This weekend’s commentary comes from Brian Lovern at Bespoke Weather. Each month Brian Lovern will provide us with the latest medium-term outlook.

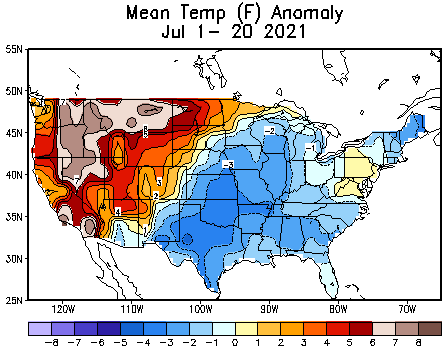

After one of the hottest Junes in our recorded history, the month of July has come in cooler vs expectations, well under the 5 and 10-year normal, thanks to below normal temperatures dominating the eastern half of the nation into the South, while heat has been mostly confined to the West.

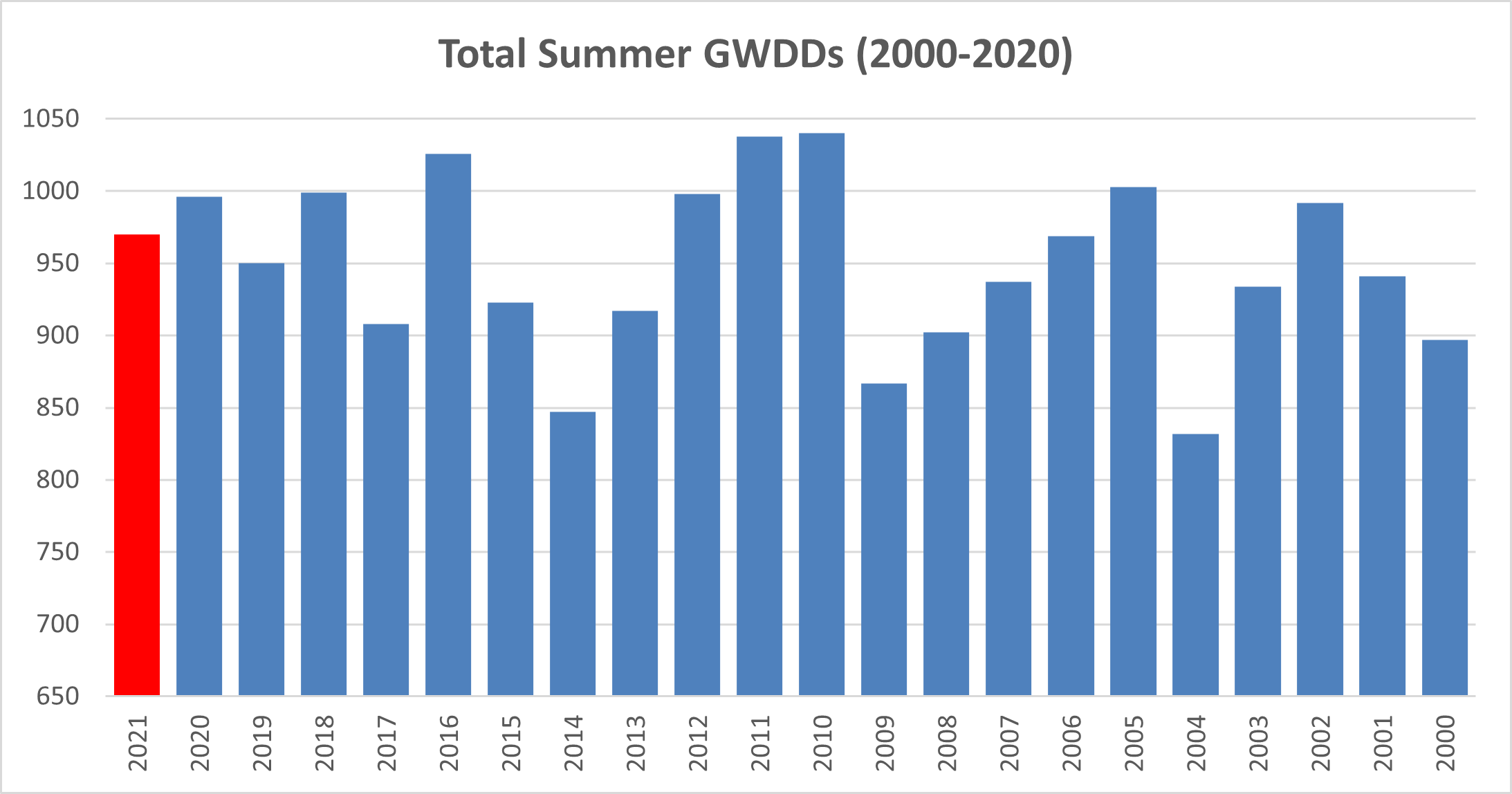

The cooler July has pushed out total summer June to August) GWDD projection down to 970, under last year’s levels, and well under the hottest summers of 2010, 2011, and 2016.

That said, we do see some heat returning to the forecast, as next week looks to be the hottest of the summer, which includes the hottest weather we have seen in the South as well, thanks to some Atlantic blocking showing up (a hotter signal in the South in summer), at least on a transient basis. Highs in cities such as Dallas are expected to reach the 100 to 105 level on multiple days. We do not see this level of heat as something that “locks in”, as of right now, with our assumption for August being close to the 5 and 10-year normal. This automatically “bakes in” some heat, however, given how much hotter those normals are when compared to the longer term, 30-year normal.

