

SENER (Secretaria de Energia) – Natural Generation List

https://www.gob.mx/cms/uploads/attachment/file/475498/PRODESEN_VII.pdf

EIA Today in Energy

https://www.eia.gov/todayinenergy/detail.php?id=44278&src=email#

Fundamentals for week ending July 10: Our early view for the upcoming storage report is a +48 Bcf injection for the lower 48. This would take storage levels to 3181 Bcf

US natural gas dry production remained flat week on week with domestic production averaging 84.8

Bcf/d for the week. Average weekly production is 0.4 Bcf/d higher than 4 weeks ago.

Natural gas demand continues to rise with heat blanketing most of the country. Residential and commercial sector consumption seems to have hit a bottom with no change week-on-week, while power consumption increased by 3.0 Bcf/d to average at 41.7 Bcf/d.

Canadian imports were lower last week averaging 4.3 Bcf/d.

Mexican exports averaged of 5.8 Bcf/d.

Deliveries to LNG facilities averaged 3.0 Bcf/d.

Expiration and rolls: UNG ETF roll starts on July 12th and ends on July 17th.

August futures expire on July 29th, and July options expire on July 28th

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.