Fundamentals for the week ending July 02: This past week the EIA reported a +76 Bcf storage injection for the week ending June 25th. This report came in 8 Bcf/d above market consensus and 6 Bcf/d above our estimate. Unlike last week, which was showed balances being quite tight vs LY this report came in only 0.6 Bcf/d tighter wx adjusted. Last year is not the best comparison, hence we also compare to the average of Summer 2018 & 2019. Compared to those two summers, this past storage report looser by 0.2 Bcf/d wx adjusted.

By simply adding on the average of the 2018 and 2019 storage trajectory going forward, storage reaches 3.8 Tcf by the end of October. This is a very simplistic way to look at it as there are many fundamental factors that constantly change the wx adjusted weekly injection levels, but it’s a good data point to keep in mind. Our end-of-season view is much more conservative at 3.55-3.6 Tcf.

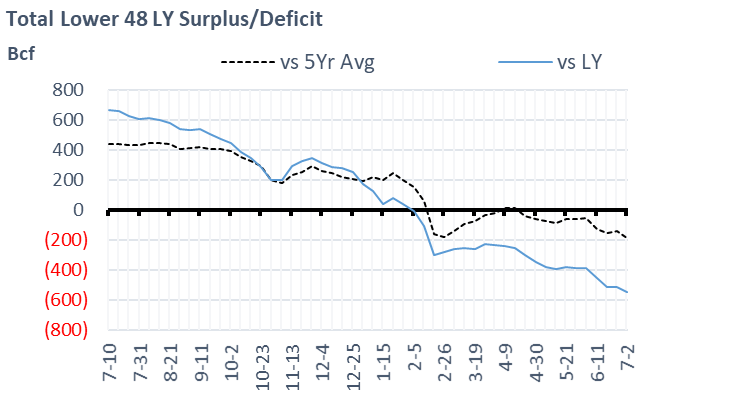

For the week ending July 2nd, our early view is +22 Bcf. The 5Yr average is a +63 Bcf injection. Our projected injection would take the L48 storage level to 2580 Bcf (-545 vs LY, -184 vs. 5Yr). As seen in the chart below, the storage levels have gone from a major surplus to a notable deficit.