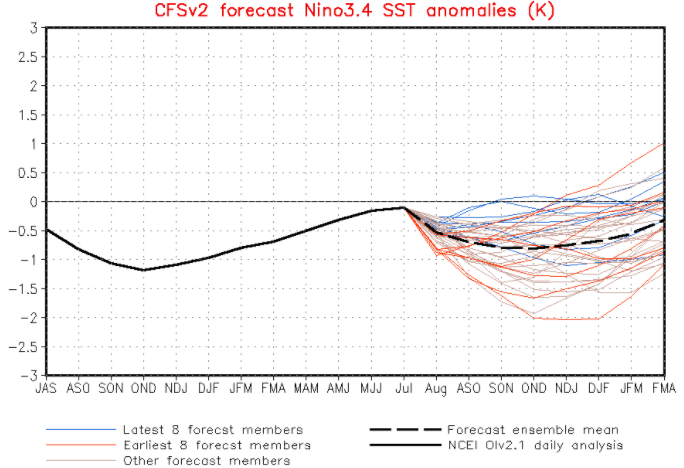

Looking farther down the road, we still see hints in the climate modeling of the return of a La Niña base state heading into Fall and Winter.

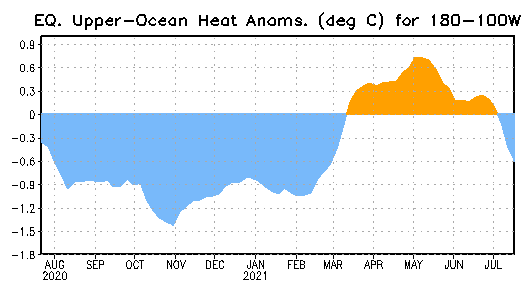

Upper oceanic heat content is on the decline, lending some support to the La Niña idea moving forward.

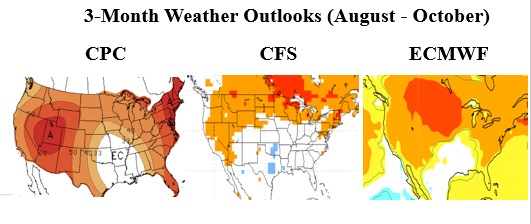

This could be a key shift in the global base state, as La Niña often leads to warmer Fall conditions in the U.S. Given how important weather will be to the natural gas market in the coming months, we will be tracking this closely, as a warm October-November period would not be kind to natural gas bulls. But, this is a long way out yet. Most projections show a similar regime for the next three months as we have seen for much of summer-to-date, with a ring of heat from the West, across the north, and along the East Coast. Should Atlantic blocking turn out to be more than just transient, that would shift the outlook hotter in the South vs what is shown here, and cooler in the Northeast.