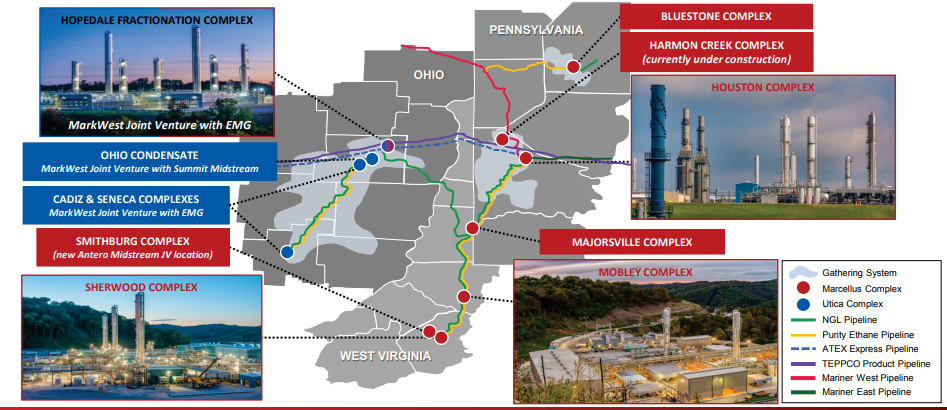

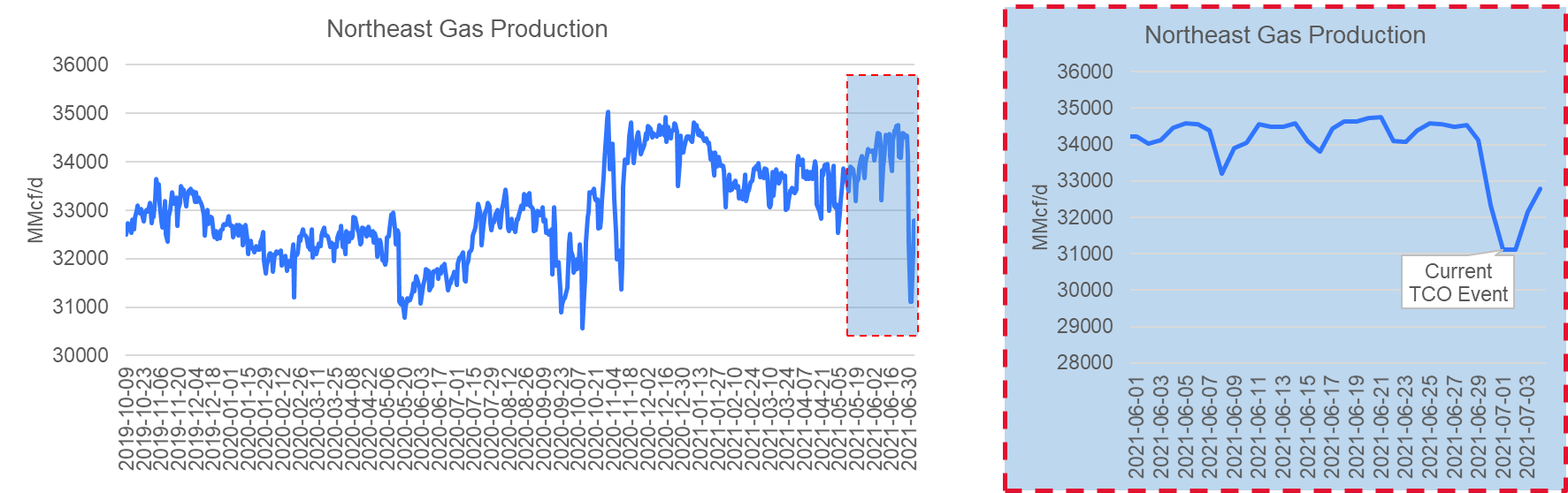

Domestic production has been an ongoing story this past June. The latest major drop comes from Marathon Petroleum Corp’s MPLX pipeline monitoring system which “detected a release of product from a (natural gas liquids) pipeline at [the] Majorsville facility in West Virginia”. We assume this was a C3+ pipeline that originates from two other gas processing plants, Sherwood and Mobley. Surprisingly the issue was first reported by Columbia Gas pipeline (TCO), not Markwest or its parent company Marathon. Here is a good map from MPLX presentation

As of July 3rd, the issues seems to have been resolved.

We see nomination from these gas processing plants on to major interstate pipelines like TCO, Equitrans and Rover. Overall production was down as much as 3.4 Bcf/d in the NE on July 1/2, but we are now trending back up to normal levels.

For the storage week, overall production is down 1.0 Bcf/d on average (as the MPLX event occurred at the end of the week). Some of the drop was offset by higher Canadian imports despite a drop in WestCan receipts due to the strong heat.

Total consumption was much higher this week driven primarily by power burns due to the extreme heat in the West and Northeast. Total national temps were higher week-on-week by 4.2F. Wind generation once again dropped this week adding to burns. The US lost on average 26 GWh of wind gen which we estimate would equate to over 4 Bcf/d of additional burns. Thankfully the sun was shining hard and coal gen helped out. Solar gen doubled week on week lightening the load on gas gen by 2.2 Bcf/d. Total average daily consumption increased by 6.6 Bcf/d to 75.8 Bcf/d.

Deliveries to LNG facilities averaged 11.2 Bcf/d, which was +0.9 Bcf/d higher than the previous week. Sabine Pass returned to full service was the only real change to report week-on-week, i.e. all 5 trains in-service. Sabine is still not operating at peak levels, but that is more related to the hot weather lower plant capability. This phenomenon is typical each summer as heat reduces the plant output. A lot of LNG uncertainty out of the way for the rest of summer with maintenance behind us on Sabine Pass, Corpus Christi, and Cameron.

Net the balance is tighter by 7.6 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on July 14th and ends on July 19th.

August futures expire on July 28th, and August options expire on July 24th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.