Fundamentals for the week ending July 23:

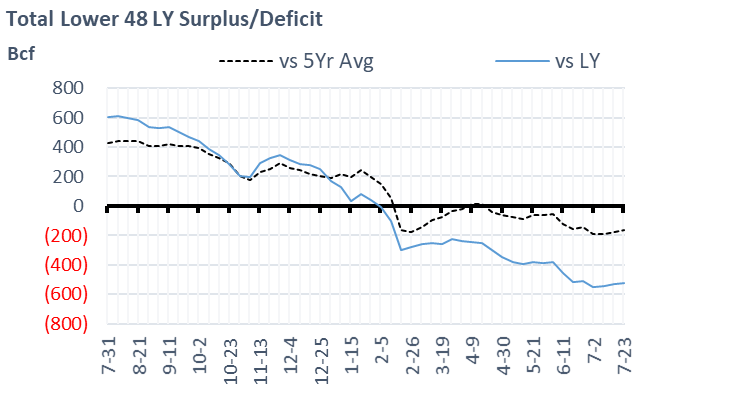

This past week the EIA reported a +49 Bcf storage injection for week ending July 16th. This report came in 6 Bcf above market consensus and 5 Bcf/d above our estimate. After some time we are seeing some consistency in the wx adj storage injections. The past two reports were ~0.8 Bcf/d tighter than LY (April through August), and 0.4 Bcf tighter than the 3 Yr average.

For the week ending July 23th, our early view is +39 Bcf. The 5Yr average is a +28 Bcf injection. Our projected injection would take the L48 storage level to 2717 Bcf (-520 vs LY, -165 vs. 5Yr). As seen in the chart below, storage balance vs past years is comfortable in this range and starting to turn the corner to a neutral level.

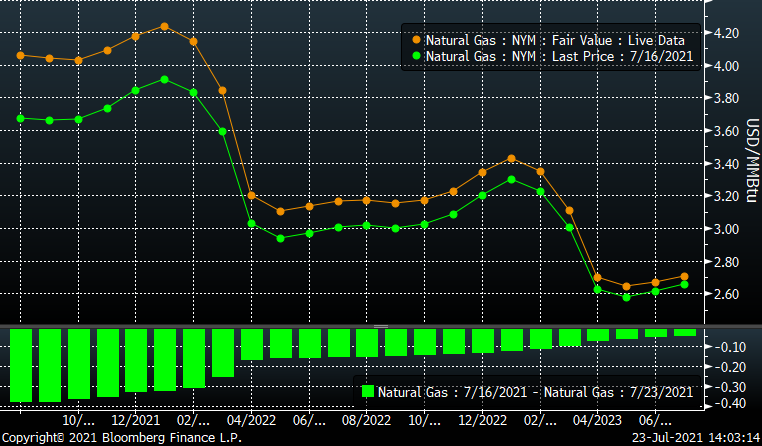

Domestic production was relatively flat to last week at 92 Bcf/d. There were no major surprises related to maintenance or critical events. The forward price structure is now in a place that should be very appealing to producers. The balance of this year now trades at $4.10+, and Cal22 is $3.33. The week-on-week price change was quite dramatic and should sway future production estimates higher. Some vendors use the natgas term structure as an input to their production model to drive rig and well activity – we should expect a big restatement higher in the production view 4months out. This could bring a bearish tone out down the curve.

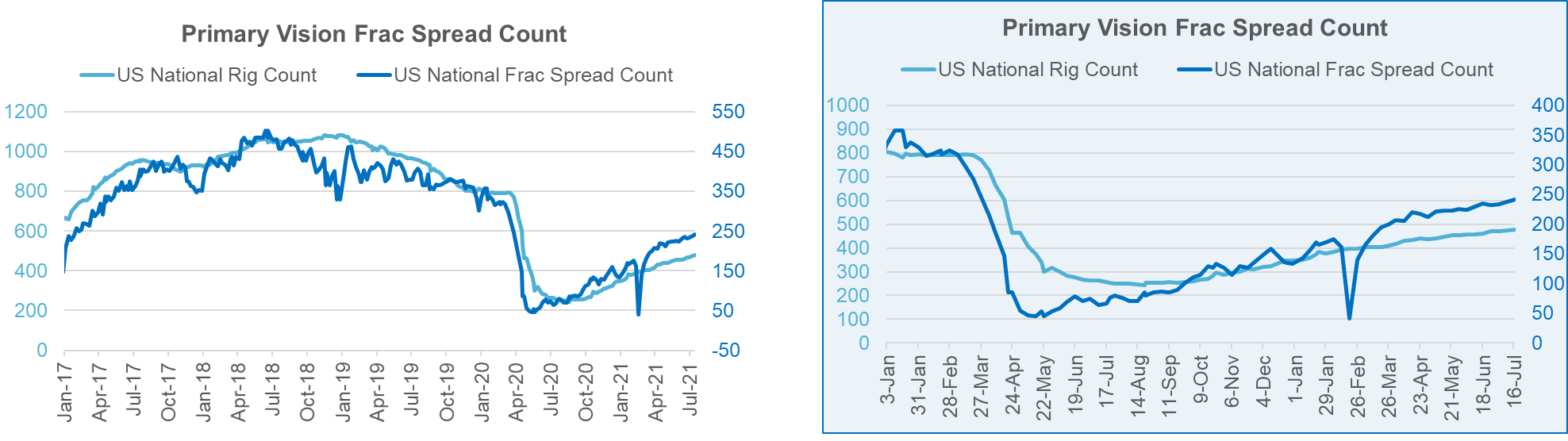

Another factor to consider in understanding future production is looking at the rig and frac spread count. With crude, products, and nat gas all trading at attractive levels, we should expect stronger producer activity to close out the year and into next year. We already see rigs moving higher at a steady pace, but more interesting (and an immediate marker) is the frac spread count. The frac spread count as reported by Primary Vision is increasing at a faster rate than rigs and now sits at 250, which is the level we were at right before the COVID lockdowns at the end of March 2020. A lot of this activity does come from oil-related wells, but the impact on natgas production is still there with associated gas making a larger share of overall dry natural gas production.

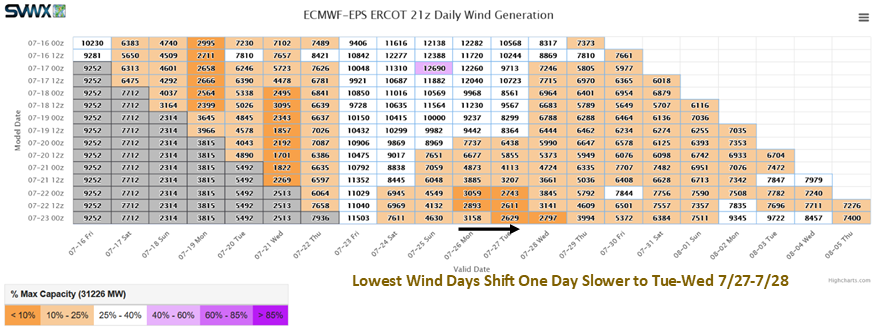

Total consumption was higher this week driven primarily by power burns. Total national temps were flat week-on-week, but the increased gas burns look to be a direct result of lower wind generation during the week. Wind gen dropped by 27+% to a daily average of 26 GWh nationwide. We calculate this to add approximately 1.7 Bcf/d of consumption by natural gas generators. This coming week we do expect a big drop in wind as nationwide temps increase (This will show up in the storage report for week ending July 30th) . Total power burns are expected to hit a new record this coming week with the warmer temps and lack of wind. ERCOT wind generation is expected to reach the lowest points next week on Tuesday and Wednesday afternoon. It should be noted that wind does typically fall of during the peak summer month, but these levels are much below expectation. Here is a view from CWG.

Deliveries to LNG facilities averaged 10.5 Bcf/d, which was -0.3 Bcf/d lower than the previous week. Both Cheniere’s plants were operating at a lower level.

Net the balance is tighter by 0.9 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Aug 13th and ends on Aug 18th.

August futures expire on July 28th, and August options expire on July 24th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.